-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Statistics and Applications

p-ISSN: 2168-5193 e-ISSN: 2168-5215

2018; 8(3): 111-118

doi:10.5923/j.statistics.20180803.01

Contribution of Financial Sector and Trade on Economic Growth: Evidence from MENA Countries

Md Shakhawat Hossain, Md Rokonuzzaman

Department of Statistics, University of Chittagong, Chittagong, Bangladesh

Correspondence to: Md Shakhawat Hossain, Department of Statistics, University of Chittagong, Chittagong, Bangladesh.

| Email: |  |

Copyright © 2018 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This research work is an attempt to examine the contribution of financial sector and trade on economic growth for the countries in MENA region. For this purpose, yearly data on inflation rate, trade service, domestic credit to private sector, domestic credit provided by financial sector and broad money on GDP, investigated for nine MENA countries over the period of 1981-2016 are collected from World Bank database. Descriptive statistics refer that variables diverge greatly among the countries. For some countries inflation rates are found to be considerably high. Significant Hausman test conferred that the random effect model is appropriate for this panel data. The empirical results from random effect model with robust standard error reveal significant effects of trade service, domestic credit provided by financial sector, inflation rate, domestic credit to private sector and broad money on GDP growth. It is mentionable that inflation rate, domestic credit to private sector and broad money have negative impact on GDP growth that might be due to high inflation rates and less stable economies of the sampled countries.

Keywords: Panel Data, Financial Sector, Trade, GDP, Random Effect Model

Cite this paper: Md Shakhawat Hossain, Md Rokonuzzaman, Contribution of Financial Sector and Trade on Economic Growth: Evidence from MENA Countries, International Journal of Statistics and Applications, Vol. 8 No. 3, 2018, pp. 111-118. doi: 10.5923/j.statistics.20180803.01.

Article Outline

1. Introduction

- The relationship between financial development and economic growth has been the subject of increasing attention. In an empirical research Levine and Zervos [1] found evidence of a robust relationship between financial development and long-run economic growth. There is ambiguity in findings due to various definitions of financial development indicators and misspecification of empirical models. The empirical assessment attempts to capture the effects of financial development and economic growth.The Middle East and North Africa region (MENA), as defined by the World Bank in the MENA 2008 Economic Developments and prospects (EDP) report, comprises Algeria, Bahrain, Djibouti, Egypt, Iran, Iraq, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, the Palestinian Territories (West Bank and Gaza), Qatar, Arabia, Sudan, Syria, Tunisia, the United Arab Emirates, and Yemen.Unfortunately, it is well documented that the wider Middle East and North Africa region has had disappointing growth performance over long periods of time relative to other emerging and developing countries (EDC). A slowdown in world trade and financial sector that is not very well intrigued has weakened economic prospects. Moreover, the stretched political transition and instability are further weighing likely on the economies in the region and likely to result in a slugging and protracted economic recovery. Trying to achieve and maintain macroeconomic stability in this environment will be a key challenge for the coming years.Although most of the empirical studies found positive relationship between financial development and economic growth, it is shocking that empirical studies from the Middle East North Africa region are inadequate as well as the fact that the empirical results are mixed. For example; Al-Awad and Harb [2] pointed out that financial development and growth may be related in the long run but their results fail to clearly establish the direction of causality. The simple quantitative measures may also give a misleading picture of financial development. For instance, although a higher ratio of broad money to GDP is generally associated with greater financial liquidity and depth, the ratio may decline rather than rise as a financial system develops because people have more alternatives to invest in longer term or less liquid financial instruments. A well- developed and dynamic financial sector is essential to achieve sustainable economic growth. Many attempts have been made in the last decade to improve the performances and efficiency of the MENA financial sector. However, there still exists a wide gap if compared to other developed and emerging regions. Although MENA countries present different levels of the financial sector’s development, some broad generalizations can be made.What leads to a well-developed financial sector? Conversely, what hinders financial sector development? These questions are the subject of a large and still growing research literature from which some general conclusions can be drawn. In this paper we attempt to show the effect of financial development on economic growth in these 9 countries from 1981 to 2016 by using World Bank Development Indicator online database.The current study is associated with the demand of following hypothesis which theorizes that economic growth propels financial development. The study is significant for two main reasons. One, contrary to the status in which the relationship between financial development and economic growth has been predominantly investigated using time series data; the current study investigates the relationship between financial development and economic growth using panel data. Besides, the study departs from the conventional interest of testing whether financial development promotes economic growth rather promoting financial development in the panel context.There have two research questions in our study which are;• What is the relationship among financial sector, trade and economic growth for MENA countries? • What extent financial sector and trade affects on economic growth of MENA countries? The rest of the paper is divided as follows. The next section focuses on review of literature followed by the data and methodology section. The penultimate section is the results section. Conclusion and recommendation section ends the paper.

2. Literature Review

- More recently, Chow and Fung [3] examined the relationship between financial development and economic growth in 69 countries using a regime switching panel vector autoregression model. They also perform a clustering analysis to identify the presence of convergence clubs based on data properties. The study found that most countries have been switching between two states: one way causality from growth to financial development but not the other way round, and coexistence of bi-directional causality. Barajaset et. al [4, 5] examined whether there might be a financial sector dimension to the Middle East and North Africa growth problem, either because financial systems there had not developed or deepened sufficiently, or because the deepening that did occur had not been as effective as in other regions in providing intermediation services that ultimately would enhance economic growth. The study found that, at least at the aggregate level, financial depth did not seem to be an issue for the region as a whole, although there was significant variation across countries in the region. Shan and Morris [6] investigating of the causal relationship among the following variables: real GDP, ratio of total credit to GDP, spread of borrowing and lending interest rates, productivity, ratio of gross investment to GDP, ratio of total trade to GDP, consumer price index, official interest rate, and stock market price index for 19 OECD countries. The authors contend that financial development leads to economic growth either directly or indirectly through the remaining examined variables.In the Middle East, Al-Awad and Harb [2] investigated the relationship between financial development and economic growth and report that in the long run financial development and economic growth may be related to some level. However, in the short run, the panel causality tests point to real economic growth as the force that drives changes in financial development.Kar, M. et. al [7] investigated the direction of causality between financial development and economic growth in the Middle East and North African countries. The empirical results showed that the direction of causality between financial development and economic growth is sensitive to the measurement of financial development in the MENA countries. Deidda and Fattouh [8] explore a non-linear relationship between financial development and economic growth. The results of their study suggested that in low-income countries there is no significant relationship between financial development and economic growth, whereas in high-income countries there is a positive and statistically significant relationship between financial development and economic growth.Gregorio, J. D. and Guidotti, P. E. [9] examined the relationship between long run growth and financial development in 95 countries. The empirical result showed that more financial development leads to improved growth performance. The level of growth differs from countries to country.Rachdi, H and Mbarek, H. B. [10] demonstrated that there is a long-term relationship between financial development and economic growth, but the causal effect is running from economic growth to financial development. In a research, Hossain, M. S. et. al [11] showed that market capitalization and domestic credit to private sector have a statistically significant positive contribution to the economic growth (GDP) for SAARC countries. Najid, A. and Uma-Tul, S. J. [12] found a positive relation between inflation and economic growth of Pakistan.Abbas, A. O. et. al [13] examined the impact of stock market development on Tanzanian economy based on time series data from 2000-2011 and they found Dar-es Salam Stock Exchange has no effect on economic growth of Tanzania.Hossain, M. S. and Rokonuzzaman, M. [14] studied the impact of stock market, trade and credit by bank on economic growth for Latin American countries and found that inflation rate, import and credit by banking sector have negative impact on GDP growth and exports, stock market, broad money, credit by private sector and interest rate have positive contribution to the GDP growth.The review reveals that a number of researchers were worked on financial development and economic growth in various ways. But there is still a specific gap of working the impacts of financial development, trade on economic growth for MENA region.

3. Data and Methodology

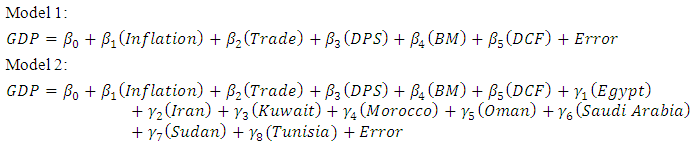

- In this study, data is collected from the World Bank Development Indicator online database for MENA countries. Although it is a large database but information for some countries are not available. Due to unavailability of complete information only nine MENA countries and some selected factors related to economic growth over 36 years data with the period 1981-2016 are considered for the analysis. Here the following variables and countries are considered:Dependent Variable: Per capita GDP growth in % (GDP)Independent Variable: Inflation, GDP deflator annual % (Inflation), Trade Service in % of GDP (Trade), Domestic Credit to Private Sector in % of GDP (DPS), Broad Money in % of GDP (BM), Domestic Credit provided by Financial Sector in % of DP (DCF).Panel countries: Bahrain, Kuwait, Saudi Arabia, Egypt, Morocco, Sudan, Iran, Oman, TunisiaIn this study various descriptive statistics are computed for all the variables that are considered. In the next step, the ordinary least squares (OLS), least squares dummy variable approach and random effect model are fitted for the data. Also conduct the Hausman test to determine the suitable model for this panel data. All the analyses are done using computer software STATA-12.0.The following models are considered for these aforementioned analyses:

4. Results and Discussion

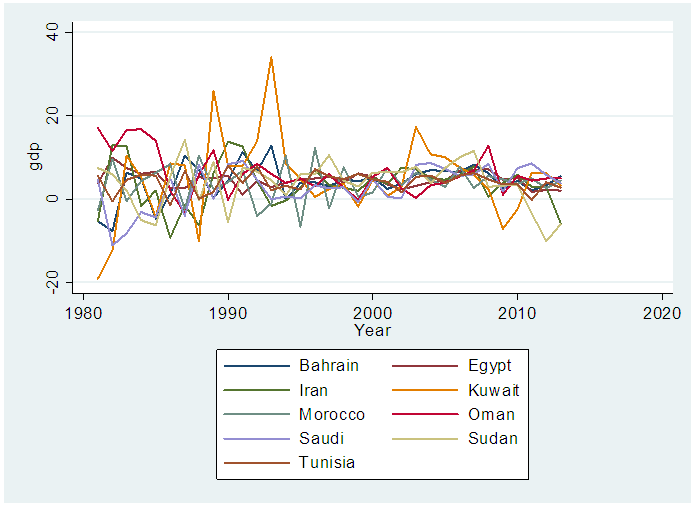

- The GDP growths for different countries over the period 1981-2013 are shown in Figure 1. It is obvious from both the figures that the GDP growths for different countries are not similar. There have distinctions of GDP growth from country to country. Also we see that GDP line of Bahrain, Egypt, Oman and Tunisia are not too much fluctuating but GDP for Iran, Kuwait, Morocco, Saudi Arabia and Sudan are very much fluctuated.

| Figure 1. Line diagram of country wise gross domestic product (GDP) in annual percentage |

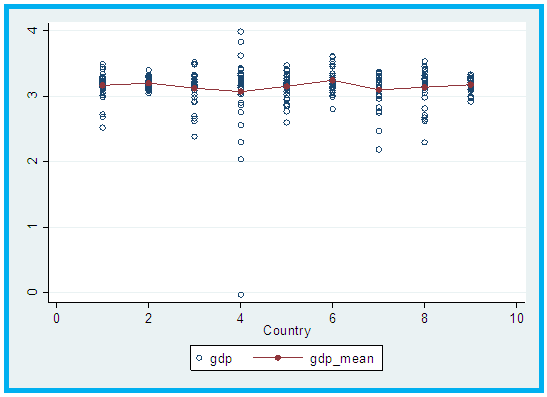

| Figure 2. Heterogeneity across countries |

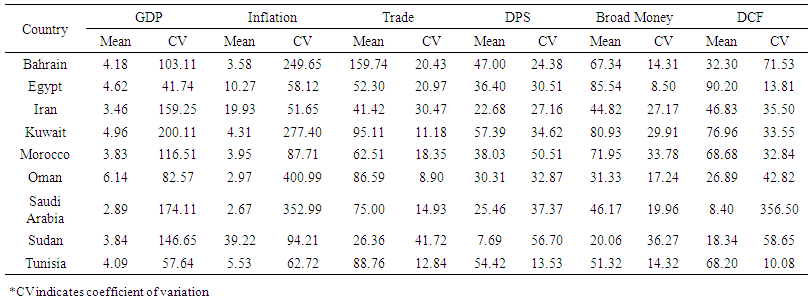

| Table 1. Country wise descriptive statistics for GDP Growth, Inflation Rate, Trade, DPS, Broad Money and DCF |

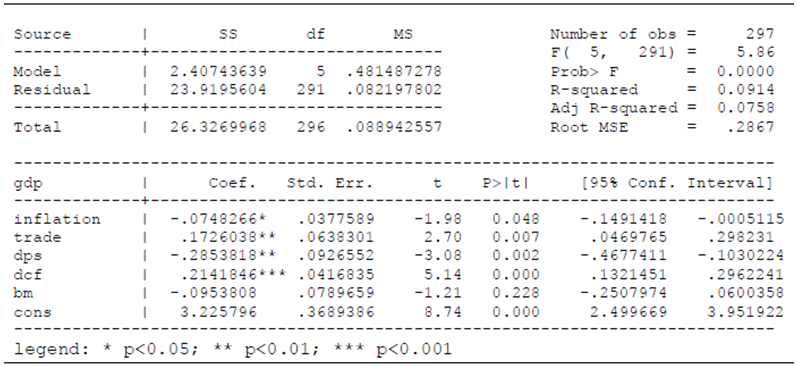

| Table 2. Stata output of least square estimates of GDP on inflation, trade, dps, dcf, bm |

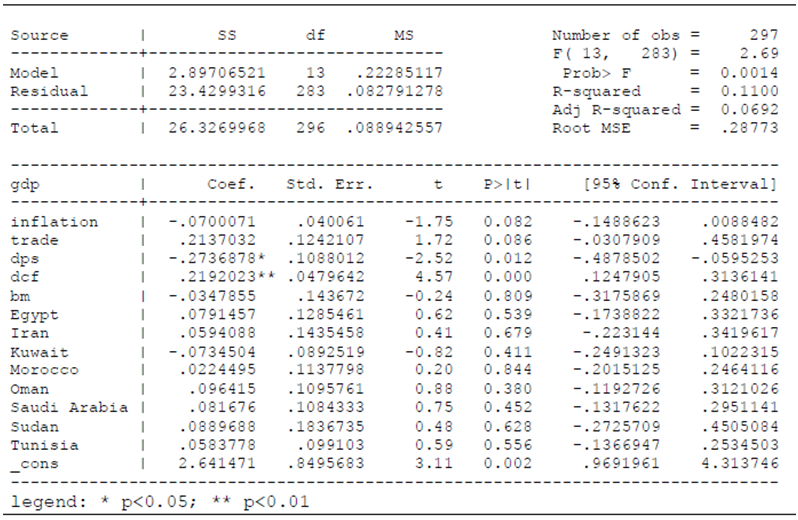

| Table 3. Stata output of estimates with its S.E of Least square dummy regression model |

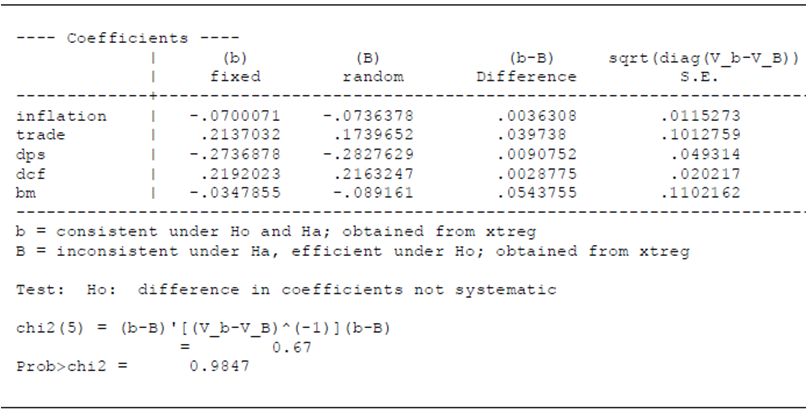

| Table 4. Stata output of calculation table for hausman test for choosing random effect model |

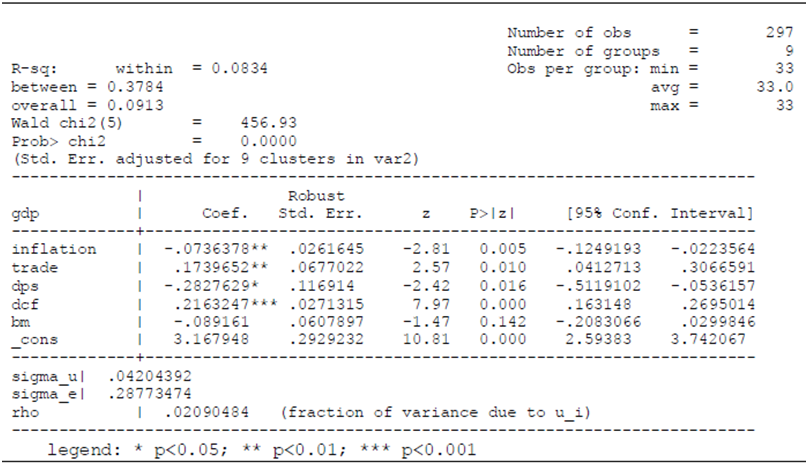

| Table 5. Stata output of random effect regression model |

5. Conclusions

- This study provides new evidence that sheds light on the effect of financial development of economic growth. The study is a piece of empirical work that contributes on the role of some selected explanatory variables on the economic growth (consider GDP growth) in nine countries of MENA region. In this investigation it is observed from figure 1 & 2 that the GDP growth of different sampled countries show heterogeneity especially in Oman, Kuwait, Saudi Arabia and Sudan.From descriptive statistics, it is found that the mean GDP growth is the height in Oman (6.14%) and the lowest in Saudi Arabia (2.89%). The average inflation rates for Sudan, Iran and Egypt are 39.22%, 19.93% and 10.27% respectively which could be considered as very high.OLS estimates showed that GDP growth has negative change with inflation rate, domestic credit to private sector and broad money while it has positive change with trade service and domestic credit provided by financial sector. Here it is also seen that inflation rate, trade service, domestic credit to private sector and domestic credit provided by financial sector are significant. The same directions of GDP changes with explanatory variables are observed in the least squares dummy variable approach and only domestic credit to private sector and domestic credit provided by financial sector are significant.The significant Hausman test statistic conferred random effect model to analyze the panel data and hence finally random effect model with robust standard error is used. Here it is found that partial elasticity of GDP has negative relation with inflation rate, domestic credit to private sector and broad money while has positive relation with trade service and domestic credit provided by financial sector in countries of MENA region. Inflation rate, trade service, domestic credit to private sector and domestic credit provided by financial sector are significant. Negative impact on GDP might be due to high inflation rate and/or less stable economy which is also consistent with study of Iabal and Nawaz [15].In view of provision over the exact role of financial sector and trade on economic growth, the results of present study should not be viewed as conclusive empirical evidence but rather as an additional inspiration for further research in this area.

6. Recommendations

- Due to data unavailability, all of the MENA countries could not be included and only some selected factors are considered in the study. One can try to collect the data for all others countries from other source rather than the database of World Bank. Also more intensive analysis and test procedure can be employed by other researcher to get better estimate for using forecasting model (Like as discriminant and PCA can be used in further analysis.) In brief, there is agreement that macroeconomic stability is critical for the growth of financial sector services. Countries should adopt appropriate macroeconomic policies, encourage competition within the financial sector, and develop a strong and transparent institutional and legal framework for financial sector activities. In particular, there is a need for prudential regulations and supervision, strong creditor rights, and contract enforcement.

7. Limitations

- (1) Due to unavailability of data, the some MENA Countries are not considered in the analysis. (2) Expected result is not found for all explanatory variables (e.g. negative estimate for credit to private sector). (3) Our response variable GDP may depends on many factors but this study considered only five explanatory variables. (4) The study may have model specification error.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML