-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Regent Journal of Business and Technology

2025; 2(1): 1-7

doi:10.5923/j.rjbt.20250201.01

Received: Apr. 12, 2025; Accepted: Apr. 28, 2025; Published: May 13, 2025

An Evaluation of the Regulatory Frameworks Governing the Ethiopian Sugar Industry

Abraham Demissie Chare

PhD in International Business, MBA in International Business, MSc in Agronomy, Deputy CEO - Ethiopian Sugar Industry Group

Correspondence to: Abraham Demissie Chare, PhD in International Business, MBA in International Business, MSc in Agronomy, Deputy CEO - Ethiopian Sugar Industry Group.

| Email: |  |

Copyright © 2025 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The general objective of this article is to evaluate the organizational and legal instruments that govern the Ethiopian sugar industry. In order to meet this objective, a qualitative research design, which uses the facts or information already available to analyze and make an evaluation of the information, was employed. Since the review covers the state organs that lead the industry along with the legal arrangements which directly govern the sugar industry, sample tools are selected using a probability approach. Hence, the entire legal instruments governing the Ethiopian sugar industry in Ethiopia are covered in the analysis. Data is collected from secondary sources, including the laws, policies, plans, and reports from relevant government bodies as well as verified organizational sources. The information from these sources is analyzed and meaning is driven from the context. Thus, a thematic method which identifies patterns and recurring themes within qualitative data is used for data analysis. Based on the analysis, it is concluded that the strategic development initiatives of the Ethiopian sugar industry have established a foundation for sustainable growth and enhanced competitiveness in the global arena. By implementing focused policy measures, investing in infrastructure, and prioritizing innovation, Ethiopia has successfully transformed its sugar sector into a vital contributor to economic development and poverty reduction. A key component of the development strategy for the Ethiopian sugar industry is the establishment of strong policy frameworks that direct investment choices and promote sectoral growth. The government has rolled out incentive programs, regulatory reforms, and targeted actions to foster a conducive environment for private sector engagement and foreign direct investment. Stakeholders and investors interested in entering the industry can gain numerous advantages by understanding these institutional and legal frameworks and recognizing the policy priorities. Furthermore, by taking appropriate actions regarding the frameworks that influence the sugar industry's development, Ethiopia can effectively attract substantial capital investments, thereby supporting expansion and modernization efforts. It is also advantageous to regularly examine the legal and organizational structures, and a strong legal framework consisting of declarations, laws, and regulations supports the efficient running of Ethiopia's sugar sector.

Keywords: Sugar, Sugar-Industry, Institutional-setup, Legal-framework

Cite this paper: Abraham Demissie Chare, An Evaluation of the Regulatory Frameworks Governing the Ethiopian Sugar Industry, Regent Journal of Business and Technology, Vol. 2 No. 1, 2025, pp. 1-7. doi: 10.5923/j.rjbt.20250201.01.

Article Outline

1. Introduction

- The development of sugar industry is one of the government priorities as a key driver of economic growth and poverty reduction in Ethiopia. With vast untapped potential in terms of land and water resources, the Ethiopia aims to become a leading sugar producer in Africa [1]. The industry’s origins trace back to 1951 with the founding of the Wonji Sugar Factory, situated approximately 110 kilometres east of Addis Ababa [2]. This factory was established through a partnership between foreign private investors and the Ethiopian government. Over the years, the industry has grown with the introduction of additional factories. Currently, the Sugar Industry Group, formed in 2022, oversees and manages Omo-Kuraz Sugar Factories two and three, as well as Omo-Kuraz Sugar Development projects one and five, Arjo Didesa Sugar Factory, and the Welkayiet Sugar Development Project. The Group is also the sole shareholder of the Wonji/Shoa, Metehara, Fincha, Kesem, and Tana Beles sugar factories, which have been transformed into shareholding companies under its umbrella [3].Taking into consideration the role of the industry for national development and prosperity, the government established both institutional and legal setups over past years. These setups mainly focused on establishing modern sugar factories and expanding arable land for sugarcane cultivation, utilizing both domestic and international investments [4]. Yet the Ethiopia's sugar sector is generally owned by the state and overseeing production, trade, and privatization efforts are the key areas of the legal frameworks. In this article, the legal and organizational frameworks governing the Ethiopian sugar industry development are evaluated.

2. Problem Statement

- Development of sugar industry in Ethiopia started with an agreement in 1951 between the Ethiopian Government and Handles Vereening Amsterdam (HVA), Dutch Company, for the establishment of a sugar factory in Wonji, Ethiopia [5]. Since then, the industry’s development has been guided and shaped by various institutional and legal instruments.According to Fasil G/Mariam [6], the industry, as it is a strategically important sector for economic development, is governed by a framework of proclamations, rules, and regulations designed to regulate production, distribution, and overall industry management. These legal instruments aim to modernize the sector, attract investment, and ensure fair competition [7].At the apex of this structure sits proclamations, legislative instruments enacted by the Federal Democratic Republic of Ethiopian parliament. Legislatures of the parliament outlines the fundamental principles governing sugar production, including land acquisition for sugar plantations, licensing requirements for producers, and quality control standards [8]. They also often delineate the role of government bodies in overseeing the industry.These institutional and legal tools determine the industry’s development in multiple ways- encourage or discourage the investors or other stake holders. Despite the fact that stakeholders and investors wishing to join the industry need sufficient information about the legal and regulatory framework governing sugar industry especially in the Ethiopian context, there is lack of such information in the academic arena in particular. Among the few academic works in this area, Dengia, Dechassa, Wogi, & Amsalu [9] examined the long-term yield data (1954–2022) of sugarcane plantations in Ethiopia, focusing on factors like soil type and crop variety. After a quantitative analysis of the data, the researchers highlighted the need for improved agricultural practices to address yield decline.Anito’s [7] study explored how government policies and programs in major sugar-producing countries like Brazil, India, and Thailand can provide lessons for enhancing the competitiveness of Ethiopia's sugar industry. The study employs a comparative case study method, analyzing secondary data sources to assess how different government interventions have shaped the industry. In the findings, the study suggested policy and regulatory supports from government to boost sugar production and exports.The research article by Abraham [1] examines the challenges and opportunities surrounding private investment in Ethiopia's sugar industry. It highlights that the Ethiopian government has historically owned and managed the sugar sector, which plays a significant role in the economy through job creation, import substitution, and local sugar supply. However, financial constraints and high deficits have prompted the government to initiate privatization efforts. Having identified several factors influencing the success of these privatization initiatives, the article concluded, among others, the lack of an enabling legal and institutional environment poses significant challenges, and thus underline without addressing these prerequisites, the success of the privatization initiative remains uncertain. Grounded on the fact that there is a high need to know about the tools, therefore, the key institutional and legal tools governing the Ethiopian sugar industry development are reviewed in this article.

3. Objectives

- The general objective of this article is to evaluate the organizational and legal instruments that govern the Ethiopian sugar industry. The specific objective of the article are to (1) review form and nature of organization that is in charge of managing the Ethiopian sugar industry; (2) to provide a comprehensive review of the laws and policy environment governing the Ethiopian sugar industry; (3) to map out key stakeholders and their roles and potential contributions in the industry’s development; and (4) to make recommendations to foster the sugar industry development in Ethiopia based on certain benchmarks.

4. Methods

- This research entirely focuses on reviewing the policy documents in the Ethiopian sugar sector and interprets the meaning of documents. Thus, it employs a qualitative research design, which, according to Strauss, & Corbin [10] uses the facts or information already available to analyze and make an evaluation of the information. According to Paré et al., [11], this kind of research method provides the reader with an exhaustive context to understand existing knowledge and to emphasize the value of new research as it presents a full report on recent expertise in the field under study.A judgmental sampling method is uses in determining the samples [12] because the review covers the state organs that lead the industry along with the legal instruments which directly govern the sugar industry. In this regard, six key legal frameworks purposively selected for this study are analyzed thematically. Data is collected from secondary sources, including the laws, policies, plans, and reports from relevant government bodies as well as verified organizational sources. The information from these sources is analyzed and meaning is driven from the context. Thus, a thematic method which identifies patterns and recurring themes within qualitative data [13] is used for data analysis.

5. Literature Review and Analysis

5.1. The Sugary Engine: Roles of the Sugar Industry in National Economic Development

- The sugar industry, often overlooked in discussions of economic diversification, plays a significant role in national economic development, particularly in nations with favorable climates for sugarcane [14]. Beyond simply supplying a global commodity, the industry contributes through various interconnected channels. Firstly, the sugar industry is a major employer, providing jobs across the entire value chain. From agricultural laborers and factory workers to transportation and distribution personnel, the industry supports livelihoods in both rural and urban areas, contributing to poverty reduction and regional development [15]. Furthermore, associated industries, such as fertilizer production and agricultural machinery manufacturing, also benefit from the demand generated by sugar cultivation [16].Secondly, sugar exports contribute significantly to a nation's foreign exchange earnings. This revenue can be crucial for funding imports of essential goods, servicing foreign debt, and investing in national infrastructure projects [17]. Moreover, the industry can attract foreign direct investment, bringing in capital, technology, and expertise that can modernize production processes and enhance competitiveness [18].Finally, the sugar industry can contribute to rural development through the implementation of sustainable agricultural practices. By investing in research and development, promoting efficient irrigation techniques, and supporting community initiatives, the industry can improve land productivity, enhance environmental sustainability, and foster social well-being in rural communities [19]. It is with adherence to this fact that the Ethiopian government has focused on the development of sugar industry in its growth and transformation plan particularly after the early 2010s [1], and has continuously implemented the plan with flexible policies and strategies.In general, the sugar industry is a crucial engine for national economic development. Its contributions to employment, foreign exchange earnings, and rural development underscore its continued relevance in the global economy. Nations with a well-managed and sustainable sugar industry stand to reap significant economic and social benefits.

5.2. Sugar Industry Development: Divergent Paths in Africa, Europe, and the US

- Government policies have profoundly shaped the sugar industry across continents, leading to significantly different developmental trajectories in Africa, Europe, and the US. While aiming to protect domestic producers and ensure stable supply, these policies have engendered complex consequences, including price distortions, trade barriers, and varied levels of competitiveness.In Africa, sugar industry development is often intertwined with broader agricultural development strategies and foreign aid initiatives [20]. Policies frequently focus on increasing production capacity through investment in infrastructure and improved agricultural practices. In terms of governance, the South African sugar industry, for instance is regulated by the regulatory framework of Sugar Act [27], Sugar Industry Agreement of 2000 and SASA Constitution; and statutory powers of self-governance are granted to the sugar industry. Sugar Association Council is 50/50 representation by Millers and Growers, but there is no such association in Ethiopia. In Kenya, the Sugar Board is the industry regulator, and the Sugar Research Foundation conducts research and undertakes technology transfer [6]. However, challenges persist, including land tenure issues, fluctuating global sugar prices, and competition from heavily subsidized sugar exports from developed nations, limiting the potential for African sugar industries to become truly competitive on the international market.European sugar policy has historically revolved around the Common Agricultural Policy (CAP), which until recently heavily subsidized beet sugar production. This protectionist approach created an artificial market and insulated European producers from global competition [21]. While CAP reforms have reduced subsidies, significant trade barriers remain, impacting access for cane sugar producers, particularly those in developing countries reliant on sugar exports to the EU.The US sugar industry also benefits from substantial government intervention. Policies include price supports, import quotas, and tariffs that effectively protect domestic beet and cane sugar producers from foreign competition [22]. While these measures maintain a stable domestic sugar supply, they also result in higher sugar prices for consumers and hinder the competitiveness of sugar-containing products produced in the US.In conclusion, sugar industry development policies exhibit substantial variation across Africa, Europe, and the US. While each region aims to support its domestic producers, the approaches differ significantly, leading to diverse outcomes in terms of production efficiency, trade patterns, and consumer prices. Understanding these policy differences is crucial for comprehending the complex dynamics of the global sugar market and formulating strategies for sustainable and equitable development of the industry worldwide.

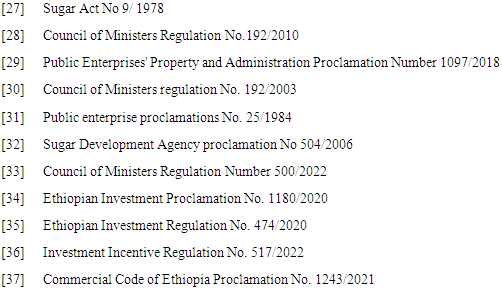

5.3. The Institutional and Legal Instruments Guiding the Sugar Industry Development in Ethiopia

- Due to its social, economic and political importance, the sugar industry is often overseen and monitored in critical ways in all nations globally. Many countries use Sugar Authorities or Sugar Boards as governing regulating bodies, some of which are parastatal and others are more participatory with stakeholder representatives [20]. Legal controls and regulations are generally prescribed through a Sugar Act and/or Sugar Industry Agreement, a legal document which details the conditions of operation within the country [23]. The Act or Agreement is often very detailed and comprehensive and covers matters such as the roles and responsibilities of industry stakeholders and supporting institutions including, cultivation of sugarcane, licensing and registration of the growers, processors, and traders, and, the administration and financial management of the industry bodies in to consideration. Moreover, the industry stakeholders and supporting institutions often includes Sugar Boards, sugar research institutions, training institutions, and industry funding institutions [8]. In Ethiopia, the Ethiopian Sugar Corporation, the state-owned entity, grows sugarcane and other sugar yielding crops since its establishment in 2010 [24]. The corporation acts as a regulatory body, ensuring compliance among both public and private sector actors, is also responsible for managing the distribution network and addressing any issues of supply chain bottlenecks.The Ethiopia Sugar Corporation came into existence on October, 2010 by the Council of Ministers Regulation [28]. The corporation is operating under a board of directors and is, currently, accountable to the Public Enterprises' Property and Administration Agency as dictated on Proclamation [29]. Sugar Corporation was mainly established to further develop the 65 year old sugar industry in Ethiopia by utilizing modern irrigation systems, expanding sugarcane plantations, increasing the number of operational sugar factories, and producing sellable by-products and co-products. The corporation, now re-established as the Ethiopian Sugar Industries Group, currently administers eight operational sugar factories (namely, Wonji-Shoa, Metehara, Finchaa, Tendaho, Arjo-Dedessa, Kessem, Omo Kuraz Two and Omo Kuraz Three) and other five sugar factories (Omo Kuraz (Omo Kuraz One and Five), Tana Beles (Tana Beles One and Two), and Welkayte Sugar Development Projects) at different levels of construction [25]. When expansion and new sugar development projects are completed, the country will have 13 sugar factories with a potential of producing 2.25 million tons of sugar yearly.In recent times, however, the government has decided to transfer ownership of the State-owned Enterprise to the private sector via one of the following arrangements: full or partial privatization, management contract agreement, or public-private partnership [1]. Other institutions and state organs that engage in the sugar industry operation include sugar industry fund, and Sugar Research Center.On the other hand, the Ethiopian Sugar factories were previously established as a share company - each of them in share company modality with having their own Article and memorandum of Association. Followed by the establishing Sugar Corporation by Council of Ministers regulation [30], however, all the Sugar Factories lost their own legal personality. Thus, whatever the kinds of the factories establishment they were supposed to be governed public enterprise proclamation [31]. The proclamation set‘s the way how public enterprise establish, capital contribution either paid up or payable, the structure of corporate governance. In this kind of type of company modality, the sugar factories are not legally recognized under commercial code as a type of business organization.Ministry of Trade determines the price in the Ethiopian of sugar market. However, in nations like Kenya, there is an independent sugar board to determine the sugar price of the market. Since the members of the board are from mill owners, out growers and Chamber of Commerce, they can determine the price of the sugar independently.In terms of legal tools, there are a number of policies, and regulatory documents that affect the sugar industry in Ethiopia. The sugar industry development issues are incorporated in sectoral, sub-sectoral and cross-sectoral policies, strategies and plans including the Growth and Transformation Plans (GTP I and II), Climate Resilience and Green Economy strategy, Investment proclamations, Directive in relation to sugar distributions and Ethiopian labor law are among the major policy documents [6].The proclamation to establish the Sugar Development Agency [32] and the regulation to establish Sugar Corporation [30], later revised and replaced by Council of Ministers Regulation are the legal tools that directly affect guide the industry’s development in Ethiopia.Building upon the foundation established by the policies and proclamations, specific rules, regulations and guidelines are formulated and being enacted to provide detailed guidelines for operational aspects. These regulations issues such as pricing mechanisms, import and export procedures, environmental protection measures, and labor standards within the sugar factories and plantations.Generally, the existing policies and strategies in Ethiopia primarily support domestic production, import substitution, efficiency and environmental sustainability. However, the legal frameworks reveal shifts in focus in past and recent times. In early times, the legal tools focused primarily on land ownership and resource allocation, setting the stage for large-scale sugar plantations. Subsequent laws, often integrated within broader economic development strategies, prioritized foreign investment and aimed to modernize the industry through technological upgrades and increased production capacity. These policies often included incentives such as tax breaks and subsidized loans designed to attract investors and stimulate growth.In recent years, however, there has been a shift towards policies emphasizing local participation and value addition. This includes promoting smallholder sugarcane farming and encouraging the development of downstream industries that utilize sugar as a raw material. The ongoing evolution of these proclamations, laws, rules, and policies remains critical for ensuring the sustainable and equitable growth of the Ethiopian sugar industry, allowing it to contribute effectively to the nation's economic prosperity while addressing the needs of its diverse stakeholders.

6. Evaluation of the Policies and Strategies for Private Enterprise and Foreign Investors in Ethiopia

- Both sugar and other business industries are governed by the national laws, policies and regulations effective in the country. Since sugar production involves agriculture (feedstock), industry (agro-processing and manufacturing), and service (transport and distribution) [26]. The industry and its actors are affected by multi-faceted legal issues, of which some key policies related to agriculture, industry, investment and trade important for promotion of the sugar industry are evaluated in this article.

6.1. The Ethiopian Constitution (1995)

- First and the supreme law that govern all activities of trade, the Federal Democratic Republic constitution states every citizen has a right to own property to sale, dispose or transfer it to other party (Article 40). The constitution also stipulates economic objectives the Government shall ensure that all Ethiopians have an equal opportunity to improve their economic condition distribution of wealth among them (Article 85).

6.2. Rural Development Policy and Strategy (2002)

- This strategy stressed the importance of agriculture as the source of livelihood for a large segment of the population and as the principal economic activity in Ethiopia. Agriculture is also considered important as the foundation for industry. The strategy has two main elements: (1) labor intensive rather than capital intensive strategy for agriculture (employ abundant and underutilized labor force in rural areas, conserve limited capital available, and distribute benefits across large section of the population through increased employment and income); and (2) appropriate land use (agro-ecologically appropriate utilization of land, increase productivity of land through irrigation, multi-cropping and other means). Even though most of the sugar manufacturing firms and factories are located in rural areas in Ethiopia, this policy gives little attention to the development of this specific industry and belittles the industry’s role.

6.3. Industry Development Strategy (2002)

- The strategy underlines the fact that Ethiopia follows a market economy and that the private sector will be the engine of growth of the economy including industry. The strategy puts agriculture as the foundation for industrialization, gives priority for export oriented and labor intensive industries, and specifies the roles of government, foreign and domestic investors. The strategy gives priority to specific sub-sectors including textile and garments, leather and leather products, and agro-processing. The key themes that correlate to the sugar industry in this strategy are (1) export oriented industrialization: in order to foster internationally competitive industries and to exploit large markets; (2) labor intensive industries: in consideration of the abundance of labour and its competitiveness; and, (3) effective domestic and foreign investment partnerships: in consideration of domestic capital, technological and managerial limitations and the potential contribution of foreign investment to fill these limitations as well as to address export markets.

6.4. Investment Proclamation

- In 2020, Ethiopia enacted a new Investment Proclamation [34] and Regulation [35] to attract investment, including in the sugar industry, and shift from a positive to a negative list approach, allowing foreign investors to invest in any area except those expressly reserved. The sugar industry, with its potential for export and foreign exchange earnings, is a key focus for investment. Areas of investment reserved for the government or joint investment with the government: investment in transmission and distribution of electric power, postal service and air transport (for more than 50 passengers) are reserved for the government; investment in manufacture of weapons and telecom services are possible only in joint venture with the government. The recent proclamation also opens up previously restricted sectors to foreign investors, including banking, insurance, domestic air transport.

6.5. Investment Regulation (2020) and the Investment Incentive Regulation (2022)

- Investment Regulation [35] and the Investment Incentive Regulation [36] provide further details on the implementation of the Investment Proclamation, including investment areas, incentives, and procedures. The Ethiopia's Investment Regulation, enacted alongside the Investment Proclamation, introduced significant changes to the country's investment framework. In its positive aspects, this provides well-defined categories for investment areas, including those reserved for joint ventures with the government, domestic investors, and foreign investors. It opens previously government-monopolized sectors, such as electricity distribution and air transport, for joint ventures, fostering collaboration between public and private entities. The regulation also simplifies procedures for obtaining investment permits, transferring projects, and registering technology transfer agreements, and emphasizes training and knowledge transfer to Ethiopian employees, promoting local capacity building. However, the regulation still restricted certain sectors exclusively for domestic investors, which may limit foreign investment opportunities. The regulation does not mandate ownership caps for foreign investors in joint ventures, leaving decisions to government discretion, which could lead to inconsistencies. Moreover, effective enforcement and monitoring of the regulation's provisions may face hurdles, potentially affecting investor confidence.

6.6. The Commercial Code of Ethiopia (2021)

- This code provides the legal framework for undertaking business activities in Ethiopia. The Code repeals some of the provisions of the code issued in 1952. Enacted in March 2021, the code introduces significant changes, including the abolition of ordinary partnerships, the introduction of limited liability partnerships and one-person companies, and provisions for group companies, supervisory boards, and improved minority shareholder protections. However, there are still certain provisions which lack clarity, potentially leading to varied interpretations and disputes. The code lacks specific provisions to adequately protect creditors and minority shareholders in transactions between related parties. This can lead to conflicts of interest and potential exploitation of minority shareholders and creditors. There is a lack of clarity in the implementation of Book V (Bankruptcy proceedings) and the roles of various entities involved in bankruptcy. The process of liquidation of assets and the distribution of proceeds to creditors needs clarification, which can take place through revision of the entire code or addition of some more articles. The code is silent on provisions dealing with investment banking and the interaction between investment banking activities and existing banking operations. This in turns can create legal uncertainty for investors and financial institutions involved in investment banking activities.

7. Conclusions

- The Ethiopian sugar industry's strategic development initiatives have laid the groundwork for sustainable growth and competitiveness in the global market. Through targeted policy interventions, investments in infrastructure, and a focus on innovation, Ethiopia has transformed its sugar sector into a key engine of economic development and poverty alleviation. One of the foundational elements of the Ethiopian sugar industry's development strategy is the formulation of robust policy frameworks to guide investment decisions and sectoral growth. The government has introduced incentive schemes, regulatory reforms, and targeted interventions to create an enabling environment for private sector participation and foreign direct investment. Being informed of these institutional and legal setups and learning the policy priorities, key stakeholders and investors wishing to invest in the industry can benefit in multiple ways. In the meantime, the Ethiopia can successfully attract significant capital inflows into the sugar industry, fuelling expansion and modernization initiatives by taking appropriate measures on the setups that affect the sugar industry’s development.

8. Limitation and Future Research

- The current article has a few limitations. This article evaluates the institutional and legal frameworks governing the Ethiopian sugar industry based on a thematic analysis of data obtained mainly from secondary sources. The study also focuses on the legal frameworks which the principal sugar industry governing body, namely the Ethiopian Sugar Industry Group, uses for the industry governance, but the regulations under the ownership of other state organs are uncovered in this evaluation. Yet, for the article is based on the extensive PhD dissertation by the researcher, the extract article puts light into the key issues the Ethiopian sugar industry players need to give attention to. Irrespective of this, future researchers can mix the methods to diversify the sources and review the regulations which affect the industry indirectly.

ACKNOWLEDGEMENTS

- I wish to convey my heartfelt appreciation to my PhD advisor and mentor at Atlantic International University, U.S., for their exceptional guidance and support during the early stages of the dissertation project from which this article is derived. Their valuable insights and expertise played a crucial role in shaping both the overall study and this specific article. I am also profoundly grateful to my wife and children for their patience and unwavering support throughout the extensive research process over the years. Additionally, I would like to extend my thanks to my colleagues at the Ethiopian Sugar Industry Group and the senior government officials across various ministries, agencies, and research institutions for their involvement in this study and for their insightful contributions and recommendations.

Appendix: List of Legal Frameworks Evaluated

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML