-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2013; 3(4): 237-242

doi:10.5923/j.mm.20130304.07

The Mediating Effect between Some Determinants of SME Performance in Nigeria

Aliyu Mukhtar Shehu, Ibrahim Murtala Aminu, Nik Kamariah Nik Mat, Abdullahi Nasiru, Popoola Oluwatoyin Muse Johnson, Musa Muhammad Tsagem, Kabiru Mai

Othman Yeop Abdullah Graduate School of Business, Universiti Utara Malaysia, Sintok, 06010, Malaysia

Correspondence to: Aliyu Mukhtar Shehu, Othman Yeop Abdullah Graduate School of Business, Universiti Utara Malaysia, Sintok, 06010, Malaysia.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

The purpose of this study is to examine the relationship of owner/manager knowledge, competitive intensity, complexity of marketing, technical competence, firm size with the mediation of advisory services on the performance of Nigerian SMEs. The study employed structured questionnaire survey involving a sample of 278 manufacturing SMEs operating in Kano State, a total of 198 valid questionnaires were completed and returned representing 71 percent response rate. Evidence suggests that there is significant relationship between owner/manager knowledge, complexity of marketing decision and technical competence and advisory services. In contrast, the result found no significant relationship between firm size and advisory services. Similarly, the result found that owner/manager knowledge, complexity of marketing decision, technical competence and advisory services have significant relationship with performance. The result also indicates that, there is no significant relationship between firm size performance and technical competence and Performance. We also found that advisory service mediates the relationship between owner manager knowledge and the complexity of marketing decision. The findings of this study will benefit owner/managers of SMEs, regulatory agencies, accounting firms, government at all levels and will also serve as frame of reference to future studies.

Keywords: Advisory Services, Owner-Manages Knowledge, Competitive Intensity, Complexity of Marketing Decision, Technical Competence, Firm Size, SME Performance

Cite this paper: Aliyu Mukhtar Shehu, Ibrahim Murtala Aminu, Nik Kamariah Nik Mat, Abdullahi Nasiru, Popoola Oluwatoyin Muse Johnson, Musa Muhammad Tsagem, Kabiru Mai, The Mediating Effect between Some Determinants of SME Performance in Nigeria, Management, Vol. 3 No. 4, 2013, pp. 237-242. doi: 10.5923/j.mm.20130304.07.

Article Outline

1. Introduction

- Small and medium sizes Enterprises have become more and more important in the pursuit of the world economic and social development[3]. Besides being an important source of creation of employment, the small and medium companies are also powerful sources of innovation[13]. Small and Medium Enterprises (SMEs) play a significant role in sustainable socio-economic development of a given country in terms of contribution to GDP, job creation, generation of wealth, poverty alleviation , capacity building and uplifting the welfare of people through provision of goods and services including education. Over the years, SMEs in Nigeria have been an avenue for Job creation and empowerment of citizens proving about 70% of all job opportunities and also for wealth formation[13].The sector had its own share of neglect as identifiedby[13],[41],[18], [43] which includes: low level of entrepreneurial skills, poor management policies, constrained access to money and capital markets, low equity participation from the promoters because of insufficient personal savings due to their level of poverty and low return on investment, inadequate equity capital, poor infrastructural facilities, high rate of enterprise mortality, shortage of skilled manpower, multiplicity of regulatory agencies, societal and attitudinal problems, bureaucracy, integrity and transparency problems, lack of access to information given that it is costly, time consuming and difficult at times.SMEs have gain recognition in the field of management because of their strategic role in promoting a nation’s economy in terms of reducing poverty by providing employment opportunities[42]. Their contribution to the growth and development of any economy is undeniable in both the developed and developing countries[36]. The significant role played by SMEs can be attributed to the level of their innovativeness and flexibility[40]. But then their ability to innovate depends to a large extent on the competence of management, their size and the availability of resources ([28],[1]).The issue of globalization and other competitive pressures strengthen and forced SMEs to reduce their costs and seize new opportunities through maximum utilization of external resources[38]. There is a need therefore, to examine ways of empowering SMEs[38]. Hence, SMEs need advice and support services because of their contributions to economy and their weakness to market inadequacies. In this context, a transformation in professional accountants’ services to the SME is critical ([9],[35]). For instance, professional accountants can assist SMEs operating in a competitive environment, to harmonized operational considerations within long-term plans[31] to enhance their survival. However, despite few studies that attempted to access the role of professional accountant and advisory services amongst SMEs, ([35],[2],[6]) much is needed in the area.Thus, the purpose of this study is to examine the relationship of owner/manager knowledge, competitive intensity, complexity of marketing, technical competence, firm size. with the mediating variable of advisory services on Nigerian SMEs as a result of[35] recommendations.Therefore, the paper is organized as follows: section two provides the literature review, section three; the research framework, methods, measurement of variables and the result of the study are presented. In section four, the managerial implications of the study and the recommendations for future research are discussed.

2. Literature Review

- The current study is an integration of two models used by ([36][35]). This study looks at the relationship between four of the combined independent variables in relation to SME performance in Nigeria and to determine the possibility of obtaining similar findings in two separate contexts.

2.1. Owner/ Manager Knowledge

- Managerial functions and ownership are responsibilities of the owner/manager, so his knowledge is vital to the success of business[20]. According to[35] owner/manager knowledge influence performance of SME. Performing the managerial and other business functions by the owner or manager can affect the performance of business[20]. However,[53],[32],[31] have shown that most SME owner/managers are either not familiar or lacking the managerial knowledge as well as availability of managerial services and support to them. Although some educated SME owner/managers may utilized the function of external service providers to complement their weakness in relation managerial knowledge[31]. Thus SMEs that are lacking managerial knowledge are more likely to employ external managerial services[20]. Therefore SME owner/managers who have experience, knowledgeable and familiar with the external managerial services providers, utilized this opportunity more than those who are not informed[5]. Hence, it is hypothesize that:H1: Owner/manager knowledge is positively related with SME performance

2.2. Complexity of Marketing Decision

- Realizing the important role of the Small and Medium Scale Enterprises in the global economy, different scholars contributed in different ways pertaining to the performance of the sector. For example[44] develop a theory of Resource-Based View (RBV) which suggested that a firm should be considered as a collection of both physical and human resources bound together in an organization structure. These resources are further classified as physical assets and intellectual assets[26]. Therefore, based on RBV of a firm[30], provides a theoretical ground for the assessment of the firm’s specific factors that affect their performance. If any of these factors is lacking the performance of the firm will be affected. One of these factors which a Small and Medium Enterprise (SMEs) should possess in order to broaden their market and achieve competitive advantage is in the area of complexity of marketing decision[36]. Thus, RBV postulates that small enterprises need to acquire external support and advice to broaden their market for achieving competitive advantage[39]. However, the need of external support and advice depend on the nature of the market in which the SMEs operates[35].[33], further argued that where a firm is operating at a local market it might be able to drive the business based on its internal resources and may only need limited external support. Sometimes, the market conditions and the regulatory environment within which the SMEs are operating are constantly changing and as a corollary the demand for external advisory services will also be required[9]. Even though in some circumstances the owner/manager of the SME may have the marketing expertise and proficiency in the marketing of the business product(s) but he may not have the expertise in the area of accounting and financial management issue or other important issue ([12],[4],[35]). Hence, the owner/manager must engage the services of professional accountants when making any complex marketing decisions[9]. Research evidences has shown that SMEs owners/managers seek professional advises and support services from professional accountant where needed[51]. As a result,[17] and[35] found that complexity of marketing decisions are critical factors that affect a firm decision to engage professional accountant advisory services in Iranian SMEs context. Hence, it is hypothesize that:H2: Complexity of market decision is positively related with SME performance

2.3. Technical Competence

- Competences are firms’ most important assets that are used to improve firm performance[10]. To enhance performance therefore, SMEs should outsource and concentrate on the functions that are not core competence ([23],[19]).[25] Suggest that smaller firms can acquire competencies by utilizing qualified persons. Thus, by outsourcing, these smaller firms can employ the external services needed[23]. Inadequate or lack of financial skills and knowledge of most SME owner/managers on financial control systems can adversely affect decision-making[14]. For example,[25] revealed that areas where SME owner/manager often lacks competence are in functions involving provision of advisory services on internal planning, decision-making and control. Consequently, external accountants are rated very high by SMEs in regards to technical competence on regulation matters[9]. In fact, services provided by external accountants’ to SMEs can sum up a range of competencies providing an important source of competitive advantage[25].SMEs innovative success therefore, depends on the effective and efficient external collaboration to acquire knowledge and expertise ([34],[8]). The resource-based view suggests that human resource systems can contribute to competitive advantage by facilitating the development of competencies that are firm specific. Hence, it is hypothesize that:H3: Technical competence is related with SME performance

2.4. Firm Size

- Several studies reported that increased in firm size can contribute towards increased performance for the following reasons: larger companies are more able to take advantage of economies of scale, concerning operating costs and the costs of innovation[29] and greater size means the likelihood of more divergence of activities, allowing businesses to cope more successfully with possible market changes, as well as with high-risk situations ([21];[54];[24]).[50] Reported a positive relationship between firm size and performance. The deductions by[55] indicate that an increase in firm size beyond the ideal level can mean reduced performance. The lesser possibility of owners controlling managerial action, as a consequence of increased size, can contribute to finding a negative relationship between size and performance ([45];[24]). One of the reasons why this occur maybe because the propensity of managers are better informed than owners about companies’ specific characteristics and investment openings, to invest in projects that make the scale of the company grow beyond the optimal level. Accordingly, increased size does not necessarily contribute to increased performance[46]. Hence, the tendency of conflicting findings; suggest further findings on the relationship between the Firm size and performance. Bearing in mind that this study focuses on SMEs, we assume that the positive effects of increased size are greater than the possible negative effects on performance, and so, we formulate the following hypothesis:H4: Firm size is positively related with SME performanceOur study also hypothesizes on the advisory service, thus:H5: Advisory service is positively related with SME performanceH6: Advisory services mediate the relationship between owner/manager knowledge, complexity of marketing decision, technical competence, firm size, and SMEs performance.

2.5. Theoretical Underpinning of Study

- In this study, we use Resource- Based view (RBV) with a major focus on how a firm resources or knowledge develop and affect its performance[35]. The RBV further encourage the sourcing of SME resources, there by linking external resources with performance. In effect RVB give a full support to the continuous discussion that SME owner/manager for instance use professional accountants as a source of professional services fundamentally as a result of gap in their internal resource base[16]. The use of resource based view (RBV) is equally acknowledged by[56] where the roles played by external service/support agencies are emphasized. In essence, RVB explains the ability of small organization to utilize limited internal resource to source from external sources.

3. Methodology

3.1. Sample and Data Collection

- The population consists of 978 manufacturing small and medium sized enterprises in Kano state, North- western region of Nigeria[52]. The study employs[37] technique for sample selection. Based on this, criterion 278 manufacturing SMEs were selected to serve as a sample, out of 278 questionnaires administered, a total of 198 were completed and returned, representing 71 percent response rate. Partial Least Square (PLS) is used for analysis.

3.2. Measurement

- For Performance, we adapted the measures of[35] and[48] each of the adapted item was assessed on a 7 point likert scale ranging from 1 strongly disagree to 7 strongly agree. Advisory service was also adapted from the work of[35],[15] and[25] also on 7 point likert scale. Owner/manager knowledge based on financial (objective) measure was adapted from[35], and[31]. Complexity of marketing decision, technical competence and firm size were adapted from[35],[17],[11],[5] and[15].

3.3. Result

3.3.1. Goodness of Measures

- In an attempt to determine the accuracy of measure, reliability and validity methods are employed. After calculating PLS algorithm the report shows that cronbach alpha coefficient ranged from 0.542 to 0.875. According[49] any value of cronbach alpha coefficient greater than 0.5 is deemed to be accepted. Hence, it can be concluded that the instrument adapted in this study are reliable, since none of the item is with less than 0.5. All items loaded on their respective construct ranges from 0.636 to 0.939, which according to[27] is acceptable since it is above the cut off value of 0.5. Likewise, the composite reliability value ranges from 0.812 to 0.902 which are also greater than the recommended value of 0.5. Finally to justify the discriminant validity, average variance extracted (AVE) is compared to correlation squared of the interrelated variables of concerned which indicated adequate convergent and discriminant validity.

3.3.2. Hypotheses Testing

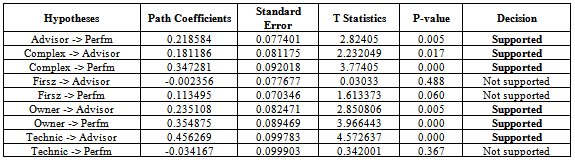

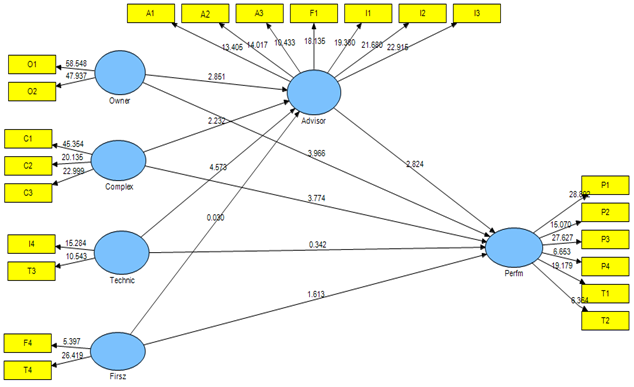

- The study examine the relationship between owner/manager knowledge, complexity of marketing decision, technical competence, firm size, and SMEs performance in Nigeria with mediating effect of advisory services. The interpretation of the hypothesis is summarized in table 2. The result indicated that there is significant positive relationship between advisory services and SMEs performance (β = 0.218, t = 2.284, p = 0.005). This finding is in line with the study of[35], thus, H5 is supported. The relationship between complexity of marketing decision and SMEs performance is found to be significant (β = 0.347, t = 3.774, p = 0.000), this in line with finding of[17] hence, H2 is supported. The relationship between firm size and SME performance is found to be insignificant (β = 0.113, t = 1.613, p = 0.06), H4 is not supported which is in line with/not with[36]. Our result also supported the relationship between owner manager knowledge and performance (β = 0.354, t = 3.966, p = 0.000), H1 is supported, which is in line with the study[5]. There is however an insignificant relationship between technical competence and performance (β = 0.034, t = 0.342, p = 0.367), H3 however, is not in line with the findings of[36] who found the relationship between technical competence and performance to be significant. To test for the mediation effect of the utilization of the advisory service and the independent variables, we found that only owner manager knowledge and the complexity of marketing decision satisfied the condition of mediation suggested by[7]. The mediation test revealed that advisory service mediate the relationship between owner manager knowledge and the complexity of marketing decision. Hence, H6 is supported for only the two mentioned variables.

|

| Figure 1. Research model |

4. Managerial Implication, Limitation and Suggestion for Future Research

- The findings of this study will benefit owner managers of SMEs, regulatory agencies, accounting firms, government at all levels and will also serve as frame of reference to future studies. The study has some methodological constraints. Firstly, the data for the study was collected from selected owner managers of manufacturing SMEs in Kano. Hence the findings of the study cannot be generalized. Secondly the study is cross sectional in nature, because the data was collected at one point in time, therefore, the direct effects of the independent variables on the dependent variable are difficult to conclude.

4.1. Conclusions

- This study examine the relationship betweenowner/manager knowledge, complexity of marketing decision, technical competence, firm size, advisory services and SMEs performance by using a sample of manufacturing SMEs in Nigeria. The finding of the study shows that there is a positive and significant relationship between advisory services and SMEs performance; complexity of marketing decision and SMEs performance and owner/manager knowledge and SMEs performance. However, the study found a negative relationship between firm size and SMEs performance and technical competence services and SMEs performance.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML