-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2019; 9(2): 37-47

doi:10.5923/j.mm.20190902.01

Impact of Working Capital Management Practices on Profitability in State-Owned Enterprises (SOEs)

Jean Bosco Nzitunga

Administration and Operations, International Criminal Court (ICC), Bangui Field Office, Bangui, Central African Republic (CAR)

Correspondence to: Jean Bosco Nzitunga, Administration and Operations, International Criminal Court (ICC), Bangui Field Office, Bangui, Central African Republic (CAR).

| Email: |  |

Copyright © 2019 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The importance of effective working capital management in enhancing an organisation’s profitability cannot be overemphasized. In Namibia, the profitability of several State-Owned Enterprises (SOEs) has constantly been the cause of taxpayers’ concern for the past few years as these SOEs have incessantly depended on Government bailouts. While a number of scholars have concentrated their research on understanding the relationship between working capital management (WCM) and an organisation’s profitability, the Namibian SOE context has not been empirically studied with regards to these aspects. The discovery of this absence of research therefore generated the following question: “what is the impact of working capital management practices on the profitability in Namibian State-Owned Enterprises?” To address this research question, an empirical investigation was conducted in 23 Namibian SOEs.

Keywords: Working capital, Profitability, State-Owned Enterprises

Cite this paper: Jean Bosco Nzitunga, Impact of Working Capital Management Practices on Profitability in State-Owned Enterprises (SOEs), Management, Vol. 9 No. 2, 2019, pp. 37-47. doi: 10.5923/j.mm.20190902.01.

Article Outline

1. Introduction

- The significance of working capital management in enhancing a firm’s profitability cannot be overemphasised. This emphasis is justified. First, the creation of stockholders’ equity greatly depends on how efficiently and effectively a firm manages its working capital (Dong & Su, 2010, p. 60). Second, given that “working capital management seeks to maintain an optimum balance of each working capital component thereby ensuring that firms operate with sufficient fund (cash flows) that will service their long-term debt and satisfy both maturing short-term obligations and upcoming operational expenses” (Qazi et al., 2011, p.11006). Therefore, it makes sense to underline the importance of effective working capital management in improving a firm’s profitability.In Namibia, there is a compelling narrative of the need for SOEs to improve their profitability. The poor performance in many Namibian SOEs in terms of profitability has been evidenced by continued yearly bailouts from the Government. One of the main determining factors of profitability is effective working capital management (Zubair & Muhammad, 2013, p. 384). After independence in 1990, the Namibian Government deemed it strategic and imperative to nationalize several strategic and key organisations/industries. In so doing, the Government’s aim was to maximize its regulatory powers over these industries whose revenues are considered very fundamental for the provision and advancement of required services to Namibian citizens, especially socio-political programmes. In the post-independence Namibia, the SOEs were thus perceived and expected to carry a crucial development objective. A good profitability of these organisations is deemed as a key element for the enhanced delivery of fundamental public services, as well as employment creation (Jauch, 2012, p. 2).However, the profitability and performance of several SOEs continue to raise concerns among taxpayers. The problem of SOEs squabbles have been acknowledged by the current Prime Minister Saara Kuugongelwa-Amadhila as a headache to the State finances. She stressed that, after more than two decades in operation, there are still SOEs in Namibia that are going about their business without as much as a thoroughly planned budget (Ndayanale, 2013, p. 18). Over the recent years, and often for wrong reasons, Namibian SOEs have been constant media headlines. With expectations of adequate returns, the Namibian Government continues to make gigantic investments in SOEs while a considerable number of these organisations continue to suffer losses on a yearly basis (Kangueehi, 2007, p. 23; Ndayanale, 2013, p. 19). These yearly massive bailouts from the Government are persistently raising heightened but unaddressed taxpayers’ anxieties and grumbles (Ndayanale, 2013, p.19). While several scholars have demonstrated that a positive relationship exists between a firm’s working capital management and its profitability (Rahman, 2011; Usama, 2012; Ali & Ali, 2012; Oladipupo & Okafor, 2013), there is a dearth of empirical research in this regard in the Namibian SOE context. The implication of this is that, in the context of Namibian SOEs, the link that is thought to be existent between these aspects is rather assumed than proven empirically. Therefore, this is still a stimulating avenue for research.

2. Literature Review

2.1. Defining Profitability

- Profitability is generally defined as “an organization’s ability to earn financial profit or gain” (Tauringana & Afrifa, 2013, p. 454). The success and growth of any business substantially depend on its profitability (Onwumere, Ibe & Ugbam, 2012, p. 192). Here, one can deduce that the long-term survival of a firm is very much dependent on its profitability. A firm’s net profit is the difference between the revenue and all its operating expenses (Oladipupo & Okafor, 2013). The key goal of any commercial entity is profit (Al-Debi’e, 2011, p. 76). The main point here is that, without making a profit, the business is likely to collapse at some point (Tauringana & Afrifa, 2013, p. 455). This then underlines the importance of profitability in a commercial entity. According to Mathuva (2010, p. 2), “although present profitability of an organization may be good, opportunities for growth should always be explored, since this offers opportunities for greater overall profitability and keeps or moves the corporation into the line of sight of analysts and potential or current investors.”A further interesting point is made by Al-Mwalla (2012) who argues that an understanding of a firm’s present profitability position is the key to the development of an effective growth strategy. Supporting this proposition, Oladipupo and Okafor (2013), as well as Mathuva (2010) underscore that it is imperative for a firm to identity and enhance the drivers of its profitability if it hopes to successfully achieve its goals. This is also supported by Abuzayed (2012), who underlines the complementarity between profitability and growth in determining a firm’s success. Abuzayed (2012) further notes that “profit is key to basic financial survival of a firm, while growth is key to profit and long-term success” (p. 156). Scholars such as Tauringana and Afrifa (2013), Akoto et al. (2013) and Raza, et al. (2015) have emphasized that profitability is positively influenced by working capital management, which is discussed in Section 2.2 below.

2.2. Working Capital Management

- According to Agyei and Yeboah (2011, p. 2), “working capital management refers to an organization's managerial accounting strategy designed to monitor and utilize the two components of working capital - current assets and current liabilities - to ensure the most financially efficient operation of the organization.” Al-Mwalla (2012, p. 147) and Onwumere at al. (2012, p. 193) concur and posit that the management of working capital management practices is concerned with the enhancement of the level of current assets through the adequate administration of current assets and current liabilities. Furthermore, Malik, Waseem and Kifayat (2011, p. 156) suggest that working capital management practices mainly seeks to strike an appropriate balance between the level of current assets and current liabilities. Several other scholars such as Hayajneh and Yassine (2011) as well as Karaduman, Akbas, Caliskan and Durer (2011, p. 63) also support the idea that working capital management practices involves the sustained insurance of an appropriate relationship between current assets and current liabilities. Mathuva (2010:3) also posits that the goal of working capital management practices is to ensure that the firm is able to continue its operations and that it has sufficient cash flows to satisfy both maturing short-term debt and upcoming operational expenses. Given that the maximisation of stockholders’ equity, which can only be achieved through profit maximization, is the core goal of a business (Hayajneh & Yassine 2011, p. 62), working capital management practices is a key aspect in this regard because effective profit maximisation is dependent on a firm’s ability to strike the right balance between current assets and current liabilities (Malik et al., 2011, p.156). This is in line with the notion of liquidity-profitability trade-off (Eljelly, 2004). Another attention-grabbing proposition is made by Sarkar and Sarkar (2013, p. 17) who advocate the need for the maintenance of an effective working capital policy by a firm, which is an “indication about how much working capital the firm should maintain should they go for zero risk management” (Aruldoss, Rajan, Jesus & Mohamed, 2013, p. 2). According to Stephen and Elvis (2011, p. 280), this “involves decisions about firm’s assets and liabilities, what they consist of, how they are used, and how their mix affects the risk versus return characteristics of the firm”.The importance of effective working capital policies in enhancing a firm’s profitability has also been underlined by a number of other authors (such as Karaduman et al., 2011; Malik et al., 2011; Sarkar & Sarkar, 2013). According to Oladipupo and Okafor (2013, p. 12), “there are two policies of working capital”. The first one is concerned with determining the appropriate total current assets level that the firm needs to hold at a given time. The second one “involves managing the relationships among types of assets and the way these assets are financed” (Stephen & Elvis, 2011, p. 281; Agyei & Yeboah, 2011, p. 2). Several scholars (Abuzayed, 2012; Malik et al., 2011; Sarkar & Sarkar, 2013, Tauringana & Afrifa, 2013; Akoto et.al, 2013; Raza et al., 2015) have studied the relationship between a firm’s working capital management practices and its profitability. These researchers postulated different working capital management practices dimensions that are key to enhanced profitability. Some scholars focused their studies on the impact of the optimal inventory management on profitability (Raza et al., 2015; Hamid & Waqar, 2013, Ghaziani & Zadeh, 2012), while others advanced account receivables management and account payables management as determinants of profitability (Barine, 2012; Ali & Ali, 2012; Arshad & Gondal, 2013). Similarly, while most studies found a positive influence of working capital management practices on profitability, some authors found a negative relationship in this regard (Jose, Lancaster & Stevens, 1996; Shin & Soenen, 1998). However, there is a general consensus that there is a relationship between working capital management practices and profitability (Abbasali & Milda, 2012; Mary, John & Laurie, 2010). For the purpose of this study, and based on the reviewed literature, four main dimensions of working capital management practices – namely cash management, debtor management, creditor management, and stock management - have been identified as key drivers of profitability.

2.2.1. Cash Management (CM)

- Cash management refers “to the management of an entity’s cash to ensure sufficient cash to sustain the entity’s daily operations, finance continued growth and provide for unexpected payments while not unduly forfeiting profit owing to excess cash holdings” (Mbroh, 2012, p. 40). On his part, Akinyomi (2014, p. 32) advances a rather short definition that cash management simply entails the adequate control of a firm’s inflows and outflows of cash, and further notes that it also involves the establishment of appropriate cash balances at any given time. Along the same line as this argument, Uwuigbe, Uwalomwa and Egbide (2011, p. 49), posit that “cash management entails taking the needed precautionary measures to ensure that adequate cash levels are maintained in the business so that the operational requirements could be met.” On the other hand, Amoako, Marfo, Gyau and Asamoah (2013, p. 189) note that “cash management is a rather broad term that refers to the collection, management of cash as well as the payment of cash from the business.” Underscoring the importance of adequate cash management, Bobitan and Mioc (2011, p. 302) put an emphasis on the costly nature of both too much cash and too little at hand in terms of interest expenses and the inability to meet short-term obligations as they fall due. As stated by Vijayakumar (2011, p. 168) and Eljelly (2004, p. 49), the trade-off theory of liquidity suggests that firms target an optimal level of liquidity to balance the benefit and cost of holding cash. Amoako et al. (2013, p.189) identify the low rate of return as one of the main costs of holding cash due to liquidity premium and probable tax disadvantage. On the other hand, Mbroh (2012, p. 40) identifies the benefits of holding cash. Mbroh (2012), notes that the first benefit is that of cost-saving on transaction related to raising funds. The second benefit is that firm can make use of the available cash in the event other sources of funding are expensive or simply unavailable. Furthermore Al-Mwalla (2012, p. 3), draws attention to the role of cash management in enhancing a firm’s outcomes. This is the same breath through which Stephen and Elvis (2011, p. 283) as well as Akinyomi (2014, p. 34) advise that firms should take advantage of the contemporary tools and techniques for cash management, in order to improve their profitability. In brief, the literature stresses that cash management is a financial discipline that uses the same principles, regardless of the type of business, size or age of an enterprise (Amalendu & Sri, 2011, p. 109; Mbroh, 2012, p. 41). The influence of an organisation’s cash management on its profitability has been demonstrated by several scholars (Bobitan & Mioc, 2011; Akinyomi, 2014; Mbroh 2012).

2.2.2. Debtor Management (DM)

- Debtor management is defined as a “collection of steps and procedures required to properly weigh the costs and benefits attached with the credit policies” (Akoto et al., 2013, p. 375). According to Ahmet and Emin (2012, p. 489), there is a number of benefits associated with allowing credit sales, including the fact that this incentivizes customers to acquire merchandise at times of low demand (Mbula, Memba & Njeru, 2016, p. 63), as much as it allows customers to check that the merchandise they receive is as agreed, ensures that the services contracted are carried out (Abuzayed, 2012, p. 159); and helps firms to strengthen long-term relationships with their customers (Al-Mwalla, 2012, p. 5). One of the key objectives of debtor management is to mitigate potential loss resulting from bad debts (Abuzayed, 2012), and an effective creditor policy is a fundamental aspect in this regard. Given its obvious role in guiding the management with regards to striking the right balance between liberal and strict credit and debtor control, credit policy has an important influence on debtor management (Al-Mwalla, 2012, p. 4). A liberal credit policy will result in increased sales and profitability, but it will also increase bad debt risk (Vijayakumar, 2011). In contrast, a strict credit policy will lead to increased liquidity and security, but to reduced profitability (Akoto et al., 2013, p. 377). Therefore, an appropriate balance needs to be ensured between profitability and liquidity through an adequate creditor policy and debtor management. In their studies, a number of authors (Akoto et al., 2013; Barine, 2012, Ali & Ali, 2012), have emphasized the existence of a positive relationship between debtor management and profitability.

2.2.3. Creditor Management (CrM)

- The literature defines creditor management as a “set of policies, procedures, and practices employed by an organization with respect to managing its trade credit purchases” (Arshad & Gondal, 2013, p. 387). Effective creditor management provides a positive contribution to a firm’s cash flow and improves its relationship with suppliers (Mensah-Agyei, 2012). Effective creditor management enables an organisation to minimize late payment costs such as penalties, interest charges, lost prompt payment discounts, payment to creditors before collecting from debtors (Enow & Kamala, 2016, p. 78). This proposition is supported by Arshad and Gondal (2013, p. 388) who hold that by ensuring well-run creditor management, the firm avoids these costs and saves money, and enhances its cash flow.In the words of Mbroh and Attom (2012, p. 37), “accounts payable are a major source of short-term financing for businesses provided that they delay payment as long as possible without damaging their credit rating or pay on the last day when payment is due to take advantage of cash discounts.” Interestingly, this idea of ensuring that payments to suppliers are delayed until the last day is echoed by Tauringana and Afrifa (2013, p. 454), who stress that this practice would provide an interest-free source of finance by re-investing these delayed funds into the business, as long as the firm does forfeit cash discounts. On their part, Mbawuni, Mbawuni and Nimako (2016, p. 54) rather puts an emphasis on the ability of effective creditor management practices to build trust between the firm and its suppliers. This aspect of enhanced trust-building is also underscored by Owolabi and Alu (2012, p. 57) who posit that this may allow the firm to benefit from better credit terms and improved networking with suppliers.What is also thought-provoking is the argument by Tauringana and Afrifa (2013, p. 455) who note that creditor management also effectively ensures that appropriate controls are in place to avoid errors such as duplicate payment, vendor fraud such as paying for goods not supplied, inefficient processes, late payment, all which do not only damage a firm’s reputation, but also undermine its viability. Owolabi and Alu (2012, p. 58) choose to focus on the risk management aspect by stressing that effective creditor management enhances the firm’s ability to detect fake or erroneous invoices, and to ensure that all invoices from supplier are accounted for. Enow and Kamala (2016, p. 79) accentuate that the importance of effective creditor management lies in enhancing a firm’s overall operational effectiveness. This is consistent with the suggestion that a firm may soon have problems settling suppliers’ invoices if its payables are too high (Mbawuni et al., 2016, p. 53) and “if the payables are too low, then the firm may be unwisely making early payments, thereby forfeiting the opportunity to re-invest (into the business) these funds used to make early payment” (Owolabi & Alu, 2012, p. 59). The above can have a negative effect on a number of a firm’s financial performance indicators such as the ‘current ratio’ and ‘payable days’ (Owolabi & Alu, 2012, p. 60). The relationship between creditor management has been evidenced by the studies by Arshad and Gondal (2013), Tauringana and Afrifa (2013), and Mbroh and Attom (2012).

2.2.4. Stock Management (SM)

- Raza et al. (2015, p. 287) define stock management as “the art and science of maintaining stock levels of a given group of items incurring the least cost consistent with other relevant targets and objectives set by management.” Efficient and effective stock management allows a firm to circumvent needless investment in inventories (Eneje, Nweze & Udeh, 2012, p. 351). This is consistent with the argument by Muninarayanaappa and Aggarwal (2013, p. 75) that failing to implement appropriate stock management mechanisms will eventually be detrimental to its profitability. While these scholars highlight disadvantages of excessive inventories, Panigrahi (2013, p. 108) interestingly argues that excessive inventories are advantageous. Panigrahi (2013) stresses that among other benefits, high inventory levels reduce the cost of possible interruptions in the production process or of loss of business due to the scarcity of products, reduce supply costs, and protect against price fluctuations. Taking a rather different standpoint from Panigrahi’s (2013) position, Sitienei and Memba (2015, p.112) contend that high inventory means blocking of funds and so it involves the interest cost, opportunity cost to the firm, storage costs such as insurance and obsolesce and movement of inputs from place of storage to the factory where the materials have to be finally used to convert them into finished goods. Here, the JIT (Just in Time) concept that is used in some countries (such as Japan) can lend inspiration to Namibian State-Owned firms on stock management. The concept ensures that stock is received when required. According to Muninarayanaappa and Aggarwal (2013, p. 74) and Eneje, et al. (2012, p. 351), excessive inventory levels represent an idle resource and an opportunity cost, and should be avoided as much as possible. Sekeroglu and Altan (2014) concur and stress that a firm should always seek to ensure an optimal and balanced level of investment in inventories. As underlined by Anichebe and Agu (2013, p. 94), effective stock management should aim at avoiding unnecessary inventory and maintaining suitable stock levels for optimum business operations. A firm needs to ensure that “orders are placed at the right time, from the right source, in the right quantity, and at the right price and quality” (Ogbo Onekanma & Ukpere, 2014, p.11). The literature underlines the influence of stock management on profitability (Raza et al., 2015; Hamid & Waqar, 2013, Ghaziani & Zadeh, 2012). It thus stands to reason that this is also the case in the context of Namibian State-Owned Enterprises.

2.2.5. Literature Gap

- Despite heightened interest by scholars in exploring the influence of working capital management practices on profitability (Bartlett, Vager, Lange, Erasmus, Herfer, Madiba et al., 2014; Akoto et al., 2013; Tauringana & Afrifa, 2013; Raza et al., 2015), there is a dearth of literature in this regard in the Namibian SOE context. Hence this literature gap has to be filled. By proposing a model of working capital management practices and its influence on profitability in Namibian State-Owned Enterprises, this study offers a notional support and contributes to fill the prevailing research gap in this regard.

3. Research Model and Hypotheses

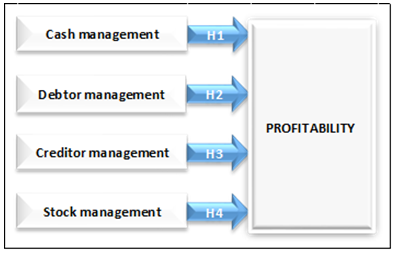

- Grounded on the problem statement and the reviewed literature, this study seeks to expand the body of knowledge in the area of working capital management practices by advancing and analysing a model which hypothesises working capital management practices (WCM) dimensions as determinants of profitability in Namibian State-Owned Enterprises. The research model is presented in Figure 3.1.

| Figure 3.1. Research Model (adapted from Nzitunga, 2015) |

4. Methodology

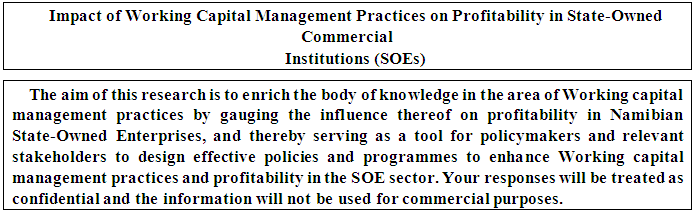

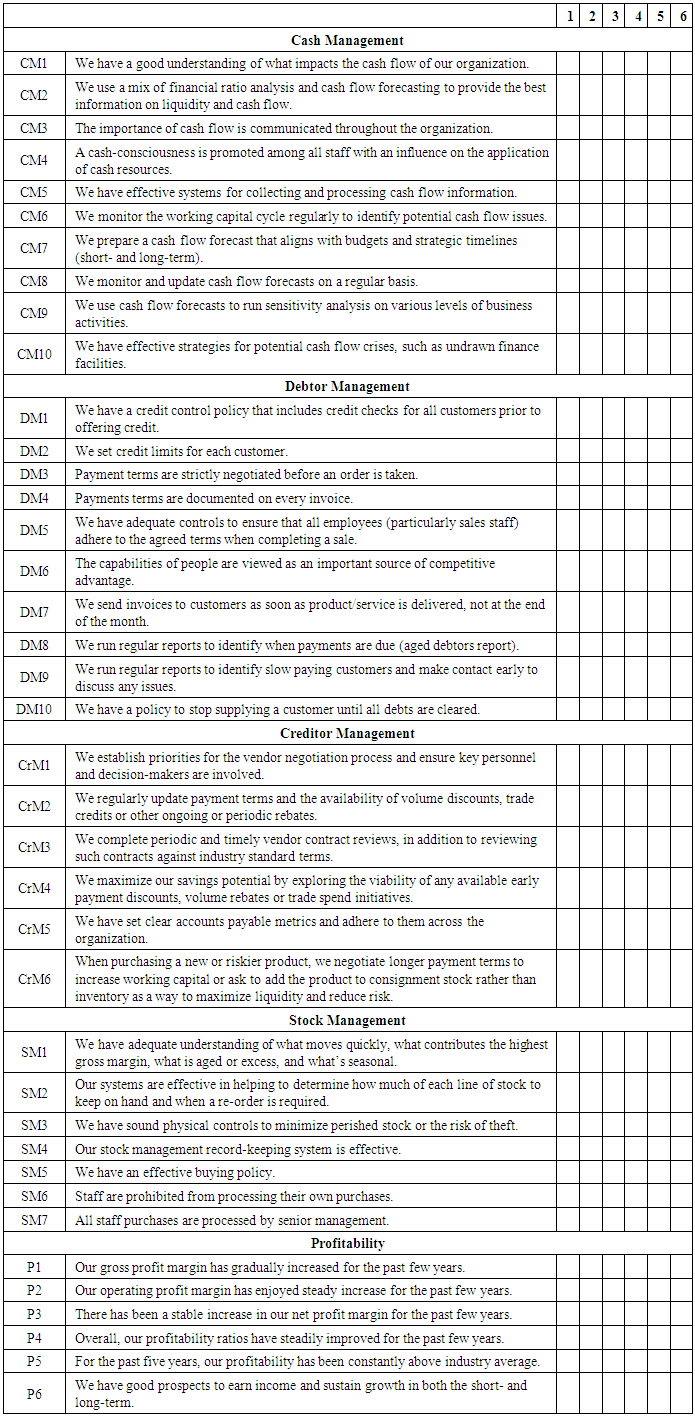

- This study used a quantitative approach to assess the influence of working capital management practices on profitability in Namibian State-Owned Enterprises. In a quantitative study, behaviours, attitudes, and perceptions are quantified through the generation of numerical data, and findings from a larger population sample are generalized (Bhattacherjee, 2012, p.113; Singleton & Straits, 2010). The population for this study comprised finance employees from 23 State-owned institutions. These institutions had a combined total of 125 finance employees countrywide and a 6-point Likert scale questionnaire survey was administered to all of them via e-mail. This method was preferred because it is quicker, cheaper, and allows respondents to comfortably respond to the questions at their own convenient time (Scheepers, 2007). While a sample of 125 respondents had been originally selected, only 100 questionnaires were successfully completed. The response rate was 80%.

4.1. Validity and Reliability

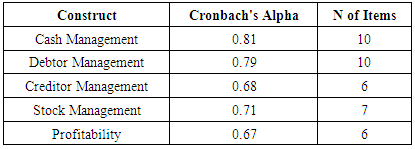

- The importance of evaluating the research instrument based on the “validity and reliability” criteria has been underscored (Cooper & Schindler, 2006). As stated by Scheepers (2007, p. 116), the data gathered in a research survey needs to be reliable and valid if the survey results are to be credible.For this study, face validity was ensured through the use of notional definitions and corroborated measuring instruments (Bhattacherjee, 2012; Scheepers, 2007), which were refined where necessary. Cronbach’s alpha coefficient was used as a measure of internal consistency-reliability of the scale used in this study. Cronbach’s alpha is a measure of internal reliability for multi-item summated rating scales. Its values range between 0 and 1, where the higher the score, the more reliable the scale. At a minimal level, scores ranging from 0.5 to 0.6 are deemed acceptable, while scores above 0.6 mean that the instrument is highly reliable (Bhattacherjee, 2012; Scheepers, 2007). The research instrument used for this study was reliable as shown in Table 4.1.

|

5. Findings and Discussion of Results

- Descriptive statistics, including mean and standard deviation, were used in this study. Given that ordinal data was collected, the relationships among the study variables were assessed using Spearman's correlation. As inferential statistics, the study used Partial Least Squares (PLS) regression analysis to determine the strength of each relationship hypothesized by the study model.

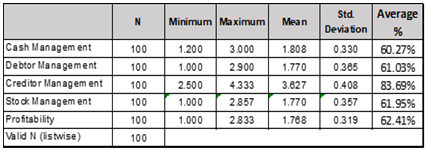

5.1. Descriptive Statistics

- The perceptions about cash management, debtor management, creditor management, stock management, and profitability are described in this section. The first step was to compute a composite score for each variable. To do this, the individual scores were totalled and an average score was calculated. Descriptive statistics of the composite variables are summarized in Table 5.1.

|

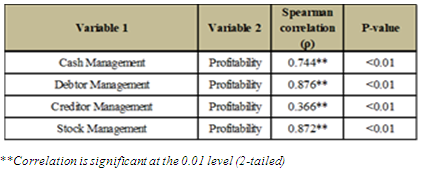

5.2. Correlations

- The relationships among the study variables were assessed using Spearman's correlation. Table 5.2 summarises the Spearman correlation coefficients (ρ) and p-values for the different variables.

|

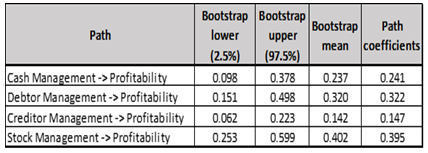

5.3. Partial Least Squares (PLS) Regression Analysis

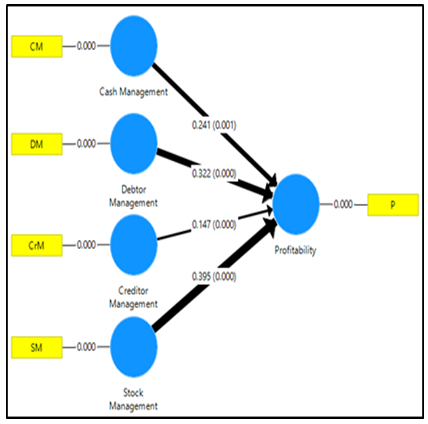

- The study made use of Partial Least Squares (PLS) regression analysis to determine the strength of each relationship hypothesized by the study model (Maitra & Yan, 2008; Abdi & Williams, 2013). The bootstrap confidence intervals utilised to gauge the statistical significance for the paths and path coefficients are presented in Table 5.3 below.

|

| Figure 5.1. Path, strength and significance of the path coefficients assessed by PLS (n=100) |

5.4. Summary of Key Findings

5.4.1. Influence of Cash Management on Profitability

- The first hypothesis, namely that there is a positive association between cash management and profitability in Namibian State-Owned Enterprises was confirmed by statistically significant path coefficients (γ = 0.241). These findings are consistent with the literature in Section 2.The managerial implications are that ensuring that there is good understanding of what impacts the cash flow of the organisation; use a of mix of financial ratio analysis and cash flow forecasting; communication of the importance of cash flow throughout the organisation; promotion of a cash-consciousness among all staff with an influence on the application of cash resources; effective systems for collecting and processing cash flow information; regular monitoring of the working capital cycle to identify potential cash flow issues; preparation of a cash flow forecast that aligns with budgets and strategic timelines; regular monitoring and updating of cash flow forecasts; use of cash flow forecasts to run sensitivity analysis on various levels of business activities; and effective strategies for potential cash flow crises, will lead to enhanced profitability in Namibian State-Owned Enterprises.

5.4.2. Influence of Debtor Management on Profitability

- The hypothesis that debtor management is likely to positively influence profitability in Namibian State-Owned Enterprises was also confirmed by statistically significant path coefficients (γ = 0.322). This means that an appropriate credit control policy that includes credit checks for all customers prior to offering credit; credit limits for each customer; strictly negotiated payment terms before an order is taken; documentation of payments terms on every invoice; adequate controls to ensure adherence to the agreed terms; recognition of people’s capabilities as an important source of competitive advantage; invoices sent to customers as soon as the product/service is delivered; regular reports to identify when payments are due; regular reports to identify slow paying customers; and a policy to stop supplying a customer until all debts are cleared, will contribute in enhancing profitability in Namibian State-Owned Enterprises. This is also in line with the literature reviewed in Section 2.

5.4.3. Influence of Creditor Management on Profitability

- The third hypothesis, namely that there is a positive link between creditor management and profitability in Namibian State-Owned Enterprises, is confirmed by statistically significant path coefficients (γ = 0.147). These findings are consistent with the literature in Section 2. The managerial implications are that the establishment of priorities for the vendor negotiation process and assurance that key personnel and decision-makers are involved; regular update of payment terms; periodic and timely vendor contract reviews; maximisation of savings potential by exploring the viability of various discounts; clear accounts payable metrics; and negotiation of adequate payment terms to maximize liquidity and reduce risk, will lead to improved profitability in Namibian State-Owned Enterprises.

5.4.4. Influence of Stock Management on Profitability

- Consistent with the literature reviewed in Section 2, the hypothesis which advanced that stock management is likely to be positively associated with profitability in Namibian State-Owned Enterprises was also confirmed by statistically significant path coefficients (γ = 0.395). What this implies is that ensuring an adequate understanding of stock items; effective stock management systems; sound physical controls; effective stock management record-keeping system; effective buying policy; prohibition to staff from processing their own purchases; and processing of all staff purchases by senior management, will enhance the profitability of Namibian State-Owned Enterprises.

6. Summary

- Working capital management practices is a crucial business dimension for enhanced profitability. Any firm requires enough resources to sustain its operations and needs to ensure that such resources are efficiently and effectively utilised to enhance its profitability and overall performance. Acknowledging the shortage of literature in this regard in the context of Namibian State-Owned Enterprises (SOE), this study has contributed in supplementing the body of knowledge in the field of working capital management practices by gauging the influence thereof on profitability in Namibian State-Owned Enterprises, and it is expected to serve as a guiding instrument for SOE managers and relevant stakeholders to formulate appropriate policies and programmes for the enhancement of working capital management practices and profitability in the SOE sector.

7. Conclusions

- The findings of this study show that profitability is positively influenced by cash management, debtor management, creditor management, and stock management. The study also found that, except for creditor management, the respondents were not satisfied with the current practices in terms of cash management, debtor management, and stock management. Without further organisational strategies aimed at enhancing these factors, the achievement of organisational objectives and goals will continue to raise concerns in the SOE sector. These aspects are measurable and consequently manageable. SOE managers and policy-makers should therefore ensure due improvement in this regard, and thus they will require relentless support from researchers and other pertinent stakeholders.Based on the findings of this study, managerial interventions should focus on enhancing cash management, debtor management, creditor management, and stock management. Although the findings of the study indicated high respondents’ satisfaction level with the existing creditor management practices, there is always room for improvement. Steps that can be immediately taken to address the current situation can include but are not limited to the following: strategic planning incorporated into all stages and aspects of working capital management practices; ensuring that key personnel have the required and relevant academic or professional training in the aspects of working capital management practices; comprehension of contemporary working capital management practices concepts and principles by the top management of relevant departments; objectively measuring performance in terms of working capital management practices activities; and ensuring that there is appropriate technology to effectively support contemporary working capital management practices. These recommendations will only be effective if there is a strong desire and commitment on the part of the SOE managers to actively work towards improvement in this regard and to avoid any political pressure that may seek to undermine these efforts. It is the hope of this study that by evaluating the present working capital management practices in Namibian State-Owned Enterprises, an avenue for change and transformation is possible.

ACKNOWLEDGEMENTS

- I wish to express my sincere appreciation and gratitude to the Management and Finance employees of the 23 Namibian SOEs for their kind participation and support.

Appendix 1: Research Questionnaire

For each of the statements below, please rate your answer and mark with (x) the appropriate box as follows:Strongly disagree (1); Disagree (2); Disagree moderately (3); Agree moderately (4); Agree (5); and Strongly agree (6).There are no “right or wrong” answers to these questions; so please be as honest and thoughtful as possible in your responses. All responses will be kept strictly confidential.

For each of the statements below, please rate your answer and mark with (x) the appropriate box as follows:Strongly disagree (1); Disagree (2); Disagree moderately (3); Agree moderately (4); Agree (5); and Strongly agree (6).There are no “right or wrong” answers to these questions; so please be as honest and thoughtful as possible in your responses. All responses will be kept strictly confidential.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML