-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2013; 3(4): 195-205

doi:10.5923/j.mm.20130304.02

Combining Top Management Team (TMT) with Research and Development Intensityfor Patent Performance Measurement

Tolulope Bewaji

Graham School of Management, St. Xavier University, Chicago, IL, 60655, USA

Correspondence to: Tolulope Bewaji, Graham School of Management, St. Xavier University, Chicago, IL, 60655, USA.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

Extant research posits that the research and development (R&D) intensity of firms is highly correlated with knowledge creation as measured by patent citation. This paperargues that there are unexplained variables thatmoderate the effectiveness of research and development knowledge creation. Using the resource-based view, the top management team (TMT), is examined as an intangible asset. Hypotheses are developed on how high-technology firms’ creation of knowledge, operationalized as theirpatent citations output, is affected by the TMT characteristics of average age, education level, education background, founder presence, and industry experience. The study was based on a cross-sectional data sample of128firms that had their initial public offering (IPO) between the years 2002 and 2004. The findings show that TMT education background andindustry experience are significant influences on firm patent citation. When controlling forthe TMT variables, R&D intensity was not significantly related to patent citation.

Keywords: Research , Development, Top Management Team (TMT), Demography

Cite this paper: Tolulope Bewaji, Combining Top Management Team (TMT) with Research and Development Intensityfor Patent Performance Measurement, Management, Vol. 3 No. 4, 2013, pp. 195-205. doi: 10.5923/j.mm.20130304.02.

Article Outline

1. Introduction

- High-technology firms refer to companies with high percentage research and development expenditures anda large amount of technology embodied in their products and production processes[1].High-technology firms rely on innovations to a greater extent than other firms[2]. Innovation encompasses both the creation and harnessing of new technical ideas of this new knowledge with the resultant creation of valuable products and services[3]. Knowledge creation promotes innovation. Innovative activities however can be risky[4]and expensive[5] with a high impact potential if successful[4].Existing research has shown a positive relationship between research and development (R&D), investment and knowledge creation, as measured by the number of firm patents applications([6],[7], and[9]). [3] proposed, however, that factors other than R&D intensity lead to knowledge creation. Using the Resources Based view (RBV) lenses this paper suggests that the human resource characteristics of the TMT play a significant role in generating new knowledge and commitment to innovation. According to the RBV, the right set of resources is a key determinant of firm performance ([10],[3], and[11]). One of the resources utilized by high technology firms is research and development, but there are others that are important. It is known that the processfrom inventions, based on research and development, to patents is not a fully clear and direct one ([7],[3]). Resources that are important to firms are ones that are rare, valuable, imperfectly inimitable and non-substitutable. The question is: what other resources play a role on the result of patents in high-technology firms? The top management team members can be endowed with these resources. The strategic vision and experience, and relevant education of top management team members of the firm can boost the intensity of knowledge creation of the firm. We argue that even with the undertaking of research and development, the right set of planners and visionary people have to channel the research and development towards the correct focus of knowledge creation.By embarking on the question of the impact of the top management team on patents, we delve further into how resources improve firm performance ([8]).For firms trying to increase their patent performance, it is important to know what resources other than research and development have a crucial role.In this paper we attempt to investigate the effects of top management team (TMT) characteristics on firm knowledge creation as evidenced by patents, focusing on average age, education level, education background, founder presence, founder industry experience and total industry member experience of TMT members, while controlling for R&D intensity. Using the resource-based view ([10]) we acknowledge the importance of the right resource combination and we focus on the combination of top management internal (in-house) capabilities and the right focus of research and development by this cadre of staff to generate patent performance. Each firm has resources but the right combination is needed for value ([8]); using the top management team, we annotate the top management as a resource that can be combined with research and development to create value.This paper provides contribution to research by answering the question of what other resources can improve the patent performance of firms. This paper delves further into the concept of top management, as specific resource for organization based on their capabilities. The paper will now proceed with a literature review and hypotheses development. These sections will be followed by a description of the methodology and variables measurement. The paper continues with a description of the data analysis, followed by results and a discussion of the findings. The paper concludes with theoretical and practical implications, followed by limitations, and indications for future research directions.

2. Literature Review and Hypothesis Development

- The foundation of a firm’s competitive advantagein the marketplace is itsmanipulation of available resources ([11],[10]). According to ([12]); “Resourcesare defined as tangible and intangible assets that firms use to conceive of and implement their strategies” (p. 138). To become the source of competitive advantage, such resources should be valuable, rare, inimitable, and non-substitutable; this isabbreviated as VRIN ([10]). The effective and innovative management of resources has been shown to increase financial returns ([13]). An essential firm resource is the top management team (TMT) as it affects the expected performance of the organization ([14]). The “top management team” encompasses the highest level of executives in the organization and includes the chief executive officer, chief operating officer, chief technical officer, chief information officer, legal counsel, chief financial officer and vice presidents. The organization’s TMThas a vital influence on deciding the goals, strategy, capabilities and performance of an organization ([15]). Small high technology entrepreneurial firms in their initial stages of development featurestrongerinfluence from the TMT in achieving goals and creating paths, due to their size as well as their process of formation ([16]). In small high technology firms, the ideas of the TMT members are transmitted easily through the firm. Extant research has examined the effect of TMT characteristics on high-technology firm performance ([16],[17],and[18]) and entrepreneurial growth ([16]). Given the effect of TMT characteristics on firm performance and the effect of R&D intensity on knowledge creation, it is imperative to understand the combined effects of TMT characteristics and R&D intensity on high-technology firm knowledge creation.We posit that the top management background and characteristics build up an intrinsic and tacit knowledge that is crucial to the firm. TMT tacit knowledge is accepted as a central firm resource ([19]). It is important to have knowledge which cannot be easily replicated, yielding a competitive advantage and improved performance ([19]). Researchershave examined howtacit knowledge is created in an organization and how knowledge transfer can be facilitated ([20],[21]).([20]) found that R&D generates innovation. Consequently,this paper posits that tacit knowledge is important in facilitating R&D which,in turn,fosters innovations and valuable knowledge creation. The present study uses the resource-based view (RBV) to investigate the effects of TMT characteristics on knowledge creation beyond those attributable to R&D intensity. The focus is on the tacit knowledgeof the TMT members as it influences knowledge creation. TMT characteristics such as age, education, tenure, and functional background are used as proxies by researchers in measuring TMT tacit knowledge and cognition ([14],[22]). The article focuses on age, education, type of education, founder presence, and industry background. It builds on prior research by[3], which established that TMT background affects knowledge creation in firms as measured by patent citations.[3] found that the patent law knowledge of the TMT affects patent citation of the firm. Prior research has focused on how TMT characteristics affect knowledge creation in large established firms[3]. This study utilizes a sample of small high-technology firms in their initial stages of development. It includes firmsat the initial public offering (IPO) in the software and pharmaceutical industries. The focus is placed on pharmaceutical and software firms as they are both highly innovative with high R&D intensity[51]. Both industries have a need for high technology to be successful and focus on research and development as a part of their DNA. Sectors such as pharmaceuticals, communication equipment, computers and software have a higher ratio of R&D to sales than other firms in the United States[51],[52]. The pharmaceutical and software industry both have in common the need to deal with appropriability issues[51], which is one of the important aspects as it relates to the tacit knowledge that is derived from research and development. It is expected that there will be similarities in the outcome of the impact of demography on patent performance for these two industries.

2.1. Age

- It is noted that in organizations, youth of directors and top executives is linked to more innovation and riskier strategies which are important in increasing patent performance ([14],[23],[18],[24],and[25]). ([18])suggested that firms in growing industries have younger managers in the top team, in comparison to firms that are in declining industries. It was also argued that the information processing capabilities, along with physical and mental stamina, decrease with age ([26],[27],[28]), leading to the expectation that older top management team membersare less effective than younger TMT members. A lower ability to grasp new ideas and learn new behavior precedes a deficiency in knowledge creation. Knowledge creation requires support, innovation and the ability to take risks. ([14]) found that younger managers were more likely to seek additional information before they make their decisions and also more likely to examine information more carefully than older managers. Information is an important precursor to decision-making, especially in situations of high uncertainty. High-technology entrepreneurial firms require risk taking and maintaining continuous product development ([29]). High-technology firms need to be flexible, foster R&D, and maintain a culture that promotes innovation. Younger managers can be more energetic and more prone to risk taking, innovative actions, and information seeking. The presence of younger managers makes firms more likely to generatenew knowledge creation, especially that which leads to important breakthroughs. Thus,it is hypothesized that:H1: When controlling for research and development intensity, a firm’s TMT average age is negativelyrelated to knowledge creation in high-technology entrepreneurial firms.

2.2. Education

- Education levelThe TMT of an organization influence the strategy and path the organization embarks on. Studies have found that increase in education of workers increases the technological innovation and diffusion in an organization ([30],[31], and[32]). The amount of education that someone has is positively associated with innovation ([33],[14]). Education level of top managers was found to be positively correlated with problem-solving ability and innovation ([33],[34]). Higher education increases the ability to successfully absorb new information ([35],[36]). ([36]) found that the years of education of TMT members are positively related to the individual knowledge creating capability. They also established that TMT education level has a positive effect on the number of new firm products or services. Thus it is hypothesized that:H2a: When controlling for R&D intensity, a firm’s TMT education level is positively related to knowledge creation in high-technology entrepreneurial firms.Education backgroundLevel of education is considered to be a way of measuring an individual’s human capital ([37]). Human capital involves knowledge specific to the organization and not easily transferable, which helps generate a competitive advantage ([10]). ([3])established that in-house patent law expertise of the TMT is positively associated with patent citation. ([38]) also found that specific human capital plays a role in performance and survival of businesses. We suggest that TMTs with education in the sciences or engineering arefirm specific, since they are related to the kinds of technologies involved in these industries. Education of top managers in these fields has been found to be positively related to support for R&D ([39]).Thus, it is argued here that the educational background of TMT members will affect propensity to generate relevant knowledge and to innovate. For pharmaceutical and software backgrounds, having education in medical/pharmacy and computer/software fields respectively will spark interest in innovation and increase a firm’s knowledge creating capability. The managers of entrepreneurial firms in high-technologyindustries need flexibility and the ability to promote innovativeness developed through higher education. The level, as well asthe type of knowledge, increases firm specific knowledge and thus the future knowledge usage of TMT members. Both factors affect knowledge creation and product innovation. Thus,it is hypothesized that:H2b: When controlling for R&D intensity, a firm’sTMT member industry/firm related education is positively related to knowledge creation in high-technology entrepreneurial firms.

2.3. Founder Presence

- Founders play a key role in imprinting the structure and culture of the organization ([40],[41]). Founders have historical, firm-specific and tacit knowledge, which is valuable for the optimal allocation of the financial and human resources of the firm ([16]), seizing opportunities ([42]) and generating growth ([16]). Founders are a resource, based on their background and presence,which affect the success of new high-technologyventures.Founders by nature find opportunities. The expertise of the founders is a resource that is important to technology start-ups ([43]). This expertise which promotes start-ups will aid in knowledge creation and ideas to fulfill the demand of opportunities. Founders’ ties and capabilities have a positive relationship with the innovative capabilities of the small firm. Thus, it is hypothesized that:H3: When controlling for R&D intensity, the proportion of founders in a firm’s TMT is positively related to knowledge creation in high-technology entrepreneurial firms.

2.4. Industry Experience

- TMT industry experienceThe industry background of a top manager is posited to be influential ([16]). An industry background consistent with organization needs increases the firm’s background knowledge and information. Industry experiences create dominant logic which allows the TMT member to more easily conceptualize and analyze complex situations ([44]). A TMT member without previous experience lacks resources and networks useful to the firm and its learning curve.This executive experience increases the culture of innovation and promotes knowledge creation. Thus,it is hypothesized that H4: When controlling for R&D intensity, a firm’s TMT industry experience is positively related with knowledge creation in high-technology firms.

3. Methodology and Measurement

3.1. Samples and Sources of Data

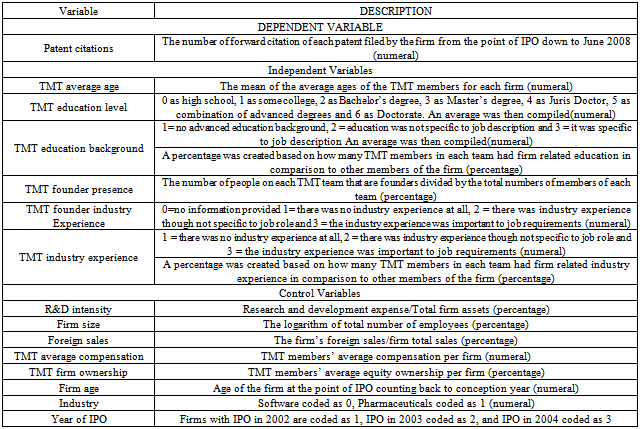

- Information on the top management team was derived from SEC filings at the point of IPO of American software and pharmaceutical industry firms. The sample was on software and pharmaceutical firms that had their IPO between the years of 2002 and 2004.Focusing on the SIC codes; 7371, 7372, 2834, 5045 based on the Edgar database listings. Substantial data was obtained for 128 firms out of the initial 162 firms with IPO between the years 2002-2004 in the two categories examined, based on Edgar. A listing and detailed description of the variables is available in Table 1.

3.2. Dependent Variables

- The dependent variable in this study was knowledge creation. This was measured by the frequency of U.S. patent citations which is an innovation indicator ([45]). To protect knowledge creation, firms acquire patents on their intellectual property to shield the firm’s innovation. According to Rivette and Kline, (2000 p. 54),“More companies are learning to exploit patents as potent competitive weapons and as a source of unexpected revenue”. Patents are a progeny of innovations, and are considered to be manifestations of a firm’s ideas, techniques and products ([46]). Firm patent rates are escalating due to increased innovative activity ([47]) based on increased R&D investments, and the strengthening of patent protection ([7]). It is suggested however, that calculating the raw number of patents does not show a clear picture of innovativeness, whereas patent citations will show a clearer measure of a firm’s innovation success[6]. Accordingly, the effect of TMT characteristics on patent citations rather than patents rates is assessed. Patent rates measure inventive output but not its quality[6]. Patent citations give a better picture of technical and scientific progress[6]. Counting from the point of IPO for each firm, the number of citations is tabulated based on the patents that the firm had until June 2008.

|

3.3. Independent Variables

- Based on the study by ([48]), TMT average age in research was calculated as the average of the ages of the TMT members of each firm at the time of IPO. Education level was measured on a scale with 0 as high school, 1 as some college, 2 as Bachelor’s degree, 3 as Master’s degree, 4 as Juris Doctor, 5 as a combination of Masters and JD and 6 as doctorate. Professional certificationwas tabulated as 3, as it usually is earnedsimultaneously with or after a Bachelor’s degree. For each team the average of education level was calculated.Education background was based on type of advanced education; that is above bachelor’s degree education the TMT member has. If the education background information was not provided, the TMT member was coded as 0; if there was information provided but TMT member has no advanced education, it was coded as 1; if the advanced education was unrelated, a code of 2 was given; and if the advanced education was related, the TMT member is given a code of 3. The average of this for each team was calculated. Education background was also calculated as a percentage; based on the number of TMT members that had related education background in comparison to the rest of the members on each TMT. In calculating education background as a percentage, for some firms, there was missing data and this was taken into account by making sure all firms in analyzed sample had at least 25% of the data available. Founder proportion was tabulated as the percentage of founders among the total number of TMT members for each firm. For all the TMT members, TMT industry experience was coded as0 if there was no information provided, 1 if there was no industry experience at all, and 2 if there was industry experience though not specific to job role and 3 if the industry experience was important to job requirements. For each team, average TMT industry experience was calculated. A percentage of TMT members with industry related background, in comparison to other members of the TMT,were also calculated.

3.4. Control Variables

- The control variablesin this study were research and development intensity, firm size, foreign sales, TMT average compensation, firm ownership, firm age, industry effect and year of IPO. The main control variable in this study was research and development intensity, calculated by R&D expenses as a percentage of total assets and by R&D expenses as a percentage of total sales. R&D intensity is highly related to patents and thus patent citations in small firms ([49]). To understand the true TMT effects,R&D intensity was controlled for.Firm size was measured by the logarithm of employees of the company.Since this affects firm performance;it should have an effect on patent citation. Foreign saleswas also a possible factor that may affect firm performance ([50]) and, thus, this was controlled for usingthe ratio of foreign sales compared to total sales. The top management team average compensation level was controlled for, since this may affect the corporation’s performance level. TMT average compensation was calculated as the average of the earnings of all the TMT members in the firm. Firm ownership by the top management team was also controlled for, as the principal-agent effects may alter the decision making and performance of the firm. Firm ownership was calculated as the average of the stock ownership of the TMT members of each firm. Another control factor was the firm’s age, since it is assumed that the knowledge resources of an older organization will be more than that of a younger one. Older firms may possess more collective experience and perhaps better financial performance. Age was calculated as the age of the firm at the point of IPO. Finally industry effect and year of IPO were controlled foras factors that may have an influence on knowledge creation. Industry effect was controlled for as having a possible effect on performance, and for this control variable a classification of companies into the two groups of software and pharmaceutical firms was created. Industry effect is coded as 1 for software firms and 0 for pharmaceutical firms. Firm IPO was tabulated as 1 to 3 for going to IPO from 2002-2004, (e.g. firms that had IPO in 2002 were coded as 1, and those with IPO in 2003 were coded as 2).

4. Data and Results

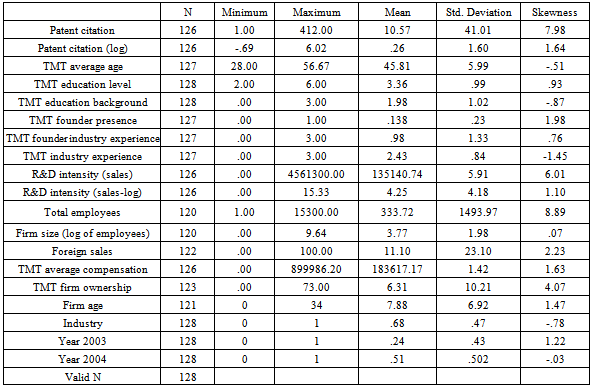

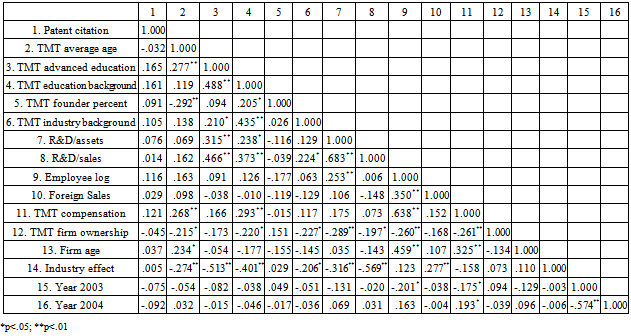

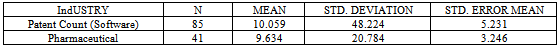

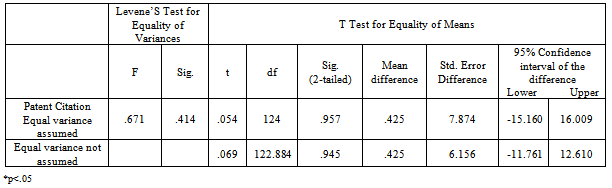

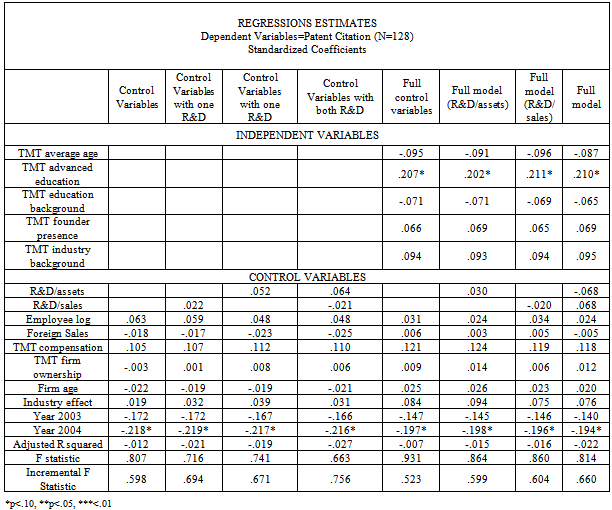

- The firms with missing data on industry, or educational background, were excluded from the analysis. Table 2 provides the descriptive statistics. An interesting occurrence was the result of zero as the minimum value for firm size, since the log of one employee is zero. Correlation results of the variables are accessible in Table 3. To ensure that there are no statistical differences between the pharmaceutical and software industries an independent sample T-test was conducted on the patent count based on the industry as shown in Table 4. The group statistics showed that for software firms (M=10.059, SD=48.223) and for pharmaceutical companies (M=41, SD=9.634). Using Levene’s test for equality of variances, the result was found to be T (124) =.054, P=.957 which showed no significant difference in terms of patent citation for pharmaceutical versus software companies, with .05 as the level of significance for P. The next step was to conduct a regression analysis, since both industries are found to be statistically similar in the focus in the focus of this article. A regression analysis was employed to determine the effect of TMT variables on patent citation when controlling for R&D intensity, specifically SPSS 15.0. This data did not have substantial missing data and mean substitution was not needed. The dependent variable of patent citation and the control variable of firm employees were skewed and thus the log was calculated. The regression model in Table 5showcases a model with just the control variables, followed by one with the independent and control variables.

|

|

|

|

|

5. Discussion

- Extant research has examined the effect of TMT characteristics on firm performance, rather than TMT characteristics effect on the processes that lead to firm performance. This study enhances extant research by investigating the effect of TMT characteristics on knowledge creation for high-technology firms. The data used firm patent citation from the IPO date to June 2008 as a proxy for knowledge creationin high-technology firms. No effect of TMT average age on firm patent citation was found, possibly due to the fact that average age had a mean of 45.81 with a variation of 5.99 (see table 2). This limited variation of TMT average age may have reduced theeffect of this variable; in the data sample TMT average age was so similar that the firms can be considered to be roughly equivalent. The study also found that, TMT education level has asignificant positive effect on patent citation, which highlights the effect ofeducation in knowledge creation. Job related TMT education was found to be negatively related to firm patent citation, even though the result was not significant. This finding suggests that theoretical knowledge may not equal applied knowledge. TMT members with highly job related education have the required abilitybut the value of this education will not be realized until it is put into application. Industry experience was found to be positively, though insignificantly, related to patent citations, which contribute to the suggestion thatlearning is more valuable when it is actually put into application. It is speculated that the knowledge that the TMT members have does not have significant effect on patent citation creation if the knowledge is not practiced. Without practice instinct is not developed, and there is no trial and error on what is a marketable or feasible innovation.The results show that TMT founder presence does not play much of a role on the decision making on firm patent citations. This outcome counteracts all expectations of firm founders’ effect. The prior belief was that in small high-technology firms, founders are very important ([16]). This non-finding is quite significant in TMT research.This paper posits that founder presence has no effect on firm patent citation, since the founder is more important in other facets of the firm. These founders need to be more focused on application of their knowledge, rather than on managing the firm. Further analysis of the job descriptions of managers in successful entrepreneurial firms might depict positions in areas of innovation.It was found that experience of the TMT, inclusive of founders and non-founders is positively,though not significantly,related to firm patent citation. Having prior experience increases a TMT member’s ability to innovate and know when to invest in innovation. They will also have an instinct, based on prior industry experience,as to which forms of innovation generate positive firm returns. Having prior industry experience increases TMT member knowledge about the patent process, especially with regard to the protocols needed. These TMT members also will have important social networks and suppliers’ knowledge that will be important in marketing the knowledge created. It is posited that an increase in sample size may increase the significance of some of the effects. It was interesting that the firm age does not seem to have an effect on patent citation. This result could represent a lack of resources in general for software and pharmaceutical firms. Age is not an issue; at the point of IPO these firms are all similar. Firm ownership and TMT average compensation also do not have a significant effect on patent citation. The equity or compensation a TMT member has in the firm may not be a form of incentive for small firms such as in this study. The issue of agency theory will not arise as yet. The size of the firm as measured by the log of employees does not have a significant effect. Once again, these firms are similar in resources, independent of size. Foreign sales do not affect patent citation, possibly since most firms in the data do not have high levels of foreign sales. The level of globalization of the firm does not affect patent citation. These firms were just at the point of IPO and most are not global yet, leading to the lack of significant results.The year of IPO was controlled for and year 2004 had a strong negative correlation to patent citation. This may be showing the attenuation of knowledge base created prior to year 2000; the farther away the year from year 2000, the lessening of the trickledown effect of knowledge created and harnessed before the year 2000 crash. R&D intensity was controlled for with no significant effect, which leads researchers to state more conclusively that there are other factors outside of R&D intensity that have a significant impact on patent citation; which reflects the premise for this paper.

5.1. Theoretical Implications

- The motivation for this paper was an interest in what affects patent citation outside of the realm of R&D intensity. It was found that TMT factors play a stronger role on patent citation than R&D intensity. The theoretical implication is that strategy researchers need to do more research on how TMT factors can affect patent citation. The findings contradicted expectationsabout education effect, leading to the proposition that education has to be utilized to be valuable; learning in a vacuum without sequential application, will lower one’s ability of knowledge creation. Education itself had a strong positive effect, whereas the applicability of the education had no effect. A more nuanced study that investigatesthe effect on patent citation when job-related education is ensued concurrently with application will be helpful. This paper investigated experienceof TMT members and founders in TMT, showing that industry experiencedoes not significantly impact patent citation. It is proposed that this is still a significant finding, due to the positive effect. Now research has another arena of research to investigate, because even though researchers assess founder and TMT effects, theyrarely review the effects of their industry experience. This model showed that related experience can be more significant than unrelated experience. This study broke down the type of prior experience relevant to patent citation and as a consequence enriched extant research on TMT characteristics.A lack of founder presence effect on patent citation was found. Research states that founders are valuable in the firm. The conjecture is that founders are very valuable in the firm, but that sometimes, especially for a firm just at the point ofIPO, founders may be more valuable in other capacities. In high-technology firms, founders who encompass the goals of the firm need to be applying their knowledge. It is posited that more research needs to be done to see where founders actually are in a firm by the point of IPO. Researchers might find that founders are in more hands-on roles. In a sample of 128 firms, only 40% had founders in the top team. This paperposits that founders are placed in positions where they are more valuable, but studies to investigate this position are needed.

5.2. Practical Implications

- An overriding proposition, based on this research, examines the value of experience. Managers of firms should try to increase their level of experience in the industry to boost their knowledge creation and the final outcome of performance. If education is increased, it is only when experience is thereafter increased that the TMT member is capableof innovation production. Otherwise, the value of education may not be fully realized and higher industry related education will have a negative impact on patent citation.For top management, education and experience work together. The finding is important for managers, as it shows how knowledge creation can be enriched. For practitioners trying to become founders, the findings illustrate that, to become owners of highly successful firms with patent citations, founders should try to increase their industry related experience, and should be willing to step down into more innovation sections of the firm.This paper raised questions about founders. It seems that founders should be given the freedom to explore and utilize their knowledge, by staying in more research intensive parts of the firm. The use of founders with experience in alliance with TMT with experience will increase patent citation.

5.3. Limitations and Future Research

- The study has some limitations. Firstly, the data sample for this paper used 128 companies and thus the sample size is adequate but not that large. Secondly, the focus is on high-technology firms leading to a question of generalizability to other types of firms. In this study data was collected on two industries specifically thepharmaceutical and software industries. An independent sample t-test was conducted to ensure that there is no significant difference between the two industries in terms of patent citation. The result shows that there is no significant difference as it relates the dependent variable. The data was collected from 2002-2004 and thus may face time period effects. The dependent variable patent citationwas examined,which is a more valuable measure than citation rate. However, the patent citation was tabulated from the IPO date based on Derwent database. It might be more valuable to see if there is a lag effect of sometime after IPO and also to do a longitudinal study to see the effect of TMT characteristics on patent citation from year to year.The use of patent citation as highlighted, it is a proxy since one cannot measure knowledge creation itself. The study showed a significant value of industry experience; it will be interesting to increase the sample size and to see if industry experience is significant. Also, research can be done on the co-alignment of knowledge and application to see how this factor affects patent citation.Future research can examine how factors outside of the firm, such as alliances with university, affect patent citations of the firm. Finally, the paper measured the importance of three variables on patent citation; future research can measure the effect of such factors as social networks and risk adverseness on TMT decision-making on knowledge creation.

6. Conclusions

- This paper researched the effect of TMT characteristics on patent citation. Specifically,the paper examined the effects of TMT average age, level of TMT education, TMT education background, founder presence, and industry experience on patent citation intensity. Thus, this paperinvestigated the finer aspects of TMT characteristics by not only exploringTMT education and TMT founder presence along with TMT average age but also the TMT education background and TMT industry experience. Education level is positively associated with patent citation. It was found thatthe background of TMT education and TMT industry and founder industry background might affectpatent citation. The findings suggest that there is still substance to the TMT characteristics research. Unexpectedly,it was found that for software and pharmaceutical firms at the point of IPO, not all the TMT characteristics matter, especially in terms of founder effect, which counteracts expectation for founders for the small firms in the data sample. Overall,education level is a key antecedent of patent citation, as a representation of knowledge creation. Extant research has rarely focused on the complex issues of TMT characteristics. The paper showed the value of not just examining a characteristic, but the level or type of characteristics as circumstances that have significant effects on patent citation.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML