Genebelin Valbuena

Independent Consultant, Houston, 77494, USA

Correspondence to: Genebelin Valbuena, Independent Consultant, Houston, 77494, USA.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

Abstract

The operational context and the competitive environment in which companies do business nowadays impose a level of certainty in our decisions as never before. In spite of the level of effort to reduce the downside risk and maximize the upside risk in our enterprises, bad decisions eventually are made. Bad decisions can erode our financial performance and competitive position, adversely impact our projects, programs and portfolios, and eventually jeopardize our survivability. From here, the importance of implementing a decision making process (DMP) that systematically and consistently addresses the different key drivers that affect the outcome in terms of upside and downside risk. This paper describes an approach for carrying out DMP, particularly for field development concept selection and will provide some practical applications carried out in the oil and gas industry. The proposed DMP consists of performing a trade-off based on the ‘value’ proposition and the ‘risk’ of the options identified in order to select the best ‘value-risk’ option. The proposed DMP approach represents a framework to systematically and consistently conduct DMP and provides guidelines to enhance our decisions by ensuring a higher level of objectivity and traceability in addition to provide mechanisms to evaluate the robustness of the results.In most of the unsuccessful cases, a retrospective analysis reveals a pitfall in one or more of the decision making processes (DMP) involved in the enterprise considered. In some cases, the analysis reveals a poor problem framing; or the fact that important aspects were not considered, or they were addressed without covering the complete spectrum of feasible possibilities; in some other cases, the framework used was not robust enough to ensure the consistency of the results or to measure the compliance of these results to the predefined risk acceptance criteria or decision makers risk preferences. From here, the importance of implementing an

Keywords:

Decision Making Process, Field Development Concept Selection, Value Assessment, Risk Assessment

Cite this paper: Genebelin Valbuena, Decision Making Process - a Value-Risk Trade-off Practical Applications in the Oil & Gas Industry, Management, Vol. 3 No. 3, 2013, pp. 142-151. doi: 10.5923/j.mm.20130303.02.

1. Introduction

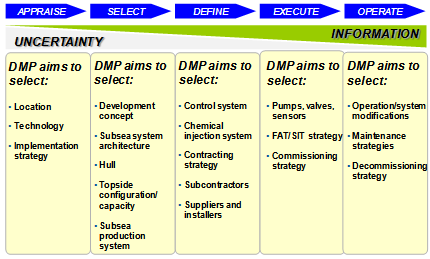

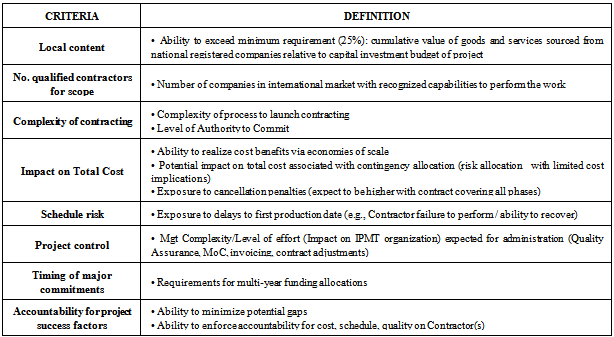

The operational context and the competitive environment in which companies do business nowadays impose a level of certainty in our decisions as never before. Objectives and performance targets supported and implemented through stringent management systems are continuously set up with the intention to reduce the downside risk and maximize the upside risk[1]. More and deeper technical and economic analyses are considered in our enterprises; however, not always we can reach the performance and financial results expected and we end up facing undesirable outcomes that diminish the financial integrity of our companies. integrated DMP that systematically and consistently addresses the different key drivers that affect the outcome in terms of upside and downside risk[1-3].This paper describes a general DMP used for field development concept selection, which is based on a value risk trade-off approach. The proposed DMP consists of assessing the certainty of our decisions based on the ‘value’ proposition and the ‘risk’ of the options identified to accomplish our enterprise. The ‘value’ represents the level of fulfillment of the enterprise objectives; so, in the context of DMP it will address how and to what extend the options under evaluation will fulfill the enterprise objectives. Value is normally evaluated by identifying and measuring key value attributes, also referred to as value selection criteria (e.g., constructability, cost, schedule, operability, reliability, future expandability, etc).On the other side, ‘risk’ is a measure of the overall enterprise uncertainty and the effect of unexpected events on the enterprise life cycle that can affect the achievement of the value proposition positively or negatively. When the impact is expected to be positive, it is called “opportunity”, while an event with negative impact is called “risk”. Even though both types of events should be evaluated, from hereafter we will use the word “risk” to highlight negative impact events. Under this context “risk” is normally assessed through the identification and characterization of key events or uncertainties that could affect adversely the enterprise. | Figure 1. Potential DMP Applications for Offshore |

2. General Application

The DMP describes hereafter, pertains to all types of decisions, from decisions related to field development concept selection, subsea architectures, installation strategy, equipment selection, etc, to decisions related to contracting strategies and project management team (PMT) organization structures. Although this methodology is intended to be general, its application will typically be to field development concept selection related to the upstream oil and gas industry.DMP can be applied to any project execution phase, but the potentiality of adding value will be even higher during the first stages of the Front-End Loading (FEL) process, particularly during the Select and Define phase. DMP can be conducted to select the most appropriate subsea configuration/equipment layout, the most suitable pigging philosophy, the most appropriate PMT organizational structure to support the project execution, or the particular long lead package or vendor provider (see Figure 1). In general, any decision process that involves two or more feasible options under a set of decision criteria, sometime different in nature (qualitative vs. quantitative) can be addressed through the systematic application of the proposed DMP.During the appraise phase, sometime referred to as visualization phase, a DMP is conventionally used to prioritize and select the business opportunities that will be included in the corporate project portfolio.[4-6].

3. Field Development Concept Selection

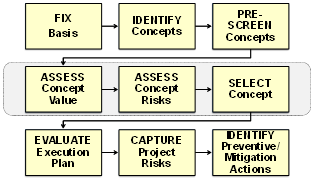

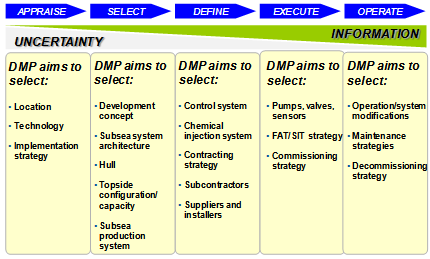

Figure 2 represents an overview of the overall field development concept selection process. The first steps involve collecting, documenting and validating all assumptions, premises, requirements and objectives of the proposed development; identifying and clearly defining the different concepts to be evaluated; and in some cases, depending on the number of evaluated concepts or “family concepts”, performing a pre-screening process beforeapplying a more systematic DMP. At this point it is important to reject those concepts that do not fulfill the mandatory requirements, sometime referred to as prerequisites[7].After having a limited number of validated concepts/”family concepts” a more formal DMP is conducted where the value and risk for each concept is assessed and characterized and the value-risk trade-off is performed. Once the best value-risk option is selected, additional tasks are conducted to define and improve the execution plan, capture the project risks (in a more comprehensive way) and identify the preventive/mitigation measures that should be implemented to assure the success of the project execution and asset operation.  | Figure 2. Field Development Concept Selection Process Overview |

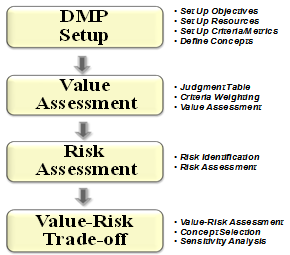

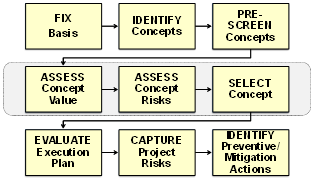

As highlighted in Figure 2, embedded in the concept selection process, there is a DMP focuses on selecting the preferred field development concept, based on semi quantitatively assessing the trade-off between value and risk for each concept. The decision is performed based on a set of criteria, whose meaning and level of importance (weight) should be clearly defined. These criteria, and eventually sub-criteria should be aligned to the project/enterprise objectives. The general overview of this DMP is shown in Figure 3. | Figure 3. DMP Overview |

3.1. Decision Making Process Set-up

During this first stage, it is important to have a clear picture of the objective and potential value proposition of the enterprise considered and align these objectives to the DMP objectives. The nature of the decision to be made, its importance and level of effort required to deliver the process should be assessed[1,8].This stage involves identifying the decision making team, defining the decision criteria, risk attributes and matrix, and identifying and documenting each concept to be evaluated. The decision team must represent the decision-makers; therefore, it should consist of a combination of management and technical knowledge[8]. It is desirable to use the same team for the different workshops to be conducted during the entire process. The decision criteria and sub-criteria form the basis for the value assessment (VA). They assess the characteristics and features that would make a concept more or less attractive to the decision makers. The criteria should address how and to what extend the concept under evaluation will fulfill the enterprise objectives. These are some of the most common value criteria used:a)Schedule• Time to 1st production• Time to full potentialb)Life-cycle cost• DRILLEX• CAPEX• OPEXc)Operability• Liquid management/’Piggability’• Hydrate management• Ease of start-up/shutdown• Data gathering and control•Operational flexibility (e.g. flexibility to operate at two pressure level)• Turndownd)Constructability/Installability• Standard design• Modularity/Phasing• Drilling/Installation overlap• Subsea and Pipeline Complexity• Resources availability/Limited installation vesselse)Availability• Reliability• Ease of maintenance• Impact of maintenanceSimilar to the VA, the risk metrics, matrix and scaling factors form the basis for the risk assessment (RA). The RA is divided in two parts. The first addresses risk exposure from the appraise/select phase to the start of operations, referred to as Project Risk[9]. The second addresses in-service exposure, from start of operations to abandonment, and is referred to as In-Service Risk. The distinction is made to capture the difference in nature of the exposure. Project Risks address HSE (during project execution phases), CAPEX, and schedule to start of operations, while In-Service Risks address HSE (during asset operational phase), OPEX and downtime. The most common risk metrics (risk attributes) used are:a)Financial impactb)Schedule/Downtimec)Social and Community Affaird)Healthe)Safetyf)EnvironmentThe Project and In-Service risk assessment may use different risk metrics and matrices; but once defined, they should be applied to all options through the DMP for consistency purposes. Eventually some of these risk attributes can be over sighted. During the RA process, special attention should be given to the ranking/scoring mechanism to determine the relative impact of each risk.[9,10]It is common to identify concepts that follow a similar philosophy; grouping them in ‘family concepts’ facilitates identifying those that are clearly better within the specific family and reduces the number of concepts while ensuring that all key concepts are still represented. In some cases it is necessary to perform additional pre-screening to reduce the number of concepts/’family concepts’ that will be advanced to the more formal DMP while selecting the ones that best suit the enterprise objectives. In order to minimize the effort, the basic strategy is the following:a)Select a minimal set of pre-screening criteria which can be applied across the entire set of concepts.b)Organize the screening into key decisions with the potential to eliminate a large set of concepts.c)Eliminate concepts within a given family that are clearly superseded by better concepts within the same family.d)Select the top candidates within each remaining family of concepts using the pre-screening criteria.It is recommended to use a minimal set of pre-screening criteria (~ three) which can be quickly evaluated across the whole set of concepts. At the end of this stage, we will have a limited number of well defined/validated concepts that will be further evaluated though a more formal VA and RA

3.2. Value Assessment

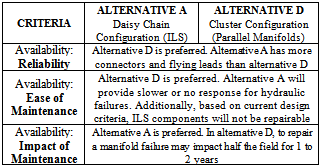

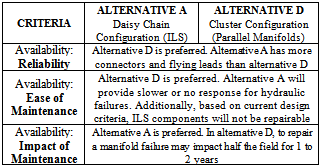

The VA combines different decision criteria into a single qualitative measure of value, to establish a comprehensive picture of the relative merits of each concept. This stage involves developing and validating the judgment table, establishing the weighting factors for the decision criteria and conducting the VA.a)“Judgment” table The first task in the VA is the preparation of the ‘judgment’ table highlighting the features of each concept that make it attractive. This table contains the relevant facts for each concept under consideration per decision criterion and sub-criterion[7]. An example of a ‘judgment’ table is shown in Table 1. The table entries can be numbers or statements, supported by a reference where appropriate. The ‘judgment’ table provides systematic documentation of the basis for any decision. It also ensures the decision team has the same, validated information. The table furthermore provides guidance for the engineering work, as it will show any gaps in the information required for the decision. b)Relative weight for each criterionThe weighting factors for each criterion can be determined using the Analytical Hierarchy Process (AHP)[11,12]. It guides the team through a series of pair-wise comparisons in which they must express their preference for one criterion over the other, and to what degree. Then, the technical team weights all sub-criteria within each major criterion, using the same methodology (AHP). After going through all criteria, a complete set of weights is attained.c)Value assessmentUsing the ‘judgment’ table, the VA workshop is organized, where again using AHP each concept is compared to the others for each decision criterion or sub-criterion and the corresponding score is assigned by determining the relative preference of a concept for each criterion and sub-criterion. The individual score assigned to each concept within a particular criterion, describes the degree to which this concept fulfils the enterprise objective or satisfies the required/desired feature highlighted by the criterion. Once the VA has been completed for all criteria/sub-criteria, a total concept valuation is computed.Table 1. Example of “Judgment” Table

|

| |

|

3.3. Risk Assessment

The risk assessment (RA) aims at determining to what extend the concepts evaluated are affected by undesirable events/uncertainties during the project execution process (project risks) and/or operational phase (in service risks). This step involves developing a risk register and conducting the RA.a)Risk identification: risk registerDuring the risk identification workshop, events that could affect the project/asset performance are identified. Effort is made to identify major events that should affect concepts in different ways, different extent and/or with a different likelihood, thus making them “differentiator events”.Typically the number of events is limited, since the intention is not to develop a comprehensive list of events and subsequently set up a mitigation plan, but to distinguish between concepts.As mentioned in the DMP setup section, the risk assessment is divided in two parts; Project Risk and In-Service Risk. Prior to the workshop, a list of threats to a) project execution and b) in-service performance is generated, based on prior projects. This preliminary list is used as a basis for the Project Risk and Asset Risk workshops. During each workshop, the pre-populated threats are validated and complemented through a structured brainstorming sessions guided by a prompt list[10]. After completing the brainstorming sessions the list of threats is documented in a risk register.b)Risk assessmentDuring the risk identification workshop, each threat will be ranked using either the Project Risk matrix or In-Service Risk matrix. The rankings will be translated to scores for the Value-Risk trade-off. The RA involves the following tasks:• Determine the relative impact that each event, in case of occurring would have on each concept. • Appraise the probability of occurrence/likelihood of each event on each concept. • Assess the risk score for each concept, by adding up across all events and all risk attributes for each concept the result of the expected probability of the event times the expected severity of its impact.At the end of the assessment, risk scores from each concept will be summed up to obtain a total risk score for that particular concept. This total risk score will be used as pointer/indicator to ascertain a relative standing among all concepts.During the risk assessment process double counting risk should be avoided. Special attention should be given to the definition of risk events and uncertainties, their assessment and potential relationship with the definition of the value attributes selected, as well as the selection of the appropriate metrics (probability of occurrence and severity) and scaling factors. A key drawback of this approach is that the risk assessment may be very susceptible to the metric and scaling factors, compromising the risk assessment process and in general the overall DMP. The robustness of the entireprocess should be evaluated through different sensitivity cases.

3.4. Value-Risk Trade-off

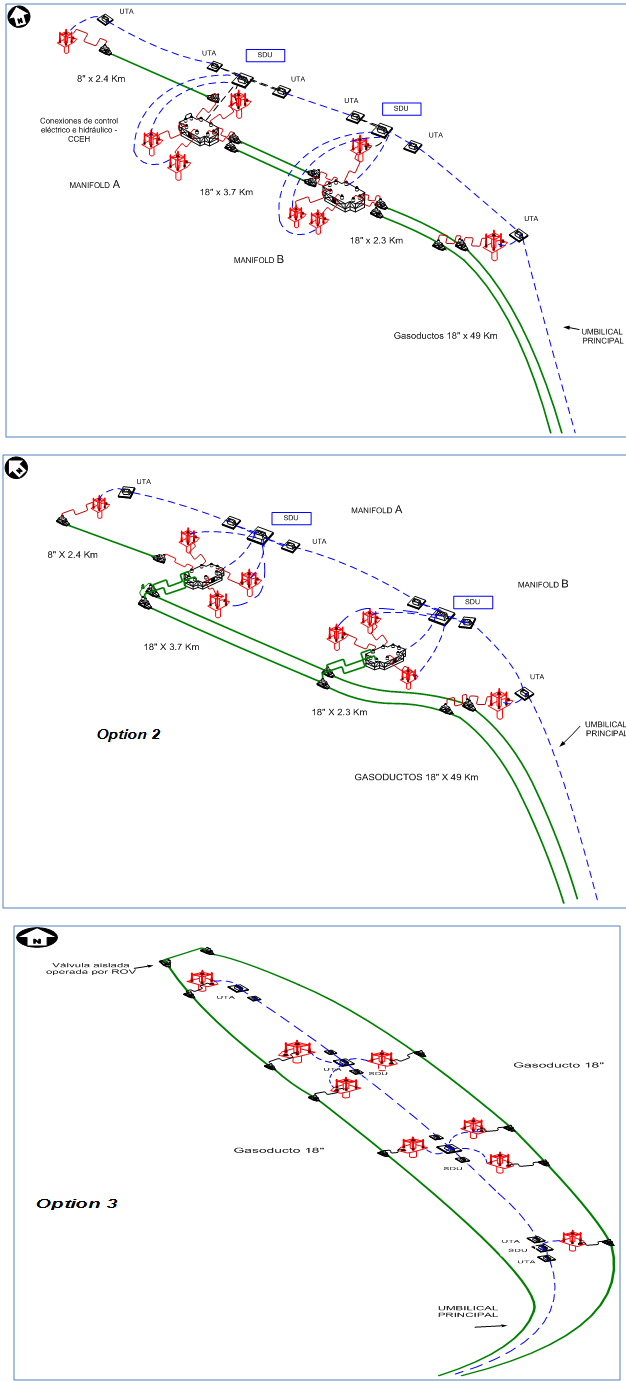

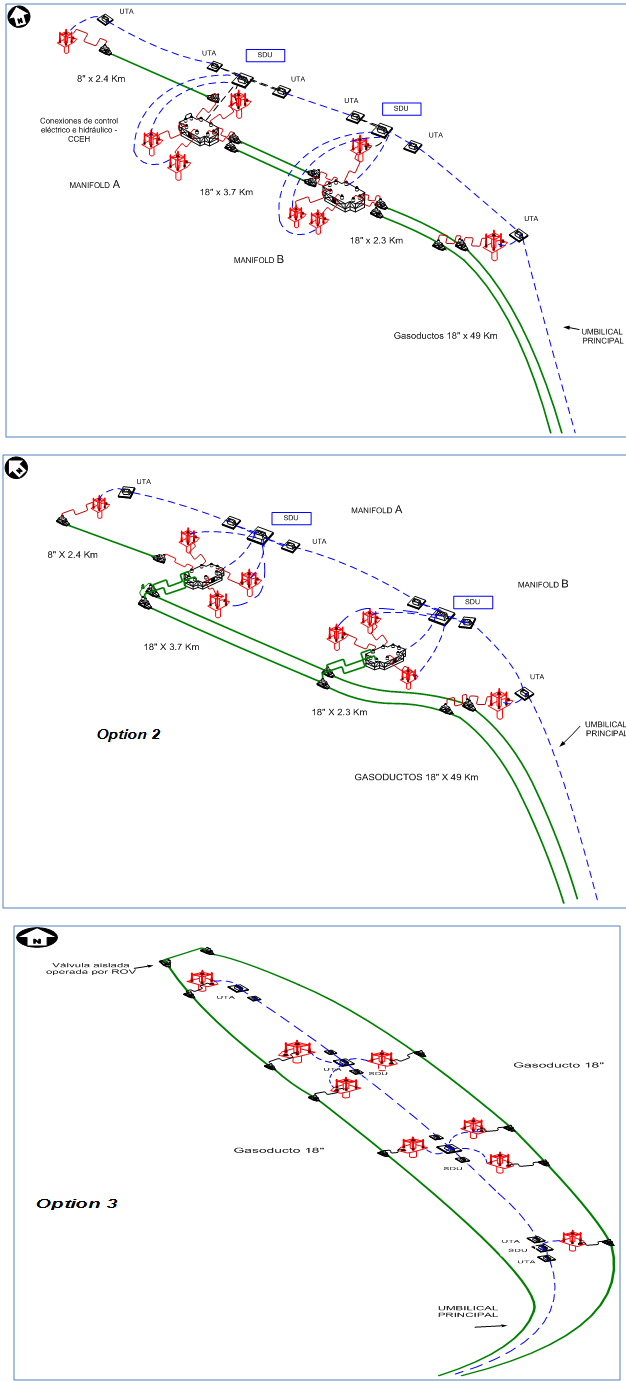

Finally, once the relative value and risk scores are determined, reflecting the team’s consensus, a graph similar to the one shown in Figure 4 can be plotted, showing the concept that provides the most favorable trade-off between value and riskThe concept with the highest ratio value/risk (highest slope) is the one that offer the maximum value at minimum risk among the options evaluated. In this hypothetical case, Concept 1may be selected.It is important to incorporate the decision makers risk behavior into the value-risk assessment[5, 13]. Typically it is found that options offer additional value at higher levels of risk and thus it is necessary to assess the risk tolerance of the decision makers. Similarly, there are cases where the client maximum tolerable risk is exceeded and consequently regardless of the value assessed the concept is rejected as Concept 3 in Figure 4. As indicated previously, the robustness of the result is assessed through a sensitivity analysis. This may include factors in the VA as well as the RA. If certain changes in the assessments change the preferred concept, additional work may be recommended to address these sensitivities and improve the final result. This may for example apply to assumptions made, or any dominating risk, or the effect and cost of certain mitigating measures or the metric and scaling factors. For example, in order to determine how dependant is the decision to variation in the value-attribute weights, a sensitivity analysis may be performed. The final result reflects the joint preference of the decision team, accounting for a comprehensive set of decision criteria and risks. Through the process described, the decision is well documented, facilitating easy communication andjustification if needed.The approach described above has been used in different concept selection process, among them the definition of a subsea gas development concept as depicted in Figure 5.An alternative approach to deal with certain DMP is to quantify the value of each option in terms of a financial figure of merit, such as Net Present Value (NPV) or Return on Investment (ROI), and develop an economic model that aggregate the total cost of the option, the expected revenues and the potential risk expenditures[8,14]. This quantitative approach requires the development of an integrated value model that quantifies the economic impact of each critical variable associated with the DMP[1,5,15]. In these particular applications, the appropriate manage of uncertainties, probably through the development of influence diagrams and decision trees[8], and the appropriate propagation of uncertainties through the value model play a key role[16]. In some cases, particularly in early stages of the enterprise development (e.g., visualization phase), the lack of hard data, the level of uncertainty in the impact of critical variables in the selected financial figure of merit, and our ability to interrelate these variables, may limit our capability to build such integrated economic model.

4. Other Applications

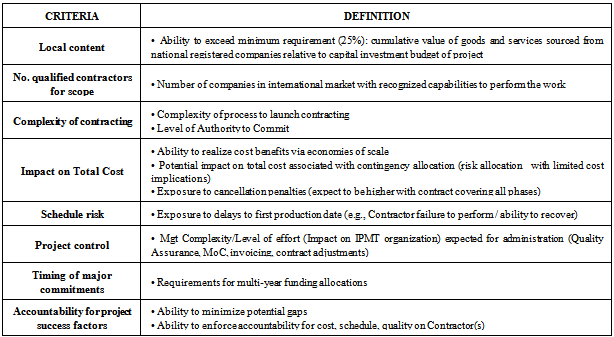

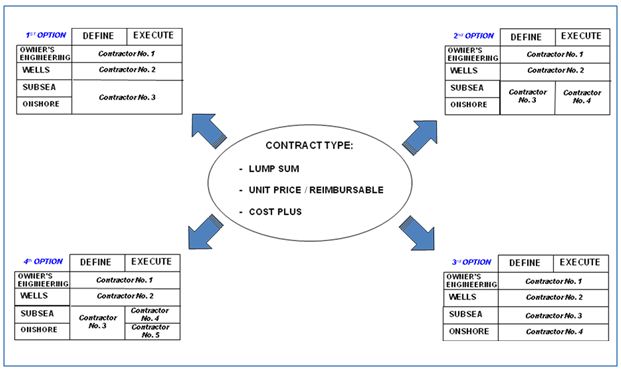

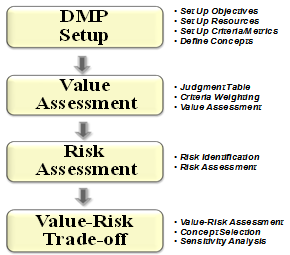

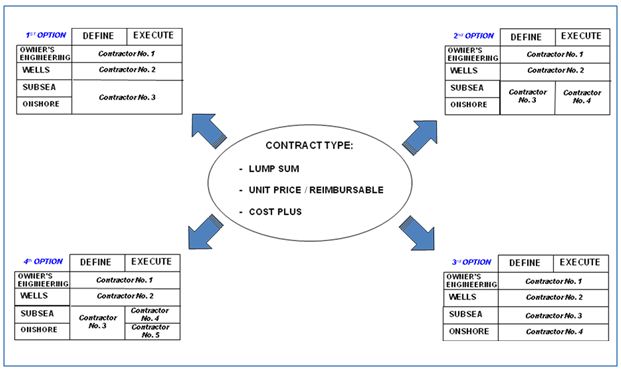

The proposed approach has been applied to different decision making problems, including the selection of the most appropriate contracting strategy for a project. In this particular case, the objective was to select the most appropriate contracting strategy based on a predefined set of criteria oriented to maximize project’s objectives.Figure 6 shows a pictorial representation of the different contracting strategies evaluated. As reader can see a variety of options were evaluated, some of them splitting the scope per project phase (definition vs. execution), per project scope of work (onshore plant, subsea, wells and owner’sengineering), and some other considering hybrid arrangements.For this application, a similar approach described in Figure 3 and Figure 4 was used with slightly differences given the nature of the decision, but basically following the same sequence. As an example, Table 2 shows some of the value criteria used in the DMP.The proposed DMP has been also used to select the most appropriate organizational structure for an integrated PMT for the definition and execution phases. In this case, the objective was to select the most appropriate organization structure based on the set of criteria shown in Table 3.Figure 7 shows the general models (function based, phase based, etc) evaluated. Some of these models were further evaluated considering a more detail structure brake down, but basically the same approach explained in previous pages was used. | Figure 4. Value-Risk Trade-off Chart |

| Figure 5. Subsea Gas Development Concepts |

| Figure 6. Contracting Strategy Options |

Table 2. Contracting Strategy DMP – Value Criteria

|

| |

|

Table 3. PMT Organization DMP – Value Criteria

|

| |

|

| Figure 7. Project Management Organization Options |

5. Conclusions

Given the dynamic and complex operational context and the competitive environment in which companies do business nowadays, it is vital for their survivability to implement a coherent DMP that systematically and consistently addresses the different key drivers that could affect the outcome in terms of upside and downside risk. The DMP proposed provides a traceable and consistent way to make decisions in a systematic manner, offering the following benefits:a)Objectivity: by defining a structured and systematic work framing, the method is an objective conduit for expert opinion elicitationb)Flexibility: suitable to handled multi attribute DMP, both using soft or hard data, and expert elicitation process. Provide qualitative assessment based on team’s state of knowledge. It also works well for limited definition of information.c)Consistency: provide mechanisms to identify inconsistencies in the options VA and criteria weighting factor processesd)Systematic: a predefined and structured process that breakdown the DMP in smaller and more manageable tasks, without compromising the comprehensiveness of the analysis (holistic picture)e)Traceable/Auditable: by documenting each step a paper trail is created, which clearly shows the basis of the decisionOther importance characteristic of the approach proposed is the feasibility to perform sensitivity analysis to evaluate the robustness of the results. On the other hand, the early identification of potential risk events and major uncertainties allows development of preventive/mitigation measures and their inclusion in further concept development/definition work, which contributes to venture/enterprise success.

References

| [1] | Judd B., Spetzler C., Tani S., and Winter H. Decision Quality in Organizations. Strategic Decision and Risk Management. Stanford University. Course handout. SCP, Stanford, 2011 |

| [2] | Valbuena G., Yanez M., and De La Vega H. DMP. Uncertainty Management: The art of decision making by quantifying the unknown. Reliability & Risk Management, Maracaibo, 2003 |

| [3] | Barton T., Shenkir W., and Walker P. Making Enterprise Risk Management Pay Off. Prentice Hall PTR, 2002 |

| [4] | David and Jim Matheson. The Smart Organization, Creating Value through Strategic R&D, Harvard Business School Press, 1998. |

| [5] | Walls Michel. Managing Risks and Strategic Decisions in Petroleum Exploration & Production. Colorado School of Mines. Course handout. PIECE, Houston, 2009 |

| [6] | Andersen J., Judd B., Matheson J., Spetzler C, etc. Strategic Portfolio Decisions. Strategic Decision and Risk Management. Stanford University. Course handout. SCP, Stanford, 2011 |

| [7] | Errol Wirasinghe. The Art of Decision Making: Expanding Common Sense & Experience. Shanmar Publishing, Houston, 2003. |

| [8] | Peter McNamee and John Celona. Decision Analysis for the Professional. 4th Edition, SmartOrg, Inc., 2007 |

| [9] | Harold K. Project Management: A System Approach to Planning, Scheduling, and Controlling, 8th edition. John Wiley & Sons, Inc. Hoboken, New Jersey. 2003. |

| [10] | Vose D. Risk Analysis: a Quantitative Guide, 2nd Edition. Wiley, Chichester, 2000. |

| [11] | Saaty, T.L. Decision Making with the Analytic Hierarchy Process. Int. J. Services Sciences, Vol. 1, No. 1, pp.83–98, 2008 |

| [12] | Schmoldt D., Kangas J., Mendoza G., and Pesonen M. The Analytical Hierarchy Process in Natural Resource and Environmental Decision Making. Kluwer Academic Publisher, 2001 |

| [13] | Howard Ronald. Decision Analysis. Strategic Decision and Risk Management. Stanford University. Course handout. SCP, Stanford, 2011 |

| [14] | Murtha J. Decisions Involving Uncertainty An @Risk Tutorial for the Petroleum Industry. Palisade Corporation, 2000 |

| [15] | Coppersmith E., Dean G., McVean J., and Storaune E. Making Decision in the Oil and Gas Industry. Oilfield Review. Winter 2000/2001 |

| [16] | Valbuena G., Yanez M., and De La Vega H. Reliability Engineering and Probabilistic Risk Analysis. Reliability & Risk Management, Maracaibo, 2003 |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML