-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Statistics and Applications

p-ISSN: 2168-5193 e-ISSN: 2168-5215

2017; 7(6): 311-315

doi:10.5923/j.statistics.20170706.06

Power of Some Tests of Heteroscedasticity: Application to Cobb-Douglas and Exponential Production Function

Iyabode Favour Oyenuga1, Benjamin Agboola Oyejola2

1Department of Mathematics and Statistics, The Polytechnic, Ibadan, Nigeria

2Department of Statistics, University of Ilorin, Nigeria

Correspondence to: Iyabode Favour Oyenuga, Department of Mathematics and Statistics, The Polytechnic, Ibadan, Nigeria.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

There are several methods for detecting presence of heteroscedasticity in a single equation econometrics non-linear model. This paper compares the power of Breusch-Pagan, White, Glejser, Park and Goldfeld-Quandt in testing for homoscedasticity when using Cobb-Douglas and Exponential production function non-linear models. The two nonlinear models were transformed to an intrinsically linear model through the natural logarithms. The sample sizes of 10 and 30, 50 and 100, 150 and 200 for small, medium and large sample sizes, respectively and 10,000 replications. The levels of heteroscedasticity introduced were 0.1, 0.5 and 0.9 for mild, moderate and severe heteroscedasticity respectively. The tests were carried out at 0.01 and 0.05 levels of significance. The results showed that as the sample size increases, for every level of heteroscedasticity, the power of the Glejser and Park increases in detecting heteroscedasticity compare to other tests. The asymptotic behavior of the power of the test showed that Glejser and Park tests are more consistent and efficient.

Keywords: Intrinsically nonlinear model, Cobb-Douglas, Exponential, Power of the test

Cite this paper: Iyabode Favour Oyenuga, Benjamin Agboola Oyejola, Power of Some Tests of Heteroscedasticity: Application to Cobb-Douglas and Exponential Production Function, International Journal of Statistics and Applications, Vol. 7 No. 6, 2017, pp. 311-315. doi: 10.5923/j.statistics.20170706.06.

1. Introduction

- There are certain circumstances in which the assumption of constant error variance or homoscedasticity in the linear model is not tenable. In testing for heteroscedasticity, there is need to have a relatively large samples in order to observe the problems of such errors and evaluate their behaviors. Researchers have observed that heteroscedasticity is usually found in cross sectional data. For example, one expects to observe greater variation in the profits of large firms than in those of small ones. The variance of profits might also depend on product diversification, research and development expenditure and industry characteristics and may therefore vary across firms of similar sizes. When analyzing family spending patterns, we find that there is greater variation in expenditure on certain commodity groups among high-income families than low ones due to the greater discretion allowed by higher income [Prais and Houthakker (1995)].Goldfeld-Quandt (1965) observed that the power of their test depend on (a) the number of centrally omitted observations c and (b) the nature of the sample values of the variable used as the deflator. They also observed that, for very large valves of c, the power of their test is rather weak. Cook and Weisberg (1983), in their simulation study, investigated the χ2 approximation of their test. They showed that their test is superior to Ancombe (1961) and Bickel (1978) because their χ2 approximation of the sampling distribution is poor.Kyung (2000) presented a paper on ‘Robustifying Glejser test of Heteroscedasticity’ where they proposed a simple modification to Glejser tests to make it more robust to disturbances with asymmetric density with flat tail. This problem had earlier been studied by Koenker and Bassett (1982) and Newey and Powell (1987). The later in particular focused their attention on the test proposed by Glejser (1969) which test whether the regression of the absolute values of residuals are correlated with some other variables. Newey and Powell (1987) presented a more elaborate test which is more powerful than the squared residual based test. Glejser test revisited by Machhado and Silva (2000) showed that the proposed test statistics are asymptotically valid even when the disturbances are not symmetrically distributed.Xu (2006) presented new nonparametric tests for heteroscedasticity in nonlinear and nonparametric regression models. Monte Carlo simulations showed that, when the parametric tests misspecify the form of heteroscedasticity, the non parametric tests have much higher power against heteroscedasticity than the parametric tests. Thus, the non parametric tests are most useful when the form of heteroscedasticity cannot be specified with certainty or when the form is too complicated to be specified parametrically.

2. Methodology

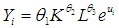

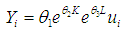

- The Nonlinear Models Investigated 1. The Cobb-Douglass production function, developed by Charles Cobb and Paul Douglass (1928) is a function showing the relationship between the output and the combination of factors, or inputs, used to obtain it. It is of the form:

| (2.1) |

| (2.2) |

is a dependent variable,

is a dependent variable,  is the intercept,

is the intercept,  and

and  are the regression coefficients, K and L a re independent variables and

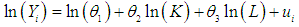

are the regression coefficients, K and L a re independent variables and  is the error term.The model in (2.2) can be transformed to linear model by taking the natural logarithms of both sides of the equation to obtain a regression model of the following form:

is the error term.The model in (2.2) can be transformed to linear model by taking the natural logarithms of both sides of the equation to obtain a regression model of the following form: | (2.3) |

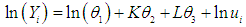

| (2.4) |

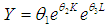

| (2.5) |

is a dependent variable,

is a dependent variable,  is the intercept ,

is the intercept ,  and are the regression coefficients, K and L are independent variables and

and are the regression coefficients, K and L are independent variables and  is the error term.By taking the natural logarithms of both sides of (2.5), we have

is the error term.By taking the natural logarithms of both sides of (2.5), we have | (2.6) |

3. Simulation

- i. A sample infected with heteroscedasticity using uniform distribution to generate data for Capital (K), Labour (L) and Output (Y). The study used fixed values for

and

and  for the two models.ii. The set of parameter estimates obtained were used to compute the residuals which represented the dependent variable for the auxiliary regression. The error structure data were drawn from a normal distribution with mean, zero and variance,

for the two models.ii. The set of parameter estimates obtained were used to compute the residuals which represented the dependent variable for the auxiliary regression. The error structure data were drawn from a normal distribution with mean, zero and variance,  .iii. The sample sizes for the simulation were 10 and 30, 50 and 100, 150 and 200 for small, medium and large sample sizes respectively. Each experiment was replicated in 10,000 times.iv. The levels of heteroscedasticity,

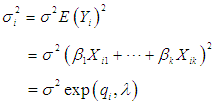

.iii. The sample sizes for the simulation were 10 and 30, 50 and 100, 150 and 200 for small, medium and large sample sizes respectively. Each experiment was replicated in 10,000 times.iv. The levels of heteroscedasticity,  , introduced were 0.1, 0.5 and 0.9 for mild, moderate and severe heteroscedasticity respectively.v. The Harvey (1976) model of multiplicative heteroscedasticity error structure was assumed with general formulation

, introduced were 0.1, 0.5 and 0.9 for mild, moderate and severe heteroscedasticity respectively.v. The Harvey (1976) model of multiplicative heteroscedasticity error structure was assumed with general formulation  Where

Where  and

and  are both unknown real constants, which determine the levels or degree of heteroscedasticity. The following five tests were considered in this paper namely; Breusch-Pagan (1979), White (1980), Glejser (1969), Park (1966) and Goldfeld-Quandt (1965).

are both unknown real constants, which determine the levels or degree of heteroscedasticity. The following five tests were considered in this paper namely; Breusch-Pagan (1979), White (1980), Glejser (1969), Park (1966) and Goldfeld-Quandt (1965).4. Results and Discussion

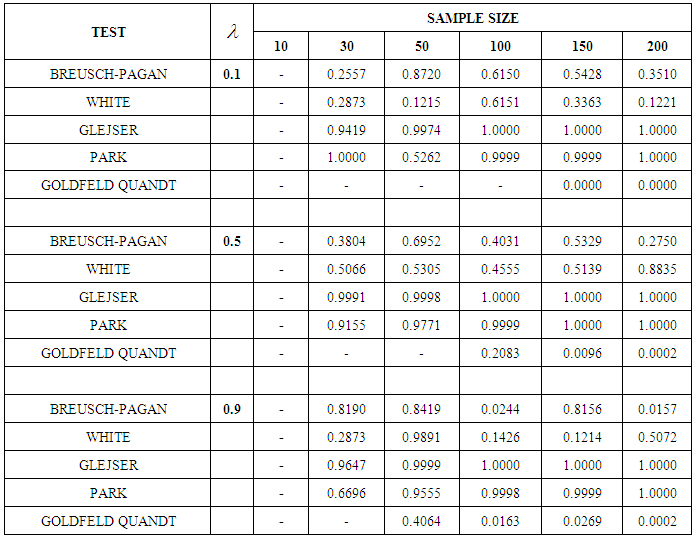

- Table 1 shows the power of the tests for Cobb-Douglas Model at

. There is no result for sample size 10 at all levels of heteroscedasticity

. There is no result for sample size 10 at all levels of heteroscedasticity  for all the tests due to insufficient sample size. The result revealed that at every level of heteroscedasticity, as the sample size increases, the power of the test for Glejser and Park test improves and remains powerful. It can also be seen that at

for all the tests due to insufficient sample size. The result revealed that at every level of heteroscedasticity, as the sample size increases, the power of the test for Glejser and Park test improves and remains powerful. It can also be seen that at  , the power of the test for White also improved. When the sample size is equal to 50, the power of all tests improved at both

, the power of the test for White also improved. When the sample size is equal to 50, the power of all tests improved at both  and 0.9. Goldfeld-Quandt test is not a reliable test at all levels of heterogeneity and sample sizes.

and 0.9. Goldfeld-Quandt test is not a reliable test at all levels of heterogeneity and sample sizes.

|

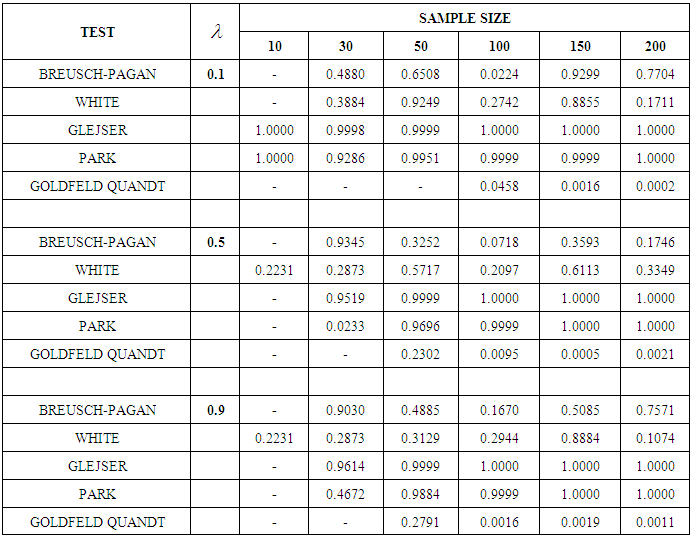

. The result shows that at every level of heteroscedasticity, as the sample size increases, Glejser and Park tests are powerful. It can also be seen that at

. The result shows that at every level of heteroscedasticity, as the sample size increases, Glejser and Park tests are powerful. It can also be seen that at  when n =50 and 150 all the powers of test improved except Goldfeld-Quandt test, likewise, at

when n =50 and 150 all the powers of test improved except Goldfeld-Quandt test, likewise, at  when n=150.

when n=150.

|

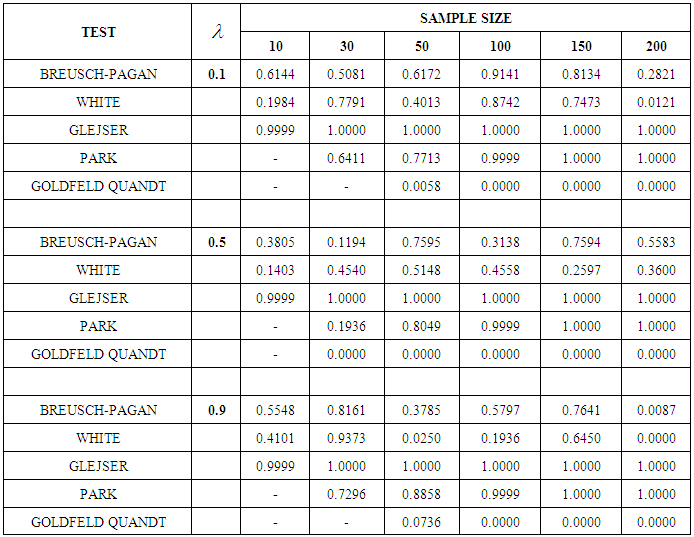

. The result shows that at every level of heteroscedasticity, as the sample size increases, the power of the test for Glejser and Park test is very high. The power of the test for Breusch-Pagan test also improves as sample size increases when

. The result shows that at every level of heteroscedasticity, as the sample size increases, the power of the test for Glejser and Park test is very high. The power of the test for Breusch-Pagan test also improves as sample size increases when  expect when n=200. The power of all the tests improved when

expect when n=200. The power of all the tests improved when  at n=30, 100 and 150 also when

at n=30, 100 and 150 also when  at n=30 and 150. Goldfeld-Quandt test is still not a reliable test at all levels of heterogeneity and sample sizes.

at n=30 and 150. Goldfeld-Quandt test is still not a reliable test at all levels of heterogeneity and sample sizes.

|

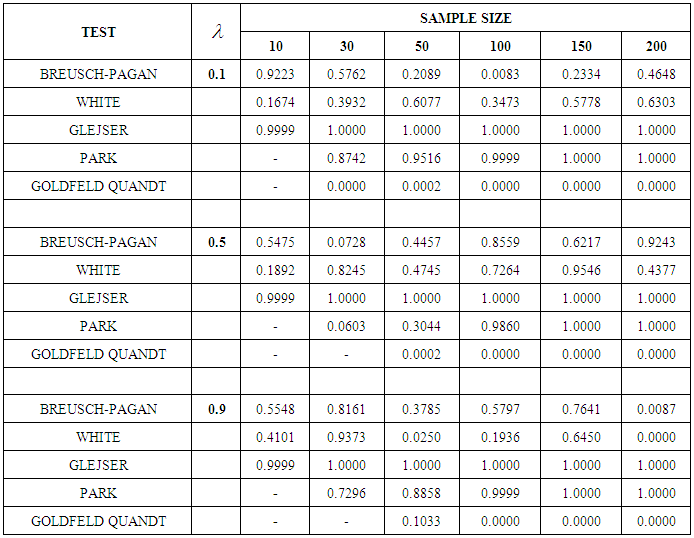

. The result shows that at every level of heteroscedasticity, as the sample size increases, the power of the test for Glejser and Park test is powerful. The power of all the tests improves at

. The result shows that at every level of heteroscedasticity, as the sample size increases, the power of the test for Glejser and Park test is powerful. The power of all the tests improves at  when n=100 and 150, so also, at

when n=100 and 150, so also, at  when n=30 and 150 expect for Goldfeld-Quandt test.

when n=30 and 150 expect for Goldfeld-Quandt test.

|

5. Conclusions

- The results obtained from the analysis conform to the asymptotic property as sample sizes increases, the power of the two tests namely, Glejser and Park, is more powerful at every level of heteroscedasticity for the two models. It can therefore be concluded from this study that Glejser and Park tests should be used for detecting the heteroscedasticity when nonlinear models are used in analyzing data.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML