-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Public Health Research

p-ISSN: 2167-7263 e-ISSN: 2167-7247

2022; 12(2): 25-30

doi:10.5923/j.phr.20221202.01

Received: Mar. 21, 2022; Accepted: Apr. 11, 2022; Published: Apr. 21, 2022

Role of Social Health Insurance in Achieving Universal Health Coverage

Njuguna K. David1, Stephen Macharia2, Daniel Mwai3, Daniel Mulinge4, Easter Olwanda5

1Health Economist, Ministry of Health, Nairobi, Kenya

2Director (Policy and Planning), Ministry of Health, Nairobi, Kenya

3Senior Lecturer, University of Nairobi, Nairobi, Kenya

4Manager (Strategy and Planning), National Health Insurance Fund, Nairobi, Kenya

5Assistant Coordinator (Costing), Centre for Microbiology Research, Kenya Medical Research Institute, Nairobi, Kenya

Correspondence to: Njuguna K. David, Health Economist, Ministry of Health, Nairobi, Kenya.

| Email: |  |

Copyright © 2022 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

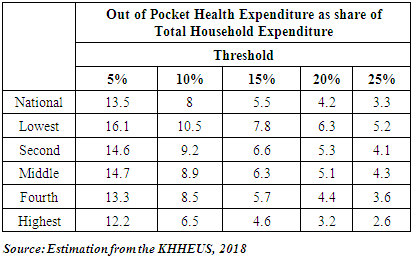

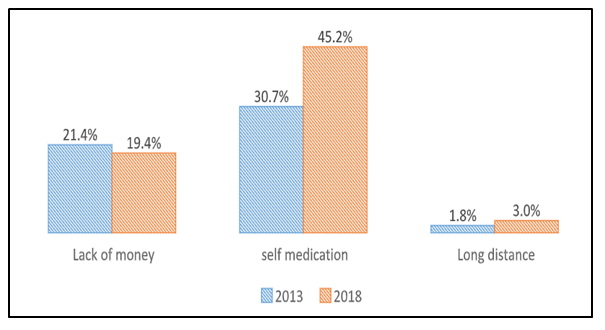

Background: Sustainable financing is the key to achieving universal health coverage (UHC). Kenya is keen on attaining the UHC by expanding the National Hospital Insurance Fund (NHIF). Methods: We extracted findings from the National Health Accounts (NHA) for Financial Years 2016/17 to 2018/19, the 2018 Kenya Household Health Expenditure and Utilization Survey, and evidence from other health sector documents that assessed health sector performance. Publications reporting access to health services were included to consolidate the findings. The Kenya National Health Accounts (NHA) estimation was done to track the flow of funds to the health sector. Results: The Out of Pocket expenditures and non-profit institutions serving households controlled 24.3% and 17% of Current Health Expenditure (CHE) respectively in 2018/19 from 22.7% and 20.3% in 2016/17. The MOH allocation increased to 15.3% of CHE in 2018/19 from 14.9% in 2016/17 while counties' remained relatively the same in 2018/19 at 18.3% compared to 19.3% in 2016/17. Also, social Health Insurance increased gradually from 10.3% in 2016/17 to 13.8% in 2018/19. Households that reported illness but did not seek health care increased from 12.7% in 2013 to 28% in 2018 citing mainly self-medication and lack of money (45.2% and 19.4% respectively) as the barriers to healthcare utilization. Moreover, 68% of households reported receiving quality health care services in 2018, an increase from 57% reported in 2013. Conclusion: NHIF must expand population and service coverage and reduce out-of-pocket payments with the new reforms. This will have positive implications for the health system goals of equity, efficiency and quality. The NHIF national and county government should also make deliberate efforts to align the design and implementation of such reforms with strategic purchasing actions that aim to improve the health system in general.

Keywords: Social insurance, NHIF, Health financing, Quality, Efficiency and Universal Health Coverage

Cite this paper: Njuguna K. David, Stephen Macharia, Daniel Mwai, Daniel Mulinge, Easter Olwanda, Role of Social Health Insurance in Achieving Universal Health Coverage, Public Health Research, Vol. 12 No. 2, 2022, pp. 25-30. doi: 10.5923/j.phr.20221202.01.

Article Outline

1. Introduction

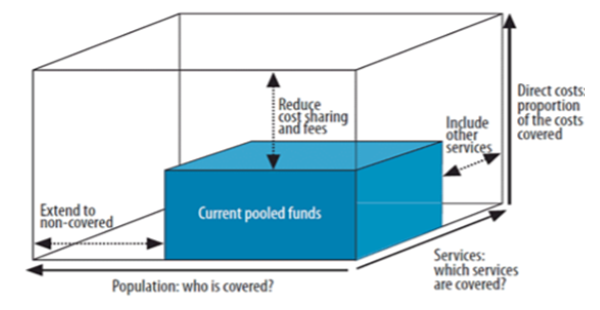

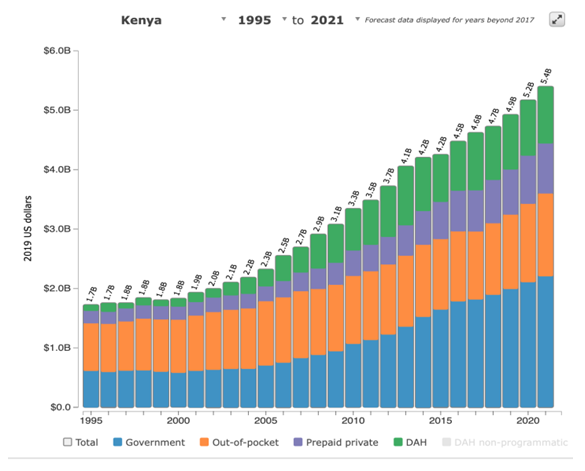

- The UHC ensures that all people access the needed health services of sufficient quality and experience financial risk protection [1]. The momentum towards the UHC is growing within Africa as a crucial public policy agenda. Moreover, the right to quality affordable health care as envisaged in the Constitution of Kenya 2010 can be achieved through a concerted effort of the national and county governments coupled with the various stakeholders [2]. Kenya is committed to achieving the Universal Health Coverage (UHC) as indicated by the strong political commitment to UHC exemplified in the Governments Big Four Agenda. Granted the importance of UHC as a global and national agenda, there’s a need to review and measure the country’s progress over time [3].Financial risk protection is concerned with safeguarding people against the financial hardship associated with paying for health services. In order to be universal, the domestic financing system must reduce reliance on out-of-pocket payments, shift to prepaid funds including progressive taxes, insurance premiums, or a mix of both [4]. Monitoring financial protection focuses on out-of-pocket payments (OOPS) made at the time of service use, which is a barrier to seeking the care they need [5]. Imposing taxes on specific products and services to increase general government revenue has also gained attention through the World Health Report 2010 [6].Pooling serves to spread the financial risk associated with the need to use and pay for health services, so that this risk is not fully borne by an individual who falls ill [7]. Risk pooling through health insurance can alleviate financial barriers and increase access to services by ensuring that pool members have varying degrees of health, financial status, and demography [8]. The larger degree of pooling, the less people will have to bear the health financial risks. Social Health Insurance (SHI) is becoming a more popular option in providing healthcare, particularly in developing countries where it is challenging to sustain the tax-based or out-of-pocket financing options. Social health insurance (SHI), which involves fund and risk pooling, is widely accepted as a key instrument for moving towards UHC [9].The Social Health Insurance (SHI) principally involves compulsory membership among all the Populus. Workers, self-employed, enterprises, and the government pay contributions into a social health insurance fund. The base for workers’ and enterprises’ contributions is usually the worker’s salary. The contributions of self-employed persons are either flat-rate or based on estimated income. The government may provide contributions for those who otherwise would not pay, such as unemployed and low-income informal economy workers. SHI either owns its provider networks, works with accredited public and private healthcare providers, or uses a combination of both. The SHI has several functions including, registration, collection of contributions, contracting and reimbursement of providers which is done by parastatal or non-governmental institutions, often referred to as sickness funds [10].Prior to the expansion of social health insurance in Kenya, the existing policy of user fees and other out-of-pocket payments (OOPs) led to massive decline in the utilization of health services [11]. Initiatives including free maternity services, the removal of user fees at primary care facilities, expansion of insurance coverage into the informal sectors, and provision of insurance for indigent and vulnerable populations have cushioned the population from the cost of healthcare.UHC concept is presented as a three-dimensional cube where the first dimension represents the coverage for the entire population by a package of services (access). The second dimension represents the inclusion of an increasing range of services into the package, while the third dimension looks at the rising share of the pooled fund so that it reduces out of pocket expenditure on health services [12].See Figure 1 below

| Figure 1. Universal Health Coverage Cube |

2. Methodology

- We extracted findings from the National Health Accounts (NHA) for Financial Years 2016/17 to 2018/19, the 2018 Kenya Household Health Expenditure and Utilization Survey, and evidence from other health sector documents that assessed health sector performance. Publications reporting access to health services were included to consolidate the findings. The Kenya National Health Accounts (NHA) estimation was done to track the flow of funds to the health sector.

3. Results/Findings

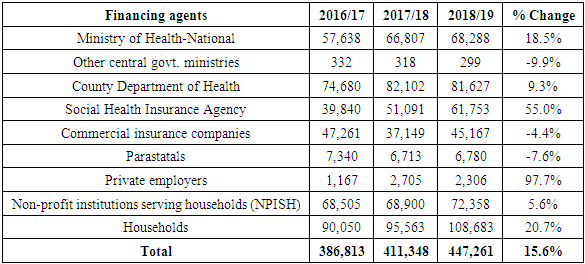

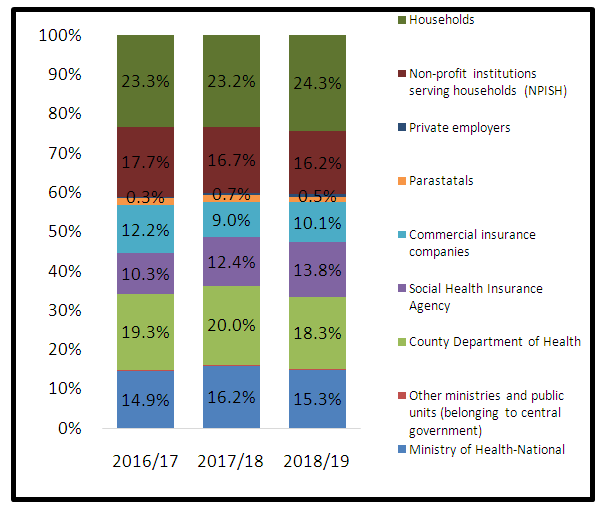

- Financing agents are institutional units that manage healthcare financing arrangements for raising revenue, pooling resources, and purchasing services.According to the 2021 National Health Accounts (NHA), out of pocket expenditures and non-profit institutions serving households controlled 24.3% and 17% of CHE respectively in 2018/19 from 22.7% and 20.3% in 2016/17.The MOH allocation increased to 15.3% of Current Health Expenditure (CHE) in 2018/19 from 14.9% in 2016/17 while counties' remained relatively the same in 2018/19 at 18.3% compared to 19.3% in 2016/17. Social Health Insurance increased gradually from 10.3% in 2016/17 to 13.8% in 2018/19. The trend in current health expenditures (CHE) for each financing agent is shown in Figure 2 shown below.

| Figure 2. Financing Agents for Current Health expenditures |

| Figure |

|

|

| Figure 3. Comparing the main reasons for not seeking care in 2013 and 2018 (Source: Estimation from the KHHEUS, 2018) |

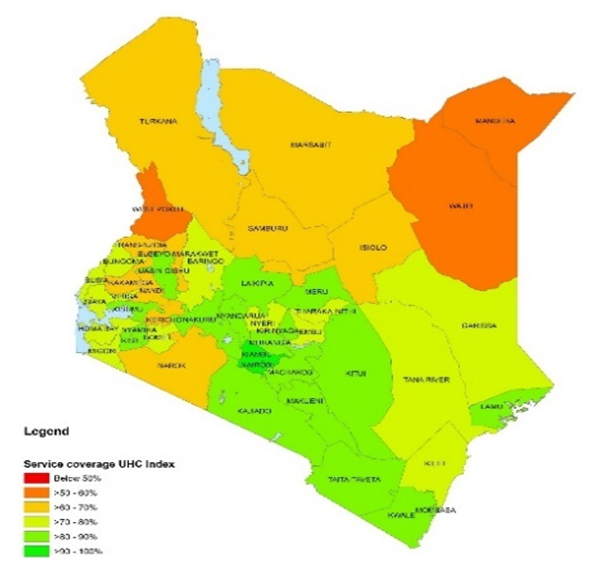

| Figure 4. UHC service coverage index score by county |

|

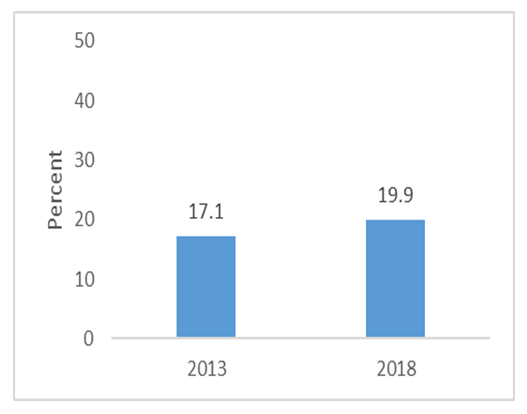

| Figure 5. Trend health insurance coverage. (Source: Estimation from the KHHEUS, 2018) |

4. Discussion

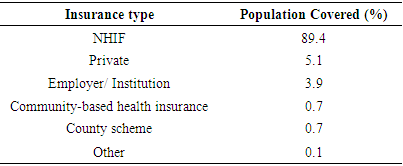

- The success of the UHC requires significant governance reforms and close strategic collaboration between the national and county governments. The reforms envisaged under UHC should improve efficiency in spending healthcare, and lead to better resource mobilization for health.Social health insurance is one of the most innovative and efficient ways of financing healthcare. The NHIF is a contributory scheme, with mandatory coverage of the formal sector through direct taxation of salaries and voluntary enrollment of the informal sector. Through the NHIF, Kenya has achieved near-universal coverage of the country’s formal economy in contrast to only 15% NHIF coverage among the informal sector. Future expansion depends on its ability to reach and retain informal sector members. While membership is compulsory for the formal sector, and contributions are reliably deducted from their payroll by their employers; participation is voluntary for informal sector workers. Unfortunately, enrolling informal sector members who can pay for insurance is difficult, and demand creation can be costly with variable efficacy. It is also more challenging to collect premiums from informal sector workers [13]. Consequently, the 2021 National Hospital Insurance Fund (NHIF) Amendment Bill stipulates mandatory registration for all Kenyans under NHIF in the new Universal Health Coverage (UHC) program. The bill seeks to increase the revenues raised by NHIF by making NHIF mandatory for all Kenyans aged above 18 years, requiring employers to match their employees’ NHIF contributions, and for providers to bill the private insurer first before NHIF pays for the co-insured patients [14]. These changes are on the wings of reforms to reposition the National Hospital Insurance Fund (NHIF) into a strategic purchaser. However, the bill is fiercely contested because the amendments threaten to hurt the wage bill and limit an employer’s ability to create jobs in an already challenging pandemic economy. Besides, since the cost of this access will fall heavily on Kenyan employers, there is a likelihood of employers opting out of private medical health care schemes and only offering their workers NHIF cover to mitigate the cost of the proposed amendments [15].Health financing reforms targeting the lower wealth quintile, who have poor insurance penetration, through identification of indigents, and provision of a social health insurance are required to bridge the insurance gap, and increase the population covered [16]. This will also reduce the out of pocket expenditures at the health facilities from the current 24.3%. Currently, NHIF is lacking in its coverage of vulnerable groups of the population [17]. Besides, unaffordability of the new premiums is a barrier to enrolment particularly for the unemployed; those living in rural and marginalized areas; the elderly; people living with disabilities and those in the informal sector with meagre and unstable earnings. This raises concerns regarding equity in contributions. There is a need to accelerate poverty reduction strategies that increase income levels and extend financial accessibility among the poor and vulnerable, thereby increasing the demand for NHIF. The majority of the unemployed youth should be insured and their information linked to the unemployment/employment bureau database through an improved information management system such that once people are employed and vice versa, their status is recognized. Moreover, there is a need to enforce compulsory health insurance for all employees in both the formal and informal sectors as provided for in the national social health insurance Act 2021.The success of the UHC program also depends largely on improved service quality. Moreover, the quality of healthcare is now a determinant of the success of health care financing reforms. For many LMICs, the main aim of seeking additional resources for the health sector is to improve health care quality [18]. To institutionalize a regulatory framework that promotes quality health care, PharmAccess, launched a strategic collaboration with the Kenya Ministry of Health and the National Hospital Insurance Fund (NHIF) to embed accredited clinical and business quality standards into a national quality assurance system and to introduce the standards and quality improvement methodology into the contracting process of health-care providers by the NHIF. The program offers a stepwise certification process complemented by technical assistance whereby a facility pursues explicit levels of quality based on an obvious criterion by implementing improvement plans to work toward the next level. Where financing for improvement is required, facilities, through the Medical Credit Fund, can get access to affordable loans with local banks. [19]. This approach offers both the incentive and the enforcement mechanism to encourage providers to participate in quality improvement initiatives.The quality of care should also be improved at health facility level, with a focus on both clinical quality of care, and responsiveness to the patients, as this has been seen as a potential cause of reduced utilization. It is dependent on improvement of health facilities in the counties and employment of more health workers [20].

5. Recommendations

- Kenyans of different wealth quintiles, currently paying OOP, should be encouraged, engaged and empowered, to contribute to an affordable social health insurance scheme, using currently available resources.Quality improvement measures such as mandatory assessment of quality of care at the time of licensing, insurance empanelment, coupled with continuous quality monitoring and medical claim spot-checks will protect the patients from making ill-informed decisions based on their perceived quality of care.Strengthen the stewardship role of the national and county governments to ensure that only the healthcare providers who offer quality care and improved health outcomes are operational. 1. Avoid fragmentation of financing systems into separate schemes with different levels of funding and benefits for different population groups while targeting resources to remove financial barriers facing the poor and most vulnerable. For instance, NHIF should reduce the number of insurance schemes, in order to enhance cross-subsidization of individual financial risks. 2. Advocate for both National and county governments to increase their health finance collections, allocations and efficiency.

Conflict of Interest

- The authors declare no conflict of interest.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML