-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Textile Science

p-ISSN: 2325-0119 e-ISSN: 2325-0100

2022; 11(2): 27-36

doi:10.5923/j.textile.20221102.02

Received: Oct. 22, 2022; Accepted: Nov. 12, 2022; Published: Nov. 24, 2022

Covid-19 and Post Covid-19 Impact on Knit and Woven Ready-Made Garment Industry of Bangladesh

Nadvi Mamun Pritha , Mayesha Maliha , Sushama Saha Swati , Nusrath Jahan Khanam , Tanzima Zoha Chowdhury

Department of Textile Engineering, Primeasia University, Dhaka, Bangladesh

Correspondence to: Mayesha Maliha , Department of Textile Engineering, Primeasia University, Dhaka, Bangladesh.

| Email: |  |

Copyright © 2022 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The Covid-19 pandemic is the deadliest in recorded history and has altered the economic landscape of numerous nations. Bangladesh, the world's second-largest exporter of ready-to-wear clothing, saw its fiscal GDP fall 2.7% between FY 2019 and FY 2020. This analytical study intends to investigate the effect of Covid-19 on Bangladesh's knit and weaved industries using primary and secondary data gathered from various sources. This study discovered that the export tendency would likely increase if the pandemic didn't happen. The woven business has been more severely impacted than the knit industry by the pandemic's destructive effects. It took woven industries longer than knit businesses to get back to their pre-Covid-19 export growth rates, even in the post-Covid-19 era. Additionally, this pandemic disrupted the textile supply chain and raised the cost of cotton yarn. This study also sheds light on the shifting global market share of ready-to-wear textiles.

Keywords: Covid-19, Export, Knit, Woven, Ready-made garments (RMG), Market share

Cite this paper: Nadvi Mamun Pritha , Mayesha Maliha , Sushama Saha Swati , Nusrath Jahan Khanam , Tanzima Zoha Chowdhury , Covid-19 and Post Covid-19 Impact on Knit and Woven Ready-Made Garment Industry of Bangladesh, International Journal of Textile Science, Vol. 11 No. 2, 2022, pp. 27-36. doi: 10.5923/j.textile.20221102.02.

Article Outline

1. Introduction

- Bangladesh is categorized as one of the least developed countries in the world [1]. The leading contributor to Bangladesh's economy is the apparel sector. In 2019-2020 Bangladesh exported RMG products of 27949.19 million USD, which was 83% of total export earnings [2]. This ready-made clothing industry supports about 20 million people directly or indirectly [3]. Reaz Garments began exporting woven shirts in July 1978 with the assistance of the Trading Corporation of Bangladesh (TCB), which marked the beginning of the exportation of ready-made clothing [4]. Bangladesh gradually increased its textile export diversification, and today it is exporting a more comprehensive range of textiles. In 2010, Bangladesh earned the distinction of being the second-largest exporter of RMGs worldwide [5]. However, in 2020, Bangladesh lost its position as the second-largest apparel exporter to Vietnam when it earned 27.47 billion USD, whereas Vietnam earned 29.80 billion USD from RMG export [6]. This sudden change happened because of an unexpected pandemic called Covid-19, which has shaken the whole world. The first coronavirus case was discovered in Bangladesh on March 8th, 2020, and it gradually spread throughout the country, killing over 29 thousand people [7]. Bangladesh's economic system was completely destroyed by this pandemic, notably the RMG industry [8]. Many shipments have been delayed or canceled, and 2.20 million garment workers have been impacted by this pandemic, according to BGMEA sources. [9]. After passing a hard time, Bangladesh regained its glory again in 2021. By exporting 35.81 billion USD, 3.06 billion USD more than its rival Vietnam, it rose to the position of second-highest RMG exporter [6]. In this period, knitwear products export rose from 14.22 billion USD to 19.59 billion USD, and woven wear products export rose from 13.24 billion USD to 16.21 billion USD [2].This study primarily investigates and analyzes the impact of Covid-19 on the knit and woven garments export business of Bangladesh. It also intends to find out the causes of different impacts of Covid-19 in diverse sectors of the garments industry, i.e. knit and woven.

2. Background

- Bangladesh's RMG sector has played a significant part in the country's rapid economic expansion in recent decades. It plays a vital role in generating most of the country's export revenues [10]. The unprecedented Covid-19 outbreak severely impacted this industry, costing 6 billion USD in damages as orders from overseas purchasers were turned down [11]. Covid-19 is a new transmittable disease caused by a new strain of coronavirus which was announced as the “2019 novel coronavirus” by the WHO (World Health Organization) on December 31, 2019 [12]. It was deemed a worldwide health emergency by WHO on January 30, 2020 [13]. In late 2019, China became the first country to battle this dangerous disease [14]. This pandemic sickness has impacted the global economy as a whole [15]. According to a report, the requirement for services has been reduced by 35%-65% for some companies, even down to zero during the pandemic [16]. Bangladesh’s remittances decreased by 18% between April and May 2020 [17]. The apparel industry is the most affected area among the pretentious economic sectors of Bangladesh. Two reasons are liable for the devastating impact on the RMG sector of Bangladesh. China serves as a major export hub for textile raw materials and other related accessories, which plays a noteworthy role in the overall production process of the Bangladesh RMG business [18]. China is the source of one-third of Bangladesh's textile-related machinery, components, and other accessories, as well as nearly half of its raw material imports [19]. Due to the shutdown of China, Bangladeshi industries faced a severe crisis in raw material supply, and as a result, these factories were unable to continue their production process [20]. The second factor is explicable by the widespread dissemination of the coronavirus throughout the world [21]. Because of the global proliferation of Covid-19, most renowned retail brand shops had to halt operations and go into lockdown. As a result, they have cancelled the orders and consequently stopped ordering, impacting the economy in the long run [18]. According to a report released on March 27, 2020, 316 Bangladeshi suppliers encountered a severe scenario during the pandemic [22]. They said that approximately 93% of apparel producers in Bangladesh faced a delay during raw material shipments [23]. Through the end of March 2020, 650 million garment orders were cancelled, and 1.5 billion USD worth of RMG exports were put on hold in Bangladesh. Around 738 factories and 1.42 million jobs were influenced by Covid-19 [22]. The industrial closures have left the workers in a precarious situation. A recent survey found that 23.4 percent of suppliers had cancelled "most" orders, while 22.3 percent claimed they had cancelled a sizable chunk of current orders. According to the study, 5.9% of suppliers said that they had completed all of their in-process orders. As a result, the long-term viability of RMG manufacturing appears to be dismal [24]. The garment products can be roughly separated into two categories based on the sort of clothing they are: woven goods and knitwear items. Knitwear apparel includes T-shirts, polo shirts, sweaters, pants, joggers, and shorts, while woven clothing includes formal shirts, pants, suits, denim, and jeans [25]. In 1980, the primary woven exports were shirts and pants, which accounted for over 90% of the industry's output. After that, the production of knit dresses began steadily, reaching parity with woven garments in terms of their proportion to overall exports. However, since the previous ten years, the situation has altered. The EPB data show that knitted apparel now accounts for a larger proportion of the nation's overall exports than woven clothing [26]. According to the BGMEA data in 2021, the ready-made garment (RMG) sector earned $35811.87 million, where the share of woven products was 45.28 %, and knit products were 54.21%. The ratio of woven clothing was 48.28%, and the ratio of knit clothing was 51.79% of the $27470.73 million in export revenues in 2020. The Ready-Made garment (RMG) sectors earned $33072.38 million in 2019, where the share of woven wear fetched 50.28%, and knitwear fetched 49.71% [2]. As per data, it is seen that the percent change woven and knitwear in a drastic manner.

3. Data and Methodology

3.1. Field Data Collection

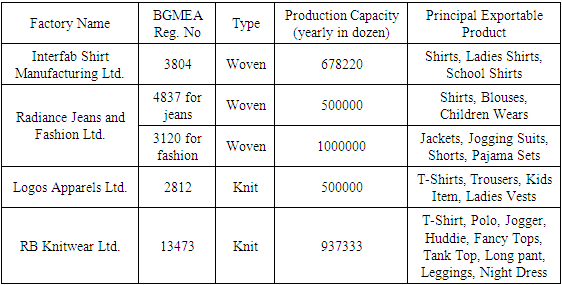

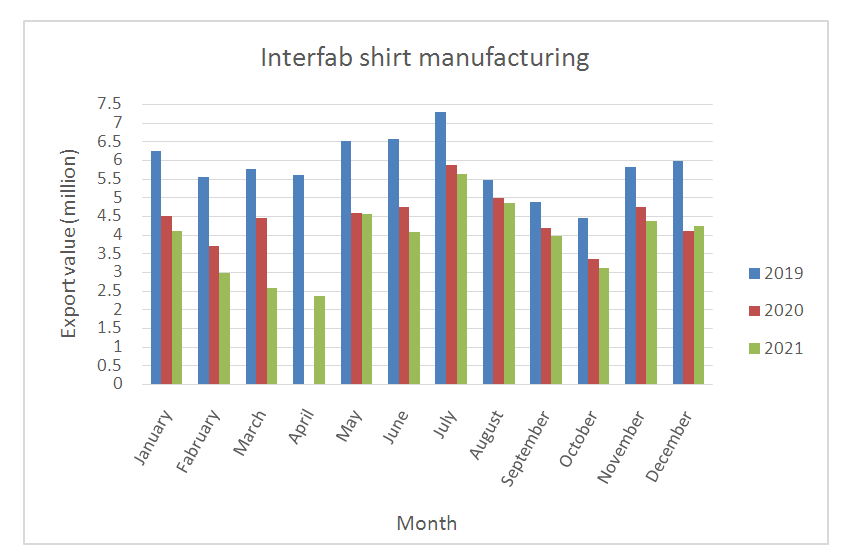

- This essay serves as both an explanation and a description using information from various primary and secondary sources. A survey was conducted on two woven and two knit industries, which are shown in Table 1 as primary data. Both qualitative and quantitative methodologies have been used for data collection and analysis. Secondary data were gathered from numerous publications and journals published by national and international organizations. Some statistical tables and graphs are employed to present and analyze the required data.

|

4. Results and Discussion

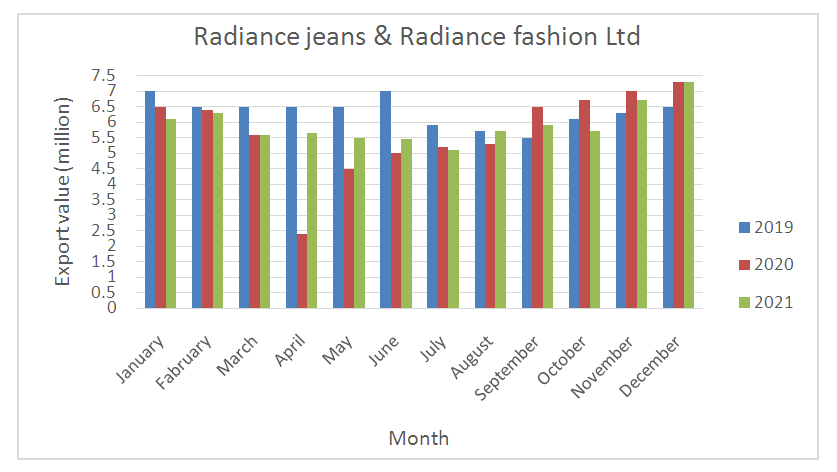

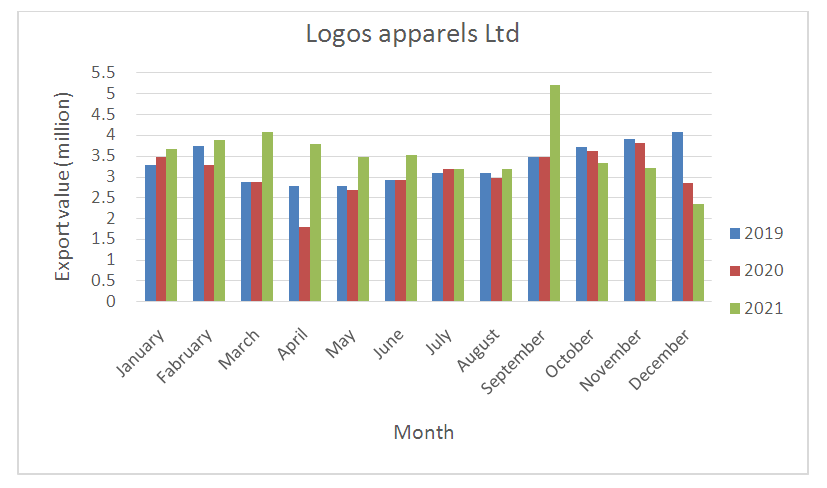

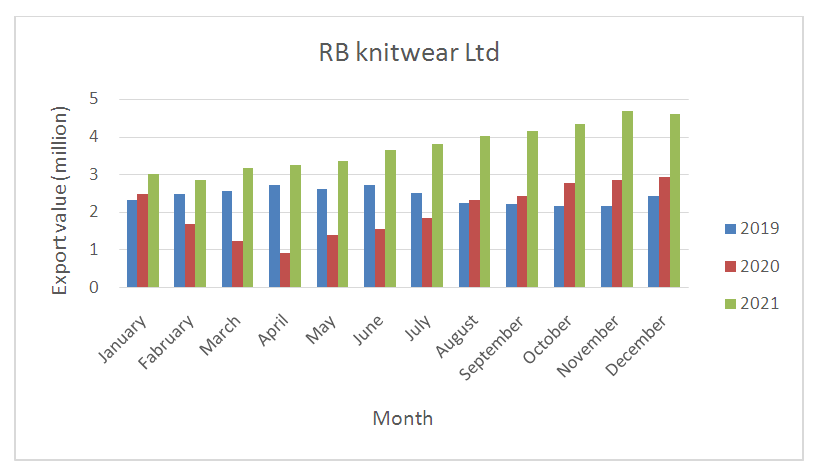

- Interfab Shirt Manufacturing, Radiance Jeans & Radiance Fashion Ltd, Logos Apparels Ltd and RB Knitwear Ltd.'s month-by-month and year-by-year export data are shown in Table 2 for 2019, 2020, and 2021, respectively. Among them, Interfab Shirt Manufacturing and Radiance Jeans & Radiance Fashion Ltd show the data for woven export, and Logos Apparels Ltd and RB Knitwear Ltd indicate the data for knit export.

|

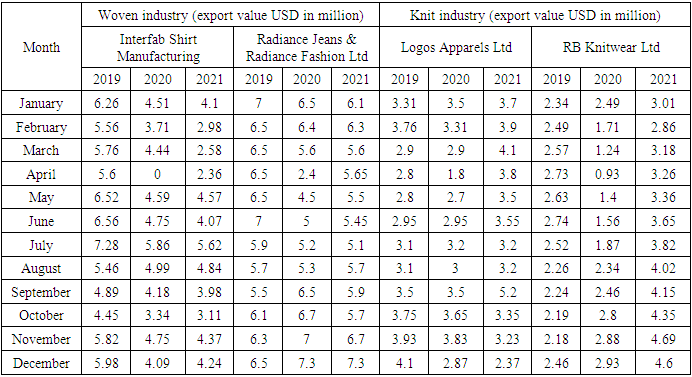

4.1. Study on Woven Export

- The export value of Interfab Shirt Manufacturing from 2019 to 2021 is depicted in Figure 1 as USD million. The data demonstrated that the export rate significantly changed between 2019 and 2021. Every year, it appears that the typical distribution curve peaks in July. The export value of Interfab Shirt Manufacturing was adequate and largely grown in the first half of 2019. After August 2019, the export value began to decline, but the export flow over the subsequent two months returned to a respectable level. The export scenario again moved to a lesser scale at the start of 2020. Since they did not export a sizable amount in April 2020 due to shutdown and order cancellation, the export rate was worse. Following April, the export value changed during the year. As a result, export in 2020 was 49.21 million USD which was 20.93 million USD less than in 2019. Post Covid-19 impact was also seen in export value in 2021, and the total export was 23.32 million USD less than in 2019. However, the export growth rate in December 2021 improved by 3.66% compared to the same month the previous year, which is encouraging for this sector. Due to the shutdown of the Covid-19 pandemic situation, the lowest export value was discovered in April 2020, and the maximum export value was discovered in July 2019 before the pandemic crisis occurred.

| Figure 1. Export value (in million USD) of Interfab Shirt Manufacturing from 2019-2021 |

| Figure 2. Export value (in million USD) of Radiance Jeans & Radiance Fashion Ltd from 2019-2021 |

4.2. Study on Knit Export

- Figure 3 reflects the export value in USD millions of Logos Apparels Ltd from 2019 to 2021. Figure 3 shows that among the corresponding months of 2019 and 2020, September had the most excellent month-by-month export value for Logos Apparels Ltd. in 2021.n 2020, the Covid-19 effect will be apparent in the declining export value. Only 1.8 million USD worth of exports were made in April 2020, which is a million USD less than in the same month the previous year. Its export value has fluctuated during the rest of 2020 due to shutdowns and order cancellations. Logos apparel exported 37.21 million USD in the year 2020, with a declining growth rate of 6.97% than the prior year. For Logos clothing Ltd, the post-pandemic effect was beneficial. In 2020, the company's growth rate was 15.82%, with exports totalling 43.1 million USD, an increase of 3.1 million USD from 2019. The export value peaked in September 2021 as orders increased, and it reached its lowest point in April 2020 due to the pandemic scenario.

| Figure 3. Export value (in million USD) of Logos Apparels Ltd from 2019-2021 |

| Figure 4. Export value (in million USD) of RB knitwear Ltd from 2019-2021 |

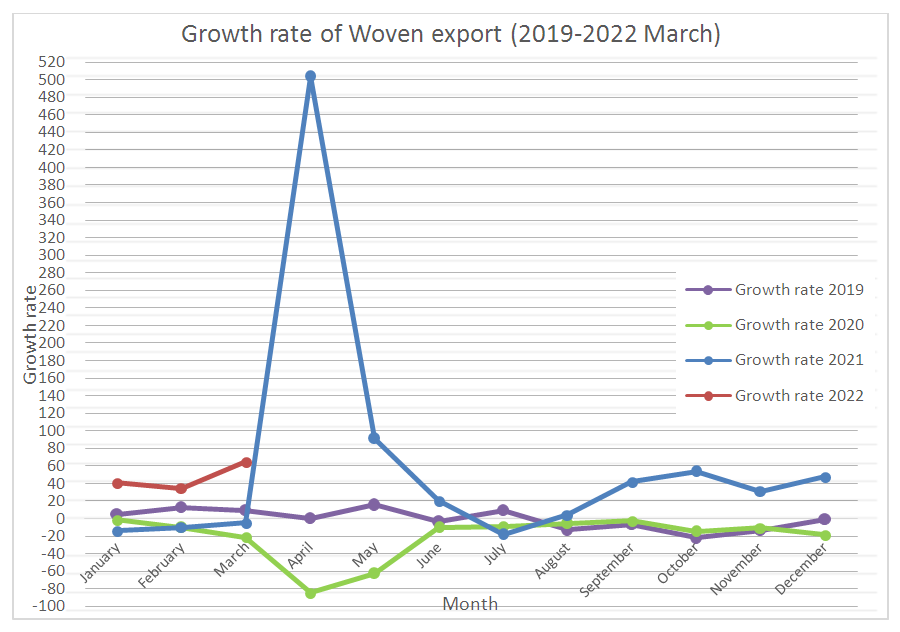

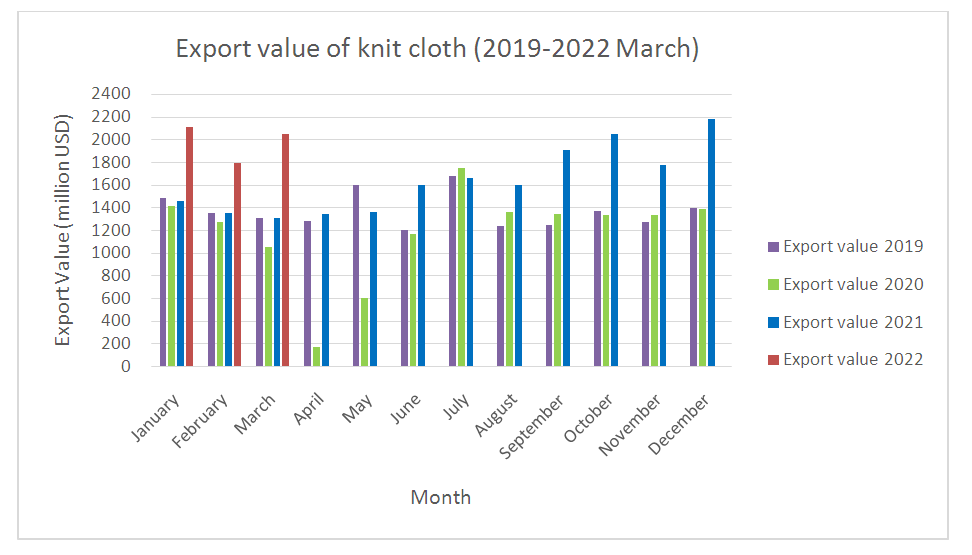

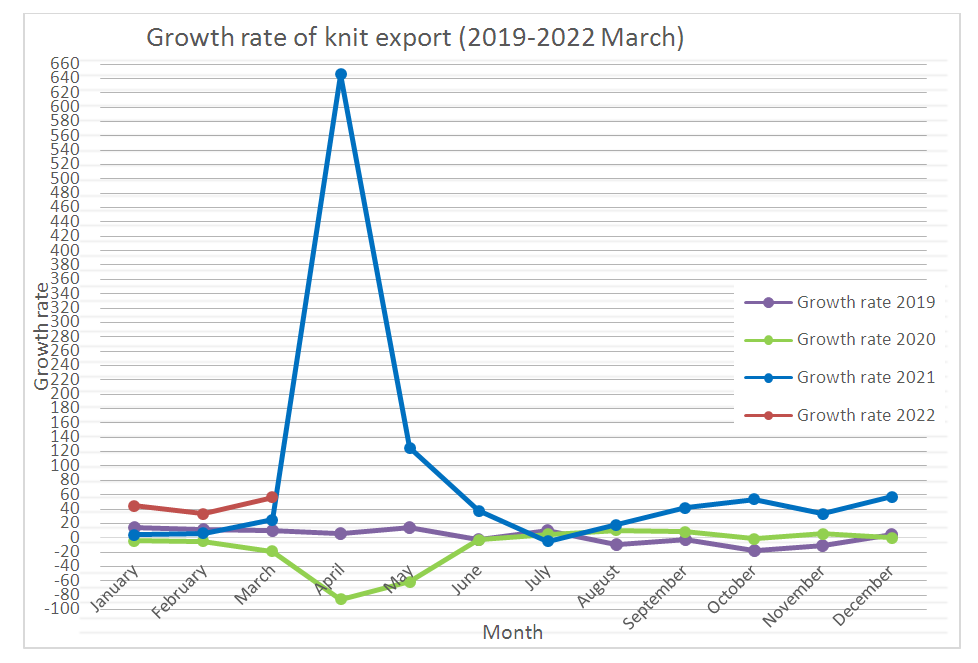

4.3. Impact on Growth Rate

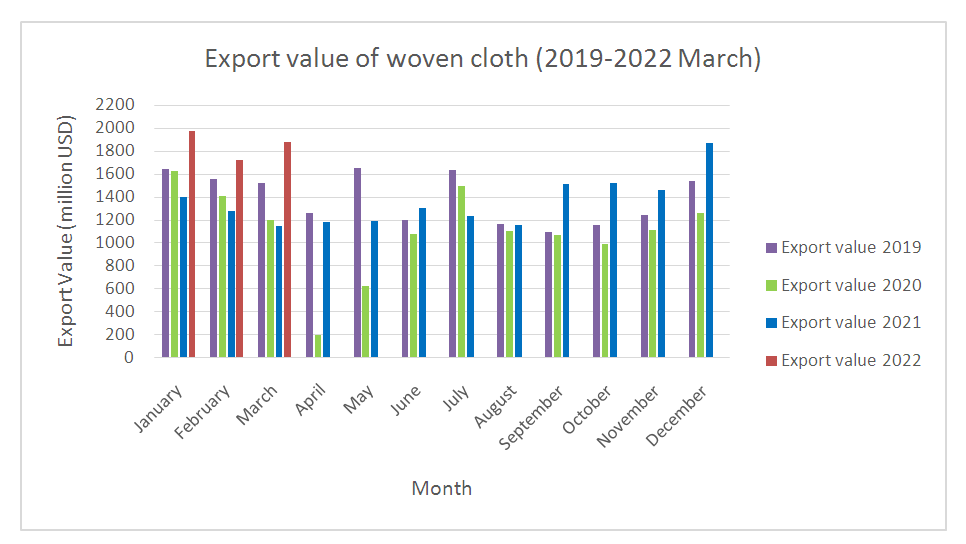

- Table 3 expresses the year-wise and months-wise woven and knit export value in a million USD and the growth rate of export of Bangladesh from 2019-2022 March.

|

| Figure 5. Total export of woven products (2019-2022 March) |

| Figure 6. Trend of growth rate of woven export (2019-2022 March) |

| Figure 7. Total export of knit products (2019-2022 March) |

| Figure 8. Trend of growth rate of knit export (2019-2022 March) |

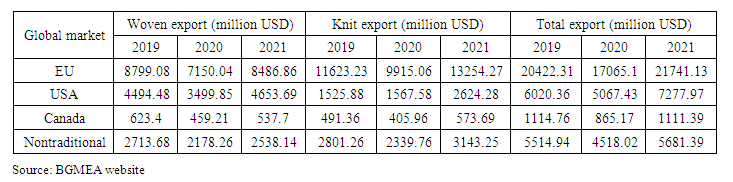

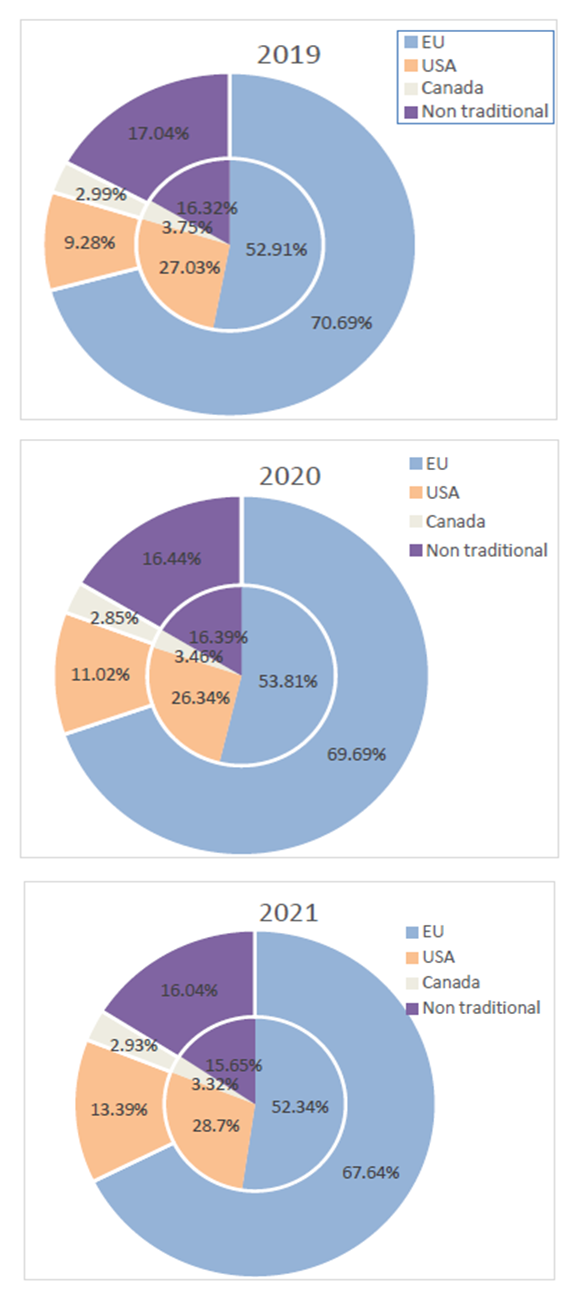

4.4. Impact on the Market Share

- Table 4 describes the knit and woven Ready-Made Garments exports value in million USD for EU, USA, Canada and Nontraditional Global Market from 2019 to 2021.

| Table 4. Bangladesh apparel export (knit and woven) to the global market from 2019 to 2021 |

| Figure 9. Comparison of global market share for knit and woven RMG products from 2019- 2021 (middle circle indicate woven market share and outer circle indicate knit market share) |

4.5. Export Order Cancellation

- In the course of Covid-19, nearly 3.7 billion USD purchases were delayed, paused, or cancelled by at least 1931 brands. Most orders were cancelled by retailers like Tesco, Marks & Spencer, H&M, and Primark [27]. The European market cancelled an order worth 1.93 billion USD, whereas the US cancelled an order worth 574 million USD. The Canadian and Non-traditional markets cancelled orders worth 52 and 620 million USD. In the interim, negotiations have helped to restore some order [28].

4.6. Impact on Supply Chain

- Global supply chains have been severely disrupted during COVID-19. There are 425 yarn manufacturing units, 796 fabric manufacturing facilities, 240 dyeing, printing, and finishing units, and many accessories suppliers in Bangladesh's textile value chain. Due to worldwide lockdown and border restrictions, these units failed to meet the schedule, which impacted the whole supply chain [24].

4.7. Impact of Yarn Price Rise

- Internationally, raw cotton costs increased from 0.70 USD per pound to 1.1 USD per pound in 2021 [29]. Because of the rising cost of imports and the price of cotton, the yarn has increased in price on the local Bangladeshi market. However, yarn was less expensive on the worldwide market than in the local one. In May 2022, cotton yarn cost 5.25 USD per kg on the local market compared to 4.30 USD per kg on the Indian market. The price of yarn in the local market and other markets are vastly different. As a result, more businesses are emphasizing yarn imports. According to the sources of Bangladesh Textiles Mills Association (BTMA), 1.70 million tons of yarn was imported in 2021, which was 65% higher than the previous year [30].

5. Conclusions

- Recently Bangladesh has been recovering from the Covid-19 pandemic, which has shaken the RMG sector, the backbone of the country's economy in 2020. This article discussed the effects of Covid-19 on the knit and weave industries in Bangladesh and its effects on the supply chain, the raw material shortage, the increase in yarn prices, order cancellations, and numerous other pandemic-related consequences. It also sheds insight into the pandemic's long-term effects on Bangladesh's overall economic development concerning the RMG industry. Data on exports from 2019 to 2022 revealed that knitted apparel had surpassed woven clothing to gain market share. Due to the fast fashion trend, availability of backward linkage for knit garments, and better pricing policy, the demand for knitwear has been increasing gradually over the last few financial years. Although during the Covid-19 pandemic, the demand increased remarkably as people had to stay home, so they preferred more comfortable and easier to wear cloth. From this research, a significant change in ready-made garment export from Bangladesh to the global market has also come forward. The US global market is focusing on Bangladesh for importing their knit and woven products. However, the rest of the world market concentrates more on importing knit goods from Bangladesh than woven goods.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML