-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2014; 4(1): 10-20

doi:10.5923/j.mm.20140401.02

Merger and Acquisition Transactions–Important Aspects of the Newly Developed Holistic Process Model Using the Example of the TÜV NORD Group

Maksim Saat1, Jürgen Himmelsbach2

1Department of Business Administration, Tallinn University of Technology, Tallinn, 12618, Estonia

2Department of Finance and Legal TÜV NORD Group, Essen, 45259, Germany

Correspondence to: Maksim Saat, Department of Business Administration, Tallinn University of Technology, Tallinn, 12618, Estonia.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

Empirical research studies and literature analyses show a high failure rate of implemented Merger and Acquisition (M&A) transactions in enterprises in the service sector. Against this background the aim of the paper is to show important success factors of a newly developed holistic model for national and international M&A processes (transactions), especially for enterprises in the testing service market (TICET market) and the service sector market in general. Until now such a detailed holistic model for national and international M&A processes is missing in the literature, which considers the special features of M&A transactions in thetesting service market and the service sector market in general. Within this new holistic model important success factors are especially the developed and implemented country analysis concept and the risk management concept. Furthermore the results of M&A transactions on the basis of the developed holistic M&A process model will be analysed, measured and objectivised with the help of a case study. As part of the case study the results of M&A transactions carried out by TÜV NORD and by its main competitor TÜV SÜD were used.The presented success factors and individual measures can especially be used by enterprises from the testing service market and service market in general. This is of great importance because of the increasing worldwide consolidation rate of marketsand consequently of enterprises especially in light of the technology development in connection with increasing of complexity. Therefore it can be expected that in the future the demand for sustainable M&A transactions will further increase.

Keywords: Holistic Merger and Acquisition Model, Risk Management Model, Country Analysis Model, Competition Analysis, Benchmark Analysis

Cite this paper: Maksim Saat, Jürgen Himmelsbach, Merger and Acquisition Transactions–Important Aspects of the Newly Developed Holistic Process Model Using the Example of the TÜV NORD Group, Management, Vol. 4 No. 1, 2014, pp. 10-20. doi: 10.5923/j.mm.20140401.02.

Article Outline

1. Introduction and Literature Analysis

- A lot of publications and studies show the enormous importance ofM&A transactions in the context of realising growth and profit targets and the accompanying value increase in an enterprise[1, 2]. Against this background the implementation of M&A transactions allow the assumption that M&A should be a very successful strategy for the development of enterprises. However, an analysis of the numerous available empirical research studies and further literature shows a high failure rate of implemented M&A transactions. For example, a study made by J.P. Morgan showed a failure rate in the implementation of M&A transactions of approximately 40%; the failure rate of M&A transactions in the service sector was even higher, at around 50%[3, 4, 5]. What are the reasons for such a high failure rate of M&A transactions?In the relevant scientific literature most publications on the topic of M&A only present a rough and not detailed M&A process model and they vary from author to author. For example the authorPicot[6] presents only a part of a holistic M&A process model especially on the basis of reorganization issues. The author Grill[7] is only presenting human resources aspects as part of a holistic M&A process model. In the meantime the authors Bauer, Düsterlho illustrate only the reorganization and distressed issues as part of M&A process model[8]. Furthermore the authors Berens, Brauner, Strauch[9] show especially the due diligence process as necessary part of a M&A process model but not further important issues.While other authors as Theurl, Tschöpel[10] show only rough structural concepts of M&A processes.Also the five phase approach developed by Aiello, Watkins illustrates only rough structural concepts of M&A processes[11]. This conceptincludes the phases of screening of potential M&A possibilities (first phase), reaching initial agreement (second phase), conducting due diligence (third phase), setting final terms (fourth phase) and achieving closure (fifth phase). In the first phase, according to Aiello, Watkins, successful acquirers should be searching for potential acquisition targets at all times. During this phase it is completely normal for a successful acquirer to look at many potential acquisition targets, although only few will be realised in the end. In the second phase, initial agreement should be reached. The authors state that “initial negotiations can take place in a variety of ways. Some cases occur through a structured process, such as an auction; others happen less formally through conversations between senior executives”[12]. In the third phase, the due diligence process is the most important and time consuming part of the transaction. During this phase, the economic risks of the target enterprise have to be analysed. An understanding of the way of working of the management of the target enterprise can be gained and the presented business plan should be examined.In the fourth phase, the most sensitive issue is the price negotiations between the management teams of both sides. “A typical mistake for novice teams at this stage is to come to the table with a large list of outstanding issues, which they then try to resolve in no particular order. The danger of this approach is that talks will get stalled on relatively trivial items, exhausting the hard-won goodwill gained during earlier stages and affording openings for rival bidders”[13]. Furthermore, the negotiations can be on several fronts simultaneously. The legal team can work out the details of the acquisition agreement and the financial team can structure the financing of the deal. In the fifth phase, the closing of the deal should be achieved. In some M&A transactions cancellations were made between the signing and closing. “There are sometimes very good reasons for that to happen – an environmental disaster may happen, some undisclosed liability may become apparent, or some adverse change in the target`s competitive position may occur”[14].Fundamentally, it must be stated that the five phase approach developed by Aiello, Watkins presents only rough structural concepts of M&A processes. Within this process descriptionfor M&A transactions no detailed information, modelsor concepts for enterprises (e. g. for analyzing of strategic business fields, risk analyzing, country analyzing, post merger integration or value chain management) will be presented or explained.However, according to the intense research by the authors, no detailed and holistic model exists which considers the special features of M&A processes in the testing service market and in the service sector market in general. In these circumstances the aim of the authors of the paper in the first step is to show the most important success factors of a newly developed holistic model for national and international M&A processes, especially for the testing service market (TICET market) and for the service sector market in general. In the second step, the results of the developed holistic M&A process model will be analysed, measured and objectivised with the help of a case study, and management instruments will be highlighted. As part of the case study the results of M&A transactions carried out by TÜV NORD (more than 10.000 employees) and by its main competitor in the business field – TÜV SÜD (more than 16.000 employees) – were used[15, 16]. Both enterprises are global leaders in the testing service market with comparable business activities and with more than 140 years of enterprise history. The testing service market has an estimated market volume of at least €40-50 billion.

2. Newly Developed Holistic National and International M&A process Model

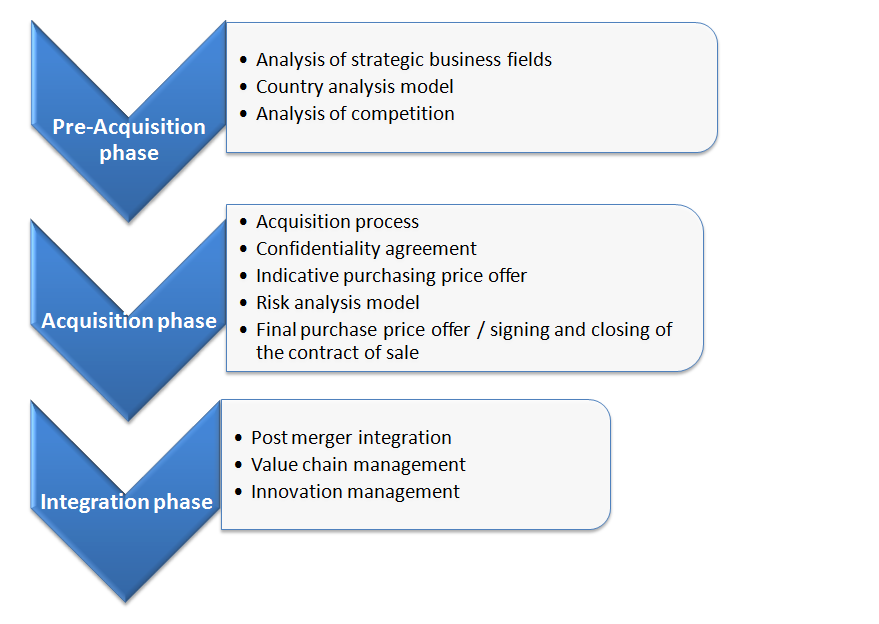

- In this section, the most important aspects of the holistic M&A process model, which has been developed by the authors specifically for enterprises in the testing servicemarket and also for the service market, is presented together with many success factors, by using the example of TÜV NORD in comparison with TÜV SÜD. The newly developed holistic national and international M&A process model consists of the following three phases, and is shown in the following figure 1.

| Figure 1. Holistic national and international M&A process model (author’s illustration) |

2.1. Country Analysis Model – as Part of the Newly Developed Holistic M&A Process Model

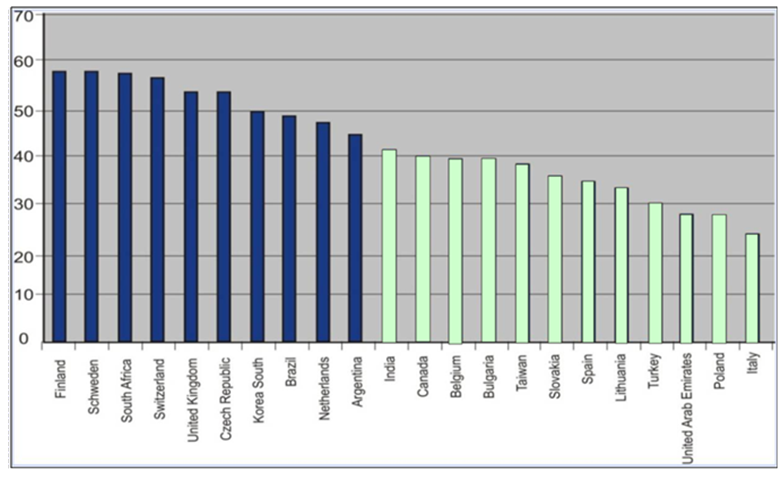

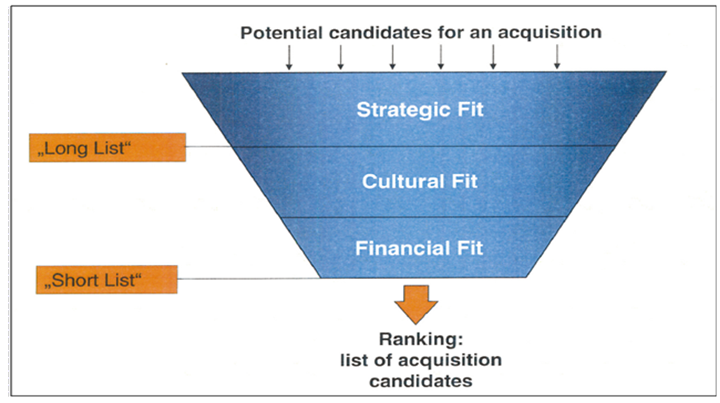

- As part of the pre-acquisition phase within the holistic M&A process model as a first step an analysis of the strategic business fields in an enterprise has to be done before the developed country analysis model can be implemented.Therefore parallel to determining the mission and vision and the code of conduct in order to achieve the long-term objectives of the enterprise, an analysis has to be carried out in order to identify the medium term enterprise strategy of the strategic business fields. This is of central importance for enterprises which are active in several business fields and is often referred to by the term portfolio management[17]. Portfolio management for an enterprise means to manage its portfolio of business activities in such a way that it (the enterprise) will be able in a larger time- and activity scope to maintain its activities with regards to finance and personnel. The portfolio approach is based on the idea that enterprises should have an optimal mixture of business activities by following four criteria: risk diversification, yield opportunity (return), growth opportunity and financial feasibility[18]. The bases for the portfolio approach are for example the concepts of the product/market life cycle and the learning curve (see a detailed representation of the Life cycle model[19]. The systematic and careful analysis and appraisal of the present condition, of the activity and of the business portfolio is the basis of an active portfolio management.As part of the strategy process and the strategic new positioning of TÜV NORD with the support of the authors, the strategic business field nuclear energy was identified within the business division of industry services. Due to the fact that an extension of the operating time of nuclear power plants was decided in 2010 and then this decision was cancelled in 2011 through the moratorium of the government as a result of the nuclear catastrophe in Japan, long-term investments in this field in Germany are associated with considerable uncertainties. The strategic business field nuclear energy provides in Germany and world-wide expert services for the legally responsible authorisation and supervision offices. At TÜV SÜD, the business field of nuclear energy is part of the business division TÜV SÜD Industry. The importance of the business area nuclear energy at TÜV SÜD can be recognised by the fact that in 2009 TÜV SÜD acquired a South Korean company which is active in the field of nuclear technology.Internationally the discussion about nuclear energy is conducted more quietly and factually. Numerous countries throughout the world plan – despite the nuclear accident in Japan[20] – the construction of nuclear power stations; on the one hand, they do so in order to satisfy the need for energy, and on the other hand it is to fulfill the agreed climate targets. Within Europe, Finland has advanced the most in this area. Since TÜV NORD possesses considerable and world-wide recognised Know-How in the area of nuclear energy, it is natural to look for organic growth in the form of expanded international sales or consider the establishment of new nuclear technology enterprises in other countries.Another option is the complete or partial acquisition of suitable enterprises. In order to check these options in a meaningful way, countries have to be selected in which TÜV NORD could provide these services. Therefore a country analysis model was developed with the support of the authors and parameters have been defined for this purpose in order to rank countries in accordance with their attractiveness. Important parameters in the creation of this ranking of countries, in which TÜV NORD could offer nuclear technology services, include the following:• No danger of war• Political stability• No closed markets• Compatibility with the value system of TÜV NORD (code of conduct)• No exclusion criteria of the IAEA (authorities)• Existing nuclear safety program • Economic viability (e.g. hourly rates, inflation, etc)On the basis of these and other parameters and with the help of key figures the countries were assessed and a ranking was established. The key figures are determined by awarding points for each individual parameter, whereby a parameter could reach a maximum of 10 points. With the help of certain criteria the attempt was made to award points as objectively as possible. For example, in the case of the parameter economic viability an analysis of the achievable hourly rates was carried out in the different countries. Subsequently, points were awarded for economic viability from the yield perspective. The ranking of countries produced the following result:

| Figure 2. Ranking of countries 2012 by TÜV NORD (author’s illustration) |

| Figure 3. A Concept for Partner Selection[22] |

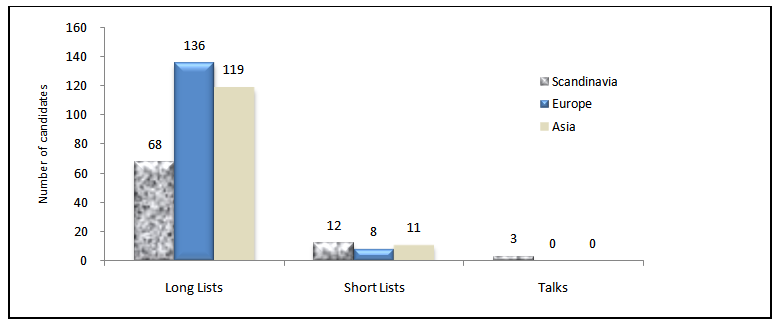

| Figure 4. Candidates screening of the strategic business field nuclear energy (authors constructed) |

2.2. Risk Management Model - as Part of the Newly Developed Holistic M&A Process Model

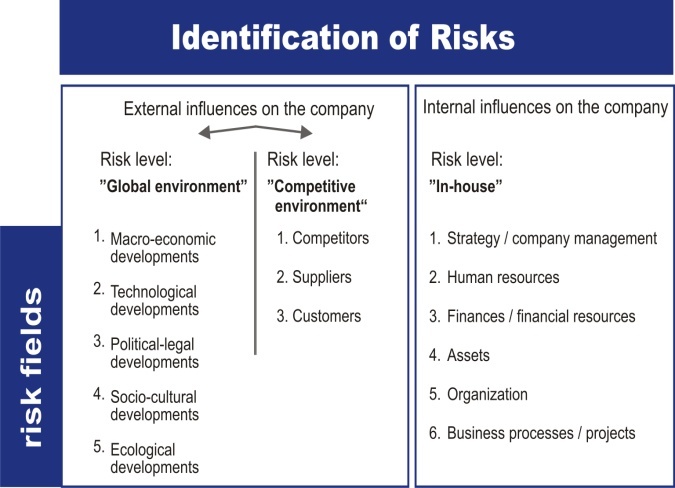

- Within the acquisition phase of the newly developed holistic M&A process model the risk analysis of M&A transactions and therefore the development of a meaningful risk management model is of highest priority.In the last seven years, the TÜV NORD Group has made 28 acquisitions. 17 of the enterprises purchased are headquartered in Germany and 11 abroad. Due to the acquisitions, the number of employees has increased from more than 2,000 to more than 10,000. At the same time period the TÜV SÜD Group also has acquired 28 enterprises[23]. Against the background of new knowledge and experience gained in connection with the expansion of the TÜV NORD Group, the risk management is continuously developed and extended.In order not to have to register unknown or unforeseen risks in the context of the integration of acquired enterprises, a risk analysis should be performed in the context of the acquisition process. However, risk analysis is different from operational risk management, in particular with regard to its project character and information basis (publicly available information and information provided by the target enterprise)[24]. Risk analysis should include the most important elements of risk management, i.e. risk identification and risk evaluation, and can be integrated into the due diligence process. A due diligence procedure also should be carried out for each acquisition. {According to Section 11 of the US Securities Act of 1933, brokers reproached for having withheld important information from investors were able to relieve themselves from personal liability by the defence of due diligence. To do this, they had to prove, among other things, that as a consequence of an appropriate investigation they had reasonably believed that all information published had been true and no essential information had been omitted[25]}. The aim of due diligence has to be the identification of all risks of an enterprise and their subsequent minimisation or inclusion into the calculation of the enterprise value. In a due diligence process the enterprises can also cooperate with external advisors such as auditing and law firms to perform due diligence checks and risk analyses. In the following, the authors will deal with issues of risk management or risk analysis in the acquisition processes which are of great importance for every enterprise. For this background to ensure a complete record of all important risks, it is necessary to adopt a systematic process to identify them, which was developed and implemented from the authors in the TÜV NORD Group in the last years to reduce the risks concerning acquisitions. For this the issues will be classified by external and internal influences on the enterprise (see Figure 5).

| Figure 5. Identification of Risks (Source: Own diagram based on internal documents of the TÜV NORD Group) |

3. Comparing Merger & Acquisition Transactions by TÜV NORD and TÜV SÜD – Case Study

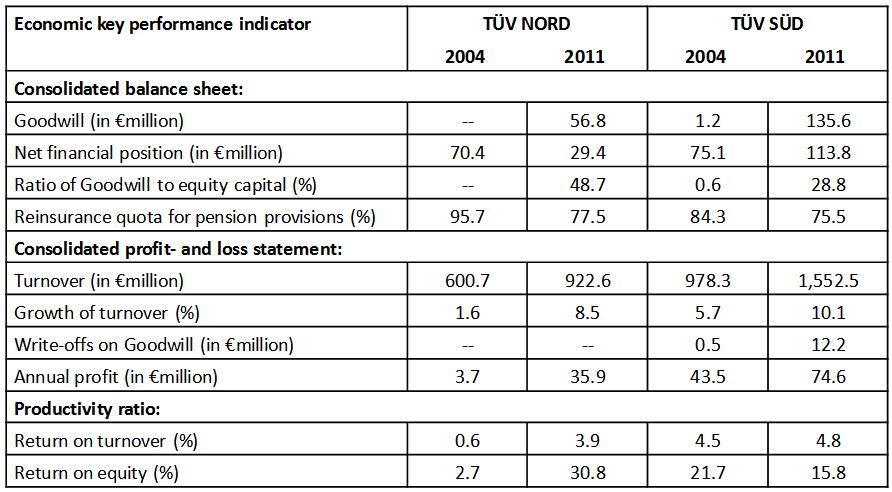

- In this section the results of the M&A transactions on the basis of the developed holistic M&A process model will be analysed, measured and objectivised with the help of a case study. Therefore the authors developed specifically a benchmark analysis for that purpose in order to make value contributions of M&A transactions directly visible for enterprises, which will then allow the comparison of different M&A strategies. The benchmark analysis has been implemented by the authors over a specific period.Against this background, the results of M&A transactions of TÜV NORD and its biggest competitor in the business field – namely, TÜV SÜD – are summarised, measured, analysed and objectivised with the help of the most important economic key performance indicators in the balance sheet, the income statement and profitability key performance indicators; and with the help of standard procedures, which are used for the evaluation of enterprises. Both enterprises are global leaders in the testing servicemarket, they have similar product portfolios and enterprise histories, and therefore they are very suitable for comparison in this case study. Their comparison offers convincing research results and the results can be applied to third parties. The results of the analysis and benchmark of the economic key figures is presented in the figure 6.

| Figure 6. Economic Key performance indicator (author's illustration based on[27]) |

4. Summary

- A literature study and analysis of numerous empirical studies shows however a high failure rate of at least 40% to 50% of the implemented M&A transactions (e.g.[4, 5]). An intensive research in the relevant scientific literature has shown that there are some more or less detailed structured theoretical models for M&A processes but there is missing a detailed and holistic concept for national and international M&A processes which consider the special features of M&A transactions in the testing servicemarket and the service market in general. For this background it was the aim of the authors to develop such a holistic national and international M&A process model for enterprises in the testing servicemarket and the service market to reduce the high failure rate of implemented M&A transactions.Finally, it can be stated by the authors that with the help of the newly developed holistic M&A process model in connection with further success factors (e.g. risk management model, country analysis model) TÜV NORD did not have to record failures during the observed time period concerning the implementation of their M&A transactions, while the failure rate of TÜV SÜD, the main competitor in the business field, regarding M&A transactions has reached approximately 15% - 20% of the investment volume as shown in the section before. Both enterprises are global leaders in the testing servicemarket with comparable business activities and with more than 140 years of enterprise history. Thus, the holistic M&A process model implemented in TÜV NORD is working properly. In the following, the most important success factors and individual measures of the developed and implemented holistic M&A process model by the authors will be presented:• In connection with the evaluation of the strategic business fields regarding the world-wide growth potential through M&A transactions a model for a country analysis can be introduced. This model which was developed with the support of the authors and shown in the paper uses various parameters and key figures to evaluate and rank countries. In countries with the best rankings the highest priority is given to an examination of a possible entry into that market, e.g. through M&A transactions (close interlocking of the enterprise strategy with M&A transactions has specific importance, so that the resource of the enterprise can be used most efficiently).• In many cases M&A transactions are driven by opportunism, since regular market knowledge and market screenings are missing[29]. In contrast, the authors help to perform regular market screenings at TÜV NORD, as this paper illustrates. These market screenings should be carried out under the leadership of a central staff unit in the respective strategic business fields. A stringent process should be installed for that purpose, where through central data bases such as Euler Hermes, M&A Database or so-called exchanges, where enterprises are searching for successors, regular queries are made. In addition the management should be trained to examine possible strategic alliances, e.g. in the form of M&A transactions, during visits of small market competitors or consortium partners.• The evaluation and assessment of all potential world-wide M&A possibilities should be performed centrally by the M&A Team, which is a very important success factor (the author and his department is responsible for the evaluation of all potential M&A possibilities). Without the involvement of the M&A Team the submission of a purchasing price offer or the purchase of another corporation should not be possible. This prevents a possible “hunting instinct” during the acquisition process from the employees who will later be responsible for the operational integration. In addition the risk of paying excessive purchasing prices as part of M&A transactions and the subsequent risk of future write-offs on the acquired enterprises or the capitalised Goodwill is reduced. Furthermore, so-called Earn Out Models can be used – in order to avoid exaggerated purchasing prices – where prices are paid to the seller, depending on achieved future result. With the support of the author Earn Out Models were developed and implemented in TÜV NORD for individual cases.• In order to avoid the high purchasing prices in the testing servicemarket companies with a turnover volume of €50 million or lower can be acquired and thus could bypass the usual bidding process and buy at acceptable/lower prices.• As part of every M&A process during the transaction phase a detailed risk analysis should be done. The implementation of a risk analysis model as developed and shown by the authors is an important success factor. Thereby the rather typical risk checks such as an examination of the financial and tax data and the legal foundations will be supplemented through a detailed examination of the Human-Resource-Assets. The latter is especially important in connection with M&A transactions in the service sector and related cultural aspects with regards to the company that is targeted for acquisition because the business model is based on services that will be performed by people. The core of the Human-Resource examination is the evaluation of the Human-Resource-Assets on the basis of hard and soft facts. With the contribution by the authors TÜV NORD uses special check list for this, which were specifically developed for the testing service market and the service market in general. • In the process of the risk examination of a potential target for acquisition no “black box” is accepted and all talks are terminated immediately in such cases. • Before M&A transactions will be implemented in enterprises, besides the agreement of the TOP-Management, the agreement of a special investment committee exclusively responsible for M&A transactions should be necessary. This committee should be composed of responsible persons from the different enterprise divisions e.g. strategy, personnel, finance, controlling or law. This investment committee performs one more independent quality assurance to check, whether all relevant standards are observed during the M&A transactions. • Specific significance as part of M&A transactions should be given to an early and comprehensive process for the optimal integration of acquired corporations into the group. Appointing an integration manager is an advantage; with the contribution by the authors TÜV NORD does this regularly.• Identification of value driving aspects and innovation potential during a M&A transaction; avoidance of acquisitions where the Know-how lies only within some individual people in an enterprise.Especially the above success factors enabled TÜV NORD with the help of a sustainable M&A strategy to improve its competitiveness – while maintaining the cultural identity – to increase its national and international growth and secure workplaces. The above aspects have to be also seen in relation to the flexibility an enterprise has to access financial sources and equity capital. Medium and larger sized enterprises often have more flexibility in this regard since they can use the capital market if they are publicly listed. These enterprises can obtain cash from the capital market by raising their equity capital or by using alternative financial products for their M&A transactions or they can implement M&A transactions by using their own stock shares and preserving their cash.The optimal integration of newly acquired corporations will require considerable management capacities, but these are generally a scarce resource in enterprises. To avoid excessive demands, phases of strong growth through M&A transactions should be followed by phases of consolidation. In the same way the internal and external growth through M&A transactions should be balanced; this will help to distribute the risks that come with managing and developing enterprises equally on both types of growth.The presented success factors and individual measures can also be used by other enterprises especially those from the testing servicemarket and service market in general.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML