-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2013; 3(7): 484-490

doi:10.5923/j.mm.20130307.20

Performance Measurement Usage in Developing Countries: The Case of Banking Sector in Sudan

Nayla Babiker Eltinay 1, Ridzuan Masri 2, V G R Chandran Govindaraju 3

1School of Business Infrastructure IUKL

2Department of Business Infrastructure IUKL

3Department Development Studies, University Malaya

Correspondence to: Nayla Babiker Eltinay , School of Business Infrastructure IUKL.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

The role of appropriate measures could not be underestimated and measurement has been regarded as the key for controlling, managing and improving organizational performance. Banking is considered as one of the main gears of a financial system, since it has a broad impact on the overall financial stability and strength of an economy. While developed economies have invested heavily in their performance measures tools, developing economies have done little to advance their performance measurement tools. This paper attempts to (a) explore performance measurement usage in developing countries, (b) understand the available tools the private banks use in measuring performance, and (c) identify the key factors affecting the performance measurement usage. This research deploys both quantitative and qualitative analysis. Future work is proposed and some conclusions are reached.

Keywords: Usage, Performance Measurement, Developing Countries, Sudan

Cite this paper: Nayla Babiker Eltinay , Ridzuan Masri , V G R Chandran Govindaraju , Performance Measurement Usage in Developing Countries: The Case of Banking Sector in Sudan, Management, Vol. 3 No. 7, 2013, pp. 484-490. doi: 10.5923/j.mm.20130307.20.

Article Outline

1. Introduction

- Since the late 1980s performance measurement has become topical with ever-increasing interest in the subject which has been driven by the rapidly changing business environment in different sectors (McAdam & Bailie, 2002). According to Ghalayini and Noble (1996), the literature concerning performance measurement has had two main stages. The first stage started in the late 1880s and walked off through the 1980s. In this stage the importance was on financial performance measures such as profit and return on investment. The second stage started in the late 1980s as a result of changes in the world market. Organizations in less developed countries began to lose market share to overseas competitors who were able to provide higher-quality products with lower costs and more variety. Performance measurement is a significant component of the management control process of any organization (Olson & Slater, 2002). However, performance measurement is an important management control tool for business firms in the currently competitive environment. It is directly related to the formation of a firm’s core competency and has a significant impact on the firm’s growth (Xiong, Su & Lin, 2008). To regain a competitive edge, organizations not only shifted their strategic priorities from low-cost production to quality, flexibility, short lead time and dependable delivery, but also implemented new technologies and philosophies of production management. The implementation of these changes revealed that traditional performance measures have many limitations.Therefore, organizations started to use non-financial performance measures such as customer satisfaction and product quality. Therefore, organizations started to use non-financial performance measures such as customer satisfaction and product quality. In this context, Bourne et al (2000) expressed a general dissatisfaction with traditional backward looking accounting based performance measurements. The study of banking performance is quite important for the following reasons: First, the financial sector is a major player in today’s competitive economies, as it enacts a role as a producer of financial services and as an employer in same time. The value-added of the financial sector as a share of GDP has grown considerably over the last three decades. Banking system fulfill essential functions in intermediating between savers and investors, financing private sector trade and investment, and helping to ensure that the economy’s financial (Khaled, 2001). Second, the growth of international financial activities has been more rapid than the growth of domestic markets and access to international capital markets for developing and transition countries have grown rapidly. Domestic banks have to work side by side with foreign banks. Less efficient banks with high operating costs are likely to suffer from international competition. Sudan is an extremely poor country that has had to deal with social conflict, civil war; the oil sector had driven much of Sudan’s GDP growth since it began exporting oil in 1999. For nearly a decade, the economy boomed on the back of increases in oil production, high oil prices, and significant inflows of foreign direct investment. Following South Sudan’s secession, Sudan has struggled to maintain economic stability, because oil earnings now provide a far lower share of the country’s need for hard currency and for budget revenues. Sudan is attempting to generate new sources of revenues, such as from gold mining, while carrying out an austerity program to reduce expenditures. The study aims to make a valuable addition to management accounting research in general and performance measurement in particular as it relates to a developing country such as great Sudan. Performance measurement and hence organizational performance has become a topic of growing interest both among academics and among practitioners (AlSawalqa, 2011). Most of the studies were conducted in western context rather than developing one. this study is of importance in this era of banking sector in a developing country. The study, consequently seeks to explore possible strategies for improving banking sector performance. The study nature will have both theoretical and practical contributions for practitioners who implement performance measures usage in Sudan such as senior managers, policy makers, government offices, performance managers, human resource specialist and strategists; they can benefit from a better understanding performance measures usage practices.

2. Literature Review

- A key challenge facing the financial sector especially in developing countries is to respond to the recent wave of globalization and the move towards global financial markets (Schmukler, 2004). It is argued, that performance measures ignore the softer less measurable performance indicators as well as the relationship between different business units and their variable objectives (Kaplan & Norton, 1992). In addition, much has been written in theory about performance measures but still less is known in practice about their operation (Propper and Wilson, 2003). In the same context, Fisher (1995) argued that organizational performance is poorly defined in previous studies as most of the previous studies relied primarily on the financial dimension. In banking, particularly Islamic banks, should give greater attention to is to reorient their size and operations for higher efficiency in order to face intense competition in banking industry.The selection of performance measures which are appropriate to a particular company ought to be made to suit the competitive business environment in which it operates. Accordingly the choice of relevant performance measures, and the system, is one of the most critical challenges facing organizations in all business sectors (Burgess, Ong & Shaw, 2007; Kennerley & Neely, 2002). However, the current understanding of performance management practices and the consequences of different performance measurement and control system designs is limited (Stivers, Covin, Hall & Smalt, 1998; Stringer, 2007).Ittner and Larcker (2003) found that companies need to concentrate on non-financial performance to advance their strategy; Hwang, Lee, Liu and Ouyang (2009) argued that PMS play a critical role in evaluating the achievement of firm goals, compensating managers, and developing strategies. However Franco-Santos et al. (2007, p. 797) summarized the roles of PMS into the following five categories: 1. Measure performance, 2. Strategy management, 3. Communication, 4. Influence behavior, 5. Learning and improvement.

3. Research Methodology

|

4. Findings

- The findings of this research shed the light on the progress of PMS in Sudan which is a developing country currently experiencing express and rapid transformations and changes in the business environment. The findings of paper studies to emphasize a significant role for management accounting systems in banks in which management accounting information is now used in planning, decision-making, control, performance measurement and business strategy in most organizations (Akbar, 2010). For example, Kaplan (1984, p. 390. As one of these systems, PMS can be used for internal or external control purposes in organizations (Fried, 2010).

4.1. Performance Measurement in Sudan

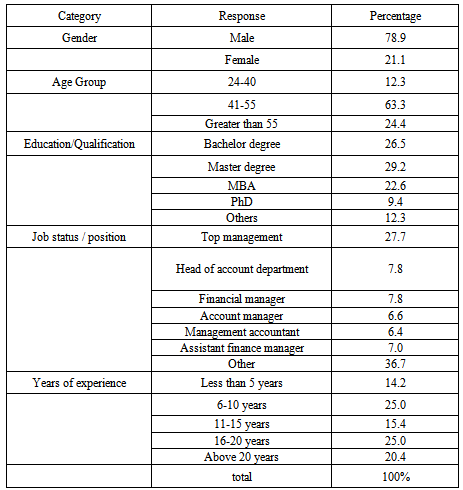

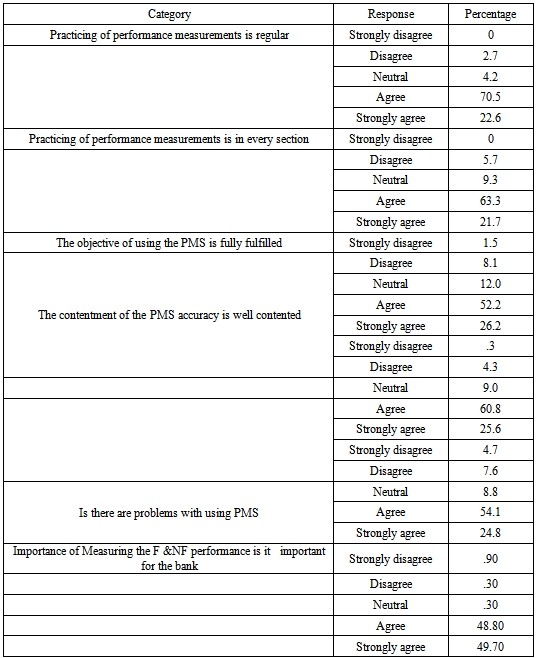

- Regarding Performance measurement practices, Table 2 reflects that the Practicing of the measuring financial and non-financial performance measurements is regular practice received appropriate notice from the all executives’ management represented by 93.1% were agree and strongly agrees as represented in the above table 2. Furthermore practicing of performance measurements financial and non-financial is in every section represented by 80% of management agreements, however some interviewees expressed the view that NFP measurement was on casual basis. The objective of using the PMS is fully fulfilled prospective was 78.4% positively support by the respondents despite 9.6 disagree. Concerning the contentment of the PMS accuracy is well contented senior managers are so delight with 86.4 agreeable and 4.6 disagree. Also 78.9 of the managers are believed that there are problems with using PMS of fulfilling the demand and expectation of the banks partners and client during the intensity of opportunity completion. Additionally the all the managers consideration is measuring financial and non-financial was fundamental to operating effectively and efficiently and the 98.5 % were agree up on that while 1.2% were disagree.

|

4.2. Factors Affecting the Performance

- Various factors as came in table3 relevant to the Sudanese financial institutions environment on the extent of performance measurement diversity usage. It has been noted that the most important change in management accounting is the broad emphasis and publicity attached to organizational performance measurement during the last decade. Recently, special performance measurement frameworks focusing on the integration of organizational strategies and performance measurement with the mixed use of financial and non-financial measures have been introduced (Jänkälä, 2007).“Performance measurement diversity”, “combination of financial and non-financial measures”, “measurement diversity”, “multiple performance measures”,“multidimensional performance measurement”, and “multi-criteria measures” are concepts that are used interchangeably and synonymously in the previous contingency-based literature (see, for example, Chenhall & Langfield-Smith, 2007; Dossi & Patelli, 2008; Franco-Santos, 2007; Hall, 2008; Henri, 2004, 2006; Hussain & Gunasekaran, 2002; Iselin et al., 2008; Ittner & Larker, 1998; Ittner et al., 2003; Malina & Selto, 2004; Moers, 2005; Otley, 1999; Van der Stede et al., 2006).This study informed by the new institutional sociology theory and contingency theory prospective, such prospective helps develop an understanding of how organizational phenomenon or behaviour is a product of internal and external institutions, albeit socially and institutionally constituted (DiMaggio & Powell, 1991; Greenwood and Hinings, 1996).Contingency theory has been argued to be one of the leading paradigms for research in management accounting (Chenhall, 2007; Dent, 1990). This study supported one of the main arguments of contingency theory, which indicates that the appropriateness, effectiveness and use of PMS are affected by the circumstances or contexts in which an organization operates by having investigated the impact of several contingent and organizational factors on the PMS In particular, this research contributes to and extends the contingency theory literature (Chenhall, 2003; Chenhall & Morris, 1986; Fisher, 1998; Haldma & Lääts, 2002; Henri, 2004; Maltz et al., 2003; Otley, 1980, 1999; Paranjape et al., 2006). (Hoque et al., 2001), (e.g. Hutaibat, 2005; Zuriekat & Al-Sharari, 2008).

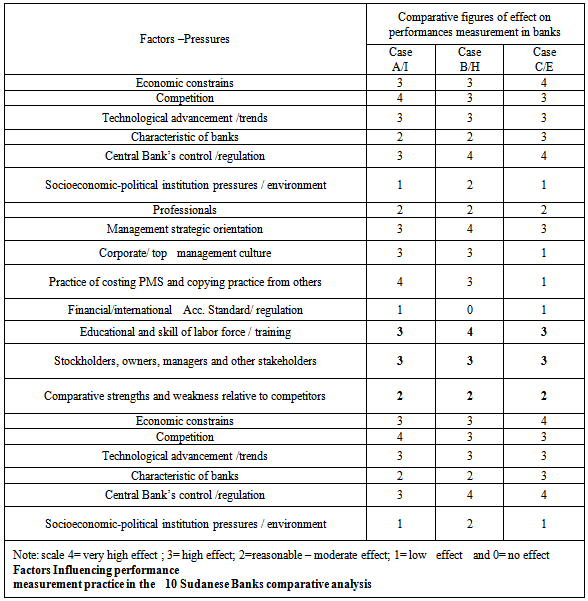

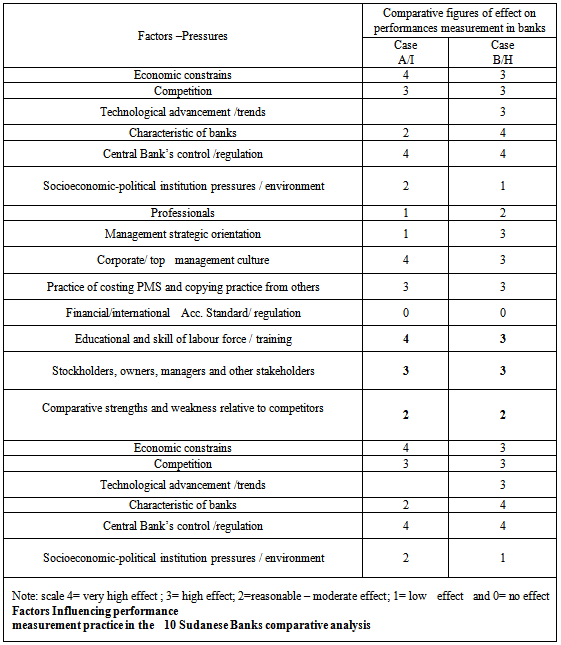

4.3. Factors Influencing PM Analysis

- Table 3 (a&b) summaries the impact of various institutional and contingent forces on the FP and NFP measurements practices in the ten banks ranged from one (low impact) to four (high impact). This ranking has been consequential using the qualitative data from the interviews, table 3 indicates thoughts variation in the impact of the factors on financial and non-financial measurements practice in Sudanese banks, as mentioned before the uncertainty of economic condition created huge pressures evidence on management to improve financial performance but, as the interview evidence suggest, management’s strategy, objectives, etc. also have role to play in NFP (Miles and Snow, 1978, Simons,1990.2000). The research found majority of the banks believed that the non-financial operation progress isn’t resulting better when FP did. as discussed by Bourne, et. al., 2000; Sharma And Bhagwat, 2007; Mathuur et. al. 2011). On the other hand they believe on their strategy to have a chance of going global by any type of alliance to provide high quality service to global customers and improve both Financial and non financial performance also believed that the important of those client is essential to satisfy them provide them with the better quality service and carry out the undertakes the same as argued by (Franco-Santos, et. al., 2007; Brudan, 2010; Fukushima & Peirce, 2011). Also the study found that there is no effect of the significant impact on national accounting principle, standard, on NFP measures in Sudan expect the three expect governmental bank that is for the internationalization effort and attempt to accept GAAP, as argued by Young (2009).

|

|

5. Conclusions and Future Work

- A wide-ranging usage PMs not only increases a firm’s awareness of opportunities for undertaking competitive actions, but also allows the bank to achieve greater efficiency, enhancing its ability and responding quickly to the dynamic changes of the competitive environment. Even though Future studies could then use contingency theory in parallel with institutional theory (Alam, 1997) to gain a deeper understanding of the factors that impact the extent of usage of performance measurement diversity approach. Thus, adding further relevant explanatory variables could improve their explanation of the dependent variable. These future studies could also examine the interaction effect between these factors on the extent of performance measurement diversity usage. Moreover, future studies may inspect the outcome of the fit or match between some relevant factors on organizational performance (Lee & Miller, 1996). What's more, the study neglected the interaction between the selected contingent factors and their immediate effect on the extent of performance measurement diversity usage.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML