O. Y. Halid

Department of Mathematical Sciences, Faculty of Science, Ekiti State University, Ekiti State, Nigeria

Correspondence to: O. Y. Halid, Department of Mathematical Sciences, Faculty of Science, Ekiti State University, Ekiti State, Nigeria.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Abstract

This paper examined the relationship between crude oil production and the Nigerian economic performance using the Cobb-Douglas Production Function. The model was fitted to Nigeria’s data of crude oil production, labor input, capital input, oil domestic consumption and oil exports.The empirical results showed that crude oil output has a significant impact on Nigerian economy because there was a significant relationship between the variables in this model.

Keywords:

Crude oil, Cobb-Douglas Production Function, Labor, Capital, Export

Cite this paper: O. Y. Halid, The Cobb-Douglas Production of the Nigerian Economy (1974-2009), International Journal of Statistics and Applications, Vol. 5 No. 2, 2015, pp. 77-80. doi: 10.5923/j.statistics.20150502.05.

1. Introduction

Crude oil is a major source of energy in Nigeria and in the world at large. Oil being the mainstay of the Nigerian economy plays a vital role in shaping the economic and political status of the country. Although, Nigeria’s oil was discovered at the beginning of the 19th century, it was not until the end of the civil war (1967-1970) that the oil industry began to blossom.Nigeria was categorized as a country that is primarily rural, which depends on primary product exports before oil exploration. Since the attainment of independence in 1960s, it has experienced ethnic, regional and religious tensions, magnified by the significant disparities in economic, educational and environmental development in the south and the north.Crude oil discovery has had both positive and negative impacts on the economy. On the negative side, this can be considered with respect to the surrounding commodities within which the oil is being explored. Some of these communities still suffer environmental degradation which leads to deprivation of means of livelihood as well as other economic and social effects. Although, large proceeds are obtained from the domestic sales and exports of petroleum products, its effects on the growth of Nigerian economy as regards returns and productivity is still questionable. This necessitate the need to evaluate the relative impacts of crude oil on the economy.The oil boom of 1970s led to the neglect of agricultural and other manufacturing bases in favor of an unhealthy dependence on crude oil.In the year 2000, oil and gas exports accounted for more than 98 percent of exports and about 83 percent of the federal government revenue. Nigeria’s proven oil reserves are estimated to be about 35 billion barrels, natural gas reserves are well proven to be over 100trillion barrels while its crude oil production averages around 2.2 million barrels per day. This in turn contributes highly to the G.D.P of the country through the foreign exchange earnings and immense revenue generation. It is also a source of energy and provides employment opportunities. Poor corporate relations with indigenous communities, vandalism of oil infrastructure, severe ecological damages and personal security problems throughout the Niger Delta oil-producing regions continue to plague Nigeria’s oil sector. These unrest in the Niger-Delta region maybe partly due to neglect of social responsibilities to host communities on the path of government and some multinational companies (exploring the crude oil).Other challenges that plague this industry includes public control and bureaucracy, poor funding, smuggling and diversion of petroleum products, fraudulent domestic marketing practices, low level of domestic technological development among all.Despite, the ‘rich’ returns from Nigeria’s crude oil exploration, more than half of her population still languish in abject poverty and her economy still falls within the developing class.

2. Methodology

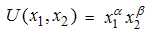

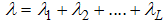

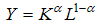

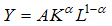

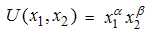

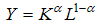

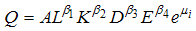

Although, there exists numerous non-linear econometric models, the Cobb-Douglas production function of the following form is considered according to Cobb and Douglas (1928) | (1) |

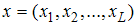

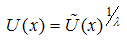

Q = total production, K = capital input, A = total factor productivity and L = labor inputα and β are the output elasticities of labor and capital respectively.It can be applied to utility as follows  | (2) |

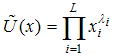

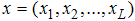

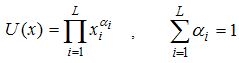

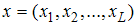

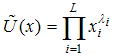

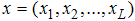

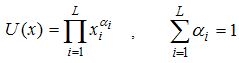

Where and are quantities consumed of good 1 and good 2In its generalized form, where  are the quantities consumed of good 1, good 2,…, good L, a utility function representing the Cobb-Douglas preferences may be written as :

are the quantities consumed of good 1, good 2,…, good L, a utility function representing the Cobb-Douglas preferences may be written as : | (3) |

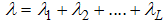

with  .Setting

.Setting  and because the function

and because the function  is strictly monotone for

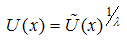

is strictly monotone for  .It follows that

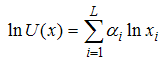

.It follows that  | (4) |

represent the same preferences.Setting  , it can be shown that

, it can be shown that | (5) |

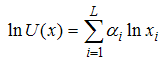

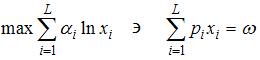

The utility may be maximized by looking at the logarithm of the utility  | (6) |

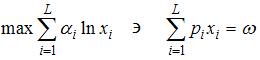

which makes the consumer’s optimization problem; | (7) |

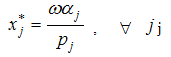

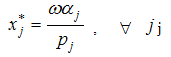

This has the solution that | (8) |

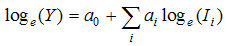

which has the representation that per-unit fraction of the consumers’ incomes used in purchasing good j is exactly the marginal term  .The Cobb-Douglas function can be estimated as a linear relationship using the following expression;

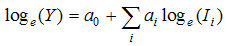

.The Cobb-Douglas function can be estimated as a linear relationship using the following expression; | (9) |

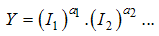

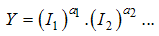

Where Y = output Ii = inputs and ai = model coefficientsThe model can also be written as  | (10) |

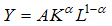

As noted, the common Cobb-Douglas function used in macroeconomics modeling is | (11) |

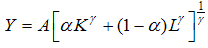

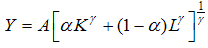

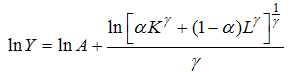

where K is capital and L the labor.This follows from  | (12) |

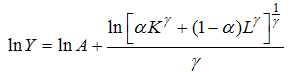

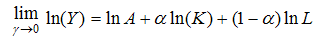

called the Constant Elasticity of Substitution (CES) functionWhere  = 0 corresponds to a Cobb-Douglas function in (1) above.(12) can be written as,

= 0 corresponds to a Cobb-Douglas function in (1) above.(12) can be written as, | (13) |

Upon the application of L’Hopital’s rule, | (14) |

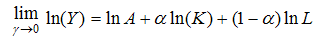

So that, | (15) |

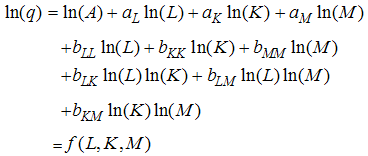

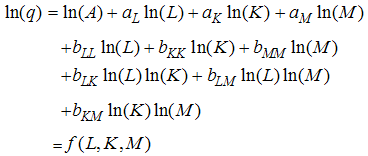

When the model coefficients sum to one, as in this example, the production function is first-order homogenous, which implies constant returns to scale, that is, if all inputs are scaled by a common factor greater than zero, output will be scaled by the same factor.Whereas if their sum is less than one, return to scale are decreasing and if greater than one, return to scale are increasing.The transcendental logarithmic form is | (16) |

Where L, K, M and q are labor, capital, materials and supplies and product respectively.The empirical analysis of this model will be carried out. The analysis will include estimation of the parameters of the Cobb-Douglas model through the use of Nigeria’s data of crude oil production obtained from the Nigeria’s National Bureau of Statistics (NBS). The analysis will also include tests of hypotheses about the statistical significance of the variables or parameters.

3. Application

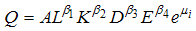

The production function of order (3) that takes into account capital input, labor input, domestic consumption and oil export for output of crude oil production was proposed. It is of the form | (17) |

This is similar to (3) where L and K are as specified. D and E represents the crude oil domestic consumption and exports respectively,  and

and  are the model input coefficientsQ is the crude oil production whereas

are the model input coefficientsQ is the crude oil production whereas  represents the random error term.The adoption of this model was justified by its exploratory analysis. The work of Odularu (2007) provides a good motivation for this work since this literature has applied this model earlier on.Upon fitting the data to the model by the ordinary least squares (OLS) method, the estimated model is

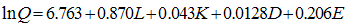

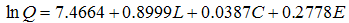

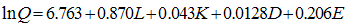

represents the random error term.The adoption of this model was justified by its exploratory analysis. The work of Odularu (2007) provides a good motivation for this work since this literature has applied this model earlier on.Upon fitting the data to the model by the ordinary least squares (OLS) method, the estimated model is | (18) |

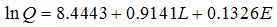

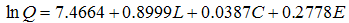

with a coefficient of determination (R-Squared) value 0.84, an adjusted R-Squared value of 0.82 and a standard error of regression estimate 0.05.After the removal of the least contributory variable (domestic consumption) , (18) reduces to | (19) |

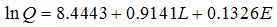

With a coefficient of determination (R-Squared) value 0.92, an adjusted R-Squared value of 0.91 and a standard error of regression estimate 0.039. Upon the removal of the second least contributory variable, (19) reduces to | (20) |

With a coefficient of determination (R-Squared) value 0.97, an adjusted R-Squared value of 0.96, a standard error of regression estimate 0.03 as well as an increasing returns to scale 1.0467. The removal of statistically insignificant variables is one of the common approaches towards achieving higher goodness of fit in econometrics.

4. Discussion of Results

It is important to note that fitting econometric models appropriately helps to determine appropriate functional relationships that exists between the variables.The coefficient of determination 0.84 in (18) is an indication of multicollinearity.From (18) –(20), it is observed that the coefficient of determination increases each time a variable with the least contributory effect is removed.From (20), it is obvious that the labor input and the crude oil export are the variables which have higher contributory effects with a coefficient of determination of 0.97. This indicates that 97% of the variation in crude oil output was explained by the labor input and export and it follows that production model of order (1) proposed is ideal for the data. There is no more problem of multicollinearity in the analysis after the removal of these less contributory effect variables. Coincidentally, the response of output to a proportionate change in labor inputs and oil exports brought was 1.0467(a value greater than one) which implies that the Nigerian Oil sector is characterized by increasing return to scale. Other fitted models in (18) and (19) also give a clear indication of an increased returns to scale. Also, test of significance of the parameters gave t-statistic values 35.00, 23.44 and 15.50 respectively which are greater than the critical values at 1% and 5% levels. The results (t-values) of the hypothesis tested about the (significant relationship between crude oil production and Nigerian economy) shows that the proposed model in (20) sufficiently fits the data as there exists a significant relationship between the endogenous and exogenous variables.Also, in testing the hypothesis about the variability of the explanatory variables, it is observed that the F-statistic value of 384.29 obtained is greater that the critical values at 1% and 5% levels which shows that the overall model in (20) is statistically significant.This follows that the explanatory variables in (20) namely oil labor input and export simultaneously explain variation in Nigeria’s economy.

5. Conclusions

Labor input and oil export are well explained in the model than domestic consumption and capital input and this led to the adoption of the Cobb-Douglas production function of order (1) for the Nigerian Economy. This is contrary to the American economy (1899-1922) and Mexican economy (1955-1974) which both relied upon labor and capital input according to Neter, kutner, Nachtsheim and Wasserman (1996). It must be noted that capital input and domestic consumption also play some part in Nigeria’s oil production (and consequently, her economic performance) but labor input and oil export play more significant roles since the latter variables are well explained in the model than the former due to a higher coefficient of determination obtained in (20).Although, all the input variables in the estimated models (18), (19) and (20) gave value of returns to scale (parameter) greater than 1, we adopted (20) as the most appropriate model for our data, because it has the highest coefficient of determination and the lowest standard error estimate. As at the period under consideration, the Nigerian oil sector was characterized by increasing returns to scale and doubling the inputs will double the output. From the discussion above, it is clear that crude oil production has significant effect on Nigeria’s economy as there exist a massive relationship between crude oil production and the economic performance. Since Nigeria’s economy solely depends on crude oil exports and capital input, it is advised that these inputs must be increased more significantly to enhance increased output or productivity.

References

| [1] | Adler, J.H., 1956, The Economic Development of Nigeria, The Journal of Political Economy, 64, 425-434. |

| [2] | Cobb C.W. and Douglas P.H., 1928, A Theory of Production, American Economic Review 18 (Supplement), 139-165. |

| [3] | Falola, T., 1999, The History of Nigeria, The Twentieth Century 133-156. |

| [4] | Genova, A and Falola, T., 2003, Oil in Nigeria: A Bibliographical Reconnaissance History in Africa, Vol. 30, pp. 133-156. |

| [5] | Gujarati D.N., 2003, Basic Econometrics, Fourth Edition McGraw-Hill Publishing Co., 563-573. |

| [6] | Halid O.Y., 2012 “A Survey of Statistical Tools in the Field of Economics and Other fields” International. Journal of Science & technology 2(5), 255-258. |

| [7] | Halid O.Y., Ogunwale O.D. and Babalola B.T., 2012, A Comparative Analysis of the Cobb-Douglas Model and the Linear Regression Model of Order (2)” International Journal of Innovative Research & Development 1(5), 290-297. |

| [8] | Iyoha, M.A and Ekanem O.T., 2002, Introduction to Econometrics, Mareh Publishing Co. Benin. |

| [9] | Koutsoyiannis A., 1977, Theory of Econometrics, Second Edition, Palgrave,134-137. |

| [10] | Neter J., Kutner M.H., Nachtsheim C.J., Wasserman W. ,1996 “Applied Regression Analysis” Third Edition, Irwin, 139-165. |

| [11] | Odularo G.O., 2007 “Crude Oil and the Nigerian Economic Performance”, Oil and Gas Business, 1-29. |

are the quantities consumed of good 1, good 2,…, good L, a utility function representing the Cobb-Douglas preferences may be written as :

are the quantities consumed of good 1, good 2,…, good L, a utility function representing the Cobb-Douglas preferences may be written as :

.Setting

.Setting  and because the function

and because the function  is strictly monotone for

is strictly monotone for  .It follows that

.It follows that

, it can be shown that

, it can be shown that

.The Cobb-Douglas function can be estimated as a linear relationship using the following expression;

.The Cobb-Douglas function can be estimated as a linear relationship using the following expression;

= 0 corresponds to a Cobb-Douglas function in (1) above.(12) can be written as,

= 0 corresponds to a Cobb-Douglas function in (1) above.(12) can be written as,

and

and  are the model input coefficientsQ is the crude oil production whereas

are the model input coefficientsQ is the crude oil production whereas  represents the random error term.The adoption of this model was justified by its exploratory analysis. The work of Odularu (2007) provides a good motivation for this work since this literature has applied this model earlier on.Upon fitting the data to the model by the ordinary least squares (OLS) method, the estimated model is

represents the random error term.The adoption of this model was justified by its exploratory analysis. The work of Odularu (2007) provides a good motivation for this work since this literature has applied this model earlier on.Upon fitting the data to the model by the ordinary least squares (OLS) method, the estimated model is

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML