-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Software Engineering

p-ISSN: 2162-934X e-ISSN: 2162-8408

2025; 12(1): 1-13

doi:10.5923/j.se.20251201.01

Received: Apr. 29, 2025; Accepted: May 26, 2025; Published: May 30, 2025

Efficient Underwriting Using Agentic AI

Mohammad Asif Ali

Technical Lead, PNC Financial Services Group, Inc, Pittsburgh, PA, USA

Correspondence to: Mohammad Asif Ali, Technical Lead, PNC Financial Services Group, Inc, Pittsburgh, PA, USA.

| Email: |  |

Copyright © 2025 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

In the financial industry, the underwriting process is an essential yet often protracted element of risk assessment. Traditional methods of underwriting are largely reliant on human expertise, rule-based evaluations, and statistical models, which can result in inefficiencies, inconsistencies, and delays in processing. This paper examines the groundbreaking implementation of Agentic Artificial Intelligence (AI) in underwriting, employing large language models (LLMs), retrieval-augmented generation (RAG), and robotic process automation (RPA) to automate and refine decision-making processes. Through empirical validation, we demonstrate that Agentic AI significantly enhances the efficiency of loan processing, reduces bias, and improves the precision of risk assessments. Furthermore, the study compares the efficacy of AI-driven underwriting models against conventional methods, highlighting substantial advancements in processing speed, cost efficiency, and consistency in decision-making. Finally, we explore the challenges related to AI explainability, adherence to regulatory standards, and future prospects for AI-enhanced underwriting.

Keywords: Agentic AI, Artificial Intelligence, Loan Underwriter, Large Language Model (LLM), Automation, Retrieval Augmented Generation (RAG), Risk Assessment

Cite this paper: Mohammad Asif Ali, Efficient Underwriting Using Agentic AI, Software Engineering, Vol. 12 No. 1, 2025, pp. 1-13. doi: 10.5923/j.se.20251201.01.

Article Outline

1. Introduction

- The financial sector, especially in the realm of loan underwriting, encounters considerable obstacles stemming from inefficiencies in manual processing, subjective risk evaluations, and increasing compliance requirements. Conventional underwriting practices typically rely on manual verification of documents, credit assessments, and human judgment, which can lead to inconsistencies and delays. The introduction of Agentic AI presents a revolutionary solution by incorporating AI-driven automation, intelligent decision-making capabilities, and real-time adaptability to enhance the efficiency of underwriting processes.

1.1. Research Objective

- The objective of this paper is to:1. Examine the influence of Agentic AI on the automation of underwriting processes.2. Compare AI-driven underwriting with traditional approaches regarding accuracy, processing time, and risk profiling.3. Analyze the contribution of Large Language Models (LLMs) and Retrieval-Augmented Generation (RAG) in the decision-making process of underwriting.4. Explore the aspects of AI explainability, compliance, and future improvements.

1.2. Background of Agentic AI

- Agentic AI is an emerging technology that is revolutionizing a wide range of industries. In order to create autonomous AI agents that can analyze data, set goals, and take actions with less human supervision, it combines enterprise automation, machine learning, and large language models (LLMs). With each interaction, these agents can make decisions, solve problems dynamically, learn, and get better.With its constant learning and output optimization, Agentic AI is ideal for dynamic environments. In contrast to AI applications, which are frequently task-specific and excel in specialized fields like data analysis or image recognition, Agentic AI manages intricate, multi-step workflows that require real-time contextual understanding and decision-making.AI agents, RPA robots, and humans work together in a symbiotic relationship in agentic automation. People give the agents their objectives, maintain governance, and intervene when human review and judgment are needed (human in the loop). By gathering the data needed for AI agents to make decisions (such as logging in, connecting, and comprehending information across multiple systems), RPA robots make AI agents more accurate, productive, and successful. They can also carry out a variety of other predetermined tasks for agents.

1.3. Agentic AI Levels

- The concept of Agentic AI includes multiple levels, with each level indicating a varying degree of independence and intricacy in the actions and learning capabilities of AI systems.1. Reactive Agents: Operating under a fundamental sense-and-respond paradigm, reactive agents respond to present inputs without the ability to retain information or engage in planning.2. Proactive Agents: Proactive agents surpass the act of responding by utilizing lessons learned from past experiences and formulating targeted actions to reach their goals.3. Adaptive Agents: Through dynamic learning from their interactions, adaptive agents enhance their responses and strategies, allowing them to operate efficiently within complex environments.4. Fully Agentic Systems: Fully independent AI systems are designed to autonomously determine their objectives, make choices, and perform activities in environments that are not structured.

1.4. Future of Agentic AI

- With the advancement of Agentic AI, its possibilities will broaden into more complex applications:1. Advanced Enterprise Autonomy: AI agents that go beyond mere execution to include strategic planning and process optimization.2. Cross-Disciplinary Integration: Merging domains like banking and finance, healthcare and legal research to achieve more profound solutions to challenges.3. Collaborative Human Interaction: AI functioning as an active collaborator, working in harmony with human teams.

2. Literature Review

2.1. Traditional Underwriting vs. AI-Driven Underwriting

- Traditional underwriting methods are based on rule-based decision-making, statistical analysis, and human oversight. Conversely, AI-enhanced underwriting utilizes machine learning (ML) models, natural language processing (NLP), and automation to boost efficiency and accuracy. Studies have demonstrated that AI underwriting can shorten loan approval times by 40-60% and increase the consistency of risk assessments by 30%.

2.2. Role of Large Language Models (LLMs) in Underwriting

- The use of Large Language Models (LLMs), like Mistral 7B, is on the rise in areas such as document analysis, information extraction, and automated support for decision-making. By leveraging Retrieval-Augmented Generation (RAG), these models facilitate adherence to underwriting policies and regulatory requirements during the decision-making process.

2.3. AI Bias, Explainability, and Compliance in Financial Decision-Making

- One of the primary challenges associated with AI-driven underwriting is the presence of bias in model predictions, which can result from imbalances in the training datasets. Research underscores the necessity for interpretable AI models to comply with Fair Lending Practices and the Equal Credit Opportunity Acts. This study examines mitigation approaches, such as human-in-the-loop (HITL) oversight and federated learning, aimed at securing credit assessments.

2.4. Problem Statement

- The high operational cost and the practice of traditional underwriting in the financial services industry has been reliant on human expertise, rule-based evaluations, and statistical models to assess the ability to pay the borrowed funds, determine loan eligibility, and evaluate insurance risks. While human underwriters provide critical domain knowledge, judgment, and ethical considerations, they are limited by factors such as subjectivity, inefficiency, extended processing times, and scalability challenges. Additionally, human-driven underwriting is at risk of biases, inconsistencies, and fatigue, which can negatively influence financial inclusion and risk management strategies.With the advent of Agentic AI, there exists a promising opportunity to develop autonomous, adaptive, and self-improving underwriting agents that can carry out real-time risk assessments with superior efficiency, consistency, and scalability compared to traditional human underwriters.

2.5. Why Choose an Agentic AI Underwriter

- The Agentic AI Underwriter has a very strong framework that leverages retrieval augmented generation (RAG) with large language models (LLMs) for faster indexation and knowledge retrieval. By harnessing Mistral AI services (Mistral 7B and MoE 8x7B), it creates a robust knowledge-driven AI agent which can generate intelligent suggestions, handle complex analysis and decision making. The data can be sourced from historical loan data, API integration with financial data sources, websites, policy documents, regulatory guidelines. By simulating human judgment, Agentic AI Underwriter reduces the human intervention. AI agents prioritize tasks, allocate resources, and predict outcomes—implementing the decisions they make to move the process forward and achieve the desired outcome. It addresses the discrepancies like missing data or unexpected formats without human intervention.Advantages: 1. Enhanced efficiency and accuracy: The conventional underwriting process is characterized by its labor-intensive nature and susceptibility to human error. By automating the phases of data collection and analysis, the AI agent greatly enhances the efficiency of underwriting, enabling human underwriters to evaluate applications at an unparalleled speed while maintaining the integrity of risk assessment.2. Automated Risk Profiling: The Agentic AI underwriter significantly influences the assessment of risk factors. By utilizing AI platforms, the companies can swiftly gather and evaluate extensive datasets, including personal information and financial records, which enables them to develop a thorough understanding of an applicant's risk profile.3. Uniformity in Underwriting Practices: The Agentic AI underwriter also promotes the uniformity of underwriting standards, guaranteeing that each application is assessed according to identical criteria. This consistency not only improves the equity of the underwriting process but also reduces the likelihood of human bias. 4. Reduces operational cost: The advantages of using the Agentic Ai underwriter go beyond the improvements in efficiency and accuracy. It helps to decrease the operational cost by reducing the extensive manual intervention. Additionally, the improved precision in risk evaluations creates a more competitive, equitable pricing and robust environment.

| Figure 1. Human vs Agentic AI |

2.6. Ethical Considerations in Automated Underwriting

- As the use of AI in decision-making becomes more common in underwriting, it is essential to address ethical issues to ensure fairness and accountability:• Fairness: AI systems can reflect biases present in historical data, resulting in unfair outcomes. Implementing proactive strategies such as bias assessments and varied training datasets is crucial.• Accountability: When AI is utilized, identifying who is responsible for incorrect or unfair decisions can be difficult. It is important to establish a clear accountability framework, including human oversight.• Transparency for Applicants: It is necessary to inform applicants about the use of AI in decision-making processes and to provide them with clear explanations regarding their approval or denial to uphold procedural justice.

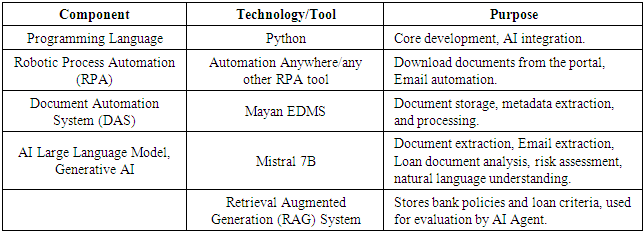

2.7. Traditional AI vs. Agentic AI in Underwriting

- Traditional AI systems utilized in underwriting are predominantly rule-based, static, and limited in scope. They heavily depend on predetermined decision trees or machine learning models that are specifically trained for tasks like credit evaluation or document sorting. While these systems enhance processing speed and decrease manual labor, they are constrained in their ability to adapt, understand context, and make autonomous decisions.In contrast to traditional AI systems, which are typically rule-based, static, and narrowly focused, Agentic AI systems operate as autonomous agents that exhibit goal-oriented behavior, dynamic learning, and contextual reasoning. They incorporate elements such as Large Language Models (LLMs), Retrieval-Augmented Generation (RAG), and Robotic Process Automation (RPA) to manage intricate workflows—performing data ingestion, analysis, and compliance checks in real-time. Unlike their traditional counterparts, Agentic AI can mimic human-like judgment, clarify data uncertainties, and autonomously engage with multi-source systems, rendering them considerably more effective for complex, high-stakes tasks like underwriting.The below comparison demonstrates that Agentic AI signifies a crucial advancement over conventional AI models in underwriting, facilitating intelligent automation with greatly enhanced scalability, accuracy, and transparency in decision-making.

|

3. Methodology

- The Agentic AI Underwriter methodology integrates robotic process automation (RPA), sophisticated artificial intelligence (AI), and human oversight to enhance and refine the loan underwriting process. The procedure commences with the gathering of applicant information through document submissions and email interactions. A software robot is responsible for downloading these documents and forwarding them to Mayan EDMS for data extraction, utilizing the Mistral 7B large language model (LLM) to process and extract essential details such as the applicant's name, address, and income.Concurrently, the bot accesses the applicant's credit score from credit bureaus via APIs. Additionally, it analyzes the sales representative’s email to extract pertinent loan information. This collected data is then input into the Mistral 7B Loan Recommendation AI Agent, which assesses the loan application in accordance with the bank's policies and guidelines stored within a Retrieval Augmented Generation (RAG) system, producing a recommendation based on compliance and risk evaluation.The decision-making process bifurcates into two outcomes: approval or denial. In either scenario, a human-in-the-loop task enables a loan underwriter to review and confirm the AI-generated recommendation. Following the final decision, the bank’s Loan Management System is updated through API, and automated email notifications are dispatched to all relevant parties, ensuring transparency and effective communication.By merging automation, AI, and human oversight, this methodology significantly improves efficiency, shortens processing times, and upholds compliance, resulting in a robust and scalable loan underwriting solution.

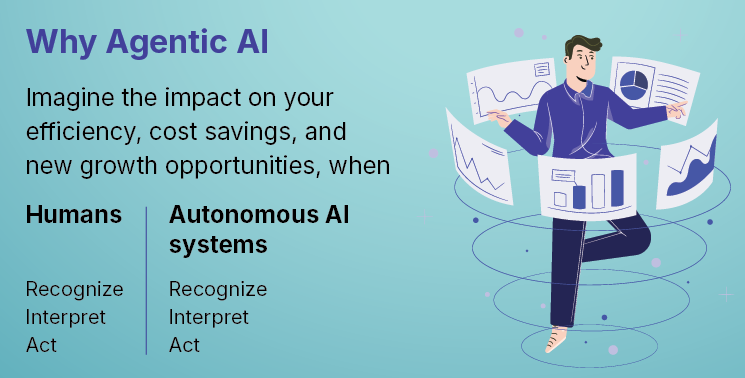

4. Technology Stack

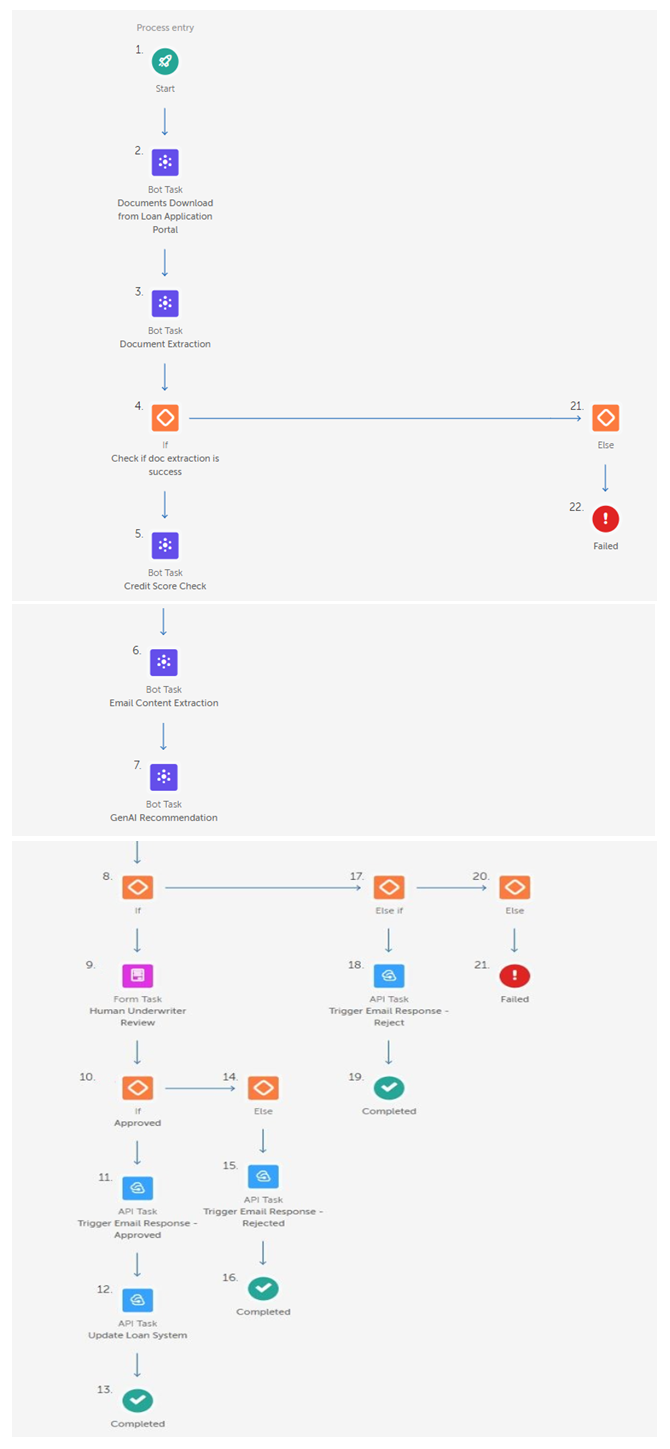

5. Design Flow

- The Agentic AI Underwriter follows the below execution steps:1. Data Collection• The Loan applicant uploads the required documents (W2, pay stubs, bank statements, address and ID proof, photograph etc.) to the loan application portal. • The sales representative emails the bank loan department with key loan details, including purchase price, taxes, down payment, and the applicants income.2. Document Extraction• A software robot (bot) downloads the documents from the loan application portal.• The Documents are sent to Mayan EDMS a Document Automation System (DAS) for data extraction (e.g. applicant’s name, address, income, etc.) using Mistral 7B – a large language model (LLM).3. Credit Score• The bot pulls the applicant credit score from credit bureaus via APIs (e.g. Experian API, Equifax API) using Python.4. Email extraction• A Mistral 7B Generative AI powered Email Extractor processes the sales representative’s email.• It extracts the relevant loan details (loan amount, income, down payment, taxes, etc.).5. Loan Recommendation: • The extracted data (loan amount, income, credit score, etc.) is sent to the Mistral 7B Loan Recommendation AI Agent.• The AI Agent evaluates the application against bank policies, and loan criteria stored in a Retrieval Augmented Generation (RAG) system using Mistral 7B.• Generates a loan recommendation based on compliance and risk assessment.6. Decisioning• Approval Processi. If the AI Agent recommends approval, it highlights risk and proposed loan terms.ii. A human-in-loop task is triggered, allowing a loan underwriter to review and validate the recommendation.iii. The underwriter submits the final decision, initiating further action.• Denial Processi. If the AI Agent detects any non-compliance policy, it recommends the denial.ii. Similar to approval task, a human review task is triggered to validate the denial decision.7. Communication• The Agentic AI System updates the bank’s Loan Management System with the final loan status using API.• The bot sends the automated emails to the respective stakeholders (applicant, sales rep, loan department) regarding the approval/denial.

6. System Flow Summary

- 1. Data Collection → Loan application submission.2. Document Extraction → OCR and structured data extraction.3. Credit Score Retrieval → API calls to credit bureaus using Python.4. Email Extraction → Mistral 7B Generative AI for email processing.5. Loan Recommendation → AI-driven risk assessment & recommendation using Mistral 7B and RAG.6. Decisioning → Human review triggered for approval/denial.7. Communication → Automated notifications & system updates using API.

7. Flow Diagram

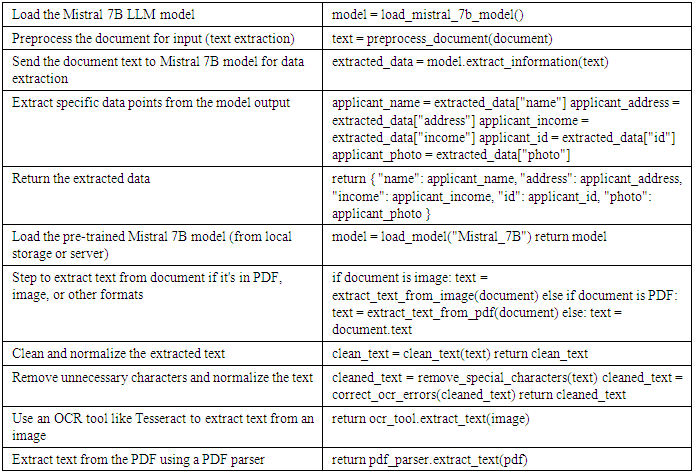

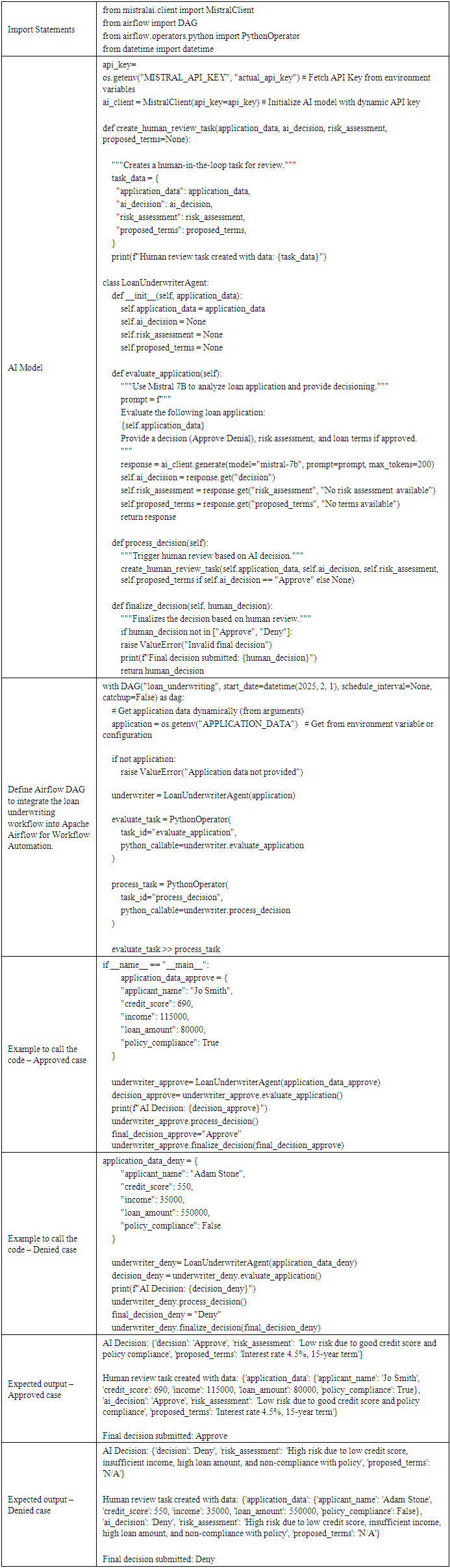

8. Technical Design

- This section explains the implementation approach for the Agentic AI Underwriter. Step 1: Download documents from Loan Application portal using Python API Integration 1. Setup and Configuration:a. Define the base_url for the API.b. Set up the API_KEY for authentication.c. Create a directory for storing downloaded documents.2. Initialize API Session:a. Create a session object with headers containing the Authorization token.3. Fetch Loan Applications:a. Send a GET request to the /applications endpoint.b. Parse the response to get a list of application IDs.4. Fetch Documents for Each Application:a. For each application ID:i. Send a GET request to /applications/{application_id}/documents.ii. Parse the response to get a list of document metadata (e.g., document ID, type).5. Download Documents:a. For each document in the list:i. Send a GET request to /documents/{document_id}/download.ii. Save the document to the local directory with a unique filename (e.g., including application ID, document type, and timestamp).6. Send Documents to Mayan EDMS – Document Automation System (DAS)a. For each downloaded document:i. Open the file and prepare it for upload.ii. Send a POST request to Mayan EDMS via it's REST API to the upload endpoint with the document file and metadata (e.g., application ID, document type).iii. Log the response from the automation system.7. Logging:a. Log all activities, including successful downloads and errors.8. Create Document Index:a. Generate a CSV file containing metadata for all downloaded documents (e.g., application ID, document type, filename).9. Error Handling:a. Handle network errors, authentication failures, and invalid responses gracefully.Step 2: Documents Extraction using Mistral 7B Large Language Model (LLM)

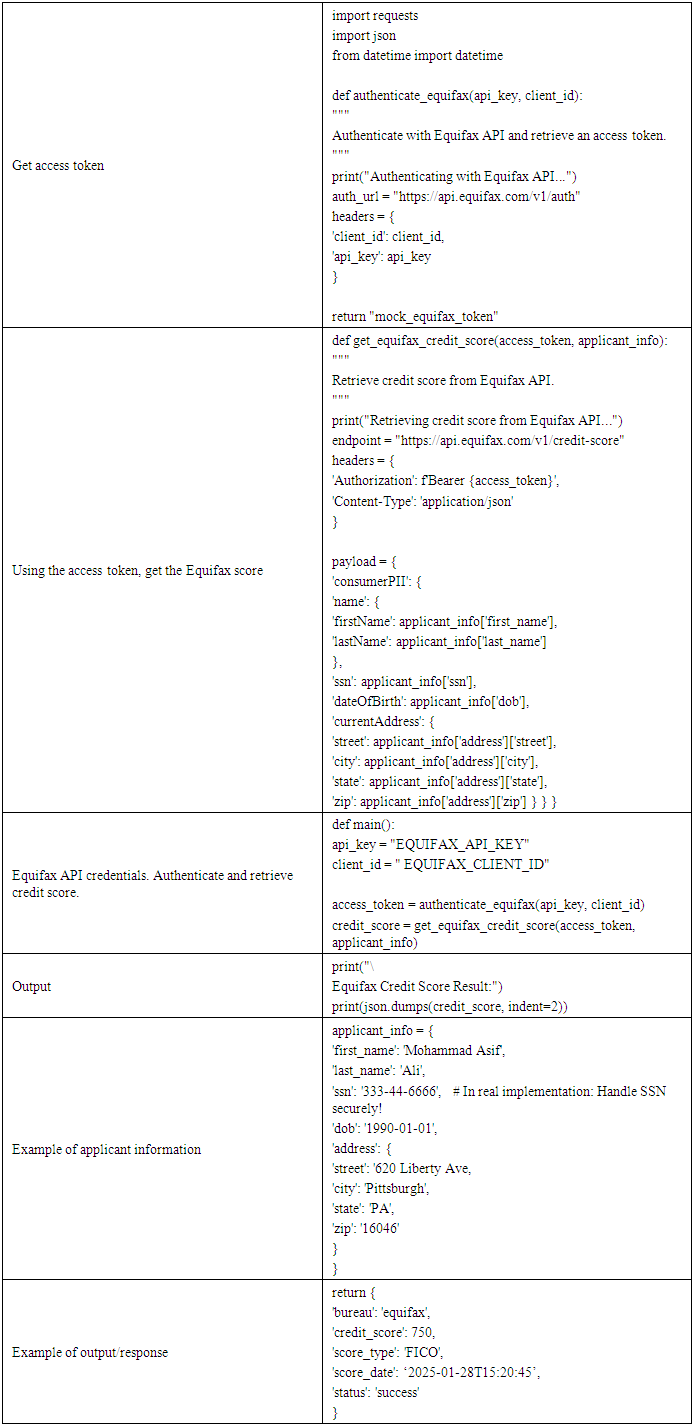

Step 3: Credit Score Pull from Credit Bureaus API using Python

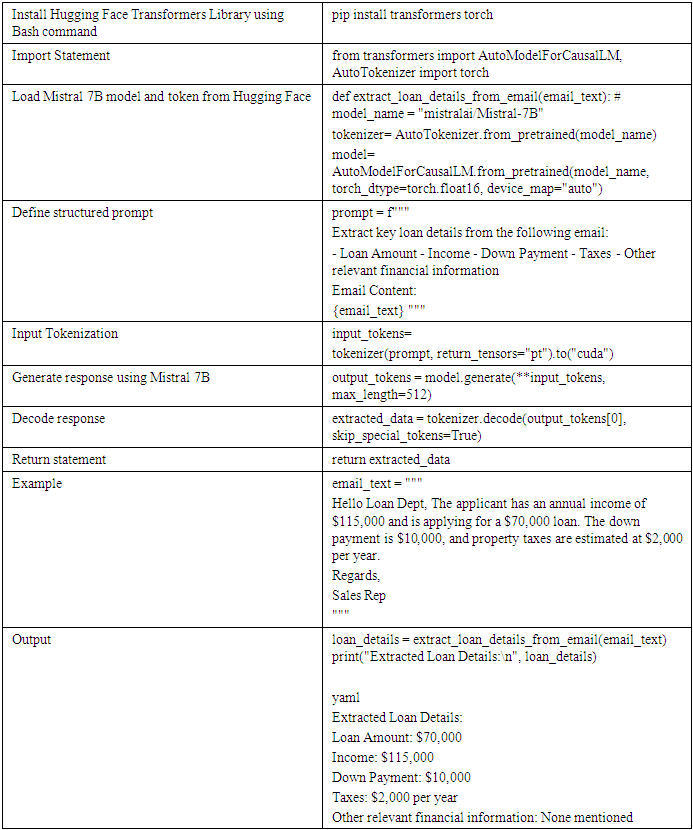

Step 3: Credit Score Pull from Credit Bureaus API using Python Step 4: Email Extraction using Mistral 7B Generative AI Extractor (Hugging Face Library)

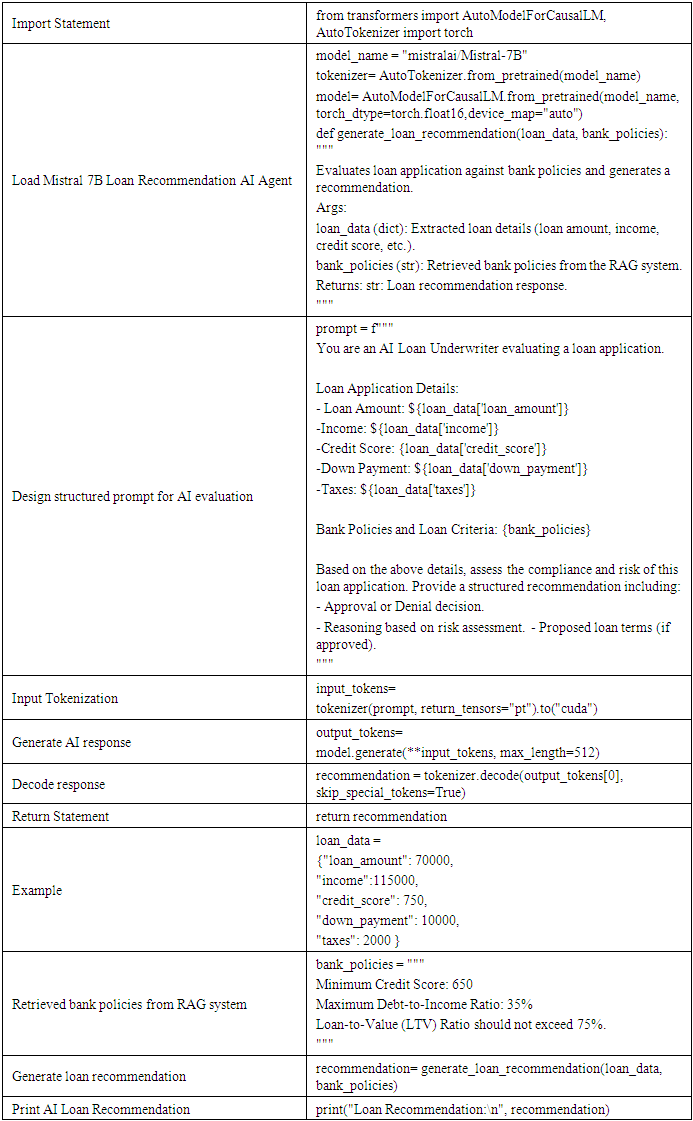

Step 4: Email Extraction using Mistral 7B Generative AI Extractor (Hugging Face Library) Step 5: Loan Recommendation integrated with RAG

Step 5: Loan Recommendation integrated with RAG Step 6: Decisioning Approval/Denial

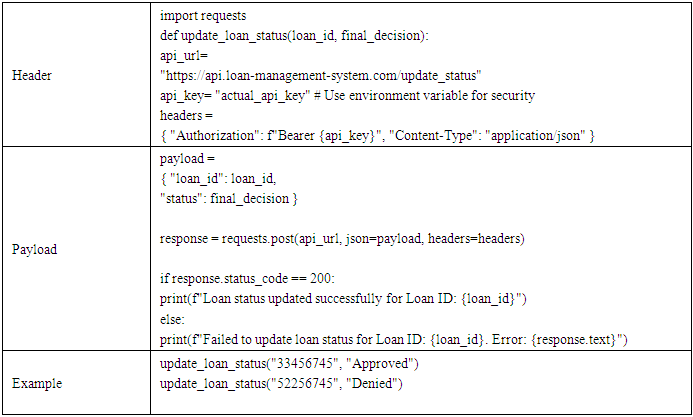

Step 6: Decisioning Approval/Denial Step 7: Communication• Update Loan status to Loan Management System using API

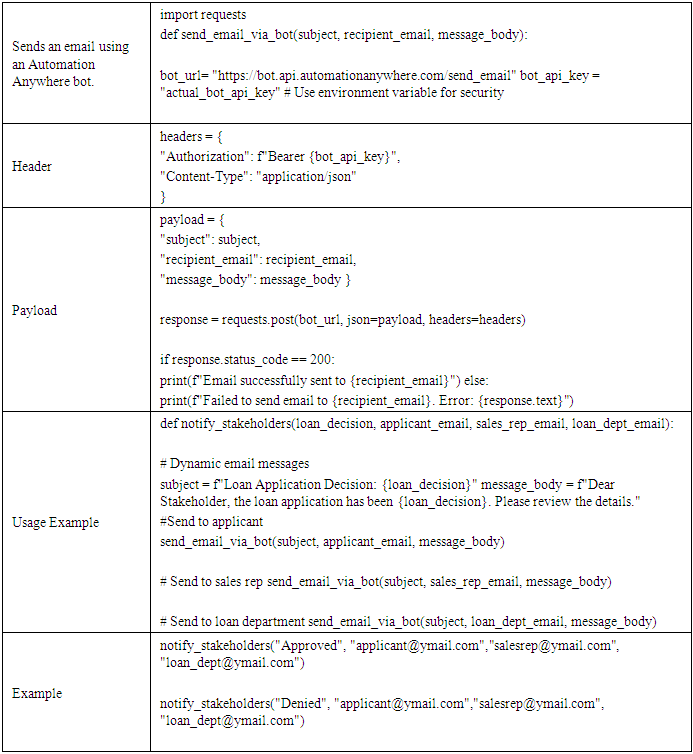

Step 7: Communication• Update Loan status to Loan Management System using API • Python code to trigger Automation Anywhere for email notification

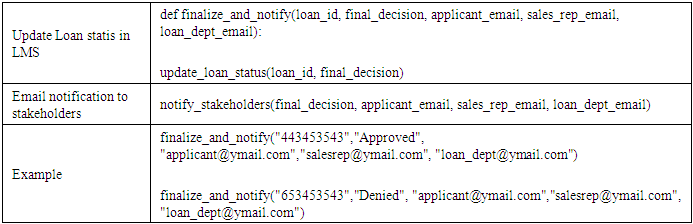

• Python code to trigger Automation Anywhere for email notification • Integrate Loan Management System and Email Notification

• Integrate Loan Management System and Email Notification

9. Limitations and Implementation Challenges

- Although Agentic AI has the potential to revolutionize underwriting, there are notable challenges in its implementation:• Data Privacy: Agentic AI systems necessitate access to sensitive personal and financial information. It is essential to ensure data protection and adhere to regulations such as GDPR and CCPA to avert breaches and uphold user trust.• Regulatory Compliance: The financial sector is subject to stringent regulations, and artificial intelligence systems are required to comply with transparency and regulatory standards, including the Equal Credit Opportunity Act (ECOA) and Fair Lending Practices.• Explainability: Agentic AI models, especially those utilizing large language models, frequently function as opaque systems. This absence of transparency hinders the auditing process and diminishes the confidence of both regulators and applicants.• Operational Complexity: The implementation and upkeep of these sophisticated systems require substantial IT infrastructure, ongoing model updates, and stringent validation procedures to guarantee fairness and precision over time.

10. Conclusions & Future Work

- The application of Agentic AI in the loan underwriting process signifies a major shift within the financial sector, providing improvements in efficiency, precision, and scalability. By utilizing large language models (LLMs), retrieval-augmented generation (RAG), and robotic process automation (RPA), this methodology automates repetitive functions, optimizes decision-making, and lowers operational expenses.Through the adoption of Agentic AI, financial institutions can establish more agile, transparent, and scalable underwriting system, ultimately facilitating greater loan accessibility and promoting financial inclusion.However, challenges related to AI explainability, regulatory compliance, and model bias persists. Future research should focus on:1. Enhancing AI interpretability to increase transparency in loan decisions.2. Developing federated learning models for secure and unbiased credit risk analysis.3. Expand the testing across different financial institutions to validate AI's impact further.By addressing these areas, Agentic AI can revolutionize the underwriting industry, improving financial inclusion while maintaining ethical AI governance.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML