-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

International Journal of Statistics and Applications

p-ISSN: 2168-5193 e-ISSN: 2168-5215

2015; 5(2): 72-76

doi:10.5923/j.statistics.20150502.04

On Performance of Shrinkage Methods – A Monte Carlo Study

Gafar Matanmi Oyeyemi1, Eyitayo Oluwole Ogunjobi2, Adeyinka Idowu Folorunsho3

1Department of Statistics, University of Ilorin

2Department of Mathematics and Statistics, The Polytechnic Ibadan, Adeseun Ogundoyin Campus, Eruwa

3Department of Mathematics and Statistics, Osun State Polytechnic Iree

Correspondence to: Gafar Matanmi Oyeyemi, Department of Statistics, University of Ilorin.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Multicollinearity has been a serious problem in regression analysis, Ordinary Least Squares (OLS) regression may result in high variability in the estimates of the regression coefficients in the presence of multicollinearity. Least Absolute Shrinkage and Selection Operator (LASSO) methods is a well established method that reduces the variability of the estimates by shrinking the coefficients and at the same time produces interpretable models by shrinking some coefficients to exactly zero. We present the performance of LASSO -type estimators in the presence of multicollinearity using Monte Carlo approach. The performance of LASSO, Adaptive LASSO, Elastic Net, Fused LASSO and Ridge Regression (RR) in the presence of multicollinearity in simulated data sets are compared Akaike Information Criterion (AIC) and Bayesian Information Criterion (BIC) criteria. A Monte Carlo experiment of 1000 trials was carried out at different sample sizes n (50, 100 and 150) with different levels of multicollinearity among the exogenous variables (ρ = 0.3, 0.6, and 0.9). The overall performance of Lasso appears to be the best but Elastic net tends to be more accurate when the sample size is large.

Keywords: Multicollinearity, Least Absolute shrinkage and Selection operator, Elastic net, Ridge, Adaptive Lasso, Fused Lasso

Cite this paper: Gafar Matanmi Oyeyemi, Eyitayo Oluwole Ogunjobi, Adeyinka Idowu Folorunsho, On Performance of Shrinkage Methods – A Monte Carlo Study, International Journal of Statistics and Applications, Vol. 5 No. 2, 2015, pp. 72-76. doi: 10.5923/j.statistics.20150502.04.

Article Outline

1. Introduction

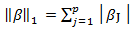

- Multicollinearity can cause serious problem in estimation and prediction when present in a set of predictors. Traditional statistical estimation procedures such as Ordinary Least Squares (OLS) tend to perform poorly, have high prediction variance, and may be difficult to interpret [1] i.e. because of its large variance’s and covariance’s which means the estimates of the parameters tend to be less precise and lead to wrong inferences [2] . In such situations it is often beneficial to use shrinkage i.e. shrink the estimator towards zero vector, which in effect involves introducing some bias so as to decrease the prediction variance, with the net result of reducing the mean squared error of prediction, they are nothing more than penalized estimators, due to estimation there is objective functions with the addition of a penalty which is based on the parameter. Various assumptions have been made in the literature where penalty of

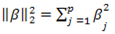

- norm,

- norm,  norm or both

norm or both  which stand as tuning parameters

which stand as tuning parameters  were used to influence the parameter estimates in order to minimized the effect of the collinearity. Shrinkage methods are popular among the researchers for their theoretical properties e.g. parameter estimation.Over the years, the LASSO - type methods have become popular methods for parameter estimation and variable selection due to their property of shrinking some of the model coefficients to exactly zero see [3], [4]. [3] Proposed a new shrinkage method Least Absolute Shrinkage and Selection Operator (LASSO) with tuning parameter

were used to influence the parameter estimates in order to minimized the effect of the collinearity. Shrinkage methods are popular among the researchers for their theoretical properties e.g. parameter estimation.Over the years, the LASSO - type methods have become popular methods for parameter estimation and variable selection due to their property of shrinking some of the model coefficients to exactly zero see [3], [4]. [3] Proposed a new shrinkage method Least Absolute Shrinkage and Selection Operator (LASSO) with tuning parameter 0 which is a penalized method, [5] for the first systematic study of the asymptotic properties of Lasso – type estimators [4]. The LASSO shrinks some coefficients while setting others to exactly zero, and thus theoretical properties suggest that the LASSO potentially enjoys the good features of both subset selection and ridge regression. [6] had earlier proposed Ridge regression which minimizes the Residual Sum of Squares subject to constraint with

0 which is a penalized method, [5] for the first systematic study of the asymptotic properties of Lasso – type estimators [4]. The LASSO shrinks some coefficients while setting others to exactly zero, and thus theoretical properties suggest that the LASSO potentially enjoys the good features of both subset selection and ridge regression. [6] had earlier proposed Ridge regression which minimizes the Residual Sum of Squares subject to constraint with  [6] argued that the optimal choice of parameter

[6] argued that the optimal choice of parameter  yields reasonable predictors because it controls the degree of precision for true coefficient of

yields reasonable predictors because it controls the degree of precision for true coefficient of  to aligned with original variable axis direction in the predictor space. [7] Introduced the Smoothing Clipped Absolute Deviation (SCAD) which penalized Least Square estimate to reduce bias and satisfy certain conditions to yield continuous solutions. [8] was first to propose Ridge Regression which minimizes the Residual Sum of Squares subject to constraint with

to aligned with original variable axis direction in the predictor space. [7] Introduced the Smoothing Clipped Absolute Deviation (SCAD) which penalized Least Square estimate to reduce bias and satisfy certain conditions to yield continuous solutions. [8] was first to propose Ridge Regression which minimizes the Residual Sum of Squares subject to constraint with  thus regarded as

thus regarded as  - norm. [9] developed Least Angle Regression Selection (LARS) for a model selection algorithm [10], [11] study the properties of adaptive group Lasso. In 2006, [12] proposed a Generalization of LASSO and other shrinkage methods include Dantzig Selector with Sequential Optimization, DASSO [13], Elastic Net [14], Variable Inclusion and Selection Algorithm, VISA [15], (Adaptive LASSO [16] among others.LASSO-type estimators are the techniques that are often suggested to handle the problem of multicollinearity in regression model. More often than none, Bayesian simulation with secondary data has been used. When the ordinary least squares are adopted there is tendency to have poor inferences, but with LASSO-type estimators which have recently been adopted may still come with its shortcoming by shrinking important parameters, we intend to examine how this shrink parameters may be affected asymptotically. However, the performances of other estimators have not been exhaustively compared in the presence of all these problems. Moreover, the question of which estimator is robust in the presence of a LASSO-type estimators of these problems have not been fully addressed. This is the focus of this research work.

- norm. [9] developed Least Angle Regression Selection (LARS) for a model selection algorithm [10], [11] study the properties of adaptive group Lasso. In 2006, [12] proposed a Generalization of LASSO and other shrinkage methods include Dantzig Selector with Sequential Optimization, DASSO [13], Elastic Net [14], Variable Inclusion and Selection Algorithm, VISA [15], (Adaptive LASSO [16] among others.LASSO-type estimators are the techniques that are often suggested to handle the problem of multicollinearity in regression model. More often than none, Bayesian simulation with secondary data has been used. When the ordinary least squares are adopted there is tendency to have poor inferences, but with LASSO-type estimators which have recently been adopted may still come with its shortcoming by shrinking important parameters, we intend to examine how this shrink parameters may be affected asymptotically. However, the performances of other estimators have not been exhaustively compared in the presence of all these problems. Moreover, the question of which estimator is robust in the presence of a LASSO-type estimators of these problems have not been fully addressed. This is the focus of this research work.2. Material and Method

- Consider a simple least squares regression model.

| (1) |

are exogenous,

are exogenous,  are

are  random variable with mean zero and finite variance

random variable with mean zero and finite variance

is

is  vector. Suppose

vector. Suppose  takes the largest possible dimension , in other words the number of regressors may be at most

takes the largest possible dimension , in other words the number of regressors may be at most  but the true p is somewhere between 1 and

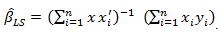

but the true p is somewhere between 1 and  The issue here is to come up with the true model and estimate it at the same time.The least squares estimate without model selection is

The issue here is to come up with the true model and estimate it at the same time.The least squares estimate without model selection is with

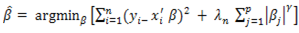

with  estimates.Shrinkage estimators are not that easy to calculate as least squares. Thus the objective functions for the shrinkage estimators:

estimates.Shrinkage estimators are not that easy to calculate as least squares. Thus the objective functions for the shrinkage estimators: | (2) |

is a tuning parameter (for penalization), it is a positive sequence, and

is a tuning parameter (for penalization), it is a positive sequence, and  will not be estimated, and

will not be estimated, and  will be specified by us. The objective function consists of 2 parts, the first one is the LS objective function part, and then the penalty factor.Thus, taking the penalty part only

will be specified by us. The objective function consists of 2 parts, the first one is the LS objective function part, and then the penalty factor.Thus, taking the penalty part only If

If  is going to infinity or to a constant, the values of

is going to infinity or to a constant, the values of  that minimizes that part should be the case that

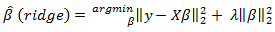

that minimizes that part should be the case that  We get all zeros if we minimize only the penalty part. So the penalty part will shrink the coefficients to zero. This is the function of the penalty.Ridge Regression (RR) by [17] is ideal if there are many predictors, all with non-zero coefficients and drawn from a normal distribution [18] In particular, it performs well with many predictors each having small effect and prevents coefficients of linear regression models with many correlated variables from being poorly determined and exhibiting high variance. RR shrinks the coefficients of correlated predictors equally towards zero. So, for example, given k identical predictors, each would get identical coefficients equal to

We get all zeros if we minimize only the penalty part. So the penalty part will shrink the coefficients to zero. This is the function of the penalty.Ridge Regression (RR) by [17] is ideal if there are many predictors, all with non-zero coefficients and drawn from a normal distribution [18] In particular, it performs well with many predictors each having small effect and prevents coefficients of linear regression models with many correlated variables from being poorly determined and exhibiting high variance. RR shrinks the coefficients of correlated predictors equally towards zero. So, for example, given k identical predictors, each would get identical coefficients equal to  the size that any one predictor would get if fit singly [18]. Ridge regression thus does not force coefficients to vanish and hence cannot select a model with only the most relevant and predictive subset of predictors. The ridge regression estimator solves the regression problem in [17] using

the size that any one predictor would get if fit singly [18]. Ridge regression thus does not force coefficients to vanish and hence cannot select a model with only the most relevant and predictive subset of predictors. The ridge regression estimator solves the regression problem in [17] using  penalized least squares:

penalized least squares: | (3) |

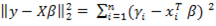

is the

is the  –norm (quadratic) loss function (i.e. residual sum of squares),

–norm (quadratic) loss function (i.e. residual sum of squares),  is the

is the  of X,

of X,  is the

is the  – norm penalty on

– norm penalty on  and

and  is the tuning (penalty, regularization, or complexity) parameter which regulates the strength of the penalty (linear shrinkage) by determining the relative importance of the data-dependent empirical error and the penalty term. The larger the value of

is the tuning (penalty, regularization, or complexity) parameter which regulates the strength of the penalty (linear shrinkage) by determining the relative importance of the data-dependent empirical error and the penalty term. The larger the value of  the greater is the amount of shrinkage. As the value of

the greater is the amount of shrinkage. As the value of  is dependent on the data it can be determined using data-driven methods, such as cross-validation. The intercept is assumed to be zero in (3) due to mean centering of the phenotypes.

is dependent on the data it can be determined using data-driven methods, such as cross-validation. The intercept is assumed to be zero in (3) due to mean centering of the phenotypes. 2.1. Least Absolute Shrinkage and Selection Operator (LASSO)

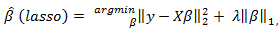

- LASSO regression methods are widely used in domains with massive datasets, such as genomics, where efficient and fast algorithms are essential [18] .The LASSO is, however, not robust to high correlations among predictors and will arbitrarily choose one and ignore the others and break down when all predictors are identical [18]. The LASSO penalty expects many coefficients to be close to zero, and only a small subset to be larger (and nonzero).The LASSO estimator [3] uses the

penalized least squares criterion to obtain a sparse solution to the following optimization problem:

penalized least squares criterion to obtain a sparse solution to the following optimization problem: | (4) |

is the

is the  -norm penalty on

-norm penalty on  which induces sparsity in the solution, and

which induces sparsity in the solution, and  is a tuning parameter.The

is a tuning parameter.The  penalty enables the LASSO to simultaneously regularize the least squares fit and shrinks some components of

penalty enables the LASSO to simultaneously regularize the least squares fit and shrinks some components of  to zero for some suitably chosen

to zero for some suitably chosen  The cyclical coordinate descent algorithm, [18], efficiently computes the entire lasso solution paths for

The cyclical coordinate descent algorithm, [18], efficiently computes the entire lasso solution paths for  for the lasso estimator and is faster than the well-known LARS algorithm [9]. These properties make the lasso an appealing and highly popular variable selection method.

for the lasso estimator and is faster than the well-known LARS algorithm [9]. These properties make the lasso an appealing and highly popular variable selection method. 2.2. Fused LASSO

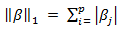

- To compensate the ordering limitations of the LASSO, [19] introduced the fused LASSO. The fused LASSO penalizes the

-norm of both the coefficients and their differences:

-norm of both the coefficients and their differences: | (5) |

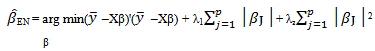

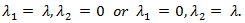

2.3. Elastic Net

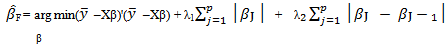

- [14] proposed the elastic net, a new regularization of the LASSO, for the unknown group of variables and for the multicollinear predictors. The elastic net method overcomes them limitations of the method which uses a penalty function based on

Use of this penalty function has several limitations. For instance, in the "large p, small n" case the LASSO selects at most n variables before it saturates. Also if there is a group of highly correlated variables, then the LASSO tends to select one variable from a group and ignore the others. To overcome these limitations, the elastic net adds a quadratic part to the penalty

Use of this penalty function has several limitations. For instance, in the "large p, small n" case the LASSO selects at most n variables before it saturates. Also if there is a group of highly correlated variables, then the LASSO tends to select one variable from a group and ignore the others. To overcome these limitations, the elastic net adds a quadratic part to the penalty which when used alone is (known also as ). The elastic net estimator can be expressed as

which when used alone is (known also as ). The elastic net estimator can be expressed as | (7) |

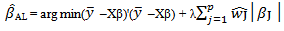

2.4. Adaptive LASSO

- [7] showed that the LASSO can perform automatic variable selection but it produces biased estimates for the large coefficients. [16] introduced the adaptive LASSO estimator as

| (8) |

|

where

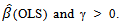

where  is a

is a  consistent estimator such as

consistent estimator such as  where

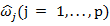

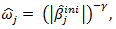

where  are the adaptive data-driven weights, which can be estimated by,

are the adaptive data-driven weights, which can be estimated by,  where

where  is a positive constant and

is a positive constant and  is an initial consistent estimator of

is an initial consistent estimator of  obtained through least squares or ridge regression if multicollinearity is important [16]. The optimal value of

obtained through least squares or ridge regression if multicollinearity is important [16]. The optimal value of  can be simultaneously selected from a grid of values, with values of

can be simultaneously selected from a grid of values, with values of  selected from {0.5, 1, 2}, using two-dimensional cross-validation [16]. The weights allow the adaptive LASSO to apply different amounts of shrinkage to different coefficients and hence to more severely penalize coefficients with small values. The flexibility introduced by weighting each coefficient differently corrects for the undesirable tendency of the lasso to shrink large coefficients too much yet insufficiently shrink small coefficients by applying the same penalty to every regression coefficient [16].

selected from {0.5, 1, 2}, using two-dimensional cross-validation [16]. The weights allow the adaptive LASSO to apply different amounts of shrinkage to different coefficients and hence to more severely penalize coefficients with small values. The flexibility introduced by weighting each coefficient differently corrects for the undesirable tendency of the lasso to shrink large coefficients too much yet insufficiently shrink small coefficients by applying the same penalty to every regression coefficient [16].3. Monte Carlo Study

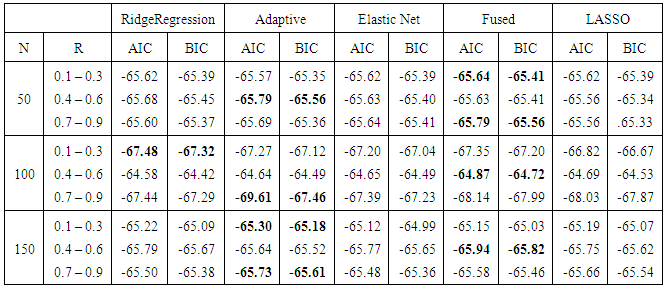

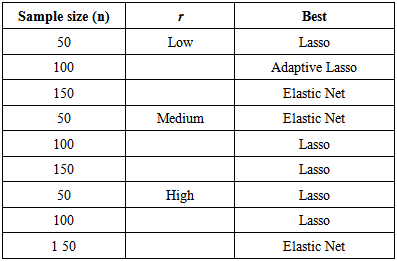

- In this section we carried out simulation to examining the finite sample performance for LASSO, Adaptive LASSO, Elastic LASSO, Fused LASSO and Ridge Regression via AIC and BIC are compared. We infected the data with multicollinearity by generating sets of variables of sample sizes n (n = 50, 100 and 150) using normal distribution respectively. The level of multicollinearity among the variables are small (r = 0.1 – 0.3), mild (r = 0.4 – 0.6) and serious (r = 0.7 – 0.9). Each simulation was repeated 1000 times for consistency using R package.

|

4. Conclusions

- We have considered Lasso type estimator in the presence of multicollinearity in linear model due to Ordinary Least Squares (OLS) bring about poor parameters estimate and produce wrong inferences. Lasso type estimators are more stable likewise provide performances (outperforms) simple application of parameter estimator methods in the case of correlated predictors and produce sparser solution.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML