-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2013; 3(7A): 1-7

doi:10.5923/s.mm.201310.01

The Russian Car Industry in the Conditions of Globalisation: Factors, Features, Development Strategies

Diana V. Arutyunova, Vlada G. Orlova

Department of Management, Southern Federal University, Taganrog, 347930, Russia

Correspondence to: Diana V. Arutyunova, Department of Management, Southern Federal University, Taganrog, 347930, Russia.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

In Russia new fields of activity have arisen along with new goods, methods of business and development of enterprises as a result of globalization. Conditions of global markets with their high dynamics demand the other understanding of the choice strategy and this is the objective of our study. There the analysis of situation in domestic and foreign auto industry is held, the importance of strategic management in the process of actions choice is proved, methodology of forming strategic scenarios is defined in the present study. The main attention is paid to the analysis of the automotive industry in Russia, to the tendencies of its development and to the main points of growth. Special attention is drawn to domestic strategy of Russian car industry and to the influence of global competition upon positions and strategies of the national companies. Being based on the SWOT- analysis of automobile branch of Russia, strategies of the further development are chosen and scenarios of their realization are presented.

Keywords: Globalization, Development of Automotive Industry, Global Strategy, Strategic Choice, SWOT- Analysis

Cite this paper: Diana V. Arutyunova, Vlada G. Orlova, The Russian Car Industry in the Conditions of Globalisation: Factors, Features, Development Strategies, Management, Vol. 3 No. 7A, 2013, pp. 1-7. doi: 10.5923/s.mm.201310.01.

Article Outline

1. Introduction

- Modern analysis of the industry and enterprise development process requires consideration of the trend of globalization. This is evident the most clearly in Russia, as it existed in a closed economy for a long period. The necessity of Russian industry integration to world economics puts the problems of conformity of enterprise and its product to the world standards.But, at the same time, a problem of identification of strategic targets and optimization of control systems is put forward.Thereupon the importance of developing a strategic line of behavior and improvement of management in Russian companies with new business concepts in a changing environment influenced by globalization is increasing.As an object of research one of the most dynamically developing sectors of economics of Russia - mechanical engineering and in particular motor industry has been chosen.The development of the automotive industry shifts the emphasis from the extractive industries into the direction of efficient industrial production, investment, access to international markets. The world experience of the advanced countries in the development of a competitive auto industry showed that it renders an essential multiplicate effect on development of other branches of economy and is the "engine" of export-oriented development.In particular, a significant event in the development of the domestic automobile production was the emergence of the industrial assembly plants.At the present stage of development of the Russian car industry there is a strategic transformation of forms and methods of its management:- The internal regulators and influence mechanisms of companies are being changed at regional, federal and interstate levels;- There are new relationships between car factories and component suppliers;- Economic communications between separate enterprises are being optimized;- Dealer systems are changing.In the process of decision-making by transnational corporations (TNC) on the placement of its production many parameters are taken into account. In addition to market conditions and resources the security of the working environment and infrastructure is important. TNCs are interested in locating production close to the global transport routes, in the first place - to the sea routes[1].This proves the concentration of assembly plants in certain places: In the area of St. Petersburg, there are seven plants of different brands: «Toyota», «Nissan», «Ford», «Hyundai», «General Motors», «Scania», «MAN»; in the area of Azov Sea - 2 great enterprises («TagAz» and "RoAz").The industrial structure is being changed under the impact of globalization: the new companies appear; seaports industrial areas are developing. But the development is accompanied by manifestations of a different origin: there is the increasing international competition and the need to get over global crisis that requires the situation analysis; the development of a new vision and competition strategy alternative. Global crisis has narrowed the market, therefore the majority of the industrial enterprises have difficulties of methodological, methodical and informational support of decision-making.Thus, the aim of this study is to determine the elements of a strategic choice and to reveal strategic initiatives in Russian car industry under the impact of globalization and access to international markets.To achieve the objectives several tasks will be considered:1 – Overview of researches on development of Russian and foreign car industry; 2 – Definition of strategic management methodology in a context of the analysis and the choice of global strategy;3 – Analysis of Russian motor industry and revealing of basic tendencies of the market;4 – Substantiation of strategy of an entry of the international companies to the Russian market;5 – Influence of a global competition on competitive positions and strategy of the national companies.Meeting these objectives will identify trends in the further development of the Russian automotive industry in the context of globalization and justify specific strategic solutions for enterprises engaged in this field.

2. The Methodology of the Analysis of the Situation and Strategic Choices

- There the analysis of methodological foundations was conducted in the first stage of our research for to solve the allocated problems.Complexity, diversity and importance of effective functioning Russian motor industry had generated great interest among researchers.Intensive formation of strategic alliances, including technological ones with the participation of different countries became the feature of economic development of the last decade of the XX-th century.[2]. In recent years in order to save manufacture scales there the global automotive industry alliances are created for carrying out perspective joint scientific researches as well as for providing design works.The influence of this process on motor industry development in Russia is considered by A. Dagaev[3]. In the paper there is the analysis of objective preconditions for formation of the international strategic alliances between the Russian and foreign car factories (the main form is a joint venture). The author also defined the reasons which have caused backlog in realization of the international cooperation plans.The manuscript of D. Shatunov[4] is also devoted to the role of the international strategic alliances in Russian motor industry. He evaluates their impact into the country's exit from an economic crisis, but also defines negatives of their activity during the postcrisis period (minimum participation in R & D, importing of unmodern technologies and the equipment). He noted the current vector of motor industry development is different: transition from quantity to quality indicators demands innovative transformations in production. In line with the strategy of development of the automotive industry in Russian Federation up to 2020[5] the toughening of conditions of industrial assemblage takes place. It demands more active introduction of high technologies in production. It promotes creation of new strategic alliances in motor industry, that in turn requires additional investments and revision of existing investment projects[6]. One of priorities of Strategy of development of a car industry is stimulation of workings out and manufacture of innovative vehicles and automobile components, creation new and modernisation of operating manufactures in territory of the Russian Federation.Necessary condition of competitiveness of the enterprise is not only the unique technological process, but the clear orientation to the consumer and to the full application of marketing strategy. S. Karpova and I. Rozhkov[7] proved this thesis and stated that during the post crisis period it is necessary to activate marketing strategy; to improve vehicles design constantly; to develop more perfective types, making them not only ecologically sound, but also cost-effective.Besides the subject of innovation can not only be new products and new technologies that are usually taken into account but also new markets, new management techniques, new organizational structures, etc.[8].At a choice of object of an innovation it is necessary to start with analysis of potential and resource possibilities of the multinational corporation: SWOT-analysis of internal and external factors, a choice of global strategy of functioning, working out of functional strategy of activity of the company (financial, innovative, marketing, investment, etc.)[9].Thus, globalization conditions form new requirements to development of organizations and, hence, define management system changes, to improve competitiveness by focus on new forms and methods of deliveries, manufacture and distribution. The importance of strategic behavior of the organisation sharply increases under these conditions. There is a change of administrative paradigms: the priority of current results is replaced by the goal of the further development. In this connection, the methodology of carrying out of the strategic analysis and a strategic choice as the main methodological framework is chosen.The researchers of M. Porter[10] and P. Drucker[11] are devoted to theoretical study and development of approaches and methods of strategic management.Now strategies of many companies are focused on the global markets. According to the authors[12] the introduction of the companies into the global markets is predetermined by following factors:- Attraction of new clients that becomes the necessity at saturation of domestic market;- Reduction of costs and increase of competitiveness at the absence of possibility of achievement of a scale effect in domestic market;- Reception of advantage for the account of key competence formation;- Decrease in risk at the expense of market expansion.Global markets with high dynamics require another understanding of the choice of strategic actions. It implies the development of strategic management methodology on the basis of modern theories of strategic management, and introduction of tools and methods such as PEST-analysis, the branch analysis, the competitive analysis, the SWOT - analysis and others in practice[13]. Issues on this subject are presented by L. Fahey[14], R. Grant[15], etc. This will take into account the peculiarities of the market caused by globalization and determine the choice of development strategy of the organization.From the standpoint of analyzing the situation one should determine the degree of competition and globalization of markets. It can be represented both in: - Multinational competition - the market is presented by set of the isolated domestic markets of the separate countries.- Global competition – the prices and competitive conditions at different domestic markets are closely interconnected, and competitiveness of the separate country depends on other countries’ competitiveness[16].This situation is typical for the automotive industry as a whole: the competitive advantage created by the internal market, is complemented by the benefits created in other countries, such as the location of production in countries with cheap labor resources, the reputation of the trade mark, service multinational clients.In the current conditions the main focus is shifted to the macro level. There are important questions to have well-informed decisions:1 - analysis of the external environment: industry analysis, competition analysis, analysis of the needs of global markets, identifying key trends;2 - development and justification of the exiting strategy for the international and global markets;3 - impact of global competition on the positions and strategies of the national companies.

3. Results

3.1. Analysis of the Industry and Identifying of Trends

- The following investigation phase includes the revealing of basic market tendencies as a starting point of the strategy choice.Economic and political factors are the underlying environmental factors that affect the strategic choices. According to the global financial ratings Russia takes the unattractive position: 53d place on the availability of business financing, 41st - on the relative instability of the financial system.[17]But the competitive situation is aggravated by foreign companies that entered the Russian market. This is due to the favorable trends of a political nature: the introduction of preferential customs regime on imports of parts and components of foreign production, state-supported distribution policy (the government's program for recycling of old cars). Another important factor of the development is a technological component: globalization gave rise to the acquisition of a foreign experience «Autotor» was built in 1996; «TagAz» - in 1997. They are the enterprises with «screwdriver assembly».The Russian market of automotive industry in recent years has shown steady growth. In 2012 the market volume of new passenger cars in the country rose to $ 71 billion (2.76 million cars), which is higher than the 2008 figure and sets new record in the Russian market. According to PricewaterhouseCoopers it is possible to wait for the new growth of sales (5%, or 2.9 million units) in 2012 - 2013 years[18]. The consumer boom had made the market for foreign cars one of the most dynamic in Russia, foreign automakers are forced to look at Russia as at very promising market, which benefits not only the seller but also the manufacturer. Since the early 2000s, the majority of the world's automakers have built or started to build their assembly plants in Russia unlike the companies that entered the Russian market earlier with licensing strategies (eg «Hyundai»). The main center was in Leningrad region, as it is situated close to the border and to the major port for to import components. In St. Petersburg for three years (2005-2008) there three car plants were built: «Toyota Motor Manufacturing Russia» (2007), «Nissan Manufacturing Rus» (2008) and «Ford Motor Company». Then more companies such as «Hyundai Motor Manufacturing Rus», «Suzuki Motors», carmaker «General Motors», «Volkswagen Group Rus» began to appear at the market. Analysis of the Russian automotive market should be carried out in following segments:1. Cars of Russian manufacturers - Segment is represented by major manufacturers: Ulyanovsk Automobile Plant (UAZ), Gorky Automobile Plant (GAZ), Kama Automobile Plant (KamAZ), Moscow Society «Plant named after Likhachev» (ZIL), Volga Automobile Plant (AvtoVAZ) - the market leader.2. Foreign cars assembled in Russia. At the beginning of 2007 there eight assembly plants for the production of cars of foreign brands were operating on the territory of Russia. This rapidly developing segment is now represented by more than 20 companies and factories. The car industry in Russia is geographically located in different federal districts - North-West, Central, Volga region; assembly plants are located in Kaliningrad region, Taganrog, Yekaterinburg, Novosibirsk region. At the end of 2009 the production of motor vehicles started in the Far East. But the most of the enterprises are concentrated in the European part of Russia.3. New car import. In recent years imports is growing: in 2011 it was imported 280.400 for the first 4 months; 2012 - 324.200 (import from foreign countries is 293.900). Thus, there is a tendency to demand restoration. restore the supply. The leaders of import in Russia are «GM», «Hyundai», «Kia», «Toyota», «Nissan», «UZ-Daewoo» and «BMW». Recent trends indicate the volume decrease of used car import (almost to 80%). The share of used car import is only 2.5%.[19]An analysis of the market situation and of industrial specifics revealed some trends that should be considered in the formulation of the fundamental strategic choice:1. Domestic manufacturers lead in the sector of economy car (primarily «AvtoVAZ»), that is achieved by a relatively low price. However, despite the fact that «AvtoVAZ» remains a top seller, its share in this market is rapidly shrinking. At the moment «AvtoVAZ» has market share of 18.3%[20].2. The growth trend in the market of foreign cars assembled in Russia is confirmed by the structure of sales of passenger cars. The given growth occurs at the expense of replacement of other Russian enterprises production and to a lesser degree at the expense of production of "Autovases" [21].According to the study in 2012, the dynamics of sales in terms of quantity is as follows:- The number of domestic cars declined to 6.5% (580,000 units),- The number of sales of foreign cars assembled in Russia increased to 17% (1,215,000 units)[22].As for foreign cars, Hyundai Solaris takes the first place confidently (110, 7 thousand units sales). The second place in terms of sales takes Chevrolet (205,000 units). Renault is the third leader (190,000 vehicles). 3. Along with the enterprises of foreign companies there are domestic multi-brand ones operating under foreign licenses. For example, «Autotor» and «TagAz» perform the multi-brand assembly, but their lines do not intersect; SUV of Korean and of own domestic models do not compete in "TagAz"; Korean suppliers had diversified risks of component supply delay by building the plant for the production of automotive components in Korea, 200 km from Seoul.Thus, the situation analysis has allowed to reveal basic factors of macro-and microenvironments influencing activity of the Russian car industry companies at the national and international world markets. In this connection the next stage of research is the description and the analysis of a market situation from a position of two basic mutually supplemented scenarios:1 – The strategy of introduction of foreign car industry companies at the Russian market,2 – The strategy of development of the Russian car industry companies at the national and world markets.

3.2. Justification of the Strategy to enter the Russian Market

- We select the basic variants of companies’ behaviors in implementing the strategy of entering the Russian market:1. The strategy of creating distribution networks and representative reduces direct investment in other countries. Creating a dealer network is quite common for companies that have a strong brand. Dealer network of «TagAZ» is gaining momentum - 30 dealers: 16 - domestic brands and 14 - «Hyundai», as well as «Autotor»: 91 - passenger cars and 13 - lorries. 2. Licensing strategy is to minimize the economic and political risks. This strategy is interesting in the early stages of market entry. License Agreements of Russian enterprises with foreign producers were signed in 1998. They were based on partnership of «GM» and «AvtoVAZ»; «Hyundai» and «TagAZa»; «KIA», «BMW» and «Autotor». And when the prospects of the market are clear the risks are reduced there comes the next stage of development: companies are starting to arrange the long haul[23]. For example, with the launch of its own automobile «Hyundai» in St. Petersburg in 2010, the company has ceased to be in need of «TagAZe». In this connection «TagAZ» had to change the portfolio strategy. They negotiated with the 14 Chinese manufacturers and began to compete in the segment of Chinese cars.3. The strategy of joint ventures and strategic alliances helps strengthen the position of the participating companies, allowing them to remain independent. The first strategic alliance in Russia was signed in 2007 between the «General Motors» and OAO «AvtoVAZ» joint enterprise, which produces SUVs Chevrolet-Niva. «Renault» created an auto factory «Avtoframos» at the territory that belonged to enterprise «Moskvich» -and controls 95% of the shares with a production capacity of 160 thousand per year. These patterns can be found not only on the domestic market. The company «Renault» is an alliance with «Nissan» to achieve a competitive advantage over «DaimlerChrysler», «General Motors», «Ford» and «Toyota», which come in different unions in their turn. To date, the cooperation is to conduct research and development of capacity utilization and grounds, joint marketing, etc. This allows to fill in the gaps in technical and technological experience, in knowledge of the market, etc. Cooperation gives chances to gain position in the industry by combining the efforts of the participants.But there are some obvious drawbacks in the implementation of this strategy, in particular, the problem with the alignment of goals, issues of trust and mutual exchange of information. In a competitive environment it is necessary to implement a strategy of conquest of the leading positions alternative, of the merger and acquisition[24].

3.3. The Influence of Global Competition in the Competitive Positions and Strategy of the National Companies

- Looking through the market situation from a position of domestic producers we can consider results of two types: a positive one - development of automotive market; and negative - loss of Russian product competitiveness. For example, repeated the threat of bankruptcy of «TagAZ» with debt of 11 banks led to changes in the composition of the founders. Thus, the «United Auto Group» (the unit of "Savings Bank") has become the new founder of «TagAZ». Under these conditions, the main strategic objective is to obtain international experience, which also has positive significance for the development of the Russian industry. In this aspect the special attention is paid to a problem of loan of technologies by means of direct investments by many researchers[25],[26].This principle of borrowing existing technologies is in the basis of Russian automobile industry development strategy. The result of such a strategy is domestic market expansion.Development of a domestic car industry correlates directly with evolution of modes of assemblage (central assemblage, license assemblage, industrial assemblage). The positive and negative aspects of these models are described in details in[27].Formation of strategic alliances is the further stage of development.

3.4. SWOT-analysis of the Russian car industry and the Strategy of Industry Development

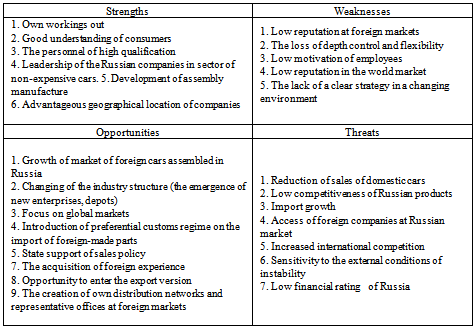

- Let's generalise the basic tendencies of the market of a car industry of Russia. The growth of foreign car market will be maintained to 1.33 million units. In particular the demand of foreign cars assembled in Russia could increase. It is possible due to their lower cost at the same capacity. At the same time, the market of Russian car industry looks more attractive market in Europe, where car sales fell by 8.2%, and the competition is increasing due to the reluctance of businesses to lower production volumes[28]. To draw conclusions from this study we have constructed a SWOT matrix for Russian automobile industry market as a whole.This matrix has allowed revealing the strengths and weaknesses of the Russian companies, and also the possibilities and threats from the environment (Table 1). The analysis of the factors specified in a matrix has allowed to draw a conclusion on necessity of accentuation of attention to interrelation квадрантов "Strengths" and "Threats". The interrelation of data presented in the quadrants is the most significant from the point of view of the further prospects of development of the Russian car industry and therefore it is on the basis of these relationships options for strategic action should be offered.To develop a strategy it is necessary to move from the SWOT- matrix to matrix of strategies that is presented in[29]. The transition to the matrix of strategies has shown that for the field of «Force and Threats» it would be effective to mitigate external threats at the market through diversification and integration.

|

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML