-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Statistics and Applications

p-ISSN: 2168-5193 e-ISSN: 2168-5215

2015; 5(6): 293-301

doi:10.5923/j.statistics.20150506.05

Estimation of Missing Values for Pure Bilinear Time Series Models with Student-t Innovations

Poti Abaja Owili1, Luke Orawo2, Dankit Nassiuma3

1Mathematics and Computer Science Department, Laikipia University, Nyahururu, Kenya

2Mathematics Department, Egerton University, Nakuru, Private Bag, Egerton-Njoro, Kenya

3Mathematics Department, Africa International University, Nairobi, Kenya

Correspondence to: Poti Abaja Owili, Mathematics and Computer Science Department, Laikipia University, Nyahururu, Kenya.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

In this study optimal linear estimates of missing values for pure bilinear time series models whose innovations have a student-t distribution are derived by minimizing the h-steps-ahead dispersion error. Data used in the study was simulated using the R-software where 100 samples of size 500 were generated for simple bilinear models. In each sample, three data positions 48, 293 and 496 were selected at random and artificial missing values created at these points. For comparison purposes, artificial neural network (ANN) and exponential smoothing (EXP) estimates were also computed. The performance criteria used to ascertain the efficiency of these estimates were the mean absolute deviation (MAD) and mean squared error (MSE). The study found that optimal linear estimates were the most efficient for estimating missing values of the pure bilinear time series followed by exponential smoothing estimates. Further, these estimates were equivalent to one-step-ahead forecast. The study recommends the use of optimal linear estimate for estimating missing values in pure bilinear time series data whose innovations have student-t distribution.

Keywords: ANN, Exponential smoothing, MAD, Performance criterion, Simulation

Cite this paper: Poti Abaja Owili, Luke Orawo, Dankit Nassiuma, Estimation of Missing Values for Pure Bilinear Time Series Models with Student-t Innovations, International Journal of Statistics and Applications, Vol. 5 No. 6, 2015, pp. 293-301. doi: 10.5923/j.statistics.20150506.05.

Article Outline

1. Introduction

- Data analysts are frequently faced with situations where one or several time series observations are missing at certain points within the data set collected for modeling. This creates missing values at such points. Being unable to account for missing values may result in a severe misrepresentation of the phenomenon under study or can cause havoc in the estimation and forecasting of linear and nonlinear time series as in [1]. The missing values can be reconstructed using imputation techniques. The basic idea of an imputation approach, in general, is to substitute a plausible value for a missing observation and to carry out the desired analysis on the completed data as in [2]. There are several methods that can be used for imputing missing values in numerical data. These methods include mean substitution, linear regression, neural networks and nearest neighbor approach and optimal linear interpolation. In this study we were interested in estimating missing values for a class of bilinear nonlinear time series models called the pure bilinear time series models whose innovations have a student-t distribution using linear interpolation approach. The student-t distribution can be used to model the innovation of financial data which is known to be highly skewed. There is no evidence to show that optimal linear interpolation approach has been used to estimate missing values for bilinear time series and specifically, pure bilinear time series.

1.1. Bilinear Models

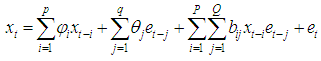

- A discrete time series process

is said to be a bilinear time series model of order BL (p, q, P, Q) if it satisfies the difference equation

is said to be a bilinear time series model of order BL (p, q, P, Q) if it satisfies the difference equation | (1) |

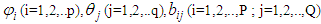

are constants; the innovation sequence

are constants; the innovation sequence  are i.i.d random process which has a student-t distribution and

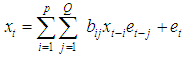

are i.i.d random process which has a student-t distribution and  =1. For pure bilinear time series, only the bilinear coefficient is not equal to zero. Thus the pure bilinear time series model, BL(0,0,P,Q) is given by

=1. For pure bilinear time series, only the bilinear coefficient is not equal to zero. Thus the pure bilinear time series model, BL(0,0,P,Q) is given by  | (2) |

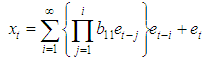

are the coefficients of the model, and

are the coefficients of the model, and  are i.i.d student-t process with zero mean and common finite variance. Some important properties of this model such as invertibility and stationarity have been studied. Invertibility conditions for some particular stationary bilinear models has been derived as in [3] and [4]. [5] has established the conditions under which the general bilinear model is invertible and a condition of invertibility of model (2) can be derived from this result. This condition is expressed as

are i.i.d student-t process with zero mean and common finite variance. Some important properties of this model such as invertibility and stationarity have been studied. Invertibility conditions for some particular stationary bilinear models has been derived as in [3] and [4]. [5] has established the conditions under which the general bilinear model is invertible and a condition of invertibility of model (2) can be derived from this result. This condition is expressed as  where

where  is the correlation coefficient. The notion of invertibility is very useful for statistical applications, such as the prediction of

is the correlation coefficient. The notion of invertibility is very useful for statistical applications, such as the prediction of  given its past.A stationary bilinear model can be expressed in a kind of moving average with infinite order as in [6]. This enhances its application in making inferences. Bilinear models have the property that although they involve only a finite number of parameters, they can approximate with arbitrary accuracy ‘reasonable’ nonlinearity. [7] showed that with a large bilinear coefficient bij, a bilinear model can have sudden large amplitude bursts and is suitable for some kind of seismological data such as earthquakes, underground nuclear explosions. The variant of the bilinear process is time dependent. This feature enables bilinear process to be used also for financial data as in [8].Researchers have achieved forecast improvement with simple nonlinear time series models. [9] reported a forecast improvement with bilinear models in forecasting stock prices. The statistical properties of such models have been analyzed in detail as in [4], [10], [11] and [12].Several techniques have been used in estimating missing values. Most of them are nonparametric and includes use of artificial neural network as in [13]; [14]; [15] and exponential smoothing as in [16]. The techniques used for estimating missing values do not consider the distribution of the innovation sequence. They also don not consider nonlinear models. Therefore in this study estimates of missing values for nonlinear bilinear time series models with student-t distribution are derived using an optimal linear interpolation technique based on minimizing the h-steps-ahead dispersion error.

given its past.A stationary bilinear model can be expressed in a kind of moving average with infinite order as in [6]. This enhances its application in making inferences. Bilinear models have the property that although they involve only a finite number of parameters, they can approximate with arbitrary accuracy ‘reasonable’ nonlinearity. [7] showed that with a large bilinear coefficient bij, a bilinear model can have sudden large amplitude bursts and is suitable for some kind of seismological data such as earthquakes, underground nuclear explosions. The variant of the bilinear process is time dependent. This feature enables bilinear process to be used also for financial data as in [8].Researchers have achieved forecast improvement with simple nonlinear time series models. [9] reported a forecast improvement with bilinear models in forecasting stock prices. The statistical properties of such models have been analyzed in detail as in [4], [10], [11] and [12].Several techniques have been used in estimating missing values. Most of them are nonparametric and includes use of artificial neural network as in [13]; [14]; [15] and exponential smoothing as in [16]. The techniques used for estimating missing values do not consider the distribution of the innovation sequence. They also don not consider nonlinear models. Therefore in this study estimates of missing values for nonlinear bilinear time series models with student-t distribution are derived using an optimal linear interpolation technique based on minimizing the h-steps-ahead dispersion error. 2. Literature Review

2.1. Student-t Distributions

- The departure from the standard white noise is becoming prevalent in the literature of nonlinear time series as in [17]. An alternative distribution that can be used is the student-t distribution. It plays an important role in modeling. [18] presents the R package BayesGach which provides functions for the Bayesian estimation of the parsimonious and effectiveGarch (1,1) model, with student-t innovations. The Garch (1,1) model with student-t distribution is able to reproduce the volatility dynamism of financial data. Given a model, specification for log of return disturbances can be modeled using either the student-t distribution or the normal distribution. The student-t is particularly useful since it can provide the excess kurtosis in the conditional distribution that is found in financial time series unlike the models with normal innovations.[19] focused on the bilinear time series model with GARCH innovations (BL-GARCH). It has an important property that it can take into account explosions and related volatility features of non-linear time series. Specifically, he studied the BL-GARCH (1,1) process, which is mainly used in applications with normal, Student-t and GED noises. Other than the normal (stable) case the distribution of the white noise {et} is often quite different from that of the observations Xt. [20] have shown that Xt and {et} both can have student-t distribution if the noise is allowed to be non-white (exchangeable).

2.2. Missing Value Imputation: Linear Time Series Models with Finite Variance

- [21] discussed a method based on forecasting techniques to estimate missing observations in time series. He also compared this method with other methods using minimum mean square estimate as a measure of efficiency based on forecasting techniques. [22] obtained estimates of missing values for time series processes with finite variance.Within the frame work of the state space formulation, estimates of missing values and their corresponding error variance can be derived conveniently through the use of recursive smoothing methods associated with Kalman filter. Such smoothing methods are described in general terms as in [23]. Algorithms for computing the likelihood function when there are missing data in scalar case have been provided by [24] and [25]. They also showed how to predict and interpolate missing observations and obtain the mean squared error of the estimate. [25] pointed out that the problem can be solved by setting up the model in state space form and applying the Kalman filter. [1] Applied both the kalman filter and optimal linear estimation method and demonstrated the superiority of the optimal method. [26] used kalman filter to estimate missing values for AR(1) model. They withheld values at certain points and then estimated them as though they were missing. Their results revealed that simple exposition of state space representation for commonly used time series models can be formulated.[27] developed an optimal method that is based on linear combination of the forward and back forecasts for estimating missing values for ARMA time series models. [28] discussed different alternatives for the estimation of missing observation in stationary time series for autoregressive moving average models. [29] demonstrated that missing values in time series can be treated as unknown parameters and estimated by maximum likelihood or as random variables and predicted by the expectation of the unknown values given the data. [10] extended the concept of using minimum mean square error linear interpolator for missing values in time series to handle any pattern of non-consecutive observations. The paper refers to the application of simple ARMA models in discussing the usefulness of either the nonparametric or the parametric form of the least squares interpolator. Later, [30] demonstrated a linear recursive technique that does not use the Kalman filter to estimate missing observations in univariate time series. It is assumed that the series follows an invertible ARIMA model. This procedure is based on the restricted forecasting approach, and the recursive linear estimators are obtained when the minimum mean-square error are optimal. It is evident that Kalman filter technique has been widely used as an imputation method for ARMA processes.

2.3. Missing Value Imputation: Nonlinear Time Series Models

- [31] derived a recursive estimation procedure based on optimal estimating function and applied it to estimate model parameters to the case where there are missing observations as well as handle time-varying parameters for a given nonlinear multi-parameter model. More specifically, to estimate missing observations,they formulated a nonlinear time series model which encompasses several standard nonlinear models of time series as special cases. It also offers two methods for estimating missing observations based on prediction algorithm and fixed point smoothing algorithm as well as estimating functions equations. However, little was done on bilinear time series models.[32] investigated influence of missing values on the prediction of a stationary time series process by applying Kaman filter fixed point smoothing algorithm. He developed simple bounds for the prediction error variance and asymptotic behavior for short and long memory process. [33] derived a recursive form of the exponentially smoothed estimated for a nonlinear model with irregularly observed data and discussed its asymptotic properties. They made numerical comparison between the resulting estimates and other smoothed estimates. It is evident that not much has been done on missing value estimation for bilinear time series models.

2.4. Classes of Bilinear Models Studied

- The bilinear model has been widely applied in many areas such as control theory, economics and finance. The structure of model (1) has been studied in the literature especially for some special cases. For example, [7] considered model BL (p,o,p,q); [11] studied the asymptotic behaviour of the correlation function for the simple bilinear model BL(0,0,1,1); [34], [35] and [36] studied the model BL(1,0,1,1); [37] considered the model BL(0,0,1,1). [38] estimated the coefficients of a bilinear model using the maximum likelihood method. However, she restricted the analysis to investigating the subclass of bilinear processes with a single bilinear term, BL(1, 0, 1, 1). [39] claimed that estimating bilinear models is quite challenging. Many different ideas have been proposed to solve this problem. However, there is not a simple way to do inference even for its simple cases. They proposed a generalized autoregressive conditional heteroskedasticity - type maximum likelihood estimator for estimating the unknown parameters for a special bilinear model.It can be seen from the literature that there are a variety of methods used for estimating missing values for different time series data. What is however lacking is an explicit method for estimating missing values for bilinear time series models. We therefore want to estimate missing values for bilinear time series which have different probability distributions.

2.5. Estimation of Missing Values Using Linear Interpolation Method

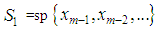

- Suppose we have one value

missing out of a set of an arbitrarily large number of n possible observations generated from a time series process

missing out of a set of an arbitrarily large number of n possible observations generated from a time series process  . Let the subspace

. Let the subspace  be the allowable space of estimators of

be the allowable space of estimators of  based on the observed values

based on the observed values  i.e.,

i.e.,  where n, the sample size, is assumed large. The projection of

where n, the sample size, is assumed large. The projection of  onto

onto  (denoted

(denoted  ) such that the dispersion error of the estimate (written disp

) such that the dispersion error of the estimate (written disp  is a minimum would simply be a minimum dispersion linear interpolator. Direct computation of the projection

is a minimum would simply be a minimum dispersion linear interpolator. Direct computation of the projection  onto

onto  is complicated since the subspaces

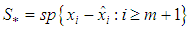

is complicated since the subspaces  and

and  are not independent of each other. We thus consider evaluating the projection onto two disjoint subspaces of

are not independent of each other. We thus consider evaluating the projection onto two disjoint subspaces of  To achieve this, we express

To achieve this, we express  as a direct sum of the subspaces

as a direct sum of the subspaces  and another subspace, say

and another subspace, say  such that

such that . A possible subspace is

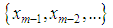

. A possible subspace is , where

, where  is based on the values

is based on the values  . The existence of the subspaces

. The existence of the subspaces  is shown in the following lemma.

is shown in the following lemma.2.5.1. Lemma

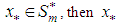

- Suppose

is a nondeterministic stationary process defined on the probability space

is a nondeterministic stationary process defined on the probability space  . Then the subspaces

. Then the subspaces  defined in the norm of the

defined in the norm of the  are such that

are such that  Proof:Suppose

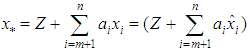

Proof:Suppose  can be represented as

can be represented as

where

where  . Clearly the two components on the right hand side of the equality are disjoint and independent and hence the result. The best linear estimator of

. Clearly the two components on the right hand side of the equality are disjoint and independent and hence the result. The best linear estimator of  can be evaluated as the projection onto the subspaces

can be evaluated as the projection onto the subspaces  and

and  such that disp

such that disp  is minimized. i.e.,

is minimized. i.e., But

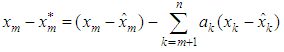

But  where the coefficients’ are estimated such that the dispersion error is minimized. The resulting error of the estimate is evaluated as

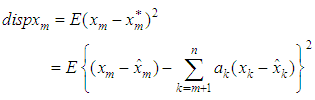

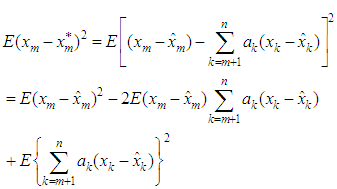

where the coefficients’ are estimated such that the dispersion error is minimized. The resulting error of the estimate is evaluated as  Now squaring both sides and taking expectations, we obtain the dispersion error as

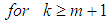

Now squaring both sides and taking expectations, we obtain the dispersion error as | (1) |

and solving for

and solving for  ) we should obtain the coefficients

) we should obtain the coefficients

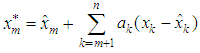

which are used in estimating the missing value. The missing value

which are used in estimating the missing value. The missing value  is estimated as

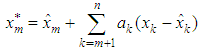

is estimated as  | (2) |

3. Research Methodology

- The data was simulated from pure bilinear time series models: BL(0,0,1,1) and BL(0,0,2,1) which have student-t innovations using R-statistical software. For each bilinear time series model, a program code was used to simulate the data. 100 samples of size 500 were generated and missing artificial points were created at data point 48, 293 and 496. These points were selected at random. Data analysis was done using statistical and computer software which included Excel, TSM and R and Matlab7. The mean square error (MSE) and mean absolute deviation (MAD) were used as performance measures. The MAD (Mean Absolute Deviation) and MSE (Mean Squared Error) were used. These were obtained from equation (3) and equation (4) respectively.

4. Results

4.1. Derivation of the Missing Values for Bilinear Time Series Models with Student-t Innovations

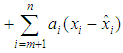

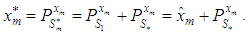

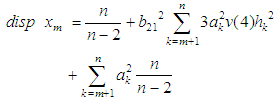

- Estimates of missing values for pure bilinear time series models whose innovations follow student-t distributions were derived based on minimizing the h-steps-ahead dispersion error. Two assumptions were made in the process of the derivations. The first one was that the time series data is stationary and thus their roots lie within the unit circle. Secondly, the higher powers (of orders greater than two or products of coefficients of orders greater than two) of the coefficients are approximately negligible. This was consequence of the result of the first assumption. Recall from lemma 2.12 and equations (1) that the optimal linear estimate

for the missing observation

for the missing observation  is by given

is by given  where

where is the estimate obtained from the model based on the previous lagged observations of the data before the point m, the missing data point and xm the missing value, the coefficients

is the estimate obtained from the model based on the previous lagged observations of the data before the point m, the missing data point and xm the missing value, the coefficients

are to be estimated by minimizing the dispersion error

are to be estimated by minimizing the dispersion error  given by equation (1).

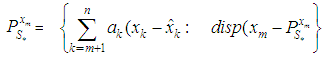

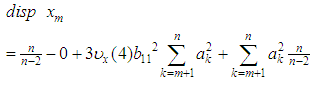

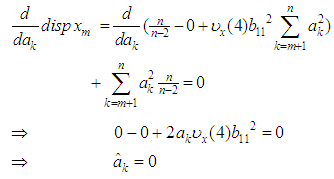

given by equation (1).4.2. Estimates of Missing Values BL (0,0,1,1) with Student T Errors

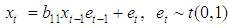

- The pure bilinear time series model with student t innovations of order one BL (0, 0, 1,1) is of the form

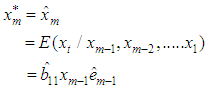

The estimate of the missing value for this model is given by theorem 4.1.Theorem 4.1The optimal linear estimate for missing observation for BL (0, 0, 1,1) with student errors is given by

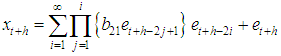

The estimate of the missing value for this model is given by theorem 4.1.Theorem 4.1The optimal linear estimate for missing observation for BL (0, 0, 1,1) with student errors is given by ProofThe stationary bilinear model, BL (0, 0, 1,1) is given by

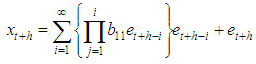

ProofThe stationary bilinear model, BL (0, 0, 1,1) is given by and the h-steps ahead forecast is

and the h-steps ahead forecast is  Therefore the forecast error is

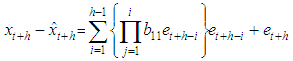

Therefore the forecast error is | (5) |

| (6) |

Hence equation (6) can be simplified as

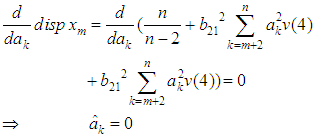

Hence equation (6) can be simplified as Now differentiating equation (4) with respect to

Now differentiating equation (4) with respect to  and equating to zero, we obtain\

and equating to zero, we obtain\ Substituting the values of

Substituting the values of  in equation (1), we obtain best estimator of the missing value as

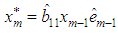

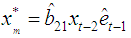

in equation (1), we obtain best estimator of the missing value as  This shows that the missing value is a one-step-ahead forecast based on the past observations collected before the missing value. This is in agreement with other studies that have estimated missing values using forecasting as in [29] and [1].Theorem 4.2The optimal linear estimate for BL (0,0,2,1) with student–t distribution

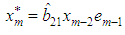

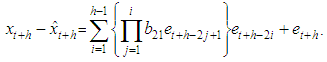

This shows that the missing value is a one-step-ahead forecast based on the past observations collected before the missing value. This is in agreement with other studies that have estimated missing values using forecasting as in [29] and [1].Theorem 4.2The optimal linear estimate for BL (0,0,2,1) with student–t distribution ProofThe stationary BL(0,0,2,1) is given by

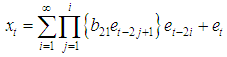

ProofThe stationary BL(0,0,2,1) is given by The h-steps ahead forecast error is expressed as

The h-steps ahead forecast error is expressed as Therefore the forecast error is

Therefore the forecast error is or it can also be represented as

or it can also be represented as Substituting equation (6) in equation (1), we have

Substituting equation (6) in equation (1), we have | (9) |

Hence equation (7) can be simplified as

Hence equation (7) can be simplified as | (10) |

and equating to zero, we obtain

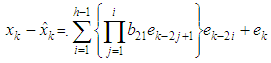

and equating to zero, we obtain Therefore the estimate of the missing value for the BL(0,0,2,1) is

Therefore the estimate of the missing value for the BL(0,0,2,1) is

4.3. Simulation Results

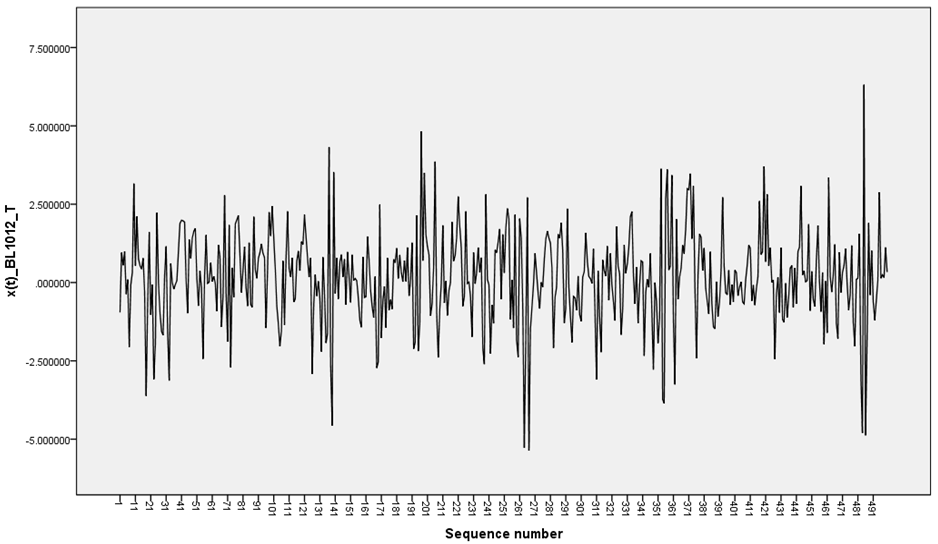

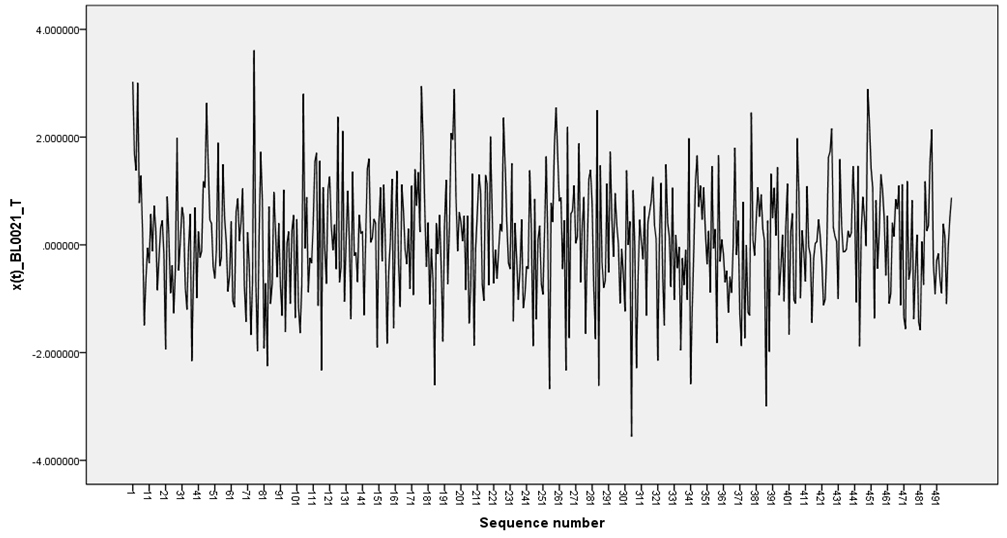

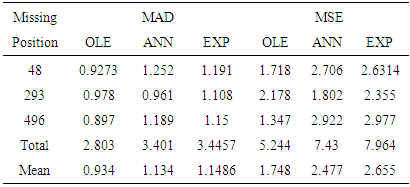

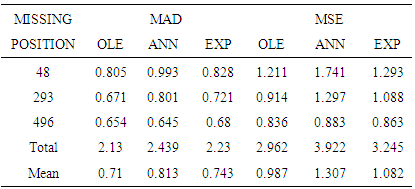

- In this section, the results of the optimal linear estimate, artificial neural networks and exponential smoothing based on simulated generated data for the student-t distributed innovations are presented. The R software was used to generate the bilinear random variables. One hundred samples of size 500 were generated for each model and missing values created at positions 48, 293 and 496. The mean absolute deviation and mean square deviations were calculated for each model used. The data generated were plotted in Figure 1-2 below.

| Figure 1. BL(0,0,1,1) with t-distributed innovations |

| Figure 2. BL(0,0,2,1).with t-istributed innovations |

| Table 1. Efficiency Measures obtained for student-tBL (0,0,1,1) |

| Table 2. Efficiency Measures obtained for student-BL(0,0,2,1) |

5. Conclusions

- In this study we have derived estimates for missing values for pure bilinear time series with student-t innovations. The missing values were found to be equivalent to the one–step-ahead forecast based on the lagged observations before the point of the missing value. Therefore to estimate missing values for pure bilinear time series which has student t distribution, we use one step ahead forecast. Further, the study found that the efficiency of the estimates obtained are correlated with the position of the missing observation. The further the position of the missing value from the first observation, the less efficient the estimate is. The estimates based on linear interpolation were on average better than the estimates based on ANN and exponential smoothing.

6. Recommendations

- The study recommends that for bilinear time series data with student t-innovations, OLE estimates be used in estimating missing values. More research needs to be done on whether the accuracy of an imputation method depends on the distribution of the data. Other research should focus on the comparison of the efficiency of the estimates obtained using other techniques such as kalman filter and estimation function. Other distributions for the innovation sequence should be considered.

Appendix

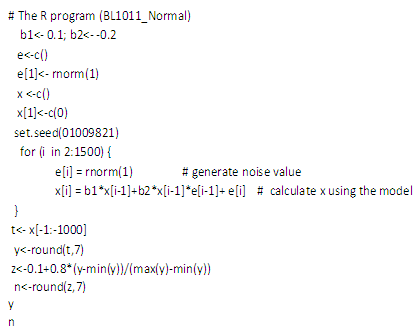

- This appendix has two parts, Appendix A and B. Appendix A contains the R codes used in simulating the time series data used in the analysis. The same codes are also used to obtain normalized data used in artificial neural network imputations. The moments of the various distributions are given in Appendix B. The codes for different bilinear models used in this data are given below.

|

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML