-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2018; 8(2): 41-46

doi:10.5923/j.mm.20180802.01

Investigating the Relationship between Domestic Production, Investment Flows, and Development of Financial Markets of Iran

Atefeh Sabernia, Akbar Sabernia, Hamidreza Shamakhi

School of Accounting and Management, Islamic Azad University, Eslamshahr Branch, Eslamshahr, Iran

Correspondence to: Atefeh Sabernia, School of Accounting and Management, Islamic Azad University, Eslamshahr Branch, Eslamshahr, Iran.

| Email: |  |

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

In this research, the relationship between domestic production, investment flow, and development of financial markets of the Islamic Republic of Iran has been investigated in 2000-2015. The research is post-event, which is applied in terms of purpose and follows a correlation and regression method to conduct the analysis method. The applied econometric method is the combined data method, the integration of cross-sectional data, and time series. Fisher's test, regression model, and Hausman test were used to analyze the data using Eviews. The results of the research showed that the financial market plays a role in the relationship between direct foreign investment and gross domestic product.

Keywords: Domestic production, Foreign direct investment, Iran's financial market, Gross national product

Cite this paper: Atefeh Sabernia, Akbar Sabernia, Hamidreza Shamakhi, Investigating the Relationship between Domestic Production, Investment Flows, and Development of Financial Markets of Iran, Management, Vol. 8 No. 2, 2018, pp. 41-46. doi: 10.5923/j.mm.20180802.01.

Article Outline

1. Introduction

- Currently, a large part of the economic literature confirms that the long-term economic growth and welfare of a country are related to the degree of financial development in that country in addition to other important factors. Financial development is generally due to the accumulation and equipping of capital resources and the optimal allocation of these resources affects economic growth. In other words, financial development indicators affect the capital aggregate indicators and their productivity. These factors also affect economic growth. The development of the financial system through the expansion and diversification of the financial markets of the country leads to a more appropriate allocation of resources and, ultimately, faster economic growth [10]. In this research, it is intended to evaluate the impact of financial market development on the economic growth in Iran in 2000-2015.

2. The Problem Expression and Theoretical Foundations

- Iran's central bank statistics show that Iran's GDP has experienced a lot of stagnation in the current century. Iran's gross domestic product reached an upward trend from 44 to 242 trillion Rials (at constant prices in 1992) from 1960 to 1967. In fact, the size of the Iranian economy has increased by 5.5 times over the course of 17 years. The production process is reversed and began its downward trend with the advent of revolutionary conditions in 1978. The downward trend in production is due to the instability of the revolutionary period and then the beginning of the Iran-Iraq war because the production declined as much as 30% from 242 trillion Rials in 1976 to 170 trillion Rials by the end of 1981. Subsequently, in spite of increasing production in 1982 and 1983, the downward trend continues until 1988 (the end of the war), but the upward trend in production began again since 1989 and continued until the end of the year 2009 except for a three-year period (from 1993 to 1995, when production was stopped) so that the production reached 519 trillion Rials from 180 trillion Rials in 2008. In fact, the size of the Iranian economy has been 2.9 times over the past 21 years [1].Theoretically, capital flows are one of the basic requirements of the economic growth process, which can be financed from domestic (savings) and foreign sources of finance. Foreign finance is not only a supplement to domestic savings, sometimes fills the gap between savings and investment, which is a solution to the foreign exchange gap. In developing countries, financial resources include bilateral assistance from developed countries, financial flows derived from multiple sources, such as the World Bank and regional banks, investment, and foreign direct investment (FDI) [11]. Apart from the first two cases, which actually involve the debt crisis and debt service problems, often by governments and institutions such as the International Monetary Fund and the World Bank, the latter two are most often carried out by the private sector, and it is referred to as the private capital flow [13]. Capital as the engine of economic growth and development is one of the fundamental pillars of the economy. Many countries, especially developing countries, are struggling to achieve economic development, and they are endeavoring to provide full employment and continuous economic growth by adopting economic policies.Such countries seek to create an appropriate environment for national investment in order to win the confidence of foreign and domestic investors by encouraging public investment and special privileges [4]. Using investment opportunities through the optimal use of production resources is one of the most important factors for achieving economic progress. From a theoretical point of view, the injection of capital into the economy stems from the belief that economists consider capital as a growth engine. Obviously, funding for capital formation is possible in a variety of ways, including foreign debt, the use of domestic savings, attracting foreign capital, etc. [14]. Since the domestic savings of developing countries are not able to cover the gap between investment and savings and their stock markets are in the early stages, the study of the relationship between capital flows and economic growth should be considered with an emphasis on the role of financial markets. Since Iran is one of the developing countries, this can be a comprehensive study.

3. Research Literature

- So far, many studies have been conducted on the capital flow, economic growth, and financial markets based on various case studies and the role of intermediary and control variables. Beckmann, J. and Czudaj (2017) have examined the capital flow and GDP in the economic growth of developing countries. Research results have shown a positive and strong impact between capital flows and GDP on the economic growth of developing countries [7]. Baharumshah et al. (2015) investigated the relationship between different types of foreign capital and economic growth with regard to the role of financial markets. The results of this study indicate that there is a meaningful relationship between foreign capital and economic growth as a nonlinear relationship based on financial development [6]. Komla et al. (2014) evaluated the relationship between the private capital flow and economic growth with regard to the role of domestic financial markets. The results of the research have shown that strong financial markets of the private capital flow have a positive effect on economic growth. In addition, controlling population, saving and liberalizing financial markets also affect economic growth [13]. Carp (2014) explores the financial information of several countries in the world. The results of this study showed that the classic economic growth model is meaningful for variables such as inflation, the degree of economy openness, population growth and government size, but the effects of the liberalization of financial markets and capital flows, although affect the economic growth, have their effects largely due to crises and its indirect effects [9]. Ketenci (2015) has examined the impact of financial market development on the impact of FDI on economic growth in host countries. According to the research results, the effect of foreign direct investment in developed countries is positive and significant on economic growth in terms of the financial market. In the less developed countries, the effect of the foreign direct investment on economic growth has not been significant [12]. Ahn (2013) concluded in their research that the relationship between economic growth and capital flows is positive and affects the effects of globalization and its implications on the economic environment of the capitalist countries. In this regard, the variables of the new economic hypotheses that emerged from the 1990s, such as technology knowledge and new management practices are effective in economic growth partly due to foreign investment [2]. Azman- Saini et al. (2010) investigated the relationship between investment and economic growth. Research results have shown the positive impact of investment on economic growth [5]. Beugelsdijk et al. (2008) have analyzed the impact of horizontal and vertical investment on the economic growth of the host country. The results of the research indicate that horizontal and vertical investments have a positive and significant effect on the economic growth of developing countries [8]. Alguacil et al. (2011) have examined the relationship between investment and economic growth according to economic variables. In the research, it has been reported that investment in the short term has only had a negative effect on growth. The trade variable has a significant and positive effect on economic growth both in the short run and in the long run [4].

4. Research Method

- According to the research data, this paper is a post-event type, which is applied in terms of purpose and follows a correlation and regression method to conduct the analysis method. In the correlation research, the main goal is to determine if there is a relationship between two or more variables, and if so, how much. The research plan is quasi-experimental using the post-event approach (casual). The applied econometric method is the combined data method, the integration of cross-sectional data, and time series. Fisher's test, regression model, and Hausman test were used to analyze the data using Eviews.

5. Research Model

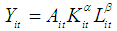

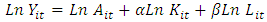

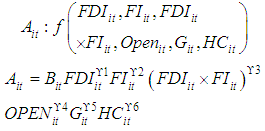

- In this research, the proposed model is based on the Cobb-Douglas function model, which is presented in the research (2004) by Alfro et al [3]. The overall form of the model is as follows:

| (1) |

and

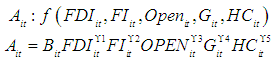

and  in this function represent the elasticities of the factors related to the production factors that are directly estimated from the estimated production function, and t and i respectively indicate Time and country. The linear form is obtained by conducting logarithm on both sides of Equation (1):

in this function represent the elasticities of the factors related to the production factors that are directly estimated from the estimated production function, and t and i respectively indicate Time and country. The linear form is obtained by conducting logarithm on both sides of Equation (1): | (2) |

| (3) |

| (3) |

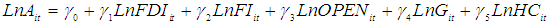

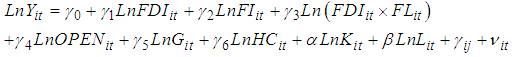

is the intercept of the efficiency equation. Now, by putting Equation (4) in Equation (2), the mathematical model of economic growth for country i and time t can be defined:

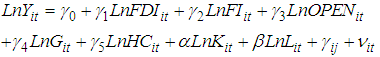

is the intercept of the efficiency equation. Now, by putting Equation (4) in Equation (2), the mathematical model of economic growth for country i and time t can be defined: | (5) |

| (6) |

describes the individual effects of the states, and

describes the individual effects of the states, and  also defines a random error that is supposed to be good behavior. In this study, foreign direct investment (FDI) was used as a percentage of gross domestic product. FI is the development of the financial market, which is the ratio of payments from the private sector to the gross domestic product. Openness is also derived from the total export-import ratio to the gross domestic product. In addition, G is government costs as a percentage of GDP. HC is human capital. In most studies, such as Doytch and Uctum (2011), the rate of enrollment for high school students is used as a human capital indicator [11]. K is the capital stock used by the Perpetual Inventory Method (PIM) to estimate capital stock. L is also considered as the labor force of the total labor force population in the country.

also defines a random error that is supposed to be good behavior. In this study, foreign direct investment (FDI) was used as a percentage of gross domestic product. FI is the development of the financial market, which is the ratio of payments from the private sector to the gross domestic product. Openness is also derived from the total export-import ratio to the gross domestic product. In addition, G is government costs as a percentage of GDP. HC is human capital. In most studies, such as Doytch and Uctum (2011), the rate of enrollment for high school students is used as a human capital indicator [11]. K is the capital stock used by the Perpetual Inventory Method (PIM) to estimate capital stock. L is also considered as the labor force of the total labor force population in the country. | (7) |

| (8) |

6. Research Results

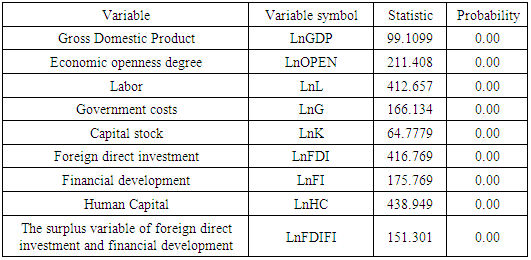

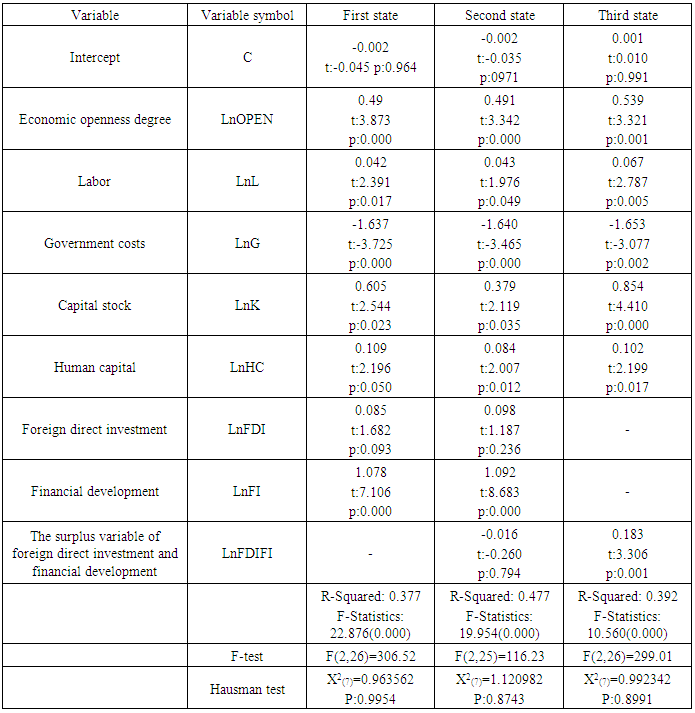

- In this section, the impact of financial market development on the impact of foreign direct investment on economic growth in Iran over the period 2000 to 2015 has been analyzed using the combined data and model estimation. First, it is necessary to test the variability of all the variables used in the estimates. For this purpose, Fisher test has been used. The results for the variability of the variables are reported in Table (1):

|

|

7. Discussion and Conclusions

- The results of this study showed that the financial market plays a significant role in the relationship between direct foreign investment and gross domestic product. Despite the fact that the FDI does not have a significant effect on GDP in the financial market of Iran, the results showed that the crossover of foreign direct investment and the financial market index (banking sector credit to the private sector) had a positive and significant effect on GDP. Therefore, this indicator should be strengthened so that the financial market affects the foreign direct investment on GDP in a greater level. It is also necessary to reduce the government's ownership of banks, and the transfer of credits to inefficient economic sectors without high added value should be stopped by creating a competitive environment in the banking system and efficient interest rates. On the other hand, due to the fact that the development of the financial market and the crossover of foreign direct investment and financial market development have a positive and significant effect on economic growth; if Iran pursues the development of its financial market through the expansion of foreign direct investment, it can affect the country's economic growth. Crossover effect has caused direct foreign investment in the country to affect economic growth if foreign direct investment alone has not had a significant effect on the country's economic growth. Therefore, as stated, the effectiveness of this crossover effect indicates that when there is financial development in the country, direct foreign investment will be effective on economic growth.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML