-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2017; 7(2): 84-88

doi:10.5923/j.mm.20170702.02

Mergers and Acquisitions: Quo Vadis?

M. Ikhwan Maulana Haeruddin

Department of Management, Universitas Negeri Makassar, Indonesia

Correspondence to: M. Ikhwan Maulana Haeruddin, Department of Management, Universitas Negeri Makassar, Indonesia.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

In this high-speed and globalized era, organizations are demanded to be able to execute strategic steps in enhancing their competitive advantages. One of the strategies that commonly adapted by organization is Merger and Acquisitions (M&A’s). However, in their implementations, it is argued that M&A’s not only gains benefit, but also claimed to bring several disadvantages. This paper aims to review extant literature and provides further directions in M&A’s area.

Keywords: Mergers, Acquisitions, Managing HR, Literature Review

Cite this paper: M. Ikhwan Maulana Haeruddin, Mergers and Acquisitions: Quo Vadis?, Management, Vol. 7 No. 2, 2017, pp. 84-88. doi: 10.5923/j.mm.20170702.02.

Article Outline

1. Introduction

- Mergers and Acquisitions (M&A’s) have been confirmed to be a key method in achieving organization’s growth, diversity, and profitability. Several researchers endorse that M&A’s are appealing to organization that seek to increase their market share and profit by uniting with another one (Chatterjee, Lubatkin, Schweiger, and Weber, 1992; Cartwright and Cooper, 1993; Sudarsanam, 1995; Wullaerts, 2002; Schmidt, 2015; Friedman, Carmeli, Tishler, and Shimizu, 2016). However, misconduct of M&A’s practices (henceforward called acquisitions) has led to the high failure rates (Krug, Wright, and Kroll, 2014). It is found that “a 1 percent loss in return on investment can lead to hundreds of millions of dollars in lost shareholder value” (Chanmugam, Shill, Mann, Ficery, and Pursche, 2005). Thus, the fundamental aspect to accomplishment of merger and acquisition is a coherent planning for the transition. Organizational vision, missions, and its new strategic plan should be developed and shared with the acquiring and the acquired company for an effective and efficient transformation process. It is also claimed that mergers and acquisitions involve organizational changes be prepared in one or both organizations for strategic benefits to be recognized (Schweiger, Csiszar, and Napier, 1993). This paper aims to review several extant literatures on mergers and acquisitions and relevant areas, considering the high investment return and great risk of failure involved in this processes. In presenting the literature review, this paper consists of the characteristics of mergers and acquisitions, its advantages and disadvantages. Finally, this paper presents the keys to success with the cases of both the best practices and unsuccessful transformations through mergers and acquisitions. Suggestively, this paper also encourages further avenues of research in pursuing effective ways to lessen the drawbacks from improper practices of mergers and acquisitions, and also to minimize the risk and maximize the higher outcome in M&A’s activities.

2. The Characteristics of M&A’s

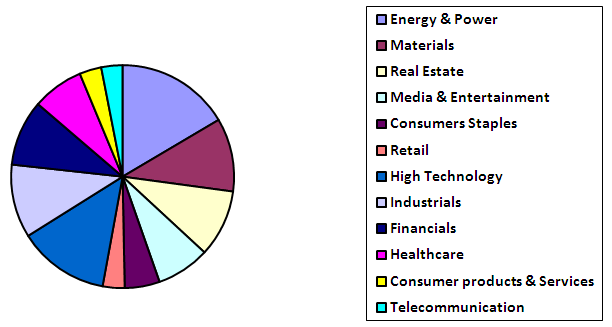

- Mergers and acquisitions (M&A’s) practices are considered as a major strategy and commonly acknowledged by organizations that strive for to accomplishment in corporate profitability, diversity, and growth. For example, since 1989 to present, over 100,000 American based companies have been actively engaged in mergers and acquisitions in order to pursue business growth (Schweiger and Weber, 1989; Sinclair and Keller, 2017; J.P. Morgan, 2017). Furthermore, according to the 2016 M&A’s review by Thomson Reuters (2017), worldwide deal making decreases around 16% whereas the number of the deals themselves is increased 1%. Also, M%A’s activity completed around US$3.7 Trillion during 2016. Along similar lines, it was found that energy and power sectors are the most targeted industry by value by accumulating around 16.6% of the total industry following this is the high technology sector which totaled around 13.3%. The least announced targeted industry is telecommunications sector for 3.1%. Industry comparison in worldwide announced M&A’s targeted industry by value can be seen from the following figure 1.

| Figure 1. Worldwide Announced M&A Target Industry by Value (Adapted from Thomson and Reuters, 2017) |

3. Advantages and Disadvantages

- In general, mergers and acquisitions activities do not based on the similar reasons. There are several different reasons for organizations in getting other organizations. For example, to penetrate and to expand into market in particular area, to strengthen current products by uniting complementary product portfolios; and vertically or horizontally integrate into new potential growth or low cost technologies and market segment. Several researchers have come to the conclusion that mergers and acquisitions should bring about an improvement in performance of the combined companies which creates a competitive advantage to the firms (Lubatkin, 1983; Krug, Wright, and Kroll, 2014; Sinclair and Keller, 2017). The collaboration between the combined organizations will likely stimulate interaction to improvement in the competitive position and thus resulting in an effective performance (Schweiger and Weber, 1989). For example, in order to strengthen current products, Facebook, was focused in finding an existing partner within a similar market by uniting complementary product portfolios, WhatsApp. Analysists in Facebook took more than half a year in exploring possibilities of WhatsApp, in term of its orientation and compatibility, before confirming the acquisition in 2014 (Cunha, 2015). The integration was completely successful in terms of the original reasons for the deal (Galpin and Herndon, 2014). Overall, achieving operating mergers and acquisitions has been less than successful. For example, recent research indicates that averagely over 60% of mergers and acquisitions are failed to meet the desired outcomes (Krug, Wright, and Kroll, 2014). The common challenges encountered by acquiring manager are how to manage the transformation and shifting organizational culture from two different entities (organizations) to one integrated entity. It is also claimed that the extent of success in merger and acquisition processes will be determined by the readiness, extensive planning, and a careful implementation (Blake and Mouton, 1984; Jemison and Sitkin, 1986). Failing to do so will not only damage projected competitive advantages but also induce morale suffering for the employees and managers of both organizations. The failure of mergers and acquisition will result in many forms, such as productivity problems, a decline in shareholder value, absenteeism and loss of effective human resources (Sinetar, 1981; Schweiger, Ivancevich, and Power, 1987; Walsh, 1988; Chatterjee et al., 1992; Schuler and Jackson, 2001; Krug, Wright, and Kroll, 2014). For instance, Hewlett-Packard has lost their 30,000 employees after merger with Compaq in 2002 (Goldman, 2015). It is found that Hewlett-Packard purchased Compaq without careful considerations and preparations on the transformation processes, in particular on the HR aspects. Along similar line, it is also argued that the most common reason of merger and acquisition failure was people mismanagement. It is found that many acquiring organizations underestimated the impact of managing HR issues and organizational change, which lead to the failure of mergers and acquisitions (Mark and Mirvis, 1985; Kanter, 1987; Schuler and Jackson, 2001; Krug, Wright, and Kroll, 2014). It is recommended that a successful merger and acquisition process not only includes comprehensive planning on financial and strategic analysis aspects, but also inn planning regarding compatibility between the both organizations’ preferences about the implementation strategy for the transformation. It is found that the implementation requirement for each organization is different to each other. As a result, differences will become a significant concern in divisions that are either being combined or are establishing new interrelationships with other units (Schweiger et al., 1993). Furthermore, Schweiger et al. (1997) claim that the extent of a merger or an acquisition successfulness will be depending on how the organizations managed and resolved these differences.

4. Keys to Success

- From a merger and an acquisition perspective, the differences between firms are critical in carrying out the transformation processes. For instance, organizations that buy a related organization might encounter minor changes when compared to an organization that acquire an unrelated one. Organizations that buy a related organization will likely to have prospects in common with the acquiring organization in order to integration relative to an unrelated acquisition where there are few synergies and opportunities. As a result, the key point is that the organizations may engage in organizational changes in different levels (macro, meso, and micro) which depend on how their strategies are. It is found that mergers and acquisitions require that organizational changes be done in organizations engaging in merger and acquisitions transaction for its strategic benefits to be recognized. The quality of the organizational transformations and the implementations effectiveness will determine the financial success of mergers and acquisitions. However, it is found that unnecessary changes should be avoided in the merger and acquisition implementation process (Schweiger et al., 1993). Allowing a minor change when it is needed is more valuable than the extensive change when it is unnecessary. As a result, changes needed to be considered in term of the value of a merger and acquisition strategy. This means organizations should focus only on those areas where the both organizations are necessary to capture synergies and integration of, and differentiate themselves from one another where management divisions of the targeted organizations need to be performed dissimilarity. Cuypers, Cuypers, and Martin (2017) assert that there are at least 3 main aspects in increasing the success of mergers and acquisitions. They find that strategic reasons, purchase price, and post transformation strategy implementation are critical to achieve in any merger or acquisition. In term of strategic reasons, organizations should commence merger and acquisition in order to develop or enhance their competitive advantages, such as by minimizing costs and expenses implementing latest technology, boosting and strengthening company’s differentiation through innovative product design, expand products and customers based, and enlarge geographic existence. Secondly, the mergers and acquisitions are less likely to succeed when the purchase price exceeds either the actual market, inherent or combination value. For instance, Time Warner and AOL merger was hailed as the greatest merger of the century as the scenario of uniting these companies was declared. Nevertheless, the merger of the century has transformed into a catastrophe when AOL’s official announcement regarding their merger with Time Warner resulted to their plummeting stock price (Colvin, 2003). Next, it is argued that some companies unsuccessful to live up to the financial expectations after merging and acquiring as they fail to achieve an implementation plan. For example, Korean automobile manufacturer, Daewoo Motors had suffered setbacks after acquiring companies in Romania and Poland. Since various explanations have been suggested concerning the success of mergers and acquisitions, human resources are also an outstanding key issue to draw the success between acquirer and acquiring firm. Therefore, communication is particularly emphasized as a useful apparatus to decrease the uncertainty and ambiguities of merger and acquisition, which can result in lower productivity, commitment to the organization, job satisfaction and higher stress, turnover and higher absenteeism (Ivancevich et al., 1987; Schweiger and DeNisi, 1988). For example, Esmark’s CEO, Donald Kelly, talked to more than 100 Norton Simon headquarters staff people on the issue of a number of holding-company staff position would be eliminated and the compensation plan being offered. Due to Kelly’s honest approach to not being able to maintain dual staff and straightforward treatment with a generous severance pay plan, it can reduce the frustration among resigned employees and maintain a much better relationship with remaining employees of the two companies (Gutknecht and Keys, 1993). Also, it is argued that social identities and communities are influenced by M&A’s which eventually lead to the level of employee’s morale (Spoor and Chu, 2017). Spoor and Chu (2017) argue that in managing employee’s morale, organizations must exploit the organizational communities of practice (CoPs) as the medium where employees share both explicit and tacit knowledge, “to improve knowledge sharing within the post-M&A’s organization” (p.1). However, how post-M&A’s context influences the employee’s identity work both on the acquirer side (dominant) and the acquired side is remaining unsolved (Melkonian, Monin, and Noorderhaven, 2011; Xing and Liu, 2016). Furthermore, employees will have to deal with one another who are familiar with their own ways of thinking and behaving style, and who have political stakes or power in the status quo (Cuypers, Cuypers, and Martin, 2017). As a result, acquiring another company requires the buying firm to understand differences in political, economic, legal and cultural issues. For example, initial enthusiasm about the proposed merger between Daimler-Benz and Chrysler met warning that employees may have to deal with the cultural differences could inhibit the success of the proposed union (Simonian, 1998). Accordingly, Buono, Bowditch, and Lewis (1985) offer two distinct conceptualizations of organizational culture which are subjective culture, which includes shared values and beliefs among organizational members and objective culture, which includes artifacts in an organization such as office locations, physical setting and office décor. According to Buono et al.’s two distinct conceptualizations of organizational culture, Hofstede, Neuijen, Ohayv, and Sanders (1990) conclude that organizational culture is holistic and soft, but it is difficult to change. The difficulty in cultures adaptability becomes reasonably prominent during mergers and acquisitions.

5. Conclusions

- It is accepted that mergers and acquisitions (M&A’s) have demonstrated to be a significant mean for accomplishing corporate profitability, diversity and growth. Several organizations seek to expand their profit and market share by combining with one another. However, misconduct of mergers and acquisitions has also resulted in high failure rates. Literature has mentioned the characteristics of mergers and acquisitions. It is found that mergers and acquisitions are the best practices of firm transforming which has contributed to organization’s competitive advantages. Several organizations seek to sustain their competitive advantages by expanding geographic market access, merging complementary product portfolios, integrating into new high growth or low cost technologies and expanding market segment vertically or horizontally. However, there are huge percentage that organizations fail to sustain their competitive advantage through mergers and acquisitions. Whether or not the merger and acquisition will be beneficial to the acquirer and the acquired firms depends on extensive planning and a careful implementation. Employees, therefore, are a key issue to draw the success between acquirer and acquiring firm through its implementation. It is also becomes a managerial implication for the organizations. If employees are well informed to the organizational change, the resistance to change will be minimized. Furthermore, employees will have to deal with differences in political, economic, legal and cultural issues. Understanding the differences and adaptability becomes prominent during mergers and acquisitions.Although there have been much literature that conducts the research in mergers and acquisitions, it seems that most of them only concentrated on the characteristics of mergers and acquisitions and its implementation. Several firms still fail to achieve its expectations and goals. Therefore, mergers and acquisition still needs more future researches in many areas such as its effectiveness, consequences and organizational changes through mergers and acquisitions, particularly in HR aspects, in individual level (e.g. managing survivor syndrome or identity work on the survivor of M&A’s).

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML