-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2018; 8(3): 86-93

doi:10.5923/j.mm.20180803.03

The Corporate Governance and Its Effect on the Marketing Performance Strategy in the Lebanese Banking Sector

Abir El Fawal 1, Allam Mawlawi 2

1Assistant Professor of Management at the Lebanese University, Faculty of Business, Lebanon

2Assistant Professor of Marketing at Jinan University, Faculty of Business, Lebanon

Correspondence to: Abir El Fawal , Assistant Professor of Management at the Lebanese University, Faculty of Business, Lebanon.

| Email: |  |

Copyright © 2018 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The following paper investigated the influence of the corporate governance on the marketing performance in the banking sector in North Lebanon. The researcher chose this topic to check the level of applied corporate governance in banks regardless their sizes, categories and financial structure; choosing banks as corporations to test the existing link between corporate governance and marketing performance is based on the fact that banks are really aware about applying the convenient corporate governance in order to maintain a stable profitability, a transparent financial procedures, a clear marketing approaches, an increased market share and a steady customer’s loyalty and satisfaction. Banks as corporations dynamically advertise their financial products and services and take good care of this issue in order to attract customers, win competitive advantages, enrich their products’ lines and enlarge their segments. In Lebanon all managerial, marketing and financial strategies are usually decided and set up by banks’ head offices and applied by branches, this means that strategies are prêt-á- porter methodologies for all other branches. The researcher chose the area of North Lebanon to investigate about this topic to measure how banks branches in this region deal with the idea of corporate governance and how well and professional do they apply it and to test if this governance is capable to affect pre-prepared marketing strategies applied in this area. The researcher used the quantitative deductive approach and a questionnaire of 15 Likert scale questions to investigate about this topic. The chosen sample consisted of 90 mid and top managers, supervisors and chief departments working in 18 different Alpha, Beta and Gama commercial Lebanese banking categories based on probabilistic sampling; the researcher secured confidentiality for banks and respondents names. This research proposed four components for banking corporate governance that affect the marketing performance in the banking sector; these components are information disclosure, information transparency, compensation of the marketing personal and the board performance. Results of this research confirmed that three components of the corporate governance affect the marketing performance of commercial banks in North Lebanon; these components are information disclosure, information transparency and the compensation of the marketing personal. The component of the board supervision performance is not found to impact the marketing performance in the banking sector.

Keywords: North Lebanon Banks, Corporate Governance, Marketing Performance

Cite this paper: Abir El Fawal , Allam Mawlawi , The Corporate Governance and Its Effect on the Marketing Performance Strategy in the Lebanese Banking Sector, Management, Vol. 8 No. 3, 2018, pp. 86-93. doi: 10.5923/j.mm.20180803.03.

Article Outline

1. Introduction

- Corporate governance can be defined as the strategic plans and decisions established by the board of directors with a primary goal to increase the organization overall performance and more specifically the financial results (Young & Thyil, 2014). All organizational managerial engagements in strategic decisions’ and governance have a significant impact on the marketing performance. Therefore, an adjustment in the organization’ marketing performance is directly interrelated to the effectiveness of the governance applied by organizations and corporations (Filatotchev, Toms, & Wright, 2006). The above facts prove that governance and marketing relationship is affected by numerous factors. The development of corporate governance is a fundamental factor to the universal economy because the right governance is connected with international and local competitiveness and strategies (Nwokah & Ahiauzu, 2010). Hence, governance is considered as a vital aspect that guarantees financial credibility, high marketing performance, social liabilities and objectivity in commercial reports. Consequently, governance’ strategies, applications and decisions are associated to the success of marketing activities and their performance in the market place. The importance of corporate governance on the corporate level has been developed as a set of rules and regulations applied in order to safeguard capitals, strategic efficiency, increase profitability for shareholders to accomplish business’s performance and to deliver credible and trustable data that enables the market share to make suitable investment decisions (Aidt, 2009).The corporate governance set rules and regulations for all the organizational integrated activities in order to guarantee institutional performance, customer’s efficiency, profitability and valuable service quality; such activities include marketing, promotion, finance, economics and accounting. Hence corporate governance may be defined as the execution of a certified and authorized inspection on the corporate’s financial records and managerial procedures (Claessens & Yurtoglu, 2013).Consequently, the significance of marketing performance is impacted by its functions and components in accomplishing a goal oriented mission and vision on both level, internal and external (Aguilera & Jackson, 2010). From an accounting perspective, corporate governance has an impact on marketing activities that are performed internally, this demonstrates its vital characteristics in processing perfection for marketing performance and work quality (Grönroos, 2009).Corporate governance has a lot of components affecting its performance and applications; to be able to determine how corporate governance can affect the marketing performance, it is a must to identify what are the real corporate governance performance components that effectively affect the marketing strategy performance (Rehman & Mangla, 2012).

2. Theoretical Framework

2.1. Corporate Governance

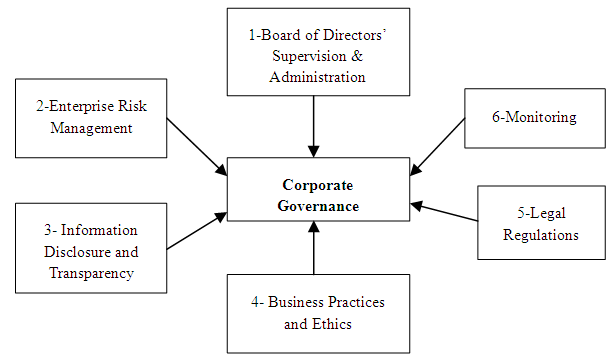

- From a theoretical perspective, corporate governance is based on comprehensive principles that are applied as an effective and efficient framework planned to support corporations’ profitability, performance, productivity, customers’ satisfaction and public interest. Corporate governance applied by commercial banks is used to develop an effective strategy, contribute to emerging and developed market shares, improve performance, secure engagement and develop awareness for institutional obligations, duties and responsibilities in the market (Andres & Vallelado, 2008). When good corporate governance is applied, the overall strategic performance will increase. It is a must for the board supervising corporations to ensure stable, profitable and trustable corporate governance performance.To guarantee effective corporate governance, it is a must to decide how the board is reacting and what steps, policies and approaches are to be applied. Corporate governance has specific components to be applied in order to guarantee its effectiveness and success.According to the OECD, researchers have developed a comprehensive framework setting six main components for the corporate governance. The objective of this framework is to eliminate uncertainty among stakeholders to decrease expenses, enhance performance, increase market shares and influence positively marketing strategies. The corporate governance main components are presented as below (OECD, 2004).

| Figure 1. Corporate Governance Components |

2.2. Marketing Performance

- Marketing performance can be defined as a method to measure the success of the marketing strategic planning activities to advertise products and services in the market. This facet can be discussed as the appraisal system of marketing activities (Taghian & Shaw, 2008). To be able to evaluate the marketing performance, it is important to know how corporations are governing the business. Marketing strategy performance has been developed as a function to investigate, assess and evaluate the applied organizational marketing activities. It proposes a standard model to measure the performance structure for an efficient corporate planning to maximize optimistic awareness, generate demand, in addition to perform a significant task in establishing the business major strengths and taking advantage of opportunities in the market (Morgan, 2012). Various researchers have set quantifiable outcomes as a scheme to evaluate the effectiveness and the success of their marketing procedures. The performance of marketing is found to be related to a variety of corporate governance factors, these factors are how the board of directors are governing the business, how much the used information in the marketing strategy is credible and how the marketing team is performing the job to advertise for organizational products and services (Morgan, Clark, & Gooner, 2002). Therefore, the evaluation of marketing performance is a must to identify needed adjustments and alterations to improve organizational image and leverage its performance related to sales; the evaluation of marketing performance has a positive impact on the company performance in terms of sales growth, profitability and companies' values (Morgan, 2012). When the marketing performance is proved, sales and market shares will increase, organizational reputation is enforced and the institutional brand name positioning will be stronger in the market; accordingly, marketing performance can be directed by an external or internal audit group (Morgan et al., 2002). A successful practice of marketing performance is related to the knowledge and expertise of the corporation, marketing inspection freedom and the validity of the inspection objectives and goals (Matari, Swidi, & Fadzil, 2014). In regards with the impact of the corporate governance for commercial banks on the marketing performance, a recent research showed that the most noticeable corporate governance factors affecting the marketing performance and its success are summarized as below (Lamoreaux, 2016).Ÿ The usage of appropriate administrative tactics while evaluating marketing activities and this can be related to the board of directors’ organizational performance and governance.Ÿ Sufficient financial remuneration and compensation for the internal workforce responsible to perform marketing activities and strategies.Ÿ Transparency in financial, economic, administrative and fiscal reports.Ÿ Disclosure of information related to financial and economical situations and activities.

2.3. Banking Corporate Governance and Marketing Performance

- Banking corporate governance is found to impact the marketing performance through information disclosure, information transparency, the good performance of the board supervising the organizational operations and activities and the marketing team compensation. A Reliable, consistent, trustworthy banking governance will ensure integrity and increase marketing performance success (El-Chaarani, 2014). Commercial banks governance should be professional to guarantee profitability for all parties including suppliers, shareholders customers and investors. Respectable and suitable banking governance is considered as a critical and essential factor that leverages the efficiency of marketing performance in the market. In other words, banking governance summarizes essential managerial, marketing, financial and economic objectives and values including the return on investment and all requirements encompassed in the corporate governance framework. Finally, banking corporate governance marketing strategies objective is to endorse promotions towards competitors to give customers the chance to make their decisions regarding the market banking products and services offerings.

3. Problem Statement, Conceptual Model & Hypotheses

3.1. Problem Statement

- Banking corporate governance affects all of managerial, marketing and financial functions, strategies and activities; one of the most important strategies the banking corporate governance affects is the marketing strategy performance.Banking governance represents fiscal managerial administrative actions that are used to promote equilibrium between the bank mission and objectives and the interest of customers, investors, stakeholders and shareholders.Governance aims to promote high corporate information and monetary transparency and disclosure, following up activities and strategies profitability, applying the right codes of monetary practices, managing and supervising the corporation performance through its board of directors.The problem of this paper is based on the fact of identifying what are the effective components of the corporate governance of North Lebanon commercial banks that impact the marketing performance strategy?

3.2. Conceptual Model & Hypotheses

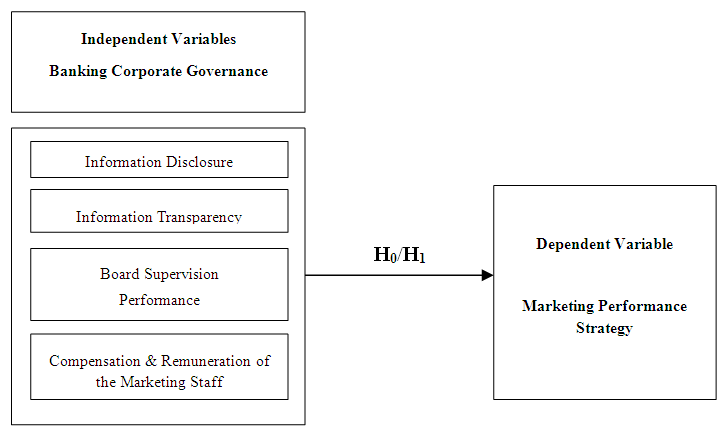

- The below model proposes 5 variables from which 4 are independent and 1 is dependent, it also use the null and the alternative research hypotheses.

| Figure 2. Conceptual Model of the Research |

4. Research Methodology

- In this paper the researcher followed the deductive quantitative approach. A questionnaire of 15 questions was distributed to 90 respondents occupying mid and top level positions in banks’ branches located in North Lebanon. Respondents were all managers and departments’ chiefs; all of questions followed the Likert scale except the descriptive questions.The researcher chose 18 banks located in North Lebanon regardless their banking category, value of total assets, market share size and official total reserve; 5 questionnaires were distributed in every bank. Chosen banks belong to different banking categories that are Alpha, Beta and Gama; the researcher chose 6 banks for every banking category and banks’ and respondents’ names will remain anonymous. Data collection was accomplished personally where the researcher was responsible to visit branches and contact respondents in person.The used questionnaire was pre-tested by the OECD and divided into three sections; the first one covered the population demographics information, the second section incorporated questions related to the implementation of corporate banking governance and the third section included questions that evaluate marketing strategies performance in relation with the banking corporate governance.

5. Findings and Results

- Findings of this paper are distributed into four parts; the first displays the Alfa Cronbach value, the second illustrates some descriptive information about the conducted population, the third part presents simple frequencies related to the corporate governance components and the last part illustrates a regression table.

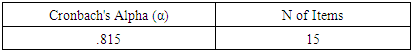

5.1. Alfa Cronbach Test

|

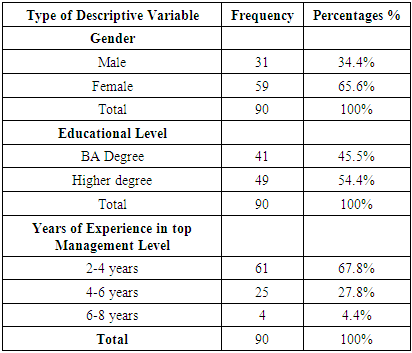

5.2. Demographics Results

- The below table will give a general overview about the demographic characteristics of the 90 investigated managers and chiefs.

|

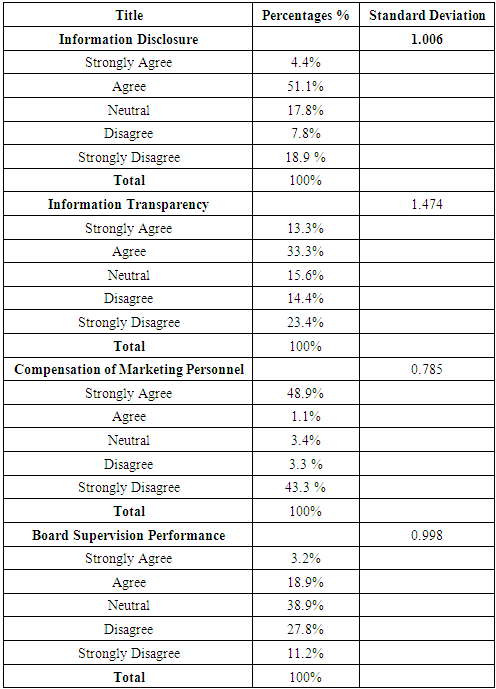

5.3. Corporate Governance Components Frequencies Affecting the Marketing Performance

- The table below investigates respondents’ opinion about the components of the banking corporate governance effectively impacting the marketing performance in the North Lebanon commercial banking sector.

|

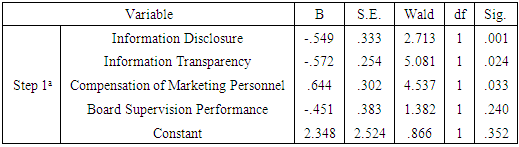

5.4. Regression Test

- This below table will be used to testify if the banking corporate governance components impact the marketing strategy performance in North Lebanon commercial banking sector.

|

6. Conclusions

- Results of the above investigation showed that information disclosure, information transparency and the compensation & remuneration of marketing personal as components of the banking corporate governance impact the marketing strategy performance in North Lebanon commercial banking sector and the component of board supervision does not impact the marketing performance.All of these results help in validating the proposed null and alternative hypotheses above, where alternative hypotheses- H1 for information disclosure, information transparency and the compensation & remuneration of marketing personal are accepted and the null hypotheses-H0 for these components are rejected and the null hypothesis-H0 for the board supervision is accepted and the alternative hypothesis-H1 for this component is rejected.The hypotheses validation will help in answering the problem statement of this investigation; the banking corporate governance components that are found to impact the performance of the marketing strategy in North Lebanon commercial banks are information disclosure, information transparency and the compensation of the marketing personal. This means that the marketing performance strategy is impacted by the transparency and credibility of the disclosed information used in the marketing of banking products and services; it is also affected by the level of remuneration marketing personal get. All of these factors seem to impact the performance of the marketing approaches and strategies applied in commercial banks in North Lebanon.The supervision performance applied by the board of directors in commercial banks can’t impact the performance of the marketing strategy since it is hard to reflect its professionalism, follow up, monitoring and commitment in marketing activities. Even when the workforce of the board in charge in commercial banks in the area of North Lebanon is professional, competent, skilled and knowledgeable this will stay invisible to the market; this will always be considered as internal key success factor for these banks but will remain unseen to the public. The board supervision professionalism in commercial banks can be shown to the market share when employees in banks are responsible to increase customers’ satisfaction and loyalty, proficiently serve clients, apply banking code of ethics, demonstrate customers’ intimacy, apply banking standards and laws, deal with financial and banking problems efficiently, increase institutional trust and rise customers’ ongoing commitment to banking products and services.

7. Recommendations

- In this paper the following recommendations are to be taken into consideration:- Insure valid and credible financial reports release and factual information disclosure to the public to guarantee the market institutional trust through marketing strategies promotions and advertisements.- Apply and openly declare both budgetary and monetary transparency policies by adopting international and local banking standardized code. - Make sure that marketing personals are getting enough salaries, compensations, remunerations and incentives to guarantee their creativity and innovation in marketing strategies; this can guarantee a steady level of novelty, originality, uniqueness and performance to the banking marketing strategy.- Guarantee a professional performance, supervision, and monitoring for the board governing banks by applying economic policies and regulations for financial statements and fiscal audit even if the board performance is not going to be visible enough in the marketing strategy.

8. Study Limitations and Future Studies

- The researcher wanted to address this investigation only to marketing directors and supervisors responsible of preparing , elaborating, executing and measuring marketing strategies performance; this was hard since this managerial level is located in banks Beirut head offices, it’s hard to find marketing supervisors in branches.As for future studies, the researcher wanted to enlarge this investigation to test if the corporate governance can impact banking institutional values and how it does so.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML