Aubrey Chilambwe1, Simon Tembo2

1Graduate School of Business, University of Zambia, Lusaka, Zambia

2School of Engineering, University of Zambia, Lusaka, Zambia

Correspondence to: Aubrey Chilambwe, Graduate School of Business, University of Zambia, Lusaka, Zambia.

| Email: |  |

Copyright © 2023 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

The study aimed at empirically investigating the effectiveness of revenue collection strategies employed by the LCC. The study used primary data which was obtained by means of individual questionnaires and in-depth interviews. The data was collected from Payers and the LCC employees. Using the Survey Monk formula, the sample size was 385 individuals comprising council workers and residents in the study area. The study employed purposive sampling method in selecting the sample. The study found that online systems and bank transfers were the main strategies used by LCC to collect revenue. The findings had shown that there was belief among the interviewees that the revenue collection strategies were appropriate. The findings established that the extent of revenue collection strategies was poor and emphasised that strengthening the legal framework, constant sensitisation and opening up more collections points was what they envisaged in revenue collection going forward so as allow them collect revenue more effectively like ZRA. It was worth to note that the results mainly shown that the interviewees stated that the manner or method of assessing revenue collection was not effective at all and that the LCC mainly assessed the existing revenue collection strategy through the use of open meeting (Department or Sections). The results of the study clearly showed that LCC is not effective in its collection of revenue and as such there is need for the council to develop more strategies that can enhance revenue collection in its Jurisdiction. Being one of the oldest councils, the LCC should be a model in collecting revenue so as to sustain its operational expenses without depending heavily on central government for financial aid. Other findings of the study had shown that LCC was largely dependent on the legislative framework, measures and remedies in revenue collection. It was, however, noted that the legislative framework, measures and remedies were not sufficient in enhancing revenue collection. In addition, the study found that the respondents mainly disagreed understanding the use of the revenue collection by LCC and they did not think revenue collection by LCC was necessary. The study strongly recommended that the legal framework supporting revenue collection needed to be harmonised or reviewed to allow the Local Authority to exercise its full potential. The study also highlighted that LCC computerises all its revenues sources in order to minimise corruption in revenue collection and accounting. Lastly, the study recommended that to boast the willingness of the Peri-urbans residents in paying for all applicable fees, levies, permits and charges there must be equity in service provision and not only prioritising the urban areas.

Keywords:

Revenue Collection Strategies, Effectiveness, Lusaka City Council, Zambia

Cite this paper: Aubrey Chilambwe, Simon Tembo, The Effectiveness of Revenue Collection Strategies Used by Local Authorities in Zambia: The Case of Lusaka City Council, Management, Vol. 13 No. 1, 2023, pp. 21-31. doi: 10.5923/j.mm.20231301.03.

1. Introduction

Local Governance is a broader concept and is defined as the formulation and implementation of collective action at the local level (Boadway and Shah 2009). Governance is made up of the political and institutional processes through which decisions are taken and implemented. Governance is most effective when these processes are participatory, accountable, transparent, efficient, inclusive, and respect the rule of law. A sound revenue system for local authorities is an essential pre-condition for the success of fiscal decentralisation (Olowu & Wunsch 2003). Despite the many comprehensive Central Government tax reforms during the last decade, local authorities revenue systems in sub-Saharan Africa have remained largely unchanged. Generally, a fundamental requirement when redesigning local revenue systems is greater emphasis on the cost-effectiveness of revenue collection, taking into account not only the direct costs of revenue administration, but also the overall costs to the economy, including the compliance costs to taxpayers.

1.1. Problem Statement

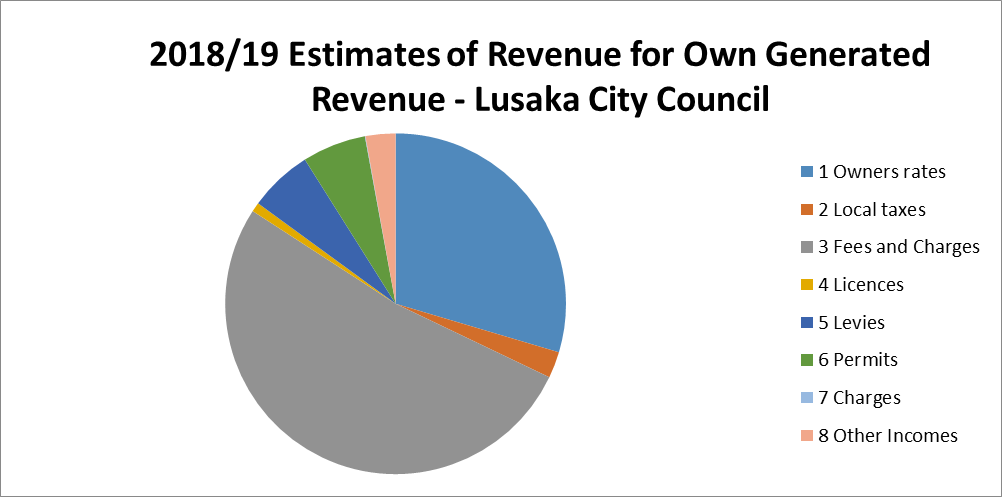

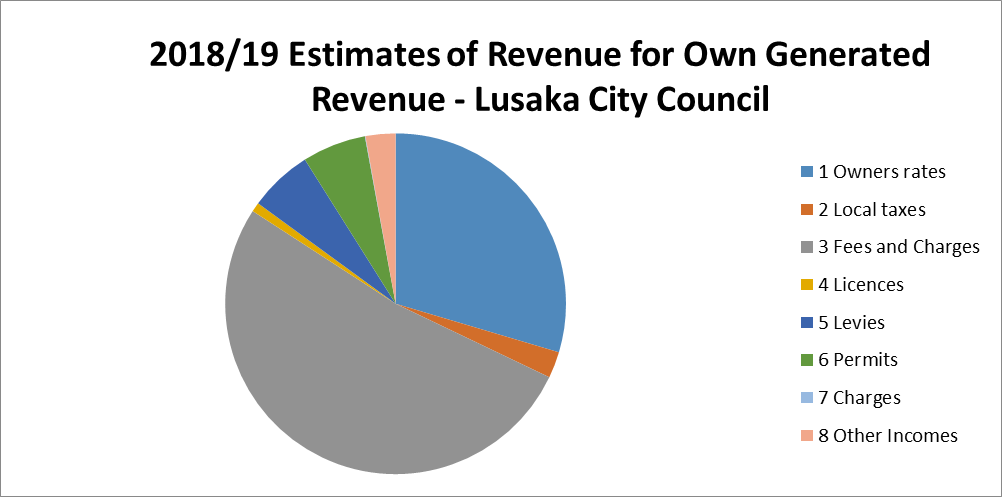

The failure by most local authorities to utilise their potential at the optimum level has resulted in their failure to provide the much needed services to the citizens within their jurisdictions. Being a capital city of Zambia, LCC was expected to be an example of how local authorities should utilise their full potential but the opposite is the current scenario. Using the records maintained at the Lusaka City Council for the financial years ended 31st December 2018 and 2019, the Lusaka City Council budgeted to receive grants from the Ministry of Local Government and to generate funds from various sources in amounts totaling K851,250,595 against which amounts totalling K521,651,066 were received and generated resulting in a negative variance of K329,599,529 as set out below in table 1.1. | Figure 1.1. 2018/19 Estimates of Revenue for Own Generated Revenue – Lusaka City Council |

The potential to generate more own source revenue is very clear as evidenced by the budget estimates presented above. Using the information in a pie chart, it is also evident that there is a dire need for the City Council to relook at strategies to enhance their revenue collection especially on Charges, Local Taxes, Licenses and Other Incomes where very little amounts were being collected. The other worrying sign is on the debt stock. As at 31st December 2019, the City Council owed the Zambia Revenue Authority (ZRA), National Pension Scheme Authority (NAPSA), Local Authority Superannuation Fund (LASF) and Workers Compensation Fund Control Board (WCFCB) amounts totalling K912,769,625 in respect of tax and pension contributions. In addition during this same period, the City Council owed former and existing employees amounts totalling K54,889,742 in respect of terminal benefits, long service bonus and gratuity some of which had been outstanding from as far back as 2017.In terms of expenditure, using the year 2019 as an example, the statement of receipts and expenditure and its corresponding graph above indicates that despite collecting an amount of K272,550,760, an amount of K273, 554,700 was spent resulting in an adverse variance of K1,003,940. The failure to raise these revenues could arise from lack of political will, non-compliance, conflicting pieces of legislation, to mention but a few. Despite being one of the oldest local authority in Zambia, there is little to no understanding of how effective the Lusaka City Council was employing its strategies on revenue collection.

2. Literature Review

An article written by Resultist Consulting (2021) suggests that the proper revenue strategy aligns revenue collection, and client experience teams around a singular goal: good or optimum service provision and enhanced revenue collection could be achieved. Without a strategic roadmap, healthy and sustained growth simply cannot flourish, which is why organisations put so much emphasis on the planning process. The right strategy would ensure you achieve your revenue and profit goals. It would be a foundation for selecting and developing the right team, the right software and tools, developing effective processes, remarkable products and services. Khan et al. (2011) conducted a diagnostic on tax gadget restructuring as a vital determinant of nations’ revenue collection and found out that restructuring the tax gadget at the federal level is critical to enhancing economic reforms of an economy. Moreover, direct tax reforms at the federal level provides key element of vast reforms in terms of economic development not only in developed economies but in also developing economies as well. Panday, (2006) asserts that in economies like India, the tax reforms are geared towards correcting the monetary imbalances that has existed for several decades because of the ever-increasing Value Added Tax (VAT). A study by Gidisu, (2012) brought forward major insights in Turkey on the relevance and usefulness of automated tax collection systems both in operations and management of municipalities in turkey. Among the key elements of automation tax collection systems are costs savings and efficiency of the tax collection process. This is because since the adoption of the system, the turkey counties managed to save approximately $23.1 million. This was because the system led to a reduction in the number of workers while at the same time enhancing the effectiveness of the workforce. On the other hand, the system played a critical role in effective management in a limited timeframe and therefore saved a lot of time that would otherwise be spent using manual system. The system also provided a great opportunity for prompt payment of taxes and therefore the situation in Turkey provides evidence that the adoption of automated tax collection system creates a framework that enables all taxpayers to be tracked and therefore increasing revenue collection. Ajaz and Ahmed (2010) points out several challenges faced by developing countries in regards to revenue collection. Among the challenges include corruption on the part of public officers who are mandated with the responsibility of tax collection. Moreover, poor governances also plays an integral part as it affects the quality of the process which eventually leads to low revenue generation. Another challenge faced by developing economies is the issue of political instability that has an adverse effect on the long-term reforms of tax collection processes and therefore leading to low economic growth. A study by Muhaki (2009) on the Factors Influencing Revenue Collection in Local Governments in Uganda established that both endogenous and exogenous factors in the local authorities of Uganda negatively affect the prospects for increased revenue in the local Government. Gyamfi (2014) also did a study on effective revenue mobilisation by districts assemblies in Ghana. The study revealed that data inadequacy, inadequate training and poor enforcement of revenue collection by-laws, policies and regulations inhibits revenue mobilisation. Another study conducted by Cottarelli (2011) on revenue mobilisation in a sample of developing countries with Kenya excluded indicated that governance was a major issue hindering revenue collection effectiveness in developing countries. Hoffman and Gibson (2005) used data from local authorities budgets in Tanzania and Zambia. Their study found that Local Governments in both countries produce more public services as their budget’s share of local taxes increases. Alternatively, revenue that Local Governments receive from sources outside their boundaries such as transfers from the central Government and foreign assistance, increases the share of local budgets consumed by employee benefits and administrative costs. Because there is no variation in the powers of Local Governments in Tanzania and Zambia, the effects of revenue sources on public expenditure that we find are independent of political institutions. The results suggest that fiscal accountability is an important factor to consider when designing policies to enhance local authorities capacity. However, the study did not take into account the strategies that can necessitate effective collection of revenue in local authorities. Therefore, this study seeks to fill this research gap.

3. Theoretical / Conceptual Framework

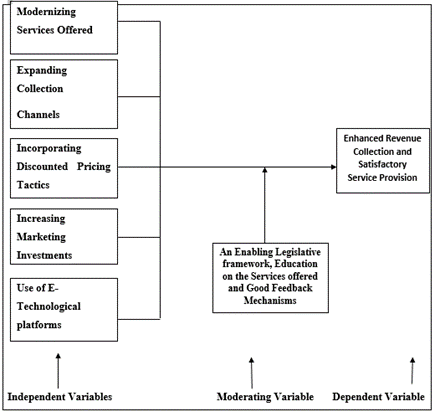

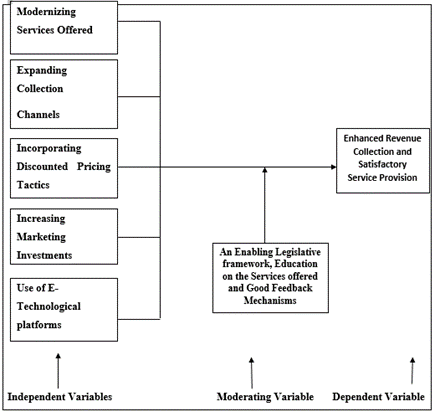

Erika (2003) defines a conceptual framework as a network of interrelationships that is logically developed among variables that are believed to be the fundamental part of the dynamics of the case being investigated. From the empirical studies reviewed the researcher was able to identify the various revenue collection strategies that can be used to enhance revenue collection in the local authorities. Using Figure 3.1, the conceptual framework seeks to explain if the local authorities adopt revenue collection strategies such as modernized Services, Expanded Collection Points, Offering of promos including discounts and other offers, increasing investment and use of e-transactions, good relationship between tax payer and Government, and an enabling legislative environment, this would result in an efficient and effective revenue collection.  | Figure 3.1. Conceptual Framework |

4. Methodology

4.1. Research Appraoch and Design

This study employed a descriptive survey research design which was intended to collect data on occurrences such as opinions, attitudes, feelings, and habits. Orodho (2002) stated that descriptive survey research studies were designed to obtain pertinent and precise information concerning the current status of phenomenon and wherever possible to draw valid general conclusions from the facts obtained. On the other hand, Gay (1992) stated that descriptive survey design was used to investigate educational problems to determine and report things the way they are or were. This study adopted a case study design rooted in mixed methods approaches, which basically seeks to describe a unit in detail, in context and holistically using both qualitative and quantitative research methods (Barbie, 2012). There are five primary research designs for qualitative methodology (Yin, 2013). For purposes of this study, the researcher considered three: ethnography, phenomenology, and case study. Of the three, the researcher used the case study design because, as Yin (2013) stated, it is appropriate for developing recommendations because it involves subjective analysis of participants‘ views. Madu (2016) determined that case study design is ideal for exploring views of participants. Houghton, Casey, Shaw, and Murphy (2013) determined that using case study design is appropriate in context like this because a researcher can make sound conclusions by comparing views of different participants. It specifically enables the researcher to obtain accurate representation of views on the effectiveness of revenue collection by local authorities in Zambia. Credible information can also be collected timeously at a relatively low cost as compared to other research designs.

4.2. Study Area

The study was conducted on Lusaka City of Zambia. The selected local authority involved citizens from Peri-Urban and Urban areas.

4.3. Study Population

The study focused on Lusaka City and was considered due to it being in existence for over 50 years in Zambia. This enabled the researcher to identify the pattern of behavior in revenue collection overtime at the selected local authority.

4.4. Study Sample

A sample size consisted of 30 council employees involved in revenue collection and molilisation who are operating in the targeted area. This will involve staff from the markets, bus stations, fire stations and their finance management team at the main office (Civic Centre). This also included the Director of Finance from the selected local authority. The sample will also include business owners and residents from the target population. Kothari and Garg (2014) indicate that a sample size of 10 percent of a target population is considered large enough so long as it allows for reliable data analysis and allows testing for significance of differences between estimates. Since it is estimated that staff directly collecting revenue were about 450 across the district, the sample size on staff was therefore sufficient. In terms of the catchment by the three selected areas, the total sample size had been computed at 385 using SurveyMonk formular. The areas include Mulungushi (Olympia), and Mutendere Townships.

4.5. Sampling Techniques

The sample was selected using a non-probability sampling method called the 'Purposive sampling method'. Purposive Sampling involves choosing information rich-cases for purposes of helping a researcher conduct an in-depth study in understanding the cases under consideration without the need or desire to generalize to all such cases (McMillan and Schumacher, 2006). This sampling method is applicable for this study as the researcher will conveniently select the respondents for the sample. This was done as the respondents were readily available at the selected local authority.

4.6. Data Collection Instruments

The instruments which was used in collecting primary data included questionnaires and in-depth interview guides. The questionnaire provided both the qualitative and quantitative data that was needed to study the effectiveness of revenue collection strategies by the selected local authorities while the in-depth interview will further provide a detailed insight into qualitative information that provided the in-depth information of the problem. The research also used direct observation from the interactions of the researcher and the participants.

4.7. Data Collection Procedure

Data was collected through primary sources by means of individual questionnaires and in-depth interviews. The questionnaires were answered by respondents from the selected local council. In-depth interviews was answered by the Director of Finance from the Head Office and other key revenue collectors while secondary data was used to gain an in depth understanding and critique the collection of revenue by the selected local councils.

4.8. Data Analysis

For quantitative data, the questionnaire was coded and the codes entered into SPSS software for data analysis of the variables by use of graphs and pie charts for this study. In qualitative analysis, a narrative analysis approach was used. In-depth interviews were used to get a deeper insight and sub-categories formed with the aim of obtaining the final themes.

5. Results and Discussion

5.1. Background Characteristics

5.1.1. Gender

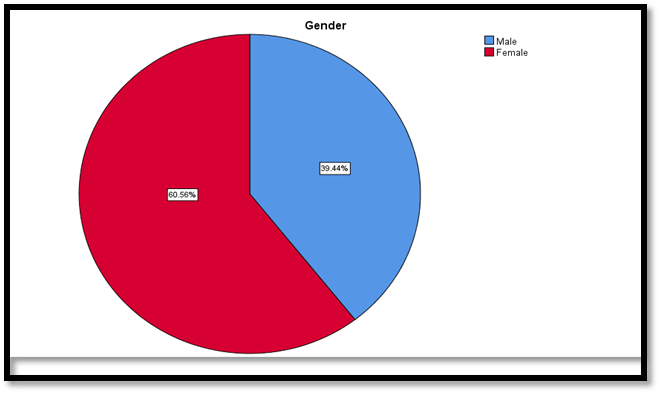

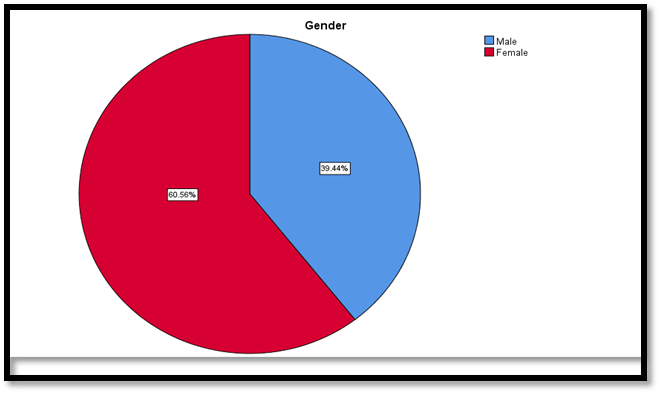

Figure 1 shows that the majority of the study respondents were Female, constituting 60.56% of the sample size, 39.44% of the study respondents were Male.  | Figure 1. Gender |

5.1.2. Age Groups

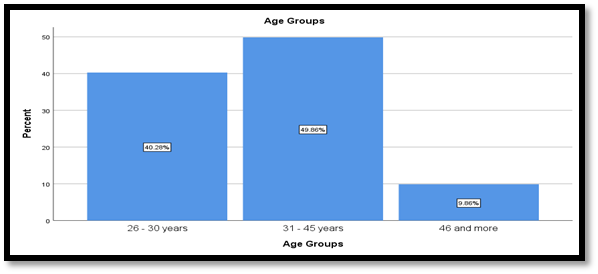

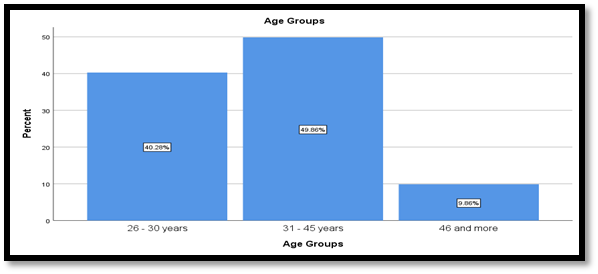

Figure 2 shows that the majority (49.86%) of the study respondents were of the age group 31 – 45 years, 40.28% were 26 – 30 years and 9.86% were 46 and more. | Figure 2. Age Groups |

5.1.3. Marital Status

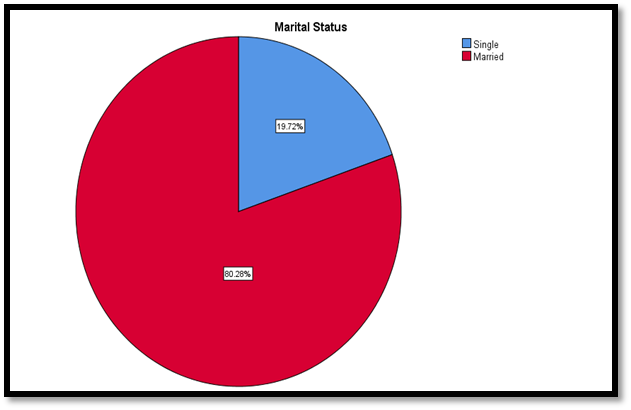

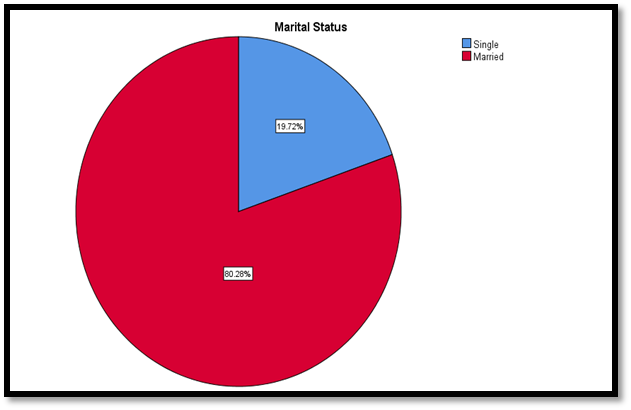

Figure 3 shows that the majority (80.28%) of the study respondents was of Married and 19.72% were single.  | Figure 3. Marital Status |

5.1.4. Education Level

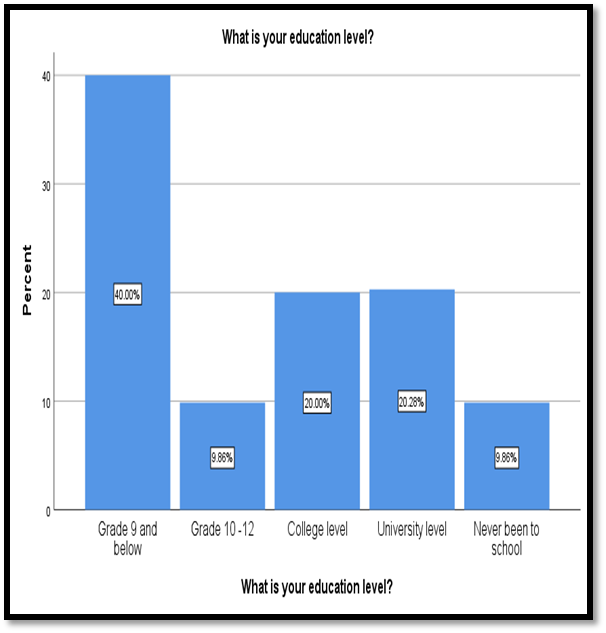

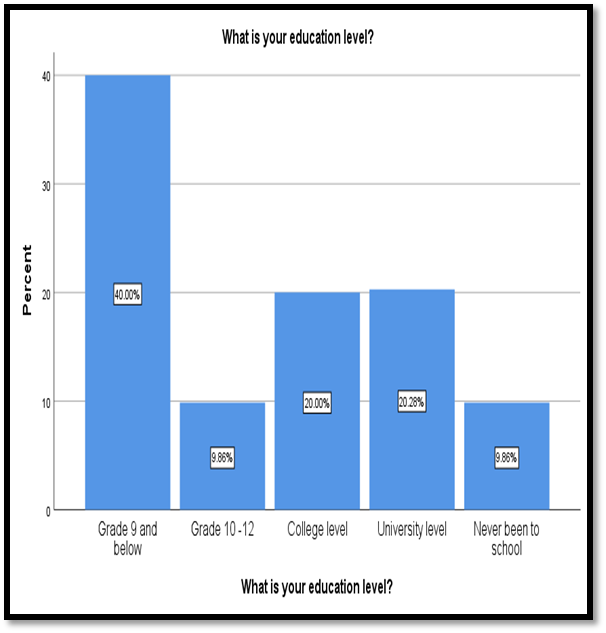

Figure 4 shows that the majority (40.00%) of the study respondents had a grade 9 and below level of education level, 20.28% had a University level, 20.00% had college level, and 9.86% had a grade 10 -12 and never been school respectively.  | Figure 4. Education Level |

5.1.5. Area of Residence

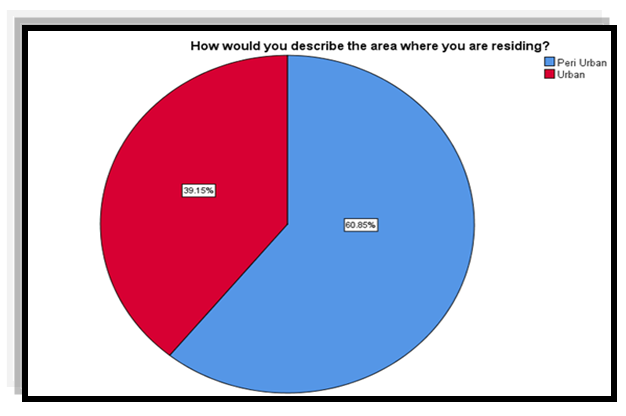

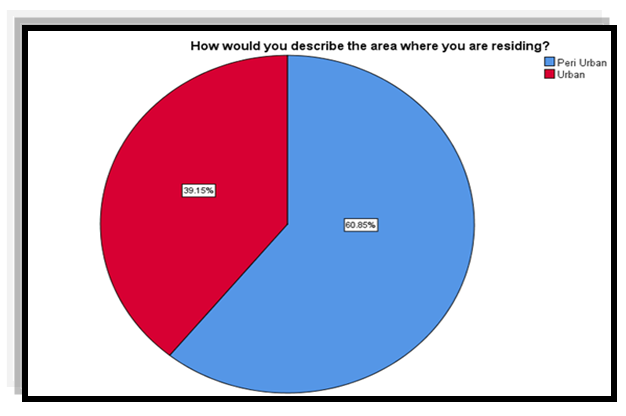

Figure 5 shows that the majority (60.85%) of the study respondents resided in the Peri Urban area and 39.15% resided in the Urban area.  | Figure 5. Area of Residence |

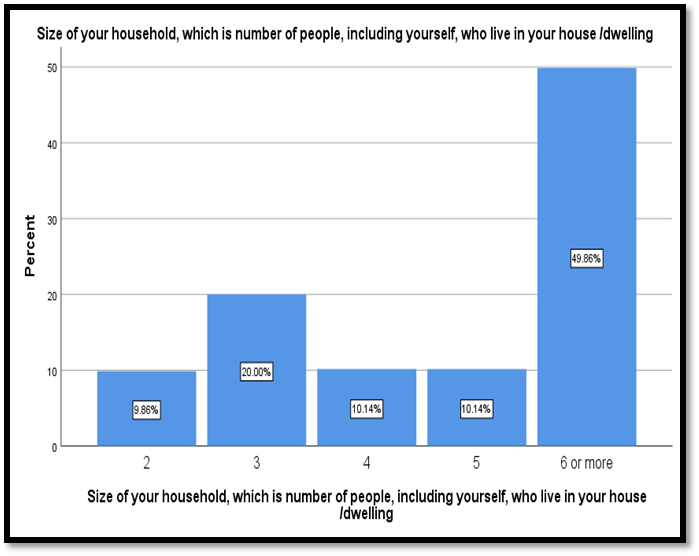

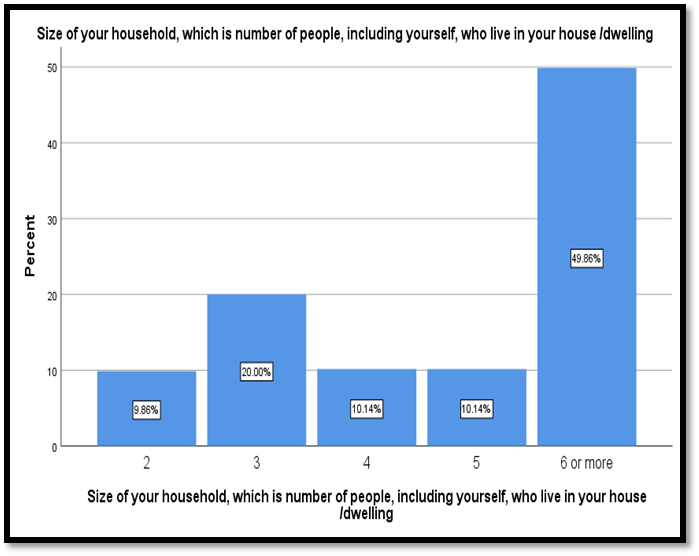

5.1.6. Household Size

Figure 6 shows that the majority (49.86%) of the study respondents had a household size of 6 or more, 20% had 3, 10.14% had 3 and 5 respectively, and 9.86% had 2.  | Figure 6. Household size |

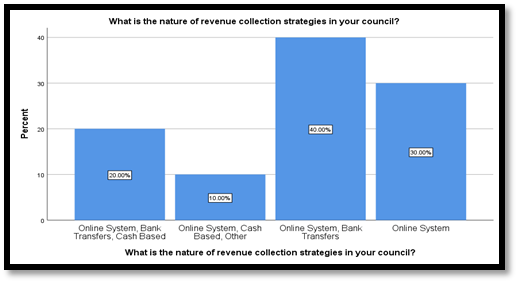

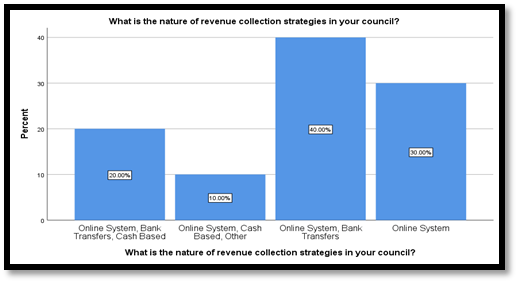

5.2. What are the Strategies Used by the Lusaka City Council in Revenue Collection?

| Figure 7. Nature of revenue collection strategies in your council |

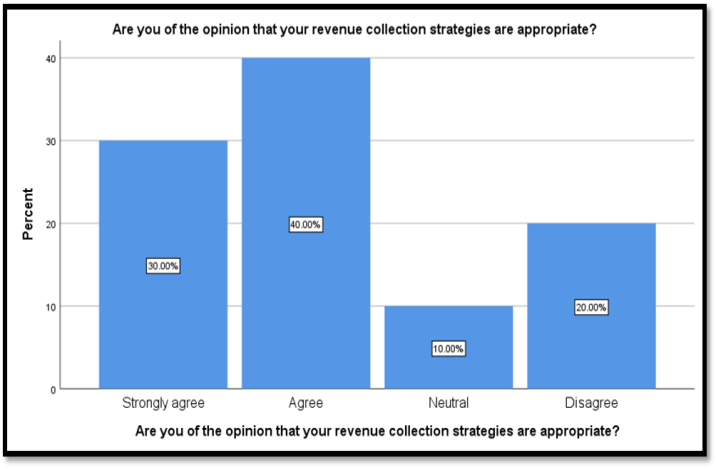

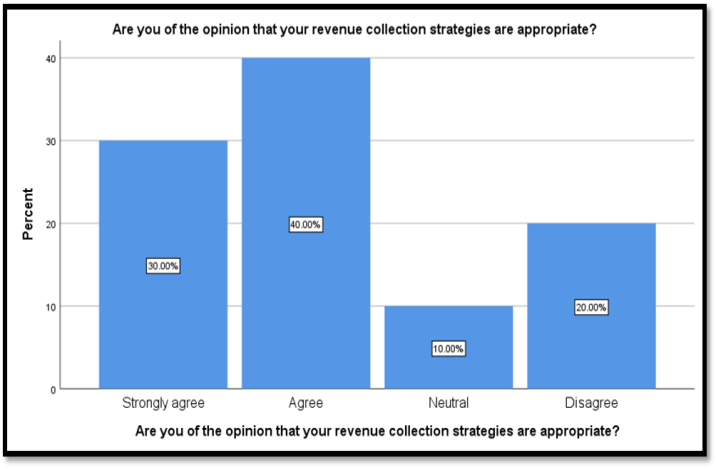

Figure 8 below shows that the majority (40.00%) of the interviewees stated that they agreed that the revenue collection strategies were appropriate, 30% strongly agreed, 20% disagreed and 10% were neutral.  | Figure 8. Opinion about the revenue collection strategies being appropriate |

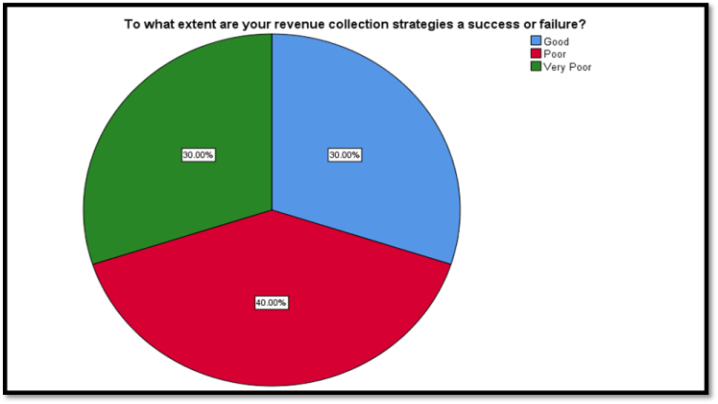

5.3. What are the Successes of the Strategies Used by LCC in Revenue Collection?

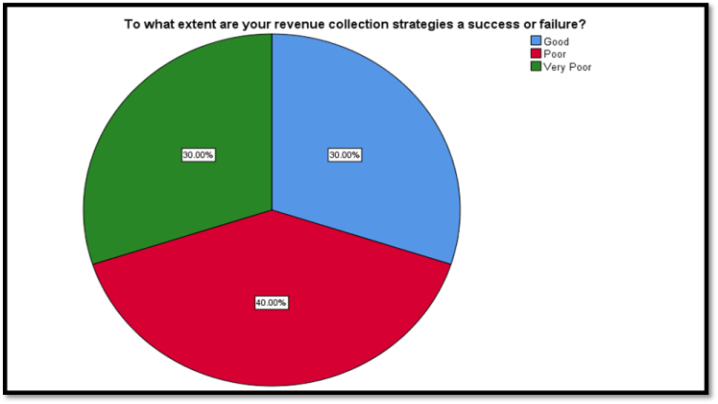

Figure 9 below shows that the majority (40.00%) of the interviewees stated the extent of revenue collection strategies were poor, 30% were very poor, and good respectively. | Figure 9. Extent of the revenue collection strategies |

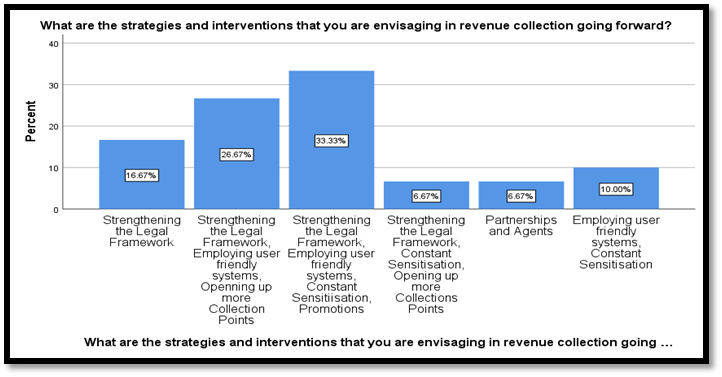

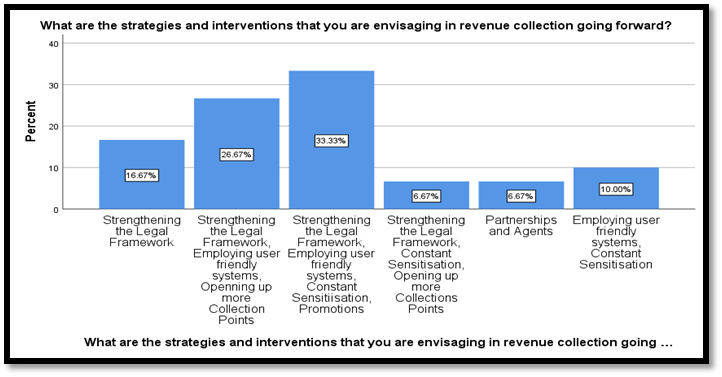

Figure 10 below shows that the majority (33.33%) of the interviewees stated strengthening the legal framework, constant sensitisation, Opening up more collections points was what they envisaged in revenue collection going forward, 26.7% stated that strengthening the Legal Framework, Employing user friendly systems, Opening up more collection points, 16.7% stated strengthening the legal framework, 10.0% employing user friendly systems, constant sensitisation and 6.7% for both Strengthening the legal framework, constant sensitisation, opening up more collection points and Partnerships and Agents. | Figure 10. Envisaging of the revenue collection strategies going forward |

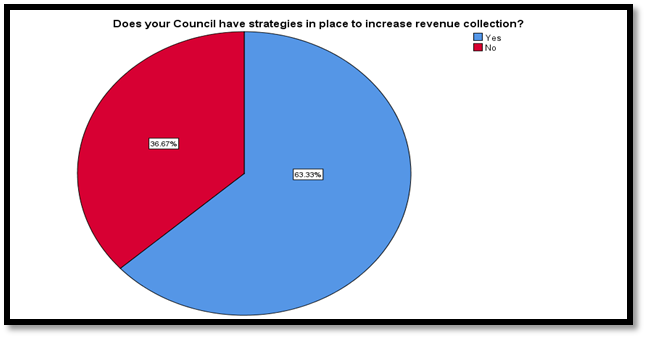

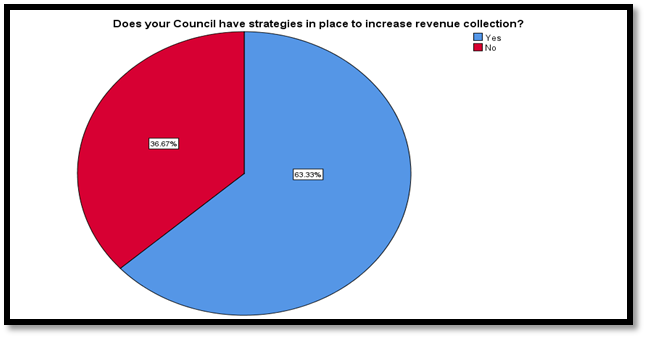

Figure 11 below shows that the majority (63.3%) of the interviewees stated that the council, has strategies in place to increase revenue collection, and 36.67% stated otherwise. | Figure 11. Strategies increasing revenue collection |

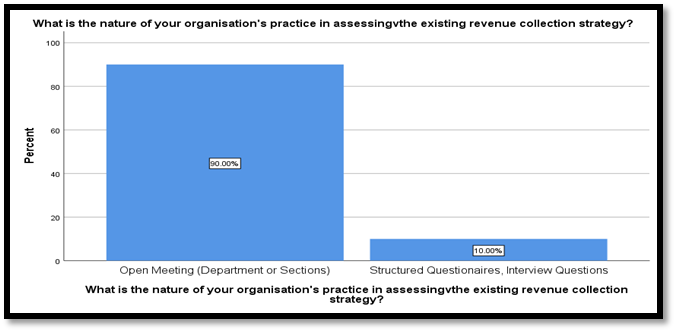

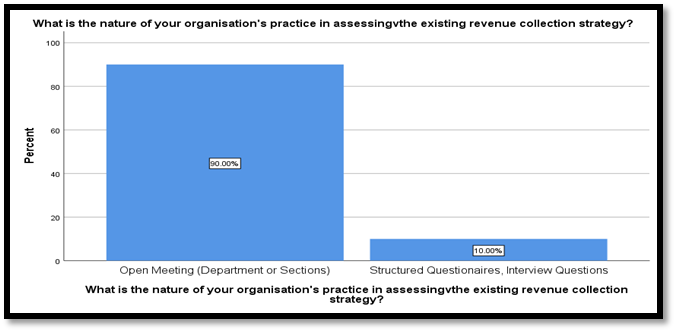

Figure 12 below shows that the majority (90.0%) of the interviewees stated Open Meeting (Department or Sections) was the nature of LCC assessing the existing revenue collection strategy and 10.00% Structured Questionnaires, Interviews. | Figure 12. Nature of your organisation’s practice in assessing the existing revenue collection |

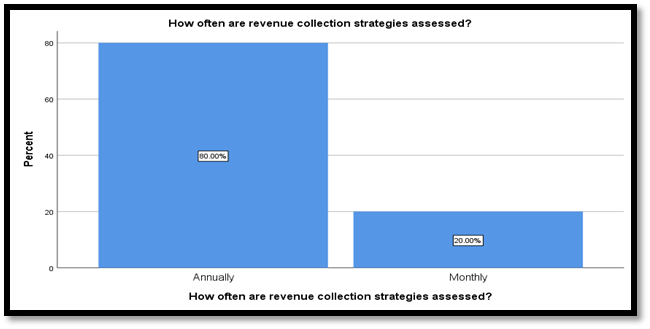

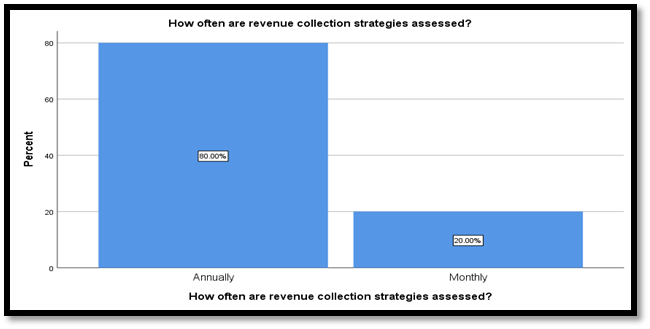

Figure 13 below shows that the majority (80.0%) of the interviewees stated that LLC often assessed the revenue collection strategies assessed Annually and 20.00% monthly. | Figure 13. Often revenue collection strategies assessed |

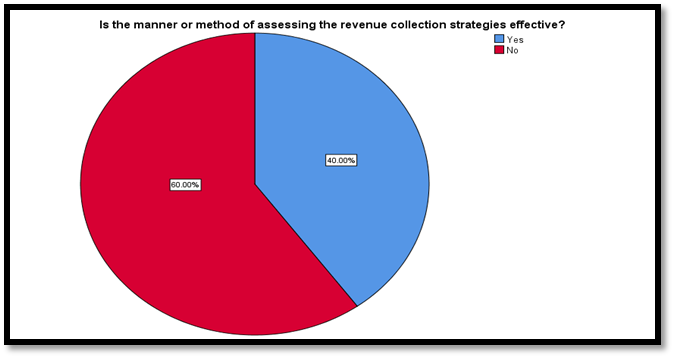

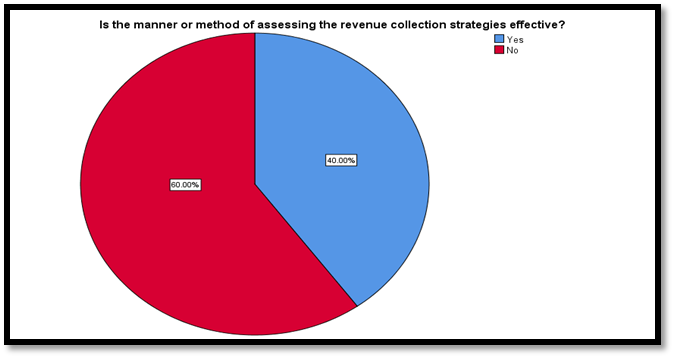

Figure 14 below shows that the majority (60.0%) of the interviewees stated No to the manner or method of assessing revenue collection effectively and 40% stated otherwise. | Figure 14. Manner of revenue collection strategies being effective |

5.4. How is the Attitude of the Citizens and Firms Towards the Payment of Local Rates, Taxes, Fines, Fees and Other Payments to Local Authorities?

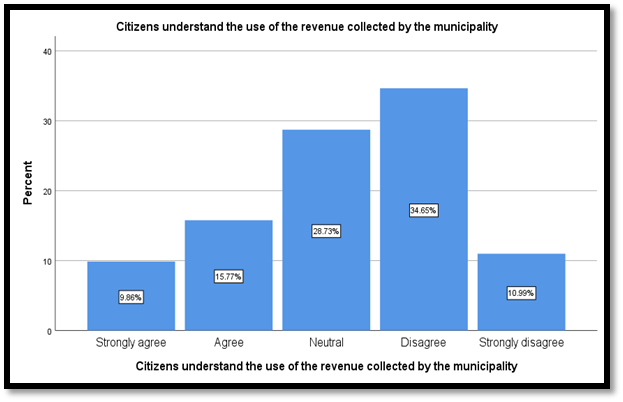

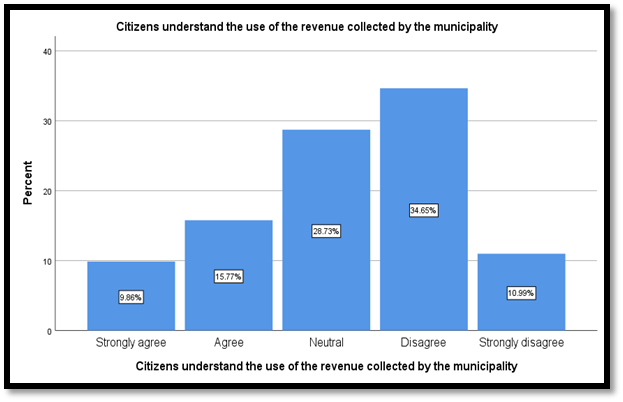

Figure 15 below shows that the majority (34.6%) of the respondents stated that they Disagree with them understanding the use of the revenue collection by LCC, 28.7% were Neutral, 15.8% agreed, 11.0% strongly agreed and 9.9% strongly agreed. | Figure 15. Citizens understand the use of revenue collection |

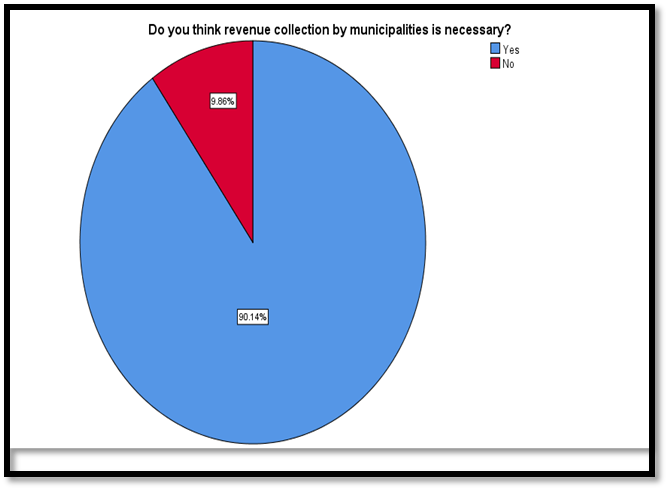

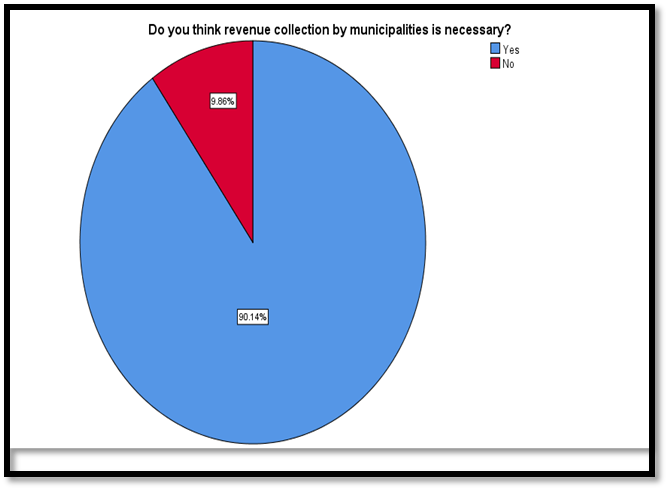

Figure 16 below shows that the majority (90.14%) of the respondents stated that they do not think revenue collection by LCC is necessary and 9.86% stated otherwise. | Figure 16. Revenue collection Necessary |

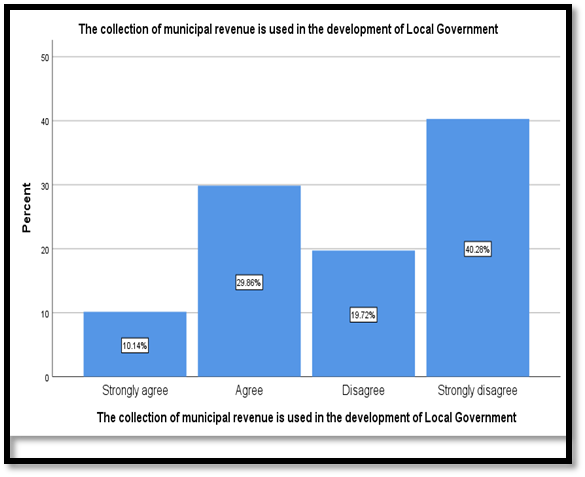

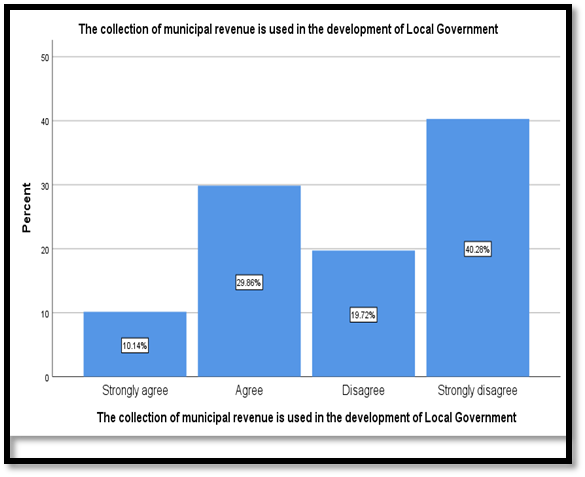

Figure 17 below shows that the majority (40.28%) of the respondents stated that they Strongly Disagreed to LCC using the revenue collected for the development of Local Government, 29.86% agreed, 19.72% disagreed and 10.14% strongly agreed. | Figure 17. Collection of revenue collection being used in the development of Local Government |

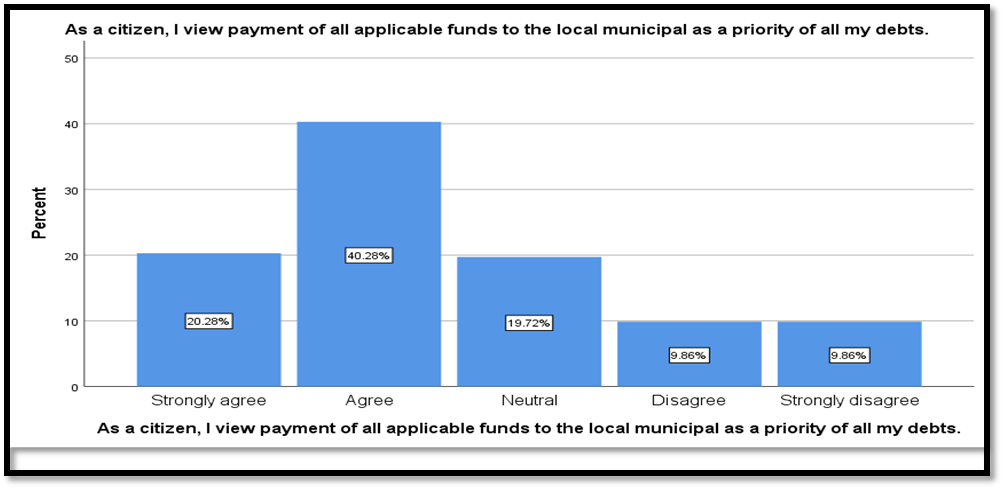

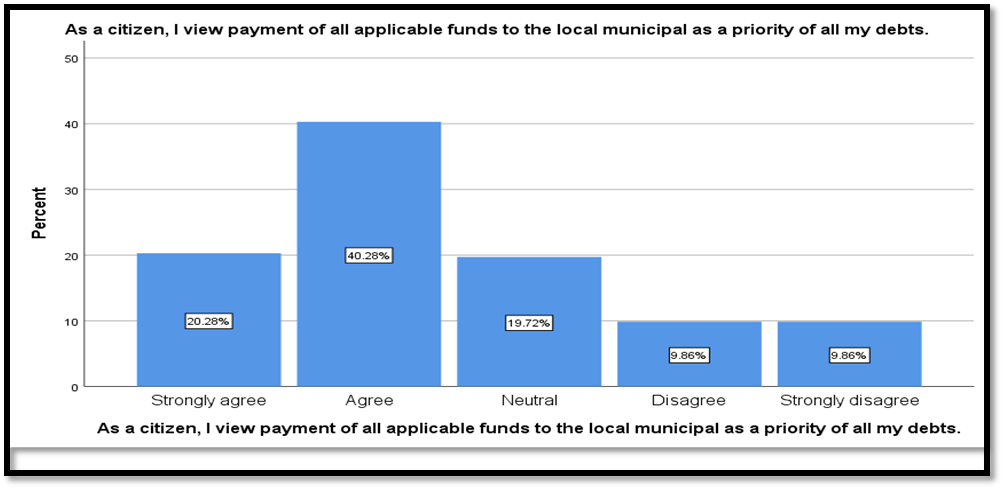

Figure 18 below shows that the majority (40.28%) of the respondents stated that they agreed that payment of the LCC is a priority of all their dates, 20.28% agreed, 19.72% neutral, 9,86% disagreed and strongly disagreed. | Figure 18. Payment |

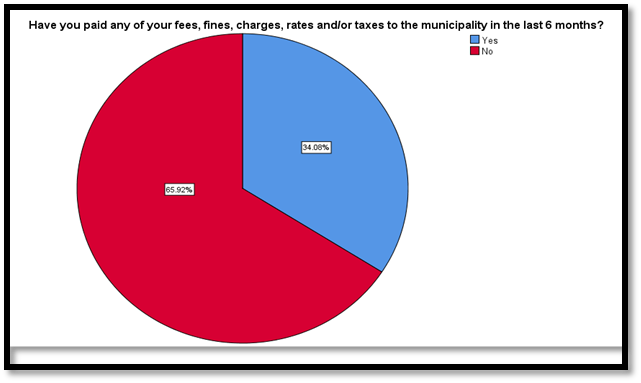

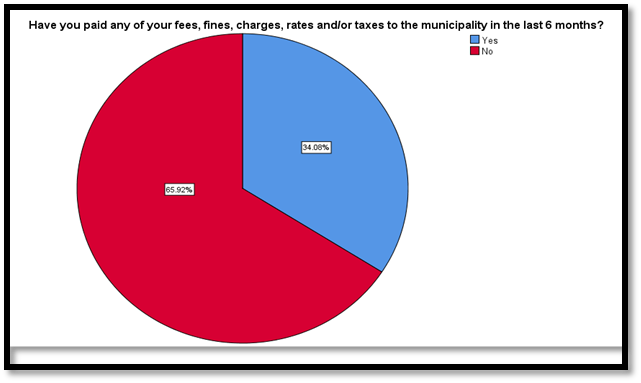

Figure 19 below shows that the majority (65.92%) of the respondents stated that they paid to LCC (Fees, fines rates and/or taxes) to LCC in the last 6 months and 34.08% stated otherwise. | Figure 19. Paid to LCC in the last 6 months |

5.5. How Effective is the Lusaka City Council in Service Provision to the Citizenry within Their Jurisdictions?

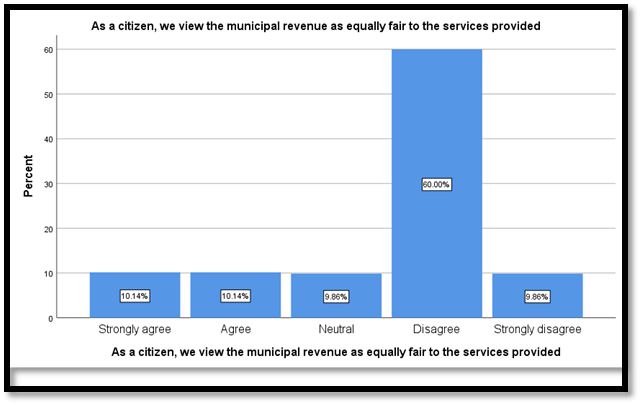

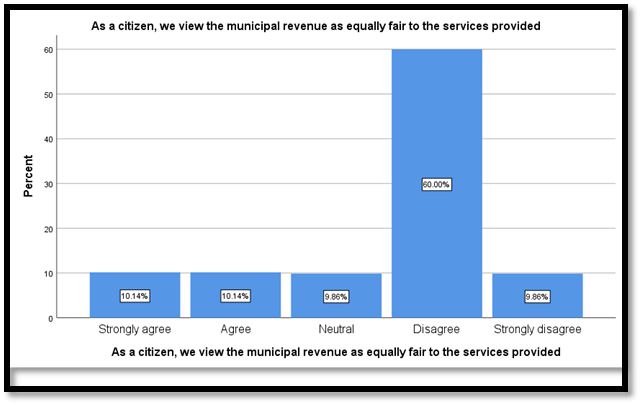

Figure 20 below shows that the majority (60.0%) of the respondents stated that they disagreed with the view that LCC was equally fair to services provided, 10.14% for both strongly agreed and agreed and 9.86% for both Neutral and Strongly disagree.  | Figure 20. Service Delivery |

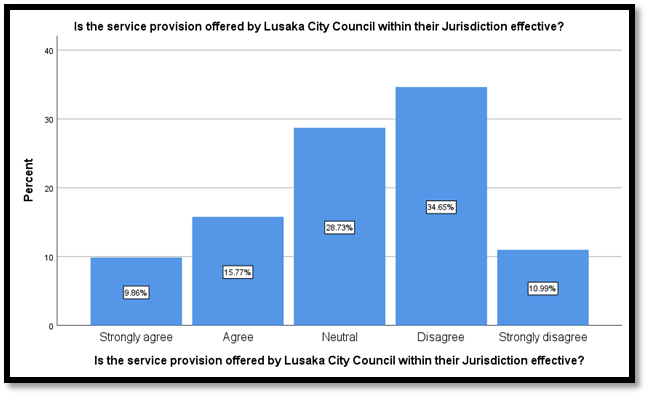

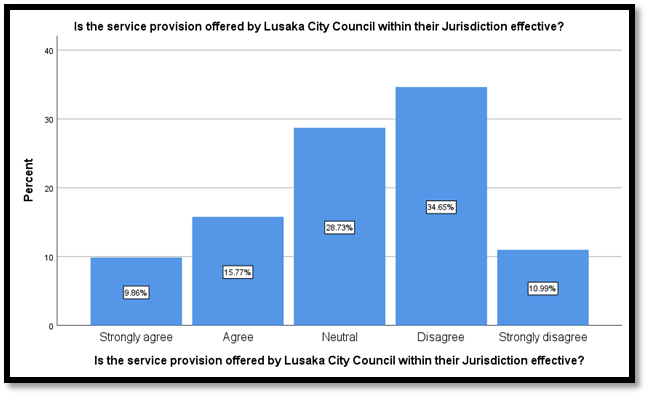

Figure 21 below shows that the majority (34.6%) of the respondents stated that they Disagree with LCC being effective in the service delivery within its jurisdiction, 28.7% were Neutral, 15.8% agreed, 11.0% strongly agreed and 9.9% strongly agreed. | Figure 21. Service provision effective |

6. Discussion

LCC has made attempts to use various strategies to raise revenue collected. However, the findings mainly found that the interviewees indicated that Online systems and Bank Transfers were the strategies used to collect revenue at the LCC. This could be attributed to the fact that electronic payment systems have become increasingly more efficient and effective in making payments. This lowers transaction cost and enhances transparency and accountability of the revenue collection Process. In addition, the findings further found that the interviewees mainly stated that they agreed that the revenue collection strategies were appropriate. This suggests that LCC believes that the strategies being used for revenue collection are appropriate for their level of operation. Despite, the fact that they have failed to integrate the payment system to mobile money platforms to make it more accessible and user friendly for the informal sector who may not have a bank account.Despite, having strategies to collect revenue the study found that the interviewees mainly indicated that the revenue collection strategies were poor or ineffective. It is for this reason, the interviewees mainly emphasized that if LCC has to envisage in revenue collection going forward it has to strengthen the legal framework, do constant sensitization, and opening up more collections points. However, the interviews continued to state that LCC had strategies in place to increase revenue collection even though the revenue collection is far from target. The study further revealed that the interviewees mainly indicated that Open Meeting (Department or Sections) was the nature of LCC assessing the existing revenue collection strategy and that they often assessed the revenue collection strategies assessed Annually. Whether open meetings really offer substantial opportunities for participation with significant impact is still an open question (Adams 2004; Baker, Addams, & Davis 2005; Cole & Caputo 1984; McComas 2001). Moreover, meeting once per year cannot be sufficient to address all the revenue collection challenges. In addition, that is why the findings mainly found that the interviewees clearly stating that the manner or method of assessing revenue collection being was not effective.As regards to the attitude of citizens and firms, the findings found that respondents mainly did not understand the use of the revenue collection by LCC. As a result, the findings established that the majority of the respondents mainly stated that they do not think revenue collection by LCC is necessary. In addition, the findings showed that the majority did not agree that LCC uses the revenue collected to the develop their local areas. This can be attributed to the failure by LCC to collect garbage on time, no proper constructed water and sanitation systems, failure to install the much needed amenities such as street lights and drainages, etc. However, the respondents mainly stated that they agreed that payment of the LCC is a priority of all their dates but they did not make payment to LCC of (Fees, fines rates and/or taxes) to LCC in the last 6 months.It then becomes increasing clear that LCC may fail to meet service provision due to failure to improve its revenue collection strategies. For instance, the majority of the respondents stated that they did not agree with the view that LCC were equally fair to services provided. Thus, they mainly stated that they did not agree that LCC was being effective in the service delivery within its jurisdiction. The results suggest that the LCC service delivery is mostly done in the urban and that Peri – urbans have been neglected. This could be the reason as to why they are not paying their rates, fees and charges because they may feel that they are not receiving the much needed services despite them having full knowledge about their debt.

7. Conclusions

The study aimed at empirically investigating the effectiveness of revenue collection strategies employed by the LCC. The study used primary data which was obtained by means of individual questionnaires and in-depth interviews. The study found that Online Systems and Bank transfers were the main strategies used by LCC to collect revenue. The findings had shown that there was belief among the interviewees that the revenue collection strategies were appropriate. The findings established that the extent of revenue collection strategies was poor and emphasized that strengthening the legal framework, constant sensitization, opening up more collections points was what they envisaged in revenue collection going forward so as allow them collect revenue more effectively like ZRA. It was worth to note that the results mainly shown that the interviewees stated that the manner or method of assessing revenue collection was not effective at all and that the LCC mainly assessed the existing revenue collection strategy through the use of Open Meeting (Department or Sections). The results of the study clearly show that LCC is not effective in its collection of revenue and as such there is need for the council to develop more strategies that can enhance revenue collection in its Jurisdiction. Being one of the oldest councils the LCC should be a model in collecting revenue so as to sustain its operational expenses without depending heavily on central Government for financial aid.

8. Recommendations

From the findings of the study the following emerged as the challenges faced by LCC in implementing strategies to enhance revenues collection.a) Weak Formulation and Implementation of the Legal frameworkIt is evident that despite the legal framework being sufficient, the ones supporting collection of revenue are not enforced fully because the central Government have conflicting pieces of legislation targeting the same revenue sources. It is, therefore, recommended that the legal framework supporting revenue collection needs to be harmonized or reviewed to allow the Local Authority exercise its full potential. The Central Government must ensure that space is given within the legal framework to allow the local authority collect revenue within its jurisdiction and hence consider harmonizing the legal framework that has over the years conflicted with the City Council’s existing laws. b) Increasing Marketing Investments or Commercial VenturesThis is an urgent need to consider scaling up marketing investments to generate more leads, which is a direct revenue driver. However, flooding the pipeline with more revenue generating opportunities is only an effective strategy for organisations where the Revenue staffs are well prepared to handle this influx, which is why Information dissemination to clients cannot thrive in a vacuum. To be successful, information dissemination teams which includes management need to communicate openly to all teams about current undertakings, upcoming plans, and overall objectives. The Local Authorities must effectively use this strategy hence avoid overdependence on national support which is usually released late to them.c) Sensitisation for Taxpayers – Creating Awareness It is so evident that ratepayers do not pay because they are of the view that no action is usually taken against them by the Local Authority. Also emerged as one of the disincentive to compliance on the part of the property taxpayers, is that a substantial number of people who own properties including politicians who are expected to be exemplary do not pay their dues. Some of the taxpayers’ opinion is that if they pay their tax bills while others are not paying, it would amount to betrayal to their neighbors. Non-compliance by the taxpayers is another serious problem impacting negatively upon property tax collection. Voluntary compliance is limited as taxpayers feel they get insignificant benefit in return to the taxes they pay. Taxpayers’ unwillingness to pay makes property tax collection a difficult undertaking resulting in very low collection efficiency levels. It is also argued that, it is always difficult and expensive to collect tax if the people disagree with the system and the level of taxation, which is being imposed. Strengthening policy linkages between service delivery improvements and tax compliance is key to record the success agenda. To further improve tax compliance, local councils must ensure the supply of essential services are enhanced. Until own revenue sources are sufficient, formula based central Government transfers will need to be fully implemented to provide equitable, needs-based financial and human resources so as to enable LCC to fulfill their role of delivering quality services to the community.On the other hand taxpayers find the probability of being caught or found wanting as being in conflict with the law for not paying property tax when it is too low. In addition, even where one was caught for non-compliance, the prescribed penalties are generally affordable. This is because the tax liability for individual property owners is generally very low due to tax rates also being very low. Hence even the prescribed penalties are smaller and can hardly induce the property owners to comply. As a result substantial property tax sums remain unpaid and consequently affecting the council’s revenue performance.It is also worth noting that the taxing authority is less plausible to the taxpayers as it has failed to live up to the expectations of the taxpaying community. The Council is perceived to be good at making promises that are rarely fulfilled. For instance there is a dire for public persuasive announcements occasionally to remind taxpayers about their obligation to pay taxes as: “pay your taxes and: be proud of your clean environment, expect improved roads and clean surroundings. Please pay your taxes to avoid penalties”. d) Computerisation of Revenue ManagementIn order to enhance efficiency and minimize human-cash contact and corruption opportunities, a simple computerized revenue management system would be feasible. Such a system should be able to automate the key tax administration functions of registration, assessment, collection and accounting for the revenue collected. The Zambia Revenue Authority, Ministry of Lands and Natural Resources and other key institutions in Zambia have well designed revenue collection systems to manage local revenue collection. It is recommended that, LCC computerises all its revenues sources in order to minimise corruption in revenue collection and accounting. e) Outsource Revenue CollectionA major challenge facing privatized revenue collection in LCC is related to the assessment of the revenue potential for various tax bases. Currently this assessment of the revenue is conducted on an ad hoc basis, often based on the previous year’s reported collection. Substantial underestimation of the revenue potential may imply that actual collection by the agent is substantially higher than what is reflected in the contract. Consequently, there is a risk of ending up in a situation where the agent keeps the substantial portion of the revenues collected, which already seems to be the case in some council. To meet its objectives, the councils’ outsourcing systems need to establish criteria that ensure that private contractors accomplish a reasonable return to the LCC. Hence, it is important for the City Council to conduct a rigorous assessment of the revenue potential before outsourcing takes place or is expanded, and to update the assessment regularly. One option for consideration is to move the responsibility for revenue assessment out of council administration by establishing an independent body responsible for such assessments.f) Enhancing Partnerships for Efficient Revenue CollectionIt is important that LCC partners with strong revenue collectors like the ZRA by using a One-Stop collection facility which when strongly enforced will yield good results. Data could also be shared, in particular, relating to business incomes which are required for establishing revenues from sources that are shared by both central and local authorities revenue authorities. A taxpayer information centre should be established for all taxpayers; one that responds to requests for all types of local and central Government taxes, fees, and licenses. This would yield maximum compliance by the ratepayers who are also required to pay their obligations towards central Government.g) Expanding Collection CentresWhile it has been observed that most ratepayers know their obligation towards the City Council and that they prioritised paying their debts, it is clear that the payment arrangements may not be user friendly to the customers. This was also seen from the fact that a handful of the ratepayers paid their obligations in the past six months. This has been greatly hampered with the existence of only one centralised payment centre for all applicable fees, levies, permits and charges. This is exacerbated by the presence of long queues and sometimes limited working hours which usually discourage and scare off rate payers to fulfil their obligations.It is recommended that, in addition to computerising their collection system, in arrears where this may not be applicable, the Lusaka City Council must take collection centres closer to the people by opening up pay points within their customers’ reach to avoid movements.h) Equitable Provision of Service DeliveryGiven that the results revealed that LLC service delivery is poor in peri urban areas compared to Urban areas. It is recommended that to boast the willingness of the residents of peri urbans to pay for all applicable fees, levies, permits and charges there must be an equitable service provision and not only limited to the urban areas.

ACKNOWLEDGEMENTS

This paper and the research behind it would not have been possible without the exceptional support of my supervisor, Dr Simon Tembo (Dr. Eng (AU, Japan), M.Eng (UEC, Japan), B.Eng (UNZA), MIEEE, MEIZ, R Eng) Head of Department, Department of Electrical and Electronics Engineering, School of Engineering, University of Zambia. His enthusiasm, knowledge and exacting attention to detail have been an inspiration and kept my work on track from my first encounter to the final draft of this paper.

References

| [1] | Boadway, R., & Shah, A. (2009). Fiscal Federalism: Principles and Practice of Multiorder Governance. Cambridge: Cambridge University Press. |

| [2] | Cottarelli, C. (2011). Challenges of Budgetary and Financial Crisis in Europe", . Presentation by Carlo Cottarelli, Director, Fiscal Affairs Department, International Monetary Fund. |

| [3] | Gay, L. (1992). Educational Research: Competences for Analysis and Application (4th Ed.). Merrill: Englewood Cliffs. |

| [4] | Gidisu, T. E. (2012). Automation System Procedure of the Ghana Revenue Authority on the Effectiveness of Revenue Collection: A Case Study of Customs Division. Unpublished MBA Thesis, Kwame Nkrumah University of Science and Technology. Government, Kenya.European Journal of business and management. |

| [5] | Gyamfi, E. (2014). Effective revenue mobilisation by districts assemblies: A case study of Upper Denkyira East Municipal Assembly of Ghana. Public Policy and Administration, 2(1), 97-122. |

| [6] | Hoffman, B., & Gibson, C. (2005). Fiscal Governance and Public Services : Evidence from Tanzania and Zambia. Semantic Scholar. |

| [7] | Khan, R., Khan, F., & Khan, M. (2011). Impact of Training and Development on Organizational Performance. Global Journal of Management and Business Research, 11, 62-68. |

| [8] | McMillan, J., & Schumacher, S. (2006). Research in Education: Evidence- Based Inquiry (6th Ed.). Boston: Pearson Education. |

| [9] | Muhaki. (2009). Size, Causes and Consequences of the Underground Economy. Aldershot, England: Ashgate Publishing. |

| [10] | Olowu, D., & Wunsch, J. S. (2003). Local Governance in Africa: The Challenges of Democratic Decentralization. Boulder: Lynne Rienner. |

| [11] | Orodho, A. J., & Kombo, D. (2002). Research Methods. Nairobi: KenyattaUniversity Open and E-Learning Module. |

| [12] | Panday, M. (2006). Direct Tax Reforms In India. International Journal Of Business And Social Science, 2 No. 19. |

| [13] | Yin, R. (2013). Case Study Research: Design and Methods. Sage Publications, Thousand Oaks. |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML