-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Science and Technology

p-ISSN: 2163-2669 e-ISSN: 2163-2677

2022; 12(1): 14-20

doi:10.5923/j.scit.20221201.02

Received: Nov. 8, 2022; Accepted: Dec. 5, 2022; Published: Dec. 14, 2022

Impact of Information Communications Technolgy on the Postal Sector – A Case Study of Zambia

Sylvia Mulenga, Simon Tembo

Department of Electrical and Electronic Engineering, University of Zambia, Lusaka, Zambia

Correspondence to: Sylvia Mulenga, Department of Electrical and Electronic Engineering, University of Zambia, Lusaka, Zambia.

| Email: |  |

Copyright © 2022 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

There has been a notable decline in postal services offered by Designated Postal Operators (DPOs) globally. The Designated Operator in Zambia, namely Zambia Postal services Corporation is no exception. This study proposed to understand the status of ZAMPOST and how Information Communications Technology (ICTs) have impacted its operations and activities. ZAMPOST is among the large entities in Zambia with its operations distributed across the entire country; therefore a decline in services could lead to potential loss of revenue and potential job losses. The study adopted a mixed methodology, which included qualitative and quantitative representation of questionnaires distributed among 273 randomly selected respondents. These were distributed using online means and hardcopies. The use of online method of distribution assured a wider reach of selected respondents. The data collected was analysed using excel and SPSS. Structured interviews were also undertaken with key stakeholders such as ZAMPOST and ZICTA. The study revealed that critical services offered by ZAMPOST have increasingly lost popularity as shown in the declining volumes of the services offered. The study further revealed that ZAMPOST’s attempt at adopting ICTs in its service provision has the potential to improve its positioning on the postal sector market in Zambia. The study also recommended critical services that could be integrated with ICTs to offer versatile and efficient services.

Keywords: Postal services, Information Communications Technology (ICTs), Universal service obligation, Social media platforms, Designated operator

Cite this paper: Sylvia Mulenga, Simon Tembo, Impact of Information Communications Technolgy on the Postal Sector – A Case Study of Zambia, Science and Technology, Vol. 12 No. 1, 2022, pp. 14-20. doi: 10.5923/j.scit.20221201.02.

Article Outline

1. Introduction

- The Postal sector provides postal and courier services through the public and private postal operators. Postal services as defined by the Zambia National Postal Policy of 2021, is the transportation and delivery of letters, printed matter, and mailed packages including acceptance, collection, sorting and other ancillary functions while courier services refer to any specialised postal service for the speedy collection, dispatch, conveyance, handling, and delivery of postal articles [1]. The postal sector in Zambia is comprised of the public postal operator, the Zambia Postal Services Corporation (ZAMPOST) and several private courier operators. ZAMPOST, as the Country’s Designated Operator (DO) is mandated to provide Universal Postal Services on behalf of Government as an obligation by the Government to ensure the provision of postal services to all citizens in Zambia. ZAMPOST has the largest footprint with about one hundred and forty-six (146) post offices spread across the country while most private postal operators provide services along the line of rail as well as in Provincial and District centres that are highly populated in order to generate profits. Core services offered by the operators include mail and parcel services. Other services offered by ZAMPOST include Money transfer services, Post box rentals, transportation services through the post bus and post boat as well as various agency services through partnerships with stakeholders such as the Road Transport and Safety agency (RTSA), Professional Insurance and Workers compensation fund. As of December 2021, the postal sector had one (1) licensed public operator, ZAMPOST as well as thirty-five (35) licensed private operators with licenses for the provision of domestic, local and international services. The global postal sector has recorded massive declines in the main service, namely mail distribution. The United States Postal Service report (2018) expressed that volumes for first-Class Mail, generating approximately 40 percent of total revenue and more than 50 percent of total contribution in the fiscal year 2016 had declined significantly over the years. The report stated that the portion of overall postal revenues had fallen from over 60 percent in the late 1970s to just 40 percent in 2016. [2]The study focused on understanding the status of the postal sector in Zambia and the impact that ICTs have had on ZAMPOST. Findings from this study are expected to recommend opportunities for integration of ICTs in ZAMPOST to facilitate efficient operations and provision of services.

2. Literature Review

2.1. Postal Sector History

- The Postal Industry can be traced back through centuries in history. Bellis, states that postal systems, which involved the passing of messages from one person in one place to another person in another place, started with the invention of writing and may well have been one of the reasons writing was invented. She further states that the first documented use of a postal system occurred in Egypt about 2400 BCE, when Pharaohs used couriers to send out decrees throughout the territory of the state. [3]In 1653, Frenchman Jean-Jacques Renouard de Villayer established a postal system in Paris. He set up mailboxes and delivered any letters placed in them if they used the postage pre-paid envelopes that he sold. Bellis [3].The postal sector provided a means for people to communicate with one another across vast distances.

2.2. Postal Sector in Zambia

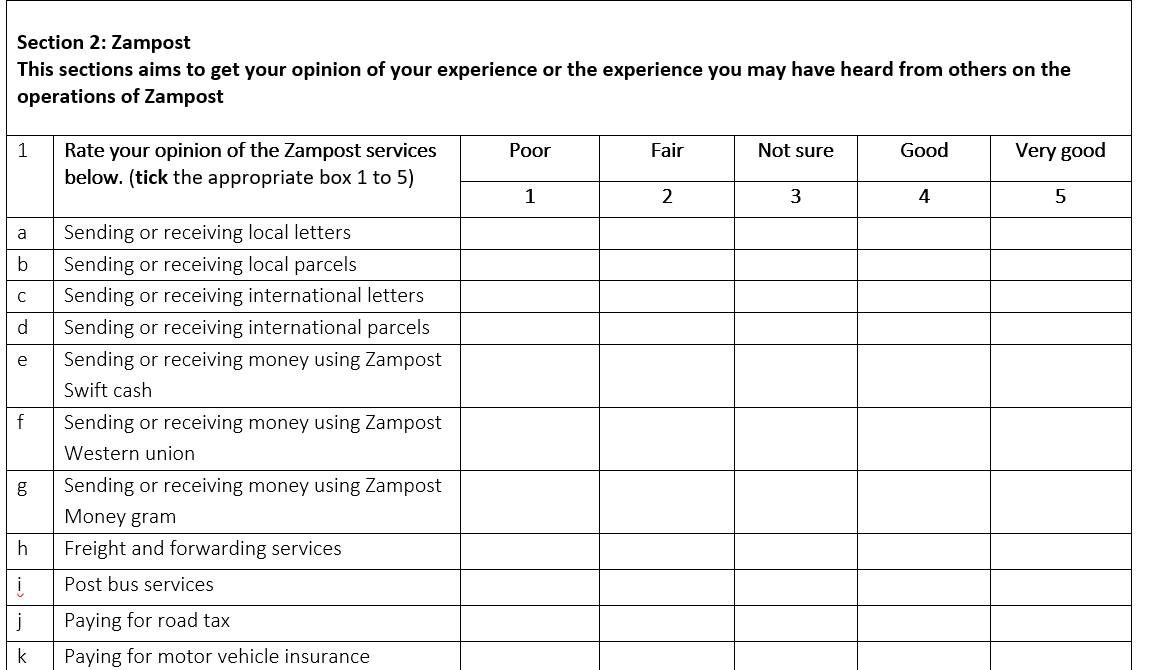

- The postal sector in Zambia is comprised of the designated Postal Operator, ZAMPOST and several private operators. ZAMPOST holds a public licence while private postal operators comprise of licence holders of local, domestic and international licences.

|

3. Methodology

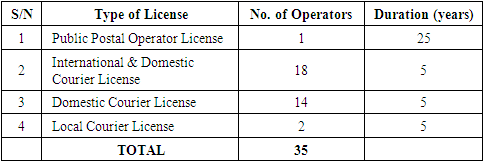

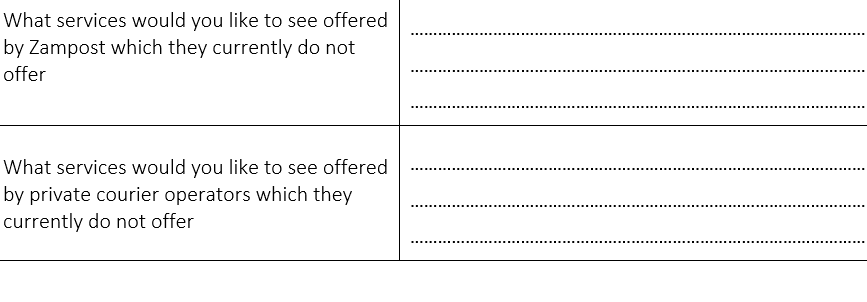

- This study adopted a combination of qualitative and quantitative research methods. These methods are suitable for this study to effectively analyse the sector and in particular ZAMPOST and effects of ICTs. In this study, primary data was obtained using questionnaires that included both structured and semi-structured questions administered to users of postal services, ZAMPOST as the designated public postal operator and selected private courier operators. Semi structured questions to respondents, such as ‘request for information on the various challenges experienced by the users and suggestions on what could be done to improve services’ helped in analysing possible solutions to the identified challenges. Use of open-ended questions such as the one shown in figure 1 facilitated for more information which was necessary in this study, as it provided for varied qualitative data that that supported the determination of key services, that if adopted may improve the current postal operations.

| Figure 1. Example of semi structured question |

| Figure 2. Example of structured question |

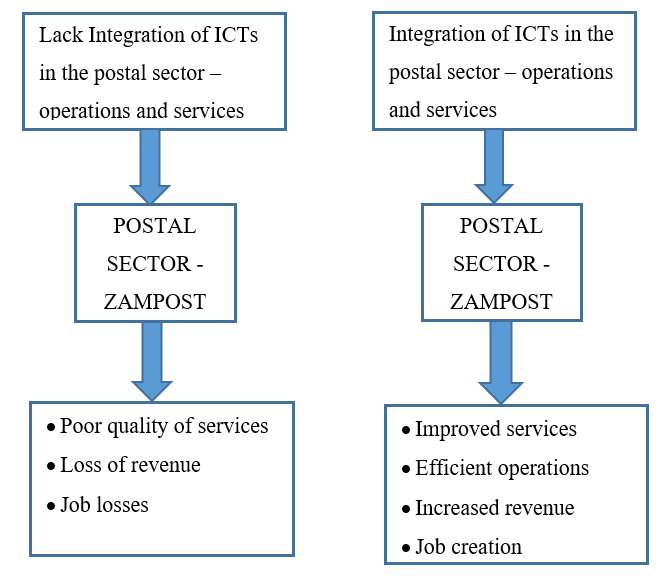

| Figure 3. Conceptual framework |

4. Findings

- The findings from this study, which was undertaken using the mixed methods methodology, will be shown in two parts, i.e. in the first part to understand the status of ZAMPOST and in the second part to understand how ICTs have impacted ZAMPOST and the opportunities that exist to promote efficiency in its operations and provision of services.

4.1. Services

4.1.1. Global postal market

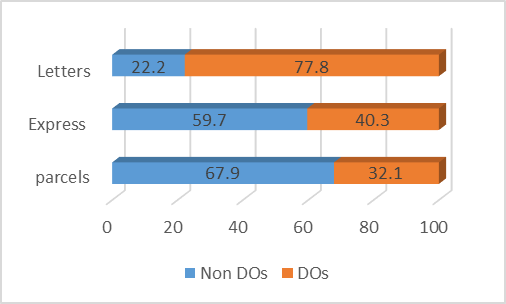

- This figure below presents the results of market share estimates from a sample of 86 countries over the 2018–2020 period. This was as reported in the UPU Postal Economic Outlook of 2021.The study revealed that DOs dominate the global market share on letters while the Non DOs held a larger market share on express mail service and parcel service.

| Figure 4. Global postal market share |

4.1.2. Mail services in Zambia

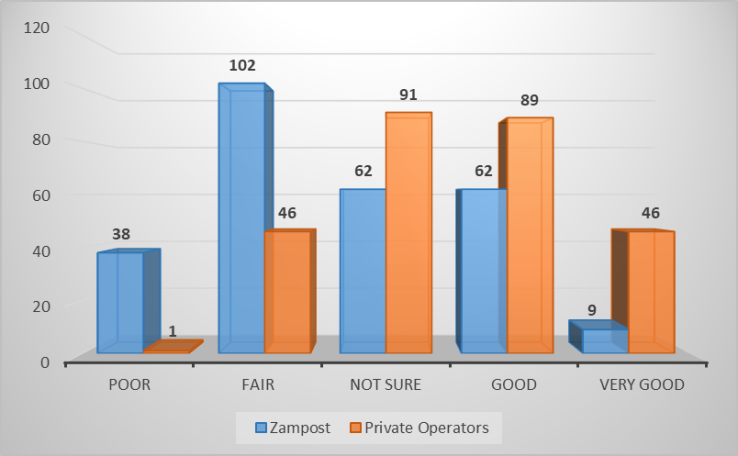

- The study findings revealed that respondents preferred using private operators for the provision of mail services. The figure below shows that the private operators scored higher against ZAMPOST across the ratings of ‘fair’, ‘good’ and ‘very good’. Indicating that 66.3% of the total respondents preferred private operators against 63.3% using ZAMPOST.

| Figure 5. Mail services |

4.1.3. Parcels Services in Zambia

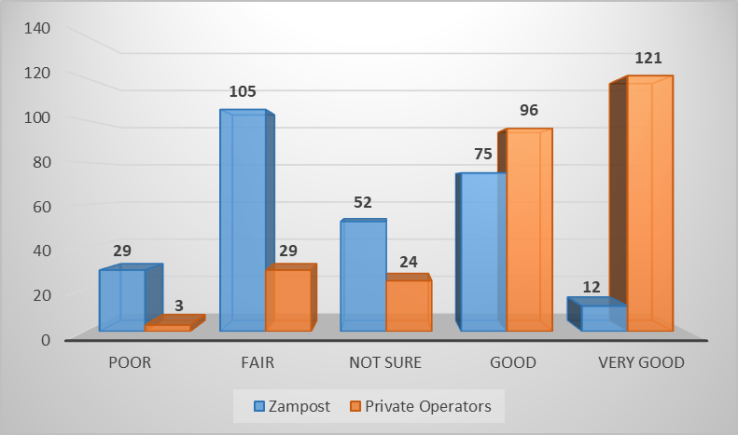

- The study findings revealed that respondents preferred using private operators for the provision of parcel services. The figure below shows that the private operators scored higher against ZAMPOST across the ratings of ‘fair’, ‘good’ and ‘very good’. Indicating that 90.1% of the total respondents preferred private operators against 70.3% using ZAMPOST.

| Figure 6. Parcel services |

4.1.4. Freight and Forwarding

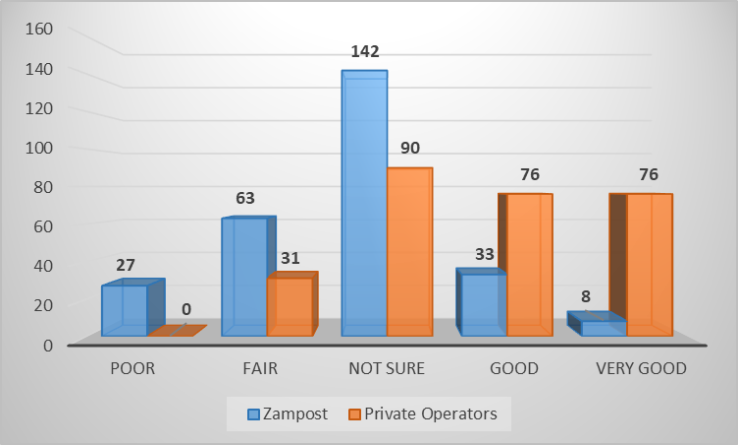

- The figure below shows that the private operators scored higher against ZAMPOST across the ratings of ‘fair’, ‘good’ and ‘very good’. Indicating that 67% of the total respondents preferred private operators against 38% using ZAMPOST.

| Figure 7. Freight and Forwarding |

4.2. Information Communications Technology

4.2.1. Cost of Mobile Phones Against Physical Mail

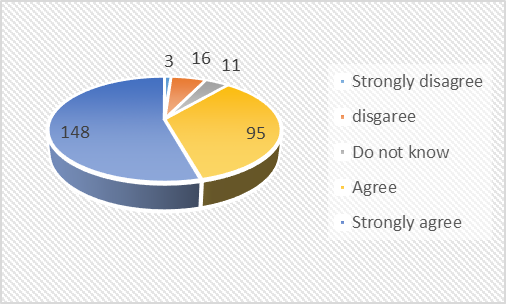

- The study revealed that respondents when asked if using a phone for communication was cheaper than sending physical mail, the mobile phone was considered cheaper as compared to sending physical mail.

| Figure 8. Cost of using a phone against mails |

4.2.2. Analysis on Reliability

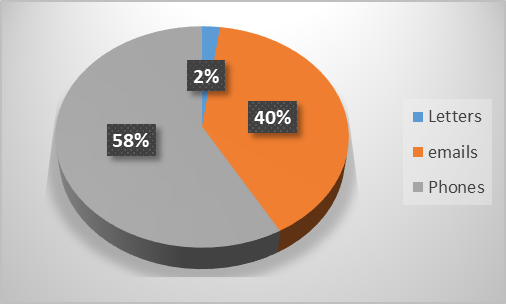

- The study revealed that respondents regarded phones as a much more reliable form of communication, with emails following close behind. While letters were rated very low, as can be seen in the figure below.

| Figure 9. Reliability of ICT platforms against mails |

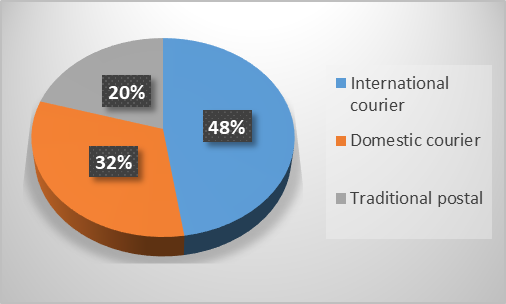

| Figure 10. Market share on courier against traditional postal services |

5. Discussion of Results

- The study was able to determine the status of ZAMPOST and found that there has been a reduction in the revenue generated from a number of critical services namely mails, parcels, freight and forwarding as well as money transfer services. In comparison with the global postal sector Designated Operators, it shows that ZAMPOST has lost its monopoly on the mail service, previously a preserve of ZAMPOST. The study further revealed that private operators are still enjoying a larger market share on parcel service as compared to ZAMPOST. This can be attributed to the fact that ZAMPOST being a state-owned enterprise has limited autonomy that may allow it to be versatile in improving on the services offered. Further, the reduction in money transfer services can be attributed to the various money transfer services that have come on to the market using mobile-based platforms. ZAMPOST’s failure to adopt mobile platforms and agent booths for money transfer services has made ZAMPOST to lag behind. Swift cash previously the earliest mode of money transfer in Zambia is now competing with the Mobile Network Operators who are offering convenient options.The study also revealed that e-commerce has increased the need for courier services on the market for the distribution of parcels both locally and internationally. This can also be attributed to the advent of the COVID 19 pandemic, which caused customers, in a bid, adhere to COVID restrictions, to increase online purchase of goods providing an opportunity for the courier operators who already have a greater market share on parcel post. ZAMPOST needs to improve in the parcel post if it is to benefit from the increased use of electronic platforms for purchase of goods. ZAMPOST’s lag in the provision of parcel services can be attributed to its lack of electronic systems to efficiently track parcels. Further, a lack of fleet to support the timely delivery of parcels has a negative effect on ZAMPOST. This disadvantage ZAMPOST from entering into partnerships with other sectors to provide courier services such as the Health sector who may require a time bound distribution of parcels.

5.1. Interventions under Consideration by ZAMPOST

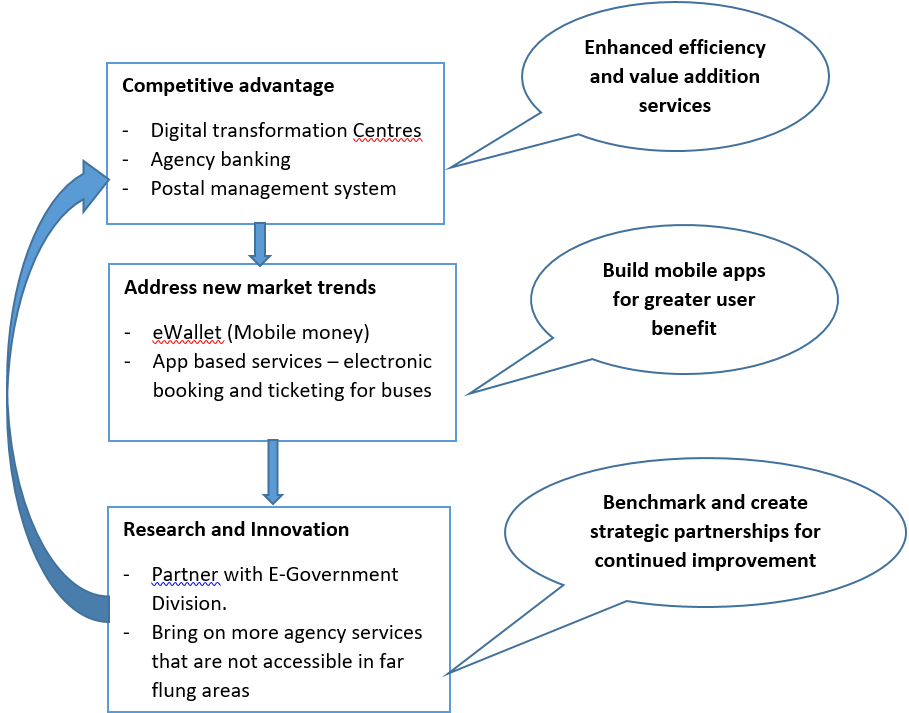

- Despite the grim outlook, the study revealed that there are opportunities for ZAMPOST to align and adopt ICTs, which if implemented effectively could provide a shift in the positioning of ZAMPOST on the postal sector market in Zambia. Findings from the study also showed that ZAMPOST is already considering initiatives intended to transform its operations. These include;

5.1.1. Digital Transformation Centres

- ZAMPOST is collaborating with relevant stakeholders to introduce Digital Transformation Centres (DTCs) in every post office. If implemented successfully this will take electronic services, including electronic government services to various parts of the country that currently have limited access to such services. The wide footprint of the ZAMPOST would facilitate wider coverage and competitive advantage as the main distributor of electronic services in unserved and underserved parts of the country.

5.1.2. Agency Banking Platform

- Through the installation of an agency-banking platform, ZAMPOST can propel digital financial inclusion to various locations in the country where large a number of the population remain unbanked.

5.1.3. Mobile Money Service (eWallet)

- ZAMPOST currently offers money transfer services through swift cash, money gram and western union. However, these systems are reliant on physical presence. This is not very convenient especially with the competition from mobile money payment systems. Therefore, introduction of an electronic wallet that can be accessed from any available mobile network will provide versatility for consumers as well as introduce new markets.

5.2. Other Proposed Interventions

- Apart from the initiatives that ZAMPOST is currently implementing, the study also revealed the following initiatives that should be considered in order to mitigate the identified challenges;

5.2.1. Postal Management System

- Automation of postal services and operations will give value addition to customers. This will also reduce on the ques in the post office as well as improve efficiency.

5.2.2. Use of Application Software

- Use application software (Apps) for services such as the post bus and the post boat can improve the efficiency of these services. For example, an app that allows the customer to book and procure a ticket online will improve the quality of service and allow more customers to use the service because of the convenience unlike the prevailing situation where a customer needs to go to a physical location to procure tickets.

5.2.3. Research and Innovation

- The study has shown that the postal sector is one of the most versatile industries for the adoption of technology. Therefore, continuous research and innovation will ensure that services and the operations of the sector are continually evolving. ZAMPOST must dedicate resources to research and innovation in order to be competitive. Further, ZAMPOST integration with already existing online platforms such as the Government Service Bus (GSB), would provide the opportunity to have a much larger electronic footprint allowing customers access to ZAMPOST services online from various parts of the country. Government through the GSB is offering various services online including payment of road tax and motor vehicle insurance, which ZAMPOST currently offers as one of its agency services. With increasing adoption of ICTs, there will be less need for customers to physically go to a post office for services that can be obtained online. Therefore, these key findings of the study reveal the urgent need for ZAMPOST to adopt and adapt to the changing landscape with increased use of ICTs.The study revealed that a phased approach in integrating ICTs in critical areas of ZAMPOST operations and services could improve efficiency and effectiveness in service delivery. This includes use of applications that can provide convenience and ease of access to services. Further, introduction of value-added services on traditional services such as use of online ticketing system for the post bus and post boat as opposed to physical procurement will introduce new markets and encourage customers to utilize ZAMPOST more. This proposal is further depicted in the matrix below;

| Figure 11. Priority matrix |

6. Conclusions and Recommendations

- The study was conducted to understand the impact of ICTs on the postal sector in Zambia with a focus on ZAMPOST, the designated public postal operator. The findings revealed that a number of services had been affected in preference to the convenience of ICTs. However, the study also revealed how ICTs can support and improve ZAMPOST operations and services.The study further revealed that with the influx of service providers in the courier space in Zambia using various forms of delivery, the normal brick and mortar structure is no longer as adequate as it used to be as the focus has shifted to which operator is able to efficiently support the courier eco system. Therefore, ZAMPOST while maintaining its role to provide universal services in Zambia by law must also re-establish itself in the courier space in order to compete favourably with players on the market. To this effect, it is recommended that ZAMPOST expand its operations on the parcel service through integration with other online markets as it is expected that the boom in e-commerce service will continue growing. Therefore, this is a great opportunity for ZAMPOST to be an active player on the market with an advantage of having the largest footprint in the country. There is also need for the Ministry responsible for the postal sector and the sector regulator ZICTA to review policies and legal frameworks that guide the implementation of the universal services obligation in the postal sector.

ACKNOWLEDGEMENTS

- I wish to thank my supervisor, Dr. Simon Tembo for not giving up on me and consistently reminding me of my capabilities. Your effort Sir will always be appreciated. I also wish to extend my gratitude to the Ministry of Technology and Science, ZAMPOST and ZICTA for giving me audience whenever necessary. Special thanks go to colleagues who took the time to encourage and offer assistance whenever possible. Lastly, gratitude goes to my family for their patience and understanding during my research.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML