-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2019; 9(2): 48-55

doi:10.5923/j.mm.20190902.02

Impact of the Value Added Tax Increase on the Lebanese Macroeconomy and Financial Figures (Economic Growth, Inflation and Purchasing Power)

Abbas Khawaja, Mohammad Yassine

Faculty of Business Administration, Jinan University, Tripoli, Lebanon

Correspondence to: Abbas Khawaja, Faculty of Business Administration, Jinan University, Tripoli, Lebanon.

| Email: |  |

Copyright © 2019 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The increase of the VAT Tax in Lebanon from 10 to 11 percent was seen as a necessary step in tax reform and to fund the increasing demands on the state’s treasury, especially with regards to the scale of salaries and ranks. While this increase has generated additional revenues for the state’s treasury, it has also had a negative impact on the country’s key indicators of economy: inflation, consumer purchasing power and economic growth. Using qualitative and quantitative research and data, this project will explore the theoretical background of the tax concept, the specific VAT increase in the case of Lebanon and its impact on the country’s economic growth, purchasing power of its citizens and inflation levels ever since it was applied in 2018. The paper finds that as a result of the VAT increase, inflation levels have increased, economic growth has remained stagnant and the consumers’ purchasing power has decreased over the years.

Keywords: Value-Added Tax, Lebanese economy, Purchasing power, Economic growth, Inflation

Cite this paper: Abbas Khawaja, Mohammad Yassine, Impact of the Value Added Tax Increase on the Lebanese Macroeconomy and Financial Figures (Economic Growth, Inflation and Purchasing Power), Management, Vol. 9 No. 2, 2019, pp. 48-55. doi: 10.5923/j.mm.20190902.02.

Article Outline

1. Introduction

- The increase of the VAT in Lebanon from 10 to 11 percent had an impact on the economy in different ways, on the micro and macroeconomic levels in Lebanon. However, the problem is that this tax increase comes at a time of high economic challenges that limit the country’s economic growth and consumer purchasing ability. There has been various types of analysis and discussion on the impact of the 1% increase on the VAT, but no specific empirical evidence has been provided on the impact of this increase on the country’s inflation levels, economic growth and purchasing power of its consumers in the Lebanese economy.

2. Research Questions, Hypothesis, Objectives

- 1. How will the 1% increase on VAT impact the consumers’ purchasing power in Lebanon?2. How will the 1% increase on VAT impact the inflation levels in Lebanon?3. How will the 1% increase on VAT impact the country’s economic growth in Lebanon?

2.1. Hypothesis

- The research proposes the following three hypothesis: H1: The VAT increase negatively affects economic growth H2: The VAT increase leads to inflation increaseH3: The VAT increase diminishes the consumers’ purchasing power

2.2. Research Objectives

- 1. To provide a theoretical background on the topic of taxes, VAT tax and their role in the economy.2. To provide a scientific, quantitative finding on the impact of the VAT increase on inflation, economic growth and consumer purchasing power.3. To provide a list of relevant recommendations that limit the negative impact of tax increases on the country’s financial situation.

3. Significance of the Study

- The significance of the study is for two reasons: first, because it provides a strong theoretical base for its findings, gathering data from credible, high quality, relevant journal articles, books, news websites and others. Second, because it provides statistical figures and evidence from scientific, empirical methods which include graphical illustrations showing the specific impact of the 1% VAT increase on the consumers’ purchasing power, inflation levels and economic growth.

4. Methodology and Scope

- In terms of its design, this research project included both qualitative and quantitative research approaches: qualitative, meaning the information was gathered from secondary sources and it was theoretical and subjective information on the topic of VAT, its history and impact. Quantitative, meaning that real numbers and statistical figures were obtained in order to provide more accurate data to support the findings, mainly related to inflation levels, economic growth levels and the consumers’ purchasing power changes as a result of the VAT increase. In order to test the main hypothesis (impact of the VAT increase on the consumers’ purchasing power), this research chose the controlled experiment method. By definition, a controlled experiment is an experiment where all factors are kept constant except for an independent variable. It includes both an experimental group and a control group. In both groups, all variables are identical except the factor being tested. The researcher has chosen this experiment because it makes it easier to eliminate uncertainties in a result. The hypothetical question being tested here: does the VAT level increase negatively affect the consumers’ purchasing power in Lebanon? The hypothesis is therefore: the 1 percent VAT level decreases the consumers’ purchasing power. In the controlled experiment, control group Alpha and Beta were used. Each of these groups contained five heads of households who earn between $1000 to $1,500 and shop once every month for groceries. The control group (Alpha) was asked to shop from a mini market, which is small in size (in terms of revenue and turnover) and accordingly does not charge the VAT increase. The experimental group (Beta) was asked to shop from a supermarket which is subjected to the VAT increase given its size (revenue and turnover). Each group was asked to buy essential product items which it needs from its respective target. None of the subjects were aware what the experiments was, and they were selected randomly. The quantity and value of the products bought by each group were then compared to measure the purchasing power of each group: the one subjected to the VAT increase and the group not subjected to VAT increase. The other two hypotheses will be evaluated through statistical findings from secondary sources related to economic growth and inflation levels over the past three years.

4.1. Scope

- In the beginning, the research paper will provide a theoretical background on the concept of Tax and its various types, then move on to discuss specifically the VAT concept, its challenges and impact on the economy. The second part will provide more specific numbers on the correlation between the VAT increase and the specific variables: purchasing power, inflation and economic growth. Finally, the third section will provide the conclusion and a list of recommendations.

5. Literature Review

- In general, Tax is a monetary amount imposed by the state on individuals and companies, in order to finance the expenses incurred by the state to provide social services, pay salaries of employees in government departments and ministries, and to establish and rehabilitate infrastructure, and to support commodities to provide them at a lower price. Taxation has three main functions, including a financial function, an economic function and a social function.Tax functions: The financial function of the tax is to secure the financial revenues of the State Treasury in order to cover the expenses incurred.The economic function of taxation refers to the role of taxation as a tool of the state's fiscal policy, which it uses to stimulate growth or reduce inflation levels. This means that during high growth periods associated with high inflation levels, governments are raising tax rates to absorb large monetary availability in order to avoid further inflation. During periods of deflation, tax rates, or even tax ex-emptions, are often reduced to stimulate spending, thereby increasing production and the consequent increase in in-vestment and long-term employment, thereby rebalancing markets. Import taxes also play an important role in the protection of local products and industries, thus protecting the production of enterprises, factories and their employees. Tax also plays a social role in social stability, where tax revenues are used to provide social services at a lower cost, or even free, redistributing income among the strata of so-ciety. Tax classification: The tax rate is the same for all categories, without taking into account the value of the income or the tax imposed on the property. For example, Akiki (2017) explains in his article that the tax on real es-tate is 5%, whatever the value of the tax. Also, he adds that the tax rate increases, so that the tax rate increases as the value of the property rises or the income rises. For example, it is 3% for those earning less than $ 1000, 5% for those who enter between $ 1001 and $ 2000 and 7% for income between 2001 and $ 4,000 according to Akiki (2017) A retroactive tax is the one that decreases as the income or the taxable amount rises. For example, the tax rate is 5% for the income of less than $ 1000, and 3% for the income of between 1000 and 3000 dollars (Akiki, 2017).With regards to the type of taxes, two types of taxes can also be distinguished: direct and indirect taxes.Direct taxes are taxes paid directly by the taxpayer to the tax authority. The direct tax is imposed on the income of individuals and on commercial and industrial profits of companies, on real estate assets and property. This type of tax is imposed directly on the individual / family or company, the individual or the tax authority bears the full burden, unlike indirect taxes. Finally, the indirect taxes are collected for the government through an intermediary, such as retail stores, such as VAT and sales tax

5.1. VAT: Overview

- The origin of the VAT Tax comes from France, where it was introduced back in 1954 Its main rules were established by the economic researcher Maurice Loreé from the year 1953 and since then it has had social and economic effects and advantages that triggered the interest of decision makers and politicians around the world. By definition, the Value Added Tax (VAT) is a general indirect tax included in the selling prices of goods or services and paid by consumers. VAT may be subject to legal exemptions. VAT 2018 is applied at different rates depending on the products or services imposed. There are three types of rates: the standard VAT rate, the reduced VAT rate and the intermediate VAT rate.To elaborate, the VAT is a tax paid by consumers, calculated on the value of the goods and services they buy. Today, it is the first resource of many states, especially in Europe, but originally it is a French invention. The value-added tax was first implemented in 1954, at the instigation of a finance inspector named Maurice Lauré, and it was a small revolution. In the past, taxes on consumption had the disadvantage of being cumulative: they applied to each stage of marketing and therefore hit the same goods several times. Tires, for example, were taxed a first time at the exit of the Michelin factories and a second at the exit of the Renault factories, since the diamond company had put on its models. VAT avoids this distortion. Also, the Value Added Tax (VAT) is an indirect tax on consumption. The consumer is consumed by the end buyer. Nevertheless, it is the company producing goods or services that collects this tax on behalf of the State. The company invoices the customer and vice versa, the deduction made to VAT on its constituting its cost price. This indirect and painless tax is the effect of almost half of the state budget and tax adjustments.How can it be successfully applied? For example, when a company sells a good for 100,000 LBP, it actually bills 111,000 LBP to the customer, giving back 11,000 LBP to the state. It is not she who pays the tax, but the buyer, she plays here a role of tax collector. But to manufacture this good, she herself had to buy from other companies products, services or materials, also subject to VAT. And this time it was she who paid for it, since she was the buyer.Why is it considered an unfair tax ? For some, VAT is considered unfair because it strikes proportionately less rich than poor. While low-income households consume all of their income, well-off households spend only a portion (sometimes very small) of their resources - the rest are saved. The burden is therefore less onerous for them.Are VAT rates particularly high in Lebanon? Not at all, as Lebanon has one of the lowest VAT rates in the world. For example, in the European Union, only four other countries have a standard rate below 20%: Germany (19%), Luxembourg (15%), Cyprus (18%) and Malta (18%). Conversely, the Netherlands, Italy, Spain or Belgium are 21%. (World Bank, 2018)In France, for example, these rates were last modified on January 1, 2014. Prior to this date, the standard VAT rate was set at 19.6%. The standard VAT rate is 20%. This rate applies to most goods and services. Also in the case of France, the VAT rate applicable to equestrian centres is 20% (compared to 7% before 2014). The intermediate rate of VAT is 10%, compared to 7% before 2014 (hotel, renovation of housing, transport ...). In addition, the World Bank (2018) adds that VAT applies at the reduced rate or the intermediate rate depending on the nature of the product. Products sold for immediate consumption are subject to the 10% rate, while those sold for deferred consumption (ie those packaged for preservation) are 5.5%. % that applies (World Bank, 2018). Different rates also apply for drinks. For those alcoholic, the normal rate of 20% applies. For other drinks, there are also those immediately consumable those to be preserved. Example: for a coffee served in a brewery, the rate of 10% is applied. For bottles and cans, the rate is 5.5% (World Bank, 2018).Operation: In general, the VAT is initially paid by the customer to the professional (trader, company, craftsman ...). It is thus included in the selling price of the product or service. The professional then transfers the amount of VAT to the State. When supplying a good or a service, the price (excluding tax) and the price (including tax) are included, which includes VAT. Declaration: An enterprise that falls under the normal tax regime is therefore subject to VAT reporting obligationsSimplified plan and franchise: Smaller companies may under certain conditions benefit from the simplified VAT scheme. Some companies may also benefit from a VAT exemption. This is particularly the case for self-employed entrepreneurs, who do not collect VAT below a certain turnover, cf. the VAT of self-entrepreneurs (World Bank, 2018).

5.2. VAT in the Case of Lebanon

- According to the Ministry of Finance (2017), in the case of Lebanon, As of 1 January 2004, any person or company with a turnover of 150 million LL in the course of 2003 (previously 250 million LL) will be subject to VAT. This measure is supposed, according to the Ministry of Finance, to ensure fairer competition on the markets, beyond its expected revenues. Then, in March 2004, there was a lower threshold of subjection for companies mandatory to pay the VAT. At that time, Beirut traders dispute the lowering of the mandatory VAT threshold to 150 million pounds of turnover or 100,000 USD and called on the Ministry of Finance (2017) to save small traders, the main category concerned. In a detailed study he submitted to then Minister Fouad Siniora, the secretary of the Association of Beirut Traders, Mounir Tabbara, said that taxing small traders to VAT “will not be profitable for the Treasury.” He explains that the financial costs that will have to support this category of merchants as well as the direction of the VAT charged to manage the statements of the new taxpayers will be far superior to these receipts. Cautious of the negative repercussions of this problem on the national economy, Mr Tabbara called on the minister to find a solution as soon as possible, especially since the maximum time limit for the application for registration with the management of the VAT was fixed on 28 February 2004.Concerning the registration and formalities, in Lebanon, the persons or companies concerned had to register with the VAT department before the end of February 2004. The turnover to be taken into account included: - Transactions subject to VAT. Operations exempted by their nature from VAT but giving right to restitution, such as export for example (Akiki, 2017). After approval of the application for registration, the administration concerned will issue a certificate indicating the number of the taxpayer and the date from which the taxpayer must pay the VAT due and be refunded the tax paid on his purchases. Failure to register or delay in registration leads to the imposition of a fine of one million LL to which must be added all arrears - amounts and interest. Once in possession of this certificate, the taxpayer must keep daily books of account. Also, the taxpayers taxed on the basis of estimated or flat-rate income may continue to report their profits on the same basis for income tax purposes. The taxpayer should also issue invoices in accordance with the provisions of the VAT Act. He should also ensure that the purchase invoices are also in compliance with the provisions of this law, in order to benefit from the refund of VAT (Akiki 2017). For companies that cannot, by the nature of their activities, constantly issue invoices (shops, groceries ...), the receipt includes VAT. However, they will have to obtain prior approval from the VAT department (Akiki, 2017).Regarding the declaration and payment, currently, reporting and payment are quarterly. The VAT Directorate sends the declaration form which includes the payment deadlines, by post, to the taxpayer. The latter must complete the form and send it back within 20 days from the end of the quarter. According to Hatem (2004), in the event that the taxpayer has not received his declaration form, he will have to check with the VAT department. Completed returns can be sent by mail and payments made to banks. Declaration and payment are two independent operations, one not canceling the other. Non-declaration entails the imposition of a fine of 10% of the amount of VAT for each month of delay (minimum 500 000 LL) according to the Ministry of Finance (2017). The non-payment penalty is 3% per month of the amount to be paid. It is therefore in the interest of any taxpayer to submit his return even if, for one reason or another, he can not pay the VAT within the time limit (Ministry of Finance, 2017)It should be noted that the VAT tax does have advantages. Research shows that the main advantages of Value Added Tax (VAT) are as follows:- It is very general, in other words targeting “all the money and services consumed in Lebanon, whether national or foreign, or imported from abroad”.- Being an indirect tax, it is collected from commercial institutions, not the customer- The tax is also neutral, covering all economic cycle operations and is a fixed rate. So the VAT is not affected by price structure, the competition or other economic changes (Simkovic, 2015).- As a neutral type of tax on consumption, it is less likely to create economic distortions and it is imposed on both imported and local products sold by commercial institutions. Even the goods that are excluded from the VAT are done in neutrality regarding internal and external trade (Simkovic, 2015).- The main advantage of its neutrality is that there is no accumulation for the tax regardless of the several stages of production and distribution of services and goods by the institution.

5.3. The One Percent Increase

- Lebanon decided through its House of Representatives in July 2017 to increase the VAT level from 10 percent to 11 percent under the pretext of funding the new salary scale. The government also imposed fees on real estate sales contracts, tax on profits of financial companies, and increased fees on all types of tobacco, tobacco and spirits, as well as fees on travel cards and cement production. Moreover, the VAT is applied in more than 160 countries around the world, and Saudi Arabia and the United Arab Emirates began implementing them at the beginning of the year to boost their budget. An indirect tax that includes some goods and services determined by the government according to the needs and realities of the country.Value added tax in Lebanon is levied at each stage of the supply chain from production through distribution to the final sale of the commodity or service. Governments favor this tax because it provides immediate and direct revenue to the state budget. This raises the question: what are the goods and services covered by the TVA 11% tax? The tax includes the products and services needed by the Lebanese in their daily lives, although the government considered them fair to exempt more than 60 basic commodities such as bread, flour, meat, fish and milk ... In fact, it covers 70 percent of household spending. For example, although bread is exempt from value added tax (VAT) of 11 percent, its price will increase automatically with the rise in oil prices, the price of which increased by 200 Lebanese pounds.Government revenues from TVA were 10%, or LL 3,200 billion, or 30% of combined tax revenues according to the Ministry of Finance (2017). Today, with a 1% increase, government revenues will increase by 320 billion LBP, according to Lausanne. In one previous study, Saerty (2017) argued that the tax is unfair, as it affects the income of the poor and middle class by 80 to 90 percent, while only 40 percent of the income of the wealthy and affluent class, stressing the need to be replaced by other taxes, such as tax on the rise in profits and others, which reduce the burdens of the citizen. In another previous study, Abou Zaki (2010) explained that the government has been looking for the most tax to collect money for two decades, which is the result of inflation and high prices. The Lebanese citizen can not bear any direct and indirect tax, whatever its form (Saerty, 2017).

5.4. Impact on Inflation, Economic Growth and Purchasing Power

- Additional previous studies have pointed out that Lebanon has been suffering from economic stagnation, and with the addition of taxes, this will naturally lead to further contraction and negatively affect purchasing power and stimulate investment and growth, especially in the real estate and services sector, such as one study by Abou Chakra (2017). This is because these taxes were put without study, they contributed to the increase in the economic recession, which requires the opposite measures, that is, tax cuts and increased spending, but what happened is the opposite, which has stifled the economy and increased indebtedness and benefits, as well as increasing inflation and contraction of the economy. As for the Chairman of the Consumer Association, Dr. Zuhair Brou,: “We are experiencing a stage of large inflation in prices. From the legal point of view, Pro stresses that "raising prices by traders is not allowed and they are entitled to do so, of course without forgetting the monopoly side that is forbidden to this process, but the Lebanese regime is free economy” he said, according to Abou Chakra (2017).However, the role of the consumer association become paramount in this situation, as it is primarily tasked with defending and representing the consumer in such challenges. However, the law of consumer protection in Lebanon has not been applied since 2005 and has not issued its organizational decrees until today (Ministry of Finance, 2017). Moreover, the law does not limit the commercial competition.As for the economist, Dr. Nabil Sorour, For his part "Necessity" control the prices The market and activate the role of the Directorate of Consumer Protection in the Ministry of Economy "and proposed solutions that have a long-term impact." There is a need to balance the restructuring of the Lebanese economy in order to encourage collective action through productive institutions that provide commercial, industrial and agricultural initiatives, Economic and support all production possibilities to create jobs”, according to him. Furthermore, economic recovery and stability should encourage and attract investors and invest their funds in Lebanon (Abou Chakra, 2017), as previous studies also by Akiki (2017) recommended that Lebanon must also work on evaluating the structure of public administration and administrative reforms that will lead to the production of an effective and balanced economic cycle that will limit the waste of the state budget.Moreover, previous studies by Akiki (2017) indicated that the increased inflation is a result of the fact that the 1 percent increase in value-added tax is not only what citizens will expect, but also the other taxes that have been approved (stamps, bills ...). It is known that the salary chain will benefit about 250 thousand employees in the public sector, financed by themselves with 750 thousand workers in the private sector. In the opinion of the public, the benefit of public sector employees from the chain will be simple and for a limited period due to the decline in public finances. Furthermore, the rise in prices leading to the decline in purchasing power reflected negatively on the expected revenues from raising the tax and estimated at 320 billion pounds . Also, a study by the United Nations Development Program showed that the 11% VAT will increase the percentage of people living below the extreme poverty line (those living below 2.4 dollars a day) from eight to ten percent. (Poverty, Growth and Income Distribution in Lebanon, 2015). It is also expected to increase the level of citizens living below the upper poverty line (which is 4 dollars per person) to 35 percent up from 28 percent (Poverty, Growth and Income Distribution in Lebanon, 2015). Furthermore, it should be noted that the value added tax law, in its articles 16 and 17, exempted certain services and products, for example: education, medical services, raw agriculture, newspapers, papers and books, food products for children of all kinds, bread and flour. Under these exemptions, TVA will not have a negative impact on the living conditions of the population, especially as the products and services not included in the luxuries are exempted (Central Administration of Statistics, 2017). However, if we go back to Article 17, which exempts gas (for domestic consumption) and is exempted from VAT, and does not mention gasoline, which means that the increase of one percent goes up. According to previous studies, this is the main point: it is clear that the process of production and transfer of goods will be directly affected by higher fuel prices (especially with the addition of 4 percent tax on diesel) and thus will be reflected in the prices of all goods and services even those exempted from value added tax (Central Administration of Statistics, 2017).

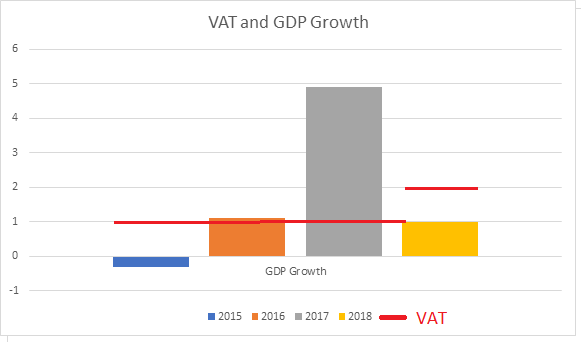

5.5. Impact on Economic Growth

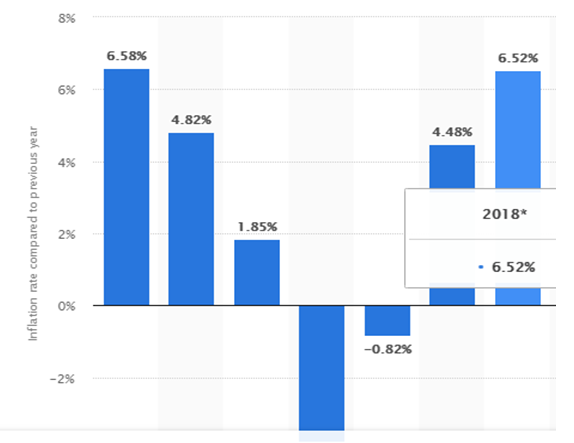

- When it comes to economic growth, we see the following: In 2015, economic growth was: 0.8% (2015), while in 2016, it was 2.0%, similar to 2017 and 2018 (also 2%). And so, we can conclude that the impact of the tax on economic growth was that it kept the growth stagnant, without further increase over the years (Ministry of Finance, 2017). As for inflation, we can see the following levels:

| Figure 1. Inflation compared with previous years from 2012 until 2018 (Source: Economena, 2018) |

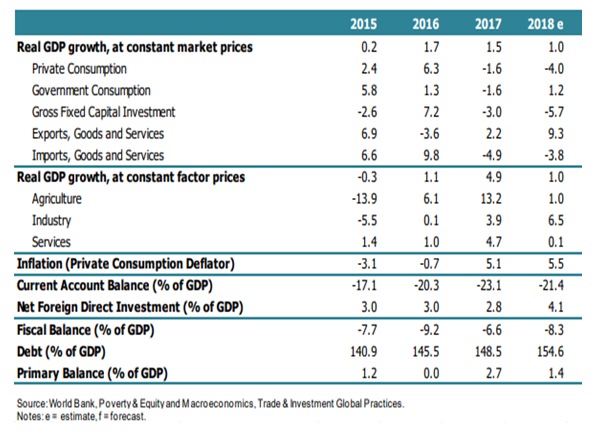

| Figure 2. Decreasing macroeconomic figures. (Source: The World Bank, 2018) |

5.6. Hypotheses Testing

- As previously mentioned, this research project has put forward the following three hypotheses. H1: The VAT increase negatively affects economic growth H2: The VAT increase leads to inflation increaseH3: The VAT increase diminishes the consumers’ purchasing power

6. Discussion of Statistical Findings

6.1. Statistical Findings from Secondary Sources

| Figure 3. GDP growth in Lebanon from 2015 to 2018 |

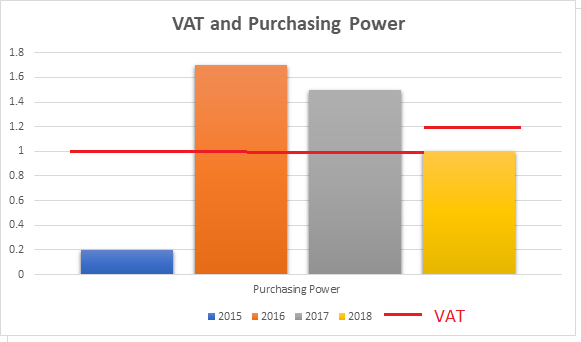

| Figure 4. Lebanese citizens’ purchasing power changes from 2015 to 2018 |

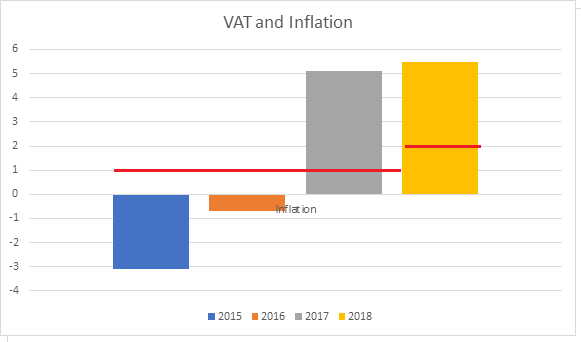

| Figure 5. Impact of VAT and inflation levels from 2015 until 2018 |

6.2. Controlled Experiment Results

- The controlled experiment result showed the following: Group Alpha (Controlled Group) bought a total of 25 items for an amount 100,000 LBP. Group Beta (the experimental group) bought a total of 17 items for an amount of 65,000 LBP. The 35,000 LBP (35 percent) difference in the amount and 8 item different in the quantity of products can be interpreted as follows: first, that the overall increase in product prices in the supermarket (which is subjected to the VAT increase) has limited the ability of consumers to buy the same number of products which they could have bought in the price levels that preceded the increase. Second, that the overall price increase in the market as a whole has put an added pressure on the consumers to make ends meet in their monthly household budget, which led them to buy less products and spare money to cover the rising expenses in other household categories. Accordingly, it can be argued that that 1 percent VAT increase does have a diminishing impact on the purchasing power of consumers, namely those from mid-income brackets.

7. Conclusions and Recommendations

- In conclusion, the research project has shown that the VAT tax increase, while it does have advantages to the Lebanese state (it is expected to increase the revenues to the state’s treasury), it increases inflation (as proven by figures), consequently weakens the consumers’ purchasing power (since not all consumers benefit from the salary scale) and does not provide strong economic growth (economic growth levels remained stagnant). Specifically, the purchasing power of consumers coming from mid-income brackets showed to be negatively affected since consumers from the same bracket bought less quantity of household products and spent less money in their shopping experience when buying from products subjected by the VAT increase by 35 percent. In all cases, there needs to be realistic and practical recommendations to prevent or at least limit the negative impact on these variables.

8. Recommendations

- Key recommendations include the following:- The Lebanese state should diversify its sources of economic boost and revenues, instead of having to depend greatly on the VAT source. Increased taxes on real estate transactions can help in adding a much needed new source of revenue to the state’s treasury.- Provide tax cuts to productive sectors, mainly: industry, agriculture and the IT sector. This will help in stimulating economic growth.- Increased customs and tariffs on imported products which are produced locally, which would help in stimulating and supporting national production, further improving economic growth.- Strengthen the analytical and data base of the government, mainly the central administration of statistics for poverty assessment and monitoring, which would allow it to keep track on the impact of the increased tax level on the consumers’ purchasing power.- New measures should be aimed at reducing the expenses of the Lebanese state and enhancing its revenues by increasing the productivity of the public sector in order to adopt the theory of partnership between the public and private sectors in the management of public utilities, which has become a burden on the Lebanese state. Therefore, the process of economic reform must be launched immediately, because this only requires a national awareness of the seriousness of the situation if we continue this approach of indifference and neglect, and this will reach all Lebanese different sects and sects and parties without distinction, “The Economist” magazine has recently warned in an article on the repercussions of the economic recession in Lebanon, pointing out that the country is heading for an economic crisis as politicians are distracted by their conflicts on the quotas in the next government. Immediate steps to combat corruption (which is draining the public treasury and the tax revenues) are necessary alongside improvements to the tax system in making it more balanced and effective.

ACKNOWLEDGEMENTS

- I wish to acknowledge the value of the contributions from the secondary research sources in this article, in addition to the support received from my supervisors and instructors at the Faculty of Business Administration at Jinan University.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML