Taibi Boumedyen1, Lamri Khadidja2

1Department of Economics, University of Saïda, Algeria, (MECAS Laboratory)

2Department of Economics, University of Saïda, Algeria, (ITMAM Laboratory)

Correspondence to: Taibi Boumedyen, Department of Economics, University of Saïda, Algeria, (MECAS Laboratory).

| Email: |  |

Copyright © 2021 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

This paper analyzes the relationship between tourism and the exchange rate of the Algerian economy, using the annual data of the number of tourists, the real effective exchange rate and gross domestic product as a secondary variable during the period 1995-2019, so that the economic model was estimated according to the econometric methodology (study of stationarity, study of cointegration relationship, estimation of VECM model). The results of the study concluded that the real effective exchange rate had a positive significant effect on the number of tourists, while the gross domestic product had a significant negative impact on the number of tourists.

Keywords:

Tourism, Exchange rate, Cointegration

Cite this paper: Taibi Boumedyen, Lamri Khadidja, Exchange Rate and Tourist Flows Into Algeria: An Econometric Approach, American Journal of Tourism Management, Vol. 10 No. 1, 2021, pp. 9-15. doi: 10.5923/j.tourism.20211001.02.

1. Introduction

The exchange rate is an important indicator in the international economy, it plays the role of a balancing factor in international trade, its variation directly or indirectly influences all international exchanges, among them tourist flows. Now, tourism is an important economic sector in many developed and developing countries alike.Tourism occupies an important place in world trade, like the exchange of material goods, international tourism trade has a strong influence on the balance of payments, because tourism services weight in international payments, just like imports and exports, this is thanks to the large volume of foreign exchange earnings generated by tourism activity.Today, governments have focused their attention on developing the tourism sector, thanks to these economic benefits. Therefore, the development of the tourism sector is a priority necessity for governments which requires medium and long-term policies and planning to achieve good tourist attractiveness. The exchange rate policy is part of the guiding policy that has an impact on tourist flows and according to the economic literature a favorable exchange rate increases the number of tourist arrivals on the other hand an unfavorable exchange rate no longer increases.In this sense, our problem in this paper is:What is the impact of the exchange rate on the tourism sector in Algeria?We proposed two main hypotheses for our research, which are:1. The devaluation or depreciation of the Algerian currencies has a positive effect on the increase in the number of tourists.2. The increase in GDP leads to attract tourists.The objective of this study is to analyze the relationship between the number of tourist arrivals, the real effective exchange rate, and the gross domestic product in Algeria from 1995 until 2019.Many recent studies have developed exchange rate models where tourism is a source of currency, as a result, among the previous studies dealing with the relationship between the exchange rate and the tourism sector / Serdar Ongan & others (2017), George Agiomirgianakis & others (2015) and Serdar Ongan & others (2017), Bilal Louail & Siham Riache (2019).SI MOHAMMED Kamel & others (2015) (Si Mohammed, 2015): The main objective of this article is to analyze the relationship between tourism and the macroeconomic variables of the Algerian economy for the period 1995-2011. To this end, they used the impulse response functions (IFR) and the variance decomposition analysis (VDCS) the estimated by Vector Error Correction Model (VECM) after estimating the equilibrium relationship between the long-term variables and the causality test. The results concluded that tourism does not contribute significantly to economic growth. On the other hand, the exchange rate has a positive effect on tourism after proving a one-sided causal relationship to the exchange rate towards tourism through the Granger causality test.- George Agiomirgianakis & others (2015) (Agiomirgianakis & others, 2015): examined the effect of exchange rate volatility for Iceland on the number of tourist arrivals during the period 1990 - 2014. In their study used an econometric methodology based on cointegration theory using the model (ARDL). Overall, their results suggest that there is a negative effect of volatility in tourist arrivals in Iceland.- Serdar Ongan & others (2017) (Serdar & others, 2017): In their article (The effects of real exchange rates and income on international tourism demand for the USA from Some European Union Countries), the authors examined the effects of real exchange rates on the tourism incomes (tourist arrivals) of countries: Germany, France, United Kingdom, the Netherlands, Italy, Spain and Sweden in the United States during the period 1996-2015. After analyzing the co-integration of the panel under a cross-sectional dependence test and a current correlated effects (CCE) approach, the empirical results show that tourists going to the United States are more sensitive to changes in the real exchange rate as GDP changes. While French tourists react strongly to GDP, British tourists react strongly to the real exchange rate.- Bilal Louail & Siham Riache (2019) (Louail & Riache, 2019): in their article (The Relationship between Tourism Receipts, Real Effective Exchange Rate and Economic Growth in Algeria during the Period (1995-2017)), the authors based on the ARDL model during the period 1995-2017, so that the results of the study concluded that international tourism revenues and economic growth affect the foreign exchange rate in the short and long term.

2. Tourism, Exchange Rates: Definitions & Analytical View

Through this part, we will deal with the definition of tourism and the exchange rate and analyze some Algerian statistics related to them.

2.1. Exchange Rate

2.1.1. Definitions

The exchange rate indicates the number of foreign unit variables that can be obtained for a unit of national currency, at a given time and under given conditions. (Branciard, 1978, p. 84)The exchange rate is the value of one currency against another expressed by the amount that must be paid to acquire a foreign currency. (Dohni & Hainaut, 2004, p. 16)

2.1.2. An Analytical View of the Exchange Rate in Algeria

We will try to present some statistics related to the Algerian exchange rate in recent years.

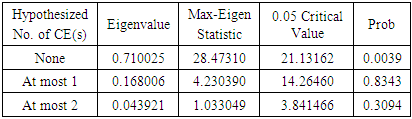

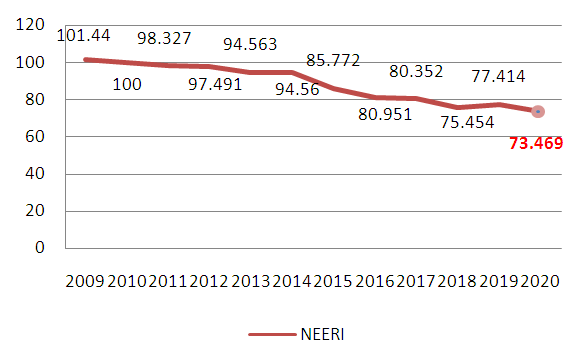

2.1.2.1. The Development of Nominal Effective Exchange Rate Index (NEERI)

Figure 1 shows the development of nominal effective exchange rate index during the period 2009-2020. | Figure 1. The development of nominal effective exchange rate index from 2009 to 2020 |

Through the above figure shown for the NEERI, we note that from 2009 to 2011 the data witnessed a slight fluctuation, then began to decline, to reach in 2020 to 73,469 and according to INS data, the index reached its highest level in 1985 at 1,591.930. And its lowest record level was in 2020.

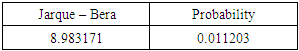

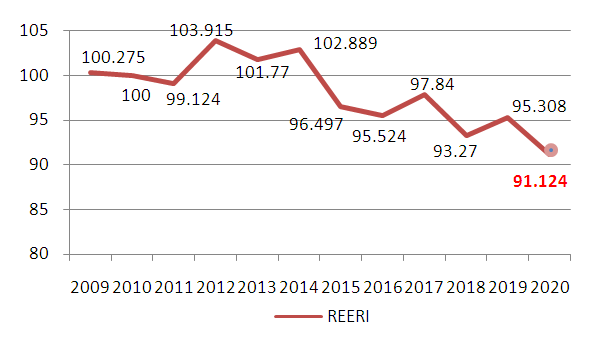

2.1.2.2. The Development of Real Effective Exchange Rate Index (REERI)

Figure 2 shows the development of real effective exchange rate index during the period 2009-2020. | Figure 2. The development of real effective exchange rate index from 2009 to 2020 |

Through the above-illustrated figure of the REERI based on the consumer price index data, we note that the index data fluctuated from 2009 to 2020, so that it achieved its lowest level in this last year with a value of 91,124.

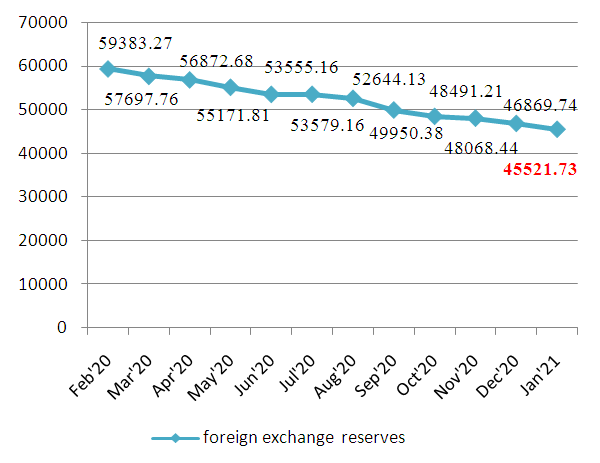

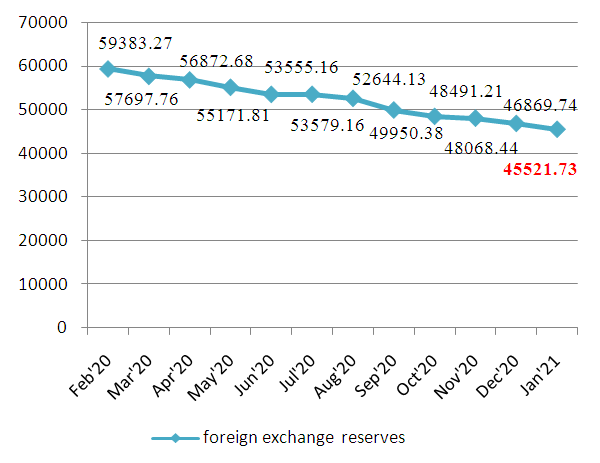

2.1.2.3. Algeria Foreign Exchange Reserves

Figure 3 shows Algeria foreign exchange reserves during the period Feb’2020-Jan 2021. | Figure 3. Algeria foreign exchange reserves from Feb’20 to Jan’21 |

Throughout figure 3, we note that the Algerian foreign exchange reserves witnessed a decline during the period February 2020 until January 2021, as it was measured at $ 45.5 billion in January 2021, compared with $ 46.9 billion in December 2020, so that the statistics showed that the highest value of foreign exchange was in April 2014 with a value of $ 193.6 billion, and the lowest measurement was in January 1971 with a value $ 69.2 million.

2.2. Tourism

Since the twentieth century, tourism has gradually established itself as an essential component of economic and social life, first in Europe and North America, then in Asia and later in other parts of the world.

2.2.1. Origin of the Word Tourism

According to Butkarat and Meddlik (1974), the word tourism appears in the English dictionary as "tour" which was generally associated with the idea of travel. (Idir, 2014, p. 365)The English invented the great educational trip called "tour" practiced by young aristocrats on the continent in order to complete their education while having fun. Then there was a series of discoveries, all British, such as the thermal season or sea bathing, the resorts and the mountains. M. Boyer (1996) considered these discoveries as a tourism revolution.Currently, tourism means traveling for pleasure. (Alhroot, 2007, p. 407)

2.2.2. Definition

The World Tourism Organization (WTO) defined tourism as travel outside the usual place of residence of an individual for more than 24 hours but less than 4 months, for professional purposes (business tourism) or a health goal (health tourism) or for leisure. Tourism includes technical, financial or cultural issues in every country or region. (Cazes, 1989, p. 07)

2.2.3. An Analytical View of the Tourism Sector in Algeria

In the last few years, the Algerian state’s interest in the tourism sector has increased through financing and preparing development plans and programs. Therefore, we will analyze the performance indicators of the tourism sector in Algeria, based on some statistics.

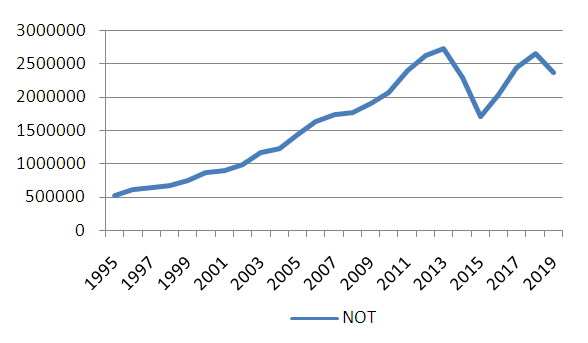

2.2.3.1. The Development of the Number of Tourists in Algeria

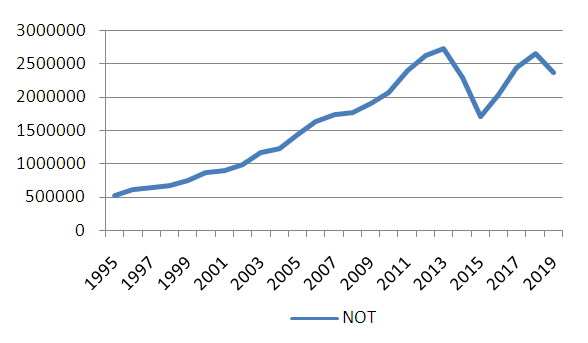

Figure 4 shows the development of the number of tourists in Algeria during the period 1995-2019. | Figure 4. The development of the number of tourists in Algeria from 1995 to 2019 |

The index of the number of tourists is one of the most important indicators on which to assess the tourism sector. Through Figure 1, we note that the number of tourists has witnessed a development from 1995 to 2019, but this growth is considered weak compared to other countries and this is due to several political and social reasons.Within the framework of international exchange, in 1989 Algeria decentralized the National Tourism Office, and some nationalized hotels were privatized and foreign companies were granted the right to operate or build new hotels in Algeria, but despite the efforts made by the Algerian state to attract the largest possible number of tourists. It is still weak in that, especially in terms of tourist sites and promotion. (Boumendjel, 2010, pp. 751-752)

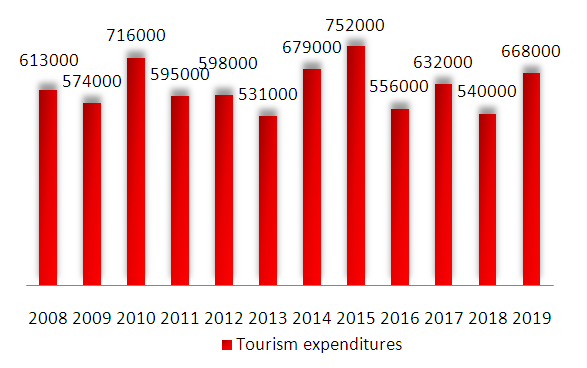

2.2.3.2. Tourism Expenditures

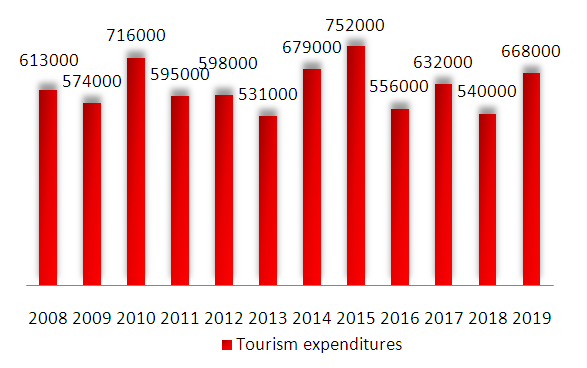

Figure 5 shows the tourism expenditures in Algeria during the period 2008-2019. | Figure 5. Tourism expenditures from 2008 to 2019 |

Through Figure 5, we note that the annual Algerian tourism expenditures have fluctuated during the period 2008 to 2019, so that expenditures amounted to $ 668,000 million in 2019 and these records an increase over the amount of expenditures of $ 540,000 million for the year 2018, so that the expenditures recorded their highest level ever at $ 762,000 million in 2015. (CEIC, 2019)

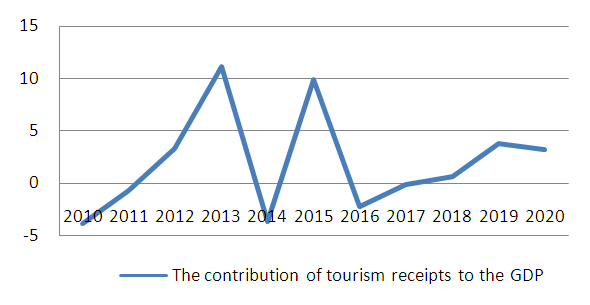

2.2.3.3. The Contribution of Tourism Revenues to the Algerian GDP

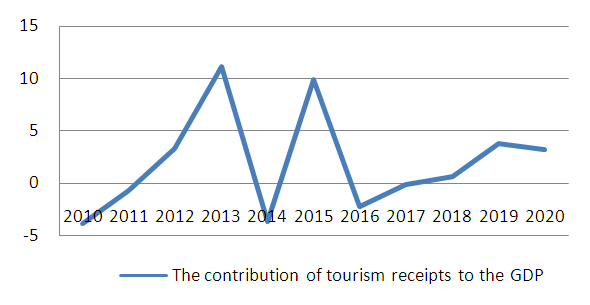

Figure 6 shows the contribution of the tourism revenues to the GDP in Algeria during the period 2010-2020. | Figure 6. The contribution of tourism revenues to the Algerian GDP from 2010 to 2020 |

Through Figure 6, we notice that the contribution of tourism incomes to the GDP is somewhat weak, and this is due to the decrease in revenues from this sector and Algeria's excessive dependence on hydrocarbons.

2.2.3.4. Algerian Tourism During the Corona virus

Given that Algeria does not depend on tourism in the first place, the tourism crisis that arises as a result of the Corona pandemic does not constitute a major problem compared to other countries. However, the Algerian airlines company recorded large losses due to the suspension of the flight since March 2020, so that it is expected to record an expected loss of $ 320 million due to the impact of COVID19, and travel agencies and hotels will be affected, which will negatively affect the purchasing power of employees working in tourism and travel agencies. (Bouarar & others, 2020, p. 330)

2.3. The Relationship between Tourism and the Exchange Rate

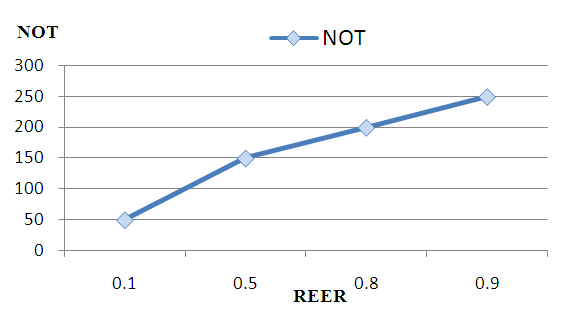

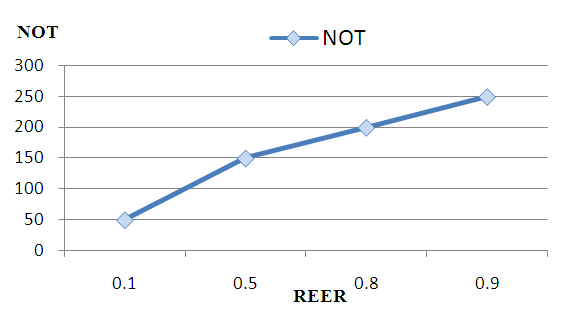

In this section, we will illustrate the relationship between tourism and the exchange rate through the curve shown below.Figure 7 shows the relation between tourism and the exchange rate, we conclude that the relation between them is positive1, that means that the exchange rate increases the number of tourists (the devaluation of the currency increases the number of tourists). | Figure 7. The relationship between tourism and the exchange rate |

3. Model and Methodology

This research paper aims to study the relationship between the tourism sector and the exchange rate for the period extending from1995 to 2019.

3.1. Definition of the Cointegration Model

"Cointegration analysis makes it possible to clearly identify the true relationship between two variables by investigating the existence of a cointegrating vector and eliminating its effect, if any." (Bourbonnais, 2015, p. 299)

3.2. Presentation of the model

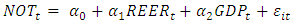

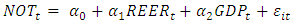

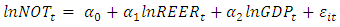

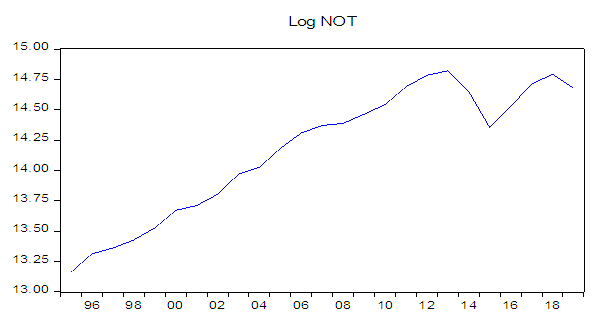

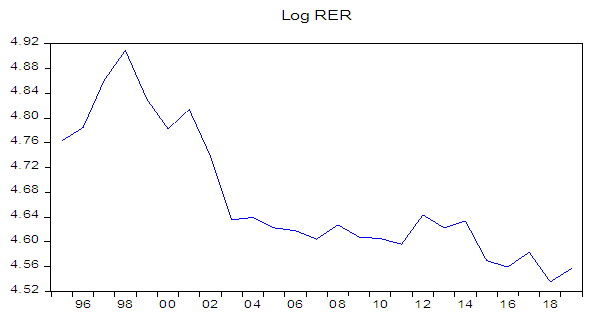

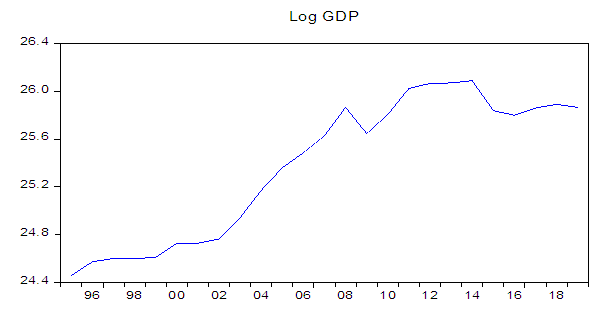

In our analysis, we used the following reduced equation: | (1) |

Equation N° 01 was used in logarithms form as follows:  With: - NOT: Number of tourists;- REER: Real effective exchange rate;- GDP: Gross domestic product.

With: - NOT: Number of tourists;- REER: Real effective exchange rate;- GDP: Gross domestic product.

3.3. Data Source

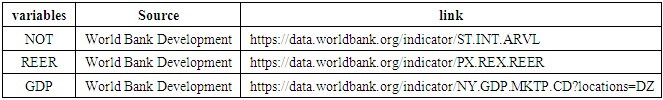

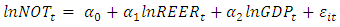

We used annual data for three macroeconomic variables for the period 1995- 2019, and the following table shows the sources of these variables:Table 1. Data Source

|

| |

|

4. Econometric Results

In this section, we will present the econometric results and their analysis.

4.1. Lag Time Periods

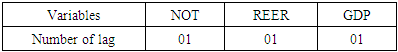

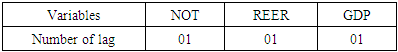

The following table shows the lag time periods according to Schwarz criterion (SC):Table 2. Number of lags in time period

|

| |

|

Through table 2 and using the Schwarz criterion, we note that the optimal lag periods are 01 for the three variables.

4.2. Stationarity and Cointegration Tests

Our approach in this chapter is to determine the impact of the exchange rate on the tourism sector in Algeria.We organized this section in four steps: stationarity tests (ADF), Johansen cointegration test, estimation of a vector error correction model (VECM), validation of the model (testing the normality of the residuals, JB test).

4.2.1. Unit root test (ADF test)

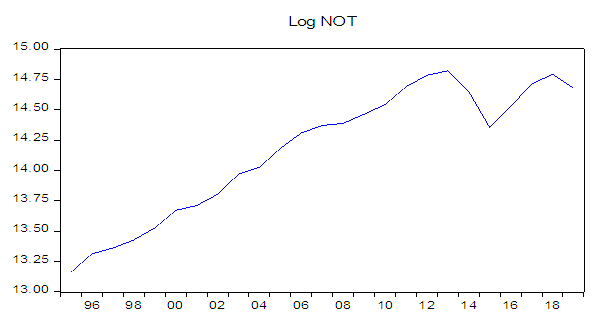

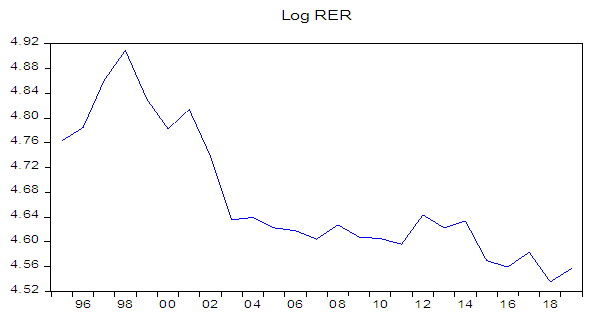

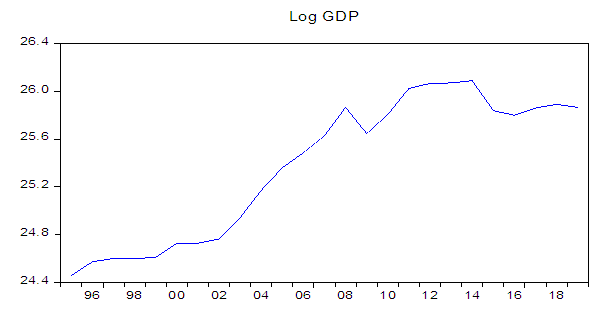

We will present the graphs which present the series of NOT, REER and GDP.According to the graphical representation of our series, we notice that there is a trend. So probably these series are not stationary, for confirmation we will apply the stationarity test (ADF test).The Augmented Dickey-Fuller (ADF) (1979, 1981) is applied to each time series and the level difference was selected continuously until the probability value presented in the level was smaller than the 5% level. (Tran & Thanh, 2020, p. 28). | Figure 8. Number of tourists |

| Figure 9. Real effective exchange rate |

| Figure 10. Gross domestic product |

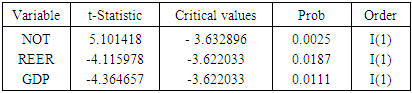

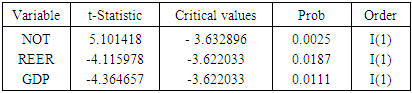

Table 3 shows the results of the ADF test, we took the model with trend and intercept:Table 3. ADF test results

|

| |

|

The result confirms that the series are all integrated of order of one (Prob < 0.05 or t-statistic > critical values) and are not stationary in level.

4.2.2. Cointegration Test

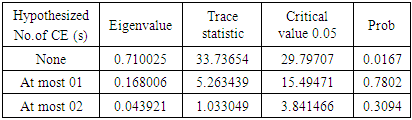

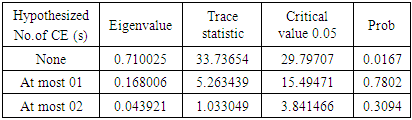

We apply the Johansen test (1988) to determine the number of cointegration vectors which are shown in Table 4:Table 4. Trace test

|

| |

|

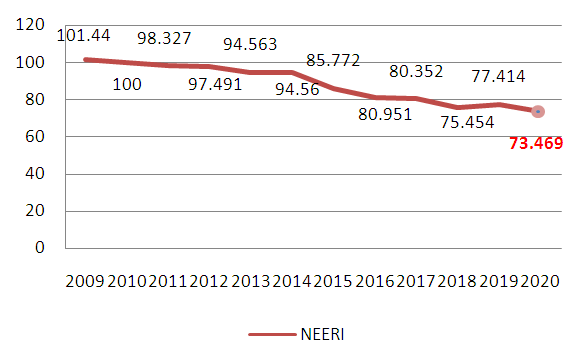

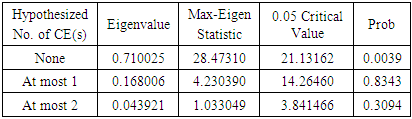

Table 5. Max-Eigen test

|

| |

|

Through The result of the Johansen test, we reject at the threshold of 5% the hypothesis null (H0: absence of cointegration relation) (33.73654 > 5.263439 for the trace and 28.47310> 4.230390 for the maximum eigenvalue).There is at least one cointegrating relationship between the variables: we reject at the threshold of 5% the H1: there are at least two cointegrating relations, (5.263439 <15.49471 for the trace and 4.230390 <14.26460 for the maximum eigenvalue). We accept the null hypothesis H0: there is at most one cointegrating relation.

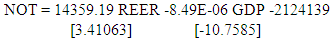

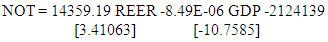

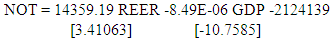

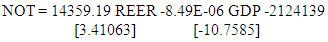

4.3. Identification of Cointegration Relationship

The equation obtained from the cointegration relationship is as follows:  The result confirmed that REER has a significant positive effect on NOT (t-student> 1.96), on the other hand GDP has a significant negative effect on NOT (t-student> 1.96).

The result confirmed that REER has a significant positive effect on NOT (t-student> 1.96), on the other hand GDP has a significant negative effect on NOT (t-student> 1.96).

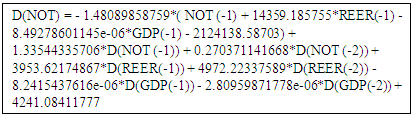

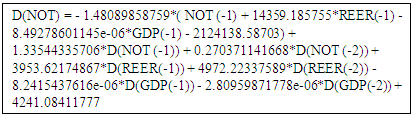

4.4. Vector Error Correction Model (VECM)

The error correction model was us to define both short-term and long-term relationship at the same time. (Maurel, 1989)Dynamic equation: Looking at the dynamic equation, we notice that the restoring force is negative -1.48. So there is an error correction mechanism, it is concluded that there is a short-term to long-term adjustment of 148% in the unit of time.

Looking at the dynamic equation, we notice that the restoring force is negative -1.48. So there is an error correction mechanism, it is concluded that there is a short-term to long-term adjustment of 148% in the unit of time.

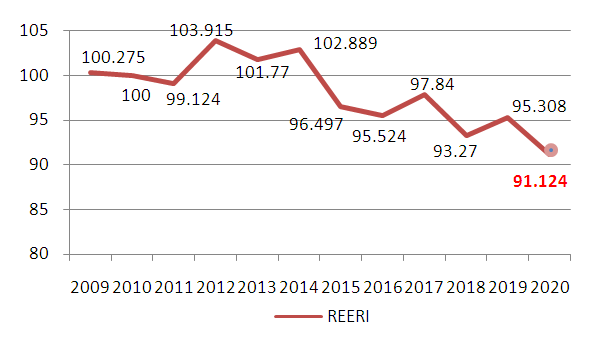

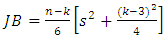

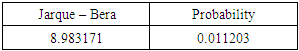

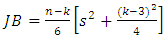

4.5. Validation of Model: Normality Test (JARQUE-BERA Test)

We will use the test of Jarque and Bera to test the normality of the residuals. Through this test, the statistical JB is compared with the critical value of 5.99, so that the null hypothesis of the normal distribution is accepted if the statistical JB is less than the critical value of 5.99, in addition to taking into account the probability and comparing it to the 5% threshold (the critical probability must be higher than 5%). (Mignon, 2002, p. 275)J-B equation can be written as follows: (Gurrati, 2004, p.149) With:n: Number of observations.k: Number of explanatory variables if the data come from the residuals of a linear regression. k = 0.s: Asymmetry coefficient of the sample tested.K: Kurtosis of the tested sample

With:n: Number of observations.k: Number of explanatory variables if the data come from the residuals of a linear regression. k = 0.s: Asymmetry coefficient of the sample tested.K: Kurtosis of the tested sampleTable 6. J-B test

|

| |

|

According to table 6 we will accept the null hypothesis of normality (the statistic of J-B is 8.98 with a probability of 1%), therefore the residues are normally distributed.

5. Conclusions

In this article, we have exposed an econometric analysis of the relationship (exchange rate-tourism) in Algeria, the objective of which is to find the impact of the exchange rate on the tourism sector.Statistically the following points can be cited:- Based on stationarity tests (ADF), all variables are stationary in the first difference I(1).- The equation obtained from the long-term cointegration relation of NBT is as follows: - All variables significantly different from zero (t-student <1.96).- Regarding the dynamic model, the coefficient associated with the force of the return is negative and significant, so there is an error correction mechanism.- To examine our two hypotheses posed previously:The effect of the REER on the NOT is positive, so the depreciation of the exchange rate encourages an increase in the NOT to Algeria. So it will have an interest of depreciation of the national currency to attract tourists since the prices of goods and services will be cheaper compared to their countries. On the other hand the result showed a negative effect of the GDP on the NOT, and can be explained by the growth in Algeria is weak in the tourism sector, this growth is generated by other sectors.Oil exports dominate a large percentage of the Algerian economy, about 98%. Given the oil crisis that Algeria witnessed in the year 1986, the government tried to rely on other sectors to boost the economy, most notably the tourism sector, so that tourism revenues contributed significantly to the increase in economic growth at that time, and this indicates that the tourism industry is an alternative to increasing the growth of the Algerian economy.The Algerian state must protect its economy from the phobia of oil depletion, as it is one of the fossil sources that are very sensitive to environmental disasters, relying on the tourism sector and showing the Algerian destination as a reference tourist destination at the international level, especially desert tourism as it occupies the fore in tourism investment due to its possession of many poles such as the pole tourist south-west of Tuat - Gourara and the tourist pole of the Great South El Hogar.

- All variables significantly different from zero (t-student <1.96).- Regarding the dynamic model, the coefficient associated with the force of the return is negative and significant, so there is an error correction mechanism.- To examine our two hypotheses posed previously:The effect of the REER on the NOT is positive, so the depreciation of the exchange rate encourages an increase in the NOT to Algeria. So it will have an interest of depreciation of the national currency to attract tourists since the prices of goods and services will be cheaper compared to their countries. On the other hand the result showed a negative effect of the GDP on the NOT, and can be explained by the growth in Algeria is weak in the tourism sector, this growth is generated by other sectors.Oil exports dominate a large percentage of the Algerian economy, about 98%. Given the oil crisis that Algeria witnessed in the year 1986, the government tried to rely on other sectors to boost the economy, most notably the tourism sector, so that tourism revenues contributed significantly to the increase in economic growth at that time, and this indicates that the tourism industry is an alternative to increasing the growth of the Algerian economy.The Algerian state must protect its economy from the phobia of oil depletion, as it is one of the fossil sources that are very sensitive to environmental disasters, relying on the tourism sector and showing the Algerian destination as a reference tourist destination at the international level, especially desert tourism as it occupies the fore in tourism investment due to its possession of many poles such as the pole tourist south-west of Tuat - Gourara and the tourist pole of the Great South El Hogar.

Note

1. The relationship is positive in the case of uncertain quotation.The relation is negative in the case of certain quotation.

References

| [1] | Agiomirgianakis, G., & others. (2015). Effects of Exchange Rate Volatility on Tourist Flows into Iceland. International Conference on Applied Economics. Elsevier B.V. |

| [2] | Alhroot, A. H. (2007). Marketing of a destination: Jordan as a case study. university of Huddersfield, Huddersfield: doctoral thesis, , Royaume-Uni, England. |

| [3] | Bouarar, A. C., & others. (2020). The impact of coronavirus on tourism sector- an analytical staudy. Journal of economics and management. |

| [4] | Boumendjel, S. (2010). The economic issue of tourism Algerian and socio-economic conditions of sustainable development in Algeria. International journal of human sciences. |

| [5] | Bourbonnais, R. (2015). Économétrie. Paris: Dunod. |

| [6] | Branciard, M. (1978). Dictionnaire économique et social. PARIS: les éditions Ouvrière. |

| [7] | Cazes, G. (1989). Le tourisme international mirage ou stratégie d'avenir. Paris: édition Hateir. |

| [8] | CEIC. (2019). Algeria Tourism Statistics. Consulté le 03 06, 2021, sur https://www.ceicdata.com/en/algeria/tourism-statistics. |

| [9] | Dohni, L., & Hainaut, C. (2004). Les taux de change: déterminants, opportunités et risques. Bruxelles: édition Deboek. |

| [10] | Idir, M. (2014). Valorisation du patrimoine, Tourisme et développement territorial en Algérie: cas des régions de Bejaia en Kabylie et de Djanet dans le Tassili N’Ajjer. France: Thèse de doctorat: Université de Grenobl. |

| [11] | Louail, B., & Riache, S. (2019). The Relationship between Tourism Receipts, Real Effective Exchange Rate and Economic Growth in Algeria during the Period (1995-2017). Management businnes economics. |

| [12] | Maurel, F. (1989). Modèles à correction d’erreur: l’apport de la théorie de cointégration. Economie et Prévision. |

| [13] | Mignon, L. (2002). Econométrie des séries temporelles macroéconomiques et financières.. Paris. |

| [14] | N. Gurrati, D. (2004). Econométrie. Paris: De Boeck. |

| [15] | Serdar, O., & others. (2017). The effects of real exchange rates and income on international tourism demand for the USA from Some European Union Countries. economies. |

| [16] | Si Mohammed, K. (2015). Tourisme, croissance et taux de change - Cas de l’Algérie: Une approche économétrique. International Journal of Innovation and Applied Studies. |

| [17] | Tran, P., & Thanh, B. (2020). Macro Variable Determinants of Exchange Rates in Vietnam. International Finance and Banking. |

With: - NOT: Number of tourists;- REER: Real effective exchange rate;- GDP: Gross domestic product.

With: - NOT: Number of tourists;- REER: Real effective exchange rate;- GDP: Gross domestic product.

The result confirmed that REER has a significant positive effect on NOT (t-student> 1.96), on the other hand GDP has a significant negative effect on NOT (t-student> 1.96).

The result confirmed that REER has a significant positive effect on NOT (t-student> 1.96), on the other hand GDP has a significant negative effect on NOT (t-student> 1.96). Looking at the dynamic equation, we notice that the restoring force is negative -1.48. So there is an error correction mechanism, it is concluded that there is a short-term to long-term adjustment of 148% in the unit of time.

Looking at the dynamic equation, we notice that the restoring force is negative -1.48. So there is an error correction mechanism, it is concluded that there is a short-term to long-term adjustment of 148% in the unit of time. With:n: Number of observations.k: Number of explanatory variables if the data come from the residuals of a linear regression. k = 0.s: Asymmetry coefficient of the sample tested.K: Kurtosis of the tested sample

With:n: Number of observations.k: Number of explanatory variables if the data come from the residuals of a linear regression. k = 0.s: Asymmetry coefficient of the sample tested.K: Kurtosis of the tested sample - All variables significantly different from zero (t-student <1.96).- Regarding the dynamic model, the coefficient associated with the force of the return is negative and significant, so there is an error correction mechanism.- To examine our two hypotheses posed previously:The effect of the REER on the NOT is positive, so the depreciation of the exchange rate encourages an increase in the NOT to Algeria. So it will have an interest of depreciation of the national currency to attract tourists since the prices of goods and services will be cheaper compared to their countries. On the other hand the result showed a negative effect of the GDP on the NOT, and can be explained by the growth in Algeria is weak in the tourism sector, this growth is generated by other sectors.Oil exports dominate a large percentage of the Algerian economy, about 98%. Given the oil crisis that Algeria witnessed in the year 1986, the government tried to rely on other sectors to boost the economy, most notably the tourism sector, so that tourism revenues contributed significantly to the increase in economic growth at that time, and this indicates that the tourism industry is an alternative to increasing the growth of the Algerian economy.The Algerian state must protect its economy from the phobia of oil depletion, as it is one of the fossil sources that are very sensitive to environmental disasters, relying on the tourism sector and showing the Algerian destination as a reference tourist destination at the international level, especially desert tourism as it occupies the fore in tourism investment due to its possession of many poles such as the pole tourist south-west of Tuat - Gourara and the tourist pole of the Great South El Hogar.

- All variables significantly different from zero (t-student <1.96).- Regarding the dynamic model, the coefficient associated with the force of the return is negative and significant, so there is an error correction mechanism.- To examine our two hypotheses posed previously:The effect of the REER on the NOT is positive, so the depreciation of the exchange rate encourages an increase in the NOT to Algeria. So it will have an interest of depreciation of the national currency to attract tourists since the prices of goods and services will be cheaper compared to their countries. On the other hand the result showed a negative effect of the GDP on the NOT, and can be explained by the growth in Algeria is weak in the tourism sector, this growth is generated by other sectors.Oil exports dominate a large percentage of the Algerian economy, about 98%. Given the oil crisis that Algeria witnessed in the year 1986, the government tried to rely on other sectors to boost the economy, most notably the tourism sector, so that tourism revenues contributed significantly to the increase in economic growth at that time, and this indicates that the tourism industry is an alternative to increasing the growth of the Algerian economy.The Algerian state must protect its economy from the phobia of oil depletion, as it is one of the fossil sources that are very sensitive to environmental disasters, relying on the tourism sector and showing the Algerian destination as a reference tourist destination at the international level, especially desert tourism as it occupies the fore in tourism investment due to its possession of many poles such as the pole tourist south-west of Tuat - Gourara and the tourist pole of the Great South El Hogar. Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML