-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Regent Journal of Business and Technology

2024; 1(1): 36-43

doi:10.5923/j.rjbt.20240101.03

Received: Nov. 23, 2024; Accepted: Dec. 17, 2024; Published: Dec. 21, 2024

Transforming Auto Insurance: The Impact of Telematics and Real-Time Data on Pricing and Risk Assessment

Xiaobai Chen

Department of Statistics, Actuarial and Data Sciences, Central Michigan University, Mount Pleasant MI, 48859, USA

Correspondence to: Xiaobai Chen, Department of Statistics, Actuarial and Data Sciences, Central Michigan University, Mount Pleasant MI, 48859, USA.

| Email: |  |

Copyright © 2024 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This paper aims to present the evolution of auto insurance pricing, driven by advancements in telematics and real-time data analysis. It discusses the transition from traditional demographic-based pricing models to innovative behavior-based approaches. It analyzes the sources of driving data, the statistical and machine learning techniques used to extract insights, and the multifaceted benefits of real-time pricing, including enhanced risk assessment, personalized premiums, and behavioral incentives. However, the implementation of these systems faces significant challenges, such as privacy concerns, technical complexities, consumer acceptance hurdles, and regulatory obstacles. Lastly, the paper forecasts the outlook, highlighting emerging trends towards telematics-only pricing, dynamic premiums, and the integration of complementary data sources. By providing a comprehensive analysis of innovational changes in automobile insurance pricing models, the paper seeks to equip stakeholders with insights to navigate the evolving landscape of behavior-based insurance.

Keywords: Telematics, Auto insurance, Innovation, Dynamic pricing, Behavioral assessment, Risk management, Machine learning, Data analytics

Cite this paper: Xiaobai Chen, Transforming Auto Insurance: The Impact of Telematics and Real-Time Data on Pricing and Risk Assessment, Regent Journal of Business and Technology, Vol. 1 No. 1, 2024, pp. 36-43. doi: 10.5923/j.rjbt.20240101.03.

Article Outline

1. Introduction

- The auto insurance industry is undergoing a fundamental transformation driven technology [1]. This innovation, enabled by advanced vehicle telematics and mobile technologies, shifts the focus from static, demographic-based pricing dynamic, behavior-based premiums. Instead of solely relying on conventional factors such as age, location, and vehicle type, insurers now have the capability to monitor and evaluate actual driving behaviors—such as driving speed, braking habits, mileage, and even the time of day or night the vehicle is used [2]—to determine insurance costs.The implications of this technological advancement extend well beyond pricing. Real-time auto insurance pricing has demonstrated promising potential in promoting safer driving behaviors and reducing accident rates. Studies from the Netherlands suggest that implementing Pay-As-You-Drive (PAYD) insurance could lead to more than a 5% reduction in total crashes, potentially preventing 60 fatalities and 1,000 injuries annually in that country alone. The impact on public safety, coupled with rapid market growth from 4.5 million subscribers in 2013 to a projected 100 million by 2020, highlights the transformative nature of this technology [3].The adoption of real-time pricing models, particularly through Behavior-centric Vehicle Insurance Pricing (BVIP), creates a direct link between driving behavior and insurance costs [4]. This connection not only promotes safer driving practices through financial incentives but also supports a more equitable insurance system by rewarding responsible drivers. With estimates indicating that Usage-Based Insurance (UBI) could account for approximately 50% of the world's vehicles by 2030 [3], understanding the implications and mechanisms of real-time pricing becomes increasingly crucial for insurers, policymakers, and consumers.This paper explores the evolution of auto insurance pricing from traditional demographic-based models to dynamic pricing. It reviews key sources of real-time driving data, along with the statistical and machine learning methods that transform this data into actionable insights, highlighting the advantages of real-time pricing for insurers, policyholders, and society. Additionally, it discusses the major challenges associated with adopting real-time pricing. Lastly, it explores the future of telematics in auto insurance, emphasizing emerging trends and innovations that are likely to drive further industry transformation. Through a comprehensive analysis, the paper provides valuable insights for insurers, policymakers, and consumers in the evolving auto insurance landscape.

2. Background: The Evolution of Auto Insurance Pricing Page Layout

2.1. Traditional Insurance Pricing Methods

- Over the past decades, auto insurance pricing has experienced a significant transformation, shifting from a static, demographic-based system to a dynamic, behavior-driven model. This evolution reflects not only technological advancement but also a fundamental shift in how the insurance industry understands and prices risk.Historically, insurers relied on a relatively simple framework of approximately 50 variables to evaluate risk and determine premiums [5]. This traditional approach focused primarily on demographic characteristics and basic vehicle information available at the time a policy was issued. Among personal attributes, age has the most significant impact on premium calculations [6]. For vehicle-specific factors, the car type plays a critical role in determining risk premiums, with higher-value vehicles attracting greater surcharges [7] [8]. Annual mileage is another key risk factor, as more kilometers traveled correlate with higher crash costs [9], and an increased likelihood of "at-fault claims" [10]. The shortcomings of traditional pricing models were apparent in several areas. Most notably, the heavy reliance on demographic factors often led to pricing inequities, where safer drivers could face higher premiums simply because they were part of a statistically "risky" demographic group. This demographic-based approach also led to a system of cross-subsidization, where lower-risk drivers effectively subsidized higher-risk drivers through standardized premium rates. Furthermore, the static nature of traditional pricing models meant that insurers had limited ability to incentivize safer driving behaviors, as premiums were largely disconnected from actual driving patterns.

2.2. Evolution of Real-Time Pricing in the Digital Age

- The rise of digital technology and telematics initiated a new era in insurance pricing. This transformation began with the deployment of vehicle-mounted devices that could track basic metrics like mileage and speed. As telecommunications and informatics capabilities progressed, these early innovations paved the way for more sophisticated Usage-Based Insurance (UBI) concepts. Early programs like Pay-As-You-Drive (PAYD) and Pay-How-You-Drive (PHYD) started to link actual driving behavior with premium costs, signalling a shift from demographic assumptions to behavior-based assessments [11].The real breakthrough came with the integration of advanced telematics systems and mobile technology. The adoption of sensors is increasingly impacting various industries on a global scale [12]. Today’s insurance platforms leverage a complex network of sensors and data collection tools to capture details of driving behavior. These systems monitor factors from acceleration patterns and braking force to cornering dynamics and route selection, creating a comprehensive picture of individual driving habits. The widespread use of smartphones has further accelerated this transformation, enabling insurers to collect detailed driving data without requiring specialized hardware installation.With the growth of the Internet of Things (IoT), a vast amount of data will be produced [13][14]. The processing and analysis of this vast data stream has been transformed by artificial intelligence and machine learning. Modern insurance platforms employ advanced algorithms that can process large amounts of driving data in real-time, identifying patterns and assessing risk with unprecedented accuracy. These systems have grown increasingly skilled at understanding complex behavioral patterns and predicting risk factors, enabling dynamic premium adjustments that reflect real-world driving behavior rather than demographic predictions. Not only in processing and analysis, but robotics and artificial intelligence can also play a key role in the decision-making process [15].This evolution has also brought significant improvements in customer engagement. Modern platforms offer drivers immediate feedback on their driving through user-friendly mobile interfaces, fostering a more interactive and transparent relationship between insurers and policyholders. This real-time feedback, often gamified, helps drivers understand how their behaviors impact their premiums, and promotes safer driving habits.Another innovation in modern insurance pricing is the inclusion of environmental and contextual factors. Current systems integrate real-time weather conditions, traffic density, and road reports into their risk assessments. This contextual integration also extends to historical accident data and local traffic patterns to provide a nuanced understanding of risks tied to specific locations and times.The latest stage in this evolution includes integration with connected vehicle systems. Today’s insurance platforms can interact with vehicle-to-infrastructure (V2I) and vehicle-to-vehicle (V2V) communication systems, creating an even more comprehensive understanding of driving conditions and risks. This connectivity enables insurers to consider real-time interactions with traffic signals, road conditions, and other vehicles, leading to an unprecedented level of accuracy in risk assessment.This transition from traditional to modern insurance pricing represents not only a technological evolution, but a fundamental reimagining of how risk can be assessed and priced in the automotive insurance industry. As these technologies continue to evolve and integrate, they promise even more sophisticated approaches to insurance pricing —— moving ever closer to a system that truly reflects individual driving behavior and associated risk.

3. Real-time Data Collection and Analysis

- The landscape of auto insurance pricing has been profoundly transformed by advancements in real-time data collection and analysis. With the integration of telematics, mobile technology, and sophisticated analytics, insurers are now equipped to assess risk with far greater precision, moving away from traditional demographic factors toward a behavior-based approach. This section explores the sources of real-time data and the advanced analytical techniques employed to transform this data into actionable insights for insurance pricing.

3.1. Sources of Real-time Data for Auto Insurance Pricing

- The primary source of real-time driving data comes from telematics devices, particularly On-Board Diagnostics (OBD) systems installed in vehicles [16]. These devices provide a direct link to the car’s internal computer systems, continuously monitoring a vast array of driving parameters, such as instantaneous speed, acceleration patterns, engine RPM, fuel consumption, and GPS coordinates. Data is often collected at high frequencies—sometimes multiple times per second—creating rich datasets that encapsulate the nuances of individual driving behavior.The breadth of collected data extends beyond basic vehicle operation metrics. Modern telematics systems track various contextual aspects of driving behavior, including the distribution of driving across different road types (urban, motorway, and others), temporal patterns of vehicle usage, and specific driving events. Of particular interest are harsh movement events, such as sudden acceleration, aggressive braking, and sharp cornering, which are typically normalized to occurrences per 100 kilometers to facilitate comparative analysis.However, the collection of real-time data presents significant challenges that must be addressed for effective analysis. Raw telematics data often suffers from quality issues, including non-chronological records, difficulties in accurate trip detection, and occasional unreliable data points. The volume of data generated also poses substantial storage and processing challenges, necessitating robust technological infrastructure. These challenges underscore the importance of sophisticated data cleaning and standardization protocols in the analytical pipeline.

3.2. Statistical Analysis of Telematics Data

- The foundation of telematics data analysis rests on robust statistical methodologies that enable insurers to extract meaningful insights from vast amounts of collected data. A primary tool for this process is Exploratory Data Analysis (EDA), which plays a critical role at both the portfolio and individual policyholder levels. EDA helps uncover underlying structures, patterns, and relationships between various driving behaviors and insurance claims, providing valuable information for risk assessment. This initial exploration sets the stage for developing more advanced statistical and machine learning models.Modeling is another essential technique alongside EDA. Predicting a driver's annual usage is a crucial aspect of an insurer's work. Research cited in [17] demonstrates that the analysis incorporates the annual distance traveled into a zero-inflated Poisson model, accurately predicting the likelihood of excess zero claims.One of the notable innovations in statistical analysis is the development of speed transition matrices, which effectively capture changes in driving behavior over time by analyzing discrete speed time series data. These matrices have proved particularly effective in producing statistically significant predictors for claims, demonstrating the complex relationship between driving behavior transitions and insurance risk. Research has shown that integrating telematics variables into regression models can enhance predictive accuracy, surpassing traditional demographic-based insurance rating factors.Rigorous validation techniques are employed to ensure the reliability and generalizability of statistical findings. One of the methods is 5-fold cross-validation [3] which divides the dataset into multiple parts to validate model performance and reduce the risk of overfitting. This methodological approach has revealed non-directly proportional relationships between expected claims and various driving metrics like total driving time or distance, suggesting the need for deeper, multivariate analysis.

3.3. Advanced Machine Learning Applications in Risk Assessment

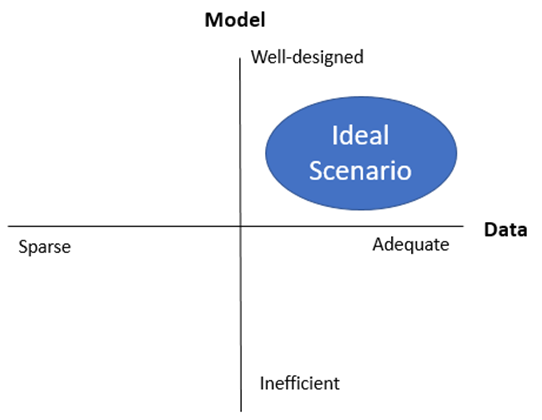

- The complexity and volume of telematics data have driven the adoption of advanced machine learning techniques to refine risk assessment models. These methods enable the analysis of non-linear relationships and the identification of intricate patterns within the data. Classification models, with various approaches demonstrating different strengths in risk prediction, form the cornerstone of these applications. Logistic regression, as a traditional statistical approach, provides a foundational approach to risk classification, while more advanced methods like neural networks, particularly Combined Actuarial Neural Networks (CANN), offer more sophisticated capabilities in feature engineering and pattern recognition [18].Cleaning techniques, which combine multiple models to enhance prediction accuracy, have emerged as particularly powerful tools in risk assessment. Among these techniques, Bagging (Bootstrap Aggregating) has shown remarkable success in improving prediction accuracy by combining multiple classifiers [16]. For example, the Naive Bayes classifier, when used within a bagging ensemble, has shown notable improvements in accuracy, compared to other statistical models in predicting driver risk levels.A breakthrough in telematics analysis has come from the implementation of ensemble learning techniques, which combine multiple models to improve prediction accuracy. Among these techniques, Bagging (Bootstrap Aggregating) has proven effective, often outperforming individual models by reducing variance and increasing stability. For example, the Naive Bayes classifier, when used within a bagging ensemble, has shown notable improvements in accuracy, outperforming other traditional models in predicting driver risk [16].The effectiveness of these machine learning approaches is evaluated through various performance metrics, including Mean Absolute Error (MAE), Root Mean Squared Error (RMSE), and the Kappa statistic [16]. These metrics provide a standardized way to measure model accuracy and facilitate comparisons between different approaches. The automated feature engineering capabilities of neural networks make them stand out in extracting relevant features from raw telematics data, streamlining the analysis pipeline and potentially uncovering previously unrecognized patterns in driving behavior.A model always works with data. When telematic devices collect data in consistent quality, the model's effectiveness and the volume of data make a significant difference Figure 1 illustrates a coordinate system, where the ideal is represented in the top-right quadrant. There is an optimal balance between sufficient data and a well-designed model. Companies are differentiated based on their ability to perform analysis and make decisions, with those in the top-right quadrant benefiting from both high data volume and model efficiency, leading to better decision-making capabilities.

| Figure 1. A coordinate system illustrating the ideal status characterized by a sufficient amount of data and a well-designed model |

3.4. Visualization and Pattern Recognition Techniques

- Given the complexity of telematics data, effective visualization techniques are essential for both preliminary and detailed analysis. One of the visualization tools is the Speed-Acceleration (v-a) heatmap, which provides a visual representation of driving behavior trends over time [18]. These heatmaps are instrumental in detecting patterns, such as sudden accelerations or decelerations, that might not be immediately apparent from raw data. They allow analysts to quickly identify outliers or recurring behavior trends that may impact risk assessments.To complement visual analysis, insurers employ pattern recognition algorithms that automate the identification of key driving behaviors and trends. These algorithms are particularly effective in identifying patterns that may correlate with accident likelihood, facilitating a more proactive approach to risk management. Time series analysis also plays a critical role in this analytical framework, with techniques like Hidden Markov Models being particularly useful for modeling and predicting driving behavior patterns over time. These models capture the dynamic nature of driving behavior and help identify temporal patterns that may indicate changes in risk levels. The integration of time-based analysis with visualization and pattern recognition provides insurers a comprehensive understanding of driving behavior patterns and their implications for risk assessment, allowing them to interpret complex data trends with greater precision. This structured analytical approach—blending rigorous statistics, advanced machine learning, and visualization techniques—marks a transformative step forward in auto insurance risk assessment. By utilizing these complementary methodologies, insurers can develop a more detailed and accurate understanding of how individual driving behavior translates into risk, paving the way for more precise and equitable insurance pricing models.

4. Benefits of Real-time Pricing in Auto Insurance

- The integration of real-time pricing, powered by telematics technology, marks a groundbreaking shift in auto insurance, fundamentally transforming risk assessment and premium determination. This innovative approach offers multiple benefits that enhance both operational efficiency and customer value while contributing to broader societal goals. This section provides a detailed analysis of the key benefits that real-time pricing brings to the auto insurance ecosystem.

4.1. Enhanced Risk Assessment and Classification

- The implementation of real-time pricing, enabled by telematics data, has redefined the way insurers evaluate driver risk. Traditional insurance models relied heavily on self-reported covariates and demographic factors, which often lacked accuracy and could introduce biases. In contrast, telematics data offers a more accurate and objective representation of driving patterns, enabling insurers to conduct more precise risk assessments [18]. Research demonstrates that models using telematics data outperform those based solely on traditional metrics, resulting in better predictions of claim occurrences and loss amounts.This enhanced risk assessment capability is particularly significant because it allows insurance companies to analyze objective behavioral metrics such as speed, acceleration, braking patterns, and route selection in real-time. The application of Behavior-centric Vehicle Insurance Pricing (BVIP) models has shown remarkable improvements in risk-level classification accuracy, providing insurers with the ability to differentiate between safe and risky drivers with unprecedented precision [16]. From a profitability perspective, UBI greatly improves underwriting performance by lowering the loss ratio, particularly among early adopters. This leads to a substantial increase in market share for these early adopters, as well as a positive effect on return on assets and return on equity overall [19].

4.2. Personalization of Insurance Premiums

- Another advantage of real-time pricing is its ability to facilitate highly personalized premium structures that reflect individual risk levels. This approach moves away from traditional flat-rate pricing based on demographic factors and offers a more equitable system where premiums are directly tied to demonstrated driving behavior [3]. The implementation of Usage-Based Insurance (UBI) schemes has been particularly effective in addressing the long-standing issue of cross-subsidization in the insurance industry, where historically, safer drivers often subsidized the costs associated with riskier drivers.This shift toward personalized premiums goes beyond basic risk metrics to enable dynamic and responsive pricing systems. Insurers can now adjust premiums based on a variety of factors including mileage, speed patterns, and overall driving behavior. This level of personalization not only promotes fairer pricing but also enhances transparency in the premium-setting process, which improves customer satisfaction and engagement.

4.3. Behavioral Modification and Safety Implications

- Real-time pricing serves as an effective tool for encouraging safer driving through financial incentives. The system creates a direct and transparent link between driving habits and insurance costs, establishing a behavioral feedback loop that encourages positive changes in driving patterns [3]. Studies suggest that this behavioral component of real-time pricing contributes to broader traffic safety and environmental benefits. This mechanism has shown promising results in reducing risky driving behaviors, decreasing crash rates and severity, lowering traffic congestion and promoting environmental sustainability. The study found a 21% decrease in the daily average frequency of hard brakes after six months of using UBI, highlighting a significant enhancement in driving safety [20].

4.4. Operational Benefits for Insurance Companies

- The implementation of real-time pricing systems also brings significant operational advantages for insurance companies, transforming various aspects of their business operations. Analysis of telematics data has enabled:Enhanced Fraud Detection and Claims Processing: Real-time data provides insurers with objective information to validate claims and identify potentially fraudulent activities. This capability has streamlined the claims processing workflow, reducing disputes and improving the efficiency of claims handling [16]. Improved Customer Engagement and Retention: Real-time systems enable a more interactive relationship with policyholders, who appreciate the regular feedback and potential savings for safe driving [11]. The ability to provide regular feedback and rewards for safe driving creates a more positive relationship between insurers and their customers, leading to increased customer satisfaction and loyalty.Operational Efficiency and Cost Reduction: Telematics data has led to streamlined underwriting and claims processes, enabling more automated and efficient decision-making. This has resulted in reduced operational costs related to risk assessment and claims processing, contributing to improved profitability for insurance companies [11].Market Expansion: Real-time pricing has also opened new market opportunities by providing tailored products for groups such as young or low-mileage drivers, allowing insurers to reach underserved segments and grow their market share [11].

4.5. Broader Societal Benefits

- Beyond individual and corporate advantages, the implementation of real-time pricing extends to deliver significant societal benefits, including:• Improved road safety and less congestions in urban areas• Decreased environmental impact through reduced emissions and fuel consumption• More responsible driving culture• More efficient use of transportation infrastructureAs technology advances and adoption rates increase, these benefits are expected to deepen, potentially reshaping the future of auto insurance pricing and risk management. Real-time pricing will play an increasingly important role in the future of auto insurance, driving innovation and improvement across the industry.

5. Challenges of Real-time Pricing in Auto Insurance

- While real-time pricing in auto insurance offers numerous benefits, its implementation and adoption face significant challenges that require careful consideration and strategic solutions. This section examines key obstacles faced by insurance providers, regulators, and consumers in adopting and operating real-time pricing systems.

5.1. Privacy and Data Security Concerns

- One of the primary challenges in implementing real-time pricing is ensuring data privacy and security. The collection and transmission of detailed driving behavior data raise significant privacy concerns among consumers and regulators. Insurers must address these concerns carefully to maintain the functionality and trustworthiness of their telematics systems. This challenge becomes particularly complex when considering the nature of the data collected, which may include sensitive information such as location data, driving patterns and personal behavioral indicators.The regulation on data protection has become increasingly stringent, particularly with the implementation of comprehensive regulations such as the General Data Protection Regulation (GDPR) in Europe [11]. These regulations require insurers to implement robust data protection measures and obtain explicit consent from policyholders for data collection and processing. Insurance companies must also ensure that individuals have rights to access, correct, or delete their data, adding complexity to data management processes. implemented anonymization techniques, such as removing GPS locations and device identifiers from their datasets, as a response. However, balancing data utility with privacy protection remains challenging.

5.2. Technical Implementation Challenges

- The implementation of Usage-Based Insurance (UBI) presents significant technical challenges that extend beyond basic data collection. Insurance companies need to invest in technological infrastructure like advanced telematics devices, mobile applications for data collection and analysis, and data processing systems. Integrating these new technologies into existing insurance platforms demands substantial resources and technical expertise [16].Data accuracy and reliability represent another critical technical challenge. The effectiveness of real-time pricing systems depends heavily on the quality and reliability of the data collected. Data quality may pose a challenge given the diverse range of vehicles, devices, and driving conditions that need to be accurately monitored and assessed. In the meantime, issues such as sensor malfunctions or data misinterpretations could also lead to inaccurate premium calculations, potentially undermining trust in the system. Insurance companies must deploy validation mechanisms to ensure data integrity while processing large volumes of real-time information.

5.3. Consumer Acceptance and Understanding

- Gaining consumer acceptance and understanding of real-time pricing is another hurdle for insurance providers. Most concerns about dynamic pricing are from the customer side [Basal]. Many consumers remain skeptical about sharing detailed driving data, despite the potential for lower premiums. This skepticism often arises from a lack of understanding about how UBI works and concerns over the misuse of personal data. Research indicates that initial consumer interest in telematics-based insurance often focuses primarily on financial incentives rather than the broader benefits of driving behavior and improved road safety [4]. Trust and transparency are essential for overcoming consumer reluctance. Insurance companies need to establish clear communication channels to explain how driving data influences pricing decisions and premium adjustments. This includes balancing customer expectations, as many welcome potential discounts for safe driving but don’t want to see premium increases caused by their driving behavior. Some customers may question whether the new technology is designed to increase their costs. Hence, building and maintaining consumer trust involves a sustained effort from insurers to demonstrate value and fairness throughout the customer relationship.

5.4. Regulatory Challenges and Fair Pricing

- Navigating the regulatory environment around real-time pricing in auto insurance presents complex challenges for insurers operating across multiple jurisdictions. Insurers must comply with a variety of regulatory frameworks while adapting to rapidly evolving technology-related regulations. Obtaining regulatory approval for new telematics-based products can be time-consuming and requires insurers to demonstrate compliance with existing regulations while proving the fairness and transparency of their pricing models [11].Fairness and discrimination concern also add complexity to real-time pricing models as different customers pay different prices for the same service or product [22]. While real-time pricing aims to reduce discrimination by focusing on actual driving behaviors rather than demographic characteristics, new forms of potential bias may arise. Insurance companies must carefully balance risk-based pricing with social equity, ensuring that their algorithms and pricing models don't unfairly disadvantage certain groups [4]. This requires continuous monitoring and validation of pricing algorithms to prevent unintended biases and uphold fairness in premium calculations.

5.5. Operational and Market Dynamics

- Integrating real-time pricing models into traditional insurance operations introduces substantial operational challenges. Insurance companies must merge telematics data with existing insurance databases, build new technological infrastructure and train staff on new systems and procedures. Processing large volumes of real-time data requires sophisticated data processing capabilities and analytical tools, placing additional demands on organizational resources and expertise [16]. Market competition and sustainability concerns add another layer of complexity to the implementation of real-time pricing systems. As these systems become more prevalent, insurers face pressure to differentiate their products while offering competitive pricing premiums. The challenge lies in balancing the costs of implementing and maintaining telematics systems with the need to offer attractive premiums to consumers [3]. This balance becomes increasingly critical in markets where multiple insurers offer similar telematics-based products, potentially leading to price competition that could affect long-term sustainability.The adoption of auto insurance involves navigating a complex array of challenges that require careful planning and strategic solutions. The success of real-time pricing systems depends on insurers’ ability to address multiple interconnected challenges while upholding ethical standards and maintaining consumer trust.

6. Implementation of Real-time Insurance Pricing

6.1. Traditional Insurance Companies' Telematics Programs

- The implementation of telematics-based insurance programs by traditional insurers has proven the practical viability of real-time pricing models. Progressive Insurance introduced usage-based insurance in 1994 with the launch of their "Snapshot" program, one of the industry’s most mature telematics systems. "Snapshot" uses real-time data to adjust premiums based on actual driving behavior, validating the concept of "Pay-As-You-Drive" (PAYD) insurance.Allstate joined the game with its "Drivewise" program, which rewards safe driving behaviors through premium discounts, showcasing how real-time data can incentivize safer driving while allowing for personalized insurance costs. Another model comes from Metromile, a provider focusing on pay-per-mile insurance, primarily for urban and low-mileage drivers. Metromile leverages in-car sensor data to calculate premiums based mainly on actual vehicle usage, offering a flexible alternative to fixed annual rates and highlighting telematics' potential to enable more precise market segmentation.

6.2. Automotive Manufacturers' Insurance Initiatives

- The integration of connected car technologies has opened new opportunities in the insurance sector for automakers. Although Tesla is not the first to enter this space, it is perhaps the most recognized automaker which is promoting its own insurance program. Launched in 2019, Tesla Insurance represents one of the most ambitious efforts by an automaker to disrupt the traditional insurance market using real-time data. Currently available in 12 states, including California, Texas, and Virginia, Tesla Insurance saw impressive growth in 2023. According to S&P Global Market Intelligence, Tesla’s written premiums reached $109.9 million in 2023, a significant increase from $12.7 million in 2022. Tesla’s direct incurred loss ratio also improved by 1.9 percentage points to 114.7% in 2023, while the industry’s overall loss ratio saw a year-over-year improvement of 4.6 points, reaching 75.5%.Other manufacturers are exploring unique approaches to leverage their vehicle data for insurance offerings. For over 20 years, General Motors (GM) has built its OnStar brand around customer safety and peace of mind. GM announced the launch of OnStar Insurance Services in November 2020, making it the exclusive agent for OnStar Insurance, which combines its legacy of safety with personalized insurance solutions. Similarly, BMW’s CarData platform provides insurers with access to the telematics data of BMW and MINI vehicles, allowing insurers to calculate premiums accurately down to the kilometer—provided the customer has given consent and has a telematics-enabled vehicle linked to a ConnectedDrive account.

7. Outlook and Conclusions

- The future of telematics and real-time driving data in auto insurance pricing is bright, with several emerging trends poised to reshape the industry.Increased Adoption of Telematics: As technology continues to advance, more insurers are expected to adopt telematics solutions to refine their pricing models. The growing availability of connected vehicles and mobile applications will facilitate the collection of driving behavior data, making it easier for insurers to implement usage-based insurance (UBI) products.Development of Telematics-Only Tariffs: Future research may lead to the creation of insurance products that rely entirely on telematics data for pricing, without the need for traditional self-reported characteristics. This approach could enable insurers to offer pricing that more precisely reflects each driver’s specific behavior and risk profile.Shift to Dynamic Pricing Models: The insurance industry may see a shift towards more dynamic pricing models, where premiums are adjusted in real-time based on ongoing driving behavior. This model could offer subscription-like flexibility, allowing monthly premium updates based on the policyholder’s current risk level.Integration of Additional Data Sources: Insurers may begin combining telematics data with other information—such as weather, traffic, and even social media—to refine risk assessments and pricing further. This multi-source approach could improve predictive accuracy and customer insights.Focus on Customer-Centric Products: Future of motor insurance pricing will likely prioritize customer-centric products that offer personalized experiences. Insurers may develop tailored offerings that reward safe driving behaviors with discounts or incentives, fostering a more engaged customer base.Regulatory Evolution: As telematics becomes more prevalent, regulatory frameworks will evolve to address privacy concerns and ensure fairness in data usage. Insurers will need to adapt to these regulations to maintain compliance and build trust with consumers.Enhanced Risk Management: The insights gained from telematics data will enable insurers to improve their risk management strategies. By analyzing driving behavior trends, insurers can develop targeted strategies to reduce claims and proactively mitigate risks.Positive Societal Impact: Telematics offers broader societal benefits, from improved road safety to reduced environmental impact, which will likely fuel further investment in these technologies. Insurers can also bolster brand reputation by positioning themselves as contributors to public safety. The future of telematics in motor insurance pricing is set to be characterized by innovation, personalization, and data-driven decision-making, resulting in more efficient and customer-friendly insurance products. Nonetheless, insurers will need to navigate evolving regulatory frameworks and address concerns around fairness and privacy to harness the potential of real-time pricing models.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML