-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2024; 14(1): 1-13

doi:10.5923/j.mm.20241401.01

Received: Jan. 30, 2024; Accepted: Feb. 26, 2024; Published: Mar. 9, 2024

The Use of Relationship Banking as an Effective Tool for Enhancing the Performance Level of Commercial Banks in Nigeria

Chinyere Chikwendu Agwamba

Management Department, University of South Wales, Cardiff, Pontypridd, CF37 1DL, United Kingdom

Correspondence to: Chinyere Chikwendu Agwamba, Management Department, University of South Wales, Cardiff, Pontypridd, CF37 1DL, United Kingdom.

| Email: |  |

Copyright © 2024 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The objective of this research was to assess the efficacy of relationship banking as a mechanism for improving the operational efficiency of commercial banks in Nigeria. There were two research questions formulated and resolved. The descriptive survey was used, and the population of this research consisted of all clients, marketing executives, and personnel from three financial institutions. The non-probability sampling procedure used consisted of three marketing managers of three branches, twelve bank employees, and forty-five bank customers. It was selected from three commercial banks in Port Harcourt, Rivers State, Nigeria, namely Zenith Bank, Ecobank, and UBA. 'Bank Customer Questionnaire (BCQ),' 'Bank Staff Questionnaire (BSQ),' and 'Marketing Head Questionnaire (MHQ)' were the respective data collection instruments. The instruments produced reliability indices of 0.79 and 0.72, respectively, for the BCQ, BSQ, and MHQ. In pursuit of this objective, the questionnaires were distributed to bank customers, bank employees, and marketing directors of three commercial bank branches in Nigeria. The findings were assessed through the utilization of frequency counts and percentages and the SPSS statistical software. The finding that received the highest rating from all respondents (100 percent) was that commercial banks must prioritize the honesty and integrity of their operations in relationship banking in order to retain customers and ultimately improve performance. Recommendations were made in light of the findings.

Keywords: Relationship marketing, Banking, Commercial banks, Corporate relationship, Developing countries, Nigeria

Cite this paper: Chinyere Chikwendu Agwamba, The Use of Relationship Banking as an Effective Tool for Enhancing the Performance Level of Commercial Banks in Nigeria, Management, Vol. 14 No. 1, 2024, pp. 1-13. doi: 10.5923/j.mm.20241401.01.

Article Outline

1. Introduction

- The banking industry being a major financial service provider has a responsibility to establish and sustain useful relationships with customers which is necessary to keep the industry remaining competitive (Zhang, Han & Kallias, 2021; Zhao, Coco & Gong, 2022). As a result, most banks do not only seek to form these bank-customer relationships, but also seek to ensure that such relationships are long lasting and this is given top priority in an industry like banking, characterised by the insatiable desire of banks to prove themselves in order to stand distinct from one another (Mosa, 2022).Relationship banking is defined as an approach utilised by bankers in establishing long duration affiliations with their customers, accompanied by high customer services; with the hope that customers may bring their lending payments and deposit accounts to the bank (Haslett, 2023). While Horton (2022) defined relationship banking as a strategy employed by banks to analyse their customers’ multiple needs, Zhao, et.al (2022) on the other hand defined relationship banking as the continuous rapport between a financial institution and a firm which creates a form of closeness due to the financial services that the former provides, in which the information gathered from the latter could be useful for developing contract agreements between both parties. To this end, Hong (2023) posited that some of the benefits of relationship banking among others included obtaining long-term planning and support for one’s business, better loan and finance opportunities, and acquiring a source of new business contacts.In developing countries like Nigeria, one important aspect of its banking industry which is said to be fast growing, gives careful consideration to is the establishment and sustenance of lasting relationship with customers. These relationships according to Zhao, et.al (2022) were said to have arisen as a result of vigorous marketing strategies undertaken by the staffs and managers of Nigerian banks, particularly among the commercial banks so as to win over customers- individuals, firms/businesses and investors alike, and to retain them. The reason for this as argued by Diyo, Madanga and Bambur (2023) was that the Nigerian commercial banks sought to carve a niche for themselves and remain highly competitive and productive in the banking industry; and this was feasible when the banks were able to start and retain viable relationships, encourage inclusion of new customers, among other things like possessing sound risk assessment strategies, banks’ deposit attraction, banks’ reserve only to mention but a few. In view of the foregoing, Olokoyo (2011) opined that one major way that the Nigerian banking industry became associated with relationship banking was through lending and this was traced back to as early as 1892 which saw the emergence of banks in Nigeria that began with the “African Banks Corporation”, after which other banks came about. He further observed that though relationships were established during this period regarded as the colonial era, lending was only favourable to expatriates and could not be seen as good practice as the banks then were colonial banks before indigenous banks were formed. However, Ojong, Ekpuk, Ogar and Emori (2014) viewed that the lending practice in the Nigerian banking industry has improved greatly over the years and has assisted the banks to spice up relationships with individuals and corporate organisations as more loans are being issued out to customers, including the Small and Medium Scale businesses in the country. On the contrary, others argued that it could be detrimental to the lending bank who might be lacking in knowledge about businesses in specific areas. For instance, some of these business ventures had turned out to be a failure, fraudulent and produced debts that became irrecoverable by the banks; and in the long run, the banks ended up counting huge amount of losses instead of making profits (Saari, 2020; Stefanelli, Ferilli; Boscia, 2022 & Twum, Agyemang & Sare, 2022).The importance of relationship banking cannot be overemphasized. It is a way of assisting the banking industry, especially those with low performance to form beneficial relationships that could ultimately affect their level of performance positively (Guo, 2018). This was because establishing and sustaining such useful relationships with customers, some of which included potential foreign investors was capable of enhancing economic ties in terms of grants, loans and so on among countries which can lead to the growth of the banking industry of the recipient country as well as its economy. As a result, undertaking this research enables commercial banks in the Nigerian banking industry to be fully aware that using relationship banking can be an effective tool which can help elevate their performance level, and it is also useful for further research in future.Statement of the ProblemThe banking industry is a very important sector that is capable of affecting an economy either negatively or positively. This is because the quality of financial services which a banking industry is able to make available to a country, speaks volume about the economic growth of such a country to other economies who may want to invest in it, due to its ability to allocate credit facilities efficiently to aid businesses as well as secure the financial investments of its customers (Guo, 2018). Various studies had also pointed out that the Nigerian banking industry has got potentials such as significant increase in terms of number of bank branches, volume of loans as well as advances, volume of deposits and so on, which were capable of measuring up to those of its contemporaries, if harnessed effectively in the right way (Pat & James, 2011; Onwuzulike, 2017; Olokoyo, 2021).Unfortunately, in spite of the constant efforts placed by Nigerian financial regulators at increasing the level of competition of the Nigerian banking industry, one of which is the financial reform which required Nigerian commercial banks to have a minimum capital base of 25billion Naira, that is, approximately $166.7million for it to continue functioning, its performance level is still considered yet to have attained the desired outcome, and that it is unlikely they are able to meet up with competition from other model economies like the USA for example, if this continues.Deng (2009) argued that this amount required by the Nigerian commercial banks to have in order to be fit to function is so little when compared to what is obtainable in well developed economies with a higher level of performance and stability in their banking industries like China, which possesses a strong minimum capital base for Commercial banks put at RMB 1 billion yuan. As a result, some studies like Oloko (2012); and Hearn (2011) had reported that developing countries particularly in Africa, like Ghana, Kenya, Cameroon and Nigeria inclusive, were engrossed with trying to use relationship banking as a means of last resort to equal the competition that arises in the banking industry worldwide. In view of this, Pratt et al (2011) opined that for it to be useful in enhancing a banks’ performance, such banks should be able to carefully assess the risks involved and create methods of diversifying these risks around the economy, and device ways of solving the problems of asymmetric information which is very important in the practice of relationship banking. It was against this backdrop that the current study was carried out.Purpose of the StudyThe purpose of this study was to establish the use of relationship banking as an effective tool towards enhancing performance level among commercial banks in the Nigerian banking industry. Specifically, the study has the following objectives, to:1. assess how commercial banks utilised relationship banking in the course of discharging their duties.2. examine the importance and impact of relationship banking on the banking industry as a financial service provider, and on the customer.Research QuestionsThe study sought answers to the following questions:1. How do commercial banks utilise relationship banking in the course of discharging their duties?2. What is the importance and impact of relationship banking on the banking industry as a financial service provider, and on the customer?

2. Literature Review

- Theoretical ModelThe main proposed simulation for this study is the ‘Relationship banking model theory’ developed by Edgar Frank Codd and Williams Island (1970). This model involves a system of interaction that cuts across personal contacts of bank and company managers. This model also creates a base for service of the customer and products which enables the bank in assisting the client during economic crises and implementation of long-term projects. The choice of this model for the study was predicated on the fact that the model basically communicates trust based on personal communication between banks and their customers. It involves trust-based personal interactions, exchange of information and relationship transactions (Guo, Holland & Kreander, 2014). Therefore, through the customer and bank exchange of information, it builds up knowledge and customer confidence. Since this study is based on determining how commercial banks utilized relationship banking in discharging their duties and the importance and impact of relationship banking, the model is best suited for the study in ensuring service quality and other benefits.Relationship banking is an area that banks have nurtured over the years in Nigeria due to the competitive nature of the job. Zhang et.al (2021) admits that banks not having a sound knowledge of business ventures in specific areas reveal the down side of relationship banking and as a result, they stand a risk of being deceived and in extreme cases, it generates loss of financial investments by the bank. They further admitted that this information gap/asymmetry arises when potential borrowers/customers also do not fully disclose all information pertaining to a business and having established a particular type of relationship or standard with the bank, the latter shies away from seeking expert advice to carry out proper monitoring on such business ventures which may eventually turn out to be a failure or a fraud. In similar vein, Dong and Guo (2011) viewed that relationship banking could grow to become a “double- moral hazard” situation if such a customer leaves the old relationship to form another relationship with a new bank in which the trend continues whereby the new bank is yet again oblivious of the full information about such a customer or business and with little or no effective monitoring of the customer or business, could result to dangerous consequences for such a bank. Various other studies have underscored the ways by which banks engaged in relationship banking with their customers and the gains involved. For example, Adiele, Gabriel and Adiele (2013) conducted a study on customers’ relationship management and bank performance in Nigeria, using 400 respondents consisting of top management staff having direct contact with customers from ten commercial banks in Nigeria. The finding showed that among the customer relationship management dimensions, customer identification and retention had a significant impact on business performance. In another study using 400 respondents which comprised customers, management and staff of both First Bank PLC and Guarantee Trust Bank PLC in Umuahia, Nigeria, Anuforo, Ogungbangbe and Edeoga (2015) found that a direct relationship existed between customer relationship, management and customer loyalty, sales volume and market share. The study clearly showed that customer relationship was beneficial to both parties. In their own study, Karim, Chandra and Balaji (2022), reported their finding in a study of customer perception on customer relationship management (CRM) with reference to banks in Tirupati, India. They found that customer relationship management provided interactive, personalized and relevant communication with customers to develop and maintain relationships. In other words, the study aimed to find out customer satisfaction and ways of retaining it; and found a high rate of efficient customer retention.Commercial banks in Nigeria have also come to the realisation that banks play a significant role in the economy. In support of this assertion, Oyebowale (2020) reiterated that growth in inflation in Nigeria was supported by previous studies. The study reported that the financial systems in Nigeria have a significant role in enhancing economic growth, with specific focus on the relevance of banking. Alvarez-Botas and Gonzalez (2023). Observed that relationship banking had a lot of benefits for a consistent and regular customer, among which included that relationship loans paid less spread than non-relationship loan; and it required less collateral; since reduction in spread disappeared during financial crisis and relationship banking and creditors’ rights were complementary.

3. Methodology

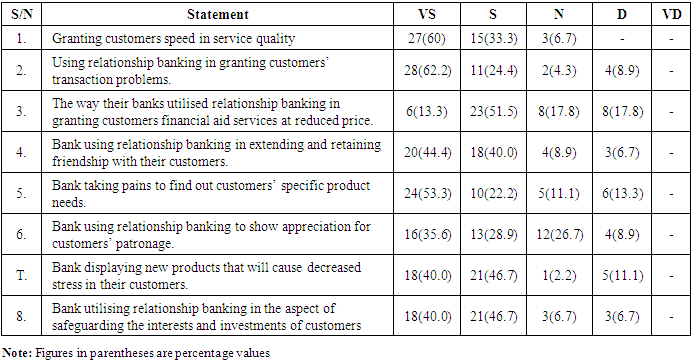

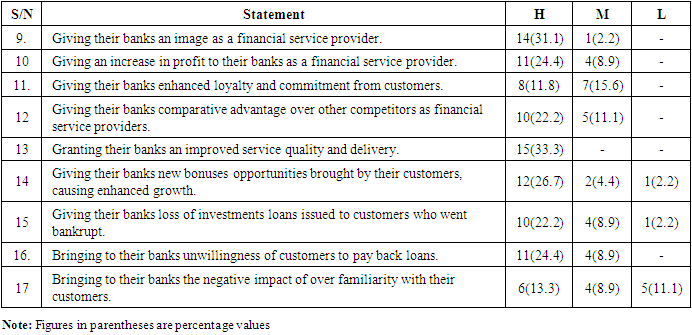

- Research DesignThe research design for this study was the descriptive survey, which involved the opinion and attitudes of respondents as regards certain behaviour or attributes. Siedlecki (2020) viewed that the survey method is concerned with the views and behaviours of particular interest groups of a research, and describes the individuals, situations, issues and behaviours. On the other hand, Shuttleworth (2019) opined that the survey method was used in observing and describing a person’s behaviour without influencing it. Examples of the survey methods include questionnaire, telephone interview, personal interview, panel technique and observations. The purpose of the study was to find out how bank staffs administer relationship banking in the course of discharging their duties with the aim of meeting customers’ needs, and to analyse the importance and impact of relationship banking on the banking industry as a financial service provider on one hand, and on the bank customer. Thus, banking efficiency in relation to its performance and customer satisfaction were looked into.PopulationThe population chosen for this study comprised all the commercial banks situated in Port Harcourt Metropolis, Rivers State, Nigeria. Out of the banks, three were randomly selected. Thus, all the Bank Staffs and Marketing Heads of the selected commercial banks, comprised the dependent variable. The population also included all their bank customers. This population was selected in order to determine the use of relationship banking as an effective tool towards enhancing performance level among commercial banks in the Nigerian banking industry.Sample and Sampling ProcedureThe non probability sampling procedure was utilised in selecting units from the population; implying that a subjective or non-random sampling was involved in selecting the sample from the population. This ensures that the sample is representative of the population, The sample size used for this study included 45 bank customers, 12 bank staffs and 3 marketing heads of 3 branches, selected from the commercial banks (Zenith, Ecobank and UBA) in Port Harcourt, Rivers State, Nigeria. The justification for using the non-probability sampling was to enable the researcher collect data easier, faster and to eliminate bias. This study made use of bank customers, bank staffs and marketing heads as respondents because all three groups were presented with the opportunity to be involved in establishing and sustaining relationships with one another in course of carrying out banking activities. The bank staffs and marketing heads practiced relationship banking when customers were marketed into banking with the banks as well as when customers’ needs were attended to while undertaking a banking transaction in such a way that will sustain the bank-customer relationship. The study also made use of this particular sample size in order to keep the study reasonably small due to the difficulties of people responding to such an instrument during working hours.InstrumentFor this research, a compound instrument was developed by the researcher, comprising three subscales namely Bank Customer Questionnaire also known as the BCQ, Bank Staff Questionnaire also known as the BSQ and the Marketing Head Questionnaire also known as the MHQ respectively. The questionnaires contained different questions relevant to the research topic described below.Bank Customer Questionnaire (BCQ) This involved series of questions administered to the 45 bank customers among the three selected commercial banks. The questions were centered on how they would you rate their satisfaction on the extent to which their bank utilized relationship banking in granting customers speed in service quality, solving customer’s transaction problems, extending a hand of warm friendship to customers and retaining that kind of friendship with them, taking pains to find out the specific needs of customers, showing appreciation for customers’ patronage, display of new products and services that will cause decreased stress to customers and obtaining feedback on them and safeguarding the interests and investments of customers in the bank; while discharging its duties, etc.Bank Staff Questionnaire (BSQ)This involved series of questions administered to the 12 bank staffs among the three selected commercial banks. The questions were centred on their level of satisfaction with the use of relationship banking in their banks, how they would rate the importance and impact of relationship banking to their banks as a financial service provider, their level of agreement or disagreement as to what could pose as a hindrance to relationship banking in their banks and; reliable and effective ways that their bank could make use of relationship banking to retain customers and enhance performance level. Each section of the questions also ended with spaces for general comments.Marketing Head Questionnaire (MHQ)This involved series of questions administered to the 3 marketing heads among the selected commercial banks. Like the BSQ, it also contained questions that were centred on their level of satisfaction with the use of relationship banking in their banks, how they would rate the importance and impact of relationship banking to their banks as a financial service provider, their level of agreement or disagreement as to what could pose as a hindrance to relationship banking in their banks and; reliable and effective ways that their bank could make use of relationship banking to retain customers and enhance performance level. Each section of the questions also ended with spaces for general comments, after which a request for a Skype interview was asked in order for more knowledge to be gained on the research study.The instrument was face validated by three experts specialized in Banking and Finance. They made their observations, which led to modifying the instrument. Thereafter, the questionnaire was pilot tested for reliability using 20 bank workers from a different bank using Cronbach alpha for its analysis, which yielded a reliability value of 0.79 for the BSQ and 0.72 for the MHQ respectively; implying that the instrument was reliable.Method of Data CollectionIn addition to obtaining data from the existing-books in the banks, the survey method using the questionnaire; was used for the groups of people known as ‘respondents to provide their knowledge or information pertaining to a particular topic which leads to identifying problems or concerns that may lead to development of a solution (Mills, 2021). The questionnaire consisted of a list of questions which was asked to the selected group of respondents. It is seen as a more suitable means for this study because of the restraints placed by time whereby respondents with tight schedules may not have the time to grant personal interviews, and it will be effective in preventing the possible lack of participation by the respondents which could occur while using the panel technique or personal interviews as admitted in (Lewis, 2009) Furthermore, the questionnaire is also suitable for this study as some area being covered might not possess sound telephone network coverage to make use of the telephone interview. Nevertheless, Smith, (2011) stated that the aim of using the questionnaire as a research instrument could be defeated if the level of literacy of the area or respondents surveyed is low. This study overcame this by simplifying the questions in the questionnaire so that it would not be difficult for the respondents to understand, and a reminder visit was also paid to remind respondents to fill the questionnaires so it could be returned in time for the data analysis.Method of Data AnalysisFor this study, the data was analysed making use of the SPSS (Statistical Package for Social Sciences) statistical software in form of descriptive statistics to analyse the quantitative data showing statistical tables such as frequencies which occurred in the responses gathered from the 3 categories of respondents in this study. The first question concerning the respondents’ satisfaction on the extent to which their bank utilise relationship banking while discharging their duties had a four-point rating scale such as: Very Satisfied (VS) Satisfied (S) Neutral (N) Dissatisfied (D) and Very Dissatisfied (VD). In the second question regarding the importance and impact of relationship banking on the banking industry, through the use of a questionnaire in order to find out about their opinions or attitudes towards ‘the use of relationship banking as an effective tool towards enhancing performance level in commercial banks in the Nigerian banking industry’, using 3 selected commercial bank branches each in Port Harcourt, Rivers State, Nigeria is below.

4. Results

- Question 1: (Bank Customers). How would you rate your satisfaction of the bank utilising relationship banking while discharging its duties?

|

|

5. Discussion of Findings

- The findings from research question one which sought to know how the respondents rated their satisfaction of how their bank utilised relationship banking while discharging its duties in each item from 1-8 of the questionnaire is discussed in relation to the views cited in the literature.Item 1 was based on the respondents’ view in terms of banks granting customers speed in service quality. In relation to the findings, it was observed that while more than half of the respondents were very satisfied, yet another considerable number of respondents were satisfied with the way their banks were utilising relationship banking in the aspect of granting them speed in service quality while discharging its duties. This means that the three Nigerian commercial banks were making most use of forming and retaining a relationship with its customers to grant a very high number of them speed in carrying out their transactions that will cause customer satisfaction. This finding agrees with Agbo (2018) who found that commercial banks that practice relationship banking can utilise it to the extent of showing considerable speed in attending to customers’ transactions while discharging its duties as this gives the customers a type of satisfaction that will make them keep patronising the banks. Onaolapo, Salami and Oyedokun (2011) on the other hand also confirmed that customers are satisfied with commercial banks that use relationship banking to attend to their transactions quickly which helps in saving the time of the customers so they could meet up with other important engagements.However, the findings also showed that only a very small number of respondents were dissatisfied, which means that this number of customers felt that the banks were not utilising relationship banking enough to grant them speed with their transactions. Nevertheless, the main highlights of the findings indicated how commercial banks utilised relationship banking in the aspect of granting customers speed in service quality, is able to cause very large number of customers maximum satisfaction which can be beneficial to the banks, as Almarzoqi (2015) maintained that it could give such banks a competitive edge over other competitors which will be very effective in increasing their performance level.In terms of solving customers’ transaction problems and granting them maximum satisfaction as seen in item 2, the findings also showed that while more than half of the respondents were very satisfied, a good number of respondents were also satisfied on the extent to which their banks were utilising relationship banking in the aspect of solving their transaction problems and granting them maximum satisfaction. This showed that in utilising relationship banking, the Nigerian commercial banks were able to identify the problems faced by a very high percentage of their customers which has helped them in solving their transaction problems, thereby granting the customers maximum satisfaction. This is in accordance with the opinion of Akroush (2010), in which he stated that a bank could utilise relationship banking to identify the specific problems that arises with the customers while banking and this makes it easier for the banks to solve those problems. Ayem and Essah (2023) also admitted that commercial banks that practiced relationship banking, could be able to utilise it to the extent of ensuring that the problems encountered by customers in their banking transactions were duly solved, which caused them maximum satisfaction and enabled such banks gain the trust of their customers better than other banks that were not in the practice of relationship banking. Meanwhile, Sani (2022) argued that being able to effectively solve the transaction problems of customers and granting them maximum satisfaction could help prevent them from switching over to other banks.The rest of the findings also indicated that a very small number of respondents were neutral, dissatisfied and very dissatisfied which showed that though this was a small number, to some, the banks had not effectively utilised relationship banking to solve their transaction problems or granted them utmost satisfaction, while others were undecided in acknowledging if their banks had done so. In view of this, Sani (2021) noted that this could happen when the banks used the transaction method in carrying out its banking activities with the customers, which did not start or retain a relationship with them other than just performing their transactions, thus, made it impossible for the banks to solve customers’ transaction problems and grant them maximum satisfaction. In all, the banks had utilised relationship banking to an extent that it had been able to solve the transaction problems of a very large number of their customers and had granted them utmost satisfaction.In the aspect of granting financial aid services at reduced price (item 3), the findings showed that while a very small number of respondents were very satisfied, half of the respondents were satisfied on the extent to which their banks utilised relationship banking in granting financial aid services at reduced price. This means that most of the customers had benefitted from this aspect in course of being in a relationship with the Nigerian commercial banks. This is supported by Iwalewa (2021) in the literature that the use of relationship marketing by banks practicing it gives the customers who remain in relationship with them, the ability to receive financial aid at a reduced price and satisfaction more than new customers who just started the banking relationship. Similarly, Lan (2015) viewed that this assisted most customers having a relationship with their banks with the ability to fund their businesses without having to go through the rigours of trying to convince another bank to provide financial aid, yet alone do so at a reduced price. In Dimitriadis (2011, p. 295) as cited in the literature, this is considered as one of the “relational benefits” of customers staying in a relationship with their banks. Nevertheless, the other smaller number of respondents who were neutral and dissatisfied with this aspect in their banks could have been as a result of just starting the relationship with the banks and so might not be afforded this same opportunity as older customers (Dimitriadis, 2011).Item 4 finding on extending a hand of warm friendship to customers and retaining that kind of friendship with them, indicated that almost half of the respondents were very satisfied and yet another considerable number of respondents were satisfied on the extent to which their banks were extending a hand of warm friendship to customers and retaining that kind of friendship with them. This implies that the Nigerian commercial banks have showed friendship and bonded with a very large number of their customers in course of practicing relationship banking while discharging their duties. In relation to this, Eads (2023) viewed in the literature that customers cherish banking relationships which makes them feel a sense of belonging, emphasising that customer service skills engender friendship. However, it was also noted by Dong and Guo (2011) that while commercial banks may be utilising relationship banking to extend friendship with customers and retaining it with them, the banks should be careful not to be overtly friendly with customers so they could effectively perform the job of monitoring credit facilities such as loans given to them. Nevertheless, the smaller number of respondents the findings indicated was neutral and dissatisfied about this aspect in their banks and meant that the Nigerian commercial banks had not been totally successful in extending a hand of warm friendship to this group of respondents and retaining it with them in course of discharging their duties. This may probably have been due to some customers’ preference for entering multiple banking relationships to just staying with a particular bank as the latter may not like to rely on just one bank for their banking transactions. In item 5, the respondents’ views in respect of the banks taking pains to find out specific needs of customers was analysed and it showed that majority of the respondents were satisfied with the banks. Specifically, it found that more than half of the respondents were very satisfied and a good number of them were also satisfied on the extent to which their banks were utilising relationship banking to take pains to find out specific needs of customers. This relates to the earlier findings in which shows the extent on which the commercial banks were utilising relationship banking to solve customers’ transaction problems and grant them maximum satisfaction. This therefore, demonstrates the ability of the Nigerian commercial banks to be able to utilise being in relationship with their customers to show dedication in identifying their needs which will enable the banks fulfil them. To this end, it showed that the banks used this means to earn the trust of their customers. In confirmation of this finding, Akroush (2010) maintained that the banks using relationship banking in the aspect of identifying the needs of the customers, makes it easier to satisfy them and this will prevent the customers from moving over to other banks. This finding corroborates that of Manyanga (2022) who reported that customers were satisfied with their needs being met, and this has increased their loyalty to the banks. In the same vein, Qadeer (2014) study found that quality service delivery by the banks lead to customer satisfaction.Meanwhile, the other smaller number of respondents that were neutral and dissatisfied with their banks on this issue may have been that the Nigerian commercial banks had not effectively utilised relationship banking to take pains to find out the specific needs of this group of customers. This may probably be as a result of the banks using the “transaction method” to attend to these customers which leaves no room for any closeness or bonding between the customers and the banks beyond the latter just performing the former’s transactions while banking, thus, the ability to identify the specific needs of the customers and fulfilling them becomes difficult.In terms of showing appreciation for customers’ patronage in item 6, the findings showed that quite a sizable number of respondents were very satisfied, while yet another sizable number of respondents were satisfied. This means that the Nigerian commercial banks had utilised relationship banking in the aspect of showing appreciation for customers’ patronage to a very large group of customers while discharging their duties. This agrees with Akani (2023) that relationship brand recognition results into customer patronage in deposit money banks in Port Harcourt, Nigeria. In Dimitriadis (2011) it was stated that these rewards could be in form of financial reductions. On the other hand, the rewards could also be in form of mutual friendship that the customers derive in the relationship while banking. Mosa (2022) stated that the rewards could also be given to customers in form of decreased stress while they undertake a banking transaction. The findings also indicated that the Nigerian commercial banks had not shown appreciation to some other group of respondents who were neutral and dissatisfied with their banks on this aspect and in view of this, Dimitriadis (2011) opined in the literature that this may have been due to the length of time these group of customers had been in relationship with the banks and as such customers who have been in a banking relationship for a long time, will be shown more appreciation for their patronage than those who have only been in it for a shorter period of time.In item 7, the findings indicated that a large number of respondents were very satisfied and even a larger number of them were satisfied on the extent to which their banks utilised relationship banking in the aspect of displaying new products and services that will cause decreased stress to customers and obtaining feedback on them. Therefore, this implies that a very high number of customers were happy with the way the Nigerian commercial banks were utilising relationship banking in this aspect. In relation to the literature, Olotu, Maclayton and Opara (2010) posited that utilising relationship banking to display new products and services afforded the customers in relationship with them the opportunity to make use of a wide range of products and services while banking to cause decreased stress.The rest of the findings however indicated that a very small of respondents did not feel the same way as the other higher number of respondents did. This implied that the Nigerian commercial banks had not successfully utilised relationship banking on this aspect to these respondents and it may be that the banks were unable to fulfil the needs of these group of customers if this aspect was not taken into consideration and this could affect their relationship with them.Lastly, in terms of safeguarding the interests and investments of customers in the bank, the findings in item 8 showed that a very high number of respondents were both very satisfied and satisfied on the extent to which their banks were utilising relationship banking to safeguard the interests and investments of customers in the bank. This implied that the Nigerian commercial banks were utilising relationship banking to protect the customers’ interests and investments in the bank and a very high number of them felt very confident about it. In view of this, Pratt et al. (2011) Olotu, Maclayton and Opara (2010), and Mosa (2022), opined that customers were drawn to remaining in a banking relationship that is able to protect its investments such as deposits in the bank. Similarly, Asikhia (2010) viewed that this aspect of relationship banking carried out by commercial banks helps to instil trust in the customers of the relationship. Meanwhile, a smaller percentage of respondents felt that the Nigerian commercial banks had not been effective in this area.In research question two, the study examined the importance and impact of relationship banking on the banking industry as a financial service provider; and on the customer using statements from item 9-17. In terms of improved image of your bank, the findings in item 9 indicated that a very high number of respondents rated high improved image of their banks as an importance and impact of relationship banking to the banking industry as a financial service provider. It means that the Nigerian commercial banks as part of the banking industry derived an improved image which occurred as a result of relationship banking. This agrees with the views of Maiyaki (2010), that relationship banking helped to improve the image of banks as they were able to bond with customers better, which according to Asikhia (2010) increased the ability of banks to provide better products that will enhance their service quality.The findings in respect to item 10 on increase in profits of your bank showed that all the respondents were in support that their banks as a result of practicing relationship banking have had noticeable increase in profits by rating its impact and importance high and medium which is good for the banking industry as a financial service provider. This implied that the Nigerian commercial banks were also getting an increase in profits due to relationship banking. In view of this finding, Dong and Guo (2011) argued that an increase in profits of a bank practicing relationship banking could arise when such bank’s profitable customers bring in numerous business opportunities that the banks can gain from. Boot (2011) and Yuan (2022) also viewed that relationship banking brings an increase to profits of a bank when it is able to attract more depositors and investors into the banks, thus, the banking industry can engage in more lending which is capable of increasing its profits as a financial service provider.In item 11 with respect to enhanced loyalty and commitment from customers, the findings showed that all the respondents felt that relationship banking had given their banks enhanced loyalty and commitment from customers by rating its importance and impact high and medium. Therefore, the Nigerian commercial banks were receiving an increase in loyalty and commitment from customers as a result of relationship banking. This is in consonance with Mosa (2022) in the literature that commercial banks practicing relationship banking were able to get more customers to stay loyal and committed to them; and this was also confirmed in the study conducted by Koech (2019), which showed that relationship quality, commitment, communication and conflict handling had an influence on customer loyalty.However, Boot (2011) in similarity to the comments from the bank staffs and marketing heads in the questionnaire, viewed that sometimes getting customers to stay loyal and committed to a particular bank in a relationship could be difficult in situations where these customers prefer to be in more than one bank relationship.In view of item 12, concerning comparative advantage over other competitors, the finding showed that most respondents rated high and the rest medium comparative advantage over other competitors as an importance and impact of relationship banking to their banks. It goes to show that the Nigerian commercial banks were deriving comparative advantage over other competitors as a result of relationship banking. In similarity to the findings, Meslier (2020) provided evidence on the impact of local banking market structure on SME’s access to credit. Furthermore, another study conducted by Meslier (2022) and Berger (2016) on renewed debate on the comparative advantage of local banks in providing relationship banking reported its importance in alleviating financial constraints; and that banks derived this type of advantage when they have more of their existing customers as well as the new customers remaining loyal to them. These studies have also noted that through relationship banking, banks were able to improve on their service quality and provide better products and services that could enable them receive a comparative advantage and this could boost the advantage the banking industry has as a financial service provider.In terms of improved service quality as well as delivery; and new business opportunities brought by customers that could give enhanced growth, item 13 and 14, the findings from both questions showed that all the respondents felt that among the importance and impacts relationship banking has had on their banks, was an improved service quality as well as delivery and; new business opportunities brought by customers that could give enhanced growth. Both questions had most of the respondents rating high and only a very small number of them rated medium. This implied that the Nigerian commercial banks derived an improved service quality as well as delivery and; new business opportunities brought by customers that could give enhanced growth as a result of relationship banking. This is related to previous findings and supported by Olotu, Maclayton and Opara (2010); Dimitriadis (2011) and Ivashina and Kovner (2011) stressing that relationship banking enabled the banks to better fulfil the needs of the customers through these means.On the negative impacts with regards to item 15 which is loss of investments /loans issued by their banks to customers who had suddenly gone bankrupt and; 16.) unwillingness of customers to pay back loans”, both findings are related and respondents rated the importance and negative impacts of loss of investments /loans issued by their banks to customers who have suddenly gone bankrupt and; unwillingness of customers to pay back loans as high and medium on their banks as a financial service provider, it means that the Nigerian banks at one point or the other suffered from these negative aspects of relationship banking. This was supported by Shabir (2023) in which he admitted that relationship banking had also had a negative effect on banks due to loss of investments/loans issued to customers who have suddenly gone bankrupt and; their unwillingness to pay back the loans. He further observed that due to the effects of the covid- 19 outbreak, the banks suffered low performance and instability. Sometimes, the banks only recover very little or nothing from their customers; and United Nations (2020), observed that on the negative side, the most worrying challenges experienced was poor appropriability, high taxes and poor property, among others. These situations could even lead to eventual bankruptcy of the banks as they may no longer be able to meet their financial commitments or continue to function as a financial service provider.Lastly, in view of over-familiarity of their bank with customers resulting to ineffectiveness in monitoring loans given to customers, item 17, the finding showed that most of the respondents rated this negative impact high and medium meaning that the Nigerian commercial banks also suffered from this as a result of relationship banking. In relation to this, Dong and Guo (2011) posited that commercial banks could show friendliness and familiarity with their customers but at the same time, there should be a limit drawn in which they would not be too familiar in order to be able to monitor the loans effectively.

6. Conclusions

- The study comprised two research questions, the first sought to find out how commercial banks utilised relationship banking in the course of discharging its duties. The second research question was to find out the importance and impact of relationship banking on the banking industry as a financial service provider, and on the customer. The descriptive survey technique was used, and a non-probability sampling technique was adopted for the study. In the first stage, three commercial banks, namely Zenith Bank, Ecobank and UBA PLC were selected in Port Harcourt, Rivers State in Nigeria. The study selected the sample comprising bank staff, managers and customers. In the second stage, the perceptions of the three sub-groups were analysed using descriptive statistics.The results of the research questions analysed has produced important facts centred on the study’s research objectives. The first research objective evaluated how commercial banks utilised relationship banking in course of discharging its duties. The fact gathered in relation to this research question showed that the surveyed commercial banks had utilised relationship banking to a very large extent and caused maximum satisfaction in the aspect of granting customers speed in service quality, solving customers’ transaction problems, granting financial aid/services at reduced price, extending a hand of warm friendship to customers and retaining it with them, taking pains to find out specific needs of customers, showing appreciation for customers patronage and displaying new products/services that will cause decreased stress to customers and obtaining feedback on them. Although, it particularly noted that the Nigerian commercial banks needed to put more effort in granting financial aid/services at reduced price, showing appreciation for customers’ patronage and displaying new products/services that will cause decreased stress to customers and obtaining feedback on them, the banks have done well overall based on the assessment of the different categories of respondents.All the facts gathered in the survey had assessed how commercial banks utilised relationship banking in course of discharging its duties. Therefore, the first research question was upheld. The second research question examined the importance and impact of relationship banking on the banking industry as a financial service provider; and on the customer. The facts gathered from the survey of the Nigerian commercial banks showed that relationship banking had great importance and positive impacts on the banking industry as a financial service provider in the aspect of receiving improved bank image, increase in profits of bank, enhanced loyalty and commitment from customers, comparative advantage over other competitors, improved service quality as well as delivery and new opportunities brought by customers that could give enhanced growth. On the contrary, it was found that not all business opportunities that were brought, were accepted by banks as it may not be genuine or viable. Also, the facts gathered showed that relationship banking has had high negative impacts on the banking industry as a financial service provider in the aspect of losing investments/loans issued to customers who suddenly became bankrupt, unwillingness of customers to pay back loans as well as over-familiarity of banks with customers that had resulted to their inability to effectively monitor loans that have been given out.The challenges posed by this study were the fact that before the questionnaire forms were distributed, some bank customers were already agitated as observed by the researcher. This makes it expedient for the banks to institute a monitoring team that should supervise the services of the bank staffs towards their customers for a continuous cordial relationship between them and their customers. This will enhance their performance and profit greatly due to increase in their customer patronage.In summary, some limitations were observed in the course of the research especially among the customers. Most of them may have responded to the questionnaire out of their subjective feelings depending on how satisfied/dissatisfied they were with their transactions on the day the questionnaire was administered to them. In view of the bank staff and managers, there was also the possibility that they may have responded to the questionnaire items to suit their purpose in order to earn credit for themselves. Moreover, this study was done on a small scale, which means that the outcome may probably have been different if a larger sample was involved in the study.

7. Recommendations

- Based on the findings of this study, the following recommendations were made:1. It is very important for commercial banks in Nigeria through their bank staffs and marketing heads, to continue in this stride by making more improvements so their performance levels can be increased in their services and relationship with their customers. In this regard, the banks should develop other forms of personalised services to ensure customers’ satisfaction, one of which could be paying prompt attention to the needs of a few who were neutral or unsatisfied with the banks’ services. This means that the commercial banks should employ workers who are relationship-driven, so that they can offer financial advice to their customers.2. As a result of the negative effects suffered by the banks, the banking industry should be cautious in investing in certain businesses and should do so with the help of professionals in those businesses that could help monitor the banks’ investments efficiently. Also, the banking industry should ensure it has sufficient information on customers in order to know if they will be able to pay back if loans are issued out to them. The bank customers should communicate their concerns and be able to entrust their investments to the bank staffs and marketing heads. This means that there should be a feedback process between the banks and their customers. For example, customer rating of the quality of services provided by the banks should be done using a well-developed instrument such as a questionnaire sent to their customers every quarter rather than requesting customers to do on the spot rating which may not be a true reflection of the customers’ opinion about the quality of services rendered to them.

Affirmation

- I hereby affirm that this manuscript has not been published previously in any form, nor is it under consideration in another journal outlet. I also affirm that it does not contain anything indecent or libellous.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML