-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2013; 3(7): 434-439

doi:10.5923/j.mm.20130307.14

Corporate Social Responsibility in Malaysian Banks Offering Islamic Banking

Sujana Adapa

UNE Business School, University of New England

Correspondence to: Sujana Adapa, UNE Business School, University of New England.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

This study examines the Corporate Social Responsibility (CSR) engagement type and CSR extent in Malaysian banks offering Islamic banking services. 10 local banks and 6 foreign banks offering Islamic banking services listed on the Kuala Lumpur Stock Exchange were analysed using content analysis. Banks websites and annual reports were studies to gather and analyse the data. Results obtained indicate that the level of importance that the local versus foreign banks assign to various CSR-based activities, CSR reporting, CSR communication and CSR board structure significantly vary. Banks in Malaysia may need to focus on alternative strategies to publicise their CSR-based activities and enhance their internal and external communication in order to attain greater brand reputation.

Keywords: Corporate Social Responsibility, Islamic Banking, Malaysia, Local Banks, Foreign Banks, Content Analysis

Cite this paper: Sujana Adapa, Corporate Social Responsibility in Malaysian Banks Offering Islamic Banking, Management, Vol. 3 No. 7, 2013, pp. 434-439. doi: 10.5923/j.mm.20130307.14.

Article Outline

1. Introduction

- Business firms and society are two different entities that are mutually benefited with each other’s actions. Firms conduct businesses and the survival of the firms and subsequent wealth creation is dependent on the society’s willingness to support firms operations[1]. In light of the events such as the passage of the Oxley Sarbanes Act, the Nike sweat shop, the Chinese melamine contamination scandal etc., businesses are embedding the concept of being responsible to the society through their acts[2]. Customers and the various forces operating within the society are becoming much more knowledgeable than before and are able to actually question the faulty acts of the businesses. As a result, today’s businesses tend to increasingly focus on embedding the concept of Corporate Social Responsibility (CSR) into their day to day business operations[3]. In light of this discussion, the concept of CSR is identified as the firms being able to contribute back to the society on a voluntary basis and being more responsible in their business activities[4]. It is evident that businesses engaged in the production of harmful goods such as Tobacco, Cigarettes etc., and manufacturing industries involved in causing pollution to the environment and the usage of vast amount of natural resources to engage in more number of CSR-based activities and voluntary reporting procedures in order to negate the impact that they cause to the society[5]. On the contrast businesses engaged in the production of services and knowledge-based industries such as banking, accounting and finance are not expected to engage in any sort of CSR-based practices[6,7].Given this context, the researcher is interested in exploring the type and extent of CSR engagement within the context of the banks operating in Malaysia. Malaysia posits a distinct dimension to the conventional banking practice with the emergence of Islamic banking. Since its inception, Islamic banking gained popularity in Malaysia and serves Islamic and non-Islamic customers alike. As the existing literature identifies Islamic banking to be different to the conventional banking practice, this research paper tries to explore the CSR engagement practices of the Islamic banks currently operating in Malaysia. With intense competition prevailing in many sectors, banking sector is no exception and as a result several local and global banks started to offer Islamic banking products and services to customers. In light of this discussion it is important to explore how well the religious principles of Islamic banking are embedded or reflected or rather outlined with the banks integral CSR strategies. Therefore the aim of this research paper is to explore whether or not significant differences exist between Local Islamic Banks (LIBs) versus Global Islamic Banks (GIBs) in terms of their type and extent of CSR engagement in Malaysia.

2. Literature Review

- Islamic banking gained attention worldwide from the late 1960s and modern day Islamic banking practices are evident in more than 50 countries[8]. Islamic principles are guided by Shari’iah Islami’iah (Islamic jurisprudence). The major distinction between the conventional banking and the Islamic banking is the use of riba the usury and excess over the principal amount is prohibited. Islamic banking operates on the basis of mudarabah and musharakah that involves profit sharing, trustee-financing contract and sharing of profits and losses in accordance with the capital contributions[9]. The three major sources of funds available to the Islamic banks include ban’s own capital and equity and transaction and investment deposits. Given the Islamic banking context, financial institutions in Malaysia need to secure permission from Bank Negara Malaysia (BNM) before offering Islamic banking related products and services to the general public. Financial institutes offering Islamic banking services in Malaysia need to appoint Shariah consultants to advise on all aspects of Islamic banking transactions. Shariah compliance is a prerequisite that aligns with the requirements of the Islamic Banking Act and the Bank’s Article of Association [10]. Islamic banking popularity as it strives for a balanced society and emphasises on many prohibitions in order to protect the interests and benefits of all parties involved in the financial transactions[11]. Currently there are 600 financial institutions operating in over 75 countries that offer Islamic banking, finance and insurance options.The term CSR is often ambiguous and lacks a proper definition even today, although the concept of CSR gained significant attention over the past two decades[12]. The term and the concept of CSR vary to a greater extent and is highly context specific depending upon the purpose in which it is stated. Broadly the CSR theories are grouped into four different types such as instrumental theories, political theories, integrative theories and ethical theories[13]. Instrumental theories assume corporation as an instrument and paces greater emphasis on wealth maximisation. These theories focus on the generation of short-term profits through shareholder value maximisation or in the generation of long-term profits through attaining competitive advantages or through their engagement in cause-related marketing practices[14]. Political theories emphasise on the social power of corporation by way of including various political considerations in their CSR framework[15]. In light of this discussion corporate constitutionalism and corporate citizenship form the integral components of the political theories. Integrative theories focus on matching the social demands by way of addressing the issues of the management through adequate public responsibility, stakeholder management and corporate social performance[16]. Ethical theories focus on the ethical requirements that bridge the relationship between business and society by way of outlining the right way of doing things and focusing on the universal rights and appropriate sustainable development strategies[17, 18]. All of these theories outlined have several interconnected dimensions that can be linked to the social phenomenon of conducting the business in a responsible manner.This research paper therefore makes an attempt to explore the type and extent of the CSR engagement followed by the Malaysian local and global banks offering Islamic banking products and services. The type of CSR engagement is envisaged in this research paper as a combination of the banks involvement in various CSR-based activities, the method that these banks adopt to disclose information to the general public about their CSR-based activities and the banks effectiveness in their communication about the CSR- based activities to the internal and external stakeholders. The extent of CSR engagement is viewed as the measures of equality, diversity and inclusiveness that are reflected through the bank’s board representation, management team structure and Shariah committee composition. Given the religious faith of Islam being embedded in the practice of Islamic banking, it is important to explore whether these banks are outlining their CSR-based activities, CSR reporting, and CSR communication strategies in a successful manner. Similarly it is also important to identify the extent to which these banks CSR strategies align with their board representation, management structure and Shariah committee’s diversity and inclusiveness.

3. Methodology

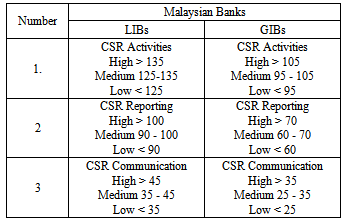

- The sample consisted of the local banks and foreign banks offering Islamic banking services in Malaysia and these banks are listed on the Kuala Lumpur Stock Exchange (KLSE). Content analysis was performed to study the CSR activities, CSR reporting, CSR communication and CSR extent of 10 local banks and 6 foreign banks offering Islamic banking services in Malaysia. The information presented on the banks websites and annual reports was analysed in order to quantify the qualitative data using content analysis[19]. Content analysis is a popular research technique and is widely used in CSR-based research[20]. Similarly extant research highlights that studying the websites and annual reports of the firms is an established research technique because of their credibility, regularity, and reporting information to the general public as well as to stakeholders [21]. Much of the ongoing debate in the literature is around the notion of the ‘unit of analysis’ that is more appropriate for conducting the content analysis. The unit of analysis in content analysis can take several forms such as words, phrases, characters, lines, sentences, pages or proportion of pages devoted to disclose the information related to the CSR-based activities or practices[22]. Each of these forms was found to be associated with certain merits and demerits. Existing research highlights that the reliability of the analysis was decreased to a greater extent by using words or areas of pages for coding[23]. The usage of the number of pages as a unit of analysis was also identified to be problematic due to the variations in the size of the font, graphics, style of writing etc.,[24]. Therefore in the present study the number of sentences was used as the unit of analysis for measurement of the CSR activities, CSR reporting, CSR communication and CSR extent since they provide accurate, meaningful, timely, reliable and relevant data for further analysis. The information present in the sentences is further analysed in order to measure the quality of the identified categories.

4. Results

4.1. CSR Activities

- Irrespective of the nature of the bank whether local or foreign, almost all banks offering Islamic banking services in Malaysia are involved in some sort of CSR-based activities. The information analysed revealed that CSR-based activities outlined by the Islamic banks fit into four broad categories such as marketplace, workplace, community and environment.

4.1.1. Marketplace

- Approximately 8 out of the 10 local Islamic banks presented information about the marketplace on their websites. To a greater extent the marketplace category covered information related to the products and services offered by the Local Islamic Banks (LIB) such as benefits associated with the offerings, responsible selling of the offerings, risk management etc., Apart from the general information related to their service offerings, some of the local banks elicited the level of importance that they place on the customers and businesses by stating customer satisfaction, customer experience, customer education, urban and rural financing and excellence in SME banking. Similarly some of the banks focused on outlining the innovation component by highlighting knowledge exchange, process enhancements, offering one or e-payment solutions. Approximately 6 out of the 10 local Islamic banks identified customers as their main stakeholders and stated that the banks’ focus will be aligned to meet customers’ diverse needs by way of outlining fair terms and fair pricing strategies on their product/service offerings. Only one bank acknowledged the role of suppliers and identified them as the important stakeholders.Approximately 4 out of the 6 Global Islamic Banks (GIB) outlined the relevance of marketplace. The focus of the GIB elicited the importance that these banks place on products and services by way of needs based banking practices and through offering superior services and provision of comprehensive product information. Similarly GIB outlined the importance of customers and shareholders as their important stakeholders to their day to day business by emphasising on aspects such as maintaining quality customer service, effective relationship building, managing customer complaints and creating long-term value for the shareholders.

4.1.2. Workplace

- Approximately 9 out of the 10 LIB elicited on the workplace category. Important dimensions included under this category include employee activities focusing on the volunteering hours, sports activities and various employee support mechanisms; professional advancement through on the job training, focus on the development of skills and competencies and structural programmes; and inclusiveness addressing the diversity, cultural, ethnicity related issues and promoting the work life balance and wellbeing for the employees. Approximately 4 out of the 6 GLB outlined similar workplace strategies to LIB. Additionally GIB emphasised on the appropriate reward mechanisms in place for treating their high performing employees, flexible work arrangements, availability of the crèches and accessibility of the online parenting resources.

4.1.3. Community

- All of the 10 LIB and 6 GIB are involved in supporting the local communities and outlined several activities that actually benefit the community. These activities mainly included school programmes such as financial literacy, financial aiding for school children, English language programmes and after school care; youth programmes such as focusing on the healthier lifestyle and promoting sports culture; sponsorship activities such as golfing, chess and offering education; donations to the poor and the underprivileged and hospital patients; and partnerships with the government and non-government organisations, National Blood Centre and Royal Malaysia Force. The emphasis of the LIB is on the use of Zakat funds.

4.1.4. Environment

- Approximately 7 out of the 10 LIB and 3 out of the 6 GIB presented information about their environmental engagement on their websites. Islamic banks environmental engagement can be differentiated into internal activities that focused on areas within their workplace and external activities that these banks are engaging in on a continued basis outside their office space. Internal activities relate to the energy conservation, waste reduction, paper recycling, carbon footprint reduction and monitoring energy usage aspects. External activities mainly focused on planting trees, running environmental sustainability programmes and Earth Hour participation. Only one LIB participated in International Carbon Disclosure project and has the Dow Jones Sustainability Index Score of 60 apart from publishing sustainability reports in 2010, 2011 and 2012.

4.2. CSR Reporting

- The nature of CSR reporting varied greatly between LIB and GIB. For example 6 out of the 10 LIB banks, CSR statements and mention of CSR-based activities can be easily accessed from the main website. Additionally for one of the LIB, CSR-related information is intricate within the Chairman’s message. Some of the banks preferred to use the term ‘corporate philosophy’ instead of CSR. The range of CSR messages varied from contributing to better society to growing profitably and responsibility to value creation to stakeholders. Almost all of the LIBs included in this study disclosed the CSR-related information to the general public through easily accessible annual reports. Some of the LIBs attributed greater importance to Shariah governance framework, Malaysian code of corporate governance, code of ethics and code of conduct statements that outline the banks CSR engagement.Although there is a mention about the CSR-based activities amongst the GIB, information cannot be retrieved until and unless the bank’s global website has been accessed. There is no mention of the CSR statement or the related activities on the respective bank’s Islamic banking website. Two of the GIB’s preferred to use the terms ‘corporate sustainability’ and ‘sustainability statement’ instead of the term CSR. The GIB’s CSR statements largely focused on the sustainability initiatives taken by the banks. Except for one or two GIBs, the location of the annual reports and further pinpointing the CSR-based information seemed to be difficult.

4.3. CSR Communication

- The LIB websites largely emphasised on communicating their engagement with some sort of CSR-based activity through well-crafted vision, mission, core values and chairman’s message. A majority of the LIB websites through their vision and mission statements, core values and Chairman’s messages outlined their ambitions of being the most preferred Islamic banking provider in the country followed by offering of Shariah compliant products and services, sustained financial performance, gaining trustworthy client engagement and human capital development. Approximately 7 out of the 10 LIBs focused on publicising their CSR-based activities widely through media contact, press releases and public relations team.The GIB websites did not emphasise too much about disclosing their level of CSR engagement in their vision, mission, core values or chairman’s message. The GIB websites focused on being Shariah compliant, relationship building and empowering business. Many GIB banks did not focus about mentioning of the role of stakeholders and their relevance in the Islamic banking operations. Similar to the LIBs, a majority of the GIBs also focused on widely publicising to the general public about their engagement with the CSR-based activities.

|

4.4. CSR Board Representation

- The websites of both LIBs and GIBs depict that the aspects of equality and diversity are under represented in terms of their board structure. The Board of Directors largely consisted of males with no representation of females except for one foreign Malaysian bank offering GIB services. Similarly the management team and the Sharia committees consisted of more number of males compared to the females. Also the representation of the members from other ethnic backgrounds or members from international context on the boards is limited.

5. Discussion

- Although banking is a service-based sector, several banks are involved in outlining their CSR engagement strategies. The underlying interest for these banks to engage in CSR-based strategies is to either gain short-term or long-term profits or to increase their image within the general public by way of engaging in ad hoc community-based activities[25]. However, the extent of CSR engagement and the level of importance that these banks place on various CSR-related categories as outlined on their websites and annual reports vary to a greater degree. In terms of the CRS-based activities that Malaysian LIBs and GIBs are currently engaged with, there is an evidence of greater variability. Both LIBs and GIBs focused on inundating the websites heavily with market related information such as the general banking information, as well as Islamic products and service offerings. LIBs identified only customers as their important stakeholders totally ignoring the roles played by suppliers, employees, investors, general public and the society. Similarly GIBs identified customers and shareholders as their important stakeholders thus focusing more on the wealth management and profit maximisation aspects[26]. Both LIBs and GIBs placed a greater emphasis on engaging with the community related activities on an ad hoc basis thus supporting the various community initiatives through sponsorships and donations. Malaysian LIBs and GIBs focus on the environmental aspect is minimal, in the sense that these banks are not focusing on developing a holistic approach through streamlined sustainability and environmental management practices. In regards to the CSR reporting, Malaysian LIBs disclosed the CSR related information present on their Islamic banking website and the annual reports are easy to access by the outsiders. However in regards to the Malaysian GIBs the access of the annual reports and the location of the information related to the CSR activities or practices deemed to be difficult. Similarly both LIBs and GIBs largely focused on publicising the information related their engagement with the local communities and the community initiatives that these banks are involved in an ad hoc basis. Malaysian LIBs and GIBs CSR engagement is not thoroughly reflected in their board representation, management team structure and Shariah committees. Equality of gender and representation from different ethnicities is a lacking concept. The banks should focus on developing strategies to recruit more females and individual from different ethnic backgrounds on their boards and management teams.The notion of CSR and certain aspects of CSR are well embedded within the Islamic faith. However, this is not represented accurately and to the extent expected by the Malaysian banks offering Islamic banking products and services neither on their websites nor through their annual reports. Similarly the level of importance that these banks offering Islamic services place on various categories of CSR is quite diverse and varied. Workplace category seemed to be highly neglected and is not publicised well enough by the banks websites. Strategically Malaysian banks offering Islamic products and services need to focus on formulating effective strategies that foster employees well-being and appropriate employee retention strategies in order to improve their loyalty levels[27]. Following this strategy will enhance the employees morale towards their employer and will effectively be reflected in their job performance[28]. This strategy will also reduce the operating costs for banks by way of retaining their existing employees for a longer term rather than spending dollars on recruiting and training the new employees.Senior management of the Malaysian banks offering Islamic banking products and services need to focus on embedding an integrative framework that outlines the effective strategies on how their banking activities and operations align with the interests of the various stakeholders. Currently Malaysian banks irrespective of being local or foreign, emphasise heavily and outline strategies to meet the unique needs of customers and shareholders alone. Banks offering Islamic products and services need to realise that the impact of their operations is huge and may need to strategically think about strategies to address the needs and interests of various stakeholders that are important for effective functioning of their day to day business activities. Similarly the senior management can extend their level of engagement in promoting sustainable business practices and conducting responsible business by way of aligning with the Islamic faith and embed in the marketing of their products and services. The impact of environment on the businesses cannot be denied and therefore greater emphasis need to be placed on meeting the changing environmental regulations. As the impact of banks on society is huge, banks can actually look at the feasibility of widely publicising their actions to mitigate the risks of ever changing environmental regulations[29]. Additionally banks may need to embed sustainability initiatives and focus on releasing the sustainability reports on an annual basis. Sustainability reports need to be included within the disclosures framework in order to gain public confidence and enhance the credibility of the bank’s actions. In terms of the theoretical underpinnings, Malaysian LIBs and GIBs focus alike in publicising their support to the community-based activities thus aligning with the cause-related marketing activities of the instrumental theories thus focusing on the long-term benefit of generating profits and reliable brand reputation. Banks’ engagement in charitable deeds creates a form of enlightened self-interest and promote win-win situation whereby substantial financial benefits are expected to promote the company as well as the cause. The greater focus of the Malaysian GIBs on wealth creation and profit maximisation aspects clearly emphasise the level and extent of importance that these banks place on financial returns and achievements thus eliciting the relevance of the instrumental theories. Partly Malaysian LIBs and GIBs also focused on embedding the frameworks of ethics and responsible governance and sustainability initiatives as well as appropriate disclosure mechanisms through their websites and annual reports that allowing these banks to align with the ethical theories. However the extent of integration of these banks CSR activities with the concept of ethics varies significantly between Malaysian LIBs and Malaysian GIBs. Analysis of the banks websites and annual reports indicate that Malaysian LIBs integration with the ethical theories is greater in comparison to their counterparts Malaysian GIBs. The relevance of the political theories seemed to be less for both groups of banks within the Malaysian context. Similarly the extent of integration of the Malaysian LIBs is greater with the integrative theories in comparison to the Malaysian GIBs.

6. Conclusions

- This paper highlights the Malaysian LIBs and GIBs CSR engagement. Malaysian LIBs and GIBs are engaging in CSR-based activities. However, their extent of involvement and categories of involvement varies significantly. The emphasis placed on the marketplace and community categories is greater compared to the workplace and environment categories. Similarly both LIBs and GIBs understanding of the stakeholder concept is varied as LIBs placed greater emphasis on client engagement practices and GIBs focused on wealth management and profit maximisation processes. Moreover the CSR reporting, disclosure of information to the general public and CSR-based communication varies greatly between LIBs and GIBs. Both LIBs and GIBs lacked alike in embedding the notion of equality and diversity on their boards, management teams and Shariah committees. This research paper suggests that there exists a need for these Malaysian LIBs and GIBs to work towards embedding a holistic and integrated model of CSR in order to fill out the identified gaps. The limitation of this study is that it has taken into account only the local and global Malaysian banks offering Islamic banking products and services. This research can be extended by comparing all the banks operating in Malaysia on their CSR-based activities and disclosures and subsequently derive the differences and/or similarities between CSR engagement between Islamic versus non-Islamic banks.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML