-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2016; 6(2): 36-45

doi:10.5923/j.mm.20160602.02

Study on Factors Affecting Mobile Payment Systems Diffusion in Zambia

Ernest Lesa , Simon Tembo

School of Engineering, University of Zambia, Lusaka, Zambia

Correspondence to: Ernest Lesa , School of Engineering, University of Zambia, Lusaka, Zambia.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Advancements in mobile technologies have led to an increased uptake of smart phones. This has led to a growing trend in mobile payment (m-payment) activities. However, Zambia’s mobile payment services have not evolved in step with mobile devices’ penetration rate. This study sought to examine consumer’s behavioral intention to use or not-use m-payment services through the applicability of the extended Technology Acceptance Model (TAM). A self-administered questionnaire was distributed to current-users, capable-users, regulators, and bank staff. 152 participants completed the survey questionnaires measuring their responses on likert-scale to Perceived usefulness (PU), Perceived ease of use (PEOU), Perceived risk (PR), Social norm (SN), Perceived cost (PC) and Behavioral intention to use (BIU), representing a response rate of 84.4 percent. SPSS analysis yielded a model linear regression Pearson correlation coefficient (R) value of 0.8, R2 of 0.56 and significance (p) value of 0.0001 indicating a significant model with very strong relationship among variables. The R values for independent factors PEOU, PU and SN against dependent variable BUI were positive with significance (p) values of 0.0001 (p<0.05) representing a scientifically and statistically significant positive influence on BUI, whilst PC(-.071) and PR(-.047) were insignificant though had negative coefficient values representing a deterrent influence on use of m-payment. This study successfully extended TAM for use to predict consumer behavioral intention to adopt m-payment services in Zambia.

Keywords: Mobile Payment, TAM, Diffusion, Zambia

Cite this paper: Ernest Lesa , Simon Tembo , Study on Factors Affecting Mobile Payment Systems Diffusion in Zambia, Management, Vol. 6 No. 2, 2016, pp. 36-45. doi: 10.5923/j.mm.20160602.02.

Article Outline

1. Introduction

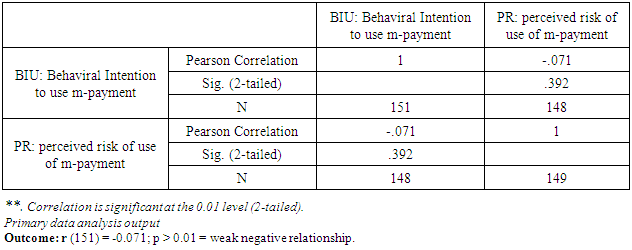

- Electronic commerce (e-commerce) is often referred to as shopping ‘anytime, anywhere’ this has been revolutionary in the way consumers shop without leaving home. The ‘anywhere’, however, requires access to a computer at work, home or at an internet café. Mobile commerce (m-commerce) overcomes this limitation, it infers to conducting business over a mobile device (Zmijewska, et al, 2004, Yang, et al, 2012). However, m-commerce cannot exist without payment systems and for any transaction to take place there must be a way for consumers to pay.Mobile payment (m-payment) is the transaction in which a mobile device is used to initiate, authorize and confirm an exchange of financial value in return for goods and services (Wu and Yang, 2013). With an increase in the uptake of smart phones, m-payments activities are expected to increase. However, Zambia’s m-payment services have not taken off as fast as expected. While several industry experts agree that m-payments will eventually take off, there are many barriers, some on the supply side and some on the demand side (Hayashi, 2012). The consumer, in this study, is seen as pivotal in the adoption/diffusion of m-payment systems. In emerging markets, such as in Africa, many consumers have mobile phones but few have bank accounts, spurring interest in mobile phones as a means of access to financial and payments services (Hayashi, 2012). Many authors’ findings indicate that mobile payment is among most recent financial channel bringing its benefit in terms of ubiquity coverage, convenience, flexibility and greater accessibility compared to traditional payment methods (King, 2010; Badeau, et al, 2011; Bamasak, 2011; Zmijewska, et al, 2004; Laukknen, 2007). Zambia is no exception to this phenomenon and even though is a good target for m-payment services, due to lack of tailored banking services, Zambia has not yet seen widespread adoption of m-payments (World Bank, InfoDev., 2014). This is contrary to the high mobile devices’ penetration rate of approximately 77 percent (Tech Trends, 2014). This would have seen m-payment as a panacea for the unbanked communities to gain access to financial services. Further evidence shows that only less than 17 percent of the total mobile money subscribers on the two major mobile network operators (MNOs), MTN and Airtel, are active users of m-payment systems(World Bank, Infodev, 2014).The slow adoption rate, in Zambia, raises many questions about what influences the adoption of mobile payment services. Therefore, this quantitative research examined the factors that influence the Zambian consumers’ intention to use or not use m-payment services through the applicability of the extended TAM originated by Venkatesh and Davis (2000).

| Figure 1. Mobile payment active users vs total subscribers |

2. Literature Review

- To predict innovation adoption, many theories and models have been applied in research studies of consumers’ intention to use or not use an innovation or Technology. The importance of researching the user acceptance of a technology has been recognised since the mid 1980s. Some of these originating theories included the theory of reasoned action (TRA), the theory of planned behavior (TPB), then the extended technology acceptance model (TAM). TRA, proposed by Ajzen (1991), suggests that the individual’s actual behavior is determined by one’s behavioral intentions (BI) to perform a particular activity. Recent studies explain BI as being influenced and shaped by one’s attitude and subjective beliefs, which in turn are shaped by their beliefs associated with motivations and evaluation of beliefs. (Phonthanukitithaworn, et al., 2014). TRA was later extended by adding an additional construct to the model, namely, perceived behavioral control in order to reflect the factor of control beliefs that relate to one’s situation, abilities, and resources (Ajzen, 1991). This became known as TPB. TAM (Davis, 1989) proposed two key constructs of intentions to use technology; perceived ease of use (PEOU) and perceived usefulness (PU) as major determinants influencing an individual’s behavioral intentions and actual behavior when considering new technology. Initially, though TAM was derived from TRA, the final model of TAM excluded the attitude construct that clearly explain intention using the underlying determinants. Hence resent studies have extended TAM to include other factors in order to apply it to a wide range of technologies, and it has, arguably, emerged as the most robust model predicting user acceptance. TAM presumes that behavioral intention is formed as a result of conscious decision making processes (Venkatesh, et al., 2003; Mohan et al., 2014). The model was extended to specify three belief factors that are salient in the context of information technology usage and acceptance: perceived usefulness (PU), perceived ease of use (PEOU), and attitude towards usage (ATU) (Ajzen & Fishbein, 2000; Davis, 1989). Perceived usefulness (PU) is defined as "the degree to which a person believes that using a particular system would enhance his or her performance" (Davis, 1989). Perceived ease of use (PEOU) refers to "the degree to which a person believes that using a particular system would be free of effort" (Davis, 1989).

2.1. Research Model and Hypotheses Development

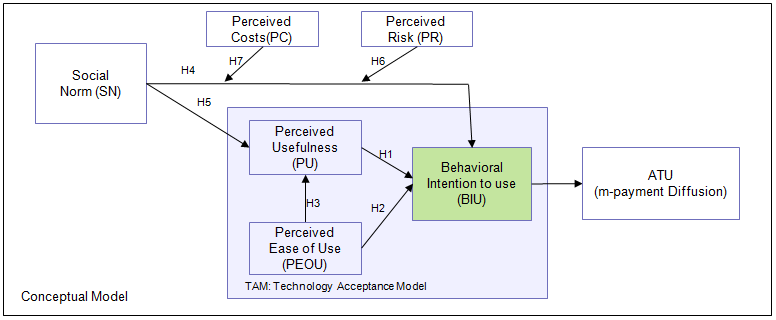

- To understand what influences user acceptance of m-payment services, literature review enabled the development of a research model and set of hypotheses. The original TAM model, consists of perceived usefulness(PU), and perceived ease of use(PEOU), in this study the model is extended by including perceived cost(PC), perceived risks(PR) and social norms(SN) as independent variables with Behavioral Intention to use m-payment services(BIU) as a dependent variable.

| Figure 2. Research Model hypotheses development |

2.1.1. Behavioral Intention to Use (BIU)

- The BIU is a dependent variable used to determine whether users will actually accept or use m-payment system. For example, past studies have found a direct and significant influence between behavioral intention and actual usage of the system (Shroff, et al, 2011).

2.1.2. Perceived Usefulness (PU)

- Perceived usefulness is defined as the degree to which a person believes that using a particular system would enhance his or her job performance (Davis, 1989). ‘Job’ can be replaced with ‘everyday life’ in regards to m-payments (Zmijewska, et al, 2004). As with ease of use, the influence of usefulness on user acceptance of new technology has also been extensively validated in various studies of TAM (Davis, 1989; Venkatesh and Davis, 2000; Slade et al, 2013). In the context of original TAM, this view is a central antecedent to attitude towards using a new technology (Davis, 1989). Phonthanukitithaworn (2015) points out that PU also captures how m-payment can help users to achieve task-related goals, such as being more effective and efficient in activities. For instance, a consumer may feel that m-payment services will allow him/her to pay via their mobile phone at anytime from anywhere. Therefore, PU will have a strong and positive effect on intention to use m-payment services in Zambia. The first hypothesis is therefore constructed as follows:H1: There is a positive and significant relationship between PU and BIU of m-payment.

2.1.3. Perceived Ease of Use (PEOU)

- Perceived ease of use is the degree to which the user believes that using a particular system would be free of effort (Davis, 1989). Much previous research has established that perceived ease of use is an important factor influencing user acceptance and usage behavior of information systems (Venkatesh, 2000). Other constructs that capture the notion of perceived ease of use, are complexity and effort expectancy (Venkatesh, et al, 2003). Given the technical limitations of mobile devices, ease of use becomes an imminent acceptance driver of mobile applications (Venkatesh 2000). The more complex the product or service is to use and understand the slower is its adoption rate. (Suki, 2010). Additionally, usage is theorized to be influenced by perceived ease of use (Davis, 1989). Therefore, two more hypotheses are constituted as; H2: PEOU has a positive effect on behavioral intention to use m-payment.H3: PEOU of use has a positive impact on perceived usefulness of m-payment.

2.1.4. Social Norm (SN)

- Social norm, also referred to as Subjective norm (SN) in the Theory of planned behaviour (TPB), is defined as the degree to which an individual perceives that most people who are important to him/her think he/she should or should not use the system (Venkatesh and Davis, 2000). Social norm reflects perceptions that significantly referents the desire for individual to perform or not perform a behaviour. Venkatesh and Davis (2000) further argues that people may choose to perform a behaviour, even if they are not themselves favourable toward the behaviour or its consequences, if they believe one or more important referents think they should, and are sufficiently motivated to comply with the referents. Therefore, it is hypothesised that SN will influence PU to be significant. H4: Social norm will have a positive effect towards acceptance of use of m-payment services.H5: Social norm will have a positive influence on perceived usefulness.

2.1.5. Perceived Risks (PR)

- Innovations usually are believed to come with risks. Perceived risk is defined as the consumer's subjective expectation of suffering a loss in pursuit of a desired outcome (Suki, 2010). Also Lockett and Littler (1997) reported that perceived risks of an innovation were inversely related to adoption in telephone based direct banking services. It is thus hypothesized that: H6: perceived risk has a negative impact towards consumer acceptance of m-payment services.

2.1.6. Perceived Costs (PC)

- Perceived cost (PC) is defined as the extent to which a person believes that using m-payment would cost money (Luarn and Lin 2005). The cost may include the transactional cost in the form of transactional charges, bank charges, mobile network charges for sending communication traffic (including SMS or data) and mobile device cost. PC was also proposed into the TAM by Amberg, et al., (2003). Mallat (2007) is of the view that, the cost of a payment transaction has a direct effect on consumer adoption if the cost is passed on to customers. H7: Perceived cost has a significant negative impact on the Behavioral intention to use m-payment services.

3. Methodology

- The literature review focused on works of previous TAM studies to ensure that a comprehensive set of constructs and list of scales were included for the purpose of extending the model. Based on this model, data collection and sampling procedures are outlined here, followed by discussions on measurement development and results used to test, evaluate and validate hypotheses.

3.1. Data Sampling and Collection

- The objective of this study was to empirically explore the factors that influences m-payment services acceptance in Zambia. Lusaka province, being the city with a higher population and wider exposure to m-payment services, was chosen to provide a representative sample population on common m-payment service platforms.

3.1.1. Subjects and Data Collection Tool

- The data collection was done from the population of interest whose individuals were likely to have been exposed to m-payment. A sampling size of 180, on paper based questionnaires, was distributed via a convenience sampling method covering current users of m-payment, capable users, Merchants and Bank staff. Out of 180 questionnaires, 152 were completed and returned resulting in response rate of 84 Percent. The questionnaire is divided into 2 sections: First section was used to collect respondents’ demographic profile and second part was used to identify level of user’s satisfaction and perception in m-payment services. The five-point Likert scale ranging from 1 – strongly disagree to 5 – strongly agree was used for the questions to indicate a degree of agreement or disagreement with each of a series of statements related to independent factors.

3.2. Acceptance Factors Variable Measurement

3.2.1. Dependent Variables

- Behavioral intention to use (BIU) m-payment services in Zambia was the dependent variable.

3.2.2. Independent Variables

- From existing literature, independent variables were; PU, PEOU, PC, PR and SN measured across 3 to 5 questions tailored to address specific m-payment characteristics.

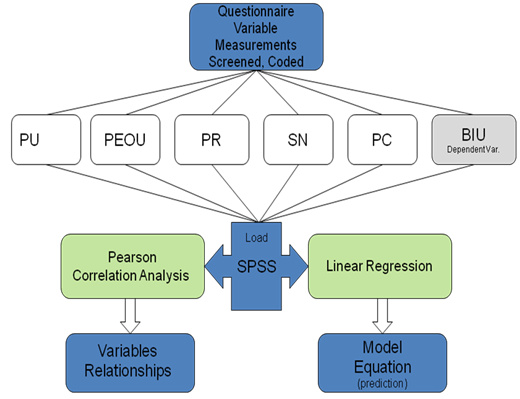

3.3. Data Analysis and Results

- Data was analyzed by use of IBM SPSS statistics package in order to yield Pearson correlations among variables and a linear regression Analysis to come up with a model for predicting respondents’ intention to adopt m-payment services.

3.3.1. Respondent Profiles

- A total of 152 responses were collected from users whose demographic profile comprised the majority between the age of 20 – 30 years constituting 38.8 percent, followed by those between 31 and 40 years old at 28.3 percent. The gender distribution of respondents consisted of 41.3 percent females and 58.7 percent males of which 91.3 percent are aware of m-payment with 74.4 percent already using m-payment services.

| Figure 3. Data processing |

3.3.2. Correlation Analysis

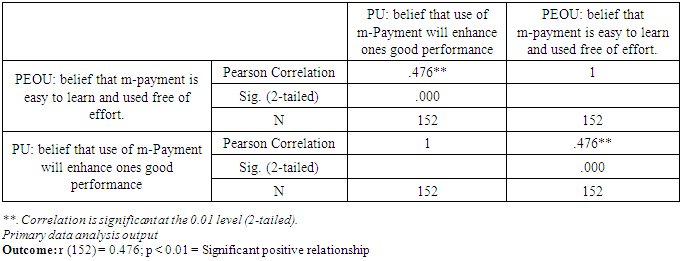

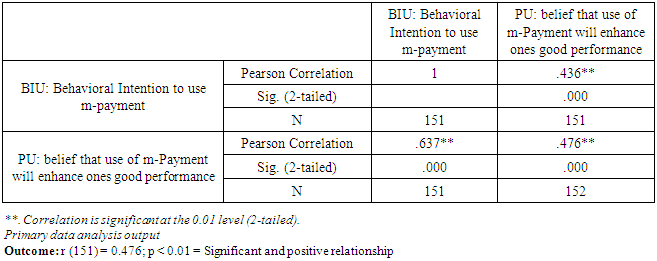

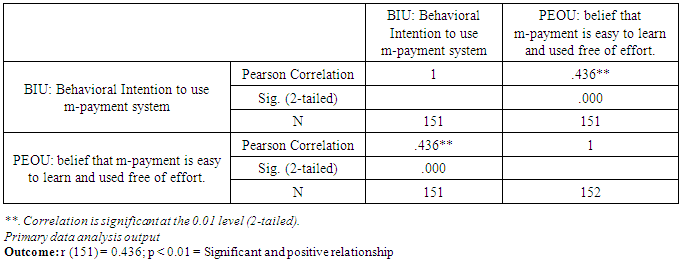

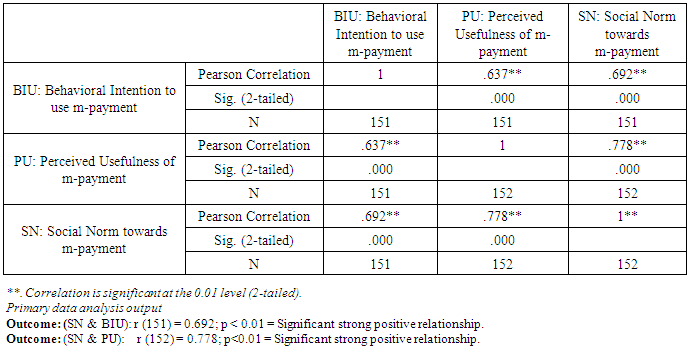

- The Pearson correlation analysis was carried out in order to determine the amount and direction of the relationships among variables. Tables 5.1 to 5.6 present the Pearson correlation coefficient (r) among independent variables and dependent variables. The r value can take a range of values +1 to -1 representing the strength of relationship between two variables. The level of significance was set at 1 percent.

3.3.2.1. Correlation between PEOU and PU

3.3.2.2. Correlation between PU and BIU

3.3.2.3. Correlation between PEOU and BIU

3.3.2.4. Correlation between SN and BIU; SN and PU

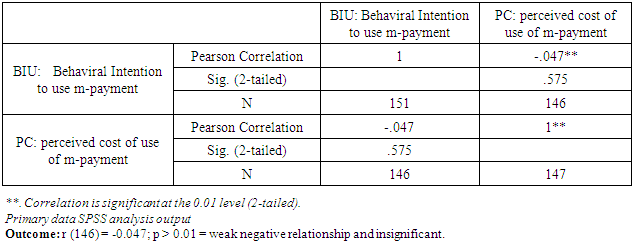

3.3.2.5. Correlation between PR and BIU

3.3.2.6. Correlation between PC and BIU

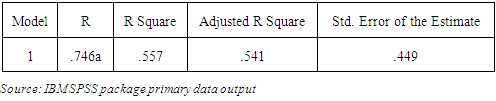

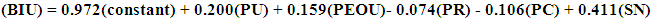

3.3.3. Regression Analysis

- A linear regression was carried out with an objective to come up with a model that can be used to predict respondents’ intention to use m-payment system. The focus was on the relationship between a dependent variable BIU and the rest of the independent variables (PU, PEOU, PR, SN and PC) whose outcome is represented in Table 5.7.

|

| (1) |

4. Summary of Findings and Discussions

- This study revealed that m-payment is not a new phenomenon in Zambia. 91.3 percent of the respondents were aware of m-payment services although not all had decided to adopt the service for various reasons, one of them, lack of end to end services and lack of business models among banks and Mobile network operators (MNOs). Further interesting revelations were made. First, the model factor correlation analysis revealed that consumer’s perception towards costs and risk of use of m-payment services had no statistically significant influence on behavioral intention to use m-payment services. This can be deduced that Zambian consumers exhibit a culture of low uncertainty avoidance and price insensitive depicting a society that is more willing to try new technologies. Furthermore, results show that out of 97.9 percent of the responded using mobile phone, 74.4 percent would prefer to use m-payment services, other research findings indicate only an average of 8.5 percent of the registered mobile money subscribers are active users (World Bank, InfoDev, 2014). This phenomenon shows that the traditional retail banks and MNOs have not delivered m-payment service awareness tailored to increase acceptance to use of m-payment as a preferred payment channel.Secondly, social norm factor was found to be the most important with regard to behavioral intention to use m-payments, followed by perceived usefulness then perceived ease of use. Equally important, consumers’ view of social norm and perceived ease of use were found to have statistically significant and positive influence on perceived usefulness of m-payment services. Social norm being the most significant factor impacting perception of usefulness of the service and behavioral intention to use m-payments implies that the influence of perception of how the product embraces people’s image and social status becomes a critical determinant in both people feelings about innovation utility and decision-making process of Zambian consumers in adopting m-payment services. This is in consistent with previous studies that have concluded that the influence of friends, parents, and colleagues can become a critical determinant in improving consumers’ willingness to use m-payment. (Phonthanukitithaworn, et al, 2014). The issues of perceived risk or perceived trust in the adoption of m-payment services can be associated with societal expectations encountered in Zambian society that has a low uncertainty avoidance culture. Insignificant perceived cost can be attributed to the respondents’ profile that comprised of the working class whose income is sufficient enough leading to price insensitivity on use or intention to use m-payment services.

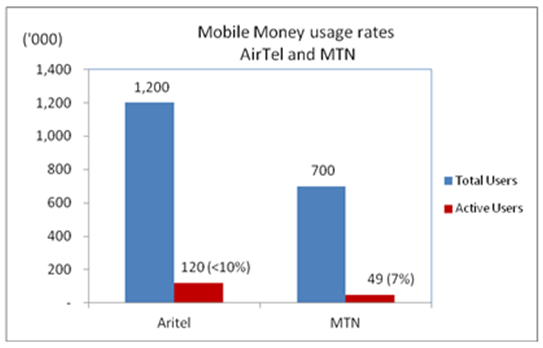

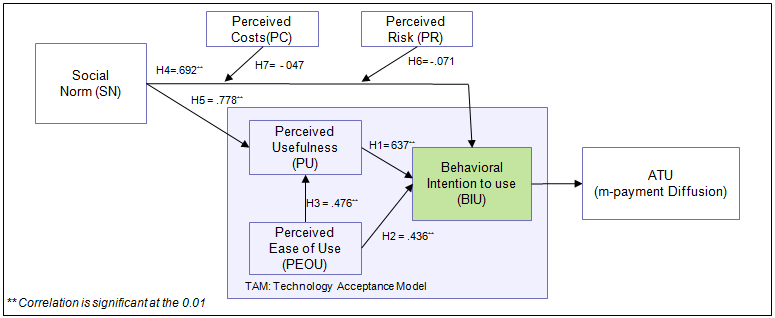

4.1. Construct Relationships and Hypothesis Testing

- This study tested each hypothesis by examining the path significance on the structural model in Figure 2. The results showed that there was a good fit of data to the model whose results are presented on Table 5.1 through to Table 5.6.The path coefficients and significance of the structural model indicates that five hypotheses (H1, H2, H3, H4 and H5) were supported and two (H6 and H7) were not significant (Table 5.5 and Table 5.6). In other words, consumer’s intention to use m-payment was determined by three factors: Social Norm, perceived usefulness and perceived ease of use. Equally important, consumers’ perceptions of social norms and perceived ease of use were revealed to have a direct and significant influence on perceived usefulness.

4.1.1. Relationship Results for PEOU, PU and BIU

- This research revealed that the consumers ‘intention to use m-payment services was affected by perceived usefulness and perceived ease of use and had a significant and positive effect on respondent’s intention to adopt m-payment. These findings are consistent with previous studies on m-payment services adoption based on the TAM approach (Chandra et al., 2010; Shroff et al, 2011; Venkatesh, V and Davis, F, 2000; Slade et al, 2013). The findings imply that if m-payment is useful and easy to use, more consumers will tend to use the service. This is consistent with original findings on TAM study by Davis, F, 1989.

4.1.2. Relationship Results for SN towards PU and BIU

- Social norm factor was found to have a positive and strong correlation towards the behavioral intention to use m-payment services. The results are consistent with findings in earlier studies by Schierz et al (2010) and Sripalawat et al (2011), also used in the UTAUT2 model of Venkatesh et al. (2012). Additionally, SN was found to have a strong positive correlation towards perceived usefulness of m-payment.

4.1.3. Perceived Risk

- Findings show that the PR has a fairly negative but insignificant influence on behavioral intention to use m-payment. Though contrary to hypothesis, this is in line with some of the findings in earlier studies. (Suki et al, 2010; Mohan et al., 2014; Slade et al., 2013). This implies that the consumers, subjectively, do not perceive suffering a loss while using m-payment services.

| Figure 4. Model structural path analysis hypotheses results |

4.1.4. Relationship Results between PC and BIU

- The findings revealed that costs have a negative effect on m-payment but very little significance on consumer’s intention to use m-payment. This finding is consistent with some of the conclusions made in previous studies like by Diniz E. et al. (2011).

4.2. Implications

- This section articulates the implication of this study followed by the limitations and suggestions for further research and ending with the conclusion of the paper.

4.2.1. Theoretical Implications

- From a theoretical standpoint, the findings of this study hold several implications in the context of technology adoption. Firstly, with reference from previous studies, this research successfully extended the original TAM in the context of m-payment with inclusion of 4 new constructs. Applying the extended TAM to m-payment services adoption in a Zambian context, explains 56 percent of the variance in behavioral intention illustrating an improvement of explanatory power in behavioral intention to adopt new technology when compared to findings in which a non-extended TAM explained 40 percent of the variance (Venkatesh and Davis, 2000). Secondly, though it’s original two facets of PEOU and PU were found valid in explaining the respondents’ intention to use new technology they were not the only factors influencing adoption. This finding is consisted with earlier findings in the study of new technology adoption by Shin (2010); Schierz et al (2010); Wu and Wang (2003); Cheong, et al. (2004). The results of the model testing indicate that social norm, perceived usefulness and perceived ease of use are significant factors affecting consumer intention to adopt m-payment services in Zambia. Therefore, the model with its constructs is a well suited research framework to provide a clear understanding of factors affecting m-payment adoption and can be further refined to explore and predict technology diffusion in a Zambian context.

4.2.2. Practical Implications

- The findings of this research embrace important implications from a practical context of providing better strategic insight to design and implementing m-payment services that yield higher consumer acceptance in Zambia.Firstly, service providers should focus on building awareness and carefully consider issues of compatibility of the service with Zambian consumers. Moreover, the significant factor of SN suggests that the influence of perception of how the product embraces people’s image and social status becomes a critical determinant. Hence aggressive marketing and awareness strategies become the main ingredient of m-payment usage in Zambia. Arguably, to enhance PEOU and PU, service providers need to ensure that the services offered to consumers meet their needs, current values and lifestyle which should seamlessly be integrated into consumers’ payment process without requiring superfluous process, equipment and training.Equally important, though not significant, is the negative impact of perceived cost that suggests that high cost may be a burden for many users since they have to bear the cost of usage. There should be increased collaboration among banks, the regulator and MNOs in the provision of m-payment services with the view to develop an acceptable business model that ultimately provides a framework for shared operational costs and turnover.

4.3. Limitations and Future Research Directions

- There are several limitations noted in this study that need to be considered for future research improvements. Firstly, this study focused only on a few respondents from the urban setup of the capital city of Lusaka for collection of empirical evidence. Though m-payment system is uniform across the country, the results may not be generalized and applicable when cultural differences are considered. The acceptance model may perform differently in different cultural settings such that some factors could become more or less important in one culture than they are in other cultures (Venkatesh, and Zhang. 2010). Secondly, this study did not capture the complexity of time as the constructs measures were collected at the same point in time. Hence further studies may consider improving measurement reliability by employing further methodology like longitudinal studies to closely observe and investigate the difference in consumers’ adoption throughout the chronological stages. Lastly, they may have been other factors that could have affected the behavioral intention to use m-payment services. Therefore, future research could strengthen construct analysis through expanding the constructs base.

5. Conclusions

- M-payment is a very influential tool that can deliver needed financial services across the country. The proposed, extended TAM, model was empirically validated with survey data whose study’s results suggests that service providers can leverage on high mobile penetration to promote M-payments services by enhancing factors that have high significance in Zambia. Thus this study has provided valuable insights in mobile and electronic payment industries to implement appropriate service strategies and business models to enhance m-payment systems usage (diffusion) in future.

ACKNOWLEDGEMENTS

- I would like to thank all the lecturers and computer centre staff at university of Zambia who supported me throughout the study. Also not forgetting my wife and the entire family for the support they rendered. Special thanks go to my supervisor Dr. Simon Tembo and Prof. Imasiku Nyambe. Lastly but not the least, thanks to my superiors at FNB and not forgetting distinguished Prof. Viswanath Venkatesh for having provided me with full text access to his journals and also to everyone that supported me.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML