-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2018; 8(3): 71-79

doi:10.5923/j.mm.20180803.01

Manufacturer’s Quality Disclosure Strategy in a Dual-channel Supply Chain Considering the Impact of Information Acquisition

Deng Li, Zheng Jian-Guo, Zhao Rui-Juan

Glorious Sun School of Business & Management, Donghua University, Shanghai, China

Correspondence to: Zhao Rui-Juan, Glorious Sun School of Business & Management, Donghua University, Shanghai, China.

| Email: |  |

Copyright © 2018 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This study investigated how information acquisition may influence original brand manufacturer’s pricing and quality disclosure decision in a dual-channel supply chain, which includes an external non-brand manufacturer. In this paper we assumed only the brand manufacturer has the ability to disclose quality information and can choose to predict consumers’ quality preference through information acquisition. We described the demand of brand and non-brand products and obtained the terminal pricing, and the wholesale price pricing strategy of the brand manufacturer. We also investigated how brand manufacturer’s pricing and information disclosure decision are affected by information acquisition. Our results suggest that: brand manufacturer is more willing to disclose information to high type consumers than low type consumers; the willingness of brand manufacturer to disclose information decreases with the increase of the cost of non-brand products; retailer can’t get benefit from information acquisition, and the impact of information acquisition on brand manufacturer is related to market capacity; compared with non-acquisition, brand manufacturer will be more willing to disclose to high type consumers under information acquisition, while the willingness to disclose to the low type consumers is related to the market capacity.

Keywords: Information acquisition, Quality disclosure, Dual-channel, Supply chain

Cite this paper: Deng Li, Zheng Jian-Guo, Zhao Rui-Juan, Manufacturer’s Quality Disclosure Strategy in a Dual-channel Supply Chain Considering the Impact of Information Acquisition, Management, Vol. 8 No. 3, 2018, pp. 71-79. doi: 10.5923/j.mm.20180803.01.

Article Outline

1. Introduction

- Under the rapid development of information, information asymmetry is still an important issue in supply chain operation management. According to GEODIS, complete transparency in supply chain information has risen from sixth in 2015 to third in 2017 at the priority level of supply chain management strategies, but only 6% of companies have achieved that goal (GEODIS, 2017). In particular, consumer preferences are diversified and changing rapidly now. Therefore, it is very important for supply chain operation management to obtain effective demand information quickly. In addition, with the improvement of the quality of life, consumers are increasingly concerned about the quality of products. So, whether the product quality information can be transmitted to consumers accurately is also an important aspect that affects the operation of the supply chain.In this paper, we consider that there are two kinds of information asymmetry in supply chain: product quality information asymmetry and product preference information asymmetry. First of all, there is asymmetry of product quality information between manufacturers and consumers. Compared with consumers, manufacturers and retailers know more about product quality, that is to say, product quality is manufacturer’s private information. Especially for brand products, quality is an important aspect of brand cognition. Consumers’ expectations of product quality can influence their purchasing decisions. Therefore, the owner of quality information can consider whether to adopt information disclosure strategy to improve sales. Secondly, there is asymmetry of product preference information between manufacturers and consumers. Compared with retailers, manufacturers are far away from consumers and know little about consumer product preferences. Therefore, the consumer is the private party to the product preference information. Grasping customer preference information, especially when promoting new products or entering new markets, is of great significance for manufacturers to carry out product positioning and market planning. Therefore, manufacturers can get consumer preference information by consumer questionnaire survey and sample test, which can improve the accuracy of demand forecast and arrange product plan rationally. Thus, under these two kinds of information asymmetry, it is worth discussing whether manufacturer should obtain consumer preference information, how to trade off the information acquisition and the information disclosure strategies, and the influence of information acquisition on quality information disclosure. In this paper, we study brand manufacturer’s quality information disclosure strategies under the influence of information acquisition, in a dual-channel supply chain with a brand manufacturer and a non-brand manufacturer. We analyze manufacturer’s wholesale pricing strategy and disclosure strategy when brand manufacturer can and cannot use information acquisition. We also compare the profits of supply chain members and the conditions of quality information disclosure under the two circumstances, and obtain the influence of information acquisition on manufacturer’s information disclosure decision.This paper involves two aspects of literatures: information disclosure and information acquisition. The literatures about information disclosure mainly focus on the information disclosure strategy in a single-channel supply chain or between two terminals, and the influence of different factors on information disclosure decision. Guo (2009) (Guo, 2009b) studies the optimal disclosure strategies of manufacturer and retailer in single-channel supply chain, and compares the disclosure strategies of direct disclosure format

and retail disclosure format

and retail disclosure format  . On this basis, Guan (2015) (Guan & Chen, 2015) discusses the information disclosure strategy when manufacturer can decide product quality. Ghosh and Galbreth (2013) (Ghosh & Galbreth, 2013) studies the disclosure strategy of two terminals, considering consumer’s attentiveness and search decision, to investigate the impact of different variables on information disclosure. Zhou and Zhao (2016) (Zhou & Zhao, 2016) take "free-riding" into the analysis of quality information disclosure strategy, and discuss the effect of free-riding on the information disclosure strategy of a dual-channel supply chain with online channel. The study found that the better the effect of terminal free-riding, the manufacturer has lower the willingness to disclose. The researches about information acquisition also focus on single-channel supply chain. Guo (2009) (Guo, 2009a) creatively studies two kinds of effects of information acquisition: strategic effect and efficiency effect. He finds that when the cost is low and the manufacturer can’t observe the information acquisition, increasing the expected information acquisition cost may be beneficial to the retailer. Furthermore, Guo, et al (2010) (Guo & Iyer, 2010) studies manufacturer’s information acquisition and sharing strategies in sequential purchasing environment. It is concluded that if manufacturer can continuously acquires market information and disclose it to downstream retailer, even if the cost of acquire information is zero, manufacturer also choose not to acquire any information. In a more related literature, Guan (2017) (Guan & Chen, 2017) studies the joint marketing, pricing and ordering strategies of enterprises through the combination of information acquisition and quality disclosure, and finds that information acquisition would be detrimental to the manufacturer if the disclosure cost is too high.Through the review of the existing literatures, it can be found that most of scholars’ research on information acquisition and information disclosure is focused on single-channel supply chain. For the relevant literatures on dual-channel supply chain, in addition to some of the literature mentioned above, the current scholars focus on investigating channel structure ‘coordination mechanism ‘pricing decisions and members’ profits (Rodríguez & Aydın, 2015) in a dual-channel supply chain. However, few literatures study the information disclosure strategies of manufacturer under the influence of information acquisition in dual-channel supply chain. Therefore, on the basis of the existing literatures, we build a dual-channel supply chain model with a brand manufacturer, a retailer and a non-brand manufacturer, to study the quality information disclosure strategies of the brand manufacturer when he can obtain information to know the type of consumers. This study is different from the existing researches from the following three aspects. Firstly, this paper studies the information acquisition and disclosure strategies in a dual-channel supply chain, whereas Guan (2017) (Guan & Chen, 2017) studies the problem in a single-channel supply chain. Although Zhou and Zhao (2016) (Zhou & Zhao, 2016) investigate the retailer’s disclosure strategy in a dual-channel supply chain, the influence of information acquisition is not considered. Secondly, this paper investigates the influence of competitive products (non-brand products) on brand manufacturer’s information disclosure strategies. Thirdly, when the free-riding effect and brand value are taken into consideration, the model setting is different from the existing literatures (Ghosh & Galbreth, 2013; Zhou & Zhao, 2016). When the information is not disclosed, consumer has different expectations of the quality of the products from the two channels, which leads to different information disclosure strategies of the brand manufacturer.

. On this basis, Guan (2015) (Guan & Chen, 2015) discusses the information disclosure strategy when manufacturer can decide product quality. Ghosh and Galbreth (2013) (Ghosh & Galbreth, 2013) studies the disclosure strategy of two terminals, considering consumer’s attentiveness and search decision, to investigate the impact of different variables on information disclosure. Zhou and Zhao (2016) (Zhou & Zhao, 2016) take "free-riding" into the analysis of quality information disclosure strategy, and discuss the effect of free-riding on the information disclosure strategy of a dual-channel supply chain with online channel. The study found that the better the effect of terminal free-riding, the manufacturer has lower the willingness to disclose. The researches about information acquisition also focus on single-channel supply chain. Guo (2009) (Guo, 2009a) creatively studies two kinds of effects of information acquisition: strategic effect and efficiency effect. He finds that when the cost is low and the manufacturer can’t observe the information acquisition, increasing the expected information acquisition cost may be beneficial to the retailer. Furthermore, Guo, et al (2010) (Guo & Iyer, 2010) studies manufacturer’s information acquisition and sharing strategies in sequential purchasing environment. It is concluded that if manufacturer can continuously acquires market information and disclose it to downstream retailer, even if the cost of acquire information is zero, manufacturer also choose not to acquire any information. In a more related literature, Guan (2017) (Guan & Chen, 2017) studies the joint marketing, pricing and ordering strategies of enterprises through the combination of information acquisition and quality disclosure, and finds that information acquisition would be detrimental to the manufacturer if the disclosure cost is too high.Through the review of the existing literatures, it can be found that most of scholars’ research on information acquisition and information disclosure is focused on single-channel supply chain. For the relevant literatures on dual-channel supply chain, in addition to some of the literature mentioned above, the current scholars focus on investigating channel structure ‘coordination mechanism ‘pricing decisions and members’ profits (Rodríguez & Aydın, 2015) in a dual-channel supply chain. However, few literatures study the information disclosure strategies of manufacturer under the influence of information acquisition in dual-channel supply chain. Therefore, on the basis of the existing literatures, we build a dual-channel supply chain model with a brand manufacturer, a retailer and a non-brand manufacturer, to study the quality information disclosure strategies of the brand manufacturer when he can obtain information to know the type of consumers. This study is different from the existing researches from the following three aspects. Firstly, this paper studies the information acquisition and disclosure strategies in a dual-channel supply chain, whereas Guan (2017) (Guan & Chen, 2017) studies the problem in a single-channel supply chain. Although Zhou and Zhao (2016) (Zhou & Zhao, 2016) investigate the retailer’s disclosure strategy in a dual-channel supply chain, the influence of information acquisition is not considered. Secondly, this paper investigates the influence of competitive products (non-brand products) on brand manufacturer’s information disclosure strategies. Thirdly, when the free-riding effect and brand value are taken into consideration, the model setting is different from the existing literatures (Ghosh & Galbreth, 2013; Zhou & Zhao, 2016). When the information is not disclosed, consumer has different expectations of the quality of the products from the two channels, which leads to different information disclosure strategies of the brand manufacturer.2. Model

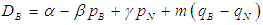

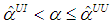

- This paper considers a two-tier supply chain, consisting of a brand manufacturer (he) and a retailer (she), as shown in figure 1. The brand manufacturer distributes his branded product to the retailer as wholesale price

, and the retailer sells brand product to the end consumer as price

, and the retailer sells brand product to the end consumer as price  through the brand channel. In addition, retailer obtains other non-branded products at cost c from a non-branded manufacturer (it) in an external market and sells them to consumers as price

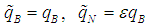

through the brand channel. In addition, retailer obtains other non-branded products at cost c from a non-branded manufacturer (it) in an external market and sells them to consumers as price  in another channel (non-branded channel). Although the products of the two channels are different in brand, they are functional substitutes for each other. This paper assumes that the quality of the products sold through the two channels is

in another channel (non-branded channel). Although the products of the two channels are different in brand, they are functional substitutes for each other. This paper assumes that the quality of the products sold through the two channels is  and

and  , respectively,

, respectively,  (Ghosh & Galbreth, 2013; Guo, 2009b) (

(Ghosh & Galbreth, 2013; Guo, 2009b) ( , B represents sales channels for branded products, N represents sales channels for non-branded products). The demand functions for the two channels are

, B represents sales channels for branded products, N represents sales channels for non-branded products). The demand functions for the two channels are  ,

, (Balasubramanian & Bhardwaj, 2004; Huang, Leng, & Parlar, 2013), respectively, where

(Balasubramanian & Bhardwaj, 2004; Huang, Leng, & Parlar, 2013), respectively, where  is the market capacity,

is the market capacity,  and

and  are the price elasticity of demand

are the price elasticity of demand  , and m represents consumer preferences for product quality (Acemoglu; & Ozdaglar, 2010). Consumers’ preference for product quality has two states:

, and m represents consumer preferences for product quality (Acemoglu; & Ozdaglar, 2010). Consumers’ preference for product quality has two states:  and

and  . m can take value

. m can take value  and

and  with probability

with probability  and

and  respectively

respectively  .

. | Figure 1. Model structure |

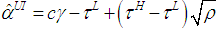

, which is standardized to 0 (Acemoglu; & Ozdaglar, 2010). Because information acquisition methods normally include customer questionnaires, sample tests, et al, which is easy to be observed. Thus we assume that retailer can observe the manufacturer’s information acquisition behavior. Besides information acquisition strategy, the brand manufacturer can also implement information disclosure strategy. This paper adopts direct disclosure format

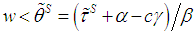

, which is standardized to 0 (Acemoglu; & Ozdaglar, 2010). Because information acquisition methods normally include customer questionnaires, sample tests, et al, which is easy to be observed. Thus we assume that retailer can observe the manufacturer’s information acquisition behavior. Besides information acquisition strategy, the brand manufacturer can also implement information disclosure strategy. This paper adopts direct disclosure format  (Guo, 2009b). Considering the cost of information disclosure, the brand manufacturer will disclose information to consumers only if the quality of the product is high enough

(Guo, 2009b). Considering the cost of information disclosure, the brand manufacturer will disclose information to consumers only if the quality of the product is high enough  . It is assumed that the brand manufacturer is the only one that has the ability to disclose information, and he can spend the cost z to disclose information through advertising, sending out samples and so on.We assume that the non-brand manufacturer cannot disclose quality information. However, non-brand manufacturer can disclose product information indirectly by free riding (Zhang, 2004), since it offers products similar to brand products. To some extent, consumers think that the quality of unbranded products is similar to the branded products, which means free-riding effect exists. Thus we use

. It is assumed that the brand manufacturer is the only one that has the ability to disclose information, and he can spend the cost z to disclose information through advertising, sending out samples and so on.We assume that the non-brand manufacturer cannot disclose quality information. However, non-brand manufacturer can disclose product information indirectly by free riding (Zhang, 2004), since it offers products similar to brand products. To some extent, consumers think that the quality of unbranded products is similar to the branded products, which means free-riding effect exists. Thus we use  to indicate the degree of free riding. However, due to the brand value, it has always been believed that the quality of brand goods is better than non-brand goods, i.e.,

to indicate the degree of free riding. However, due to the brand value, it has always been believed that the quality of brand goods is better than non-brand goods, i.e.,  .

.  represents consumers’ expectations of the products’ quality of channel i . d is used to indicate the information disclosure strategy,

represents consumers’ expectations of the products’ quality of channel i . d is used to indicate the information disclosure strategy,  . When brand manufacturer discloses information,

. When brand manufacturer discloses information,  . Then consumers update their expectations for branded products to

. Then consumers update their expectations for branded products to  , and for non-branded products to

, and for non-branded products to  because of free-riding effect. When the information is not disclosed,

because of free-riding effect. When the information is not disclosed,  . Consumers will expect the brand product quality to be average

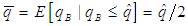

. Consumers will expect the brand product quality to be average  . Then we have

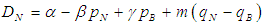

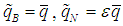

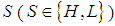

. Then we have  .Therefore, The game sequence involved in the model is: (1) the brand manufacturer acquires the distribution of consumer product preferences (

.Therefore, The game sequence involved in the model is: (1) the brand manufacturer acquires the distribution of consumer product preferences ( and

and  ); (2) the brand manufacturer decides whether to adopt the information acquisition strategy to obtain the information of the consumer’s product preference m; (3) he decides whether to adopt information disclosure strategy to disclose product quality information to end consumers; (4) the brand manufacturer sets wholesale price (w); (5) the retailer determines retail prices

); (2) the brand manufacturer decides whether to adopt the information acquisition strategy to obtain the information of the consumer’s product preference m; (3) he decides whether to adopt information disclosure strategy to disclose product quality information to end consumers; (4) the brand manufacturer sets wholesale price (w); (5) the retailer determines retail prices  and

and  based on wholesale prices provided by the manufacturers; (6) consumers make purchase decisions (see Figure 2).

based on wholesale prices provided by the manufacturers; (6) consumers make purchase decisions (see Figure 2). | Figure 2. Game timing diagram |

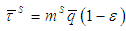

3. Retailer’s Pricing Strategy

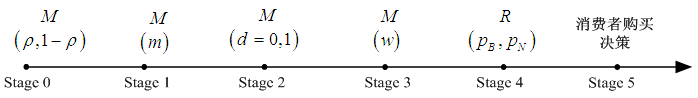

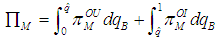

- Using reverse induction, we analyze the retailer’s pricing decision first. According to the dual-channel supply chain structure in Figure 1, the retailer’s profits come from brand channel and non-brand channel, which is given by

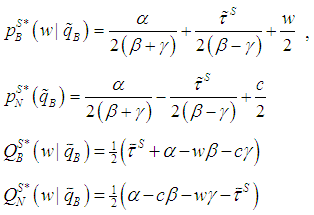

. The retailer decides the prices of the two channels simultaneously. The optimal prices of two channels can be obtained by maximizing the retailer’s profit, which is illustrated in Lemma 1.Lemma 1 The optimal prices and demand of brand channel and non-brand channel are given by

. The retailer decides the prices of the two channels simultaneously. The optimal prices of two channels can be obtained by maximizing the retailer’s profit, which is illustrated in Lemma 1.Lemma 1 The optimal prices and demand of brand channel and non-brand channel are given by where

where  , and the retailer’s participate constraints

, and the retailer’s participate constraints is satisfied.There are two types of consumer in the market, and the retailer will adopt different pricing strategies according to the type of consumer, which means price discrimination (Jing, 2016) exists. Lemma 1 shows that the retailer will set higher price for high-type consumer, i.e.,

is satisfied.There are two types of consumer in the market, and the retailer will adopt different pricing strategies according to the type of consumer, which means price discrimination (Jing, 2016) exists. Lemma 1 shows that the retailer will set higher price for high-type consumer, i.e.,  (

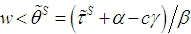

( ). In other words, when consumers care more about the quality of the product, they are more willing to pay a higher price for the product. In addition, in order to meet the retailer’s participation constraint, the brand manufacturer’s wholesale price w should ensure that the demand of brand channel is greater than or equal to 0, i.e.,

). In other words, when consumers care more about the quality of the product, they are more willing to pay a higher price for the product. In addition, in order to meet the retailer’s participation constraint, the brand manufacturer’s wholesale price w should ensure that the demand of brand channel is greater than or equal to 0, i.e.,  (it is easy to prove

(it is easy to prove  .).Based on the retail prices of the two channels determined by the retailer, we investigate the brand manufacturer’s quality information disclosure strategies with an without information acquisition.

.).Based on the retail prices of the two channels determined by the retailer, we investigate the brand manufacturer’s quality information disclosure strategies with an without information acquisition. 4. Information Disclosure Strategy with no Information Acquisition

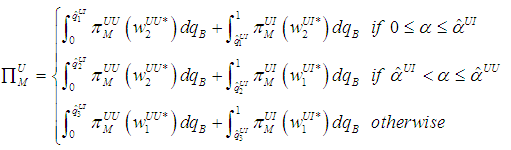

- Firstly, in this section we analyze the brand manufacturer’s information disclosure strategy when there is no information acquisition. When the brand manufacturer does not take the information acquisition action, he can only make the wholesale pricing decision and information disclosure strategy with uncertainty about the type of consumer.

4.1. Brand Manufacturer’s Wholesale Pricing Strategy

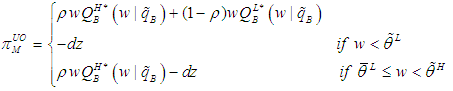

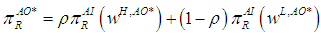

- After forecasting the retailer’s pricing strategy, the brand manufacturer makes the optimal wholesale pricing decision to maximize his profit. The brand manufacturer can’t obtain the type of consumer preference through information acquisition in this circumstance, thus his expected profit can be expressed as follows:

| (1) |

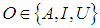

can be obtained, which is shown in Lemma 2. The superscript “OO” is used to denote the brand manufacturer’s information strategy,

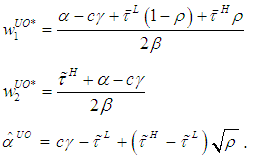

can be obtained, which is shown in Lemma 2. The superscript “OO” is used to denote the brand manufacturer’s information strategy,  , where “A” denotes information acquisition, “I” represents information disclosure, and “U” indicates that no strategy is adopted.Lemma 2 In the absence of information acquisition, the optimal wholesale pricing strategy of the brand manufacturer is:

, where “A” denotes information acquisition, “I” represents information disclosure, and “U” indicates that no strategy is adopted.Lemma 2 In the absence of information acquisition, the optimal wholesale pricing strategy of the brand manufacturer is: where

where When

When  , the demand in both high and low states is greater than 0 (i.e.,

, the demand in both high and low states is greater than 0 (i.e.,  ,

,  ). In other words, when wholesale price is low enough, the brand channel will meet two types of customers to buy brand product. In this situation, the brand manufacturer sets the wholesale price to

). In other words, when wholesale price is low enough, the brand channel will meet two types of customers to buy brand product. In this situation, the brand manufacturer sets the wholesale price to  and serves both high- and low- type customers. However, when the brand manufacturer raises the wholesale price to

and serves both high- and low- type customers. However, when the brand manufacturer raises the wholesale price to  , which can only satisfy

, which can only satisfy  , only high-type consumers buy products from the brand channel, i.e.,

, only high-type consumers buy products from the brand channel, i.e.,  ,

,  .When brand product’s wholesale price increases, the retailer’s costs rise, which will then lead to higher retail price. In this circumstance, only those consumers who have higher requirements for product quality or brand will continue to purchase branded products. In contrast, the low-type consumer will give up buying branded products because of the high price, and they will buy non-branded products for substitution. On the other hand, the brand manufacturer can also choose only to serve high-type consumers by raising wholesale prices. Moreover, Lemma 2 shows that, no matter whether the brand manufacturer discloses information or not, if the type of consumer is not obtained in advance, the brand manufacturer’s wholesale price will be segmented according to the different market capacity. Corollary 1 summarizes the relationship between market capacity and branded wholesale pricing decision in the condition of no information acquisition.Corollary 1 In the condition of no information acquisition:1) when the market capacity is large enough, i.e.,

.When brand product’s wholesale price increases, the retailer’s costs rise, which will then lead to higher retail price. In this circumstance, only those consumers who have higher requirements for product quality or brand will continue to purchase branded products. In contrast, the low-type consumer will give up buying branded products because of the high price, and they will buy non-branded products for substitution. On the other hand, the brand manufacturer can also choose only to serve high-type consumers by raising wholesale prices. Moreover, Lemma 2 shows that, no matter whether the brand manufacturer discloses information or not, if the type of consumer is not obtained in advance, the brand manufacturer’s wholesale price will be segmented according to the different market capacity. Corollary 1 summarizes the relationship between market capacity and branded wholesale pricing decision in the condition of no information acquisition.Corollary 1 In the condition of no information acquisition:1) when the market capacity is large enough, i.e.,  , the brand manufacturer will serve two types of consumers, and the higher the probability that the consumer type is high, the stronger the bargaining power the brand manufacturer will have (to set a higher wholesale price), i.e.,

, the brand manufacturer will serve two types of consumers, and the higher the probability that the consumer type is high, the stronger the bargaining power the brand manufacturer will have (to set a higher wholesale price), i.e.,  ;2) when the market capacity is relatively small, i.e.,

;2) when the market capacity is relatively small, i.e.,  , the brand manufacturer only chooses to serve high-type consumers.We can obtain

, the brand manufacturer only chooses to serve high-type consumers.We can obtain  from Lemma 2. As mentioned above, when the brand manufacturer raises wholesale price, low-type consumers will give up buying branded products, resulting in reduced demand. If he wants to increase demand by reducing wholesale price, the increase in demand due to reduced wholesale prices is limited when the market capacity is small. Therefore, it is better that the brand manufacturer only serves high-type customers by adopting higher wholesale price. When the market capacity is large enough, i.e.,

from Lemma 2. As mentioned above, when the brand manufacturer raises wholesale price, low-type consumers will give up buying branded products, resulting in reduced demand. If he wants to increase demand by reducing wholesale price, the increase in demand due to reduced wholesale prices is limited when the market capacity is small. Therefore, it is better that the brand manufacturer only serves high-type customers by adopting higher wholesale price. When the market capacity is large enough, i.e.,  , the demand increases more due to every unit of the reduced wholesale price. Hence, the brand manufacturer can attract both types of consumers to buy branded products by reducing his wholesale price to

, the demand increases more due to every unit of the reduced wholesale price. Hence, the brand manufacturer can attract both types of consumers to buy branded products by reducing his wholesale price to  , in order to earn higher profits. Furthermore, the higher the probability that the consumer in the market is a high type (i.e. the larger

, in order to earn higher profits. Furthermore, the higher the probability that the consumer in the market is a high type (i.e. the larger  is), the brand channel is more willing to serve consumers who can pay higher prices for branded products, which means the brand manufacturer’s bargaining power increases and he can set higher wholesale prices, i.e.,

is), the brand channel is more willing to serve consumers who can pay higher prices for branded products, which means the brand manufacturer’s bargaining power increases and he can set higher wholesale prices, i.e.,  .

.4.2. Information Disclosure Strategy

- Now we analyze the brand manufacturer’s quality information disclosure strategy. Since the brand manufacturer has to spend z to disclose information, he will disclose information only if the profit of disclosure

is greater than the profit of hiding information

is greater than the profit of hiding information  . Lemma 2 gives the wholesale pricing strategy when information is disclosed and not under the condition of no information acquisition. Specifically, when information is not disclosed

. Lemma 2 gives the wholesale pricing strategy when information is disclosed and not under the condition of no information acquisition. Specifically, when information is not disclosed  , consumers update their quality expectations for branded products to

, consumers update their quality expectations for branded products to  . Although the non-branded manufacturer is unable to disclose information, consumers update their expectations for the quality of non-branded goods to

. Although the non-branded manufacturer is unable to disclose information, consumers update their expectations for the quality of non-branded goods to  because of free riding. Now the optimal wholesale price for non-disclosure is

because of free riding. Now the optimal wholesale price for non-disclosure is , where

, where  ,

,  . Conversely, when information is disclosed

. Conversely, when information is disclosed  , consumers update their expectations for the quality of the two channels to

, consumers update their expectations for the quality of the two channels to  . In this circumstance, the optimal wholesale price is

. In this circumstance, the optimal wholesale price is  , where

, where  ,

,  . According to Formula (1) and Lemma 2, it is easy to obtain:

. According to Formula (1) and Lemma 2, it is easy to obtain: Therefore, the information disclosure strategy of the manufacturer in this state can be obtained by

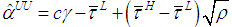

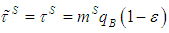

Therefore, the information disclosure strategy of the manufacturer in this state can be obtained by  , which is summarized in Conclusion 1.Conclusion 1 Under the condition of no information acquisition, the brand manufacturer are willing to disclose information if and only if

, which is summarized in Conclusion 1.Conclusion 1 Under the condition of no information acquisition, the brand manufacturer are willing to disclose information if and only if  , i.e., the quality of brand products is high enough, in which

, i.e., the quality of brand products is high enough, in which According to conclusion 1, the brand manufacturer will disclose the information only when the quality is high enough

According to conclusion 1, the brand manufacturer will disclose the information only when the quality is high enough  . Since the manufacturer cannot obtain the type of consumer’s quality preference in advance through information acquisition, the quality information disclosure strategy of the manufacturer is related to the market capacity under this mode, and it is a segmented strategy. When the market capacity is large enough, i.e.,

. Since the manufacturer cannot obtain the type of consumer’s quality preference in advance through information acquisition, the quality information disclosure strategy of the manufacturer is related to the market capacity under this mode, and it is a segmented strategy. When the market capacity is large enough, i.e.,  , the brand manufacturers serve both high- and low- type consumer when information is or isn’t disclosed, and the disclosure threshold is

, the brand manufacturers serve both high- and low- type consumer when information is or isn’t disclosed, and the disclosure threshold is  . When market capacity is small, i.e.,

. When market capacity is small, i.e.,  , he only serves high type. As high-type consumers concern more about quality, the brand manufacturer’s willingness to disclose increases and the disclosure threshold decreases to

, he only serves high type. As high-type consumers concern more about quality, the brand manufacturer’s willingness to disclose increases and the disclosure threshold decreases to  , and

, and  . When

. When  , he faces different customer groups when disclosing and not disclosing information, and the disclosure threshold is adjusted to

, he faces different customer groups when disclosing and not disclosing information, and the disclosure threshold is adjusted to  .

.5. Information Disclosure Strategy with Information Acquisition

- If the brand manufacturer can acquire information through some methods like customer surveys in stage 1 in Figure 2, then he can make the information-disclosure decision in the presence of knowing consumer preference. Under the condition of information acquisition, the retailer’s pricing strategy remains unchanged, which is shown in Lemma 1. This section analyzes the information disclosure strategies of the brand manufacturer under the condition of information acquisition.

5.1. Brand Manufacturer’s Wholesale Pricing Strategy

- In this circumstance, the brand manufacturer can predict the type of consumer preference

through information acquisition. Then he can adjust his wholesale pricing decisions according to the existing knowledge about customers. So the brand manufacturer’s profit maximization problem is derived from the following:

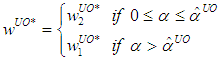

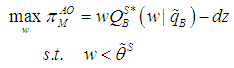

through information acquisition. Then he can adjust his wholesale pricing decisions according to the existing knowledge about customers. So the brand manufacturer’s profit maximization problem is derived from the following: Thus, the brand manufacturer’s optimal wholesale pricing strategy can be obtained. See Lemma 3.Lemma 3 Under the condition of information acquisition, the optimal wholesale pricing strategy of the brand manufacturer is

Thus, the brand manufacturer’s optimal wholesale pricing strategy can be obtained. See Lemma 3.Lemma 3 Under the condition of information acquisition, the optimal wholesale pricing strategy of the brand manufacturer is  .When the brand manufacturer can predict the type of consumer preference through information acquisition, if the consumer is a high type, he will set a higher wholesale price

.When the brand manufacturer can predict the type of consumer preference through information acquisition, if the consumer is a high type, he will set a higher wholesale price . Conversely, if the consumer preference type is low, he can only choose a low wholesale price

. Conversely, if the consumer preference type is low, he can only choose a low wholesale price  . When he faces the same type of consumers, the wholesale price when information is disclosed is higher than that when information is not disclosed, i.e.,

. When he faces the same type of consumers, the wholesale price when information is disclosed is higher than that when information is not disclosed, i.e.,  . This is because the brand manufacturer will choose to disclose information only when the quality of the product is good enough. On the one hand, he needs to raise the wholesale price to make up for the cost of information disclosure; on the other hand, the disclosure of high-quality information can help the brand manufacturer have a higher bargaining power.

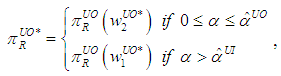

. This is because the brand manufacturer will choose to disclose information only when the quality of the product is good enough. On the one hand, he needs to raise the wholesale price to make up for the cost of information disclosure; on the other hand, the disclosure of high-quality information can help the brand manufacturer have a higher bargaining power.5.2. Information Disclosure Strategy

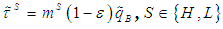

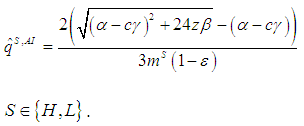

- Under the condition of information acquisition, the threshold of information disclosure for different types of customers will also be different. When the customer type is S, the brand manufacturer will disclose the information if and only if

. Now we have

. Now we have  . Similarly to 4.2, the disclosure threshold in this circumstance can be derived by comparing the brand manufacturer’s disclosure and non-disclosure profits when information acquisition is adopted.Conclusion 2 At the premises of information acquisition, the brand manufacturer will disclose information if and only if

. Similarly to 4.2, the disclosure threshold in this circumstance can be derived by comparing the brand manufacturer’s disclosure and non-disclosure profits when information acquisition is adopted.Conclusion 2 At the premises of information acquisition, the brand manufacturer will disclose information if and only if  , when he can predict the type of consumers is, where

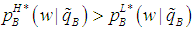

, when he can predict the type of consumers is, where Similar to the information disclosure strategy under the condition of no information acquisition, the manufacturer is willing to disclose information only when the quality of the product is high enough. The difference is that the brand manufacturer can make different disclosure strategies for different types of consumers, because he can predict the types of consumers through information acquisition. In other words, when he predicts the customer is high-type, the disclosure threshold is

Similar to the information disclosure strategy under the condition of no information acquisition, the manufacturer is willing to disclose information only when the quality of the product is high enough. The difference is that the brand manufacturer can make different disclosure strategies for different types of consumers, because he can predict the types of consumers through information acquisition. In other words, when he predicts the customer is high-type, the disclosure threshold is  . Similarly, when the consumer is low-type, the disclosure threshold will be adjusted to

. Similarly, when the consumer is low-type, the disclosure threshold will be adjusted to  . Therefore, information acquisition can help the manufacturer to clarify the target customers that receive information, and improve the efficiency of information disclosure. Furthermore, by comparing the information disclosure strategies set for the high- and low- type consumers, we can get corollary 2.Corollary 2 When the brand manufacturer can obtain information before disclosure, 1) he prefers to disclose information to high-type consumers, i.e.,

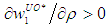

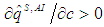

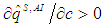

. Therefore, information acquisition can help the manufacturer to clarify the target customers that receive information, and improve the efficiency of information disclosure. Furthermore, by comparing the information disclosure strategies set for the high- and low- type consumers, we can get corollary 2.Corollary 2 When the brand manufacturer can obtain information before disclosure, 1) he prefers to disclose information to high-type consumers, i.e., ;2) the higher the cost for the retailer to get non-branded products, the less willing the brand manufacturer is to disclose information, i.e.,

;2) the higher the cost for the retailer to get non-branded products, the less willing the brand manufacturer is to disclose information, i.e.,  .As mentioned above, high-type consumers pay more attention to the quality. Therefore, when the brand manufacturer can predict customers are high type, disclosing information to them will help attract more high-type customers and boost demand. However, if the consumers are low type, who care less about quality, even if the brand manufacturer spends lots of money disclosing quality information, the increase in demand will be very limited. In other words, the increase in demand for unit disclosure cost is relatively small. As a result, the brand manufacturer are more likely to disclose information to high-type consumer, i.e.,

.As mentioned above, high-type consumers pay more attention to the quality. Therefore, when the brand manufacturer can predict customers are high type, disclosing information to them will help attract more high-type customers and boost demand. However, if the consumers are low type, who care less about quality, even if the brand manufacturer spends lots of money disclosing quality information, the increase in demand will be very limited. In other words, the increase in demand for unit disclosure cost is relatively small. As a result, the brand manufacturer are more likely to disclose information to high-type consumer, i.e.,  . In practice, it is easy to observe that most band manufacturers will provide more experience services when they can target their customers. Take cosmetics industry as an example. Many famous cosmetics companies, such as Estēe Lauder, Clarins, Lancôme, et al, choose to display their products in big mall. Through information acquisition like market and customer research, these brand companies know that there are more customers who prefer high quality products in big mall than some other small shops. They hence provide some experience services such as trying samples, consulting, et al, to disclose the quality information of their products. In addition, from

. In practice, it is easy to observe that most band manufacturers will provide more experience services when they can target their customers. Take cosmetics industry as an example. Many famous cosmetics companies, such as Estēe Lauder, Clarins, Lancôme, et al, choose to display their products in big mall. Through information acquisition like market and customer research, these brand companies know that there are more customers who prefer high quality products in big mall than some other small shops. They hence provide some experience services such as trying samples, consulting, et al, to disclose the quality information of their products. In addition, from  we can know that the brand manufacturer’s disclosure decision is influenced by the wholesale price made by the non-brand manufacturer to some extent. Because of the substitutability of brand products and non-brand products, there is a competitive relationship between them. Brand manufacturer can publicize the advantages of their products to consumers through information disclosure in order to achieve the purpose of capturing consumers from the non-brand channel. However, as the cost of the retailer acquiring non-branded products increases, the retail price in no-branded channel rises, too. The difference between unbranded products’ and branded products’ prices becomes small. Then even if the brand manufacturer does not disclose information, there will be some consumers switching to branded products. In this case, the brand manufacturer’s willingness to disclose will be lower.

we can know that the brand manufacturer’s disclosure decision is influenced by the wholesale price made by the non-brand manufacturer to some extent. Because of the substitutability of brand products and non-brand products, there is a competitive relationship between them. Brand manufacturer can publicize the advantages of their products to consumers through information disclosure in order to achieve the purpose of capturing consumers from the non-brand channel. However, as the cost of the retailer acquiring non-branded products increases, the retail price in no-branded channel rises, too. The difference between unbranded products’ and branded products’ prices becomes small. Then even if the brand manufacturer does not disclose information, there will be some consumers switching to branded products. In this case, the brand manufacturer’s willingness to disclose will be lower.6. The Impact of Information Acquisition

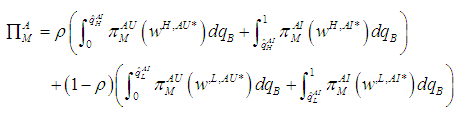

- The profits of the brand manufacturer and the retailer, and the disclosure strategies change when information acquisition is implemented. Therefore, this section examines the specific impact of information acquisition from two aspects: the profits of supply chain members and disclosure thresholds.

6.1. The Impact on Supply Chain Members’ Profits

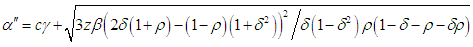

- From Conclusion 1 and Conclusion 2, we know that the brand manufacturer will disclose information only when product quality

is greater than a certain threshold

is greater than a certain threshold  , no matter whether information acquisition strategy is adopted. When

, no matter whether information acquisition strategy is adopted. When  , the brand manufacturer can get the profit

, the brand manufacturer can get the profit  after information disclosure, while he can obtain the profit

after information disclosure, while he can obtain the profit  when holding information at

when holding information at  . We can get the brand manufacturer’s equilibrium profit by

. We can get the brand manufacturer’s equilibrium profit by  (Guo, 2009b). Thus, under the condition of no information acquisition, the equilibrium profit of the brand manufacturer is given by:

(Guo, 2009b). Thus, under the condition of no information acquisition, the equilibrium profit of the brand manufacturer is given by: Similarly, at the premises of information acquisition, the equilibrium profit of manufacturer is:

Similarly, at the premises of information acquisition, the equilibrium profit of manufacturer is: The wholesale price offered to the retailer with and without information acquisition is

The wholesale price offered to the retailer with and without information acquisition is  and

and  , respectively. Thus, if the brand manufacturer does not adopt information acquisition strategy, the retailer’s profit is:

, respectively. Thus, if the brand manufacturer does not adopt information acquisition strategy, the retailer’s profit is: where

where  . The expected profit of retailer in the presence of information acquisition is

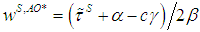

. The expected profit of retailer in the presence of information acquisition is  . By comparing the equilibrium profits of the brand manufacturer and the retailer under the two conditions, we can get the influence of information acquisition on the profits of supply chain members. See Conclusion 3Conclusion 3 If the brand manufacturer can adopt information acquisition:1) when

. By comparing the equilibrium profits of the brand manufacturer and the retailer under the two conditions, we can get the influence of information acquisition on the profits of supply chain members. See Conclusion 3Conclusion 3 If the brand manufacturer can adopt information acquisition:1) when  or

or  , the brand manufacturer can obtain more profits through information acquisition, i.e.,

, the brand manufacturer can obtain more profits through information acquisition, i.e., ; otherwise, information acquisition is disadvantageous to the brand manufacturer.2) no matter whether the brand manufacturer adopts information disclosure, the manufacturer’s behavior of information acquisition is bad for the retailer, i.e.,

; otherwise, information acquisition is disadvantageous to the brand manufacturer.2) no matter whether the brand manufacturer adopts information disclosure, the manufacturer’s behavior of information acquisition is bad for the retailer, i.e.,  .From Conclusion 3, it is shown that the impact of information acquisition on the brand manufacturer and the retailer is different. For the brand manufacturer, when the market capacity meets certain conditions, i.e.,

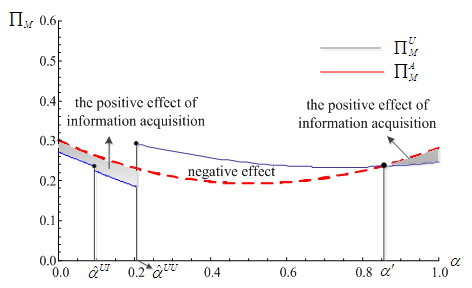

.From Conclusion 3, it is shown that the impact of information acquisition on the brand manufacturer and the retailer is different. For the brand manufacturer, when the market capacity meets certain conditions, i.e.,  or

or  , we have

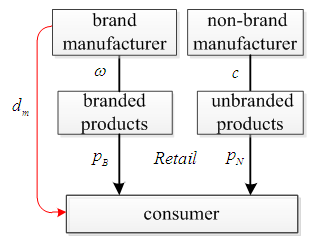

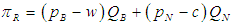

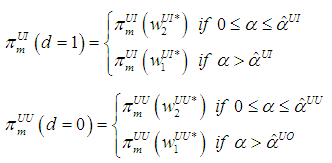

, we have  . Figure 3 illustrates the comparison of the brand manufacturer’s profits with and without information acquisition. The shadow area in Figure 3 is the area where

. Figure 3 illustrates the comparison of the brand manufacturer’s profits with and without information acquisition. The shadow area in Figure 3 is the area where  , which means information acquisition has a positive effect on the brand manufacturer’s profit. In other words, he can use information acquisition strategy to obtain a higher profit. If this condition is not met, the brand manufacturer prefers not to acquiring information at the beginning of the game. However, information acquisition is disadvantageous to the retailer. This is because the profit of the retailer comes not only from the brand channel in which she shares profits with the brand manufacturer, but also from the channel in which the non-branded goods are sold.

, which means information acquisition has a positive effect on the brand manufacturer’s profit. In other words, he can use information acquisition strategy to obtain a higher profit. If this condition is not met, the brand manufacturer prefers not to acquiring information at the beginning of the game. However, information acquisition is disadvantageous to the retailer. This is because the profit of the retailer comes not only from the brand channel in which she shares profits with the brand manufacturer, but also from the channel in which the non-branded goods are sold. | Figure 3. Comparison of the Brand Manufacturer’s Profits   |

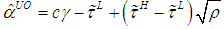

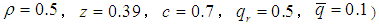

6.2. The Impact on Disclosure Thresholds

- The brand manufacturer’s behavior of information acquisition also has some influence on the decision of information disclosure. As analyzed above, if the brand manufacturer acquires information, he makes information disclosure decision with knowledge of the consumer type. From Conclusion 1 and Conclusion 2, it can be seen that the disclosure thresholds when information acquisition is adopted or not are

and

and  , respectively. Comparing the disclosure thresholds under the two conditions, the impact of information acquisition on the brand manufacturer’s information disclosure decision is shown in Conclusion 4.Conclusion 4 Compared with the information disclosure strategy without information acquisition, when information acquisition is adopted:1) if the consumer is high type, the brand manufacturer is more willing to disclose information, i.e.,

, respectively. Comparing the disclosure thresholds under the two conditions, the impact of information acquisition on the brand manufacturer’s information disclosure decision is shown in Conclusion 4.Conclusion 4 Compared with the information disclosure strategy without information acquisition, when information acquisition is adopted:1) if the consumer is high type, the brand manufacturer is more willing to disclose information, i.e., ;2) if the consumer is low type, if and only if the market capacity is large enough, i.e.,

;2) if the consumer is low type, if and only if the market capacity is large enough, i.e., , the willingness of the manufacturer to disclose information will increase

, the willingness of the manufacturer to disclose information will increase  , otherwise, the willingness will decrease under the condition of information acquisition, i.e.,

, otherwise, the willingness will decrease under the condition of information acquisition, i.e., ;where

;where  When consumers have a higher preference for quality, the effect of information disclosure will be better. When the brand manufacturer can’t get the information about the consumer type through information acquisition, both the high- and low- type customers can get products’ information from information disclosure. As low-type customers don’t care too much about product quality, so they may still not buy branded products even they know the quality of the branded products. Conversely, if the brand manufacturer can make sure the consumer belongs to the high type through information acquisition, the demand may increase more after information disclosure, which means information disclosure is more effective with information acquisition. Therefore, the brand manufacturer’s is more willing to disclose information if he can make sure the customer is high type.However, if the customer is low type, the increased demand from information disclosure is related to market capacity. Although disclosure to low type is less effective than to high types, if the market capacity is large enough, i.e.,

When consumers have a higher preference for quality, the effect of information disclosure will be better. When the brand manufacturer can’t get the information about the consumer type through information acquisition, both the high- and low- type customers can get products’ information from information disclosure. As low-type customers don’t care too much about product quality, so they may still not buy branded products even they know the quality of the branded products. Conversely, if the brand manufacturer can make sure the consumer belongs to the high type through information acquisition, the demand may increase more after information disclosure, which means information disclosure is more effective with information acquisition. Therefore, the brand manufacturer’s is more willing to disclose information if he can make sure the customer is high type.However, if the customer is low type, the increased demand from information disclosure is related to market capacity. Although disclosure to low type is less effective than to high types, if the market capacity is large enough, i.e.,  , the brand manufacturer can get more demand when he spends every unit disclosure cost. So when

, the brand manufacturer can get more demand when he spends every unit disclosure cost. So when  , the willingness of the manufacturer to disclose information is still increasing, even if the consumer is low type. On the contrary, when the market capacity is small, the willingness of the manufacturer to disclose information will decrease under the condition of information acquisition.

, the willingness of the manufacturer to disclose information is still increasing, even if the consumer is low type. On the contrary, when the market capacity is small, the willingness of the manufacturer to disclose information will decrease under the condition of information acquisition.7. Conclusions

- This paper studies the quality information disclosure strategy of a brand manufacturer in a dual-channel supply chain. We investigate how the brand manufacturer’s information disclosure strategy will be different when he can predict the type of consumer quality preferences through information acquisition. Our results suggest that: 1) when the brand manufacturer can obtain information to determine the consumer type, there will be two types of disclosure thresholds and the brand manufacturer is more willing to disclose information to high-type consumers than low-type consumers; 2) under the assumption that the wholesale price set by the non-brand manufacturer is exogenous, the higher the retailer’s cost of acquiring the non-brand product, the less willing the brand manufacturer will be to disclose information; 3) when the market capacity satisfies certain conditions, the brand manufacturer can increase his profits through information acquisition, but retailer is worse off when information acquisition is adopted; 4) compared with the disclosure strategy without information acquisition, the manufacturer are more willing to disclose information to the high type when information acquisition is adopted, whereas for the low type, only when the market capacity is large enough, the willingness to disclose information will be enhanced because of information acquisition.This paper analyzes the information disclosure strategies of brand manufacturer in a dual-channel supply chain, considering the impact of information acquisition which enriches the research of dual-channel supply chain and information disclosure. In this paper the non-brand manufacturer in the model is exogenous, and the non-brand wholesale price is an exogenous variable. In further study, we can extend the model by taking the non-brand manufacturer’s decision into the system, to investigate how non-brand manufacturer will make its decision to split the market with brand manufacturer in a dual-channel supply chain, how the decision of non-brand manufacturer will affect the strategy of brand manufacturer, and whether the influence of information acquisition will be different. All these are the direction that can deepen research in the future.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML