-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2013; 3(1): 54-58

doi:10.5923/j.mm.20130301.11

Factors Influencing Access of Poultry Farmers to Credit: The Case of the Agricultural Development Bank (ADB) in Ga East Municipality, Ghana

Fred Nimoh 1, Enoch Kwame Tham-Agyekum 2, Maxwell Seth Awuku 1

1Department of Agricultural Economics, Agribusiness and Extension, KNUST, Kumasi, Ghana

2Department of Agricultural Extension, University of Ghana, Legon-Accra, Ghana

Correspondence to: Enoch Kwame Tham-Agyekum , Department of Agricultural Extension, University of Ghana, Legon-Accra, Ghana.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

This study investigated the factors influencing poultry farmers’ access to credit with particular reference to the Agricultural Development Bank (ADB) in the Ga-East Municipality. Primary data was collected from a total of 61 poultry farmers sampled from three communities in the Municipality using the simple random sampling technique. To determine the extent to which borrowers’ and enterprises’ characteristics influenced access to ADB’s credit, the regression probit model was employed. Results of the study indicated that majority of the farmers belonged to a farmer-based organization. Secondary occupation and farmer-based organization membership positively influenced access to credit and were significant at (p<0.01) level, market turnover and age on the other hand, directly and indirectly influenced access to credit and were significant at (p<0.05) and (p<0.10) levels respectively.

Keywords: Access, Agricultural Development Bank, Credit, Farmers, Ghana, Poultry

Cite this paper: Fred Nimoh , Enoch Kwame Tham-Agyekum , Maxwell Seth Awuku , Factors Influencing Access of Poultry Farmers to Credit: The Case of the Agricultural Development Bank (ADB) in Ga East Municipality, Ghana, Management, Vol. 3 No. 1, 2013, pp. 54-58. doi: 10.5923/j.mm.20130301.11.

Article Outline

1. Introduction

- Agriculture the world over continues to contribute to economies in various ways. In developing economies, for instance, it is the livelihood of the very many who live in the rural areas. Now-a-days much of the world’s agriculture is struggling and starved of the much needed investment[1]. Heads of state and governments meeting at the 2005 world summit at the United Nations stated that they recognize the need for access to financial services, in particular for the poor, including through microfinance and microcredit[2]. This reflects what must be and increasingly is a concern of development and poverty eradication policy at national and local levels. Agriculture is typically a capital-intensive industry with investments in farmland, building, machinery, equipment, and breeding livestock dominating the asset structure of most types of farms[3]. However many of these investments have been identified to depend on success to appropriate financial services of which the provision of, and access to credit is prominent[4].Agricultural credit plays a very important role in the development of the agricultural sector. It can meet a range of needs and can be critical to the success of agriculture. In fact, circumstantial evidence shows that where agriculture has grown more rapidly, institutional credit has expanded more rapidly[5]. Credit does not only serve as a valuable source of liquidity in responding to risk, but also readily available credit has facilitated many of the significant, long-term challenges in the farm sector increasing commercialization, larger farm sizes, fewer farms, greater capital intensity, adoption of new technology, stronger market coordination and others[6].The need for credit can, therefore, not be overemphasized. In Ghana, this need gave rise to the establishment of the Agricultural Development Bank (ADB Act 286) in 1965 to promote the development and modernization of agriculture and allied industries, one of which is the poultry industry under the livestock subsector. The ADB is currently the largest provider of credit to farmers in Ghana. It, however, allows for a balance in the distribution of its loanable fund between the agricultural sector and the rest of the economy. Below shows the banks performance in terms of credit supply to the agric sector and recovery rates as a whole.ADB faces difficulty in recovering agricultural loans compared with loans for personal and non-agric purposes. According to the ADB, some farmers feel loans made available to them are from government sources and therefore are not under any compulsion to pay back. Other reasons given for this include: inadequate logistics to monitor farmers, unreliable locations and other risks associated with the enterprise with regards to production and marketing. They also face many challenges when evaluating the credit worthiness of agricultural borrowers. This is because it is argued that lenders cannot distinguish between borrowers of different degrees of risk and that loan contracts are subject to limited liability whereby borrowers are not responsible for repaying loans out of their pockets if the projects returns are less than the debt obligation[7].Faced with a complex risk environment such as lengthy biologically based production, marketing activities, contractual relationships with other parties, changes in asset values and other related income-generating activities, farmers are also faced with risks associated with financial leverage and unanticipated changes in interest rates, debt servicing requirements, and credit availability. Again, when subject to financial analysis, the farm sector’s financial statement indicate a reasonable solvent industry, but one that experiences chronic liquidity problems and cash flow pressures resulting from relatively low, but volatile, current rates-of-return to farm assets. These characteristics make the farm sector’s debt servicing capacity and credit worthiness vulnerable to downward swings in farm income and land values[3].The constraints that the farm sector faces in accessing financial services can be classified as internal and external factors[8]. The internal factors are lack of collateral due to poor quality of farm assets, poor financial management, risky nature of farm production and inability to prepare viable project proposals. The external factors are high interest rates; high cost of service delivery to the sector and perception of financial services providers about farming as being high risk. And even where banks advance loans to the farm sector, the preference is for funding less risky and shorter duration processing activities and trade, cold storage facilities, and large-scale milling and plywood manufacture, rather than for primary production (like poultry) and fishing.In view of the above, if credit is available according to[9], the general question raised in this study is, what factors influence access to ADB’s credit, especially i) what sources of credit are available to poultry farmers, ii) what factors influence access to ADB’s credit, iii) what do poultry farmers use credit from the ADB for and iv) what constraints do poultry farmers face in accessing credit from the ADB.

2. Materials and Methods

- The target population was all poultry farmers in the Ga-East Municipality. Three communities namely: Abokobi, Boi and Oyarifa were chosen for the study. This was because most of the poultry farmers were concentrated there and they formed the majority farmers in the municipality. Sixty one poultry farmers were selected randomly within these three communities. Nine were sampled from Abokobi, 15 from Boi and the remainder from Oyarifa. Both primary and secondary data were used for the study from poultry farmers and on loan amount to the agric sector and their recovery rates from the ADB, and list of poultry farmers from MoFA Directorate of Ga East Municipality. Descriptive statistics such as frequency table, charts and percentages were used to analyse the data collected to achieve objectives one, three and four. To achieve objective two, the probit model was used to analyse the factors influencing access to ADB’s credit by poultry farmers in the Ga East Municipality.

3. Results and Discussion

3.1. Farmer Based Organization (FBO) Membership

|

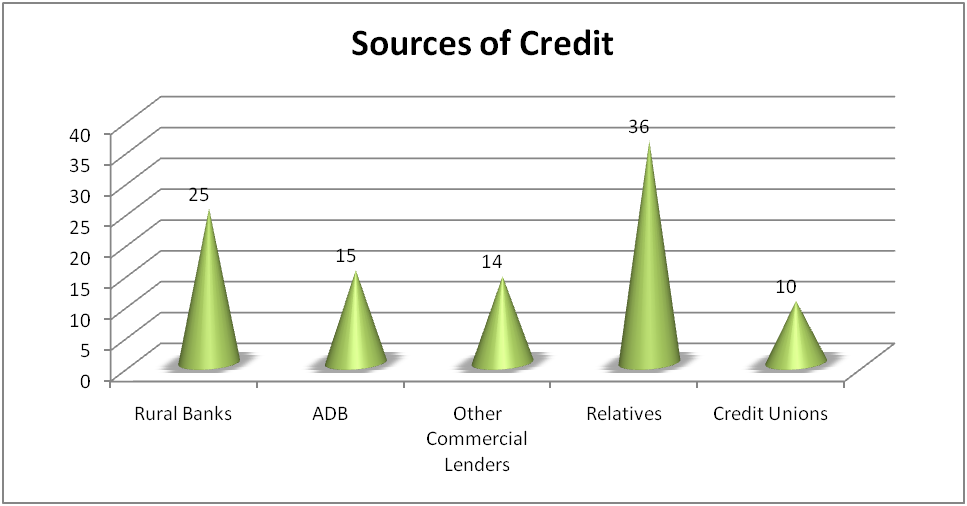

3.2. Sources of Credit

| Figure 1. Sources of credit available to poultry farmers |

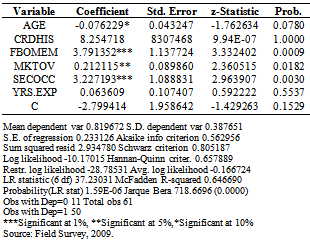

3.3. Analysis of Factors Influencing Access to Credit

|

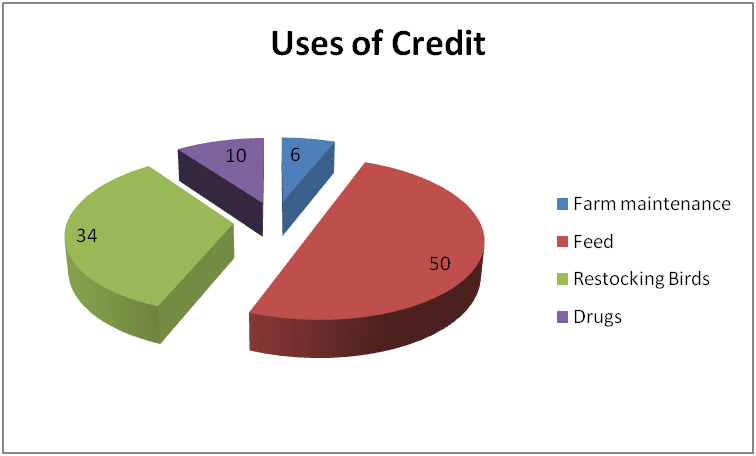

3.4. Uses of Credit

| Figure 2. Uses of credit by the poultry farmers |

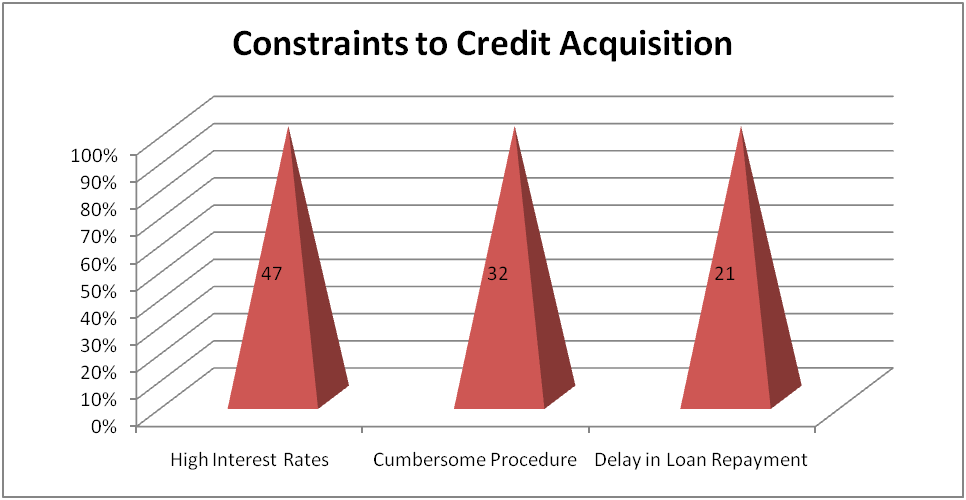

3.5. Constraints to Credit Acquisition

| Figure 3. Constraints to credit acquisition by the poultry farmers |

4. Conclusions

- A good number of the poultry farmers (46%) still preferred to borrow from informal sources to supplement that from the formal sources. Estimates of the probit model revealed that age, FBO association, market turnover and secondary occupation(s) of poultry farmers significantly affected the use of ADB’s credit. Other variables such as years of experience and credit history of farmers did not significantly affect the use of ADB’s credit. Credit use indicated that feed constituted 50% of credit use with the remainder (50%) going for other costs of production such as restocking of birds, purchase of drugs and farm maintenance. Among the constraints identified by poultry farmers affecting the access to credit included high interest rates, cumbersome loan procedures and delay in the repayment of loans among individual members of FBOs. It is recommended that there should be co-operation of indigenous NGO’s with ADB to relieve the latter of the bureaucratic procedures of financial intermediation. The intermediation such NGO’s could play would be to work on behalf of individual borrowers. Credit terms and conditions should be reviewed to allow for production by small scale poultry producers. There should be concessional interest rate special for poultry production. MOFA should strengthen small FBO’s to empower poultry farmers to access credit and finally, venture capital should be provided for experienced poultry farmers.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML