-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

American Journal of Tourism Management

p-ISSN: 2326-0637 e-ISSN: 2326-0645

2022; 11(1): 1-6

doi:10.5923/j.tourism.20221101.01

Received: Feb. 25, 2022; Accepted: Mar. 23, 2022; Published: Apr. 15, 2022

Effect of Taxation on the Productivity of Tourism and Hospitality Firms

Kukoyi Ibraheem Adesina, Oseni Oluwatosin Pelumi, Awodire Olamide E.

Department of Hospitality and Tourism, Federal University of Agriculture, Abeokuta, Nigeria

Correspondence to: Kukoyi Ibraheem Adesina, Department of Hospitality and Tourism, Federal University of Agriculture, Abeokuta, Nigeria.

| Email: |  |

Copyright © 2022 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Taxation is a significant issue in the global business space, in Nigeria the challenges with taxation ranges from high tax rates, multiple taxations, complex tax regulations to lack of harmonization between the tiers of government on taxes payment and lack of proper enlightenment or education about tax-related issues. This study investigates the taxes and levies paid by tourism and hospitality firms in Ogun State, Nigeria, intending to underscore its effect on the productivity of these companies. The study utilized survey method as a research design. Samples were drawn from the study population using availability and purposive sampling techniques to select 272 Customers and 72 Managers and Accountants from the selected companies respectively. Purposive sampling was used to determine three key informant interviewees from the tax collecting authorities. Qualitative data were content analysed while quantitative data were analysed using simple percentages and chi-square (p≤0.05). Findings revealed that about 11 taxes were levied on tourism and hospitality firms and hotels were found to be the sub-sector levied with the highest number of taxes. It was also revealed that all the 3-tiers of government collect taxes separately, and some were for similar a purpose which implies the possibility of multiple taxations. Further investigation revealed that taxes levied on tourism and hospitality firms significantly affect prices of goods and services rendered (p = 0.019). Also, there is a significant relationship between taxes imposed and productivity of tourism and hospitality firms (p = 0.011). The study concluded that taxation directly impacts the productivity of tourism and hospitality firms and therefore recommends a downward review of the existing taxes levied on tourism and hospitality firms to eradicate multiple taxations and improve their productivity.

Keywords: Taxation, Productivity, Tourism, Hospitality, Firms

Cite this paper: Kukoyi Ibraheem Adesina, Oseni Oluwatosin Pelumi, Awodire Olamide E., Effect of Taxation on the Productivity of Tourism and Hospitality Firms, American Journal of Tourism Management, Vol. 11 No. 1, 2022, pp. 1-6. doi: 10.5923/j.tourism.20221101.01.

Article Outline

1. Introduction

- Discussion on taxation has been on a global scale for a relatively long period owing to the economic importance attached to it by every nation. In an ideal and sane condition, a tax system is supposed to be flexible and straightforward to aid compliance (Oseni, 2014). It has been reported that the main objective of taxation is to mobilize funds from private hands to public treasury by imposing compulsory payment towards the financing of the public sector (Sanni 2012). As much as it is a compulsory levy on citizens and the private sector, it is also one of the major sources of government’s revenue. According to Cross (2019), the issue of taxation has become a significant problem in terms of high tax rates, multiple taxations, complex tax regulations, lack of harmonization between the tiers of government on taxes payment and lack of proper enlightenment or education about tax-related issues. Taxation policy affects business costs, for example, a rise in corporation tax (on business profits) has the same effect as an increase in costs. A rise in interest rates raises the costs of borrowing money and causes consumers to reduce expenditure (leading to a fall in business sales). So, even though corporate tax increases are not levied directly on workers, they still affect workers indirectly by lowering their wages (Amadi and Alolote, 2015). It also affects consumers by leading to an increase in the cost of goods and services they purchase. Increased price may result in reduced consumption, which may affect the sales of companies offering goods and services to customers. The tourism and hospitality industry is not left out because it is a service industry that is critical to national growth.Tourism and Hospitality are one of the most developed industries globally and are sensitive to tax (Gooroochurn and Sinclair, 2005). Apart from being a major foreign exchange earner and source of employment, they are subjected to a range of specific taxes, fees and charges. Taxation in tourism and hospitality sectors can be categorised as indirect taxes, fees and charges affecting primarily tourism-related activities and direct (specific taxes). Indirect tax receipts generated by tourism expenditure are derived from general taxes, including import duties, sales taxes or value added tax (VAT). While specific taxes are primarily tourism-related activities, such as hotels and restaurant taxes, airport taxes, visa fees, arrival and departure taxes (OECD 2014). Productivity is a measure of the efficiency of production. High productivity can lead to greater profits for businesses and greater income for individuals. According to Robert (1989), the nature of hospitality business makes productivity difficult to measure. For example, hotels produce a combination of products and services: both tangible and intangible. The best measures of productivity are those that measure the performance of output. Productivity could be as measured the number of guests, rooms occupied or meals served (patronage) divided by the number of employee-hours required (Agbor, 2013). It is pertinent to note that a high taxation regime will have implications on organizational productivity in patronage and performance in the area of profitability. According to Izedonmi (2010), when an income is subjected to more than one tax treatment, it leads to multiple taxations. This can affect the purchasing power of individuals and the spending pattern of consumers in an economy. This will have an effect on the economy of a state in the long run.For this study Ogun State, Nigeria was chosen as the study location because it has been reported to host the highest number of companies in Nigeria hence the state would be critical to the economy of Nigeria as a nation and the need for travel, tourism and hospitality services would also be on the high side in this location. One of the basic economic principles of demand and supply was be used as a guide “the higher the price, the lower the quantity demanded and vice versa”. Therefore, how increase in prices of goods and services rendered by tourism and hospitality firms that are as a result of additional or increment in existing taxes, fees and levies paid by them affects patronage shall be considered in order to investigate how taxation affects productivity. This study intends to create awareness for the government and other stakeholders in the tourism and hospitality industry about the impact of tax policies and its implementation on tourism and hospitality subsector of the economy. The following objectives guide this study.1. Identify all the taxes and levies paid by Tourism and Hospitality firms in Ogun State.2. Examine the nature and significance of each of the taxes and levies paid by Tourism and Hospitality firms.3. Investigate the perceived effects of the taxes and levies paid on the productivity of the Hospitality and Tourism firms.The following research hypotheses help to guide the research findings in this study.Hypothesis IH₀: There is no significant relationship between taxation and prices of goods and services rendered by tourism and hospitality firms in Ogun State.Hypothesis IIH₀: There is no significant relationship between taxes imposed and productivity in the tourism and hospitality firms in Ogun State.

2. Theoretical Framework: Diffusion Theory of Taxation

- The Diffusion theory of taxation is premised on the assumption of perfect competition and complete mobility of all economic agents (Awodire, 2021). The theory posits that under normal condition, when a tax is paid, it has a ripple effect throughout the community. The proponents of this theory advocate that when a commodity is taxed, the effect of the burden is shouldered by the buyers until it gets to the final consumer who purchases and utilized the commodity. The common example used in explaining this theory is the effect of a pebble thrown into a spot in a lake, this creates a circle that gives rise to another circle and the effect of the pebble diffuses to a larger portion of the lake. Similarly, when a person’s income is taxed, it also has an effect on the purchasing power of such an individual in the sense that the amount left at the disposal of the person after tax would have been reduced and this would have implications on the person’s decision to purchase and to spend. Therefore, the effect of the income tax levied on people in a community would also have a ripple effect on what they purchase and how much they spend in society, which will affect the economy of the state in the long run.The significance of the Diffusion Theory of Taxation to this study is to aid understanding on the possible effect of taxation on the prices of goods and services and patronage, which are the indicators of productivity considered in this study.

3. Methodology

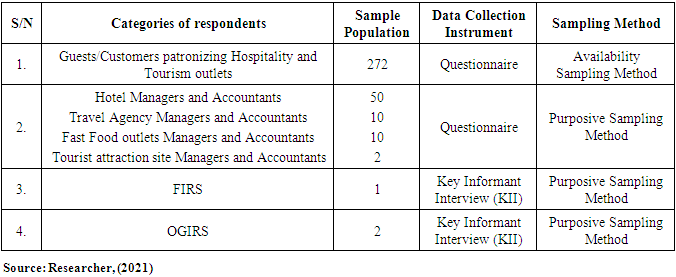

- This study utilized survey research approach to gather both quantitative and qualitative data in order to get adequate information on how taxes and levies are imposed on tourism and hospitality firms in Ogun state. The population of the study comprised staff of tourism and hospitality firms, guests/consumers patronising them, and staff members of the tax collecting authorities in the study location; Federal Inland Revenue Service (FIRS), Ogun State Internal Revenue Service (OGIRS) and the Local Government Area Authority Revenue Offices. The table below shows the summary of the sampling method adopted for the study.

|

4. Results

4.1. Identified Taxes Paid by Tourism and Hospitality Firms in Ogun State

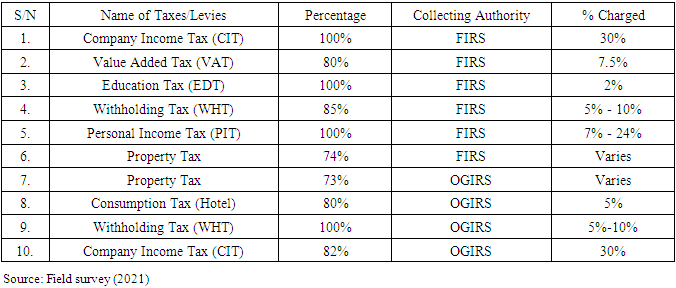

- Table 2 shows information on the various taxes collected from the tourism and hospitality firms in Ogun State as reported by some of our key informant interviewees. From the table, it can be deduced that both the federal and state governments collects the same taxes from the companies except for Value Added Tax (VAT), Education Tax (EDT) and Personal Income tax (PIT) which are collected by the FIRS only and consumption Tax which is collected by OGIRS. Table 2 further revealed that taxes such as Company Income Tax (CIT), Withholding Tax (WHT) and Property Tax are collected by both federal and state government at varying percentages. The findings suggest the possibility of double or multiple taxations in this case.

|

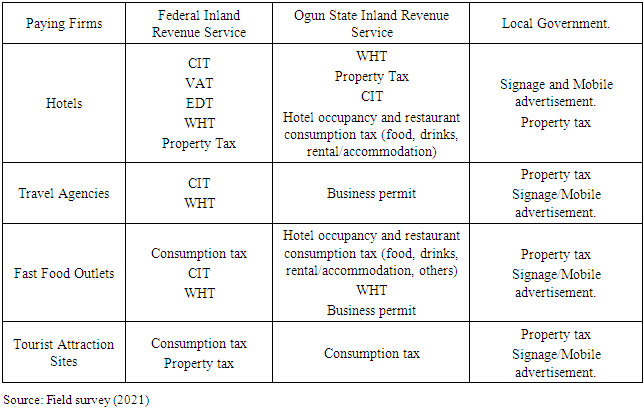

4.2. Categories of Taxes Paid by Various Tourism and Hospitality Firms in Ogun State

- Table 3 below shows the result of information gathered from the managers and accountants working in the tourism and hospitality firms selected for this study, the table revealed the various categories of taxes paid by various firms in the tourism and hospitality industry. From table 3, it can be deduced that all the three tiers of government collect taxes from tourism and hospitality firms in the study area. Also, it can be deduced that among the sub-sectors in travel, tourism and hospitality industry in Ogun State, hotels are made to pay up to six different kinds of taxes to the FIRS, five to the OGIRS and two to the Local Government, most of which are repetition. For instance, Property Tax payment cut across all the three tiers of government, CIT and WHT cut across federal government and state government. All this would make the cost of operation high. This will manifest in prices charged on goods and services by hotels, which will ultimately affect the hotel’s patronage and productivity.

|

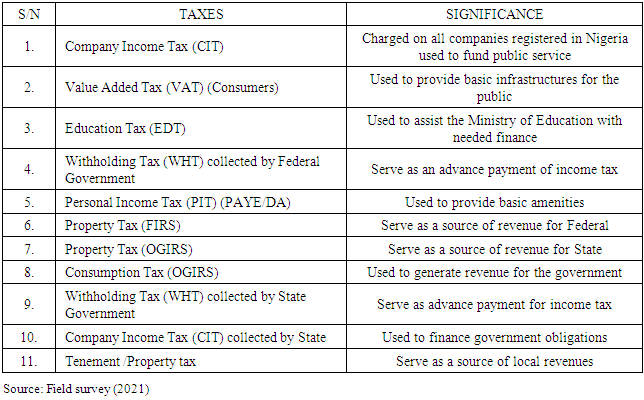

4.3. Significance of Taxes Paid by the Tourism and Hospitality Firms in Ogun State

- Table 4 shows the significance of all the taxes that are levied on tourism and hospitality firms in Ogun State. From the table, it can be deduced that taxes such as VAT and PIT are synonymous in essence. Also, property tax is a repetition of what every other tax collected is meant for (which is to generate income for the government to meet its obligations. More so, property tax can simply be collected once and the fund be shared accordingly to the three-tiers of government rather than companies haven to pay property tax to the three tiers of government separately. The consumption tax levied separately in addition to VAT which is also charged on goods and services purchased is more like a double taxation. All these extra taxes are more likely to influence prices of goods and services offered by the tourism and hospitality firms, thereby resulting in an increase in prices of goods and services, which can consequently affect patronage and may also affect productivity in the long run.

|

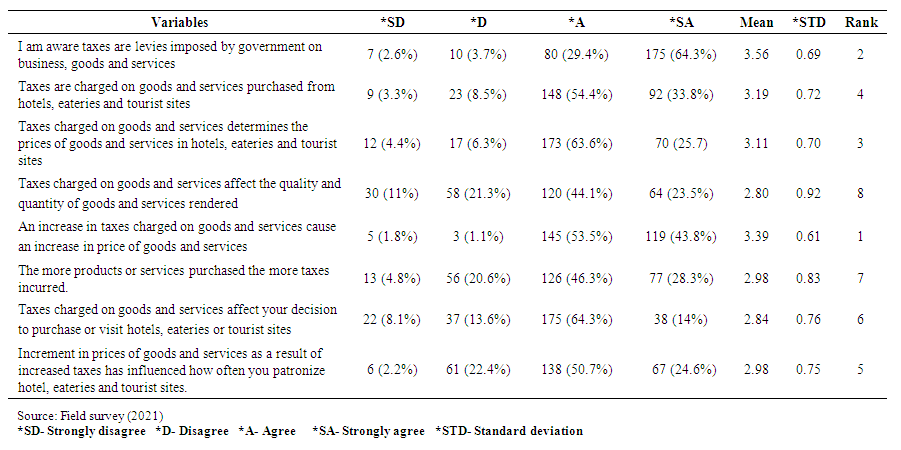

4.4. Customers’ Perception of the Effect of Taxation on Products and Services Purchased in the Hospitality and Tourism Firms

- Table 5 reveals information about the perception of tourism and hospitality firms’ patrons on the effect of taxes on products and services purchased. The table revealed that majority (97.3%) of the respondents opined that an increase in taxes charged on goods and services cause an increase in price of goods and services purchased. The table further revealed that 67.6% of the respondents are of the opinion that taxes charged on goods and services affects the quality and quantity of goods services rendered. In addition, 78.3% reported that taxes charged on goods and services affect their decision to purchase or visit hotels, eateries and tourist sites. In the same vein, 75.3% of the respondents were of the perception that increment in prices of goods and services due to increased taxes has influenced how often they patronize hotels, eateries and tourist sites. From these responses, it is evident that guests and customers are unhappy about how prices of goods and services continue to increase due to taxes levied on private entities which eventually are burdened on them.

| Table 5. Customers’ Perception of the Effect of Taxation on Products and Services Purchased in the Hospitality and Tourism Firms |

4.5. Test of Hypotheses

4.5.1. Hypothesis 1

- H₀: There is no significant relationship between taxation and the prices of goods and services rendered by Tourism and Hospitality firms in Ogun State.The Chi-square test result revealed that the “Pearson correlation” row shows that χ (1) = -0.132 and P-value = 0.019. Since the p-value (0.019) is lesser than the significant level of 0.05, the null hypothesis is rejected. Therefore, the alternate hypothesis is accepted. This shows a significant relationship between taxation and the prices of goods and services rendered by Tourism and Hospitality firms in Ogun state. This meant that taxation has an effect on the prices of goods and services and this may consequently affect patronage of the Tourism and Hospitality firms. Taxes paid by these firms need to be reviewed and properly assessed in order to aid relatively affordable prices of goods and services thereby improving patronage.

4.5.2. Hypothesis II

- H₀: There is no significant relationship between taxes imposed and the productivity of Tourism and Hospitality firms in Ogun state.The Chi-square test result revealed that the “Pearson correlation” row shows that χ (1) = -0.162 and P-value = 0.011. Since the p-value (0.011) is lesser than the significant level of 0.05, the null hypothesis is rejected. Therefore, the alternate hypothesis is accepted. This shows a significant relationship between taxes imposed and the productivity of Tourism and Hospitality firms in Ogun state.This meant that taxes imposed on Tourism and Hospitality firms should be commensurate with what can enhance good patronage, thereby improving the productivity of the companies.

5. Conclusions and Recommendations

- Haven examined the taxes and the effect of taxation on the productivity of tourism and hospitality firms in Ogun State, Nigeria, the study found that there are several taxes paid to the three tiers of government in Nigeria and some are more of a repetition of existing ones which suggest the possibility of double or multiple taxation. The study also found that taxation influences goods and services rendered as well as prices charged. The study therefore concludes that taxes imposed have direct impact on the productivity of tourism and hospitality firms.In view of the foregoing, the study recommends that,i. The number of taxes levied on tourism and hospitality firms should be downwardly reviewed to reduce it and also eradicate the likeliness of double or multiple taxations suspected by this study.ii. The amount of taxes levied on the tourism and hospitality firms also needs to be reviewed to enhance good service delivery and affordable prices that would encourage increased patronage, thereby improving the productivity of tourism and hospitality firms.

6. Significance of the Research Findings to Industry

- This study would be helpful for investors and managers in the tourism and hospitality industry to better understand taxation as one of the challenges combating productivity in their organisations and inform government and tax authorities on the implications of the numerous taxes they levy on tourism and hospitality companies.

ACKNOWLEDGEMENTS

- The researchers at this moment declare that we have not received any funds or sponsorship from any donor agency or organisation towards conducting and reporting this study. However, the researchers however sincerely appreciate Mrs. Ogunnusi S. and Mrs. Adeleye K. for their efforts during data gathering and processing for this study.

Declaration of Conflicting Interest

- The researchers at this moment express that there is no issue of conflict of interest in any form concerning this study.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML