-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2013; 3(2): 99-104

doi:10.5923/j.mm.20130302.06

Signaling and Substitution Hypotheses in Malaysian Share Repurchases

Rohaida Abdul Latif 1, Kamarun Nisham Taufil Mohd 2

1School of Accountancy, College of Business, Universiti Utara Malaysia, Kedah, 06010, Malaysia

2School of Economics, Finance and Banking, College of Business, Universiti Utara Malaysia, Kedah, 06010, Malaysia

Correspondence to: Rohaida Abdul Latif , School of Accountancy, College of Business, Universiti Utara Malaysia, Kedah, 06010, Malaysia.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

There is an increasing trend of firms undertaking share repurchases in Malaysia, yet limited studies on repurchase activities have been published. This study attempts to examine managerial motives for repurchase in Malaysia using signaling and substitution hypotheses. Unlike firms in western countries, firms in Malaysia are bound by strict rules and regulations before embarking on repurchases, thus it is argued that motives for share repurchases would be different from those of the developed markets. The results of this study are consistent with signaling hypothesis where Malaysian firms repurchase shares partly to signal undervaluation and better operating performance. They also buy back shares whenever there is an increase in cash flows. However, there is no evidence to support that these firms bought back shares to substitute dividend payments as documented by studies from western countries. In fact, repurchases are used to complement dividends. Further evidence shows that managerial ownership has significant influence on firms’ repurchase decisions.

Keywords: Share Repurchases, Share Buybacks, Signaling, Substitution Hypothesis

Cite this paper: Rohaida Abdul Latif , Kamarun Nisham Taufil Mohd , Signaling and Substitution Hypotheses in Malaysian Share Repurchases, Management, Vol. 3 No. 2, 2013, pp. 99-104. doi: 10.5923/j.mm.20130302.06.

Article Outline

1. Introduction

- Share repurchases (SR) have become an important phenomenon in corporate distribution policy in the US (e.g.[1-5]). Malaysian firms are also actively participating in repurchase activities. From the inception year in 1997 until December 2005, 305 firms or about 25 percent of all listed firms have participated in repurchases activities[6]. However, studies pertaining to repurchases in emerging economies as in Malaysia are limited and have focused mainly on the announcement effects of repurchases.Numerous studies in the west and developed market as in[4] and[8] have established that firms repurchase shares to substitute for dividends payments. To the authors’ knowledge, there is limited documented empirical evidence on substitution motive of share repurchases in emerging market as in Malaysia. Furthermore, it is argued that such motive may not be relevant in emerging economies mainly due to different ownership patterns prevalent in many Malaysian firms. Thus, this study attempts to empirically examine motives of repurchases decision in Malaysia using signaling and substitution hypotheses.

2. Literature Review and Hypothesis Development

- Share repurchases (SR) are formally allowed late in 1997 by Malaysian government after the Asian financial crisis of 1997. Unlike repurchases in the United States, the only method of SR allowed in Malaysia is through the open market. Malaysian firms must adhere to specific rules and guidance provided by the Bursa Malaysia listing requirements in order to embark on SR[7]. The guidelines in Chapter 12 of Bursa Listing Requirements specify the size of share repurchase which is not more than 10 percent of prevailing ordinary shares and the price offered should not be more than 15 percent above the weighted average market price for the shares for the 5 market days immediately before the purchase. The same rule applies for the resale of shares so bought. Economic theory provides several motives as to why firms buy back their own shares which include but not limited to: a) signal undervaluation, b) disgorge excess cash flow, c) substitute cash dividends for repurchase, d) satisfy management interests, e) reduce tax, and f) maintain optimal leverage level (e.g.[1-5]). This paper will concentrate on the signaling and substitution hypotheses.

2.1. Signaling Hypothesis

- Signaling hypothesis predicts that managers, having privy information on their firms, would be impelled to correct mispricing of their shares. One way of doing this is by announcing buyback intentions. This action implies that managers have strong beliefs that their firms are good investments and the reason for poor price performance would be due to market conditions. Reference[3] finds consistent evidence for signaling hypothesis from a survey of 194 top financial executives who engaged in open market share repurchase activities. A majority of the respondents (74.6 percent) cited that undervalued stock price is the most important reason leading to the announcement of buyback programs. From a questionnaires survey conducted among the largest 200 UK firms,[8] finds that most of the respondents believe that the important reasons for firms to buy back shares are related to information signaling hypothesis, leverage hypothesis and investment hypothesis.Signaling hypothesis proposes that managers initiate repurchases to signal the public that their firms either a) are currently undervalued, or b) would experience increase in earnings in the future or c) are expecting reduction in firms’ systematic risks. Extensive studies substantiate that these facets of signaling hypotheses were evidenced in their research but were not necessarily present simultaneously (e.g.[5] &[9]). References[8-9] find consistent evidence for signaling hypothesis from a survey of financial executives who engaged in share repurchases. Therefore it is hypothesized that;H1: Firms with poor prior price performance are more likely to repurchase shares.H2: Firms with better operating performance are more likely to repurchase shares.Reference[10] argues that managers of cash-rich firms are subjected to severe agency problems. Having more free cash at their disposal, managers are likely to over-invest in negative net present value (NPV) projects, consume more discretionary perquisites for private benefit, or unnecessarily retain cash. When firms distribute cash dividends to shareholders, the firms are actually reducing their agency costs. Free cash flow hypothesis posits that shareholders with excess funds should benefit from share repurchases. In comparison to dividend payments, disbursement of cash through share buybacks offers managers the flexibility to manage the magnitude and timing of disbursements of excess cash. There is inconclusive evidence pertaining to the importance of disgorging excess free cash flow in share repurchase decisions. References[11] and[12] find no support for excess free cash flow hypothesis for firms that initiate tender offer share repurchases announcements. However, many studies establish support for Jensen’s theory of disgorging excess free cash flow (e.g.[2] &[13]). Mature firms with low growth opportunities tend to invest in unprofitable projects. By repurchasing its own shares, a firm is actually distributing the excess cash flow back to its shareholders and thus reducing the agency cost associated with free cash flow. SR conveys a positive indication that managers do not engage in opportunistic behavior. Instead of embarking in unprofitable projects or acquisitions, the managers choose to distribute firms’ excess cash back to shareholders. Therefore it is hypothesized that;H3: Firms with excess cash are more likely to repurchase shares.

2.2. Substitution Hypothesis

- Reference[14] considers dividends and share repurchases as perfect substitute. For decades, US firms preferred to pay out cash in the forms of dividends over share repurchases despite the disadvantages of tax treatment on dividends payment. However, the trend is reversing. Reference[4] reports that while dividends payment grew at an average rate of 7.5 percent per year over the period 1980 - 1998 in the US, share repurchases volume has grown at an average rate of 28.3 percent during the same period of time. Theoretically, after a firm paid cash dividends, the price of its shares would come down proportionately with the amount of dividends paid[15]. Interestingly,[2],[16] , and[17] find that the announcement of corporate intention to buy back its shares would push the price upward with an average return of 3 to 4 percent observed during the announcement period. Positive price reaction after SR certainly gives strong inclination for a firm to choose buybacks rather than cash dividends. Unlike dividend announcements, share buyback announcements are not liabilities. It is not necessary for firms to actually buy back their own shares in order to gain its benefits. Furthermore, not all shareholders equally participate in buybacks. Despite this inequality, repurchase is considered as a great tool for management especially if flexibility is needed in a distribution policy. Managers can determine the appropriate amount of shares they are required to repurchase whenever the need arises (e.g.[2] &[5]).Reference[4] argues that if buybacks and cash dividends are substitutes and assuming that managers are concerned with shareholders benefits, managers would choose the distribution policy that would maximize shareholders’ utility functions. The introduction of Tax Reform Act of 1986 (TRA 1986) in the US reduced the gap between taxes on capital gains and dividends. Given that TRA 1986 reduced the potential capital gain benefits, which firms have enjoyed previously, it is expected that buyback activities would be slightly less evident after 1986. They reported that the mean (median) market reaction for firms announcing buybacks decision prior to TRA 1986 was a positive 3.49 percent (2.56 percent) while those that announced buyback intentions after approval of tax reform 1986 experienced market reaction of a positive 2.42 percent (1.65 percent) and the differences are significant at 1 percent level. This finding supports that TRA 1986 causes repurchases to be less attractive. Reference[2] finds lack of evidence to support the notion that firms repurchased shares to replace dividends in the US for the period from 1977 to 1996. In a censored regression analysis,[2] uses dividend payout as a proxy for substitution hypothesis. Dividend payout is the ratio of cash dividends paid to net income in the year prior to actual buybacks. The coefficient of dividend payout is consistently positive and significant in most of the sample years suggesting that firms that bought back their shares do not use funds that otherwise would be used to pay dividends. Reference[18] examines flexibility and substitution hypotheses of share repurchases and dividends using time-series vector autoregression. The study finds that repurchases are mostly related to temporary earnings but not dividends and both repurchases and dividends are not related to permanent earnings. Therefore, [18] concludes that share repurchases and dividends are not perfect substitutes. Likewise, recent survey conducted by[8] also shows weak support to the idea that firms buy back shares to replace dividend payments. In other words, firms do not substitute dividends for buybacks.References[19] and[20] show that repurchases are increasingly becoming the dominant payout method among firms in the US. Using Litner regression model on 25 years of data (1980 to 2005) to examine the relationship between dividends and buybacks to earnings,[20] finds that there is a strong relationship between earnings and buybacks but weak relationship between earnings and dividends; thus, supportive to the idea that repurchase is the preferred method of cash distributions. In summary, there is inconclusive evidence as to whether share repurchase is a perfect substitute for cash dividends. Therefore it is hypothesized that:H4: Firms are more likely to reduce dividends to embark on repurchases.

2.3. Control Variables

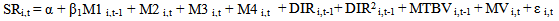

- Many firms in Malaysia are characterized by concentrated ownership whereby significant portion of equity is owned by individual or group of individuals, as in reference[6]. Given that these individuals’ wealth is tight up with firm’s financial decisions, it is expected that ownership would have significant influence in share repurchase decision in Malaysia. This study uses managerial or director ownership as a proxy for ownership influence in share repurchases decision. Previous studies have shown that size and growth opportunities affect share repurchases decisions. Likewise, this study employs market to book value (MTBV) and market value (MV) as proxies for growth opportunities and size respectively.

3. Sample and Methods

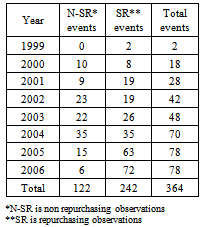

- One major difference of this study as compared to other studies is that it focuses only on firms that carried out repurchasing activities. In Malaysia, a firm is required to get shareholders’ approval before it can repurchase its shares and that approval is only valid for a period of one year. This setting allows us to investigate why firms repurchased shares in certain years and not others. Focusing only on repurchasing firms gives a better picture of repurchasing motives than comparing between repurchasing and non-repurchasing firms as non-repurchasing firms might not engage in repurchases because of other reasons such as it is not their financial policy. The sample includes all public listed companies on Bursa Malaysia Main Market that repurchased shares from 1999 to April 2006. Finance-related companies and utilities firms are excluded from the sample as these firms are bound by different regulations. A total of 122 non-financial and non-utility firms repurchase their shares are identified from Datastream database and annual reports. To ensure that repurchases implementations present measurable impact on firms’ financial figures, only firms that have bought back cumulatively more than 1 percent of their shares outstanding from the year 1999 to April 2006 are included in the final sample. This condition produces a final sample of 80 repurchase firms. Financial data are collected for each firm from the year prior to the first repurchase year. The process above produces a sample of 364 firm-year observations, consisting of 122 non-repurchase firm-years and 242 of actual repurchase firm-years as shown in Table 1.

|

| (1) |

4. Findings and Analysis

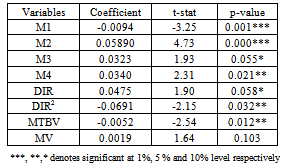

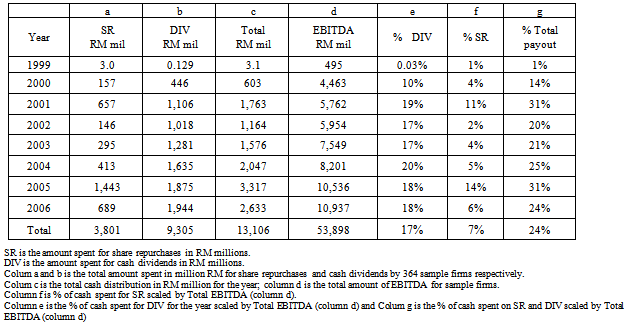

- Table 3 describe minimum, maximum, mean and standard deviation for all variables tested. On average firm repurchased 1.18% of their shares outstanding which is markedly lower than the average shares bought back by firms in the western markets, typically about 5%-6%. The sample firms have positive changes in EBITDA, changes in cash flow, changes in dividends per share and experienced positive 1.7% cumulative average abnormal returns prior to the repurchases. Managerial ownership is rather high with the mean of 42.19 %. Reference[22] also finds that the average board ownership in Malaysia is about 43.44%. The mean market value for the sample is RM885 millions with the maximum value of RM13, 982 millions.

|

|

|

|

5. Conclusions

- Firms buy back shares for multiple reasons. Those motives that are relevant in the western countries may not necessarily be prevalent in the emerging countries due to different regulations and corporate governance measures. This study examines signaling and substitution hypotheses in the context of concentrated ownership which is prevalent in many emerging markets such as in Malaysia. It is found that firms in Malaysia repurchase shares to signal undervaluation and better operating performance as well as to distribute excess cash. It is also found that firms with low growth opportunities choose repurchases to divest off excess cash. However, there is no evidence to support that firms repurchased shares to substitute for or reduce dividend payments. There are several future avenues for research regarding SR activities in Malaysia. For example, studies should look empirically into the long term accounting and price performance of SR and corporate governance measures that affect SR decisions. This evidence would be very important in understanding the current trend of corporate payout policy.

ACKNOWLEDGEMENTS

- We wish to acknowledge comments by Prof Dr. Ku Nor Izah Ku Ismail, Associate Professor Dr Wan Nordin Wan Hussin, and reviewers from School of Accountancy, College of Business, Universiti Utara Malaysia (UUM) and we are grateful UUM for funding of this research. All remaining errors are the responsibility of the authors.

References

| [1] | Paul Brockman and Dennis Y. Chung, Managerial timing and corporate liquidity: Evidence from actual share repurchases. Elsevier. Journal of Financial Economics, 61, pp417–448, 2001. |

| [2] | Amy K. Dittmar, Why do firms repurchase stock? The University of Chicago Press, Journal of Business, 73 (3), pp331-355, 2000. |

| [3] | John P. Evans, Robert T. Evans, and James A. Gentry, The Decision to Repurchase Shares: A Cash flow Story, Chapman University, Journal of Business and Management, Vol. 9, No. 2, pp 99-123, 2003. |

| [4] | Gustavo Grullon and Roni Michaely, Dividends, Share repurchases, and the substitution hypothesis, The American Finance Association ,The Journal of Finance, Vol. LVII, No. 4, pp.1649-1683, 2002. |

| [5] | Gustavo Grullon and Roni Michaely, The information content of Share Repurchases Programs, The American Finance Association, The Journal of Finance, Vol. LIX, No. 2, pp. 651-680, 2004. |

| [6] | Rohaida Abdul Latif, Share Buybacks: Determinants and Price Effect, PhD Thesis, Universiti Utara Malaysia, Malaysia, 2010. |

| [7] | Bursa Malaysia main market listing requirements available online: http://www.bursamalaysia.com.my. |

| [8] | Rob Dixon, Graham Palmer, Bob Stradling, and Anne Woodhead, An empirical survey of the motivation for share repurchases in the UK, Emerald Group Publishing Limited, Managerial Finance, Vol.34, No.12, pp. 886-906, 2008. |

| [9] | H. Kent Baker, Garry E. Powell and Theodore E. Veit, Why companies use open-market repurchases: A managerial perspective. Board of Trustees of the University of Illinois, The Quarterly Review of Economics and Finance, 43, pp. 483-504, 2003. |

| [10] | Michael, C. Jensen, Agency Costs of Free Cash Flow, Corporation Finance, and Takeovers. American Economic Association, The American Economic Review, 76 , No. 2, pp. 323-329, 1986. |

| [11] | Keith M., Howe, Jia He and G. Wenchi Kao, One-time Cash Flow Announcements and Free Cash Flow Theory: Share Repurchases and Special Dividend, The American Finance Association, The Journal of Finance, Vol. XLVII, No.5, pp.1963-1975, 1992. |

| [12] | Konan Chan, David Ikenberry, and Inmoo Lee , Economic Sources of Gain in Stock Repurchases, University of Washington, Journal of Financial and Quantitative Analysis, Vol. 39, No. 3, pp. 461-479, 2004. |

| [13] | Dennis Oswald and Steven Young, Share reacquisition, surplus cash, and agency problem, Elsevier, Journal of Banking & Finance, 32, pp.795–806, 2008. |

| [14] | Miller and Modigliani, Dividend policy and market valuation of shares, University of Chicago Press, Journal of Business, 34, pp. 411-433, 1961. |

| [15] | Ross, S.A., Westerfield R.W, and Jaffe, J.F, Corporate Finance, (7th Ed.). Boston MA: Times Mirror/ Mosby College Publishing, 2005. |

| [16] | David Ikenberry, Josef Lakonishok and Theo Vermaelen, Market underreaction to open market share repurchases, Elsevier, Journal of Financial Economics, 39 , pp. 181-208, 1995. |

| [17] | Clifford P., Stephen and Michael L., Weisbach, Actual Share Reacquisition in Open-Market Repurchase Programs, The American Finance Association,The Journal of Finance, Vol. 53, No. 1, pp. 313-333, 1998. |

| [18] | Bong-Soo Lee and Oliver Meng Rui, Time-Series Behavior of Share Repurchases and Dividends, University of Washington, Journal of Financial and Quantitative Analysis, pp. 119–142, 2007. |

| [19] | Henk von Eije and William L. Dividends and share repurchases in the European Union, Elsevier, Journal of Financial Economics, 8, pp.347–374, 2008. |

| [20] | Douglas J. Skinner, The evolving relation between earnings, dividends, and stock repurchase, Elsevier, Journal of Financial Economics, 87, pp. 582–609 2008. |

| [21] | Guay, W. and Hartford, J. (2000). The cash flow permanence and information content of dividend increases versus repurchases, Elsevier, Journal of Financial Economics, 57, pp. 385-415, 2000. |

| [22] | On Kit Tam and Monica Guo-Sze Tan, Ownership, governance and firm performance in Malaysia. John Wiley & Sons, Inc, Corporate Governance: An International Review, 15, No. 2, pp. 208-222, 2007. |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML