-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2015; 5(3): 63-89

doi:10.5923/j.mm.20150503.01

Effect of Global Financial Meltdown on the Nigerian Banking Industry and Economy

Umanhonlen Ogbeiyulu Felix1, Lawani Imade Rebecca2

1Department Banking & Finance, Faculty of Management Sciences, University of Benin, Benin City, Nigeria

2Department of Accounting, Faculty of Management Sciences, University of Benin, Benin City, Nigeria

Correspondence to: Umanhonlen Ogbeiyulu Felix, Department Banking & Finance, Faculty of Management Sciences, University of Benin, Benin City, Nigeria.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

The paper ascertained the effect of the global financial meltdown on the Nigerian banking Industry and Economy. The study explores the plausibility of the assumption of the research topic stated above, using the Nigerian banking sector and economy as a focal point. The intensity of the financial crunch in Nigeria was one that went through all facets of the Nigeria economy. The research work adopted ordinary least square method of econometric techniques to evaluate whether or not their existed a negative, positive or neutral relationship among variables of interest. The study covered a period of 42 quarters and employed secondary data. Specifically, it holds that the global financial meltdown had a negative or reverse effect both on the Nigerian banking sector and the economy. However, some quarters following the financial meltdown, there were drastic changes (negative) in the variables that explain the financial development of the economy. Hence, the research concluded by suggesting economic policies that could restore the economy to full stability as well as adequately insulate the economy against future financial crisis. The study recommends that policy makers should evolve comprehensive measures to address the crisis at the national level and in any case to bring about a return to stability in the international financial system.

Keywords: Nigeria banking industry and economy, Global financial meltdown, Policy implications

Cite this paper: Umanhonlen Ogbeiyulu Felix, Lawani Imade Rebecca, Effect of Global Financial Meltdown on the Nigerian Banking Industry and Economy, Management, Vol. 5 No. 3, 2015, pp. 63-89. doi: 10.5923/j.mm.20150503.01.

Article Outline

1. Introduction

1.1. Background of the Study

- The world is in the midst of a financial crisis which threatens a worldwide economic recession. The ‘Credit crunch’ as it has come to be known brought panic and turmoil in the summer of 2007 to the world’s financial markets causing the United States’ housing market bubble to burst. The crisis threatens a worldwide economic recession, potentially bringing to a halt more than a decade of increasing prosperity and employment for western economies and potentially wiping a staggering $1 trillion off of the value of the world economy [1]. The global economic crisis started as a financial crisis in the United State of America in 2007. It has it root in credit contraction in the banking sector due to certain laxities in the US financial system. The crisis later spread to Europe and now has become a global phenomenon. The financial crisis at the early stage manifested strongly in the sub-prime mortgages because households faced difficulties in making higher payments on adjusted mortgages [2]. Accordingly, Aluko [3] as referenced in [24] noted that this development led to the use of credit contraction by financial institutions in the US to tighten their standards in the light of their deteriorating balance sheets. Like all previous crisis much literature has once again been written about the causes of current crisis. Many economists and commentators have highlighted the causes of credit crisis due to lack of proper regulation, legislation and transparency [4-6]. In addition, financial institutions stopped lending and recalled their credit lines to ensure capital adequacy. Furthermore, this credit crunch has also highlighted the fragility of capitalism and the free-market economy, as the fallout from the credit crunch and the wider economic crisis continues, demands for alternatives are certain to grow.Historically, banks used only the money they received from depositors to lend to borrowers. They were not able to obtain money from other sources other than depositors. However, in recent years, banks have been able to rely not only on depositors but also on the wholesale money markets, where they could borrow money from other banks and then resell it to their borrowers at a higher interest rate. This secondary market was in part made possible by the creation of “credit default swaps” (CDSs). These allowed a bank to effectively insure itself against the risk that a borrower might not pay back a loan. This led to an illusion that loans were now much lower risk and allowed such loans to be bought and sold. This then led to the creation of collateralized debt obligations (CDOs), which were bought by banks as interest-bearing investments.According to Goodhart & Charles [6] the sub-prime lenders then invented another way of making money in a sector which was already highly risky. Many lenders wanted to ensure they did not lose out on possible money making opportunities in the sub-prime market and they developed a number of complex products. This was achieved by breaking down the value of the sub-prime mortgage market. In the name of the securitization, debt was sold to a third party, which would then receive the loan repayments and pay a fee for this privilege.The financial crisis has proven very clearly that the apparent strength of modern financial markets was illusionary. The happy-go-lucky mood evaporated instantly, with the write down of losses accompanied by the sackings of executives and followed by more stringent lending for the real victims of the credit crunch. Furthermore, financial crisis was accompanied by rising inflation – as demand for oil and food pushed prices up globally. This crisis has stunned both the left and the right of the political spectrum and the different economic schools of thought. Many economists and policy makers have suggested more regulation and transparency, with only a few highlighting the role greed and speculation played [4].Cecchetti [4] noted that the third world has also not been spared; Bangladesh, Indonesia, Malaysia, Pakistan, South America, Africa as well as the Middle East were all sold the idea of free markets, and all of these regions and nations now have capitalistic financial markets where large sums of wealth are the subject of speculation on the state of the economy and future revenue flows. Questions regarding bank solvency, declines in credit availability, and damaged investor confidence had an impact on global stock markets where securities suffered large losses during late 2008 and early 2009. Economies during this period slowed world-wide as credit lightened and international trade declined [7] as referenced [8]. Notable literature reviews that some critics argue that credit rating agencies and investors failed to accurately price the risk involved with mortgage-related financial productions, and that government did not adjust their regulatory practices to address 21st century financial markets [8]. Governments and central banks responded with unprecedented fiscal stimulus monetary policy expansion, and institutional bailout. However, to avoid financial meltdown, governments of many countries have intervened; several central banks have slashed interest rates and injected liquidity to their financial systems.

1.2. Statement of the Research Problem

- Since the problem of the use of credit contraction by foreign banks began, the Nigerian banking system has seriously been entangled in a financial crisis. At a time, the banks were unable to carry out their statutory function in the Nigerian economy. Like most developing countries, Nigeria felt the effect of the financial crisis largely through trade and capital flows because of the openness of the economy and the near total reliance on crude oil exports for government revenue and foreign exchange earnings. The news of the financial crisis came as a shock to the Nigerian economy. This is because, prior to the crunch, the Nigerian banking industry experienced remarkable changes after the consolidation exercise. Shortly after the recapitalization of the capital base in the industry, the public confidence in the industry became very high which can be seen from the increase in bank’s depositors’ funds. Thus, the banks went into project financing in the real sector of the Nigerian economy. Therefore, they were able to support the process of economic growth and development of Nigeria. Before the consolidation exercise started in 2005, the Nigerian banking industry witnessed a lot of stress, uncertainty and anxiety. Investor’s and depositor’s funds were not guaranteed, thereby making many of the banks to come under stress due to capital inadequacy. Moreso, the value of investor shares in the Stock Market was also depreciating. These problems greatly impaired the quality of the bank’s assets as non-performing assets became unbearable and became huge burdens on many of the banks. The financial intermediation role of the banks became heavily impaired while the macroeconomic activities seriously slowed down. This eroded the confidence of the general public which used to be a great asset of the banking sector in the past. It was against this background, that the Central Bank of Nigeria (CBN) announced a major reform in the entire Nigerian banking industry and economy. The recapitalization of the capital base of banks constituted the first phase of the reform policy in the entire banking sector of the Nigerian economy [9]. Though, the impact of the crisis through the financial system was not as direct or devastating as those of developing and emerging market economies where there was a near obliteration of the entire financial system because of the limited integration with the global financial markets. However, when the impact of the crisis permeated Nigeria’s financial system, the soundness and stability of the system was seriously threatened prompting a decisive intervention of the Central Bank of Nigeria (CBN) to mitigate the emerging crisis and restore public confidence. The aim of this research study therefore was to ascertain the impact of the global financial crisis on the Nigerian banking industry and economy. Based on the crises experienced in the banking industry in the post consolidation on which was fueled partly by the global financial meltdown, this study intend to find answers to the following research questions; • What effect did the global financial meltdown have on the Nigeria Banking Industry and Economy? • To what extent does the financial meltdown affect the Nigeria Banking Industry and Economy?• What was the position of banks in Nigeria economy before the global financial crisis? • Is there any difference in financial position of the banking industry in the Nigeria Economy before and after the Financial Crunch?

1.3. Objectives of the Study

- The aim of the study was to ascertain the effect of the Global Financial Meltdown on the Nigeria Banking Industry and Economy.The specific objectives are to:i determine the extent to which the Financial Meltdown affect the Nigeria Banking Industry and Economy.ii ascertain the Financial Position of the Nigeria Banks in Nigeria Economy before the Meltdown. iii determine the difference in financial position of the Banking Industry in the Nigeria Economy before and after the Financial Crunch.

1.4. Hypotheses of the Study

- Hypothesis 1 Ho: the financial meltdown did not significantly affect the Nigeria Banking Industry and Economy.H1: the financial Meltdown did significantly affect the Nigeria Banking Industry and Economy.Hypothesis 11 Ho: there is no significant difference in the financial position of the Nigeria Banking Industry on Economy before and after the financial meltdown.H1: there is a significant difference in the financial position of the Nigeria Banking Industry on Economy before and after the financial meltdown.

1.5. The Scope of the Study

- This research seeks to evaluate the effect of global financial meltdown on related activities of the Nigeria Banking Industry and Economy. The study covered a period of 42 Quarters (2001Q1 to 2011Q2); the first 26 quarters were for pre-meltdown period from 2001Q1 to 2007Q2, whilst the remaining 16 quarters were for meltdown period from 2007Q3 to 2011Q2. Such a period as it’s enough to carry out proper analysis of the various aspects of the topic, and the results were compared to validate the researcher’s findings.Our concerned were on banking and economy variables such as Financial Deepening (MS2/GDP) as a proxy for Nigerian Banking Industry and Economy, Inflation Rate, Exchange Rate, Inter-Bank Rate, Credit to the Real Sectors, Central Bank Lending Rate, Interest rate and Broad Money Supply. Hence, secondary data from the bureau of statistics and Central Bank of Nigeria were used for the stipulated periods of analysis above.

1.6. Significance of the Study

- This research work is significant in that • It provides the government insight over the problems, causes and impacts of global financial meltdown. • It ensures bridges are enunciated to bind the gap created by the crunch in Nigerian Banking Industry and Economy.• It provides Central bank of Nigeria and its ally’s detailed information on the extent the crunch strained the gains that were made in the banking sector as well as the economy of Nigeria.• It provides fundamental guidelines to policy makers, bankers, investors as well as student.• It enables reservoir of retrieval of materials for academia, resources persons, and interest group.• It creates awareness about the situation of the economy in prospective as well reports in real terms.

2. Literature Review

2.1. Introduction

- This Chapter reviews relevant literatures that are related to the subject matter. Issues to be reviewed amongst other things are the meaning of Financial Crisis, the Genesis of the Recent Global Financial Crisis, reasons for the Financial Meltdown, and Major causes of Financial Crisis. Others are the Effects on the Global Economy, Financial Meltdown and the Nigeria Banking experience, Effects of Global Financial Crisis on Nigerian Economy, intended Rescue Packages across the Nations of the World, and theoretical Framework of the Study. The Global Financial Meltdown started in the United States of America and the United Kingdom when the Global Credit Market came to a standstill in July 2007 [10]. The Financial Crises presumed for a while and started to show its effect in the middle of 2008. Around the world stock markets fell and large financial institutions collapsed and were bought out, and governments in the wealthiest nations have had to come up with rescue packages to bail out their financial systems.The Global Financial Meltdown has its roots in a banking practice called sub-prime lending, it is traceable to a set of complex Banking problems that developed overtime, caused specifically by housing and credit market mismatch, poor judgment by lenders, inability of home owners to make mortgage payments, speculation and over building during boom period, risky loans, high personal and corporate debt profiles, weak corporate governance etc. Banks and other financial institutions accounted for huge non-performing loans and the inability to advance credits to customers and meeting up with cash withdrawals by depositors [11].

2.2. The Meaning of Financial Crisis

- According to Ajekigbe [15] as cited in [11], global financial meltdown is a disturbance to the financial market that disrupts the market capacity to allocate capital with financial intermediation and investment consequently grinding to a halt. It occurs when there is a disorderly contraction in money supply and wealth in an economy. Such crisis is often demonstrated by a credit crunch which occurs when participant in an economy lose confidence in having loans repaid by debtors [12] as referenced in [8]. The global financial meltdown did not happen in a vacuum, it was as a result of consumers agreeing to over extend their available resources which was miss-calculated or forecasted by financial experts [13] as referenced in [24]. The financial meltdown became prominently visible in September 2008 with the failure, merger or conservatorship of several large United States-based financial firms [14] as cited in [50]. According to Torbat [13] as cited in [24] responded that with failures of large financial institutions in the United State, it rapidly evolved into a global crisis resulting in a number of European bank failures, declines in various stock indexes, and large reductions in the market value of equities and commodities worldwide. The leading was in the third quarter of 2007 when banks like UBS and Merill Lynch released their second quarter result and huge losses were revealed arising from asset base securities linked to subprime loans. But sometime around September 15, 2008 the day Lelunan Brothers went under and Merill Lynch disappeared-the containing well around Wall Street disintegrated and toxicity began leaking into the global financial system [15]. Accordingly, Jickling [16] as cited in [51] common view is that disruptions in financial markets rise to the level of a crisis when the flow of credit to households and business is constrained and the real economy of goods and services is adversely affected. The term financial crisis is applied broadly to a variety of situations in which some financial institutions or assets suddenly lose a large part of their value. However, the online business dictionary defines financial crises as a situation in which the supply of money is out paced by the demand for money. This means that liquidity is quickly evaporated because available money is withdrawn from banks (called a run) forcing banks either to sell other investment to make up for short fall or to collapse.

2.3. The Genesis of the Recent Global Financial Crisis

- The deregulation of financial markets in the United States which replaced prudential supervision with risk pricing in the 1990s led to an increase in financial assets in which there were many obscure market players and bonds replaced bank loans. During the mortgage boom of pre-2007, mortgage brokers enticed buyers with poor credit to accept housing mortgages with little or no down payments and without credit checks. As a result conventional mortgage was not offered because the lender viewed the borrower as having a larger than average risk of default on loans. Lending institutions charged interest on sub-prime mortgages at rates that were higher than a conventional mortgage in order to compensate for carrying more risk. Bank and financial institutions repackaged these debts with other high risk debts such as collateralized debt obligations and credit Default swaps and sold them to global investors. Collateral Debt obligations no doubt increased the liquidity in the system but at the same time encouraged reckless lending practices [17]. By 2005, one out of five mortgages lending in the US was sub-prime. The rates for the sub-prime were higher because they had Adjustable rate mortgages. The rates were fixed for two years; thereafter the rates were marked to the fed interest rates which rose substantially. The magnitude of the repossession that followed as rates reset to market rates, coupled with the mortgage company’s inability to renegotiate loans, led to the collapse of the government backed mortgages. Financial contagion resonated worldwide owing to the integration of the global financial system and stocks in all major exchanges tumbled steadily as the crisis grew [18]. By September 2008, the crisis had worsened as stock markets around the globe crashed and became highly volatile, while consumer confidence dipped. Apart from the U.S where the crisis of confidence that started with the Indy-Mac Bank spread to other depository and mortgage institutions, including Freddie Mac and Fanny Mae, to mention a few, it also led to the bankruptcy and eventual collapse of the third largest mortgage lender. The contagion effect was in no time felt across Europe, Asia and other emerging economies in such depth that was comparable with the great Depression of the 1930’s and the great inflation of the 1970’s. According to [17], the reality of serious economic downturn led various governments to initiate unprecedented financial bailouts, coupled with subsequent massive fiscal stimuli to reverse the trend and bring the world economics out of the doldrums. The policies adopted varied from interest rates cuts; boil-out packages, nationalization of financial institutions, swaps arrangements, coordinated rates cuts among central banks, etc. In the United States for instance, temporary swaps of treasury bills for mortgage-backed securities and on short selling of 799 financial stocks in September 2008 were also adopted. Others included the sale of Bear Stearns, bail-outs of American International Group (AIG), Fannie Mae and Freddie Mac, and Citigroup, among others. In the Euro Zone, the European Central Bank (ECB) injected about US $84.0 billion into the economy to ease liquidity problem. It engaged in coordinated rate cuts with six major central banks (the Federal Reserve, Bank of England, Bank of Japan, RBA, Bank of China, and Swiss National Bank). It also used swap lines from the fed to support its US dollar operations among others. In emerging Asian economics, the people’s Bank of China reduced interest rate on October 8, 2008 by 0.27 percent to 6.93 per cent from 7.2percent to reduce borrowing costs, while the Government created a stimulus plan in November, 2008. The Bank of Japan injected 2 trillion yen (£11.67 billion) into the money market. Indonesia, in line with the move adopted by several countries, reduced its overnight repo rate by two percentages points to 10.25 percent. The government also introduced safety net regulations that allowed the government and the central bank to quickly address financial sector weakness. It revised the year’s budget to reduce financing needs, pledged to respect the free movement of capital and also set up a task force to manage the crisis. African economies that were considered relatively insulated from the contagion became as vulnerable as other regions. The south African stock Exchange lost 27.0 percent and the rand slipped by almost 30.0 percent, while in Nigeria, the impact of the global financial crisis manifested first in the Nigerian, stock market from the second quarter of 2008 following speculations and perceived uncertainties that led to the divestments by many foreign portfolio investors from the country. This was later followed by the falling price of crude oil at the international market which triggered a subsequent depreciation of the naira against the US dollar, particularly from November 2008 [17].

2.4. Reasons for the Financial Meltdown

- The reasons for this financial crisis are varied, complex and largely attributed to a number of factors in both the housing and credit markets, which developed over an extended period of time. Though the global meltdown is generally attributed to the subprime mortgage crisis of 2007, other scholars have been precipitated by so many other factors that have been brewing up for over a decade. Osaze [20] and Adamu [19] reconciled that the crisis was caused by complex credit mortgage products, which include Collaterised Debt Obligations, Residential Mortgage Backed Securities (RMBS) and other Asset Backed Securities (ABS), in the USA and their effects on hedge funds worldwide. Jickling [16] opined that speculative excesses and error can cause liquidity to dry up and disrupt markets. Chossudovsky [21], and Adamu [19], blamed speculation (which involves buying stocks with the hope that it will increase in profit) as one of the causes of the crises, especially real estate speculation. The financial meltdown is intimately related to the unregulated growth of high leveraged speculative operations. [21] further iterated the cause to a totally deregulated financial environment characterized by extensive speculative trade and dates the history of deregulation back to the beginning of the Regan’s Administration. This economic crisis is the outcome of a process of macroeconomic and financial restructuring initiative in the early 1980s, it is the result of a policy framework, trade and financial sector reforms under World Trade Organization (WTO) auspices, not to mention the imposition of the International Monetary Fund’s (IMF) deadly macroeconomic reforms commonly referred to as the Structural Adjustment program (SAP).According to Crotty [22] as also viewed by Adamu [19], is a globally integrated system of giant bank conglomerates and the so called shadow banking system of investment of investment banks, hedge funds and bank create Special Investment Vehicle (SIV). This makes excessive risk to build up in giant banks during the boom and the NFA generated high leverage and high systemic risk with channels of contagion that transmitted problems in the US sub-prime mortgage market around the world. Other factors that have been blamed for the global financial crisis include poor credit rating, high risk loan, government policies and the growing bubble in the capital market that defied correction. Although the events leading to the financial crisis are connecting, the attribution of these events to only one factor provides an incomplete picture; there is no doubt that the balance sheet deterioration of financial intermediaries also played an important role [23] as cited in Osaze [24].

2.5. Major Causes of Financial Crisis

- The main literature specifies causes of financial meltdown will be briefly looked into as follows:

2.5.1. Mismatch on Assets and Liability

- This is a situation in which the risk associated with institutions’ debt and assets were not appropriately aligned. This mismatch can be seen in the use of short term commercial banks deposit to finance long term loans to business and home owners. In the international context, emerging nations get involved in asset-liability mismatch when they are unable to sell bonds denominated in their own currencies and therefore sell bonds denominated in dollars instead. Thus, generating a mismatch between the currency denomination of their liabilities (their bonds) and their assets (their local tax revenues) so that they run a risk of sovereign default due to fluctuations in exchange rates.

2.5.2. Regulatory Failures

- Some financial crises have been blamed on insufficient regulation and have led to changes in regulation in order to avoid a repeat while excessive regulation has also been cited as a possible cause of financial crises. While insufficient regulation was blamed for the 2008 financial crises, excessive regulation has been cited as a possible cause of Financial Crunch.

2.5.3. Uncertain Herd Behaviour

- High profiles of financial crises seem to be driven by the herd behavior and the mentality of the investors who follow the investment decisions of another investor who seem to have profiled from a particular investment. Then still, more others may follow their example, driving the price even higher as they rush to buy in hopes of similar profit. Such herd behavior causes prices to spiral up far above the true value of the assets, and thus, a Crash may become inevitable. If for any reason, the price briefly falls, so that investors realize that further gains are not assured, the spiral may go into the reverse, with price decrease causing a rush of sales, reinforcing the decrease in prices.

2.5.4. Strategic Complementarities

- Strategic complementarities is a guessing what other investor will do. In many cases investors have incentives to coordinate their choices. An example is given of someone who thinks whenever other investors want to buy lots of U.S Dollars he may expect the Dollar to rise in Value and therefore has an incentive to buy Dollar too. Likewise a depositor in a bank who expects other depositors to withdraw their funds may expect the bank to fail, and therefore has an incentive to withdraw too. Economists call an incentive to mimic the strategies of other investors’ strategic complementarities.

2.5.5. Fraudulent Acts

- Empirical finding has shown that fraud is one of the ways financial upheaval can come to place, owing to the role it has played in the collapse of some financial institutions. Typical cases of fraudulent financial practices that have the propensity to precipitate financial crises includes situations when companies attract depositors or investors through misleading claims about their investment strategies or false picture about company profile and/or financial performance indicators and then embezzling the resultant income from investment. Some examples of financial fraudulent practices that had devastating effects includes, the Charles Ponzi scam in early 20th Century in Boston, the collapse of the MMM investment fraud in Russia in 1997, as well as the collapse of Madoff Investment Securities in 2008. Many fraudulent market participants have been known to engineer large losses at financial institutions in order to cover up some questionable conduct or illegal acts. In the same vein Mortgage financing were also used to perpetuate financial fraud said financial Analysts, (Federal Bureau of Intelligence [25]. The 2008 subprime mortgage crises were attributed to fraudulent Acts. Anao & Osaze [26] also iterated that fraudulent acts cause corporate failure when individuals entrusted with the funds of a company misappropriates such funds for their own benefits and to the detriment of the company. It is pertinent to mention that while the collapse of a company is not the same thing as a financial crisis in a wider context; the collapse of financially influential company may create uncertainties in many others in the industry and thus lead to the possibility of financial crisis.

2.5.6. Leverage Tendency

- Leverage which involves borrowing to finance investment is frequently cited as a contributor to financial malpractices which results to crises. When a financial institution, an individual or any business organizations borrows in order to invest more, it can potentially earn more from its investment, but it can also lose more than all it has. Therefore leverage magnifies the potential returns from investment, but also creates a risk of bankruptcy. It has been noted that the average degree of leverage in the economy often rises prior to financial crises.

2.5.7. Contagion Ideas

- Kaufman and Scott [28] as cited in [55] refers to contagion as an idea that financial crises may spread from one institution to another or from one country to another, as when currency crises, sovereign defaults or stock market crashes across countries. A systemic risk results when the failure of one particular financial institution threatens the stability of the Thai crises in 1997 to other countries like South Korea. However, a major issue that has been the subject of debate among financial and economic experts is whether the outburst of crises in many countries around the world at the same time is, truly a consequence of contagion issue from one market to another, or whether it is, instead, caused by similar underlying problems which would have affected each country individually even in the absence of international linkages.

2.5.8. Recessionary Tendency

- According to Hornby [27] as referenced in [5], recession refers to a difficult time for the economy of a country when there is less trade and industrial activity than usual. It is the movement backwards of something from a previous position. Thus economic recession can be conjectured as the movement from an optimum position of a general economic indicator to a less than optimum position. In the same Vein, financial recession is a backward movement or a fall from a previous financial position to an inferior financial position as measured by major financial indicators. Some financial crises have little effect outside of the financial sector of the economy. Like the Wall Street Crash of 1987, there are several theories that seek to explain why financial crises could have a recessionary effect on the rest of the economy, [29]. These theoretical ideas include the financial accelerator, flight to quality and flight to liquidity, and the Kiyotaki Moore Model. Some third generation models of currency crises exploit how currency crises and banking crises, together can cause recessions. The role of recession in precipitating a financial crisis is underscored by the high level of the interdependency between the nations of the world, occasioned by globalization which has been defined as a process of worldwide economic indications.

2.6. Effects on the Global Economy

- A number of commentators have suggested if the liquidity crisis continues, there could be an extended recession or worse [30]. The continuing development of the crisis has prompted in some quarters fears of a global economic collapse although there are now many cautiously optimistic forecasters in addition to some prominent sources who remain negative [31]. The financial crisis is likely to yield the biggest banking shakeout since the savings-and-loan meltdown [32] as referenced in [30].However, investment bank UBS stated on October 6, 2007, that 2008 would see a clear global recession, with recovery unlikely for at least two years. Three days later UBS economists announced that the “beginning of the end” of the crisis had begun, with the world starting to make the necessary actions to fix the crisis: The United Kingdom had started systemic injection, and the World’s Central Banks were now cutting interest rates. UBS further emphasized the United States needed to implement systemic injection. UBS further emphasized that this fixes only the financial crisis, but that in economic terms “the worst is still to come” [33]. UBS quantified their expected recession durations on October 16: the Eurozone’s would last two quarters, the United States’ would last three quarters, and the United Kingdom’s would last four quarters [33]. The economic crisis in Iceland involved all three of the country’s major banks. Relative to the size of its economy, Iceland’s banking collapse is the largest suffered by any country in economic history [www.economist. Com].At the end of October UBS revised its outlook downwards the forthcoming recession would be the worst since the Reagan recession of 1981 and 1982 with negative 2009 growth for the U.S., Euro zone, UK; very limited recovery in 2010; but not as bad as the Great Depression of 1930s [34] as cited in [17]. The Brooking Institution reported in June 2009 that U.S. consumption accounted for more than a third of the growth in global consumption between 2000 and 2007. “The US economy has been spending too much and borrowing too much for years and the rest of the world depended on the U.S. consumer as a source of global demand.” With a recession in the U.S. and the increased savings rate of decline in GDP was 14.4% in Germany, 15.2% in Japan, 7.4% in the UK, 18% in Latvia [35]. 9.8% in the Euro area and 21.5% for Mexico, (The U.S. financial and Economic Crisis, 2009). Some developing countries that had seen strong economic growth saw significant slowdowns. For example, growth forecasts in Cambodia show a fall from more than 10% in 2007 to close to zero in 2009, and Kenya may achieve only 3-4% growth in 2009, down from 7% in 2007. According to the research by the Overseas Development Institute, reduction in growth can be attributed to falls in trade, commodity prices, investment and remittances sent from migrant workers (which reached a record $251 billion in 2007, but have fallen in many countries since) [37; IMF, 45b; 46c]. By March 2009, the Arab world had lost $3 trillion due to the crisis. In April 2009, unemployment in the Arab world was said to be a ‘time bomb’. In May 2009, United Nations reported a drop in foreign investment in Middle-Eastern economies due to a slower rise in demand for oil. (UN reports drop in foreign investment in the Mideast, 2008). In June 2009, the World Bank predicted a tough year for Arab states. In September 2009, Arab banks reported losses of nearly $4 billion since the onset of the global financial crisis.

2.7. Financial Meltdown and the Nigerian Banking Experience

- Given that Nigeria’s economic growth and development in the decade of 70s has in a large extent been influenced by massive inflows of venture capital, equity/portfolio and other foreign direct investments, it was obvious that Nigeria could not be isolated from the happenings in the global financial system. There was the initial belief that the Nigerian financial system and, indeed, the economy were shielded from the crisis. The perception was rooted in the recent banking sector reforms particularly the recapitalization exercise which repositioned them as global competitors. Nevertheless, a great deal of financial integration had inter- locked Nigeria’s financial system to that of the larger world [17]. Bartholomew Ebong, immediate past managing director and CEO of Union Bank of Nigeria Plc was of the opinion that the world’s global crisis was not Nigeria’s [39] as referenced in [46]. According to Ogbonna [39], Ebong when interviewed, said that the bank is stepping back to assess the situation, but is confident that Nigeria, and its trading partners, likely won’t get caught in the economic backlash. What is aiding Nigeria further is that unlike other nations, it has no significant foreign ownership in the United State except its foreign reserves that is currently lodged in United State and European Banks and stands at a fluctuating rate of $59B [40]. Ibegbu Cecil [40] iterated that, even the World Bank agreed with Ebong, pointing out that Nigeria (with it reference budget export oil price of below $70) wouldn’t be quite as damaging as it has been in the past [41] cited in [51] as of Nigeria’s imports. Africa News Service [42]. Although before recent, the Nigerian government had pegged its’ budget rate at an amount between $40 and $45 per barrel of oil sold. But many of Nigeria’s largest trading partners are being impacted by the meltdown [42]. Though the World Bank points out that there could be a “cut-back” in foreign capital inflows into the African region, which could impact growth, it points out that Nigeria’s current Aid assistance from foreign donors stands at about one percent of its entire budget [41] because it’s such a small percentage, the cutback shouldn’t really have a long-term impact on the capital inflow. The economist could definitely have a point, though experts are still uncertain as to the impact of the global economic meltdown on Nigeria, there are some concerns, despite the fact that the then Governor of the Central Bank of Nigeria, Professor Soludo [43] noted that the Nigerian economy wouldn’t experience a “serious adverse impact [42]. But a recent editorial on the Africa News Service expressed concerns that maybe-yet again-the government was painting too rosy a picture of the scenario in order to avoid a national panic.

2.7.1. The Impact on Nigeria

- The global financial meltdown that was insulated into Nigeria economy as straining the gain made in Nigerian banking industry early 2008 highlights the follow factors:● Reduction in capital inflows and Divestment (Foreign Direct Investment (FDI), Portfolio, Remittances, etc) leading to crash of the Nigerian capital market.● Confidence Trap’ in Stock market with N trillions loss in Value with the associated ‘wealth effect’ on domestic aggregate demand.● Collapse of commodity prices (especially oil) leading to reduction in export earnings and government revenue.● Demand Pressure on the forex market arising from divestment and repatriation of capital and dividends by foreign investors.● De-cumulation (depreciation) of foreign reserves and pressures on exchange rate.● Greater forex outflows also means liquidity mop-up and hence tightness of liquidity in the financial system, combined with greatly reduction rate of monetization of forex inflows from oil sales means drastic reduction in growth rate of money supply.● Higher Government borrowing, and slower growth rate of credit to the private sector.● Lower Growth Rate of oil and non-oil GDP projected; inflation at 10-15 percent.● Outlook of Sovereign Credit Risk rating downgraded from ‘Positive’ to ‘Negative (although Standard & Poor (S&P) confirms the BB-).

2.7.2. Impacts on the Banking System

- ● Tightening of liquidity due to net forex outflows and lower monetization of oil earnings.● Further tightening of liquidity as lines of foreign credits enjoyed by Nigerian banks were called in.● Depression of the capital market and drop in the quality of part of the credit extended by banks for trading in the capital market (liquidity pressures as loans not fully serviced or repaid).● Greater loan-loss provisioning both due to capital market exposures and decline in growth of economic activities. ● Potential exchange rate risks on foreign lines due to depreciation of the exchange rate.● Liquidity pressures push up domestic interest rates which if not addressed could pose systemic threat. ● Global credit crunch and re-pricing of risks push up interest rates on lines of credit for Nigerian banks.● Slower growth rate of banks’ balance sheet in response to the crisis and higher provisioning, leading to lower profitability [2].

2.7.3. Pressure Points for Banks

- Pressure Points for Banks were● Liquidity Pressures.● Potential Toxic Assets due mainly to capital market lending.● Economic meltdown: impact on quality and growth rate of balance sheet (higher loan-loss provisioning, lower profitability, and depletion of capital).● Possible contagion effects of global crisis of confidence.● Exchange Rate risks.● Counter-party risks.● Challenges of frozen global capital flows, including overpriced lines of credit. ● Surviving the unguarded media onslaught/ de-marketing campaign [2]. Soludo [2] noted further outcomes as follows; No bank has failed or gone out of clearing, total outstanding borrowing on Expanded Discount Window as at March 26, 2009 is N370 billion, Banks total exposure to Capital market as at end January 2009 is N 784 billion or 10% of total loans, Banks total risk assets as at end of Feb. 2009 = N12.78trn. Non-performing risk assets as at end Feb. 2009 = 4.74%, Banks total loans as at end of Feb. 2009 = N 8.13trn, Total Non-performing loans as percentage of total as at Feb. 28, 2009 = 6.2%, Estimated non-performing loans as at end of December 2009 = about 7.4%. Amount banks are prepared to turn over to an Asset management company (AMCON) if such were set up by end of the year = N350, N 400 billion or approx 4-5% of loans as at Feb. 2009. About 15 banks would have no need for AMCON. Of those that indicated interest in AMCON, there is hardly any for which it would threaten their solvency, CAMELS rating of the banks as at end- December 2008, showed an average composite score of 62 per cent and average industry rating is satisfactory. Total shareholders’ fund as at end of December 2008 was Average capital adequacy ratio of 22 percent, among the highest in the world.

2.7.4. Responses to Liquidity Management

- Reduction of the MPR from 10.25 to 9.75 Percent (below inflation rate), reduction in CRR from 4.0 to 2.0 Percent, reduction of liquidity ratio from 40.0 to 30 percent, directive to banks that they have option to restructure margin loans (if necessary) until December 2009, expanded discount window, which allows banks to borrow for up to 360 days (currently at interest rate not exceeding 500 basis points above the MPR), Suspended aggressive mop-up of liquidity since September, 2008.

2.7.5. Response to Foreign Exchange/ Exchange Rates

- As at these periods Exchange rate adjustment was to preserve foreign reserves, reversion from Whole Sale Dutch Auction System (WDAS) to Retail Dutch Auction System (RDAS) to check speculative demand for forex introduction of a band of plus or minus 3 percent to ensure stability, temporary suspension of inter-bank forex transactions. Restructuring of the Bureaux de Change operations to two classes ‘A’ and ‘B’ and reduction in Net Open Position of banks from 20% to 1%, Sale of cash forex only through bank BDCs, revision and enlargement of transactions that are eligible under the RDAS window.

2.7.6. Tightening of Regulation and Supervision

- Greater emphasis on enforcement of Code of Corporate Governance, resident examiners have been deployed to banks since January 2009, Standby teams of target examiners being deployed to any bank at any time to ensure timely regulatory actions if necessary, review of Contingency planning Framework for Systemic Distress in Banks, introduction of Credit Bureau, Advice to banks on risk management - extra conservatism during time of Crisis - capital conservation, cost minimization, de-emphasis on size, salaries/ bonuses, etc. Strengthening of institutional coordination through the Financial Sector Regulatory Coordinating Committee (FSRCC), Greater emphasis on e-FASS as a tool for banks’ returns analysis for speedy identification of early warning signals, Consolidated Supervision and Risk Based Supervision have been adopted and arrangements are being made to migrate from the current fragmented sub-sectoral supervision to all-inclusive financial sector supervision to all-inclusive financial sector supervision. All banks were examined in 2009 by consolidated teams, Adoption of common accounting year end for all banks with effect from end-Dec.2009, aimed at improving data integrity and comparability. Adoption of the international Financial Reporting Standards (IFRS), Review of BOFIA to strengthen regulatory capacity.

2.7.7. Response on interest Rate Regime

- To reduce Pressure on interbank rates, CBN reduced rates on Expanded Discount Window (EDW) to maximum of 500 basis points above MPR effective from March 16, 2009. Temporary measure was put in place to ensure that the liquidity pressures and run up to common year end do not drive banks to race to the bottom’ Bankers’ committee decided to page the maximum deposit and lending rates at 15% and 22% respectively from April 1, 2009 until end of 2009. This would also have salutary efforts on the real economy. Soludo, [2] noted that Collective Action required for the banking system to continue to survive the global shocks, Financial System Strategy 2020 (FSS 2020) as long term strategy to build an international financial centre and Africa’s Financial hub and Call for open and constructive dialogue on how the banks, the public, the media, the Government and monetary regulatory authorities could help Nigeria navigate the global financial crisis.

2.8. Effects of the Global Financial Crisis on Nigerian Economy

- The Nigerian economy was not insulated from the impact of the global financial crisis that affected most of the world economies. It is pertinent, therefore, to explore the impact of the global crisis on Nigerian economy with a view to highlighting the various intervention measures that were applied to mitigate the deleterious effects on the economy. The impact of the global financial crisis on Nigeria was not direct as the financial institutions in Nigeria were not fully integrated into the global financial market and as such did not have the financial instruments that created the crisis in their balance sheets. However, the effect was felt through the second-round effects when the Global Financial Crisis culminated into an economic crisis by early-to-mid 2008 [44]. The Global Financial crisis impacted the Nigerian economy through several channels amongst which were: Lower crude oil demand, Lower crude oil price, Lower revenue, Lower foreign exchange earnings/export receipts, and Lower capital inflow, and drying-up of lines of credit to Nigerian banks and higher capital outflow-divestment from capital market particularly of portfolio investments. The decline in foreign exchange earnings led to a reduction in revenue and expenditure profiles of the three tiers of government as a result of the steady fall in the monthly allocations from the Federation Account. The wider implication of this was the limited implementation of government projects, with the financing of capital projects limited to the priority sectors leading to non-realization of key government programmes such as the millennium Development Goals. The fiscal operations of the federal government relied heavily on funds raised through issuance of Federal Government of Nigeria bonds, which led to the crowding-out of the private sector in the credit market resulting in higher interest rates and other additional charges. The fall in government revenue necessitated the revision of the 2009 programmes and government plans to build and renovate dilapidated infrastructure [44]. Output growth fell slightly from 6.45 per cent in 2007 to 5.98 per cent in 2008, but recovered to 6.67 per cent in 2009 and projected to rise to 7.75 per cent by end 2010. The decline in output was largely associated with higher cost of obtaining working capital by industries, as banks increased interest rates and reviewed collaterals for their loans as securities such as shares lost value. Industries were also faced with high cost of procuring inputs that were mainly imported in the face of exchange rate volatility and risk. Overall, the consequences were increased unemployment, de-accumulation of external reserves owing to the sharp fall in crude oil prices and the attendant decline in crude oil export earnings. The crisis also precipitated the decline in global financial flows to Nigeria in the form of foreign direct investment, portfolio investment, Oversea Development Assistance and remittances as a result of the restriction by developed economies battling to stabilize their own economies. Owing to the global credit loans to bridge the financing gap were dimmed [44]. According to Okumagba [46] the financial sector was the hardest hit by the crisis. The capital market recorded significant divestment as foreign investors, notably portfolio investors divested to meet their obligations back home in the face of credit squeeze. Consequently, there was a continuous drop in the All-share index as well as the capitalization which was N13.0 trillion in September 2008 fell to N7.2 trillion at of first quarter, 2009. He iterated that the continuous depression of the capital market led to higher loss provisioning by banks, owing to the significant exposure through margin lending and share-backed collateral lending thereby depressing profitability and weakening their lending ability. The contraction of bank profit led to retrenchment in some of the banks. The banking sector consolidation in 2005 was aimed, among others, at repositioning the Nigerian banks to compete internationally. However, the post-bank consolidation exposed a lot of Nigerian banks to global business relationships with some foreign banks that were badly affected by the crisis. Some of them had booked significant credits from some embattled financial institutions and with the credit crunch they were not able to draw on the facilities.

2.9. Intended Rescue Packages across the Nations of World

- Late President of Nigerian Mr Umaru Yar’ Adua’ admitted that the impact of the financial meltdown had already been noticed in Nigeria and directed ministers to employ visible measures to curb the damage in 2009. Declining National Revenue, sharp fall in the value of shares, and the continuing crash of the naira against foreign currencies, according to the president, are some of major indicators that the global crisis was already affecting Nigeria. Late Yar’ Adua said it was time to rise up to the global challenge and to deliver on his administration’s promises, particularly as 2009 marked the mid-point in the life of his administration. According to him, the government needed to double its efforts in the face of the global financial meltdown, noting that no time could be more challenging for the government than now. We can feel the impact from falling oil prices, the declining exchange rate of the naira and the cascading prices of shares at the capital market,” he was quoted as saying by the Punch newspaper on Thursday [11].However, credence was given to some sectors in the economy. At this periods major sector that are already weaken were given subventions to strengthen their base, one of these grants was N 70 billion disbursed to revamp the Textile industry. To swiftly response to the emerging crises, presidential Steering Committee on Global Economic Crises was inaugurated in January 16, 2009 and the Central Bank of Nigeria quick reacted by Reducing MPR from 10.25 percent to 9.75 percent, reduction in Cash Reserve Requirement (CRR) from 4.0 percent to 2.0 percent. Also there was reduction in liquidity ratio from 40.0 percent to 30.0 percent. Directive to banks that they have the option to restructure margin loan up to 2009 was given. Expended lending facility to banks up to 360 days, introduced expanded discount window facility and stop liquidity map-up from September 2008 were other possible rescue measures by Nigerians at that period of the Crises.

2.10. Theoretical Framework

- Bellows are various theories and models that seek to explain how the resulted financial crises emanated in the World economies. Hence, the models analyze the various variables which evaluate the impact of the global financial Meltdown on the financial markets in developing economies.

2.10.1. Learning and Herding Models

- According to Banerjee [54] many models seek to explain the position of asset values and iterated that the asset value may spiral excessively up or down as investors learn from each other. Banerjee noted that purchase of an asset by a few agents often prompts other buyers to invest in that same asset, and not because the true value of the asset actually increases during buying periods, but because investors come to believe that the true value of the asset is high when they observe others purchasing them. Banerjee call the later,” Strategic complementarily” which he refers to “these models that seek to explain asset value by a few agent”. Accordingly, Chari and Kahoe [55] fined that an important fact about Herding Models is that investors although fully rational, only have access to partial information about the economy. In this models when a few investors buy some type of assets, it implies that they have some Positive information about that asset and this increase the rational incentive of others to buy the asset too. The duo noted that although this is a fully rational decision, it may sometimes lead to mistakenly high asset values and a subsequent market crash, given that the first investors may, by chance have made a mistake. According to Cypriani and Guarino [56] as cited in [51] in adaptive learning or adaptive expectations models, investors are assumed to be imperfectly rational, basing their reasoning on recent experience only. On the basis of such reasoning if the price of a given asset rises for some period of time, there is a tendency for investors to believe that its price always rises. Consequently, their tendencies to buy increase and thus drive up the price further. By the same token, observing a few price decreases may give rise to a downward price spiral. However, in a model of this kind, large fluctuations in asset prices may occur on the basis of adaptive learning expectations.In their words, Mckinnon [57] as cited in [61] and Shaw [58] as referenced in [11] observed that financial repression (meltdown) is correlated with sluggish growth in developing economies. Nnanna and Dogo [59] as referenced in [24] further asserted that such economies are characterized by high and volatile inflation and distorted interest and exchange rate structures low savings and investments and low level of financial intermediation. Financial deepening which runs counter to financial meltdown implies the ability of financial institutions to effectively mobilized savings for investment purposes. Nnanna and Doga [59] purported that financial deepening represents a system free from financial repression (meltdown). Their findings established the fact that negative real interest rates did not encourage greater investments but rather encouraged the bank to be more risk averse and more hesitant to lend.

2.10.2. Minsky and Marxist Theories

- In Minsky and Maxist theories separate opinions, John and Cooper [60] as cited in [11] hold that Hyman Minsky proposed a post-Keynesian explanation that is most applicable to a closed economy. In their relatives, financial fragility is a typical feature of any capitalist economy and that the degree of fragility has implication for the occurrence of a financial crisis. He iterates that high fragility leads to a higher risk of a financial crisis. Minsky further identified three approaches to financing which firms may choose, depending on their tolerance of risk. They include, Hedge Finance, where income flows are expected to meet financial obligations in every period, including the principal and interest on loans; Speculative Finance, in which a firm is expected to roll over its debt because income flows are expected to cover only interest costs, with none of the principal paid off, and Ponzi Finance, where expected income flows will not even cover interest cost. Furthermore, the firm is forced to borrow more or sell off assets in order to service its debt with the hope that either the market value of asset or income will rise high enough to pay off interest and principal. Cooper and John [60] elucidate further that financial fragility levels move together with the business cycle, which consist of Recession, Depression, Recovery and Boom. After a recession, firms having lost much financing, may chose only to hedge, the safest. However as the economy grows and expected profit rise, firms begin to believe that they can cope with speculative financing since they know that the profits will not cover all the interest all the time. But firms anticipate a rise in the profit and when that happens, the loans will eventually be repaid without much trouble. Increase in loan portfolio stimulates investment and a subsequent economic growth, through the multiplier effect. In the same vein, lenders also start to have confidence that they will still recover all their lending. Hence, they are ready to part with the firms without full guarantee of success. In other words although lenders know that such firms will have problems repaying still they are optimistic that these firms will refinance from elsewhere as their expected profit rise. In this direction the economy has taken on enough risk credit and it is only a question of time before some big firms start defaulting, this is the perspective of Ponzi financing. He observes that when firms begin to default, lenders stop giving credit very easily owing to their understanding of the actual risks in the economy. Therefore, financing becomes impossible for many, and more firms default. If no new money comes into the economy to allow the refinancing process, a real economic crisis begins with devastating impact on all the sectors of the economy, including the financial sector according to them. During recession firms will begin to hedge and thus bring the cycle to a close. In Marxian’s theory, Eichenbaun, Rebelo and Burnside, [29] resulted that recession can precipitate financial crises which precedes depression, they iterate that the Recurrent major depressions in the world economy at the pace of 20 and 50 years have been the subject of studies since the first theory of crisis was proposed between 1773 and 1842 by jean Charles Leonard de Sismondi in a critique of classical political economy’s assumption of equilibrium between supply and demand. Burnside, el ta [29] discover that development in an economic crisis theory becomes the central recurring concept throughout Kar Marx mature work, which asserted that there is a tendency for the rate of profit to fall. Marx theory borrowed many features from John Stuart Mills’s discussion of the tendency of profit to a minimum, (principles of political economy Book IV Capt IV). In their words, empirical and econometric researches on financial crisis are ongoing especially in the world system theory and in the debate about Nikilai Kondratiev and his popular theory on 50 years Kondratiev waves.Accordingly, Moore [47] explained that "a bank needs to hold liquid assets to meet the cash requirements of its customers … if the institution does not have the resources to satisfy its customers' demand, then it either has to borrow on the inter-bank market or the central bank". It follows therefore that a bank unable to meet its customers' demands leaves itself exposed to a run and more importantly, a systemic lack of confidence in the banking system. Bordo et al [49] suggest two explanations on the cause of liquidity runs on deposit money banks. They explained that runs on banks are a function of mob psychology or panic, such that if there is an expectation of financial crisis and people take panic actions in anticipation of the crisis, the financial crisis becomes inevitable. Bordo et al [49] also "asserts that crises are an intrinsic part of the business cycle and result from shocks to economic fundamentals. When the economy goes into a recession or depression, asset returns are expected to fall. Borrowers will have difficulty repaying loans and depositors, anticipating an increase in defaults or non-performing loans, will try to protect their wealth by withdrawing bank deposits. Banks are caught between the illiquidity of their assets (loans) and the liquidity of their liabilities (deposits) and may become insolvent.”Using a single bank, Diamond and Dybvig [50] developed a model which showed that bank deposit contracts can provide allocations superior to those of interbank markets, offering an explanation of how banks subject to runs can attract deposits. Brighi [51] however show that abandoning the hypothesis of a single bank increases the relevance of the interbank market. Further, the probability of a banking crisis at a single bank decreases when interbank transactions are introduced - relative to a stand-alone bank. Indeed, Diamond and Dybvig [50] acknowledge that "if many banks were introduced into the model, then there would be a role for liquidity risk-sharing among banks".According to Brighi [51], in a theoretical framework where liquidity crises are not only caused by bank runs, and where there is uncertainty about the proportion of depositors who may want to withdraw deposits, doing away with the assumption of an autarchic banking system decreases the risk of bank failure as a single bank on its own would be unable to meet depositors’ demands. To manage their liquidity risk and take decisions on how much cash and other liquid assets they should hold, Agenor et al [73] as cited in Unugbro [11] hypothesize that "banks internalize the fact that they can draw funds from either the interbank market or the central bank in case of unexpected contingencies." They added that in the event of illiquidity, banks must borrow the missing reserves at a penalty rate; this is the opportunity cost of not holding sufficient reserves.Peter [52] examined the impacts of the global financial crisis on the Nigerian banking industry before and after the financial crisis. Findings obtained from the research show that the banking sector before the global financial crisis was sound and vibrant enough to support the nation’s economic growth and development. This is evident from the questionnaire that was distributed to stakeholders in the banking industry. However, the crisis has eroded the confidence of the general public in the Nigerian banking industry, despite their consolidation. Even the Nigerian Stock Market (NSM) which is expected to act as buffer of fund is not left out of the financial crisis. He argued that the banks became vulnerable because of their over reliance on foreign financial institution and banks for credit lines. Peter suggested that to avoid this, the Nigerian government through the CBN should organize and strengthen the growth of institutions like the pension fund, Housing fund, Health insurance fund through a financial liberalization policy. Furthermore, the Nigerian government should find alternative ways to fund budget deficit so as to reduce the pressure of financing projects in the real sector of the Nigerian economy by banks.The recent time global financial crisis and its impact on the Nigerian Banking Sector has shown that CBN’s daily forecasts of Banking Sector liquidity is not sufficient in assessing the liquidity requirements of the sector as several banks remain relatively fragile and incapable of withstanding periodic liquidity shocks. According to Alford [53] “Following the special examination and during the period from December 2008 to December 2009, Nigerian banks wrote off loans equivalent to 66% of their total capital; most of these write offs occurred in the eight banks receiving loans from the CBN”. Most of the banks also suffered panic runs and flights to safety during the period. A point to note in the above analysis is that findings were inconclusive due to the closeness of the research to the incidence of the financial crisis. However, this research project will embrace a much larger time period.

3. Methodology and Model Specification

3.1. Introduction

- Here the study dealt with the methodology and model employed to evaluate all areas of the study. The choice of research design and the nature of data given determine the possible weight in the phenomena under study. Suffice to say that the study examines the nature, type and sources of data used in the research; the method of data presentation, the method of data analysis as well as the specification of models were employed in the study. It discusses the research methods that were employed as well as provide the models and the analytical tools that were also employed in the study.

3.2. Research Design

- The research design covered the population of the study sample and sampling design. The study is a longitudinal survey and research design is expost Facto, since, the researcher is not in any position to alter the independent variables. The research was directed towards the determination of the effect of the global financial meltdown on the Nigerian banking sector and economy.

3.2.1. Nature and Sources of Data

- The nature of any study dictates the type of data to be used. Accordingly, the sources of data solely employed on this paper were secondary data. These data are; Financial Deepening (MS2/GDP) stood as a proxy for Nigerian Banking Industry and Economy, Inflation Rate, Exchange Rate, Inter-Bank Rate, Credit to the Real Sectors, Central Bank Lending Rate, Interest rate, gross domestic product and Broad Money Supply. Secondary data was necessitated by the fact that such data are readily available and easily accessible with less probability of inaccuracy. Such data were obtained from publications of the Bureau of Statistics and the Central Bank of Nigeria (CBN).

3.2.2. Method of Data Presentation

- Due to the nature of the research project, time series analysis was adopted for the variables which mean that quarterly data were used. Data were presented with the aid of table in order to show trends in the variable of analysis.

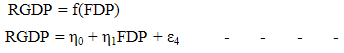

3.2.3. Method of Data Analysis

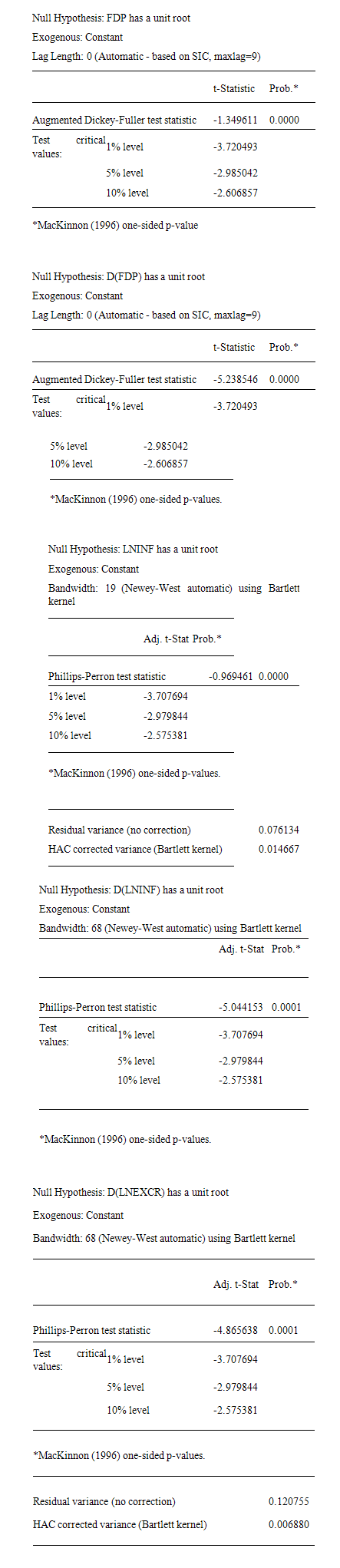

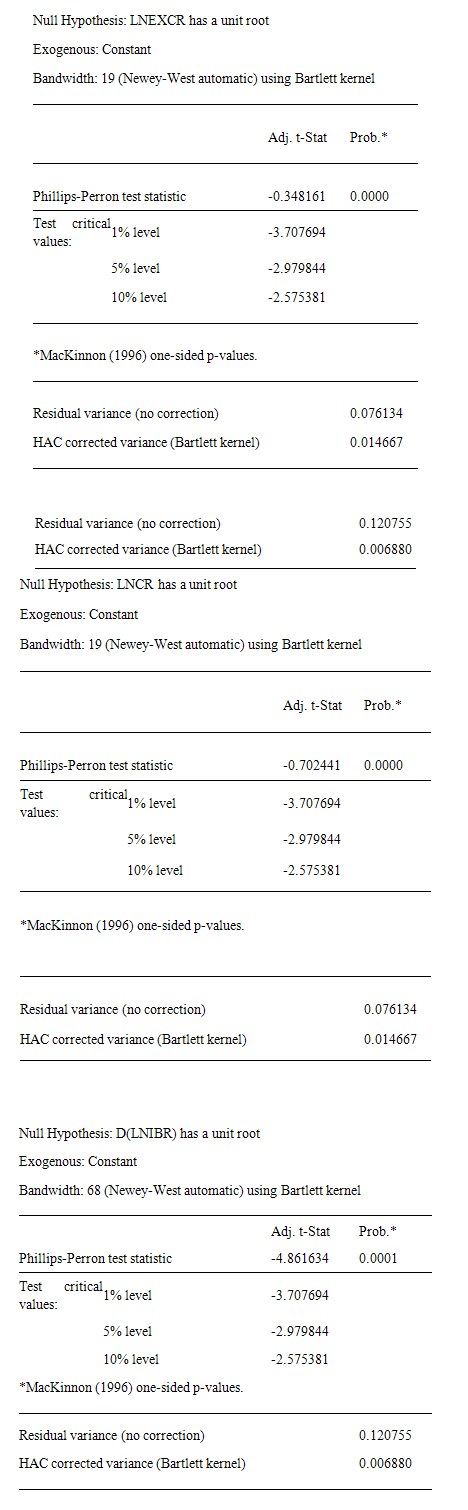

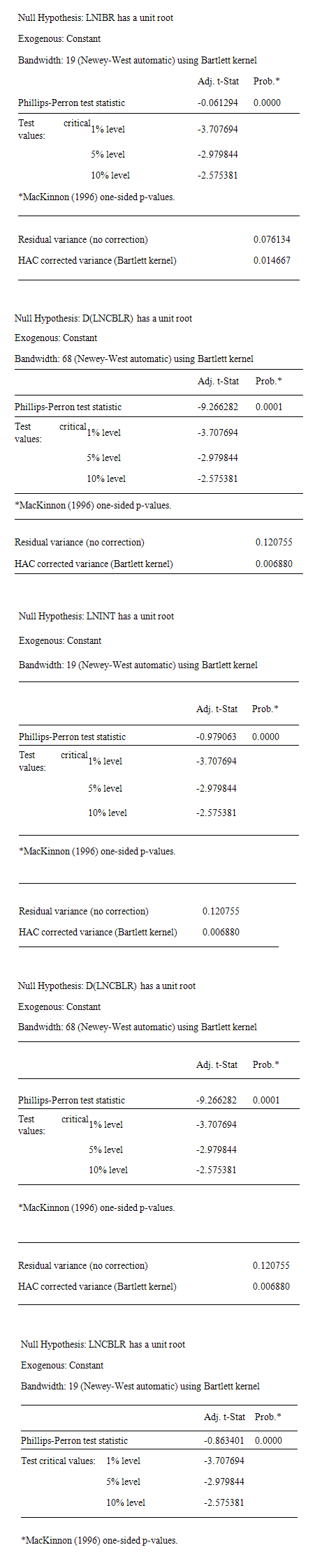

- The study used multiple regression analysis to evaluate the effect of global financial meltdown on the Nigerian Banking Industry and economy. The research adopted econometric method such as Ordinary Least Squares (OLS). This was because it empirically evaluate whether or not there exist a relationship among the variable of interest and assisted in determining the nature of the relationship so as to solve the problem of inferences and that of drawing up viable conclusions. The following tests were carried out to ensure that results from the analysis are flawless.(a), Unit Root TestIn order to resolve the problem associated with heteroscedasticity. The search carried out Logarithmic transformation on each data of the variables on the analysis. Besides that advantage, the resultant parameter estimates was read off as elasticity before the regression analysis. The test for stationarity was also carried out on the variables. A random time series Yt is said to be stationary if it’s mean and variance are constant over time and the value of covariance between two time periods depend only on the distance between the two periods and not on the actual time at which the variance is computed [65]. Economic theory requires that variables be stationary before the application of any standard econometric technique. The research tested for stationarity using the Augmented Dickey Fuller (ADF) and the Phillips-Perron (PP) tests. The null hypotheses in both tests were that the variable was non-stationary or have a unit root.

3.3. Specification of Models

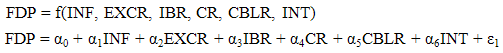

3.3.1. Model 1(2001Q1-2007Q2)

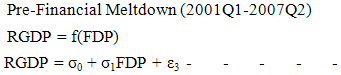

- Model 1 concerned with analyzing the effect of the financial meltdown on the Nigerian Banking Industry and Economy. Two models were specified. The first have to do with pre-financial meltdown period, while the second post-financial meltdown period. Hence, the regression models below are specified;Pre-Financial Meltdown Period (2001Q1-2007Q2)

| (1) |

| (2) |

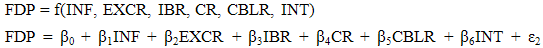

3.3.2. Model 2 (2007Q3 - 2011Q2)

- In order to ascertain the impact of the banking sector on the economic growth of Nigeria pre and during the financial meltdown, the model below is specified:

| (3) |

| (4) |

3.4. Description of Variables

- 1. Financial Deepening (FDP):- Financial Deepening refers to a variety of situation in which financial institutions effectively mobilize savings for investment purposes. In other words, FDP measures the level of financial development in an economy to determine if the financial sector is developing or under developing.2. Inflation Rate (INF):- Inflation Rate refers to as the rate at which economy activities level are measure. It is a subsistence rise in general price level of goods and services. It seems gyrating when a nation anticipate a fall in output and a hic in wages, aggregate demand, and the level of cash in circulation while converse is rebutting. Inflation is usually measure in quantitative terms depend on the economy structure. It’s usually in percentage and the indexes used at a particular time also depend on policy maker. 3. Exchange Rate (EXCR):- Exchange Rate refers to the price of one currency in terms of another currency. That is, it is the number of units of one currency that will be exchanged for one unit or a given number of units of another currency.4. Inter-Bank interest rate (IBR):- Inter-Bank interest rate refers to as the rate which commercial Banks lent and borrowed fund amongst one and other. It’s usually, fixed by the Central Bank, the rates differ from time to time. If the inter banks activities is properly monitored and due process are followed, this will minimize contagious effects, avoid financial crises mismatch and improve on the financial sector and economy5. Credit to the Real Sectors (CR):- Credit to the Real Sectors refers to as the rate at which the Banks give loans (lend money) to the major Sectors of the Economy, e.g. Agricultural sector, Mining and Quarry, Manufacturing, Communication, Oil and Gas, etc.6. Central Bank Lending Rate (CBR):- Central Bank Lending Rate refers to as the rate at which Central Bank borrows money to the commercial Banks. Put simply, it can be referred to as the cost of Credit. For instance, if Government wants to increase the money in Circulation they will reduce the bank rate through the Central Bank vice versa. This is one of the instruments of monetary policies.7. Interest rate (INT):- Interest rate refers to the rate at which all the sectors of Domestic Economy including the Government borrowed as regularized by the Apex bank from the Commercial Banks. The Apex Bank usually fixed this rate as enshrine in the Act and abided forthwith by the commercial Banks. The rate is usually tentative and considered with the level of economic activities and inflationary tendency. 8. Broad Money Supply (MS2):- Broad Money Supply refers to as (MS2 = MS1 + S +T or MS1 + Quasi Money) the sum of the savings and time deposit in the commercial banks (MS2 = C + D + S + T) whilst, MS1 = Narrow Money Supply refers to as those accepted as a medium of exchange that have immediate purchasing power. It connotes to be money outside banks plus demand deposit of the Central Bank minus Federal government deposits in the Commercial Banks. Denoted as MS2 = C + D. where; C = Currency in Circulation, and D = Demand deposit in the Commercial Banks.9. Gross Domestic Product (GDP):- Gross Domestic Product measures the total spending, income, and/or output made from home-based resources. That is output produced within the domestic economy. Exports are explicitly in the GDP while imports are excluded from it. Some factors of production are located in the home countries that are owned by foreigners, and hence the income accruing to those factors does not belong to the citizens of the home country. These incomes or output are usually included in the calculation of GDP [72]. Empirical works have showed that the effect of financial deepening on economic growth is positive [69 as cited 11; and 70]. Accordingly, Aigbokhan [71] noted that Gross Domestic Product is a flow variable since it is measured in monetary value of goods and services per year. as long as output is valued at prices in the year in which it is produced, the GDP value reflects current prices. That is Nominal GDP or GDP at current prices.10 Real Gross Domestic Products (RGDP):- Quite often economic analyses involve comparison over time. For this purpose data are necessarily adjusted for changes in prices over the period. In such case output in different years are valued, using the prices of a common base year to obtain GDP at constant prices or Real GDP. The word “real” here implies that adjustments have been made to nominal GDP to take account of price changes in years since is the base year [71]. The real GDP or GDP in constant Naira is calculated by valuing all outputs at the prices that prevailed in a particular year otherwise known as base year. Therefore, real GDP is a far better measure of changes in national production. This technique of employing constant price measurement makes comparison across time for more meaningful, and is a batter indicator of economic performance [72].

3.5. Estimation of the Model

- Estimation of the model involves obtaining numerical values for the estimate of the parameters. The Ordinary Least Squares (OLS) Method was adopted for the estimation of the relationship of the parameter of the model specified. Autocorrelation was detected by Durbin-Watson Statistical Test. Thus: variables above were represented by Y as dependent variable and Xi, X2 as Dependent and Independent variables to each model specified above respectively, for example; FDP = Y = Dependent Variables and CBLR, INF = X1, X2 = Independent variables, (explanatory Variables).

3.6. Decision Rule

- Appropriate testing of the estimates of the regression results was employed. The various statistical and econometric criteria for evaluating the parameter estimates of the regression models such as t-statistic, R2-Statistic, adjusted R2-statistic, F-statistic, as well as Durbin-Watson test were also analyzed. The period under study spans from 2001–2011. The research analysis was carried out using the EVIEWS 6 econometric package.

4. Data Presentation and Analyses

4.1. Introduction

- In this part, the results of data analyzed were presented in tables and described descriptively. All the analysis were undertaken using the ordinary least squares (OLS) multiple regression and applied to time-series data. Preliminary analysis was also carried out to validate the authenticity of our interpretation and analysis.

4.2. Regression Analysis

4.2.1. Unit Root Test

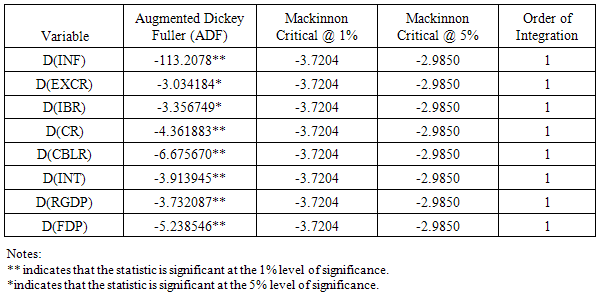

- The results of the Augmented Dickey Fuller (ADF) and the Phillips-Perron (PP) tests are reported in Table 4.1.

|

|

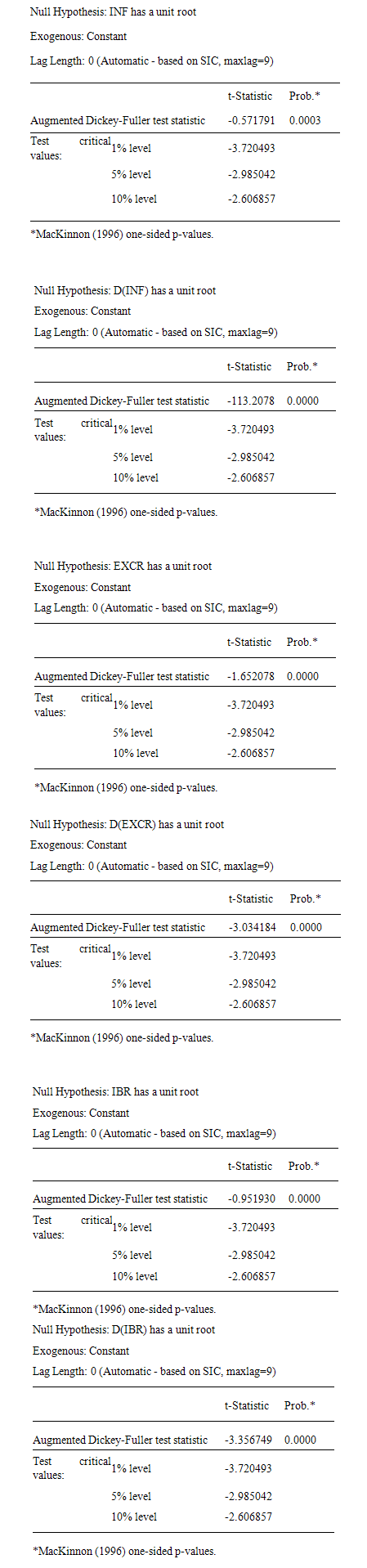

4.2.2. Test of Hypothesis 1

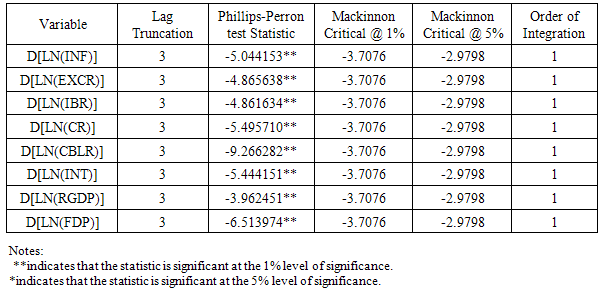

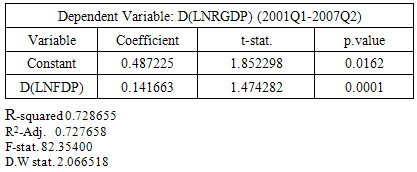

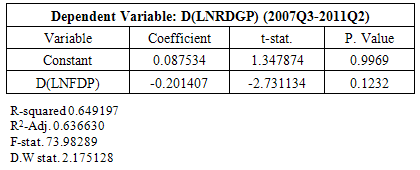

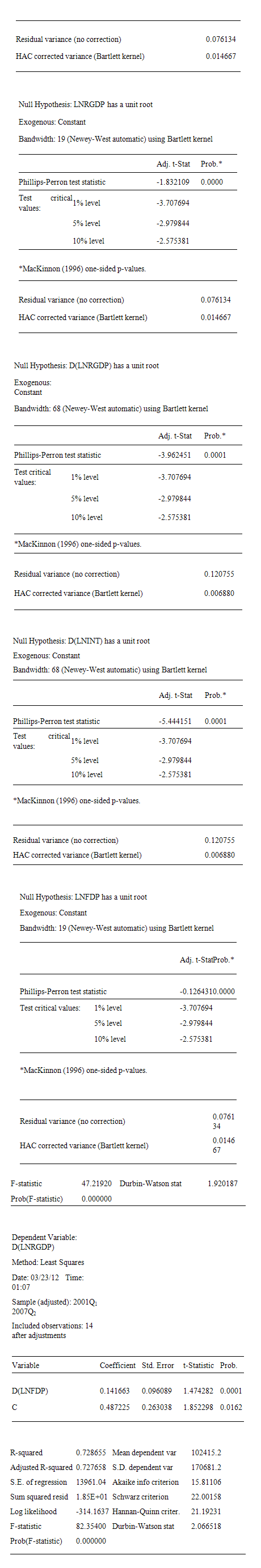

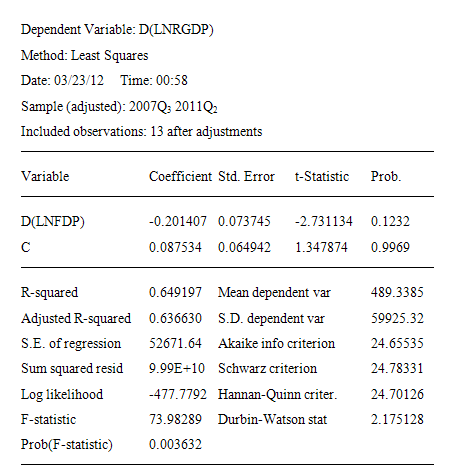

- Ho: the financial meltdown did not significantly affect the Nigeria Banking Industry and Economy.H1: the financial Meltdown did significantly affect the Nigeria Banking Industry and Economy.In examining the impact of the global financial meltdown on the Nigerian Banking Industry and Economy, the results of the econometric regression models representing pre- and during/post global financial meltdown periods are presented in Table 4.3 and Table 4.4.

|

|

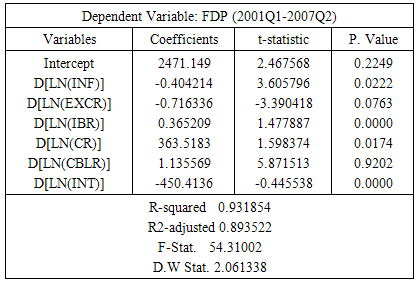

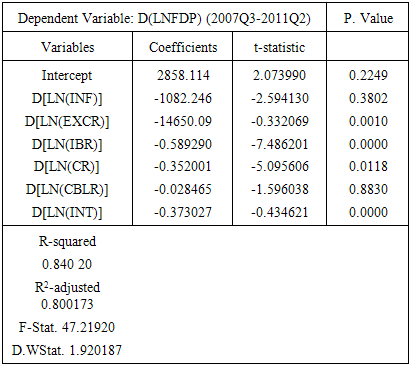

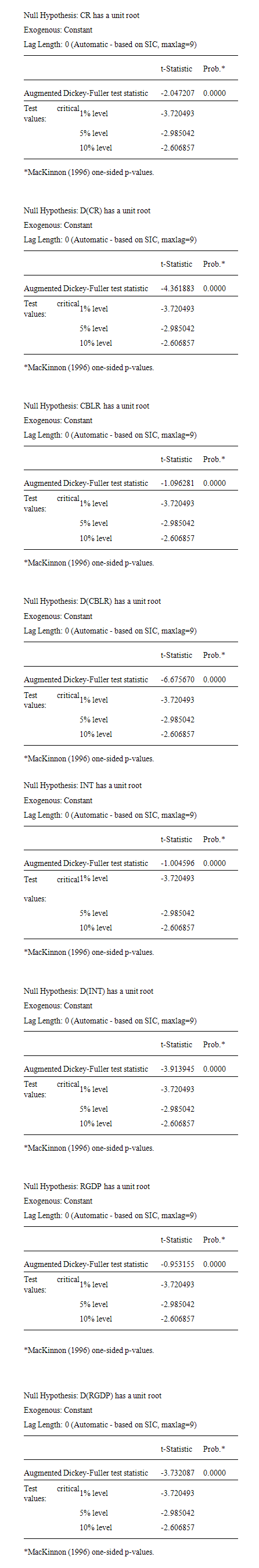

4.2.3. Test of Hypothesis 11

- Ho: there is no significant difference in the financial position of the Nigeria Banking Industry on Economy before and after the financial meltdown.H1: there is a significant difference in the financial position of the Nigeria Banking Industry on Economy before and after the financial meltdown. In examining the impact of the Nigerian banking industry on economic growth, results of the econometric regression models representing pre- and during/post- global financial meltdown periods are presented in Table 4.5 and Table 4.6. However, It should be noted that financial deepening (FDP) variable capture the financial position of the banking industry and economy, whether it is retrogressing or not.

|

|

5. Summary, Discussion, Conclusions, Policy Recommendations & Suggestions

5.1. Summary of Findings