-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2014; 4(3): 71-76

doi:10.5923/j.mm.20140403.03

The Dream of Continuity of a Family Business across Generations

Khalil Ghazzaoui1, Samer Tout2, Sam El Nemar3

1Assistant Professor, School of Business, Lebanese International University, Lebanon

2Assistant Dean, School of Business, Lebanese International University, Lebanon

3School of Business, Lebanese International University, Lebanon

Correspondence to: Khalil Ghazzaoui, Assistant Professor, School of Business, Lebanese International University, Lebanon.

| Email: |  |

Copyright © 2014 Scientific & Academic Publishing. All Rights Reserved.

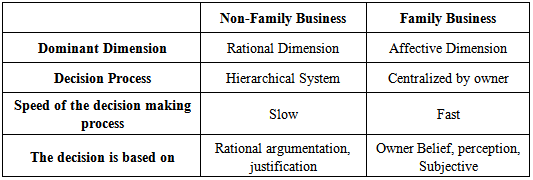

Today, the family business companies are an important subject of study and research. They form the backbone of the economy and represent 80% of worldwide companies according to the Institute for Family Business (IFB). These companies surf from a significant problem the conflicts between the family and the style of management. The different phases of business Development as the transmission are dominated by emotions. This is why the learning Institutes and consultants as IEF, OSEO, INSEE, IFA, KMPG and INSEAD were founded to help entrepreneurs and family businesses and to support their families regarding conflicts, transmission, funds transfer, properties. The main objective of this paper is to shed light on the common factors and characteristics that contribute into the success of family business companies.

Keywords: Family business, Management, Factors of success

Cite this paper: Khalil Ghazzaoui, Samer Tout, Sam El Nemar, The Dream of Continuity of a Family Business across Generations, Management, Vol. 4 No. 3, 2014, pp. 71-76. doi: 10.5923/j.mm.20140403.03.

Article Outline

1. Introduction

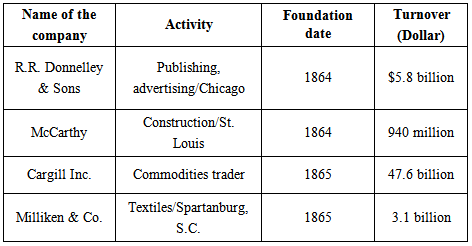

- Companies are an advanced form of ethnic operations and provide needs and services to humans. In these enterprises, the operational and the administrative officers, the managers, and the leaders work together and share the tasks to ensure the smooth functioning and sustainability of the organization. Companies differ from one another; each has its own culture, identity, values, characteristics, properties, vision, history, successes, failures and most importantly different governance. For centuries, the family business is one of the most recognized forms of organizations in the world of work. Researchers weren’t interested in the family business before but it became a research subject later. In their book on the government of the family business, B.Carty and A.BUFF (1996) describe the presence of this type of business as critical to the future of economies and these companies are the roots of capitalism and individual initiative. Studies showed that because of the family business, the developed economies countries and the under development countries can be rebuild to ensure their sustainability. Some existing businesses for centuries still belong to an nthgeneration of the same family. A lot of international companies that are globally recognized are family based. Businesses play a very important role in the economy and they are the most resistant to crises. The businesses, previously called informal, are now companies with an important position from experience, expertise, and they have an important development capacity especially because the most have succeeded with just a school education without knowledge in the field of management, commerce, or industry. Moreover, we are not talking about some thousands of dollars but about millions and milliards like for example Hojeij and Tageddine families. Hojeij and Tageddine are two Lebanese families that have achieved a great success in Africa although they have "started from scratch". This nature pushed the family members to unify and to create a family business to ensure their financial security and their sustainability over time.In terms of age, we must mention the existence of a large number of companies over the age of hundred years and till now the governance belongs to the same family.

|

2. Problem Statement

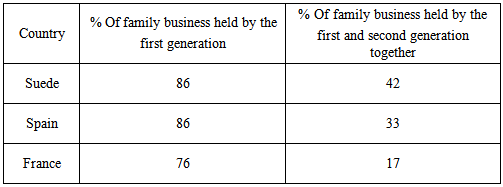

- This table below shows that less than half of family businesses are held jointly by the first and second generation. Less than half of family businesses are held jointly by the first and second generation.

|

3. Study Objectives

- • Assessing the succession process.• Describe the preparation phase of the successor.• Determine the level of interest of the heir to take over the business.• Determining the impact of the relation between the owner and the successor.• Determining the impact of the owner resistance on the succession phase.

4. Literature Review

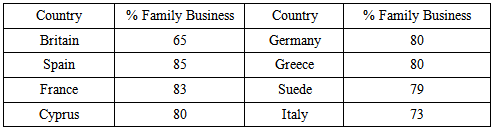

- Family Business EvolutionThe presence of family businesses is widespread in the business world. A survey of INSEAD showed that the majority of the 250 largest companies listed in France and Germany are also family businesses. Some global companies are known to be family businesses and they occupy the first rows in the economy of most countries. Family businesses play an important economic role. This table shows the presence of family businesses in some countries:

|

|

5. Methodology

- Sample DataA questionnaire is the methodology used to obtain the necessary data of this study. The multiple questions were presented into demographics, factors of success, opinion about succession and finally the strengths and weaknesses of the family business.The variables• Demographic Variables: The demographic variables are business position, gender, company type, business field, business generation and the business rate.• Succession phase variables: conflicts, decisions and general facts about the succession phase of each business.• Family business strengths and weaknesses variables: about family business issues.MethodologyThe dependent value is the business rating; the independent values are all the succession phase issues and all the family business issues.A regression analysis is done to predict the relation between the business rate of success and the succession phase issues on one hand and on the other between the business rate of success and the family business strengths and weaknesses.

6. Analysis

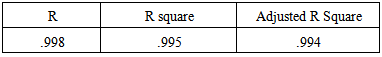

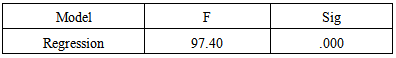

- Descriptive StatisticsSPSS statistical software was used to generate descriptive statistics reports for all the variables included in the questionnaire and here are the results:• Most of the respondents are owners: 64.3%• most owners and/or founders of family and of commercial businesses are men: 80%• Most of respondents belong to family businesses rather than commercial businesses: 71.4%• Most respondents are traders: 32.9%• Most respondents belong to the first generation: 37.1%• Most respondents described their businesses as normal businesses: 51.4%After analyzing the frequencies of 70 questionnaires, it was clear that most respondents agreed that companies usually face troubles during the succession phase. They also agreed that the owner should give his advice and share his experience with the successor, the owner of a family business usually prefers to pass the lead to the son rather than to the daughter, the owner of the family business usually prefers the eldest son to take the lead and the owner prefers to maintain the ownership during all his life.Most respondents disagreed that business transition is a big challenge to the owner, and that business owner usually prefers that his/her chosen successor is well educated, the successor has to pass through several departments before taking the lead and the successor should have an external experience before taking the leadership.Correlation AnalysisCorrelation analysis determines the strength of the relationship between the seven main variables: owner’s advice and experience, lifetime ownership, succession troubles, transition challenge, successor education, passing through departments and external experience.1. Significant positive correlation between the companies’ troubles variable and the other variables (0<0.05).2. Significant positive correlation between the owner should give his advice and share his experience with the successor variable and the other variables (0<0.05).3. Significant positive correlation between the owner prefers to maintain the ownership during his/her life variable and the other variables (0<0.05).4. Significant positive correlation between business transitions is a big challenge to the owner variable and the other variables (0<0.05).5. significant positive correlation between business owner usually prefers that his/her chosen successor is well-educated variable and the other variables (0<0.05).6. Significant positive correlation between the successor should have an external experience before taking the lead variable and the other variables (0<0.05).7. significant positive correlation between the successor has to pass through several departments before taking the lead variable and the other variables (0<0.05).Regression AnalysisIt is to determine the relevant factors that contribute to the success or failure of a business. Regression outputs are analyzed to determine the most relevant factors.Linear RegressionThis analysis examines the relations between the “business rating” and the “succession phase” variables and also between the “business rating” and the “strengths and weakness of family business” variables.

|

|

7. Conclusions

- The correlation analysis showed a positive relationship between the seven main variables: owner’s advice and experience, lifetime ownership, succession troubles, transition challenge, successor education, passing through departments and external experience upon the analysis of multiple regressions. It was concluded that Companies’ Troubles, Lifetime Ownership, Transition challenge and Owner’s advices and experiences could be used in predicting Y (the business rate of success).The results showed that the business rate of success rely for 99.5% on the succession troubles, life ownership, transition challenge and the advice experiences shared with the successor. To conclude, for a family business, the owner has to find ways to prevent the business troubles and challenges that may exist during the succession phase because it will harshly affect the success rate of the business.

8. Study Limitations

- The most important difficulties encountered in gathering the data were as follows: the limited access to family business owners from all over Lebanon, the study didn’t cover the solutions provided if a family business owner doesn’t have a son or daughter or any successor. Another limitation is represented by a lack of data about the root cause of the predominance of men owners over women owners; also, a lack of data about the preference of a son successor over a daughter successor. The patterns observed in this study may be only limited to the study selected sample. The limitations can be covered by further studies using further data on how to overcome the family businesses troubles and further psychological studies on the owner’s feelings and fears during the succession phase.

|

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML