-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2024; 14(2): 27-38

doi:10.5923/j.mm.20241402.01

Received: Sep. 18, 2024; Accepted: Oct. 5, 2024; Published: Oct. 12, 2024

Levels of Control and Audit Practices: Lebanon Period

Marita Issa Ibrahim1, Amal Abou Fayad2

1PhD Candidate at Holy Spirit University of Kaslik, Kaslik Lebanon

2Lebanese University, école Doctorale de Droit et des Sciences Politiques Administratives et économiques, Sin El Fil Beirut Lebanon

Correspondence to: Amal Abou Fayad, Lebanese University, école Doctorale de Droit et des Sciences Politiques Administratives et économiques, Sin El Fil Beirut Lebanon.

| Email: |  |

Copyright © 2024 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Since 2019, an economic crisis in Lebanon has erupted which has significantly impacted the Lebanese banking sector. This crisis has led to various challenges, notably currency devaluation, banking sector collapse, unemployment and poverty, political instability, corruption and mismanagement, inflation, infrastructure deterioration, etc. To rebuild and reorganize this sector, audit committees may play a leading role in overcoming this severe depression. Addressing these challenges requires comprehensive economic reforms, international support, and a commitment to tackling corruption and improving governance. Will the presence of an audit committee with all its components (existence, size, independence factor and frequency of meetings) have any role in reforming the banking sector? According to the quantitative analysis results, 260 respondents- including bank managers, vice-managers, and independent auditors—affirmed that the presence of an audit committee, its size, frequency of meetings, and members’ independence play a crucial role in the financial performance of any organization. The aim of this study is to find the causes that have led to the economic crisis since the governance seems to be strong and well applied. To reach our target and find the causes of the economic depression in Lebanon, we conducted 16 interviews with independent, competent and expert people. They considered that the existence of an audit committee, audit committee size and independence and frequency of meeting do not affect the financial performance of the Lebanese banks. Instead, they pointed to politics, the presence of illegal refugees, corruption and many other factors as the root causes.

Keywords: Audit committee, Committee size, Committee meeting frequency, Independence committee board members, Financial performance

Cite this paper: Marita Issa Ibrahim, Amal Abou Fayad, Levels of Control and Audit Practices: Lebanon Period, Management, Vol. 14 No. 2, 2024, pp. 27-38. doi: 10.5923/j.mm.20241402.01.

Article Outline

1. Introduction

- Lebanese banks are the engine of the financial activity for the domestic. Thus, they are the main channel for capital inflows into Lebanon and are involved in the current shortfall.The idea of the role of an audit committee in organizations is mandatory and has experienced this effect for many prior years. By adopting an independent manner, it improves the quality of financial reporting [1]. In 2002, the world faced many financial crises which led to the necessity of creating new corporate governance regulations. Consequently, the birth of the Sarbanes Oxley Act (2002) and the Blue-Ribbon Committee (1999) was instrumental in improving the audit committee’s effectiveness. As of in Middle East countries, corporate governance adopted audit committees. In Jordan, banks have found that the audit committee has an effect in reducing creative accounting practices [2,3]. They may provide misleading information that may produce a conflict of interest between the company and its management. Banks are the heartbeat of Turkey’s economic activity. That’s why auditing and controlling them is mandatory for their activity efficiency. Thus, they identified that the audit activity is performed by internal control and internal audit departments [4]. They have supported the importance of the strong relationship and the frequency of meetings between audit committee and internal auditors [55,56]. Yemenian banks have found that the frequency of meeting between Audit Committee and internal auditors is significantly related to banks’ performance. The “apex body” is responsible to control risks at banks and maintain their stability [57]. The implementation of Basel regulations, which mandate that boards of directors take part in risk-management assessment and the audit committee's function, was required following the 2008 financial crisis [58]. The creation of audit committees and their role have been created after the 2008 financial crisis in order to maintain bank stability and control risk management. Thus, bank’s performance is affected by the audit committee effectiveness. They have explained the issue that shareholders may take riskier investments, bad loans, inadequacy of bank capital, high risk loans which are against the interest of depositors [59].For instance, in Lebanon, in 2008 the BDL1 (Banque du Liban) has issued a Basic Circular No. 118 recommending from all the Lebanese banks to establish audit committees with independent members. Role, characteristics, and audit committee functions have been identified by the BDL regulations. First, the Audit committee plays a controlling role on the internal auditors’ work and the independence of external auditors as both auditors report directly to the audit committee. Second, audit committee characteristics are relative to its size (minimum three members), independence (totally independent), frequency of meetings (minimum four times) and financial representative (a minimum one member) to fulfill all the responsibilities in diverse way. Third, the audit committee cooperates with the board of directors in the decision of regulations and controlling internal and external auditors. Audit committees must be well structured, work efficiently and effectively. Additionally, audit committees’ responsibilities in banks are divided into nine categories: internal control, internal audit, risk management, ethics and code of conduct, accounting and financial reporting, independent audit, support services, valuation services, and rating bureaus according to current legislations in Turkey [4,5]. Audit committees are one of the most important organizational structures. In other words, the Audit committee and General manager report directly to the boards of Directors. Risk management, internal control & compliance and internal audit departments report to the audit committee. In 1967, the BDL has created the BCC (Banking control commission) for controlling and supervising the governance in Lebanese banks. Since 2019, an economic crisis in Lebanon has exploded at the top of it the Lebanese banking sector which has been the most affected. To rebuild and reorganize this sector, audit committees may play this leading role to sort out this severe depression. Does the presence of the audit committee have any effect on financial performance? How do audit committees play their role in reengineering the banking sector? Does the frequency of meetings influence the financial situation? Is there any relationship between the independence of audit committee members and financial performance? What has led the country to this severe depression? To address our research questions, we will follow this path: conduct a literature review, perform quantitative and qualitative analyses to confirm the audit committee’s role in financial performance and the current financial situation in Lebanon, analyze the results, and draw conclusions.

2. Literature Review

2.1. Financial Crisis: Lebanon, Spain and Greece

- On this black day, October 17, 2019, thousands of Lebanese citizens have been spread in Beirut’s streets and furiously started shouting “all government parties out”. Lebanon’s economy has melted down since that time. After the COVID-192 pandemic and Beirut blast on August 4, 2020, the Lebanese economy has been fallen. Those two factors have helped the economy to freefall rapidly. Lebanon gets out from an end of a 15-year long civil war in Lebanon, since 1990, with huge debts and economic crisis. Nevertheless, since that time fraud and corruption have thrived in the country. Severe economic depression is enduring in Lebanon where there is a real GDP3 decline and high inflation rate reaching “triple digits”. “October revolution” has generated a severe economic depression that we are until nowadays, July, 2024 still suffering. In 2009, GDP growth was 10.1% and since the mentioned year started to decline to 0.2% in 2019 [26]. Besides that, the USD$ exchange rate keeps losing its value. Poverty is growing sharply and the Central Bank (BDL) has made strict rules to control capital and cash withdrawals. Furthermore, it took severe decisions through “Lirafication” and haircuts (up to 70% on dollar deposits). The catastrophic social impact is remarkable; more than half of the country’s population is facing challenges in their basic services; healthcare, poverty, shortage of fuel, food and rise of unemployment. Decisive and rapid action REFORMS are requested to build Lebanon again. In order to start the reengineering process, a forensic audit is mandatory to stop the ongoing fraud and corruption in the country. By that, we will be able to attract funds and aid from helping countries [6]. Based on prior studies, numerous nations—including Germany, Greece, Cyprus, Spain, Nigeria, China, and others—that experienced a similar economic downturn were able to swiftly recover by implementing the recommended action plan (we will notice some referencing countries in the upcoming pages).Since last fifty years, Spain faced its worst crisis. The crisis began in 2009 as it was an extension of the international financial crisis that started in 2007. However, the internal imbalances and problems have aggravated in the pre-crisis period which has affected the situation. Failure of banks, unsustainable fiscal deficits, increase in borrowing costs, decreasing outputs, rapid job loss, increase in unemployment rate and severe financial market turmoil have fueled the crisis. The two main factors affecting the economic crisis are the real estate factor and the banking sector. The first quarter of 2009 was the hardest stage in terms of product breakdown and job devastation when GDP has fell down by 6.3% and the job loss affected around 800,000 people. The Spanish economy had a deficit in the public debt of 9.2% in 2010, having peaked at 11.1% in 2009. From the political economy point of view, a huge unemployment rate has appeared, opening the opportunity to labor-intensive activities (favoring politicians), the housing value has been affected by huge increase (favoring the home’s owner), and certainly a large amount of tax revenues, particularly real estate, for the different public administrations have been added [7]. The Greek financial crisis shared many characteristics with the financial crises in Spain and Lebanon. Since the begin of the economic crisis in 2007, Greece’s debt has increased and affected the banking sector more than it was expected. Since 2008, Greece’s economy has fell by 25% and lasted for long time even more than the Great depression that happened in United States of America. Around half of the young people in Greece has left their job rapidly and the public debt has been raised from 100% of GDP to more than 180% of GDP; most of which is now owned by other Eurozone governments and institutions. However, other than Greece, we have found Ireland, Portugal and Cyprus that faced the same economic crisis and by the aid of the Eurozone and the International Monetary Fund (IMF) after the cure from this severe depression, they got back to the capital markets. By late 2009, the imbalance fiscal has been visible which was the indicator of the beginning of the Greek crisis. On April 27, 2010; rating agencies have downgraded the country. It was out of the application of the normalizations with a cut of credit ratings to a theoretical status. No more borrowed money to the Greek government and the bonds yield started raising. Suddenly, the imports stopped, so the cash inflow have been affected. Only Economic and Monetary Union EMU countries (for instance: Austria, Belgium, Ireland, Spain, Finland, France, Germany, Italy, Netherlands, Portugal, etc…) have refused the principle of “no bail out” and kept the trading with Greece. Alike in Lebanon and other countries facing the same scenario, capital controls on bank deposits have put in place in late June 2015 [8].

2.2. Audit Committee History

- The banking regulation has been developed throughout five waves Concordat (1974-1986), Basel I (1987-1998), Basel II (1999-2008), Basel III (2009-2011), and post-Basel III (2012-2014). As Lebanon has been mandated by France directly after the WWI4 for 24 years, this long period of mandating has affected the first school in Lebanon to be the French one including many reforms and new French system adopted in the country. Accordingly, some French-Lebanese people have studied accounting in French accounting schools which has helped to implement their norms and regulations [9]. In 1963, The Union of Owners of Accounting and Auditing Offices has been created in Lebanon. In 1983, the Union has implemented and supervised a new unified accounting system in collaboration with the French Ministry. Furthermore, it has been added that the implementation of this system enhances the relationship between Lebanese accounting practitioners and France [10]. Not only the French school has dominated the accounting education but, as well, Anglo-American model has been introduced to the Lebanese markets from origin Palestinian accountants who studied at the American University of Beirut (AUB) and hold international accounting certificate such as CPA and CA [11]. In 1964, the Middle East Society of Certified Accountants has been created as a new group of accounting professionals [12].There has been a split between the French and British models in adopting taxation systems for small businesses, and the Big Four companies that rely on international auditing standards for banks, corporations, and multinational corporations [48]. The born of the Lebanese Association for Certified Public Accountants (LACPA) in the year 1994 has replaced all the above bodies two accounting models. Only this new accounting body is responsible to regulate and oversee the accounting professions in Lebanon [13].

2.3. Audit Committees’ Characteristics in Different Banks

- The efficiency and effectiveness of audit committee in banks in different countries from different culture, rules, has been illustrated by many authors. Thus, beside Lebanese banks, we have Jordanian banks. In Jordan, banks have found that the audit committee has an effect in reducing creative accounting practices. They may provide misleading information that may produce a conflict of interests between the company and its management. The Oversight Board has found that the members’ number of the Board of Directors should not be less than 3 non-executive members with financial expertise in the financial situation of the company [14]. As well as, they confirmed that in order to maintain an efficient control system, the audit committee should increase the number of its meetings [15]. Concerning the audit committee size, they have found that in order to find the best decision-making process, we should have a mix of expertise and capable members ranging from three to seven non-executive members of the board of Directors [16]. Last but not least, among the above audit committee characteristics, we mention one of the most important characteristics of audit committees’ whish is “Independence”. They explained the independence role as it plays a big role in reducing the likelihood of manipulating earnings. The audit committee’s main role is to supervise and control the financial situation of the company [17]. Although, they found that the concept of creative accounting is risky for the company as it may present an unreal picture of the company’s financial statements by manipulating gaps and the application of the accounting standards [18]. They have confirmed the idea that creative accounting may be full of gaps in accounting rules and regulations [19]. Thus, this study showed the impact of the characteristics of Audit Committee (The effect of Activity of the Audit Committee, the size of the Audit Committee, and Independence of the Audit Committee) in reducing unwanted accounting practices or fraud.

2.4. Audit Committee Importance on All Levels in All Sectors

- After the start of the depletion economy in 2019, the Lebanese Central Bank council remains until date (July 2024) suffering from three structural deficits in its budget, trade and balance of payments. In the meantime, of Lira devaluation and consequences affected the entire country, banks and individuals; the IMF (International Monetary Funds) has suggested a plan to reform the country. Mr. Riad Salameh, Ex-governor of the Lebanese Central Bank has found some ways to “calm-down” Lebanese citizens at their individual levels and for the benefit of the country. Accordingly, one of his strategies was “Sayrafa platform”. This platform was used by citizens to exchange their lira pounds to cash USD with restrictions and rules followed by many circulars, like circular 151, 158, 165, etc. now, Sayrafa platform has been replaced by “Bloomberg platform”. The new platform has been launched on September 7, 2023 by Mr. Wassim Mansouri interim governor of BDL. This platform will have more complex and strict rules aiming for transparency as it is recommended by the IMF actions. Bloomberg platform works according to the principle of supply and demand (if the supply is greater than the demand, the price will fall down and vice versa). Therefore, this will help the floating of Lira pounds and stabilizing the market. By that, the “Black money” or whitening will be controlled and maybe will avoid Lebanon to take part from the grey-list of financial crime and money laundering. Building on the literature and key findings, this study turns to mixed research methods.

3. Research Methodology and Procedures Applied on Relationship Between Audit Committee and Financial Performance

3.1. Research Methods

- We cannot pass through this subject without going into a detailed description of the following methods: qualitative and quantitative.

3.1.1. Qualitative Method

- This method relies on collecting deep details on a specific topic. It allows us to represent feelings, thoughts and emotions of the person while explaining any subject. They found that when researchers observe and interpret an action in order to get out by a conclusive theory, this approach will be considered in this case [20]. Retired bank managers, expert economists, economic university professors, ex-member in bank board of directors, economic analyst and journalist have been interviewed by the following questions for each interviewee.

3.1.2. Quantitative Method

- This method relies on a scientific method as the positivist paradigm [21]. This method ignores all feelings and subjective reasoning. It relies only on analyzing statistically fresh data collected. Similarly, researchers adopt data description rather than data interpretation. Lebanon encompasses Eight mohafazat or governorates, having 26 aqdiya or districts form. Lebanon Beirut and Mount Lebanon are the heart of Lebanon. Approximately half of the population are in Beirut and Mount Lebanon [54]. Therefore, both governorates encompass the highest economic and demographic activity in Lebanon and most of bank’s branches are in both governorates. According to [22], the “Top 1,000 World Banks” list whish they classified banks in two categories: one according to their size found from their total assets and the second is from their strength according to their Tier 1 capital; in our research we relied on the following: Byblos bank, Bank of Beirut and SGBL. The term “other” has referred to all other banks due to their globally ranked number; SGBL globally ranked number 534 (Tier 1 capital: $1.74 billion) and ranked 490 in terms of assets $25.80 billion, Byblos Bank globally ranked 537 (Tier 1 capital: $1.73 billion) and the number 504 in terms of assets: $25.01 billion and Bank of Beirut ranked 561 (Tier 1 capital: $1.62 billion) and the number 593 globally in terms of assets: $18.88 billion.

3.2. Types of Variables

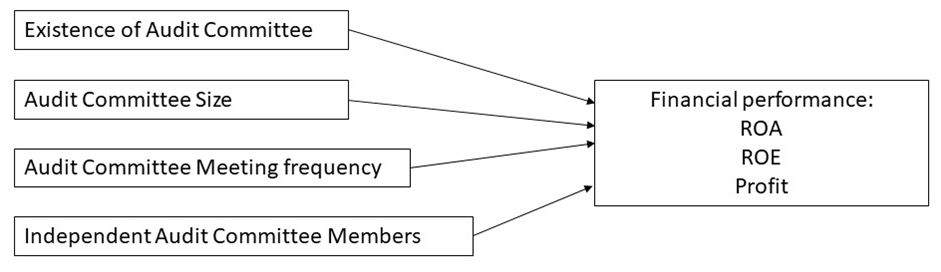

- They defined “variable” as it’s the most used word in any research [23]. In this research, we used both dependent (financial performance) and independent variables (existence of audit committee, audit committee size, frequency of meetings, independence).

3.3. Measurement Scale

- Likert-type scales are the most used measurement scales in theses and observations [24]. They usually rely on five or seven responses categories. Commonly used are the 5-point Likert scale which increases the quality of responses and reduces the respondent frustration level.

3.4. Sampling Data Collection

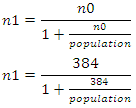

- A questionnaire formed from 27 Questions has been sent to banking auditors, Managers and vice-managers’ Banks in Mount Lebanon. The questionnaire is filled online by using “google forms”. The link has been active during the month of August 2023.Sample size calculations and methods employed for categorical data are quite analogous and remain the same, although certain differences may be observed. Suppose a researcher has pre-determined an alpha level of 0.05, intends to utilize a proportional variable, has specified a tolerable margin of error of 5%, and has estimated the standard deviation of the scale to be 0.5. in this context, we provide Cochran’s sample size formula for categorical data, along with a practical illustration of its application, while also elaborating on the rationale behind these choices. Therefore, In Beirut and Mount Lebanon governorates there is 388 bank branches. Mentioned districts are considered the heart of Lebanon as they are the engine of the economic and tourism activity due to the population density, historical significance and well-structured infrastructure. Thus, for a population of 776 managers and vice managers banks, the required sample size is 257. However, since this sample size exceeds 5% of the population (776*.05=38.8), correction formula should be used to calculate the final sample size [45]. These calculations are as follows:

n1= 256.8 (257)Where population size = 776Where n0 = required return sample size according to Cochran’s formula= 384Where n1 = required return sample size because sample > 5% of populationThese procedures result in a minimum returned sample size of 257.

n1= 256.8 (257)Where population size = 776Where n0 = required return sample size according to Cochran’s formula= 384Where n1 = required return sample size because sample > 5% of populationThese procedures result in a minimum returned sample size of 257. 3.5. Data Treatment

- SPSS (Statistical Package for the Social Sciences) is an advanced statistical software used to analyze quantitative data, combines machine learning algorithms, string analysis, and big data analysis. To navigate in this program, researchers must have the know-how of this program. Its latest version is updated in 2019 and considered the 25th [25].

3.6. Reliability Measurement & Validity

- For reliability measurement, we referred to Cronbach’s alpha method. This method is used to test the consistency and interrelation of tested questions [27]. A common interpretation of the coefficient is as follows:• α < 0.5 for low reliability • 0.5 < α < 0.8 for moderate (acceptable) reliability • α > 0.8 for high (good) reliability. Small tested questions and lot of heterogeneity of measured items that are poorly interrelated results for a low reliability with an α < 0.5.

3.7. Correlation Coefficient Test

- The direction of the relationship between variables and the strength of the linear relationship is found by the correlation coefficient test called Cramer’s V or Phi. According to [25] positive correlation is indicated by a unidirectional relationship of two variables. So, when the variable X is high, the variable Y will be high. However, negative correlation shows inverse relationship between variables. Consequently, variable X is high, variable Y will be low, and vice versa. The following criteria are used to identify the strength of the correlation between two variables:• 0 means There is no correlation between two variables • > 0.00 – 0.25 means the correlation is very weak• > 0.25 – 0.50 means enough correlation• > 0.50 – 0.75 means strong correlation• > 0.75 – 0.99 means the correlation is very strong • 1.00 means perfect correlation

4. Research Hypothesis Development

4.1. The Crucial Role of the Existence of Audit Committee Effect on the Financial Performance

- In 1999, the SEC reported that audit committees play the mandatory role in the financial performance of the organization [28]. Thus, they are composed from critical factors determining its effectiveness by using relative regulatory and legislative reforms [28,30,31]. While using their authorities, audit committees rely on internal audit department that’s why internal auditors must work effectively.For effective results of internal audit functions, audit committees must monitor their functions [29,49]. Consequently, AC5 will have power and influence on the available financial resources. They added that the internal audit budget is reviewed by the audit committee which has the authority to suggest related external audit fees and internal financial resources [49]. AC is responsible for setting the internal audit department budget.Since 1940, effective and independent audit committees have been requested from the auditing and corporate communities [28]. For effective quality of financial reporting, Audit committees are responsible to oversee both processes of internal and external auditors [32]. Recently, the SEC (2002, 2004) has maintained the idea that internal auditors play a major role in corporate governance and processes evaluation. Audit committee members must be independent and financially cultured and where directors meet frequently [33].

4.2. Effect of an Audit Committee Size on Financial Performance

- Following the requested hypothesis about the positive correlation between the existence of audit committee and the financial performance, we pay attention to the size and quantity of the audit committee members, who could be tiny or enormous [34,50]. [35] They added and supported the concept of a positive relationship on the performance of the company which is also supported by the dependence theory [36]. To sum up, with more resources, bigger audit committee size increases the effectiveness of an audit committee. Researchers have added that the effective work of any audit committee is affected by its characteristics such its size [34,50]. They have affirmed the strong relationship on the company performance by the audit committee size [39]. Thus, others added that the smaller the audit committee more effective it becomes [36]. As limited members with more expertise and knowledge have positive impact. Nevertheless, they reported that a small number of audit committee members let the members discuss and expose their knowledge and experiences easily [37].

4.3. Effect of Audit Committee Meetings’ Frequency on Financial Performance

- The idea of another audit committee feature has a significant impact on financial performance in addition to the favorable impact of the audit committee's existence on financial performance and in relation to its size: the frequency of audit committee meetings.Accordingly, they affirmed that audit committee’s meetings are mandatory for the communication process between audit committee members, internal auditors and external auditors and for the effectiveness of its work [9,14,38,51]. There is no rule for an ideal and specific number of meetings but only in the United States the rule has recommended to meet at least every quarter in a year [40]. By those frequent meetings, the level of detecting frauds will be improved in accordance to the performance [41]. Additionally, they added that the more the AC meets the more goals and targets will be achieved [42].

4.4. Effect of Independent Committee Board Members on Financial Performance

- Apart from the number of meeting’s frequency, we cite another AC characteristic: members’ independence. They identified that in order to ensure the best quality of objective financial information, audit committee members must be independent and unbiased people [43]. Independent directors enhance the audit committee work. For instance, in Germany, Spain, UK, France, Belgium, Australia, Canada, Jordan, India, Indonesia, Malaysia, China, Bahrain, and Tunisia and many other countries, independent and external directors act objectively at their levels. Their presence reduces the unwanted behavior of managers, increases the transparency in corporate governance and allows fraud detection [44,52,53] without forgetting the effect on the financial performance [45]. According to [35,46] for effective and efficient audit committee, members must be independent from the board of directors. Consequently, independent AC will be in charge to make a supervisory role with an independent and objective opinion. To improve the performance [47,46] and obtain a high quality and transparency of financial reports, external members in the audit committee must exist [44,52].Consequently, the following conceptual model has been created.

| Figure 1. Conceptual model. (Source: Elaborated by the author.) |

5. Results of Quantitative and Qualitative Analysis

- After the data collection through survey distributed to more than 200 persons. The responses were subjected to frequency counts and chi-square test. Moreover, qualitative data has been collected from more than 10 interviewees. Thus, in the following we will present the data analysis of both methods (quantitative and qualitative) conducted to answer the research questions of this study.

5.1. Reliability and Validity Measurement Result

- For reliability measurement, we referred to Cronbach’s alpha method. This method is used to test the consistency and interrelation of tested questions [27]. For the 22 questions having an α = 0.923 > 0.8. This shows high reliability.

5.2. Correlation Coefficient Test

- The direction of the relationship between variables and the strength of the linear relationship is found by the correlation coefficient test called Cramer’s V or Phi. The result of each question showed enough and strong correlation having Cramer’s V value between 0.25 and 0.75.

5.3. Results Discussion

- For the quantitative result analysis, we used Chi-square test because gathered data are nominal and ordinal. 260 people replied on the survey. Results showed that most of the respondents belong to Bank of Beirut (34.6%) and Other experts (47.3%) in the banking sector. Caller’s position is 10.8% to branch managers, 14.6% vice- managers, 21.5% employees and 53.1% others. Moreover 78.5% of respondents have more than 5 years’ experience which clarifies their positions in business. 42.7% of respondents hold Masters’ degree and 53.8% of respondents are female.

5.3.1. Audit Committee and Financial Performance

- The SPSS results show that Byblos Bank (with a 100% total agreement higher than the total 46.5%) strongly agree the statement of “Audit committee members encourage its members in understanding relevant accounting, reporting, regulatory, auditing, and industry issues.”Moreover, SGBL and Other (with a respectively agreement of 100% & 61.8% higher than the total 46.5%) agree the same statement. SGBL and Bank of Beirut (with a respectively level of 100% & 70% higher than the total 49.6%) agree the statement of “Audit committee members review its term of reference annually to determine whether its responsibilities are applied and recommend changes to the board of directors.” Bank of Beirut (with an 80% agreement level higher than the total 46.2%) agree the statement of “Audit committee members do the risk assessment process that may affect directly or indirectly the financial statement reporting (e.g.: fraud control, financing and liquidity needs, regulatory and legal requirements, market and competitive trends, and so on.” Other, SGBL and Bank of Beirut (with a respectively level of 62.6%, 100% & 50% higher than the total 50.4%) agree the statement of “Audit committee members understand and approve the process implemented by management to effectively identify, assess, and respond to the organization's key risks.” Other, SGBL and Bank of Beirut (with a respectively level of 61%, 100% & 70% higher than the total 63.5%) agree the statement of “The audit committee reports its findings and recommendations to the board after each committee meeting.” Byblos Bank (with a respectively level of 100% higher than the total 46.5%) agree the statement of “Audit committee members consider the transparency of disclosures in the financial accounting and reporting.” SGBL & Other (with a respectively level of 100% & 69.9% higher than the total 57.3%) agree the statement of “The audit committee reviews the company's significant accounting policies.” Bank of Beirut, SGBL & Other (with a respectively level of 60%, 100% & 69.1% higher than the total 60.4%) agree the statement of “The audit committee understands and approves the process used by management to identify and disclose related-party transactions”. Byblos Bank, SGBL & Other (with a respectively level of 73.7%, 100% & 61.8% higher than the total 60.8%) agree the statement of “The audit committee oversees the organization’s external financial reporting and internal control over financial reporting”. that Byblos Bank (with a level of 76.3% higher than the total 43.1%) agree the statement of “The audit committee receives sufficient information to assess and understand management's process for evaluating the organization's system of internal controls”. Bank of Beirut & SGBL (with a respectively level of 50% & 100% higher than the total 32.3%) neither agree nor disagree the statement of “The audit committee determines the audit fees paid to the independent auditors”. Byblos Bank & Other (with a respectively level of 73.7% & 62.6% higher than the total 54.2%) agree the statement of “The audit committee oversees the role of the independent auditors from selection to termination”. Bank of Beirut & Other (with a respectively level of 30% & 31.7% higher than the total 28.8%) agree the statement of “Audit committee members make adjustments to the financial statements that resulted from the audit”.The above statements show that Byblos Bank, Bank of Beirut, SGBL and Other agreed the 12 statements. However, only one statement “The audit committee determines the audit fees paid to the independent auditors” has been rated as neither agree nor disagree by both Bank of Beirut & SGBL. Considering and as discussed previously, Byblos Bank, Bank of Beirut, SGBL as ranked end of 2018 from top 10 banks in Lebanon and others refer to independent and experts in the banking sector. These factors lead to the conclusion and verify that H1: Existence of audit committee is positively correlated to the financial performance.

5.3.2. Effect of Audit Committee Size and Financial Performance

- Byblos Bank and Bank of Beirut (with a % higher than the total 42.7%) agree the statement of “Audit committee has at least one member who possesses the requisite level of financial reporting knowledge or acquires such knowledge soon after joining the committee.” Other and Bank of Beirut (with a % higher than the total 50%) agree the statement of “Audit committee members are qualified and meet the objectives of the audit committee's charter, including appropriate financial literacy.” Other and SGBL (with a % higher than the total 42.7%) agree the statement of “Audit committee members know about the industry and have a diversity of experiences.”Hypothesis H2 claims Audit committee size is positively correlated to the financial performance. The above statements’ results show that Byblos Bank, Bank of Beirut, SGBL and Other agreed the four statements. Considering and as discussed previously, Byblos Bank, Bank of Beirut, SGBL as ranked end of 2018 from top 10 banks in Lebanon and others refer to independent and experts in the banking sector. These factors lead to conclude and verify that H2 claims Audit committee size is positively correlated to the financial performance.

5.3.3. Effect of Audit Committee Meetings’ Frequency and Financial Performance

- SPSS results show that SGBL and Other (with a % higher than the total 67.7%) agree the statement of “Audit committee holds a sufficient number of meetings, scheduled at appropriate points to address its responsibilities in a timely manner. SGBL and Other (with a % higher than the total 53.5%) agree with the statement of “Audit committee makes sure the right individuals attend, particularly those with meaningful input on agenda items”. Other (with a % higher than the total 63.8%) agree with the statement of “Audit committee members plan in a calendar the appropriate time and resources needed to execute its responsibilities”.Hypothesis H3 claims that committee meeting frequency is positively correlated to the financial performance. The above results Show that SGBL and Other strongly agreed the three statements. Considering and as discussed before, SGBL as ranked end of 2018 from top 10 banks in Lebanon and others refer to independent and experts in the banking sector. These factors lead to conclude and verify that H3 claims that committee meeting frequency is positively correlated to the financial performance.

5.3.4. Effect of Independent Committee Board Members and Financial Performance

- SPSS results show that Byblos Bank and Other (with a % higher than the total 42.7%) agree the statement of “Audit committee members are independent of management”. Byblos Bank and Other (with a % higher than the total 36.2%) strongly agree the statement of “Audit committee members match all the requirements of independence”.Hypothesis H4 claims that independent committee board members have a positive relationship on financial performance. The above results show that Byblos Bank and Other strongly agreed both statements. Considering and as discussed previously, Byblos Bank as ranked end of 2018 from top 10 banks in Lebanon and others refer to independent and experts in the banking sector. These factors lead to conclude and verify that H4: Independent committee board members have a significance relationship on financial performance.Audit committee by all its components (membership size, frequency of meetings, members’ independence and its existence) has been approved beneficial for the organization. Organizations with a strong control system from internal audit, external audits and audit committees may have a very high profitable returns if all of these operations have been considered serious and all the detected findings have been followed by serious corrective actions. Controls and audits are essential for maintaining transparency, accountability, and trust in organizations. They help in identifying and mitigating risks, improving processes, and ensuring that organizational goals are met. However, unfortunately, despite the presence of these controls in Lebanese banks, a huge economic depression has occurred. This could be due to either controls not being taken seriously or other factors affecting the situation.

5.4. Qualitative Results

- According to the results of the quantitative analysis conducted with people being actively and directly to the Lebanese banking sector, several interviews have been conducted with independent people from the banking sector alike economic analyst, financial experts, governance experts, economic and financial university professors and retired banking economist in order to validate or reject the four hypotheses that were validated by dependent persons in the banking sector and didn’t let us achieve the goal to know what has led to the economic depression . The interview was made from five open-ended questions: The following shows the result of the interviews conducted with 16 interviewees:For Q1, 87.5% of interviewees have rejected the audit committee role with its components. As the independence factor doesn’t exists. Regardless of its existence, size and frequency of meetings, the audit committee role is incomplete as the independence factor is missing. An interviewee A stated that: “According to the circular 118 launched in 2008 from the BDL for Audit committee in Lebanon doesn’t meet the members’ independence requirement because members must be assigned by the Board of directors of the bank”. Moreover, interviewee B has added that “most Banks’ Board of directors’ members are made from at least one politician, board of directors’ members assign the Bank’s CEO and audit committee members. Consequently, audit committee members are affected by the board of directors and politicians”. Another interviewee C added: “Audit committee was present at that time with a size of minimum three members having at least two fully independent members. Members must be competent, because they are the eyes and ears of the board of directors in charge. But the problem is the famous Latin saying “Quis custodiet Ipsos custodes” (Juvenal, 1st and 2nd century) who will guard the guards themselves? The independence factor was missing. He added that the risk assessment in the bank is as well, missing. No alert was given to stop buying treasury bonds. Risk assessment was in big fail. Risk managers were incompetent; either not playing their role well or playing it well but the board of directors didn’t take into consideration their recommendations”. Interviewee D said that “the risk assessment role was ineffective. Audit committee, governance, controls show that yes everything is good and well present, but the problem is risk based. When there is high risk, there is high profitability. Banks are considered private organizations seeking for profits. The risk assessment must say to banks that they are taking too much risk while indebting the government regardless of if there is a lot profit or no. Many banks lack the fact that the government didn’t make any constructive investments in infrastructure, energy, and so on. Audit committee didn’t play its role adequately along with risk audit based didn’t play its role sufficiently”. The interviewees defined the crisis in Lebanon being in Quatro: monetary, financial, economics and politics. The crisis started when the government has put his power of decision on Central Bank to debt the government. Central bank has used the deposited money of domestic banks indebting the Lebanese government while in return the government didn’t invest in restructuring strategies and reforming the country. Audit committee job and role on papers is so strong but in reality, so weak. Confessionalism is the main problem of Lebanon leading the country to be directed by incompetent people. Last but not least, an interviewee has further stated that “firstly, the persistent political instability that has plagued the country since its inception has impeded the effectiveness of the government and all other official bodies. Secondly, the mismanagement of public finances has resulted in a high level of government debt, serving as the catalyst for the crisis. The third factor is widespread corruption, which has distorted market mechanisms and eroded trust in the government and its institutions, thereby leading to a significant decline in foreign investment. Fourthly the factor is political interference in the judicial system, which has fostered a lack of transparency and accountability in governance, consequently undermining trust in the economic system. Fifthly, Lebanon's involvement in regional conflicts and the spillover of these conflicts onto Lebanese soil have frequently disrupted economic activity, causing halts or slowdowns. Sixthly, the impact of COVID-19 has exposed governance weaknesses in Lebanon and highlighted the government's incapacity to effectively govern the country. These deficiencies have resulted in inadequate infrastructure and services, including electricity, water, and transportation systems, thereby hampering economic productivity, fostering public discontent, and undermining investor confidence. Collectively, these factors have led to government default, impacting both the currency and the banking sector, given that 85% of the public debt was internal, primarily in the form of deposits”.Consequently, and according to the above statements, the fourth hypotheses will be rejected considering that the existence of audit committee, audit committee size and independence and frequency of meeting don’t have any effect on the financial performance of the Lebanese banks. In Q2, we asked about the responsible parties leading to this economic crisis in Lebanon. All the interviewees have blamed the government backed by politicians certainly. Moreover, they added that we blame the Lebanese central bank, commercial banks, politicians for their incompetency and wrong leadership that are interfering in all the decisions. The system in place is extremely secure but the leaders are incompetent. Another interviewee added that “the Government is the sole responsible for the explosion of the economy. Central bank cannot do anything because it is cumulative issue due to wrong previous leadership. Citizens are the depositors that we cannot blame at all. They lost the trust in the banking sector so they rushed to banks to get their deposited money back”. Lastly, an interviewee said that “without reservation, the Government (backed by political parties), which, according to the constitution, holds the exclusive authority to formulate and enforce policies, bears the primary responsibility for the prevailing situation. By "the government," we encompass all successive administrations that have governed the nation from the 1990s onwards. Indeed, these administrations have consistently failed to fulfill their obligations. Nevertheless, culpability extends to all, as each individual has, in some manner, contributed to this collective failure and chaos. An interviewee blamed Mr. Hassan Diab, Prime Minister of Lebanon for the year of 2020-2021 because he announced the default of payments without any action plan or strategy”. For the third asked question during the interviews, most of the interviewees have ignored the played role of the Lebanese Central bank in removing the country from this depression. An interviewee has stated that “Lebanese central bank and commercial banks were playing together for mutual purposes in stating the interest rates and increasing their own profits. Currently, the BDL is doing one sole thing which is stop indebting the government, so no more print of Lebanese banking notes”. An interviewee expressed that “the solution starts by solving deposits issues”. The government should confess that he is the main looser of 80 milliards $ and that he is not in fail position. Moreover, he needs to guarantee to depositors that their deposits will be back to them but we don’t know when; it is credible to the government to guarantee this because it has an income and lot of assets like owning MEA, Port of Beirut, lands, Casino du Liban, BDL, etc. An interviewee added that “The Central Bank's effectiveness is constrained by its weakness and limited independence, alongside political interference in its decision-making. However, implementing Circular 154 could be a positive step forward (though insufficient) given the current state of affairs”.For the fourth question, interviewees responded that the steps taken are not serious enough for the recovery process. There are around 60-70 serious steps that must be taken to get out from the current crisis: unify the exchange rate according to the new budget proposition, election of new competent and independent president, election of new trusted government, designating a forensic audit (like Kroll) to assess losses, reengineering of the ministries staff and salaries, decrease the salaries of Ex-Ministers, Ex- deputies’, etc. An interviewee added to his colleague that “no laws, no capital controls nothing has happened. A suggestion to get out from the crisis, the government may assign only 1% interest on every investment profit that enters 2 milliards $. But this suggestion will be refused by politicians because usually the investors in Lebanon are politicians themselves”. An interviewee said: “Surely not! All the laws’ projects issued by the government have weakened Lebanon at the internal and external levels”. We can conclude from the official declarations and actions, that they are waiting for an external signal. Tackling the systemic challenges at hand demands thorough reforms spanning various sectors, encompassing governance, fiscal policy, and the financial system. Yet, progress is stymied by political deadlock and entrenched interests, prolonging the economic crisis and fueling social unrest. Another interviewee blamed Mr. Hassan Diab (Ex-Prime Minister) and Mr. Najib Mikati (Prime minister of Lebanon since September 2021- to date) for not taking any solution or new management of corporate governance, real reengineering, restructuring, reform, rebuilding and staffing competent persons in leading the country. One interviewee stated that Steps are taken by banks through a new digital banking system leading to less to cash economy, therefore to decrease the money whitening and laundering. Last but not least, the Lebanese crisis has ever been done in any country previously. In order to teach other countries to avoid to be escalated in crises like ours, they must avoid to debt ministries and government without paying back in returns, the control members in ministries, central banks and commercial banks must be purely independent and competent and certainly cutting the role of politicians to interfere in decisions. An interviewee respondent that there is a must in studying each step before any decision. For instance, in Lebanon, we faced an increase of government payments with a high rate of inflation due the increase of paid salaries in 2018; huge amount of personnel has joined public sector despite that the employment was forbidden in public sectors during that period: “Selselet el retab w el rawateb” has aggravated the inflation rate in Lebanon. Another interviewee responded that the fact of accountability, competency and strong risk assessment is extremely essential. Adding to studied steps is to never default payments without action plan because it will cost a lot. After each crisis, we need to plan for a recovery with good management to get out from the crisis with minimum losses and not continuing with same way without any actions. A diplomatic interviewee accepted the fact of corruption exists but asked how much corruption is good corruption? And focused on the point that we can do our own recovery from any financial and economic crisis by relying on private sector and privatization from the agriculture and production (which is the current case in Lebanon) without referring to the International Monetary Fund. Individualism with ethics and action plan can get out the country from the crisis. Another interviewee answered last question by the following: “A nation lacking a functional judiciary meets a dire fate”.To summarize, corrupted politicians, incompetent leaders, external factors, and Lebanon's geographic situation bordered by Israel and Syria have undermined all the controls that were implemented. These controls were not independent and were not taken seriously, as the interests and benefits of those in power were considered a priority over the overall benefits and development of the country.

6. Conclusions

- Lebanon, living in a honeymoon period blinded by the prolong history of excessive reliance on foreign currency inflows, lacked crucial reforms, credible economic policies and clear rounded vision that could have diverged the economic crash and put Lebanon on a secured track.As a result, in 2008, the BDL launched its first circular about the effective existence of audit committees in the control role, and in 2010, the first update was held. The audit committee in banks has several positive impacts on the country level, shareholders, private companies, and individuals. On the government level, it oversees all the operations between the central bank and different ministries and government expenditures. It is a credible and reliable source of control and compliance. Additionally, shareholders will go to invest their money in banks and companies that have an audit committee. Finally, the BDL has agreed upon the importance of the audit committee in supervising banks.AC6 evaluates the quality of work performed by independent auditors whether on the financial reporting or on the compliance work. Last but not least, proper audit committee and proper control system with corrective actions in banks, keep individual safe while investing their money and/or their retirement pensions. Hence, Lebanese citizens will be accessible to withdraw deposited money in banks without any restrictions or any equivalence rates (contrarily to what is happening nowadays). As audit committees will strength the financial system.Following the unprecedent crisis in Lebanon, the IMF7 plan to reform the country is based on the following five pillars: restructuring financial sector by reengineering banks, reforming state-owned enterprises, fighting corruption, money laundering and strengthening bureaucracy in the government and enhancing transparency, credibility and accountability (IMF, press release NO 22/108, April 7, 2022). The banking and control system in Lebanon is well established but managed by incompetent persons with the interference of corrupted politicians. Moreover, to the presence of Hezbollah that is playing a negative major effect on Lebanon leading the country to the hell. Last but not least the confessionalism join both Hezbollah and politicians in harming the economy. The problem is clear: so much corruption without any reform for personal interests. Therefore, the presence of audit committee doesn’t have any effect on the financial performance. It didn’t play its role in reengineering the banking sector and the frequency of meetings doesn’t influence the financial situation because the independence factor of audit committee members isn’t present. Briefly, the causes that have led to the economic crisis, despite seemingly strong and well-applied governance, are primarily due to political interference, both internally and externally.

Notes

- 1. BDL: Banque du Liban2. COVID19: Coronavirus disease 20193. GDP: Gross domestic product4. WWI: World War 15. AC: Audit committee6. AC: Audit Committee7. IMF: International Monetary Fund

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML