-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2013; 3(1): 39-44

doi:10.5923/j.mm.20130301.08

Cost Structures in Organizations: A Strategic Paradox

Nikolai Wasilewski

Department of Strategy, Entrepreneurship, Information Systems & Technology Management, The Graziadio School of Business and Management, Pepperdine University, Los Angeles, CA, 90045, U.S.A

Correspondence to: Nikolai Wasilewski , Department of Strategy, Entrepreneurship, Information Systems & Technology Management, The Graziadio School of Business and Management, Pepperdine University, Los Angeles, CA, 90045, U.S.A.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

Cost-cutting has been a common means in efforts to improve a firm’s ‘bottom-line’ during times of declining revenues, despite the evidence that cost-cutting has generally produced mixed results on profitability. In this paper, cost structures in firms are conceptualized as being a strategic paradox created by concurrent opposing forces which necessitate the firm to give consideration to simultaneously increasing and decreasing the cost structure. These pressures are explored via a classification of cost-programs to address alternative cost-pressures faced by firms.

Keywords: Cost-Cutting, Organization Cost-Structures, Strategic Cost-Management

Cite this paper: Nikolai Wasilewski , Cost Structures in Organizations: A Strategic Paradox, Management, Vol. 3 No. 1, 2013, pp. 39-44. doi: 10.5923/j.mm.20130301.08.

Article Outline

1. Introduction

- Organizations often employ cost-cutting as a means to sustain or improve their profitability. For example, cost-cutting may be applied during competitive battles for market share where cost structure reductions from improved operational efficiency are translated into lower prices to the customer. Also, for example, cost-cutting may be implemented to maintain positive cash flow and profitability during times of declining revenue stemming from economic downturns. The common basis for cost-cutting, especially when the cost-cutting is of the ‘x% across-the-board’ type, has been the implied assumption of unidirectional causality that, at least in the short-run, cutting costs directly yields greater profitability and/or cash flow. Yet, studies have demonstrated that cost-cutting may not have the desired effect on profitability, in part due to the differential impact of cost-cutting of varied organizational functions and activities on firm performance[1]. As such, the short- and long-term effect of cost-cutting on a firm’s profitability is influenced by the object, nature, and magnitude of the cost-cutting programs. This paper explores cost structure and cost-cutting relationships to revenue generation and to profitability, and offers an alternative conceptualization of cost structures. A model is proposed as a means to conceptualize generic situations when costs are candidates for decrease (i.e., cost-cutting), for increase (e.g., increased expenditures), or both (cost-reallocation). It is understood that costs are complex structures, characterized by and containing varied components, such as fixed and variable costs, discretionary and non-discretionary costs, etc. However, for purposes of simplicity, brevity, and clarity, the conceptual presentation and model development in this paper represent an initial attempt to view organizational costs as strategic paradoxes and, thus, approach costs in their totality. Necessarily, future theoretical and empirical studies should expand on the ideas presented here with consideration to the inherent complexities of organizational cost structures. (Note: it is recognized that positive cash flow may be viewed by the firm as important as, if not more so than, profitability; for illustration, profitability is employed in this paper; however, the conceptual framework may also be applicable to cash flow.)

2. The Driver(s) of Profitability

- In its simplest form, the relationships among a firm’s revenue, cost-structure, and profitability is commonly represented by the equation:Revenue minus Cost equals ProfitorR - C = PNow, consider two questions of this equation (for purposes of conceptual simplicity and illustration, extreme situations are employed here): first, is it possible to have costs (i.e., a cost structure), C > zero, and not have revenue, R = zero ? second, is it possible to have revenue, R > zero, but not have costs, C = zero ?With regard to the first question, the answer is likely yes. This may occur in situations as, for example, where the firm is a startup, with fixed and variable costs incurred in such activities as the production and marketing of a product (i.e., C > zero), but where sales of the product have yet to be realized (i.e., R = zero); or, for example, where costs are incurred for R&D and administrative (e.g., legal) needs (i.e., C > zero), but a commercially viable product to be licensed has not been fully developed (i.e., R = zero).With regard to the second question, the answer is likely no. As described by the concept of the ‘value chain’[2], at the very minimum, some amount of fixed and variable costs are required for the mere existence of the firm and the activities (e.g., production and sale of product, management of the firm, etc) necessary for the generation of revenue.Thus, if costs can exist without revenues, but revenues cannot exist without costs, then the only way to obtain (positive) profit is through the existence (generation) of revenue, with revenue exceeding costs. Hence, it follows that the existence of revenue ‘drives’ the existence of profit; that is, irrespective of the magnitude of costs, profit cannot exist unless revenue exists. Furthermore, it follows that the existence of revenue is ‘driven’ by the existence of costs; that is, irrespective of the existence of (positive) profit, revenue cannot exist unless costs exist.Although the foregoing seems straightforward and simple, firms, especially during times of revenue declines, typically resort to cost-cutting efforts (often of the ‘x% across-the-board’ type) to maintain, slow the decrease of, and/or increase profits[3]. Such decisions, assuming the existence of revenue (R > zero), costs (C > zero), and profit (P > zero), often reflect the logic that, ceteris paribus, increases in revenue lead to increases in profit, and reductions in revenue lead to reductions in profit; and, ceteris paribus, reductions in cost (cost-cutting) lead to increases in profit, and increases in cost lead to reductions in profit. However, this assumption rests on the premise that, at least in the short-term, there is no (or little) relation between revenue and cost, potentially an unrealistic assumption. This assumption may be unrealistic as demonstrated above by the point that the existence of revenue is ‘driven’ by the existence of costs, and, as such, changes in the cost structure do impact revenue. More realistic, therefore, is that revenues and costs are related, although the relationship may vary in nature and magnitude depending on the object, nature and magnitude of the cost increases or decreases (i.e., adding value in the ‘value chain’); for example, costs focused on R&D are likely to have a different impact on revenue as compared to the same magnitude of costs focused on marketing[1]. Also, for example, engineering activities that generate increases in operational efficiency (reducing the cost structure) may be translated into reduced prices to the customer, which in turn may increase the customer’s perceived product value, then increased product purchases, and resultant increased revenue to the firm[4]. This leads to the question – ‘how does cost-cutting, through the cost - revenue relationship, affect profit?’ which is addressed in the next section.

3. Cost-Structure–Revenue Relationship

- As noted above, cost-cutting of the ‘x% across-the-board’ type, assumes unidirectional causality, i.e., cutting costs directly yields greater profitability. But, if ( R - C = P ) and if the cost structure is reduced via such cost-cutting programs, i.e., cost decreases, i.e., ↓C , then, mathematically, profit, P , can increase, i.e., ↑P , if, and only if, one the following three conditions occur to the revenue, R :R increases, i.e., ↑R , orR is unchanged , i.e., ΔR = nil, orR decreases, but the decrease in R is less than the decrease in C, i.e., ↓R < ↓C .Thus, the assumption of unidirectional causality, that cost-cutting directly yields greater profitability, may or may not hold; it may hold in the short-term but not the long-term and vice versa. There may occur, for example, improved short-term profitability with worsening long-term profitability. That is, the short- and long-term cost-cutting effect on revenue must be ascertained before any conclusion can be reached about the short- and long-term impact of the cost-cutting on profitability. As such, any cost-cutting attempts that do not explicitly include such assessments may result in reduced short- and/or long-term revenues that exceed the cost-cuts themselves and in worsening the short- and/or long-term profitability.For example, in attempts by a firm to attain and sustain a competitive advantage, the firm often attempts to adjust its value proposition to increase perceived customer value[4], so that the firm’s product (or service) value as perceived by the customer has increased and more so than the firm’s competitors[5][6]. In addition, as customer’s wants and needs from a product (e.g., product attributes and their importance) change over time[7], the perceived customer value is dynamic, necessitating the firm to continually make expenditures to understand and respond to such changes. In simple terms, this may be represented by generating awareness by the consumer about the firm’s products (and services) (e.g., through advertising), encouraging trial of the product (and service) (e.g., through special promotions), and attaining repeat purchase of the product (or service):awareness → trial → repeat purchaseThe occurrence and progression of this sequence implies added revenue for the firm. Thus, any cost-cutting that adversely interferes with the occurrence or progression from awareness to trial to repeat purchase is likely to adversely impact revenues (either in the short-term and/or long-term, depending on the object, nature, and magnitude of the cost-cutting); and, if the adverse impact on revenues is greater than the benefits obtained from the cost structure reduction, the net result is reduced short- and/or long-term profitability.The discussion in this section suggests that the strategist understand the impact of cost-cutting on short- and long-term revenue generation, but does not suggest that cost-cutting be avoided; rather, the foregoing suggests that indiscriminate use of cost-cutting (such as the indiscriminate employment of the ‘x% across-the-board’ type) be avoided, and cost-cutting be strategically assessed for its short- and long- term impact on revenue generation and firm performance. In the next section, the cost - revenue relationship is further explored to better understand the short- versus long-term strategic implications on organizational viability.

4. Focus on Revenue and/or Cost

- The foregoing discussion leads to the questions: How then to increase profit - via focus on the cost part of the equation (cost-reduction/cutting), or via focus on the revenue part of the equation (increased revenue generation), or focus on both parts of the equation? Which approach(es) is/are preferred for the short-term and/or the long-term? These questions are addressed next.One approach to increase profit is to focus primarily on cost-reduction (i.e., cost-cutting), with little attention to revenue generation. If cost-cutting is applied, then as discussed above, the impact on profitability will depend on the impact on revenue. If it is assumed that the impact on revenue is reflected as one of the conditions which improve profit (i.e., R increases, or R is unchanged, or R decreases, but the decrease in R is less than the decrease in C) then the desired effect on profit is likely to be attained, at least, perhaps, in the short-term. But, two considerations need to be discussed here regarding the longer term. The first is - to what extent can these relatively desirable results to R be sustained with additional cost-cutting? The answer is - only a finite extent and duration. As noted above, revenue is driven by costs and should costs be cut so as to significantly, adversely affect the occurrence and progression of the sequence (awareness → trial → repeat purchase) via, e.g., cuts in advertising, then it is very likely that the adverse revenue declines on profit will eventually offset the cost-cutting benefits to profit. Cost-cutting thus exhibits ‘diminishing returns’ to improving profit.Second, to what extent can cost-cutting be maintained? As demonstrated in the prior discussions, costs may be cut up to a finite point - that minimum level of fixed and variable costs which enable the firm to exist and function (although not necessarily in a profitable state) (refer to the foregoing discussions).Hence, ceteris paribus, attempts to maintain and/or improve profitability through a continued cost-cutting focus alone, although perhaps feasible in the short-term, are unlikely to be viable or sustainable in the long-term. For example, research has indicated that cost-cutting via downsizing, where employees are laid-off in attempts to increase productivity, may produce short-term gains in productivity; however, over time, there may be resultant adverse physical and mental health impacts on those employees remaining in the firm[8][9][10] that may actually decrease productivity to sufficiently offset the short-term gains and to produce more serious, adverse, longer-term consequences on future revenue generation and profitability. Similarly, it has been reported that in economic recoveries, firms that had employed more focused, limited approaches to layoffs were more likely to have better (financial) performance than those firms that had employed deep ‘across the board’ type layoffs[11].Another approach to increase profit is to focus primarily on revenue generation/enhancement, with little attention to the costs. This approach is similar to the idea of ‘attaining market share at any cost’. A minimum of revenue generation (and market share) may be necessary to attain profitability, as in the case of e.g., a ‘minimum critical mass’ of subscribers to sufficiently cover costs to attain the ‘break even’ point (else the firm is not likely to survive). But, revenue generation is ‘driven’ by costs, and as in the market share example, incremental market share gains require incremental costs expended. As the market share is increased, then it is likely that subsequent incremental market share gains require proportionally greater incremental costs expended (i.e., there are diminishing returns to cost expenditures in generating additional market share gains). If continued unchecked, the result may likely be marginal benefits (i.e., increased revenues) from additional market share at marginal costs (to obtain that additional revenue) which exceed the marginal benefits which, if persisted, lead to eventual loss of profitability and firm demise[12]. Thus, as with ‘single-focused cost-cutting’, a ‘single-focused revenue generation’ approach to increasing profit is subject to diminishing returns and finite applicability. And, hence, ceteris paribus, attempts to maintain and/or improve profitability through a continued revenue generation focus alone, although perhaps feasible in the short-term, is unlikely to be viable or sustainable in the long-term.The foregoing suggests that for both short- and long-term (sustainable) profitability, attention is likely needed on both revenue generation (increase) and cost-reduction simultaneously. Because an ‘over-attention’ on one element (cost-reduction or revenue generation) with an ‘under-attention’ on the other element (revenue generation or cost-reduction, respectively) is unlikely to be strategically viable in the long-term, there thus needs to be ‘balanced-attention’ on both cost-reduction and revenue generation, which is consistent with the study on integrative thinking as a characteristic of successful strategic leadership[13]. The nature of this ‘balanced-attention’ is reflected by the concurrent pressures of pressures for cost-reduction and pressures for revenue increases, which is discussed in the next section.

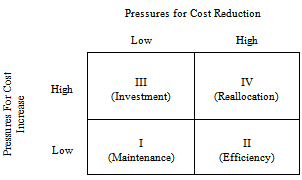

5. The Dual Pressures on Cost

- The nature and magnitude of pressures for cost-reduction are likely to vary according to the internal (organizational) and external (environmental) challenges / changes faced by the firm. Pressures for cost-reduction may be manifested in for example, demands for increased operational efficiency derived from competitive pressures to maintain ‘cost parity’[14] or in demands to maintain profitability during decreasing revenues (from e.g., a declining economy (such as a recession) and/or decreasing market size for the product/service).Similarly, the nature and magnitude of pressures for revenue increases are also likely to vary according to the internal (organizational) and external (environmental) challenges / changes faced by the firm. Pressures for revenue generation (increases) may be manifested in, for example, demands to offset growing costs stemming from inflationary conditions, or in demands to increase profits to fund product R&D programs to develop new products and services. However, as demonstrated earlier, the existence of revenue is ‘driven’ by the existence of costs; that is, irrespective of the existence of (positive) profit, revenue cannot exist unless costs exist, it may be reasonable to assert that pressures for revenue generation (i.e., increases) reflect pressures for cost-increase(s).It follows that the above-derived notion of ‘balanced-attention’ on the ( R - C = P ) equation for attainment of both short- and long-term sustainable profitability suggests that the cost structure of a firm, C, is, thus, subject to the simultaneous dual pressures for reduction and increase, and may be considered a (strategic) paradox[15]. Such paradoxes, where there exists a duality of opposing (conflicting) pressures, are not uncommon and have been studied in a variety of disciplines. For example: the need for both differentiation and integration in organizational design[16], pressures for both external flexibility and internal efficiency in the formulation of international strategy[17], and organizational needs to be “... aligned and efficient in its management of today's business demands while simultaneously being adaptive to changes in the environment ...”[18: p.375] which has been characterized as a duality[19] and as organizational ambidexterity[18][20].

|

6. Conclusions

- In this paper the relationships among revenue, cost, and profit were discussed. It was concluded that the existence of revenue ‘drives’ the existence of profit; the existence of revenue is ‘driven’ by the existence of costs. Thus, the short- and long-term cost-cutting effect on revenue must be ascertained before any conclusion can be reached about the short- and long-term impact of the cost-cutting on profitability. In addition, it was argued that for long-term strategic viability, there also needs to be ‘balanced-attention’ on both cost-reduction and revenue generation. This ‘balanced attention’ is reflected as a strategic paradox from the need to simultaneously address dual pressures for cost-reduction and cost-increase. A generic framework (CRCI Grid) was proposed as a means to address this paradox. The GRCI Grid suggests that firms may face differing combinations of pressures for cost-reductions and cost-increases, and that certain cost programs are more suitable than others in addressing the pressures. For example, while an Efficiency program is likely to be more effective addressing the cost pressures characterizing Quadrant II, it is likely to be less effective addressing the cost pressures characterizing Quadrant III (where the Investment program is likely to be more effective). Furthermore, employing an either-or approach (i.e., either Efficiency or Investment) in Quadrant IV is likely to be less effective than employing Reallocation (i.e., both Efficiency and Investment). Because internal (organizational) and external (e.g., competitive, economic, technological, etc.) environments change, the firm may find itself in different CRCI Grid quadrants at different times. As such, the firm ought not to apply cost-cutting or cost-increase (e.g., revenue-generation) programs indiscriminately, nor apply the same cost program in different quadrants. Rather, for best short-term and long-term results from a cost-program, it is imperative for the firm to continually determine the nature and magnitude of the cost-pressures it faces and then design the appropriate cost-program to deal with those pressures.The above described approach offers conceptual insights into understanding the relationships between programs for revenue generation and cost-cutting, and their impact on firm profitability. A model is proposed to enable the selection of the more appropriate cost-program to address the cost-pressures faced by the firm. However, to apply and extend the framework, much additional theoretical and empirical research is needed, for example, to understand internal and external environmental sources of the cost-pressures as well as the explicit nature (characteristics of), relationships among, and relative strategic viability of the four alternative cost-programs identified. Furthermore, this paper approached costs in their totality; but, costs may be classified into fixed and variable components (the proportion of which vary across industries reflecting the capital intensity requirements in the industry), which may lead to additional complexities and refinements to the CRCI Grid. Overall, this paper has contributed to the understanding of cost-cutting in firms and suggested a topology of cost-programs to address alternative cost-pressures faced by firms, and an approach for selection of the appropriate cost-program.

ACKNOWLEDGEMENTS

- The author wishes to acknowledge the useful comments provided by the reviewers of this paper and of the earlier version (which appeared in Erdener Kaynak and Talha D. Harcar, (Editors), Advances in Global Management Development, pp. 9-14, 2010).

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML