Wole Adamolekun1, J. A Obadeyi2, S. O. Ogbeide2, A. A. Akande2

1Department of Mass Communication, Faculty of Humanities, Social & Management Sciences, Elizade University, Ilara-Mokin, Ondo State, Nigeria

2Department of Accounting & Finance, Faculty of Humanities, Social & Management Sciences, Elizade University, Ilara-Mokin, Ondo State, Nigeria

Correspondence to: J. A Obadeyi, Department of Accounting & Finance, Faculty of Humanities, Social & Management Sciences, Elizade University, Ilara-Mokin, Ondo State, Nigeria.

| Email: |  |

Copyright © 2021 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

This study examined the extent of contribution of tradermoni scheme incentives to invigorate small business sector, with empirical approach of Oja-Oba ‘T’ Dada market beneficiaries. Government introduced an empowerment scheme only for petty and small traders to mitigate poverty and improve small businesses. The area of study was Oja-Oba ‘T’ Dada Market, Ota (otherwise known as Oja-Ota) in Ogun State, Nigeria. A survey research was conducted. The population consisted of petty and small traders who have benefited from tradermoni scheme and were purposively selected. Primary source of data was adopted via a structured questionnaire and interview. Fifty (50) questionnaires were administered to the respondents, and forty-five (45) copies were correctly filled and returned on schedule giving a 90% response rate. The respondents consisted of petty and small businesses owners. The data was analysed by descriptive and inference statistical (Analysis of Variance) techniques. The formulated hypothesis was further tested using t-test via the assistance of Statistical Package for Social Sciences version 21.0. Findings revealed that tradermoni scheme incentives invigorated the beneficiaries businesses at a very slow pace and might take an average of 12 days for small business to realize any benefit(s). The result 2.86 (p<0.05) was statistically significant. The study concluded that empowerment scheme was timely, but on the field, thousands of traders have not benefited as claimed arguably due to ineffective and inefficient channels of communication adopted by government agencies in charge of the scheme. Also the loan amount allocated for the initial phase was too small considering the effect of inflation on the naira. We recommended that government ministries, departments and agencies in charge of the scheme should provide financial report on the amount spent so far, numbers of beneficiaries per state, adopt communication channels targeted to low-income earners, and review policy framework to strengthen the scheme in order to meet its primary objectives now and in the nearest future.

Keywords:

Tradermoni scheme, Small business, Petty and small traders, Oja-Oba –T- Dada Market, Nigeria

Cite this paper: Wole Adamolekun, J. A Obadeyi, S. O. Ogbeide, A. A. Akande, Can Tradermoni Scheme Incentives Stimulate Small Business Sector? Empirical Approach of Oja-Oba ‘T’ Dada Market Beneficiaries, Management, Vol. 11 No. 1, 2021, pp. 20-25. doi: 10.5923/j.mm.20211101.02.

1. Introduction

There is no doubt that many African countries including Nigeria are facing poverty problem and other challenges such as poor infrastructure, insecurity (terrorism, banditry, robbery, kidnapping), hunger, malnutrition, food insecurity, high unemployment rate, economic recession, corruption, high electricity tariff and epileptic power supply, just to mention but a few. Over the years, the government has been introducing different schemes to reduce poverty, create employment and encourage entrepreneurship at grassroots level, however, these programmes have recorded little or no significant impact. Undisputedly, there is an extremely low influence on the citizens despite good intentions of government. In view of this development, the federal government introduced the tradermoni scheme as social empowerment programme targeting traders regardless of gender to benefit from mini credits to boost their small businesses and create wealth. The federal government explained that potential beneficiaries, who did not default are expected to receive second credit of ₦15,000 (USD $32) after the first credit of ₦10,000 (USD $21) in sequence till ₦150,000 (USD $315) would be received at maturity with terms and conditions. This loan process would help to grow the small businesses over time to take the traders out of impoverishment and enhance their standard of living. This is even so especially as several millions of working adults are found in the informal sector. To examine the fundamentals, the entrepreneurial and strategic perspectives of firm growth could be influenced by some factors such as age, gender, education, motivation, ownership, and financial resources respectively [1,2]. Furthermore, [3] and [2] posited that access to credits remained a determining yardstick that affected the capability of small business to grow. The postulations of [3] and [2] were corroborated by [4]. [4] submitted that access to funds remained a major determining factor to help start a business particularly in an unregulated market in less developed countries. While [5] claimed that personal earnings has helped to create employment opportunities and promote business expansion with small returns on investment.Furthermore, issue of financial communication could not be over-emphasized in this study. This has to do with how information about the scheme has been communicated to the people at the urban, semi-urban and rural areas (people, mainly at the grassroots). Many petty traders across the country were interested in the scheme, unfortunately, the government agencies in charge of the scheme failed to use appropriate communication channels, which were beyond radio, television, jingles, and social media platform like face book, twitter, WhatsApp to mention but a few. Moving forward, the usage of local dialects and other creative traditional communication channels to create awareness about the scheme would significantly assist petty and small traders to have a concrete understanding of the empowerment scheme due to the level of illiteracy rate among some of the targeted traders. To this extent, it is obvious that communication matters a lot in order to achieve the overall objective of either eradicating or drastically minimizing poverty. Most of these traders daily income was often sourced from the petty business’s start-up capital and little gain made from it would also be used to sustain the business and family. This became a serious challenge on the part of the traders. However, one of the questions that came up was, how possible would tradermoni scheme incentives be able to revive the traders’ business in Oja-Oba –T- Dada market? This question necessitated a hypothesis formulation. In view of this, a null hypothesis (Ho:) was formulated, which could be stated thus: tradermoni scheme incentives could not stimulate businesses of traders in Oja-Oba –T- Dada Market in Ota.This study would be the first to investigate how incentives from tradermoni scheme stimulated small business sector, with empirical approach of Oja-Oba –T- Dada, Ota beneficiaries in Ogun State. This work emphasized the importance of social empowerment scheme to help provide mini loan to petty and small traders and to become self-employed under the tradermoni scheme framework. To what extent has this scheme created wealth for the traders remained a gap that required further empirical evidences?

2. Literature Review

[6] and [7] argued that tradermoni scheme was only established to provide micro-credits to traders who are involved in petty businesses without the option of providing security/collateral; and problem of accessing small credits to sustain their small trade would be addressed. [6], [8] and [9] opined that tradermoni scheme was an empowerment platform of federal government to arrange loans for petty and small traders to create wealth. The introduction of tradermoni scheme would automatically create an avenue for potential borrowers to access small credits without tendering collaterals to alleviate poverty [10,11]. There were some social empowerment schemes that were in form of intervention to help the poorest of the poor people, artisans, and petty traders. These schemes included the Micro Credit Scheme: The scheme was meant to cater for at least one million artisans (carpenters, vulcanizers, fashion designers, mechanics). The federal government budgeted ₦60,000,000,000 (USD $125,786) for the programme. Bank of Industry (BoI) has already disbursed ₦500,000 (USD $1,048.22) to market traders. The next scheme was N- Power. The N-Power scheme captured labour who were directly employed by government comprising 500,000 graduates hired and trained to teach in primary and secondary schools to boost the standard of education in the country; and 400,000 Nigerian youths, who are undergraduates were recruited to learn skill acquisition and vocational training for few months and payment of stipends made during training. The Conditional Cash Transfer (CCT) was another scheme. The CCT allowed ₦5,000 (USD $10.5) to be paid to one million people that are extremely poor in Nigeria. Also Nigeria Youth Investment Fund was introduced by government through Nigerian apex bank, Central Bank of Nigeria (CBN). Under this scheme, ₦75,000,000,000 (USD $157,233) was earmarked targeting 500,000 Nigerian youths on a yearly basis to create job opportunities.[1] asserted that there was no specific definition of small business. Consequently, small business did not have a uniform meaning and interpretation. To this end, business could be categorized by net worth, business size and number of employees. [12] argued that small business has played a significant role in the informal sector to drive technology and innovation, create employment opportunities and improved standard of living. According to [4], micro credits were in different range to finance small businesses. [13] posited that microcredits are small credits available for farming and non-farming businesses like fishing, plantation and artisans and petty traders such as garri (cassava) seller, food vendor, rice and beans sellers respectively to help improve living standards.This study examined trade owned by individuals (sole proprietorship) with a very small start-up capital and whose means of survival depended on daily business transactions.Also there was need to understand that Oja-Oba ‘T’ Dada, in Ota, Ogun State was one of the markets in Ado-Odo local government since 16th centuries. The Oja-Oba ‘T’ Dada was also known as Oja-Ota in Afobaje community. The Ota community founding fathers were the Awori people who migrated from Abeokuta due to the evolution of the Egbas. During this period, Ota was under the control of Abeokuta. One of the major occupations of Ota people was trading. Today, the third largest industry concentration in Nigeria is in Ota community in Ogun State, Nigeria. According to [7]’s study on the assessment of tradermoni empowerment scheme in Nigeria from the Islamic perspective; with a case study of women beneficiaries at the Mandate Market, Ilorin. It was found that tradermoni scheme actually assisted the petty and small trading business owners. [6] studied tradermoni micro-credit scheme and poverty reduction in Nigeria. The study revealed that tradermoni scheme was necessary during the time that poverty rate was increasing in the country and concluded that tradermoni might crash like the other schemes previously introduced by various governments if issues of mismanagement and porous institutional frameworks for the schemes are not addressed. To appreciate how small business structure operate, there was need to understand small scale enterprise growth theory. The small-scale enterprise growth theory hypothesized that a firm could easily launch itself into a market and become unconscious of its growth potentiality. But after a while that the firm entered the market, it would now begin to know how losses could be prevented and profits maximized. In addition, it was assumed that the existing market interactions and contractions were not subjected to information asymmetry. On this background, the firm would now need to decide either to grow, diversify, expand, survive or exit the market. There are many theories in management sciences. But the articles of [14] and [3] are more relevant to this study. The evidence espoused by [14] and [3] revealed that the origin of small businesses owners/managers neither moved from a specific socio-cultural, economic nor from educational background, but from experience while undergoing trading and business training within their locality. Therefore, this means that experience could only be gathered via opportunities that emanated from socio and cultural backgrounds of either individual or group of people.

3. Methodology

The study adopted survey research on beneficiaries of tradermoni scheme in Oja-Oba T- Dada market (otherwise known as Oja-Ota Market) in Afobaje community, Ota, Ogun State. The choice of Oja-Oba T- Dada Market for the study was due to trading and economic activities that made other communities (e.g. Ifo, Ajegunle in Lagos, Lanfewa, Ajilete and Idiroko) to be trading in the market has led to business expansion; and due to proximity of one of the researchers in the area. Primary data was adopted via structured questionnaire and interview. Four (4) points scale (Likert type) was germane for the study. Data was collected and analysed through the use of descriptive and inferential approach; the former used tables and frequencies and the latter adopted Analysis of variance (ANOVA). The t-test was espoused to evaluate the constructed hypothesis with the assist of Statistical Package for Social Sciences, version 21.0.

4. Empirical Results

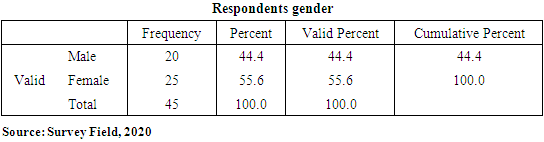

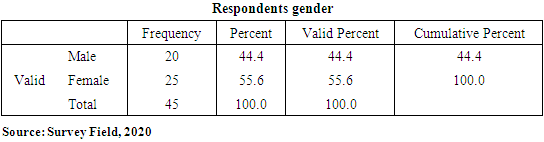

This part depicted how results were interpreted in the study. The total number of questionnaire was forty-five (45). Table 1 revealed the disposition of respondents according to gender. 20 (44.4%) of the respondents are male and 25 (55.6%) are female. This revealed that there are more female than male who are traders in the market for this study.Table 1. Respondent’s Gender

|

| |

|

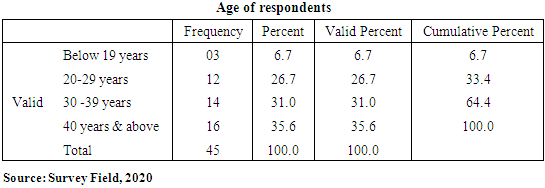

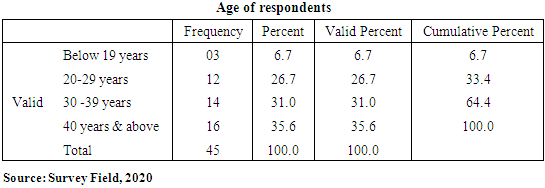

Table 2 exhibited 3 (6.7%) of the respondents, who are below 19 years old, 12 (26.7%) are between 20-29 years old, while 14 (31.0%) ranged between the ages of 30-39 years and 16 (35.6%) are 40 years and above. This implied that most of the respondents are between 40 years and above. All the respondents are matured to express an understandable opinion on the issue.Table 2. Respondents’ Age

|

| |

|

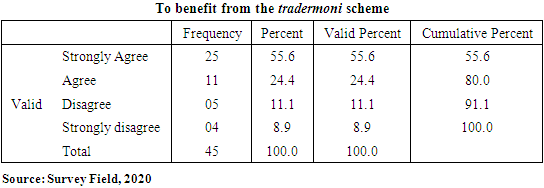

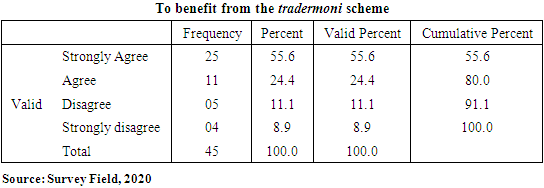

Table 3 showed that tradermoni scheme has provided financial assistance to traders in Oja-Oba –T- Dada Market, Ota. 25 (55.6%) of the traders strongly agreed that the scheme provided loans to help sustain their business; 11 (24.4%) of the traders agreed with the judgement; while 5 (11.1%) disagreed and 4(8.9%) of the traders strongly disagreed.Table 3. Traders have financially benefited from the tradermoni scheme

|

| |

|

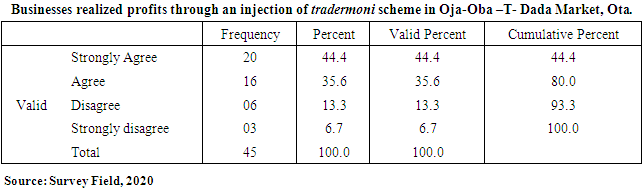

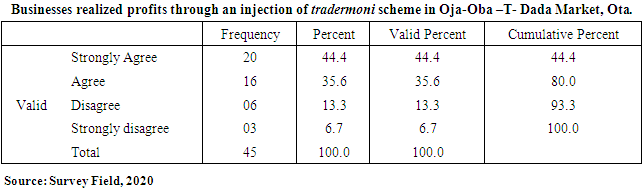

Table 4 displayed beneficiaries, who realized profits from businesses due to the intervention of social empowerment scheme. 20 (44.4%) of the respondents strongly agreed that profits were made on their businesses; 16 (35.6%) of the respondents agreed with this opinion; while 6(13.3%) disagreed with the viewpoint and 3(6.7%) of the respondents strongly disagreed with the opinion.Table 4. Beneficiaries of the tradermoni scheme realized profits on the business

|

| |

|

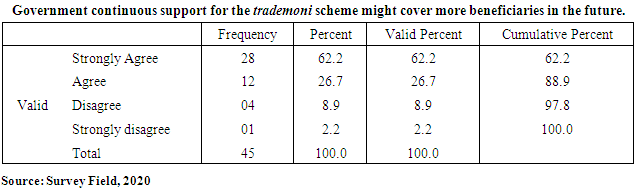

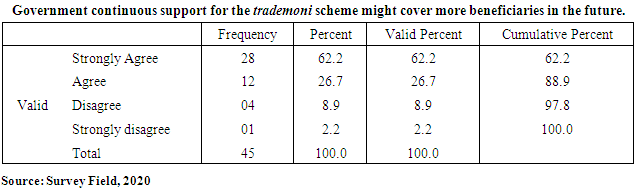

Table 5 has also displayed that government continuous support for the trademoni scheme might cover more beneficiaries in the future. 28 (62.2%) of the respondents strongly agreed that if government continued supporting tradermoni, it might cover more beneficiaries in the future; 12 (26.7%) of the respondents agreed with the judgement; while 4(8.9%) disagreed with the view and 1(2.2%) of the respondents strongly disagreed with the proposition.Table 5. Beneficiaries of the tradermoni scheme realized profits on the business

|

| |

|

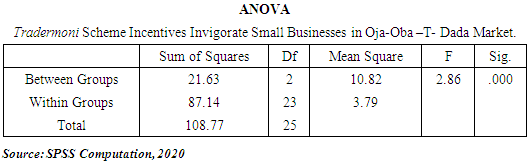

4.1. Hypothesis Testing

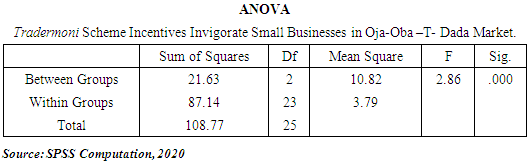

Ho: Tradermoni scheme could not stimulate business of traders in Oja-Oba –T- Dada Market, in Ota.Table 6 shows the value of F = 2.86 (p<0.05). The result was statistically significant at 5%. The result revealed that the null hypothesis would be rejected. Hence, the result confirmed that tradermoni scheme could stimulate the small business in Oja-Oba –T- Dada (Oja –Ota) market in Ota, Ogun State through expansion and slight returns increase. Table 6. Analysis of Variance of Small Businesses Invigoration and Tradermoni Scheme Incentives in Oja-Oba –T- Dada Market, Ota

|

| |

|

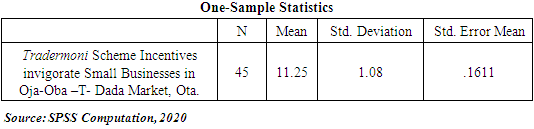

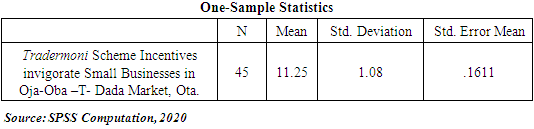

The table 7 revealed the mean value of all respondents’ judgements to be (11.25) and individual respondent opinion that deviated was 1.08. This revealed that individual opinion on the subject matter was below average, the standard error (0.1611) was an attestation that the sample mean accurately showed the actual population mean. Table 7. One-Sample Statistics on Small Businesses and Tradermoni Scheme Incentives in Oja-Oba –T- Dada Market, Ota

|

| |

|

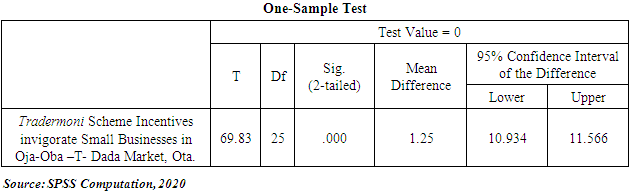

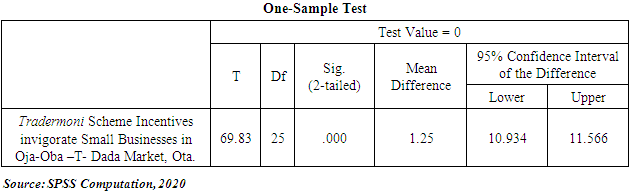

Table 8 showed the ‘t’-statistics value (69.8), which was greater than the p-value (0.000). This means that the result was statistically significant p<0.05; that is, (0.000<0.05). The null hypothesis was not accepted. Table 8. One-Sample Test on Small Businesses and Tradermoni Scheme Incentives in Oja-Oba –T- Dada Market, Ota

|

| |

|

5. Findings

i. Findings showed that majority of traders sampled to have benefited from the tradermoni scheme in Oja-Oba – T – Dada market are female traders.ii. Findings further revealed that traders’ ages were barriers to become a beneficiary under the tradermoni scheme. Also most of the beneficiaries were 40 years and above, while traders below 18 years were not considered. iii. Findings gathered from the field revealed that some of the traders were not literate.iv. Findings from (i) and (ii) were in tandem with propositions of [1] and [2].v. Findings also showed that some traders benefited and realized profits, but the contention was that only very few traders were covered under the tradermoni scheme contrary to the claims of government.vi. Findings also revealed that it would take an interval of 11days to 12 days for an average small business to benefit from tradermoni scheme incentives in Oja-Oba – T- Dada market, Ota.

5.1. Conclusion and Recommendations

This study examined the extent of contribution of tradermoni scheme incentives to stimulate small business sector, with empirical approach of Oja-Oba ‘T’ Dada Market beneficiaries in Ota, Ogun State. The paper concluded that the introduction of the scheme was timely considering poverty rate, unemployment rate and difficulties in accessing credits by the informal sector operators. The study discovered that an effective and efficient means of communication about the empowerment programme to the traders remain a vital tool in the value chain. It was also believed that loans from the scheme would further serve as buffer to small business owners in the sector. The tradermoni scheme incentives stimulated small businesses slowly in Oja-Oba –T- Dada Market, Ota. The study recommended that government should constitute a committee to carry out forensic audit on appropriated amount for the scheme in Ogun State, the audit firm must be independent, and outcome made public for transparency and accountability.

ACKNOWLEDGEMENTS

We appreciate all the traders, who gave us audience during the field research in Oja-Oba –T- Dada Market, (Oja-Ota), Ota, Ogun State.

References

| [1] | Storey, D., 1994, Understanding the small business sector. London: Routledge. |

| [2] | Fadahunsi, A., 2012, The growth of small business: Towards a research agenda. American Journal of Economics and Business Administration, 4(1): 105-115. |

| [3] | Liedholm, C., 2001, Small firm dynamics: Evidence from Africa and Latin America. The International Bank for Reconstruction and Development / the World Bank, N.W. Washington, D.C. |

| [4] | Ogunrinola O. I., and Alege, P. O., 2007, Microcredit and microenterprise development: An analysis of some rural based enterprises in Nigeria. Nigeria Journal of Economics and Social Studies, 49(1), 95 – 113. |

| [5] | International Finance Corporation., 2012, Assessing private sector contributions to job creation: IFC open source study. Theme: Access to finance, 1 – 3. |

| [6] | Ayogu, G.I., Abasi, U., and Eccoma, L., 2019, Tradermoni micro-credit scheme and poverty reduction in Nigeria. International Journal of Advanced Research in Management and Social Sciences, 8 (4), 197 -199. |

| [7] | Arikewuyo, A.I., and Akanbi, S.M., 2020, An assessment of ‘tradermoni’ empowerment scheme in Nigeria from the Islamic perspective: A case study of women beneficiaries at the Mandate Market, Ilorin. Saudi Journal of Humanities and Social Sciences, 5(2), 66 - 71. |

| [8] | A.M. Murtala., N-Power: A clash of policy and poverty. Daily Nigeria Newspaper, November, 25, 2016. |

| [9] | Odiase, V., 2020, The tradermoni empowerment scheme of Nigeria. [Online]. Available: http://tradermoniempowermentschemeofnigeria. |

| [10] | O. Ifeanyi., The punch newspaper, 21st December, 2018. Available also online at https://www.pressreader.com accessed on 25th November, 2019. |

| [11] | O. Afolabi, O., “Fg, boI launch, tradermoni in Lagos with ₦10,000 loans for grabs”: Business a.m. 20 August, 2018. [Online]. Available: http://www.pressreader.com accessed on 25th November, 2019. |

| [12] | SMEDAN, 2013, Reports on smedan and national bureau of statistics collaborative survey: selected findings. [Online]. Available: http://www.smedan.gov.ng. |

| [13] | Ugochukwu, N., and Onochie, G., 2017, Impact of micro-credit on poverty reduction in Nigeria. Journal of Arts, Management and Social Science, 2 (2), 149-156. |

| [14] | Jovanovic, B., 1982, Selection and the evolution of industry. Econometrica, 50(3), 649-670. |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML