-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2016; 6(6): 191-197

doi:10.5923/j.mm.20160606.02

Financing Based on Relationship: Case of Moroccan SMEs

Hanane Aamoum1, Abdelhadi Boussas2

1Laboratory of Search in Systems & Organizations Engineering, Trade & Management National School, University Hassan II, Casablanca, Morocco

2Scientific Committee, Public Policy Moroccan Observatory, Casablanca, Morocco

Correspondence to: Hanane Aamoum, Laboratory of Search in Systems & Organizations Engineering, Trade & Management National School, University Hassan II, Casablanca, Morocco.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The main aim of this paper is to highlight a financing mode based on relationship. We examine the relational financing in the specific framework of relationship between small and medium-sized enterprises (SMEs) and Banks. We show across a qualitative study that the establishment of a relational financing mode enables SMEs managers to reinforce their interaction experience and to enhance their negotiation capabilities. The SME manager's interpersonal competence and his bargaining ability become for the banker a vector of assessing failure risk of his client. The results of this study emphasizes how important it is for SMEs to use their interaction experience with banks so as to acquire more capacity when negotiating.

Keywords: Relational financing, SME, Diversifying financial partners, Bargaining, Bargaining capacity, Negotiation, Negotiation capacity

Cite this paper: Hanane Aamoum, Abdelhadi Boussas, Financing Based on Relationship: Case of Moroccan SMEs, Management, Vol. 6 No. 6, 2016, pp. 191-197. doi: 10.5923/j.mm.20160606.02.

Article Outline

1. Introduction

- Small and medium enterprises play a determinant role in the Moroccan economy, their impact on the economic dynamics and social fabric continues strongly to grow. They increasingly contribute to create new jobs. In numbers, they represent 93% of the enterprises population, 46% of private sector employment, 30% of exports, 33% of private investment and 38% of production.This vitality is often slowed down by constraints, notably tied to access to financing. However, the SMEs sustainability depends largely on the quality of the financial support they get and the maintaining of their competitiveness is conditioned at first instance to the support for its needs for financing. These financial constraints may hinder SMEs innovation effort and also their growth.The SMEs financial structure influences doubtless the funding decision. However, the literature emphasizes the quality importance of the relationship and social relationships in the support of the company for financing. Thus, some projects may be better supported than others, regardless of the size of their financial structure. Therefore, it is vital for the entrepreneur to be aware of the determinants of financial support linked to a funding mode based on good relationships with players in the banking sector.If banks, though sensitive to the fragility of some SMEs, adopt opportunistic behavior, Gardes and Machat (2012) showed across a qualitative study that SMEs management mode of the financing relationship, notably the manager relational competence, is able to generate mutual trust and better support for financing [1].This paper aims to show how the banking relationship management methods of managers have effects on the financial support for the companies. We intend to establish a link between the relationship management and the bank institution benevolence. This benevolence is defined by Ganesan (1994) [2], Doney and Canon (1997) [3]. This perception embodies the search for the interest of the other especially in difficult and unexpected moments, a search that reflects the one's good intentions (Narus, 1990) [4].In the first part we emphasize the interest of the development of a relational financing. In the second one, we present the results of a dyadic exploratory qualitative study conducted with four different banks and also with their SMEs customers.

2. Relationship Management of Financial Institutions-SMEs

- SMEs and the banks alike have a common interest to adopt behavior that subserves the emergence of the benevolent reciprocity. Two visions of the relationship emerge from the literature review. The first is transactional according to which the balance of power is centered on the contract. The second is relational, it includes an emotional dimension that focuses on trust, commitment and interpersonal relationships.Several studies (Ang, 1991) [5] show the effectiveness and necessity of relational financing characterized by a long-term relationship, a strong and intense communication and mutual trust to assess risk of SMEs. The manager who wishes to obtain financial resources has all the interest in knowing establish links with his bank and get into a relational management of his relationship with his banker. The quality of this relationship is essential as it influences the willingness to maintain the exchange relationship.Despite the considerable development of progress relative to the collection and processing of statistical data, only a mode of financing based on the relational capital is able to allow the bank to access to specific information and thereby remedy the lack of informational transparency characterizing SMEs. It enables the bank to accumulate and share specific and personal information about the company, but also about the ability of the owner to manage the sustainability of his business thanks to the permanent contact they maintain, whether with the owner himself or with firms partners. Berger and Udell (2006) [6] define the relational financing as credit technology in which the bank account manager produces qualitative information from multiple interactions established with the company, with its owners and also with its customers and suppliers. Only in this way the person in charge of companies in the bank (the account manager) will appreciate the asymmetry or symmetry of SMEs' relational portfolio. He then obtains important elements that will allow the bank to assess his client's prospects and make better use of his intangible assets. Based on long-term relations, the relational financing aims to maximize the relationship profitability. Many studies argued that a such configuration facilitates the exchange of private information (Bhattacharya, Chiesa, 1995) [7] thanks to the trust and relational standards established over time. Building mutual trust of and building relational standards allow the bank to not only produce and create information but also to reduce its risk (Petersen, Rajan, 1994) [8]. The company gets a better treatment that can lead to better financing conditions due to an easy control (Haubrich 1989). [9] The support for the company in difficulty gets better in this type of financing (Elsas, Krahnen 1998) [10]. The long-term relations with the bank dampen economic shocks (Okun, 1981) [11], improve management of liquidity crises (Longhofer, Santos, 2000) [12] and are a way to ensure borrowers against credit rationing (Jaffe, 1971) [13]. Thus, companies that enter into a long term relationship with their banks would be better treated and better accompanied in case of difficulties.Regarding risk assessment, it certainly cannot be done without a quantitative financial approach based on solvency and profitability. However, it cannot hide dynamic economic vision integrating the determination of the company sustainability conditions, especially its ability to cope with the changing environment. According to Paranque (2003) [14], the risk for SMEs concerns rather the profitability (more than uncertainty about their sustainability). Thus, in times of economic crisis, they become the main victims of the credit crunch. The challenge of SMEs whose informational structure is characterized by a certain opacity (Ang, 1991) [15] is to produce, for its partners, information on how it manages this sustainability in order to obtain the best possible support. For the bank, it is about assessing the situation of the company taking into account the uncertainty of its survival, it is also about producing information so as not to risk too much. Evaluating the beneficiary potential of a SME requires to take into account all future advantage of investing in its business relationships. The SME position in a business portfolio, its business opportunities and understanding its development policy provide information about the company's ability to cope with the changing environment. These elements, as necessary for proper risk assessment, do not appear in the financial statements. For example, the value of intangible capital constituted of the relational investment is undervalued by generally recognized accounting principles (Leger 2004, Aamoum 2011). [15, 16] Regarding relations with suppliers, this undervaluation is particularly regrettable that these relationships are essential assets to maintain the competitive advantage (Magretta 1998) [17]. The problem lies in the fact that very little public information is available to assess the value of this relational capital. This lack of clarity in the financial statements prevents clearly an accurate assessment of the value of relationships with suppliers, for example, it can influence the SME innovation policy. As for the relations that the SME maintains with its principal customers and contractors, it was established that they are characterized by an asymmetry of a variable scope in its customer portfolio (Johnsen, Machat, 2007) [18]. Asymmetry refers to the imbalance of the overall characteristics of the customer-supplier relationship (size, dependence, power as well, standardization of the interface, mutual goals, etc.) But a dependency relationship must also be assessed in terms of the power that the supplier may base on his expertise (French, Raven, 1959) [19]. A totally asymmetric customer portfolio (Johnsen, Machat, 2007) [18] is likely to jeopardize business opportunities of the supplier who allocates his resources in unbalanced relationships (Seyed-Mohamed, Bolte, 1992) [20]. As the opening on a network (by diversifying it financial partners) is poor in that event, the SMEs strategic redeployment will be extremely difficult in case of drop in turnover. Only the number of interconnections that SMEs establish in a network associated with the relational variety of its contacts and that reflect its interaction experience is suitable to restore its business opportunities (Hakansson et al. 1999) [21]. The bank should accordingly and differently assess the risk of a project of SMEs benefiting from cooperative relationships with customers (Guards Machat, 2012) [1] and, more generally, business opportunities behind its potential for repositioning in the network. Therefore, it is important for the bank to include in its bankruptcy risk assessment methods of SMEs an approach of its business portfolio. A performance reading that takes into account the asymmetry of the SME clients portfolio would improve forecasting capabilities, identify vulnerabilities sources and explore solutions. Only the adoption of a way of relational financing can help to integrate these elements to SMEs.More recently, a latest round of work is specifically tied to highlight the nonlinear aspect of the evolution of the cost of credit billed by banks depending on the importance of the relationship with their clients. The idea is the following: Theoretical models of banking relationship postulate, as a whole, that competing banks will initially make offers relatively attractive for companies so as to attract and engage them in a lasting relationship. As result, Banks will then propose rates relatively less high compared to the risk of the requested commitment. Secondly, the bank which won the first financing agreements through its surveillance activities acquires private information and develops a monopoly thereby enabling it to extract profit of its privileged position. Rates will therefore be billed higher than what the fair assessment of credit risk requires. Finally, for external Intermediary funds, the company's survival over a long period gives an indication of quality of its management and its prospects. That limits the market power of the internal bank. Competition resumes the progressively its rights; This leads to a reduction in the cost of borrowing contracted by the enterprise. Thus, it should exist in all likelihood a dynamic in interest rates reflecting the presence of the hold-up problem.Two studies have specifically tested this proposal. That of Kim, Vale and Kristiansen (2006) [22] focused on SMEs. On a sample of Norwegian companies with less than 100 million crowns in turnover, not having issued bonds and do not have a credit note, they test the relationship between the cost of credit and two explanatory factors of market power of banks to theoretically opposite effects: the establishment of an informational advantage and level of concentration of the banking sector. Schenone study [23] (2007), conducted on a sample of US companies which made an Initial Public Offering on the period 1998-2003 notes that the rate of syndicated loans contracted before and after the issuance of securities on the market follow two different regimes.However, it should be noted here that establishing this relational financing mode does not have the same scope depending on the type of purchase that the customer makes (cash or financing). To repeat: the SME risk affects not only profitability (guarantees concerning its funding exist), but rather the uncertainty about its sustainability (insolvency related to cash flow problems increases the failure risk). Effect of relational financing on interest rates requested on loans is ambiguous (Degryse and Ongena, 2008) [24].

3. Moroccan Companies Relational Financing

- The relational financing method encourages new interactions between Banks and SMEs. Negotiating underlies a communication and an interaction activity with others. «To quote the sociologist Simmel's say (1908) [25], negotiation is finally a way to be in relationship and in interaction with human beings, it is a conflict management modality or management of divergence of points of view» (Barth, Bobot, 2010) [26]. The authors point out that there is no need for large transactions, large projects or large investments to be in the presence of a set of negotiations, they also point out that the bargaining ability becomes essential even in situations where the commercial stake is not important. They explain that beyond «The goods as negotiation object (products, services, complaints ...), the value produced by the interaction related to negotiation (Tannenbaum and Schmidt, 1958) [27] is finally the most important». It does not matter that the financing relationship is asymmetric and that the bank is in a strong position: the financing relationship produces a value for the SME manager. He must therefore consider the negotiation game to influence the financing relation by producing some confidence, which is a consecutive series of cumulative interactions that will ultimately get to improve his negotiating capacity.Bargaining supposes to keep alternatives notably the power to withdraw (Usunier, 2004) [28]. Bonvin (2009) [29] argues that to be able to negotiate, we should be able to have the choice and to have also an informational basis of judgment, that is to say to assess the rightness or wrongness of a solution and finally to have the real freedom to accomplish an action, which leads to not have to suffer an unbearable cost if we choose not to accomplish it. Dealing with several different banks becomes a fundamental of the negotiating capacity of SMEs in that it offers alternatives. That provides an informational basis for comparison and finally not to depend on one financial partner. If it reflects a deliberate strategic choice, underlying motivation to diversify bank partners takes different forms: avoid dependency and captivity (Sharpe, 1990) [30], ensuring competition or make the most of various banking positions or meet the company's financing needs to hide the poor quality of the company and benefit from the dilution of information and the relaxation of surveillance of the creditor. Indeed, the banks have little incentive to invest informationally when playing a small role in the financing of the company (Refait2003) [31].At this stage of our research, we make and test empirically two qualitative research proposals:First proposal: Establishing a way of relational financing depends on the trust between the banker and the SME (SME as bank client).Second proposal: The SMEs negotiating capacity depends on the interaction experience.

4. The Dyadic Qualitative Study with Banks and Their SME Customers

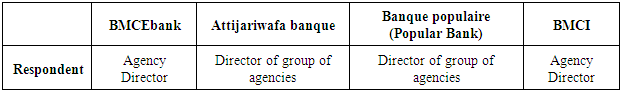

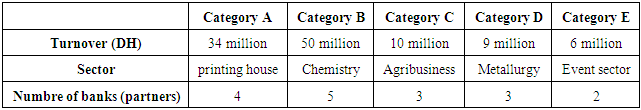

- The nature of our qualitative study is exploratory. We aim to locate in the of bankers' speech and managers' (of banks SME customers) the determinants of bank financing relationship. Semi-structured interviews lasting an average of one hour and a half were recorded and transcribed. The survey sample meets a variety of criteria both in selected banks and SMEs activity sectors (Tables 1 and 2). We were guided by the principle of thematic redundancy. The last interviews did not make emerge new themes, so we did not see useful to survey a large number of companies.

|

|

4.1. Trust is the Basis of Support for SMEs

- SMEs managers we surveyed admit to have more difficulties in getting medium and long term financing, rather in getting short-term one. Therefore, cash problems, which should have be only occasional, can turn into an insurmountable ordeal. According to the bankers whom we interviewed, the reluctance they have to finance the cash flow problems is because that a negative cash flow is an indicator of potential problems which are not always punctual. According to them, cash flow difficulties could hide deeper dysfunctions related to mismanagement or a lack of competitiveness. As stated by the Account Manager of BMCE «If there are chances that the company found a profitability we will wait and give him time until the money comes in». The account manager of Popular Bank had similar remarks «It is difficult to support a company which is no longer competitive and still does not realize it; we follow it up unless there is no unpaid. When we have two unpaid, we resort to the Court unless the company goes through circumstantial economic difficulties. In that case, we may reschedule». The manager of printing house admited being faced with the reluctance on the part of the bank: «Cash was a bit tense lately and the banker was reluctant at my request. He changed his mind as He saw that I was not happy».To get the best possible support, the bankers we have interviewed insisted on the need for transparency of information and on the confidence. Indeed, for the bank, cash is an indicator which alerts the banker to possible difficulties. The banker will then be able to implement and provide upstream solutions. As difficulties are identified as temporary, some procedures might be implemented. A lack of transparency of information and communication on the problems that the company faces can potentially be detrimental in the sense that solutions can be found if the problems are identified very early. When the situation is already too degraded, it becomes difficult to be readjusted. The cash indicator is sometimes insufficient to alert enough soon the banker. The cash can keep being good while the company is doing very bad. According to an account manager of Popular Bank: «sometimes we do not notice problems unless it's too late, the situation is too deteriorated». It is therefore necessary for the company to be proactive in anticipating and communication about difficulties.In some cases, the SMEs mismanage its relationship with their bankers, often due to lack of experience and to a defeatist attitude. There is a deficiency in information transmission, a lack of proactivity on the part of SMEs managers. «People do not want to say they have hassles: they prefer to wait for the bankruptcy filing. Upstream, there are plenty of situations where there would have been a solution. A number of companies might have survived if they had accepted the procedure well before the difficulties come», says AWB account manager (Attiajri WafaBank). In other cases, the leader of the SME hides information or attempts to manipulate opportunism. He may also admit it, the leader of the SME operating in the agribusiness is a case in point: «with my banker, I do not fit in the relationship and I'm not in the emotional. I present figures, nothing else». Whatever the case, when it goes bad with the banker, it means the beginning of the litigation.

4.2. The Relational Competence shown by the Negotiating and the Interaction Capacity

- Bankers emphasize the role of dyadic interaction (contents, consistency, duration, frequency) in the production of the trust and the company's funding agreement. A better support is carried out when the company reports its problems early and when the SME manager is transparent. Good relationships are built on sharing information. We refer to the content and consistency of the relationship. The duration and frequency of interactions allow an accumulation of private qualitative information and a better knowledge of the company and its issues. This view is also shared by the manager of SMEs operating in the chemical sector. He emphasizes the importance of frequent meetings: «The account Manager of the bank X knows me for 6 years. A matter is settled once I call. understanding and confidence are immediate. We were able to create a relationship based on trust, I work with high transparency, I share maximum information». The executive may also be the origin of a relational orientation of financing. According to the same manager «I asked at first sight to have a single interlocutor whom I can get in touch with in case of problems. In need, I am in constant communication with him to explain the situation. Human relationship is essential. If you are in the closest possible contact it goes better and faster and we, together, find solutions». A strong interaction, close and frequent relationships foster the relational financing insofar inasmuch as it reduces the bankruptcy risk perceived by the banker as the experience of interaction of SMEs grows. Indeed, the information flow and the frequent communication lead to a better understanding of the business environment and the business opportunities, and a more accurate view of the prospects of the business, the banker gets a better understanding of business needs and ultimately ensure a better support.In addition, all executives whom we interviewed recognize the importance of the learning dimension «We have learned over time to know the requirements of the bank so as that the records may be accepted», said the head of the agency of event. The intensity of the relationship allows both parties to benefit from a common work experience. Indeed, the company interaction experience may acquire knowledge of banking practices and causes of failed relationships. This can prove to be a decisive factor in obtaining a better support. According to the executive of the SME operating in the Metallurgical Sector «When the bank asked us to come back with a different record, we learn how we can increase our chances for the next times. Similarly, when we know the person who follows us up, We know we have 60% acquired in the sense that he knows our history, He knows where we are from, what we intend to do and who we are». Therefore, companies also understand the importance of personal knowledge they must have about the account manager: assessing the failure risk is conditioned in part by the quality of client-provider interaction.In addition to acquiring specific technical skills to communicate with the financial partners, the acquired interaction experience by having relations with several banks increases the negotiating capacity. It seems that this capacity has as advantage to support the learning of SMEs with different banking institutions. The BMCI account manager confirmed it: «When an enterprise deals with several different banks, it has more glances over his situation, and this allows it to figure it out better». As part of a funding relationship, having deals with different banks is in the origin of negotiating capacity. That is the key indicator of the SME interaction experience. Interaction and banking communication are multiplied (when they are diversified) and improved knowledge of banking operation. In this sense, the printing house manager confirms having acquired some knowledge «I know better introduce an investment project».Besides acquiring specific technical skills to communicate with bankers, the interaction experience gained by diversifying banking partners increases bargaining power. This power is expressed by the ability of the SME to select among competitor financial partners (Bonvin, 2009) [29]. Each SME selects banks according to the contribution it gets from them. The Metal company manager says he makes use of this plurality «sometimes, we get with a bank credit lines which other banks neither propose nor offer to us. But with another bank, we get sometimes funds over the long term, and over short term with others». Diversifying banking partners is also regarded as a tool of comparison and easy negotiation, fast and efficient according all the managers we interviewed. They all put forward the argument of increased opportunities and alternatives: «It is important to deal with several banks, that allows to compare. It's good to have multiple partners and to diversify. We advise it» stated by the printing house manager. «We did not get the rate that suited us with the first bank, so we started working with a second one. Henceforth, the first bank regained the good terms with us» said the manager of the SME operating in the chemistry sector. As for the leader of the event agency, He explains that having two financial partners «has been thanks to investments. When we put in competition several banks, we get to juggle».The interaction experience allows the actors of the relationship to construct a relational competence. Relational variety (number and diversity of players) we refer here to permit to build a knowledge base of the banking players functioning. Beyond the costs, SMEs clearly identify which bank they contact and which one to choose in order to treat this or that problem with. For instance, when the speed is a priority, they turn to banks of flat organizational structure. The manager of the SMEs operating in the chemical sector asserted choose a partner based on the nature of his needs «I'm aware of which bank to choose when I need a quick support. Depending on the needs nature, I already know the bank I have to contact, I know which will let things drag». Relationship intensity (frequency, duration, consistency and content) is supporting the development of know-how and know-being. Leaders acknowledge that the strength of the relationship creates relational norms, mutual understanding «my financial partners now know that with me it does not work like that, they have adapted and that's fine» has said one of the executives we interviewed.The empirical, exploratory and qualitative results of our investigation validate the two research proposals we formulated earlier. The verbatim powerfully illustrates how trust is the core of the establishment of a way of relational financing (First proposal). Moreover, we showed that the players in the field are aware of the role of the interaction and the interaction experience when aiming to acquire an bargaining capacity (Second proposal).

5. Conclusions

- Our research points out that establishing a way of relational financing is justified by the difficulty that SMEs encounter in getting financing through classical channels of granting loans. SMEs can adopt new behaviors that foster learning in their bargaining. The main lesson of this research is to consider the negotiation capacity as the result of an interaction experience between a client (SMEs) and provider (bank). This interaction is widely favored by the establishment of the financing relational mode. Whatever the objective position of both partners, the asymmetry of relationship, their respective power, the SMEs negotiating capacity reports a relational value that is expressed in terms of confidence and leads to a better appreciation of the SME bankruptcy risk. The empirical research we conducted shows that customer bargaining capacity appears in the eyes of banks as a good indicator of SMEs management. «We appreciate that SME negotiates and that it even diversify his banking partner because that allows all of us to share the risk» according to the AWB account manager. Banks we interviewed stated the bargaining is a signal of competence. According to the BMCE account manager «Whoever is negotiating is a wary and wakeful manager and that reassures us about the quality of the company». The fact that a leader is not ready to accept whatever in terms of financing relationship reveals the quality of his business, his negotiating ability is also a sign of managerial competence that reassures the banker.To conclude, the SME manager has to be proactive in sharing information about his business circumstance seeing as it creates the conditions for interaction propitious to the establish a relationship of trust with his banker. The negotiating capacity, produced by the interaction experience, improves the quality of funding applications and reflects the leader's ability to produce information that makes SME quality intelligible and credible. Thereby the negotiation capacity minimizes the bankruptcy risk perceived by the bank. We have also noted across interviews that diversification of SMEs financial partners has an important role in forming the negotiating capacity of managers and executives.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML