Qing Hu1, 2

1Department of Economics, Kushiro Public University of Economics, Kushiro, Japan

2Research Fellow, Graduate School of Economics, Kobe University, Kobe, Japan

Correspondence to: Qing Hu, Department of Economics, Kushiro Public University of Economics, Kushiro, Japan.

| Email: |  |

Copyright © 2018 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Abstract

We compare the licensing mechanism of per-unit and ad valorem royalties in network industries. It is shown that the standard finding that an internal patentee always prefers an ad valorem royalty to a per-unit royalty may reverse by considering the network effect. When the network effect is sufficiently intense, a per-unit royalty may be superior to an ad valorem royalty. This finding is meaningful for the firms in network industries to reconsider how to use royalty licensing.

Keywords:

Network externality, Royalty licensing, Cournot duopoly

Cite this paper: Qing Hu, Network Externalities and Royalty Licensing, Management, Vol. 8 No. 4, 2018, pp. 95-98. doi: 10.5923/j.mm.20180804.01.

1. Introduction

Patent licensing agreements provide patent holders a return on the investment in their innovation and also allow the patent buyers to use new technology. Since the research of Kamien and Tauman (1986) first comparing the optimal licensing contract for a patent holder was published, discussions about the comparison on licensing policies have been done extensively. They consider that the patentee does not produce (an external patentee), and intend to license a cost-reduction innovation to an industry where firms produce a homogeneous product and compete in Cournot. They found that licensing by means of a fixed fee is superior to licensing by means of a per-unit royalty for the patentee. In contrast, by assuming that the patentee also produces (an internal patentee), then the theoretical literature has overwhelmingly showed that a per-unit royalty is superior to a fixed fee for the patentee. The discussion is provided in Wang (1998), Wang (2002), Kamien and Tauman (2002) and etc. Sen and Tauman (2007) analysed the two-part tariff mechanism which combines a per-unit royalty and an upfront fee. They showed that an internal patentee prefers using a pure per-unit royalty policy in a homogeneous good duopoly market. Recently, more and more studies report the importance of the licensing mechanism of ad valorem royalties. The empirical evidence shows the importance of the prevalence use of ad valorem royalties. For instance, Bousquet et al. (1998) examined the French data and showed that 96 percent of royalties in licensing contracts are ad valorem royalties. Lim and Veugelers (2002) showed that at least 20 percent of technology licensing agreements include some forms of ad valorem royalties. Niu (2013) reported that the medical company CSIRO in 2005 licensed an innovative medical device to Polynovo employing ad valorem royalties. Theoretically, San Martin and Saracho (2010) pointed the importance of ad valorem royalties and compared per-unit and ad valorem royalties. They showed the standard finding that in a homogeneous Cournot good duopoly market, an internal patentee always prefers the ad valorem royalties to a per-unit royalty. In addition, since Sen and Tauman (2007) showed that the internal patentee prefers using a pure per-unit royalty policy to the two-part tariff in a homogeneous good Cournot oligopoly market as stated above, thus San Martin and Saracho (2010) also proved that the ad valorem is superior to the two-part tariff. This result showed the strategic meaningfulness of ad valorem royalties. Network externality shows its importance as the fast development of network industries in recent years. For many goods, the utility obtained derived by one consumer of the good increases with the number of the other consumers of that good. There are many researches about how network externalities change the results under standard normal product market (Katz and Shapiro, 1985; Pal, 2014; Fanti and Buccella, 2016; Pal and Scrimitore, 2016). However, there is a lack of analysis about licensing by means of ad valorem royalties in network industries. We reexamine the results of San Martin and Saracho (2010) and aim at investigating whether the standard finding that the ad valorem royalties is superior to a per-unit royalty also holds when the Cournot competition occurs in network goods industries. We find that San Martin and Saracho (2010)’s result reverses by considering network effect. The internal patentee may prefer a per-unit royalty to valorem royalty when network effect is relatively intense. This finding is very meaningful. As the dramatic development of network industries, despite the fact that ad valorem royalties are widely observed in licensing contracts, the firms in network industries may be better reconsider the use of it. The reminder of this paper is organized as follows. Section 2 presents the model. Section 3 discusses the equilibrium outcomes in two royalty mechanisms. Finally, Section 4 concludes the study.

2. The Model

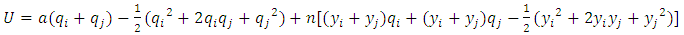

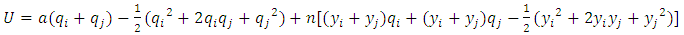

Consider a duopoly market where two firms 1 and 2 produce a homogeneous non-durable network good. Following the established literature (see, e.g, Pal, 2014; Fanti and Buccella, 2016; Pal and Scrimitore, 2016), we assume that the representative consumer utility function is given by:  | (1) |

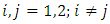

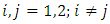

with  . Then, the inverse demand function can be derived as following:

. Then, the inverse demand function can be derived as following:  | (2) |

where  is a parameter that captures the size of the market.

is a parameter that captures the size of the market.  denotes the price of goods,

denotes the price of goods,  is the quantity of the goods produced by firm

is the quantity of the goods produced by firm  denotes the consumers’ expectation about firm i’s total sale. The parameter n and

denotes the consumers’ expectation about firm i’s total sale. The parameter n and  measures the strength of network effects-lower value n indicates weaker network externalities. We assume that firm 1 owns a patent on a non-drastic cost-reducing innovation. The firms produce the goods at a constant marginal cost which is c and

measures the strength of network effects-lower value n indicates weaker network externalities. We assume that firm 1 owns a patent on a non-drastic cost-reducing innovation. The firms produce the goods at a constant marginal cost which is c and  . The innovation reduces the marginal cost from c to zero. We consider a three stage game. At stage 1, the patentee (firm 1) sets a per-unit royalty or an ad valorem royalty on a take-it-or-leave-it basis. At stage 2, firm 2 decides whether or not to accept the offer from firm 1. At the final stage, both firms decide the outputs simultaneously.

. The innovation reduces the marginal cost from c to zero. We consider a three stage game. At stage 1, the patentee (firm 1) sets a per-unit royalty or an ad valorem royalty on a take-it-or-leave-it basis. At stage 2, firm 2 decides whether or not to accept the offer from firm 1. At the final stage, both firms decide the outputs simultaneously.

3. Patent Licensing Mechanisms

In this section, we intend to derive the outcomes under per-unit royalty and ad valorem royalty mechanism, and then compare which mechanism is preferred by the patentee considering network effect.

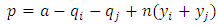

3.1. Per-unit Royalty Mechanism

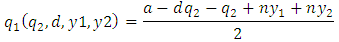

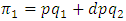

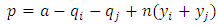

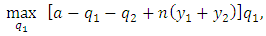

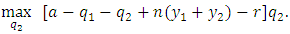

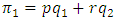

In this subsection, we consider that the patentee engages in a per-unit royalty mechanism only. Under a per-unit royalty licensing mechanism, firm 1 charges for the license a unit royalty fee r, thus the marginal cost of firm 2 with the license is r. Then at stage 3, firm 1 and 2 choose  and

and  to maximize the following profits, respectively:

to maximize the following profits, respectively:

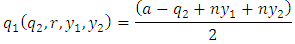

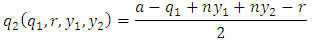

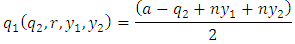

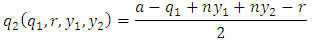

We obtain the reaction functions as following:

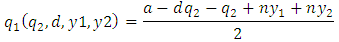

We obtain the reaction functions as following:  | (3) |

| (4) |

Then we consider the "rational expectations" conditions, which implies that in equilibrium  . Solving the best reaction functions in (3) (4) together with

. Solving the best reaction functions in (3) (4) together with  and

and  , then we have the equilibrium quantities and profits as following:

, then we have the equilibrium quantities and profits as following:  | (5) |

| (6) |

| (7) |

| (8) |

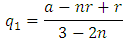

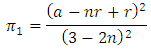

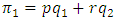

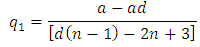

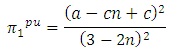

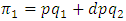

Firm 1’s total profit is  and if r is greater than c, firm 2 will not take the license. Therefore, substituting optimal

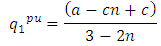

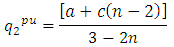

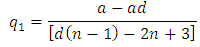

and if r is greater than c, firm 2 will not take the license. Therefore, substituting optimal  into (5) (6) (7) (8), we get the equilibriums:

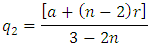

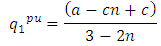

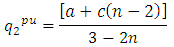

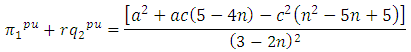

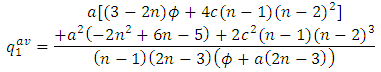

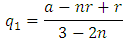

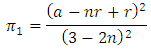

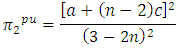

into (5) (6) (7) (8), we get the equilibriums: | (9) |

| (10) |

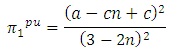

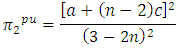

| (11) |

| (12) |

| (13) |

where the superscript  recalls that it is obtained under a per-unit royalty licensing mechanism.

recalls that it is obtained under a per-unit royalty licensing mechanism.

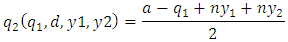

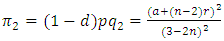

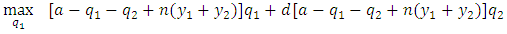

3.2. Ad Valorem Royalty Mechanism

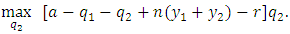

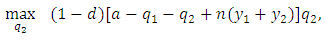

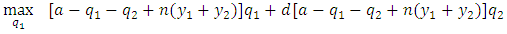

In this subsection, we consider that the patentee engages in an ad valorem royalty mechanism only. At stage 3, each firm chooses quantity to maximize its profit given the ad valorem royalty d, which is set at stage 1. Then the licensee firm 2 chooses  to maximize its following profit:

to maximize its following profit: and the patentee chooses

and the patentee chooses  to maximize:

to maximize:  We obtain the reaction functions as following:

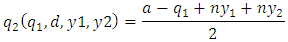

We obtain the reaction functions as following:  | (14) |

| (15) |

Solving the best reaction functions in (14) (15) together with  and

and  , then we have the equilibrium quantities as following:

, then we have the equilibrium quantities as following:  | (16) |

| (17) |

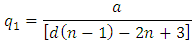

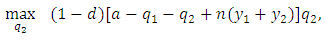

Firm 2 will buy the license if and only if his profits with the innovation are at least as high as those without the innovation, that is  . Therefore, at stage 1 firm 1 will set ad valorem d to maximize

. Therefore, at stage 1 firm 1 will set ad valorem d to maximize  subjecting to

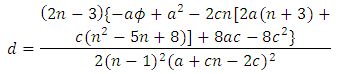

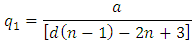

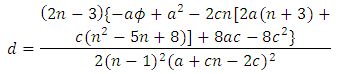

subjecting to  and (16) (17). Solving this problem, we get the ad valorem d:

and (16) (17). Solving this problem, we get the ad valorem d:  | (18) |

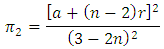

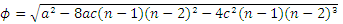

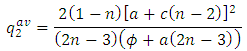

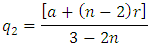

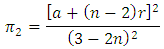

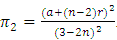

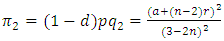

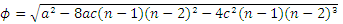

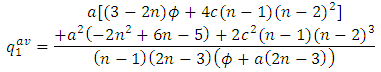

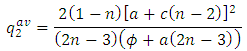

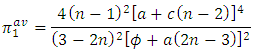

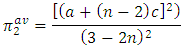

where  . By substituting for (18), then we can obtain the equilibrium quantities and profits as following:

. By substituting for (18), then we can obtain the equilibrium quantities and profits as following:  | (19) |

| (20) |

| (21) |

| (22) |

where the superscript  recalls that it is obtained under ad valorem royalty licensing mechanism.

recalls that it is obtained under ad valorem royalty licensing mechanism.

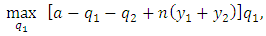

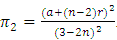

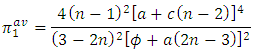

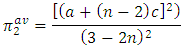

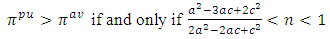

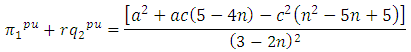

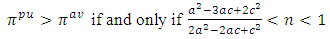

3.3. Comparison

In this subsection, we compare the profits of the patentee under a per-unit royalty and under an ad valorem. Then we get the following proposition. Proposition 1. The conventional wisdom that an ad valorem royalty is always superior to a per-unit royalty for the patentee (San Martin and Saracho, 2010) reverses if the network effect is sufficiently intense. Proof:  The intuition behind this result is as follows. In San Martin and Saracho (2010), the patentee’s profits which sets valorem royalty increase as the output price increases thus the patentee commits to behave less aggressive compared with the play under per-unit royalty. Therefore, the profits under valorem royalty are more than those under per-unit royalty for the patentee. However, as the network effect is stronger, it brings the more aggressive play more profits via consumers’ expectations. When the network effect is sufficiently intense, the profits of the patentee under valorem royalty become less than those under per-unit royalty. This result is very meaningful for the firms in network industries to reconsider the problem of licensing contract mechanism.

The intuition behind this result is as follows. In San Martin and Saracho (2010), the patentee’s profits which sets valorem royalty increase as the output price increases thus the patentee commits to behave less aggressive compared with the play under per-unit royalty. Therefore, the profits under valorem royalty are more than those under per-unit royalty for the patentee. However, as the network effect is stronger, it brings the more aggressive play more profits via consumers’ expectations. When the network effect is sufficiently intense, the profits of the patentee under valorem royalty become less than those under per-unit royalty. This result is very meaningful for the firms in network industries to reconsider the problem of licensing contract mechanism.

4. Conclusions

This paper compared the licensing mechanism of per-unit and ad valorem royalties in a duopoly market where firms produce a homogeneous network good. The paper shows that the standard finding that an internal patentee always prefers the ad valorem royalties to a per-unit royalty may reverse. When the network effect is sufficiently intense, a per-unit royalty may be superior to an ad valorem royalty. Corresponding to the widely observed presence of ad valorem royalties, our analysis reproves the importance of ad valorem royalties. When the network effect is not very strong, a valorem royalty is preferred by the patentee. However, when the network effect is sufficiently intense, firms in network industries are suggested to focus more on the use of a per-unit royalty than a valorem royalty licensing mechanism. In this paper, we only compared the licensing mechanism of per-unit and ad valorem royalties. The future extension could be considered by adding the licensing mechanism of a fixed fee and the two-part tariff together.

ACKNOWLEDGEMENTS

We are extremely grateful to anonymous referees and Prof. Mizuno Tomomichi, graduate school of Kobe university for their comments and suggestions that have substantially improved the quality of the paper.

References

| [1] | Bousquet, A., Cremer, H., Ivaldi, M., Wolkovicz, M. (1998). “Risk sharing in licensing.” International Journal of Industrial Organization, 16, 535–554. |

| [2] | Fanti, L. and D. Buccella (2016). “Network externalities and corporate social responsibility.” Economics Bulletin, 36, 2043–2050. |

| [3] | Kamien, M and Tauman, Y. (1986). “Fees versus royalties and the private value of a patent.” Quarterly Journal of Economics, 101, 471–491. |

| [4] | Kamien, M and Tauman, Y. (2002) “Patent licensing: the inside story.” The Manchester School, 70, 7–15. |

| [5] | Katz, M. and C. Shapiro (1985). “Network externalities, competition, and compatibility.” American Economic Review, 34, 424-440. |

| [6] | Lim, T. and Veugelers, R. (2002). “On Equity as a pament device in technology licensing with moral hazard.” Working Paper, Katholieke Universiteit Leuven. |

| [7] | Pal, R. (2014). “Price and quantity competition in network gods duopoly: a reversal result.” Economics Bulletin, 75, 1019-1027. |

| [8] | Pal, R. and M. Scrimitore (2016). “Tacit collusion and market concentration under network effects.” Economics Letters, 145, 266-269. |

| [9] | Niu, S. (2013). “The equivalence of profit-sharing licensing and per-unit royalty licensing.” Economic Modelling, 32, 10–14. |

| [10] | San Martin, M. and Saracho, A.I. (2010). “Royalty licensing.” Economics Letters, 107, 284–287. |

| [11] | Sen, D. and Tauman, Y. (2007). “General licensing schemes for a cost-reducing innovation.” Games and Economic Behavior, 59, 163–186. |

| [12] | Wang, X,H. (1998). “Fee versus royalty licensing in a Cournot duopoly model.” Economics Letters, 60, 55–62. |

| [13] | Wang, X,H. and Yang, B.Z. (1999). “On licensing under Bertrand competition.” Australian Economics Papers, 38, 106–119. |

. Then, the inverse demand function can be derived as following:

. Then, the inverse demand function can be derived as following:

is a parameter that captures the size of the market.

is a parameter that captures the size of the market.  denotes the price of goods,

denotes the price of goods,  is the quantity of the goods produced by firm

is the quantity of the goods produced by firm  denotes the consumers’ expectation about firm i’s total sale. The parameter n and

denotes the consumers’ expectation about firm i’s total sale. The parameter n and  measures the strength of network effects-lower value n indicates weaker network externalities. We assume that firm 1 owns a patent on a non-drastic cost-reducing innovation. The firms produce the goods at a constant marginal cost which is c and

measures the strength of network effects-lower value n indicates weaker network externalities. We assume that firm 1 owns a patent on a non-drastic cost-reducing innovation. The firms produce the goods at a constant marginal cost which is c and  . The innovation reduces the marginal cost from c to zero. We consider a three stage game. At stage 1, the patentee (firm 1) sets a per-unit royalty or an ad valorem royalty on a take-it-or-leave-it basis. At stage 2, firm 2 decides whether or not to accept the offer from firm 1. At the final stage, both firms decide the outputs simultaneously.

. The innovation reduces the marginal cost from c to zero. We consider a three stage game. At stage 1, the patentee (firm 1) sets a per-unit royalty or an ad valorem royalty on a take-it-or-leave-it basis. At stage 2, firm 2 decides whether or not to accept the offer from firm 1. At the final stage, both firms decide the outputs simultaneously.  and

and  to maximize the following profits, respectively:

to maximize the following profits, respectively:

We obtain the reaction functions as following:

We obtain the reaction functions as following:

. Solving the best reaction functions in (3) (4) together with

. Solving the best reaction functions in (3) (4) together with  and

and  , then we have the equilibrium quantities and profits as following:

, then we have the equilibrium quantities and profits as following:

and if r is greater than c, firm 2 will not take the license. Therefore, substituting optimal

and if r is greater than c, firm 2 will not take the license. Therefore, substituting optimal  into (5) (6) (7) (8), we get the equilibriums:

into (5) (6) (7) (8), we get the equilibriums:

recalls that it is obtained under a per-unit royalty licensing mechanism.

recalls that it is obtained under a per-unit royalty licensing mechanism.  to maximize its following profit:

to maximize its following profit: and the patentee chooses

and the patentee chooses  to maximize:

to maximize:  We obtain the reaction functions as following:

We obtain the reaction functions as following:

and

and  , then we have the equilibrium quantities as following:

, then we have the equilibrium quantities as following:

. Therefore, at stage 1 firm 1 will set ad valorem d to maximize

. Therefore, at stage 1 firm 1 will set ad valorem d to maximize  subjecting to

subjecting to  and (16) (17). Solving this problem, we get the ad valorem d:

and (16) (17). Solving this problem, we get the ad valorem d:

. By substituting for (18), then we can obtain the equilibrium quantities and profits as following:

. By substituting for (18), then we can obtain the equilibrium quantities and profits as following:

recalls that it is obtained under ad valorem royalty licensing mechanism.

recalls that it is obtained under ad valorem royalty licensing mechanism.  The intuition behind this result is as follows. In San Martin and Saracho (2010), the patentee’s profits which sets valorem royalty increase as the output price increases thus the patentee commits to behave less aggressive compared with the play under per-unit royalty. Therefore, the profits under valorem royalty are more than those under per-unit royalty for the patentee. However, as the network effect is stronger, it brings the more aggressive play more profits via consumers’ expectations. When the network effect is sufficiently intense, the profits of the patentee under valorem royalty become less than those under per-unit royalty. This result is very meaningful for the firms in network industries to reconsider the problem of licensing contract mechanism.

The intuition behind this result is as follows. In San Martin and Saracho (2010), the patentee’s profits which sets valorem royalty increase as the output price increases thus the patentee commits to behave less aggressive compared with the play under per-unit royalty. Therefore, the profits under valorem royalty are more than those under per-unit royalty for the patentee. However, as the network effect is stronger, it brings the more aggressive play more profits via consumers’ expectations. When the network effect is sufficiently intense, the profits of the patentee under valorem royalty become less than those under per-unit royalty. This result is very meaningful for the firms in network industries to reconsider the problem of licensing contract mechanism.  Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML