Okhiria Adebimpe O.1, Paul Philemon W.2, Obadeyi J. A.3, Afuye Folake O.4

1Department of Hotel Management & Tourism, Elizade University, Ilara- Mokin, Nigeria

2Department of Hospitality Management, Ramat Polytechnic, Maiduguri, Nigeria

3Department of Accounting & Finance, Elizade University, Ilara –Mokin, Nigeria

4Hospitality Management Department, Federal Polytechnic, Ilaro, Nigeria

Correspondence to: Obadeyi J. A., Department of Accounting & Finance, Elizade University, Ilara –Mokin, Nigeria.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

The study examined banking sector and hospitality industry in Ondo state: issues and challenges. Hospitality industry has remained one of the exciting and rewarding industries in Ondo state, but currently faced with a challenge like unavailability of funds from the banking sector to fund the sector; while recent issue on economic recession presently experienced in the country has further hindered the performance of the sector in terms of reduced local tourists patronizing and the low profit being realized by operators. The banking sub-sector has remained the major funds provider via financial intermediary process ensuring funds availability for the development of hospitality sub-sector (i.e. casinos, hotels, boarding houses, motels, tourist camps, holiday centres, resorts, bars, cafeterias, snack bars, pubs, nightclubs etc., to owners (i.e. ether individuals, group of people or corporate organizations). It was believed that sectors like, agriculture, energy, micro, small and medium enterprises (MSMEs), oil and gas etc., enjoyed more finance assistance from banks than the hospitality industry in Ondo state, Nigeria. The primary source of data adopted was via a structured questionnaire and interview. The statistics that was adopted to estimate the parameter were mean, variance and standard deviation. Also, to determine the standard error, δ√N was adopted. A simple regression was also used to address the responses of the respondents gathered though the questionnaire in order to derive logical conclusion for the study. The result showed that the dwindling trends in the hospitality sector was a result of banks’ restrictive lending patterns by not making funds (e.g. loans) available to achieve development in the industry, unbearable cost of funds and high interest rate charged. The paper recommends that policy makers should periodically evaluate the impact of bank - related policies on the sustainability of hospitality sector and ensure that the hospitality regulatory process is simple, cost effective and consolidated with economic palliatives to proffer solutions to socio-economic challenges facing the country particularly during this period of recession.

Keywords:

Banking sector, Hospitality industry, Financial intermediation, Restaurant, Ondo state, Nigeria

Cite this paper: Okhiria Adebimpe O., Paul Philemon W., Obadeyi J. A., Afuye Folake O., Banking Sector and Hospitality Industry in Ondo State: Issues and Challenges, American Journal of Tourism Management, Vol. 5 No. 1, 2016, pp. 19-28. doi: 10.5923/j.tourism.20160501.03.

1. Introduction

The banking sector was one of the components of the financial sector mainly responsible for performing financial intermediation; that is, channelling funds from the surplus sector to the deficit sector so as to achieve economic development [7]. This is the major reason the financial sector (banks) to remain the ‘engine of growth’ to achieve sustainable development [23], in any sector of interest, such as the hospitality industry. Researchers have shown that banks have concentrated more in channelling more funds to some particular sectors at the expense of other sector(s) (e.g. hospitality industry). The hospitality sub-sector ensured the provision of services for individuals, family, group of people, organizations etc., that were away from their homes for a particular period. However, it must be noted that the patterns of rendering services either by restaurants or hotels often vary in the context of specific needs and desires of the guests regardless of the operators’ rendering activities and services [3]. Hospitality was among the oldest of the human professions, which entailed ensuring a guest, client etc., to feel welcome and comfortable [5]. It was further affirmed that it had been in practice before many professions. Well, such statement is debatable. Hospitality goes beyond hotels and restaurants, but could also mean other legalized institutions that specialise in either providing shelter or food, or better still, both services to people as long as it is away from their respective homes [2]. Countries like United Arab Emirates, South-Africa, Egypt, Kenya etc., have benefited immensely as a result of mutual understanding between the hospitality industry and the financial sector (i.e. banks) to increase revenue to central purse of the governments via their collaborations for economic development [1, 8]. It was apparent that food and shelter remained significant to the livelihood of people and sustenance to the larger society to reduce poverty [6]. For instance, Banks during seminars and conferences make use of hotels, restaurants, resorts etc., during break time, food and drinks were often served by food department of the hotels – that is, either directly or indirectly there were more to an existing association between the two sectors of interest (banking and hospitality), which is, funds availability. Despite the increasing trends of globalization, the impact of banks on funding hospitality in Nigeria particularly in Ondo state, has been worrisome even before global financial crunch in the first quarter of 2008 vis- a -vis the recent continuous decline in the global crude oil prices; thereby affecting the liquidity performance of the banks, and becoming difficult to channel funds to the hospitality industry [5, 7]. The present recession period being experienced by Nigerian economy has affected all sectors leading to the reduction of the expected profitability trends of banks and hospitality sectors and drastically reducing number of guests visiting the hotels and customers.To have considered some of the functions of banks which include; to accumulate surplus funds and make it available to deficit sectors of the economy, thereby making profits via strong lending and borrowing patterns. Therefore, the smaller the size of the financial institutions, the smaller is the returns and expenditure vice versa. Severally, banks were always directed to ensure a stable capital in order to absorb operational exposures or unexpected shocks, to achieve profit and consequently minimize risks and losses so as to achieve national economic development [23]. However, with the help of provision of finance / funds by banks (financial intermediation roles) in Ondo state, a simple hospitality business could become a conglomerate where it could specialise in the provision of food service operations in different areas such as recreation centres, sports stadiums, primary and secondary schools (e.g. free meal for primary school pupils by federal government), university campuses, either individual or group home services, convention centres etc., with liberality and good will.

2. Statement of Problem

The dwindling development of hospitality industry in Ondo state, Nigeria has been traced to the low level of capital adequacy of banks, low patronage of foreign tourists, poor funding of the industry; continuous decrease of crude oil prices; cultural and traditions differences, high proportion of portfolio of non-performing loans maintained by some banks etc. These factors and others have been considered to cause low level impact of the banking sector on the hospitality industry. It was also believed that some financial institutions were undercapitalized, thereby limiting their financial intermediary roles towards the development of the hospitality industry.Some franchised restaurant companies in Nigeria did not have purchasing cooperatives. The lack of purchasing cooperatives prevented quality maintenance and further restricted co-operatives to provide one-stop shopping for virtually all products required, in terms of packaging, supply, food products with a periodically published price lists to easy price negotiating process despite its convenience during the present globalized era. Many franchisors have failed in their responsibilities to research products (i.e. either repackaging old products or producing new products) as well as monitoring and responding to the continuous dynamism in the marketplace. Whenever a product is out due to research findings, companies are often professionally advised to develop these products in the test kitchens; and tests it for consumer acceptance with taste panels for fit; and also considering the operating system in a pilot stores. This pay is now proffering solution to the gap in terms low finance impact of banking sector on the development of hospitality by examining the relevant issues and challenges.Research QuestionThe under-listed questions required answers in the course of the study;• Can the banking sector contribute to the development of hospitality industry in Ondo state, Nigeria?• What are the challenges faced by banking sector in Ondo state, Nigeria?• What are the challenges faced by hospitality industry in Ondo state, Nigeria• What are the contemporary issues both in the banking sector and hospitality industry?Research ObjectiveThe main objective is to examine the banking sector and hospitality industry in Nigeria: issues and challenges. The specific objectives include;• To determine the contribution of banking sector to the development of hospitality industry in Ondo state, Nigeria.• To identify the challenges facing the banking sector in Ondo state, Nigeria.• To examine the challenges facing the hospitality industry in Ondo state, Nigeria.• To determine the contemporary issues in banking sector and hospitality industry in Nigeria.Research HypothesisThe following hypotheses will be tested;Ho: There are no challenges faced by the banking sector and hospitality industry in Nigeria.Ho: There is no significant contribution of the banking sector to the development of hospitality industry in Nigeria.Literature Review[15] argued that the backward movement of capital to fund development in hospitality industry remained a macro-economic problem due to the economic crisis in 2008. Since that financial year, the cost of funds have remained at a very high rate. The high cost of employee turnover was often related to recruitment and selection and training. The loss of productivity served as a determining strategy to investigate employee’s annual remuneration, depending on the employee’s productivity. [10] claimed that organizations were always unwilling to retain employees for the entire working lives, particularly due to ageing. A very large number of people did not always have sufficient time to prepare delicious and elaborate food at homes. Therefore, many people conveniently eat more food away from home or purchase prepared food to eat at home. [28] claimed in the work, ‘harnessing tourism potentials for sustainable development: case of Owu water falls in Nigeria’ that tourism was a catalyst for national development, in terms of creating employment, ensuring increase in exchange earnings etc., [28] added that to effectively achieve the development of tourism, infrastructural issues (good road network, power etc.) must be thoroughly examined and provided by government, considering the use of environmental resources and the maintenance of essential ecological processes to protect the nourished natural heritage.Banking sector in Nigeria has undergone changes to meet global standards over the years in terms of institutional and existing ownership structures. There were less than 25 banks in the banking sub-sector since the reform in 2005 [7]. The banking sub-sector over time has ultimately improved the economic efficiency in Nigeria, since the elimination of distortions, such as credit ceilings and credit rationing; therefore, in the process of financial reform and market interest rates, both played important roles in Macro-economic policy [20]. Banking reform of eleven years ago has influence on domestic expenditure, external payment and ensured equilibrium level of savings. [27] concluded in the work, developments and challenges in the hospitality and tourism sectors’ that there was high influx of foreign tourists (leisure and vacation travellers and tourists dominate arrivals); the high movement has led to increase in the cost of air-ticket, causing travellers to pay more for hotels, accommodations, transports etc. Therefore, inadequate accommodations, high cost of travelling and inability of the industry to meet global tourism standards and others, to meet the needs of the tourists may serve as a hindrance to the development of the industry.[5, 9, 23] conversely argued that equilibrium in the market for saving would occur at positive interest rate which ensured an increase in supply of domestic and foreign savings, assuming such supply was interest elastic to guarantee some reasonable level of private sector investments. Therefore, it implied that elimination of distortions in the market for financial savings would be expected to yield a vital profit in terms of achievement of a higher rate of fixed capital formation and growth of output that was hitherto impracticable. [26] in the research work, ‘introduction to hospitality’ explained that students were capable of coming-up with ideas that could proffer solutions to challenges/problems being encountered in the hospitality industry and make decisions to improve management performance via acquired skills. [26] further added that students would be able to know existing associations between a guest and a host, which could either be for a profit or non-profit. It must be noted that to meet profit purpose helped to increase the earnings of the economic agents (i.e. government, firms, and households).[25] in the work, ‘the influence of the economy on hospitality industry in Nigeria’ explained that instability in the Nigerian economy has remained major constraint to the development of hospitality industry. This may be traced to the global economic melt-down and financial crunch in early quarter of 2008. [25] further claimed that devaluation of local naira, may also be termed as a restrictions to the development of hospitality sub-sector. With the temporary economic downturn as a result of restricted credit expansion/ cash crunch, the effect may lead to low effective demand for goods and services and other recessionary factors. However, the magnitude of growth level in the number of banks competing for a limited customer-base in an environment of shrinking margins may force the banking sector to greater commitment in terms of efficiency and customer satisfaction that may invariably serve as a key for economic survival and success [6, 20]. Hospitality IndustryHospitality has remained a profession without a specific definition. Hospitality is way of providing food to either guest or stranger away from home [18]. Hospitality is defined as a principles and practices of proving food, and/or drinks and/or accommodation, to visitors, strangers, guests etc., away from home [17]. However, in a contemporary context, hospitality simply mean the existing relationship just between a guest and a host [5]. Hospitality is regarded as a doctrine of making provision in terms of food, drinks and shelter, even both to strangers and guests etc., away from home at a profit [4]. [2, 8] opined that hospitality could be referred to being kind and generous in welcoming and providing the basic needs and wants of guests, relations, strangers etc., in order to satisfy with drinks, food and above all accommodations away from home with liberality and good will. Therefore, hospitality industry is simply companies or corporate organisations that specialize in providing food and/or drink and/or accommodation to all kinds of people that are away from home with liberality and good will. Therefore with food and shelter, hospitality has successfully met the two basic needs of human society. It has further shown that the roles of hospitality industry cannot be over emphasized due to its unmeasurable importance to human existence, sustenance and survival [14].The hospitality sector has since been regarded as one of the world's largest industries, attracting over five hundred (500) million people (i.e., tourists, guests, strangers, hosts etc.), and also helped to generate at most 8 percent of global gross domestic product (GDP) [4]. Hospitality entailed the provision of services (food and drinks) to places such as motels, tourist camps, holiday centres, resorts, bars, cafeterias, snack bars, pubs, nightclubs etc., away from home with special financial assistance from banking institutions [4, 12]. Banking Sector in Nigeria[20] argued that the banking sub-sector remained one of the cardinal components of Nigerian financial system that played the financial intermediation functions. Banks were regarded as a pivot to the economic development of a nation via varied services provided. Banks significantly played major financial roles in the development of economic life of nations (i.e. Emerging Markets (EMs), Less Developed Countries – LDCs and Developed Countries – DCs). The banking system all over the world played fundamental roles in the growth and development of an economy via funds channellings and resources mobilization.Banking practice globally vary depending on the financial, economic and political structures of countries within which the banks operate. Banks played its intermediation roles via the mobilization, allocation and utilization of resources from the surplus units for economic growth and development [6, 7]. In Nigeria, resources available were generally insufficient to satisfy the development needs of the economy. The healthy performance of the banking industry over time was an indication of financial stability in any economy. The magnitude at which banks were able to extend funds to the economy for productive activities would help to promote national economic growth [20, 23].Nigerian banking system was made of the Central Bank of Nigeria (CBN) – the apex bank; though, it was not a financial intermediary but owned by the federal government. Twenty-two main stream Deposit Money Banks (DMBs) with more than 5600 branches spread across the country. In addition, there were more than 775 micro finance banks, 82 primary mortgage institutions and five developmental banks to take care of small depositors and other special interest group [22]. Before the era of Universal Banking (UB) in 2001 the DMBs were segmented into commercial and merchant banks for retail and wholesale banking business, respectively. DMBs were the major players in the money markets with growth in the bank investments portfolio exerting significant influence on performance of the economy [20].The financial intermediary functions of DMBs, often allowed banking industry to positively influence the availability of resources, thereby greatly promoting the rate of economic development in Nigeria. Banks helped to mediate between demand for credit and supply of deposit world-wide via fair and healthy competition [7].Challenges of Hospitality Industry and Banking SectorHospitality industry was one of the fastest growing sector indicating averagely one-quarter of the global services, but with several challenges. Not all hospitality businesses were for profit-making [16]. The hospitality market was characterized as a face-to-face contact with the guest [11]. The challenges include;Economic Recession: Nigerian economy has witnessed high exchange rate – US$1 = #314, interest rate (MPR) -14%, and bank assets controls resulting in low direct investment. Credit aggregates moved rather slowly, which allowed continuous pressure on the banking sub – sector and the economy at large. The effect of the recession has led to the widespread decline in the values of the asset and with stakeholders suffered large losses, (i.e. cash crunch has discouraged visitors, strangers and guests to visit restaurants, hotels, casinos, etc., thereby affecting the aggregate revenue of the hospitality organizations. The effects of recession has led to the sharp decline in guests flows and spending, restrictions in length of staying in hotels, and serious limitations; thereby directly affecting the national economic development of the country.Decrease in hotel financing: Financing was perhaps one of the oldest and the most important functions of a bank. A bank through its intermediation role was able to channel the surplus deposits of its customers as credit to the needy customers in order to earn a return. The success or failure of a bank depends on, among other things, its ability to grant recoverable credit facilities and make reasonable margins from them. Hospitality was highly diversified in terms of different businesses (i.e. restaurants, bars, cafeterias, snack bars, pubs, nightclubs) that operate under its auspices. The conditions (e.g. high interest rate charge etc.) attached to lending by Nigerian banks discourage investors. The low purchasing power and high cost of financing hotels and restaurant business have retarded the improvement expected in the sector such as high inflation rate at 17.1% and consumer price index at 17.6% [14, 21]. The overall cost of maintenance, payment of staff salary and wages vis -a-vis low customers’ patronage often discouraged major stakeholders in the hospitality industry. The banking institution may decline channelling funds to industry faced with multiple challenges due to risk and uncertainty that was prevailed in the sector. The lending banking institution must evaluate the investor i.e. borrower. The credit officer needs to assess the character of the applicant for credit. Banks have to consider integrity of the borrower; if the applicant is a company, that is, examine the integrity of its directors; and the capacity of the borrower or the sufficiency of income must be from the property (collateral) to service the debt. Surprisingly, most of the customers default in meeting the repayment plan; thereby making the banks unwilling to finance the industry.Lack of Power Supply: For several years, hospitality has remained a fulcrum to achieve income generation and to ensure poverty alleviation via mobilization and utilization of resources [2]. The low in power supply has further reduced overall turnover of the sectors. Nigeria as a nation is opportune to effectively maximize opportunities to improve lives of interested people participating in hospitality industry. The ability to make the banking sector and hospitality industry viable has been hampered by the incessant power outage. This has forced hospitality industries to relocate to other countries, where the economies remain uncertain of the future. Due to power problem, provision of meals and refreshments within the framework of institutional catering; (e.g. for hospitals, office canteens, schools, University campus etc.), have become more difficulty. Hostels, banks, casino centres, restaurants, bars etc., experience at a high cost, water and electricity consumption to sustain the services rendered to customers. It is obvious that most of the organizations in these industries suffer losses and inability to maximize returns and profitability.IssuesHospitality was an innovative strategy for the development of an economy. Hotel business outlook in Nigeria is gradually becoming strong and improving. The innovation in the hospitality industry served as the key structural feature by way of discovering new sources or alternative means of financing the lucrative business [13]. The alternative sources of funds from finance houses, discount houses, bank of industry (BOI) etc., will motivate economic agents (i.e. households, firms and governments) to engage in various socio-economic and business activities in order to achieve national economic growth and development.Despite the temporal recessive trends of the nation’s economy, people still patronize hotels, bars, casinos, restaurants, resorts as part of leisure after period of hard work and busy schedules either during holiday or non-holiday. This buttresses the facts that hospitality industry plays significant roles of providing relaxation, comfortability away from home as well as generating marginal income and revenue for individuals, companies and government –regulator at large.Hospitality has improved enormously in the area of employment generation. The unemployment rate is at 13.1% [21]. For instance, the high demand and request of food at a price away from home may require different locations for it to be purchased. The increase demand for food away from home will require its availability in terms of size of the food service industry, which attracts high number of employees; hence, this fact could also be applicable and realizable in hotel facilities, casinos, and resorts etc., thereby promoting growth in the economy.Large Buying Opportunity: Many individual(s) and corporate organizations in hospitality business always endeavour and struggle to survive from the ‘claws’ of economic downturn, despite the unfriendly environment and cash crunch challenges, but hospitality industry has remained resilient. Due to the bearish trends experienced in the stock market, investors have focused more on a lucrative sector – hospitality industry; channelled more funds to hotels, restaurants etc., with more revenue - US$23 billion generated to sustain the industry [13, 15]. Globally, Middle East and millions of investors from Asia were seriously going after the American market. While American investors were pursuing the Europe opportunities gateway for value investments in order to rapidly escape the already -heated market. The Middle-East investors are searching for potential equity opportunities in Africa [1].An increasing trend is for international banks from the Middle East and China to seek lending opportunities in more established markets such as London. Since the BREXIT, many investors rather focused on the market in Germany (i.e. Frankfurt stock exchange) to enjoy the lending opportunities from the European Union (EU) zone [14]. Many potential investors were willing and interested in investing in Africa. Many bankers, who were Africans, have decided to come back home to add more taste, value and expertise to local banks. Most of these expatriate African bankers have already realized huge potential interest in hotels’ business and investment opportunities [12].

3. Methodology

This section adopts research methods and source of data for the study. Both primary and secondary data were used in the study. Primary data was collected through the structured questionnaire to determine the responses of respondents in the study. The secondary data was collected through referencing, books, newspaper, internet etc. The questionnaire consisted of two sections; firstly, demographic of the sample; and secondly research statements in the questionnaire for the study. The questionnaire adopted five point scaled questionnaire (Likert type) consisting of relevant questions to the study. In choosing the sample frame, three (3) banks, four (4) restaurants and six (6) hotels were chosen from Akure in Ondo. The locations were adopted due to nearness of the researcher to the area. The proximity helped the researcher to gather relevant data for the study. There was one hundred and ten (110) questionnaires that were administered on some bank staff, customers of banks, travellers, hoteliers, restaurants owners etc. Only ninety-five (95) questionnaires were returned. Seven (7) questionnaires were wrongly filled and three (3) were incomplete. The purposive (non–probability) sampling method was adopted; and respondents were selected randomly. The random (probability) sampling helped to ensure an unbiased sample population, by allowing all the respondents to have equal chance of being selected and well represented. This simply implied that 86.4% were correctly filled and returned, some of the questionnaires were completed immediately, and collection of other questionnaires spanned through a period of fourteen (14) days to administer.

4. Empirical Results

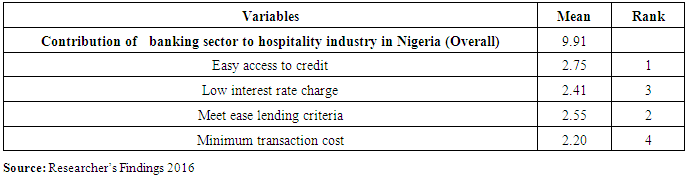

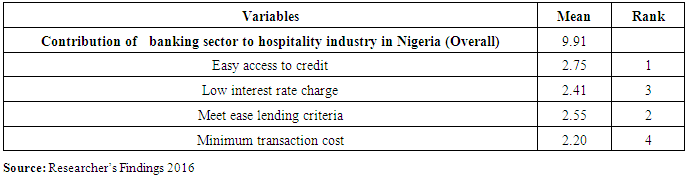

The study examined the banking sector and hospitality industry in Nigeria: issues and challenges. Descriptive statistics was adopted to analyse frequencies and percentages behaviour. Hence, ninety–five (95) respondents were simply considered. The Z- score statistics was employed in testing the hypothesis. Symbolically representation of Z0.975 – Score statistics was given as Z= X-µ/δ√N. Where Z was the Z0.975 - score value, X is sample mean, µ is the population mean and δ is the standard error of the mean. The test has adopted 95% confidence level i.e., (5%) level of significance. [19] argued that the higher the mean score, the more the respondents agreed with the statement. Testing the significance level of the z-score explained the testing of the null hypothesis (Ho) against alternative hypothesis (Hi). It must be noted that in the study, the interval was considered because the range of values within which the population parameter was thought to lie. A one –sided alternative hypothesis would be appropriate when testing the null hypothesis, that one product is better than another. The rules states that if the null hypothesis is true i.e. the zones and sample means do not lie within population means at 0.05 significant level, the null hypothesis is otherwise accepted, if not we accept the alternative hypothesis [19]. To have tested the hypothesis in Question 1 – 4, which have four (4) statements each; the results were explained thus. Table 1 below showed the mean scores of banking sector contribution to the development of hospitality industry in Nigeria. Considering the statements in the table 1, ‘easy access to credit’ (2.75), it was ranked first; ‘meet ease lending criteria,’ (2.55), it was ranked second; ‘low interest rate charge,’ (2.41) was ranked third; and ‘minimum transaction cost,’ (2.20), which was ranked fourth and overall, (9.91). Table 1. Perceptions of the banking sector’s contribution to the development of hospitality industry in Ondo state, Nigeria

|

| |

|

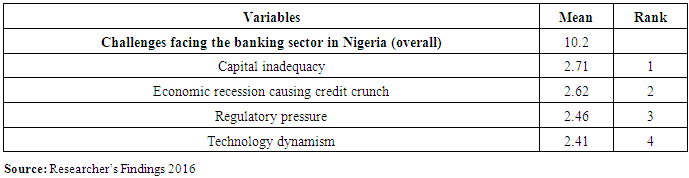

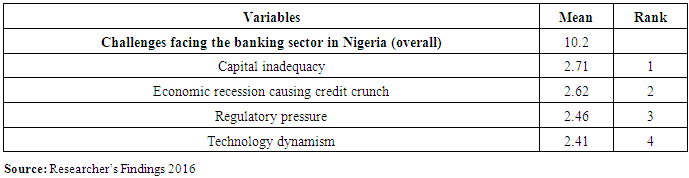

Table 2 below considered the challenges facing the banking sector in Nigeria; capital inadequacy, (2.71) was ranked first; ‘economic recession causing credit crunch,’ (2.62) was ranked second; ‘regulatory pressure,’ (2.46) was ranked third; ‘technology dynamism,’ (2.41), that was ranked fourth and ‘overall,’ (10.2). Table 2. Perceptions on the challenges facing the banking sector in Ondo state

|

| |

|

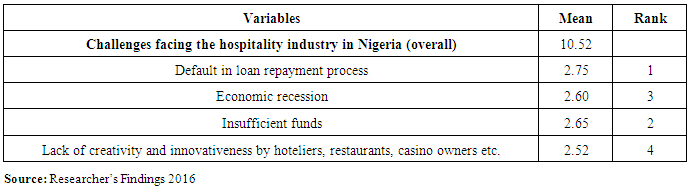

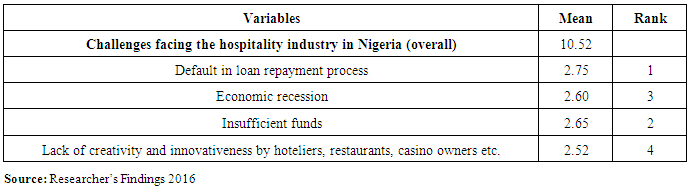

Table 3 below showed the challenges facing the hospitality industry in Nigeria; ‘default in loan repayment process,’ (2.75) was ranked first; ‘insufficient funds,’ (2.65) was ranked second; ‘economic recession,’ (2.60) was ranked third; ‘lack of creativity and innovativeness by hoteliers, restaurants, casino owners etc.,’ (2.52), that was ranked fourth and ‘overall,’ (10.52). Table 3. Perceptions on the challenges facing the hospitality industry in Ondo state

|

| |

|

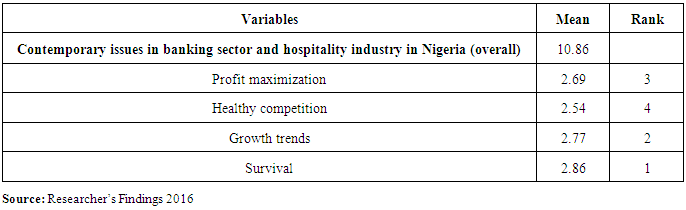

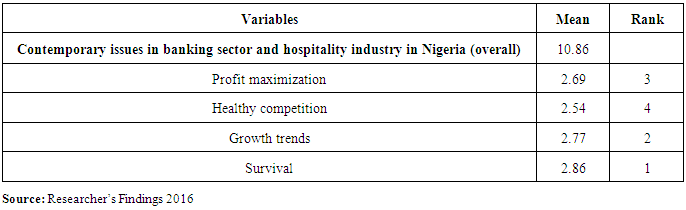

Table 4 below depicted the contemporary issues in banking sector and hospitality industry in Nigeria; ‘survival,’ (2.86) was ranked first; ‘growth trends,’ (2.77) was ranked second; ‘profit maximization,’ (2.69) was ranked third; ‘healthy competition,’ (2.54), that was ranked fourth and ‘overall,’ (10.86). Table 4. Perceptions on contemporary issues in banking sector and hospitality industry in Nigeria

|

| |

|

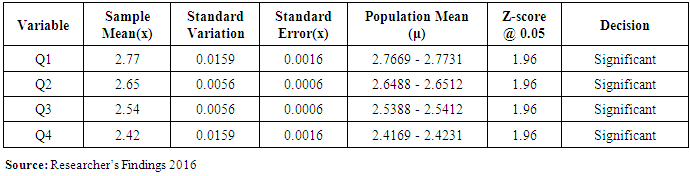

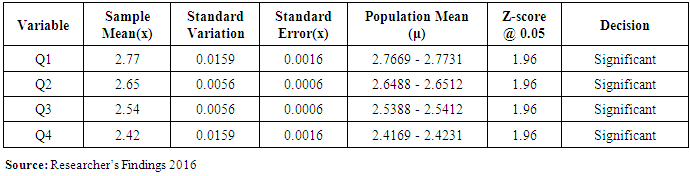

Table 5 revealed that Q1 shows that sample mean equals 2.77, standard deviation equals 0.0159, standard error of the mean equals 0.0016 and population mean ranges from 2.7669 to 2.7731, the z-score @ 1.96, the relationship between variables was significant. Also Q2 revealed that sample means equals 2.65, Standard deviation equals 0.0056, Standard error of the Mean equals 0.0006, population mean ranges from 2.6488 to 2.6512, Z-score @ 1.96 and the existing relationship between variables was significant. Table 5. Mean score, Standard Deviation, Z- Score and the Significance of the Variables

|

| |

|

Q3 revealed that sample means equals 2.54, Standard deviation equals 0.0056, Standard error of the Mean equals 0.0006, population mean ranges from 2.5388 to 2.5412, Z-score @ 1.96 and the existing relationship between variables was significant between the variables; and Q4 revealed that sample means equals 2.42, Standard deviation equals 0.0159, Standard error of the Mean equals 0.0016, population mean ranges from 2.4169 to 2.4231, Z-score @ 1.96 and the existing relationship between variables was significant. It must however be understood that there is a significant contribution of the banking sector to the development of hospitality industry in Nigeria; but faced with varied challenges. Rejecting the null hypothesis further provided the basis to examine the contributions of banking sector to the development of hospitality industry.Y is a dependent variable, which is a function of independent variable, X and η is stochastic variable/ an error term as stated in equation 1 below. The model below is adopted for the simple regression analysis as stated thus: | (1) |

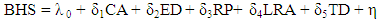

| (2) |

WhereBHS = Banking and Hospitality Sectors; CA = Capital adequacy; ED = Economic developmentλ0 = Intercept; RP = Regulatory policy; LRA= Loan repayment abilityδ1, δ2, & δ3, = coefficients; TD = Technological dynamismη = an error termEquation 2 above shall test the impact of each of the explanatory variables (CA, ED, RP, LRA and TD) on BHS in Ondo state. | (3) |

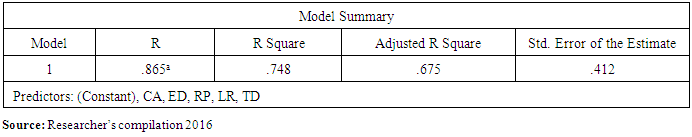

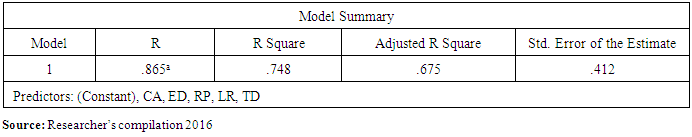

From table 6 below, the value of R Square (0.748, measuring goodness of fit) is high and it shows that the regression model is fit. The adjusted R Square (0.675) indicates that the model; capital adequacy, economic development, regulatory policy, loan repayment, and technological dynamism explain 67.5% of the variation of issues and challenges facing both banking and hospitality industries in Ondo state.Table 6. Regression Analysis

|

| |

|

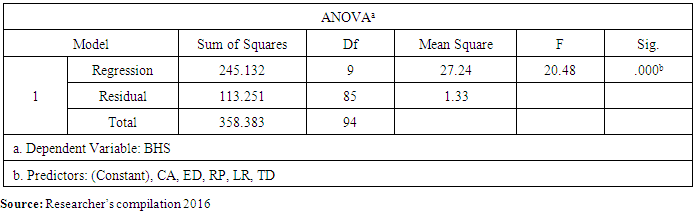

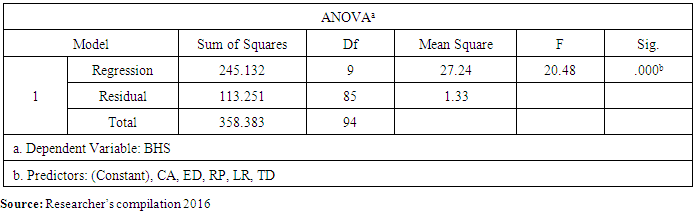

To assess the statistical significance of the results of the R Square explained the above table. It is necessary to look in the above ANOVA table. From the table 7, the F-Statistics (20.48) is high and the P-value (0.000) is less than 0.05 which all together indicates that overall impact of the independent variables on the dependent variable is significant.Table 7. ANOVA Result

|

| |

|

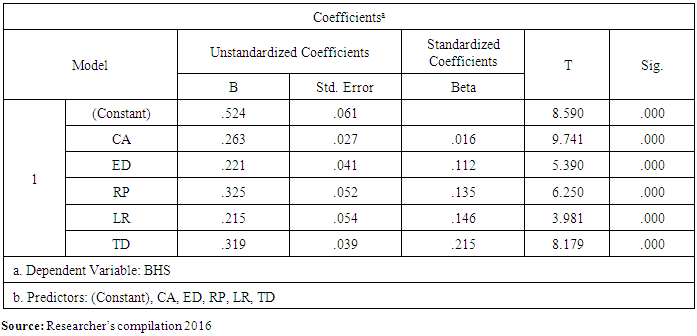

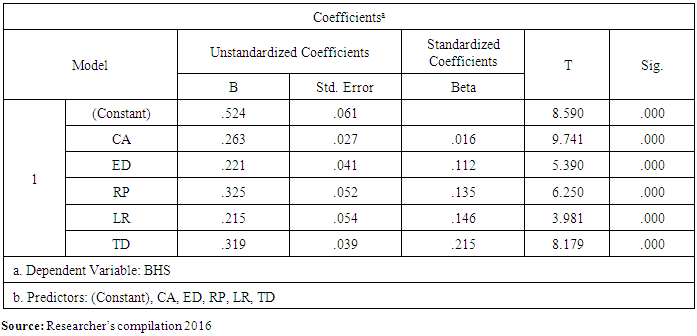

The table 8 below shows the magnitude of the impact of each of the explanatory variables on the dependent variable. Looking at the column titled “Beta” in the table, the Beta coefficient value for capital adequacy, economic development, regulatory policy, loan repay ability and technological dynamism are 0.263, 0.221, 0.325, 0.215 and 0.319 respectively. Table 8. Coefficient Result

|

| |

|

All the coefficients of explanatory variables are positive i.e. > 0. This conforms to a priori expectation of a positive relationship between the dependent and explanatory variable as shown in equation 3.From table 8, the coefficient of CA is statistically significant even at 1 per cent level of significance. This is because the t-statistic for the coefficient of CA is 9.741 i.e. high and the probability of error is 0.000. The coefficient of ED is statistically significant at 1 per cent level of significance. This is because the t-statistic for the coefficient of ED is 5.3950 i.e. high and the probability of error is 0.000. Also, the coefficient of RP is statistically significant at 1 per cent level of significance. This is because the t-statistic is 6.250 i.e. high and the probability of error is 0.000 i.e. very low. The coefficient of LRA is statistically significant even at 1 per cent level of significance. This is because the t-statistic for the coefficient of LRA is 3.981 i.e. high and the probability of error is 0.000., and the coefficient of TD is statistically significant at 1 per cent level of significance. This is because the t-statistic for the coefficient of TD is 8.179 i.e. high and the probability of error is 0.000. The overall statistic is significant at 1 per cent level of significance; since F-statistic of 20.48 is very high and the associated probability of error 0.000 is very low as shown in table 7.

5. Findings

• Capital adequacy is one of the major needs and requirements of the banking sector in order to meet the financial challenges faced in the hospitality sub-sector. • Economic recession presently being faced for the short period has also affected the performance of the banking and hospitality sectors in order to achieve economic development.• The challenges (i.e. reduced hotel funding/financing, lack of power etc.) are business and economic constraints that require both federal and state governments’ immediate intervention, which requires conducive environment for tourism and hospitality to thrive.• Both banking and hospitality sub-sectors are ‘engines’ to achieve sustainable development in Ondo state.• Hospitality sub-sector could further reduce aggregate unemployment rate in Ondo state.• High interest rate charged by banks, high cost of funds, etc., will continue to hinder easy access to funds/loans; to hoteliers and other investors in the hospitality sub-sector; in Ondo state.

6. Conclusions

The study examined banking sector and hospitality Industry in Ondo State: issues and challenges. The paper concludes that both hospitality industry and banking sector were faced with different challenges (default in loan repayment process, economic recession etc.); regulatory pressure and capital inadequacy respectively. The study further reveals that banking and hospitality industries stimulate investment and economic development in Ondo state, Nigeria. The study recommends that government in all levels should create employment opportunities in hospitality industry and also ensure the reviewing of old and existing policies to meet the modern- global standards in hospitality industry. Finally, Central Bank of Nigeria (CBN) should reduce monetary policy rate (MPR) from 14% to a single digit to reduce cost of borrowing to ease available funds for the development of the hospitality industry in Nigeria.

References

| [1] | Ateljevic, J., and Doorne, S. 2004, Diseconomies of scale: A study of development of constraints in small tourism firms in central New Zealand. Tourism and Hospitality Research, 5 (1), 6-8. |

| [2] | A. Gilbert., Principles and Practice of Hospitality, Edinburgh: Pearson Educational Ltd, 2014. |

| [3] | Hunt, R., 2013, Impact of hospitality on the development of less developed countries. Journal of Hotel Management, 3(2), 116 -210. |

| [4] | Hawkins, D., and Mann, S., 2007, The World’s Bank role in tourism developments. Annals of Tourism Research, 34(2), 349 -352. |

| [5] | Abiodun, B., 2002, The Nigerian tourism sector: Economic contribution, constraints and opportunities. Journal of Hospitality Financial Management, 10(1), 72 -78. |

| [6] | Okhiria, A.O., and Obadeyi, J. A., 2015, Terrorism, a global phenomenon threat to banking and tourism sectors in Nigeria: A True Story. European International Journal of Science and Humanities, 1(5), 35- 42. |

| [7] | Obadeyi, J. A., 2015, Microfinance banking and development of small business in emerging economy: Nigerian Approach. Journal of Economics and Finance, 6(2), 50- 60. |

| [8] | B.W., Clayton, P. Tom., and R. Dennis. Introduction to Management in the Hospitality Industry, 13th ed. New Jersey: John Wiley & Sons Inc., 2012. |

| [9] | H.L. Christopher., Services Marketing. New Jersey: Prentice Hall, 2001. |

| [10] | Christopher, J.N., 2013, Creating opportunities for youth in hospitality. International youth foundation. Hilton World Wide. |

| [11] | S. Hinds –Smith, Contemporary requirements of managers in hotels in Jamaica: The implication of soft skills. Rochester Institute of Technology, Master’s Thesis, 2009. |

| [12] | Bohdanowicz, P., and Zientara, P. 2008, Hotel companies’ contribution to improving the quality of life of local communities and the well –being of their employees. Tourism and Hospitality Research, 9(2), 150-154. |

| [13] | Martinez- Ros, E., and Orfila-Sintes, O. 2012, Training plans, manager’s characteristics and innovation in the accommodation industry. International Journal of Hospitality Management. |

| [14] | Barron, P., 2008, Education and talents management: Implications for the hospitality industry. International Journal of Contemporary Hospitality Management, 20(7), 733 -739. |

| [15] | Davidson, G.C., Mcphail, R., and Barry, S., 2011, Hospitality HRM: Past, present and future. International Journal of Contemporary Hospitality Management, 23 (4), 499 -511. |

| [16] | Olokesusi, F., 1990, An assessment of hotels in Abeoukuta, Nigeria and its implications for tourists. International Journal of Hospitality Management, 9(2), 126-130. |

| [17] | Salami, P., 2013, Hospitality Industry in Nigeria. Journal of Hospitality and Management Sciences, 3(6), 281 -289. |

| [18] | R. Agbalaka., 2015, Introduction to Hospitality Management in Nigeria. Ikeja: Nemit Publishing Ltd. |

| [19] | H. Charles., and P. Corrie, Understanding basic statistics, 5th ed., California: Brooks / Cole Centage Learning, 2010. |

| [20] | Lamido, S., 2011, We are making the banks safer. Publication of the Federal Ministry of Information and Communications on Open Government. 1 (1), 8 – 9, August. |

| [21] | CBN, 2016, Central bank monetary policy committee (MPC) meeting, held on Monday, September 19th and Tuesday, 20th, Abuja, Nigeria. |

| [22] | CBN, 2009, Central bank monetary policy committee; CBN communique No. 89 of the monetary policy committee (MPC) Meeting, held on Monday, May 20th and Tuesday, 21st, Abuja, Nigeria. |

| [23] | M. Kent., and T. John., The economics of banking, 2nd ed. Australia: John Wiley & Sons Ltd., 2008. |

| [24] | W.B. Clayton., P. Tom., and R. Dennis., Introduction to management in the hospitality industry, 10th ed. UK: John Wiley & Sons Inc. |

| [25] | Sanni, M.R. 2009. The influence of the economy on hospitality industry in Nigeria. Ethiopian Journal of Environmental Studies and Management, 2(1), 29-32. |

| [26] | M. Murray., C. Benny., and T. Tony., Introduction to hospitality –Manual on Mode II. Hong Kong Polytechnic University, Education Bureau, Wan Chai, Hong Kong, 2009. |

| [27] | International Labour Organization (ILO), 2010. Developments and challenges in the hospitality and tourism sector. Issue Paper for Discussion at the Global Forum for Hotels, Catering, Tourism Sector, 23 -24, November, Geneva. |

| [28] | Tunde, A.M., 2012. Harnessing tourism potentials for sustainable development: A case of Owu Water Falls in Nigeria. Journal of sustainable Development in Africa, 14(1), 119 -126. |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML