-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2014; 4(1): 21-29

doi:10.5923/j.mm.20140401.03

A Prognosis of the Leather Sector in Kenya; The Upheavals and Antidotes Associated with Value Creation

Mwinyikione Mwinyihija

COMESA – Leather and Leather Products Institute, Addis Ababa, 1110, Ethiopia

Correspondence to: Mwinyikione Mwinyihija, COMESA – Leather and Leather Products Institute, Addis Ababa, 1110, Ethiopia.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

The leather sector in the country has undergone tremendous ‘metamorphoses since its inception as a manufacturing and export oriented entity in 1905. To be able to cope with the external and internal trading environment, major legal frame works were developed in the 1947 and 1987 legislative reviews. Currently the legal reference in the sub-sector remains with CAP 359 (Hide, Skins and Leather trade Act) of Kenya Laws. However the approach in the past remained focused in the public domain rather than draw partnership synergies with the private sector. Unfortunately for the private sector in the 1970’s and 1980’s the export compensatory scheme operated by the Kenyan Government provided a ‘pseudo’ platform for the growth of the leather sector. The operational registered tanneries by then were seventeen. Indeed after the revocation of the export compensation scheme the number of registered tanneries reduced to about five. This scenario warranted the public sector, through various national policies, such as Economic Recovery Strategy for wealth and employment creation (ERS), Strategy for Revitalizing Agriculture (SRA) and ultimately vision 2030 to redefine and strategize on the leather sector’s economic growth. Case studies have been undertaken and the results at both the national level and the selected sites provide positive indicators on the potential of the leather sub-sector in the Kenyan economy. For instance, freight on board (FOB) export values depict an increase from K.Sh 1.6 billion (2005) to about K.Sh. 10 billion (2012) representing 525% increase in value. Veterinary Services Development Fund (VSDF) also indicated an incline on revenue of 273% when returns of 2005 and 2012 financial year were compared. Incentives towards value addition in the country contributed immensely towards such successes. Currently there are several tiers of decision making and policy implementation which creates an awkward economic platform for further growth of the leather subsector. The way forward for the industry is to harness its potential and strengthen the sector through identifying its unexplored opportunities, strategize the coordinating function of Kenya Leather Development Council for optimal results towards value addition.

Keywords: Leather sector, Legal framework, Policies, Strategies, Value addition

Cite this paper: Mwinyikione Mwinyihija, A Prognosis of the Leather Sector in Kenya; The Upheavals and Antidotes Associated with Value Creation, Management, Vol. 4 No. 1, 2014, pp. 21-29. doi: 10.5923/j.mm.20140401.03.

Article Outline

1. Introduction

- Hide, skin and leather development service was formed for the purpose of nurturing good quality production service within the British protectorate of East Africa in 1905. It was one of the most active functions run by non-veterinarians and the only such service to operate under the then Veterinary field services. The principle objective of this service was to undertake raw hides and skins quality improvement to cater for an export scheme to service the British shoe industry. The first such supply occurred in 1909 accruing £3000 worth of export revenue for the protectorate. By 2008 the leather sector had grown progressively and was estimated to earn the country about 4% to the Agriculture GDP (approximately 1.5% GDP)1 [1]. However, the potential in the leather sector has not been realized and Kenya needs to re-evaluate its national leather sector contribution after initiations of reforms post 2008.The leather industry in Kenya has continued to transform itself into one of the key agricultural sectors, with a high potential to contribute towards achieving economic growth, through an expansion of the export market for both semi-processed, finished leather and leather goods[2]. This industry depends largely on the locally available large livestock resource base standing at a livestock population (in millions) depicted as 17.5 cattle, 27.7 goats, 17.1 sheep and 4 camels in Kenya[3]. The major players in this sector are livestock farmers, butchers, tanners, exporters and traders[4]. The identified chain players are core, essentially the final quality of the hides and skins is dependent on the entire production chain including animal nutrition, control of ecto-parasitic diseases and adoption of standardized flaying procedures to storage techniques of hides and skins[5]. It is estimated that 60% of the damages to the hides and skins occur during the slaughtering process, while 40% of skins due to tick bites which could be recoverable if appropriate measures are taken to control ecto-parasites (e.g. ticks, mange etc.). Moreover, 14% of the hides, 34% of sheep skins and 29% of goatskins do not reach the commercial channels[6]. Therefore, efforts to address some of the cited issues could have long term effect to the value addition of raw stock and subsequently to socio-economic accruals from the leather sector in Kenya.

1.1. Background

- With the slow progress overtime and unexplored opportunities related to the leather sector there was dire need for extensive quality improvement of the raw material harnessed. This warranted for leather sectorial regulatory frame-work aimed to enhance on quality assurance initiatives. As a result in 1947, the first legislation towards the leather sector was promulgated with elaborate legal reviews and reforms carried out from 1985 to 1987, ending up with an enactment of an Act, Cap 359 of Kenya laws[7]. The spirit of this particular Act over and above emphasizing on quality assurance also had another fundamental dimension which later would impact on future policies of the leather sector in Kenya. The new dimension in that Act strengthened the position of public/private partnership through a legal provision of forming a Leather Advisory Board (under section 20 sub-section ‘s’ of the rules) with powers vested at the Ministerial level. It was anticipated that this provision would have provided a much needed platform where the public and private leather sector representatives would meet to deliberate on important policy issues relevant to the sub-sector. However, whilst the formation of the board was important, it attested to one major drawback of inclusivity. For instance, if the board was formed earlier than 2010, it would have left out core participants in the triple helix approach such as academia, public and research entities. In lieu, the formation of the leather development council incorporated the participants drawn from Ministries such as Finance, Industrialization, Trade, Kenya Industrial research Institute, National Science and Technology Council (currently a commission) and the private sector chain players[8]. Comparatively for the private sector, mapping of the leather value chain would have identified the critical players of the sector and thereby identified appropriate representation to the board. Unfortunately, the board was not constituted from 1987 till after the second reforms in 2009 – 2010 periods. It was during this phase that a legal notice 65 of the Kenya Gazette supplement number 19 of 7th May 2010 provided the legitimization of the Council and lead subsequently to the development of the five year strategic plan (2010-2015)[1]. Thereafter, after the launching of the strategic plan, the roadmap towards the development of the leather sector marked an important milestone to the country. Importantly, the reforms resulted to the formation of the board (also referred to as the Leather Development Council) on the 1st of July 2010 and immediately encompassed the public/private participatory approach and later the Kenya Leather Development Council as full parastatal in 2011[9]. Thusly, the aspect of inclusivity was achieved and some of the upheavals of the past started to be addressed. The result was adaptation of coherent policies within and amongst the stakeholders, and consistency in pursuance of set targets highlighted under vision 2030, particularly, in areas of leather value addition. The importance to this industry cannot be over-emphasized as the leather sector has been identified as a flag ship in the current National policy under vision 2030[10]. It is worthy of note that all through, the main policies that have been developed over time, emphasized on the need to transform the leather sector from a raw hides and skins export oriented Industry, to focus primarily on value addition, improve national consumption and regional/ international marketing development for leather/leather products[11,12]. The impact of appropriate policies, technical support to the sector, coupled up with strategic partnership in the development of the leather sector is anticipated to have immense and positive returns as demonstrated in this paper.

1.2. Purpose of the Study

- The paper attempted to assess, demonstrate and discuss the prognosis of the leather sector in Kenya. In the process, highlighting the upheavals and antidotes associated with value creation for the purpose of identifying underlying potential of the leather sector in Kenya.

2. Leather Sector’s Role in the Economy

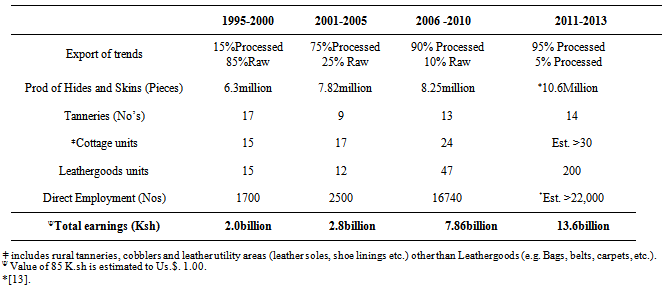

- To determine the principle factors of the sector in the economy, it was imperative to scrutinize the income generation (through export value and revenue), production and employment. The source of such information was based on operational performance of curing premises, tanneries, export godowns and cottage industries in the country (Table 1&2).

|

|

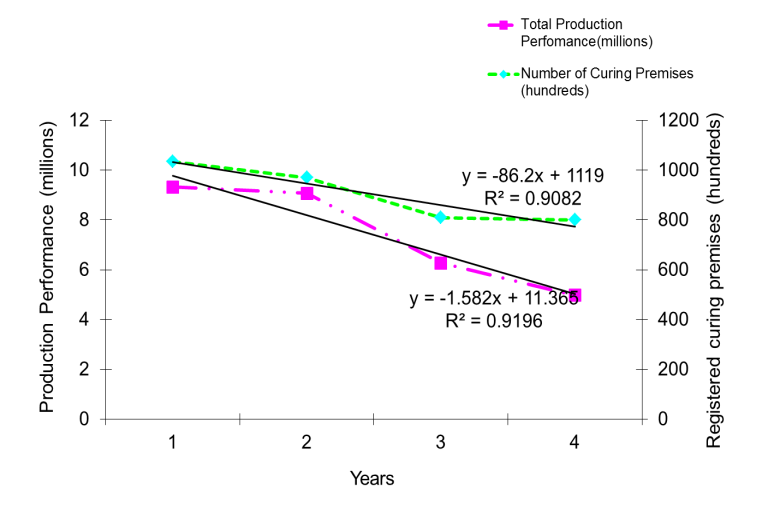

2.1. Dilemma towards Value Addition

- The indicated ninety five (95%) percent of leather processed in the country, reflectively, is not qualitative as most of the leather produced are in the ‘wet-blue’ stage which ostensibly is considered as semi-processed. The dilemma to this observation is that globally, semi-processed material contributes 6% of the total leather value[16]. This, therefore, indicates that as a country there is need to upscale to higher value chains to encompass footwear and Leathergoods stages to achieve optimal returns enjoyed in global leather markets.To determine the impact of the leather sector productivity and the operational levels of the curing premises, a comparison of selected parameters (e.g. production performance and number of registered curing premises over time) were conducted as shown in Fig. 1.

| Figure 1. Trends between registered premises and production performance |

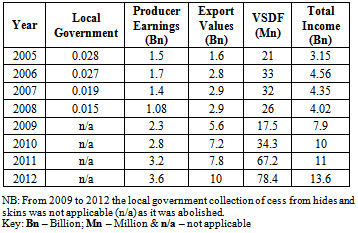

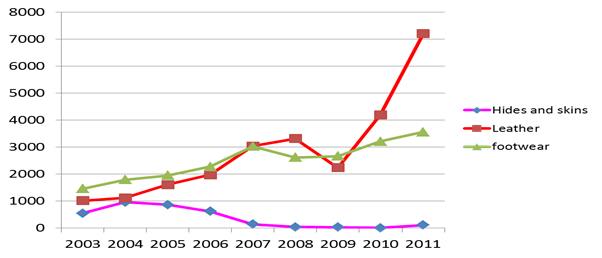

2.1.1. In Contrast to the Dilemma’s

- By and large, irrespective of not attaining the full potential in the leather sector as demonstrated earlier, the push for reforms on aspects of value addition assisted in the stability of the sector as depicted in the total income accruals in Table 2. Indeed, another critical parameter that impacts positively to the leather sector in Kenya, other than accrued revenue, was its capability to induct an appreciable ‘trickling down’ effect to its producers over time, especially between 2009 to 2013 period (Table 2).The most remarkable occasion was the post 2008 review period which showed a record total income of more than K.Sh. 3.88 billion representing 52.2% when compared to 2009 period (Table 2). This observation showed further improvement in 2013 compared to 2009 period where in a span of five years the country earned an extra K.sh 9.58billion representing a 238.3% increase in accruals. Moreover, other parameters such as earnings to producers and government revenue showed positive increases over the review period, indicating that once the unexplored opportunities in the sector are pursued, leather will be one of the major contributor the to socio-economic growth in the country[4, 17]. However, certain indicators need to be considered and addressed to sustain the envisaged growth of the leather sector in Kenya. These includes the importance of registering the persons engaged and premises that handle the hides and skins as zoo-sanitary and trade transparency prerequisites. In absentia of these aspects, concerns have arose implicating increased fraud, dishonesty and uncertainty in the leather trade particularly at the primary level where the raw hides and skins trade are involved. Therefore, remedial measures to remedy the concerns are required to propel the leather sector to its zenith of economic growth. For example, if the processed leather was finished and transformed to leather goods and footwear the value addition initiatives would have higher value returns (Figure 2). The graph (Figure 2) depicts that trend in the leather sector tilted towards processing and less in footwear where optimal returns are accrued.Figure 2, further illustrates that in 2004 there was only 56% of processed leather in relation to raw hides and skins when compared to the current (2013 period) 95% of leather exported. However, as noted earlier the strong inclination (>95%) was towards export of semi processed material (commonly referred to as ‘wet-blue’) rather than finished and/or leather goods manufacture.

| Figure 2. Indicators depicting identified growth of the identified strata of leather sector covering the period 2003-2011[3] |

3. Roadmap towards Vision 2030

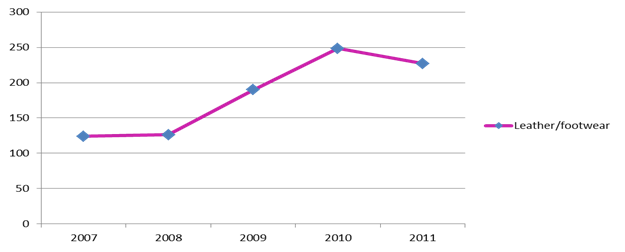

- The economic survey of Kenya (2012 edition) depicted a promising future to the leather sector (Fig. 2 and 3). In addition, the analysis in the economic survey concurs with data obtained for this paper and further forecasts the leather sector with the potential to greater growth in Kenya[3]. The results of this observation influenced the realignment of the leather sectors’ roadmap to integrate some of the core millennium goals such as; creation of wealth, employment, rural development, environmental management and conservancy in its plan[1].

| Figure 3. Quantum index for leather manufacturing covering 2007 to 2011 period[1] |

3.1. Are There Any Indications of Value Addition Initiatives in the Leather Sector?

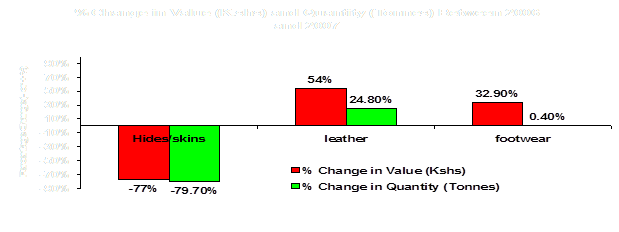

- The thematic objective for the value addition process in Kenya was to fully industrialize the leather sector by 2030. The industrialization process, therefore, meant that more than 90% of the leather industry’s output would encompass finished leather products such as footwear and leather goods for local and export market[10]. The preamble to attaining this objective showed that the footwear sub-sector depicted a 34% positive change when 2007 was compared to 2006 period (Fig. 4). Moreover, the performance was remarkable when 2007 (post reform periods) was compared to an earlier period of 2003 (pre-reform periods) where 67% positive change was observed. This observation showed a steady growth of the footwear industry from 2003 to 2007, thus, strongly positioning the subsector as one of the best drivers in realizing the aspiration towards the industrialization process and vision 2030 set objectives of the leather sector.

| Figure 4. Change in Value (K.Sh) and Quantity (Tonnes) Between 2006 and 2007 |

3.2. Market Potential and Opportunities

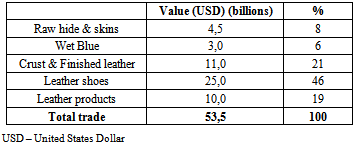

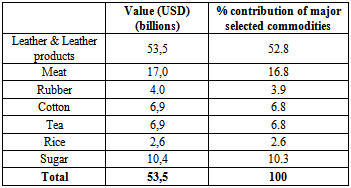

- Apparently, so far, the pathway towards value addition strongly inclines towards finishing of leather during processing, development of leather goods and footwear enterprises as fundamental in the optimization of accruals from the sector. The observation in this study is in tandem with the global observation where value addition is strategized towards production of leather footwear and leather goods rather than intermediary products (i.e. pickled pelts, wet blue etc.)[14]. Thus, earlier studies by United Nation Commodity trade (Comtrade) conducted in 2003 which centred on international trade within the leather chain clearly depict this observation (Table 3).

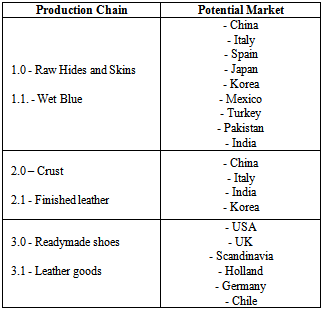

|

|

3.3. Investment Preview

- In Kenya, it is estimated that the investment portfolio in the tanning industry (for 13 operational tanneries as the 14th is about to start operations end of December, 2013) was projected as medium sized semi-processing unit at K.Sh 25Million per unit on average) stands at K.Sh 323million (excluding land). Such an enterprise requires a working capital of K.Sh. 30million per month to sustain delivery and processing of 7-8 containers (e.g. 1 container has between 20-25 tonnes of salted materials) of hides and skins per month. This scenario therefore indicates that the industry requires a high capital investment and liquidity float to meet the demands of the sector’s routine running costs. However, with good management and financial skills, the return rates are high. Access to good quality processed material (i.e. semi processed, finished and leather goods) in world markets (including national and regional markets) is a feasible venture to ensure quicker returns to investment. Markets identified at the international level, for different levels of the production chain, are diverse and are selectively indicated in Table 5.

|

3.4. Challenges and Possible Interventions to the Roadmap

- The challenges with the leather processing in Kenya, is that, the leather sector has its major stake mostly foreign owned with the exception of a few local enterprises. However, the locally owned are characterized with low operational capacity due to the high, expensive and intensive capital requirement earlier enumerated (under para 3.2). Entrepreneurial engagements such as recapitalization and investment to the sector have remained elusive to the indigenous population. As such, affordable financing and insurance, participatory policy development towards investment and capacity building are earnestly required. In addition, environmental management through adopting common tannery waste treatment plant approach could save almost 30% of operational cost to tanneries[18]. Moreover, appropriate marketing techniques through well managed auction system of hides and skins would go a long way in normalizing grading and selection of material. Currently there is an application of a system known as ‘shellabela’ which is based on buying hides and skins on dictated lot systems by the buyers rather than grade them accordingly.

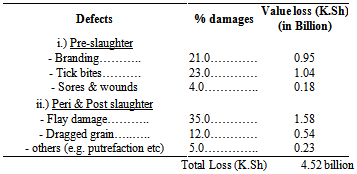

3.4.1. Establishing Partnership

- Establishing sustainable partnership is fundamental in reducing pre-, peri- and post slaughter defects that, currently contribute an estimated total loss of K.Sh 4.52 billion (Table 6) to the country’s earnings of the leather sector. The envisaged synergies of the partnership or associations could be achieved through closer cooperation in pest control (community based programmes and specialized projects), appropriate branding techniques, reduction of flay damages (using recommended skills and tools), preservation and post preservation techniques[19]. Drawn deduction from Table 6, shows that 52% of the loss is based on peri and post slaughter related defects.

|

3.4.2. Reduction of Hide Sizes

- The breeding policy of the country is of paramount importance to the leather sector and the initiative of the Ministries of Agriculture, Livestock and Fisheries in developing an all-inclusive strategy, on genetic improvement of national livestock herd is a milestone to the country[20]. The emerging challenge that potentially posed great renegation to the successes attained would have been on the reducing sizes of the Kenyan hides.This ‘bottleneck’ is attributed to the collapse of the subsidized artificial insemination (A.I) services that were popular especially in the ASAL (arid and semi-arid lands) areas of the country. To date the average sizes of the hides in the country are generally between 25-28 sqft down from an average of about 36-40 sqft in the late seventies and early eighties. The danger to this depreciation of sizes is that in a few years, if the sizes lower to 21sqft and below, than the hides and skins are prone to be reclassified as calfskins. In the world market, calfskins seek half of the prevailing full hide prices and their demand is very erratic. Therefore, adequate breeding policies and practice, stakeholder participation and government intervention is fundamental in addressing this dilemma.

4. Conclusions

- This paper attempted to evaluate the impact experienced in the Kenyan leather sector in two phases (i.e. past and present). The diagnostic approach also included the spirit of partnership between the public and private sector and its importance as a basis of development of the sector. The results deduced from the data presented, strongly, indicated the crucial role of the public (mostly facilitative and regulatory) and the private sector (whose primary role was supportive, value creating and driving productivity) with synergies actualized along the production chain. It was apparent from the study reported in this paper, that the output derived thereof included identifying strategies related to increased revenue collection, improved quality and level of value addition, and improved export value. Moreover, it was also notable that previous policies, such as ERS and SRA, were crucial in amplifying the need of the leather sector, to be considered as one of the most important drivers of the economy[21,22]. Indeed, the launching of vision 2030 as the principle guiding policy towards Kenya’s economic growth and industrialization, acted as an impetus to the leather development in the country. The prominence of this sub-sector is currently more conspicuous, particularly, when it was identified as a flagship in the vision 2030. However, the paper has also cited areas of immediate, medium and long term intervention which, require to be addressed for the potential in the leather sector to be optimized and benefit the Kenyan economy at large. The diversified focal points need to be harnessed and an organization that could do exactly that, such as the establishment of Kenya Leather Development Council, was opportune and strategic in the development of the leather sector in Kenya.

ACKNOWLEDGEMENTS

- Members of the SMC-University (Prof. William Quisenberry and staff of faculty and department of management), Kenya Leather Development Council (especially Mr. George Onyan’go and Harrison Ndung’u), Leather division Ministry of Livestock, Kenya and staff of COMESA-Leather and Leather Products Institute, Addis Ababa who directly and indirectly participated in the preparatory stages of this paper.

Note

- 1. GoK – Government of Kenya

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML