-

Paper Information

- Next Paper

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2012; 2(5): 204-213

doi: 10.5923/j.mm.20120205.09

Linking Innovations with Productivity in a Nigeria Banking Firm: What roles for ICT?

Omotoso K. O. , Dada A. D. , Adelowo C. M. , Siyanbola W. O.

National Centre for Technology Management (NACETEM), Obafemi Awolowo University, Ile-Ife, Nigeria

Correspondence to: Adelowo C. M. , National Centre for Technology Management (NACETEM), Obafemi Awolowo University, Ile-Ife, Nigeria.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

In the current knowledge-based era, the role of ICT in boosting productivity and economic growth cannot be over-emphasised. In this era, the Banking system constitutes a very important link between savings (capitalist) and investment (entrepreneurs). The banking system contributes significantly to economic development through venture financing in key sectors of the economy. Over the years, the operations of Nigeria banking sector were manual in nature. The advent of technology explosion however, had made the services faster and efficient. This paper therefore examines the roles of ICT on service delivery in a Nigeria banking firm. This is with a view to making suggestions that can improve the productivity of the banking industry in Nigeria. A survey technique was adopted using structured questionnaire with random samplingon 100 respondents of the bank. The result of the study reveals that ICT had made impacts on the productivity of the bank. However, factors such as affordability of the ICT equipment, high installation and maintenance cost, cultural factors, capability factors, inadequate skilled manpower, network connectivity, cybercrime and response to ICT dynamism among others pose challenges to the applications of ICT in the bank. Some strategies for mitigation of these challenges are suggested.

Keywords: Innovations, Productivity, ICT, Bank, Technology

Cite this paper: Omotoso K. O. , Dada A. D. , Adelowo C. M. , Siyanbola W. O. , "Linking Innovations with Productivity in a Nigeria Banking Firm: What roles for ICT?", Management, Vol. 2 No. 5, 2012, pp. 204-213. doi: 10.5923/j.mm.20120205.09.

Article Outline

1. Introduction

- The adoption and utilization of Information and Communication Technology (ICT) is fundamental to the growth and sustainability of banking system. It is a requirement for local and global competitiveness. As a result of globalization, the deployment of ICT in the banking sector has increasingly become an essential factor for business development and a platform for gaining competitive advantage, especially in a highly competitive industry like banking. This therefore, made it imperative for banks to invest in ICT to meet certain requirements for modern payments system designed to handle large scale processing of transactions[26]. Over the years, the Nigerian banking industry has undergone remarkable operational changes; from the use of tallies and registers to cutting-edge technologies such as computers, automated teller machine (ATM), point of sales (POS) among others. In the past, much time is required to consummate business transactions successfully like cheque clearing, local and international money transfers among others. This inefficiency was due to the manual approach to initiating and completing business transactions in the banking system. Also, the internal banking operations such as the inter-branch reconciliation, payroll system which deal with the remuneration, leave application, and other staff requests in the bank were less efficient. Given the challenges associated with the use of manual approach to banking and the dynamic nature of the environment that the industry operates in the country necessitated the adoption of modern technologies, especially ICT, by the Nigerian banking sector. This was aimed at improving service delivery and internal operations [3].Consequently, the adoption of ICT by the Nigeria banking industry significantly increased the efficiency of the banking operation and external customers’ business transactions. It generated a platform where customers can transact and carry out business dealings across borders without physical interface with their bankers. ICT application in form of electronic banking in the sector has also caused an unprecedented growth and transformed conventional practices in the banking industry[13]. Despite the various challenges associated with the deployment and utilization of ICT in the Nigerian banking sector, its usage has resulted in remarkable transformations of the industry. This paper therefore examines the roles of ICT on service delivery in a Nigeria banking firm. This is with a view to making suggestions that can improve the productivity of the banking industry in Nigeria.

2. Review of Related Literature

2.1. Historical Background of Intercontinental Bank Plc

- Intercontinental bank Plcwas founded in 1989. The bank is one of the corporate Nigeria’s most established brands. As part of the reform-induced consolidation process in 2005, Intercontinental Bank executed a merger with three other banks: Equity Bank of Nigeria Plc, Global Bank Plc and Gateway Bank Plc. According to its un-audited interim results at August 31, 2006, Intercontinental bank has a capital base in excess of N61bn ($491m) ranked as Nigeria’s fourth most capitalized bank. Intercontinental Bank was in the market to raise an additional N50bn ($403m) by way of a combined rights issue and public offer for subscription. According to interim results for the first six months of the bank’s financial year to August 2006, interest income was close to 150% on the same period in 2005. Profit before tax was up 91.4% to N8.14bn ($66m) and the proposed interim dividend is up 100% at N3.2bn ($26m). As at the end of February 2007, the bank has 280 branches nationwide. Around the same time, Intercontinental bankobtained approval in principle to commence operations of its continental expansion in Ghana. The bank also attempted to build its presence in major financial centres, including South Africa, the UK, USA, Hong Kong and Dubai among others.Intercontinental Bank also declared the highest ever profit before tax (N22.6 billion) by any quoted company in the history of the Nigerian Stock Exchange in the year 2006.. The bank surpassed all its projections for its financial year ending February 2007. It’s profit before tax grew by 121%, profit after tax by 105%, Gross revenue by 113% while total assets climbed by 101%. Analysts described the financial performance of Intercontinental Bank as meteoric; noting that the bank is redefining the scope of competition in the country’s banking landscape with many Nigerian Banks scurrying to the capital market and seeking international partnerships to accelerate their growth strategies.

2.2. ICT and Banking Sector Reform in Nigeria

- ICT in banking industry started with an attempt to automate the process of banking services. Simple electro-mechanical devices such as note counters and accounting calculators were then introduced to effect speed on basic transactions such as computation and money counting. However, in the 1950s and 1960s, information storage and retrieval technology which involve business data processing through punched card equipment and massive mainframe computers with lower capabilities than today’s microcomputers. The 1970s saw the advent of the primitive user networks as terminals got connected to the massive mainframes due to the challenges posed by large volumes of business data. This was the foundation of the era of Management Information System (MIS) and Decision Support System (DSS). The 1980s witnessed the fusion of telecommunications and networking technologies for business deployment. This was furthered by the emergence of data processing, office information system (OIS) and personal computers (PC). The 1990s till date advances technology which has transformed the banking operations business and how the emerging global information infrastructure has shapened and support potential networking technology to enhance corporate performance and competitiveness[23].Computerization in the banking sector increases profitability of the bank as a result of the improvement in the services of the computers which reduces the cost of business operations. In today’s business environment, many accountants and bankers utilize computer in accounting, system auditing, and internal business control. The computerized system eliminates or reduces data duplication. The computer is very useful in all aspects of managerial decision and increases the efficiency of services offered to the customers[38].

2.3. Forms of ICT Innovations in the Banking Sector

- Technological innovations have been identified to contribute to the distribution channels of banks[18]. The various ICT innovations to enhance the banking operations are as follows: a. Automated Teller Machine (ATM)The ATM combines a computer terminal record-keeping system and cash in vault in one unit, permitting customers to enter the banks[35]. It is a book keeping system with a plastic card containing a Personal Identification Number (PIN) or by punching a special code number into the computer terminal linked to the bank’s computerized record 24 hours a day. Once an access is gained, ATM offers several banking services to customers and mostly located outside the banks, airport, shopping malls, and places far away from the home bank of the customers. ATM was introduced first to function as cash dispensing machines. However, due to advancement in technology, ATM has been able to provide a wide range of services, such as making deposits, funds transfer between two or more accounts and bill payments e.g. digital satellite television (DSTV). Banks tend to utilize this electronic banking device, as all other for competitive advantage. ATM also saves the customers’ time as saved time could be invested in other productive activities. b. Telephone Banking Otherwise called telebanking, telephone banking is a form of remote banking, which is essentially the delivery of branch financial services through telecommunication devices[24]. Telebanking has numerous advantages for both customers and banks. For the customers, telebanking provides increased convenience; expanded access and significant time saving. For the bank, the costs of service delivery telephone-based services are substantially reduced than those of branch-based services. It has almost all the impact on productivity of ATM, except that it lacks the productivity of cash dispensing by the ATM. As a delivery conduct that provides retails banking services even after banking hours (24 hours a day), it accesses continual productivity for the bank. It offers retail banking services to customers at their homes and offices. This saves customers’ time, and leads to higher productivity.c. Personal Computer Banking (PC-Banking)PC-Banking is a service which allows the bank’s customers to access information about their accounts through a proprietary network, usually with the help of preparatory software installed on their personal computer. Once access is gained, the customer can perform many retail banking functions. This encourages the growth of PC-banking which virtually establishes a branch in the customer’s home or office, and offers 24-hour service throughout the week. It also has the benefits of telephone banking and ATM.d. Internet Banking Internet banking gives customers access to their bank accounts through a website[12]. Internet banking also enables the customers to carry out certain transactions on their accounts with stringent security checks. Internet banking is described as the provision of traditional banking service over the internet[28]. Internet banking offers more convenience and flexibility to customers with absolute control over their banking activities. As an alternative delivery medium of retail banking, internet banking has all the impact on productivity of telebanking and PC-Banking. In addition, it is the most cost-efficient technological means of yielding higher productivity. e. Branch Networking Networking of branches is a computerization and interconnection of geographically scattered bank branches into one unified system in the form of a Wide Area Network (WAN) for creating and sharing of merged customers’ information and records[9]. It offers quicker rate of inter-branch transaction as distance barriers are eliminated. Hence, there is more productivity per time period. Also, with the several networked branches serving the customers as one system, there is simulated division of labour among bank branches with its associated positive impact on productivity among branches. It curtails customer travel distance to bank’s branches while it offers more time for customer’s activities.f. Point of Sale (POS) POS is an online system that allows customers to transfer funds instantaneously from their bank accounts to merchant accounts when making purchases using debit card[10]. Increased banking productivity results from the use of POS to service customers shopping payment requirements instead of handling cheques and cash withdrawals for shopping the operation which still continues after banking hours.g. Regiscoping Machine or Image MachineThis machine is a photographic and signatures verification system that permits a bank to automatically store the signatures and photograph of account holders. The benefit of this machine is to help prevent payment of proceeds of cheques to fraudsters.

2.4. Effects of ICT Innovation on Banking Activities

- Over the years, banks have adopted electronic channels to communicate and transact business with both domestic and international customers. However, the range of products and services provided by banks over the electronic channel varies widely in content, capability and complexity[37]. The challenge to expand and maintain banking market share has influenced many banks to invest more in the use of internet[33]. According to[16], majority of Saudi Arabians banks had exploited internet technology to establish web sites but few offered e-banking services. Also, in a study of e-commerce in Germany, the highest mobile users are top management; self-employed; salary earners; students; and others[7]. Another study on the impact of e-banking in Iran showed that e-banking brings productivity among Iranian banks and provides satisfactions in their service delivery[25]. Similarly,[2] investigated e-payment systems and telebanking services in Nigeria found that there has been a paradigm shift in banking industry. The system is being automated and volumes of cash transactions have declined leading to a better banking operations and productivity.

2.5. Challenges of ICT in Banking

- ICT fosters online exchange of information dialogue. This enables faster resolution of conflict and quickerdetermination of a customer need. However, Nigerian banks face a lot of challenges.The most identified challenge is Nigeria’s poor infrastructure. Electricity supply is sporadic and inefficient. Nigeria also has very low internet penetration with less than one internet service provider per thousand people.[31] highlighted the following as the identifiablechallenges facing Nigerian banks in the effective implementation of ICT.i. Low internet connectivityThough there is a growing dependence on internet technology, there has been low supply in terms of connection speed. However, the introduction of wireless system has improved the efficiency rate.ii. Low Tele-densityNigeria has one of the lowest tele-densities in the world. Teledensity refers to the number of landline telephones in use per 100 individuals living within an area. A teledensity greater than 100 means there are more telephones than people. It is however practically impossible to grow and expand the Nigerian financial market without adequate telecommunication infrastructure.iii. Dearth of E-WorkforceNigeria was rated low on the technological achievement index (AI) by the UNDP human development. This is largely connected with technological incapacities of the country. Moreover, inadequate knowledge of best practices in IT utilization as well as IT-related skill deficiencies also constitutes a constraint to the optimal utilization of ICT in the banking sector.iv. SecurityAccess to bank servers by unauthorized individuals poses a great threat to the utilization of ICT in the Nigeria’s banking industry. Fraud and counterfeit money are challenge confronting ICT-enhanced banking. It is not enough to acquire sophisticated ICT equipment but exposure to information-technology related failure should be minimal. Moreover, an empirical investigation on the adoption of e-banking in Nigeria ascribed the major inhibiting factors to insecurity[8].

3.Research Design and Sampling Technique

- The study adopted a survey technique with 100 respondents randomly selected from Intercontinental Bank Plc., Ile-Ife branches, Nigeria. These respondents were made up of the officials and customers. Two sets of structured questionnaire were administered on the respondents with a view to eliciting relevant information for the study.Secondary sources of data such as annual reports of the bank, journals, magazines and internet information were also utilized. The results were analyzed using descriptive statistics such as frequency tables, percentages and presented in form of charts where necessary.

4.Result and Discussion

4.1. Types of Bank Account of the Respondents

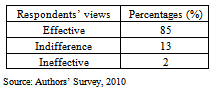

- As shown in Fig 1, most (55%) of the respondents are savings account holders while only 2% operate fixed account. This might not be unconnected with the fact that the savings account has some innovative features which offer an advantage of a debit card which can be used on POS terminals and ATM to access funds conveniently from their accounts.

4.2. ICT and Bank’s Growth and Productivity

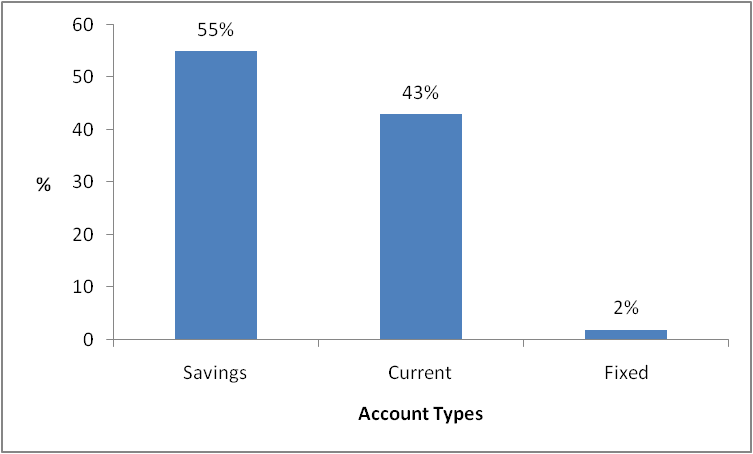

- A research in 2008 found that there was a rise in the growth and productivity of the European Union industries from the year 2000 while there was a simultaneous drastic reduction in the average working hours of the workers in most countries, especially in the retail banking sector. This feat was attributed to the adoption and usage of ICT in the industries[34]. In a similar study, it was established that increases in the size and productivity of the ICT sector and growth in industries are associated with the appropriate utilization of ICT within the relevant context[27]. The adoption intensity of ICT in the banking industry has impacted positively on the speed of banking operations and efficient service delivery, workers’ productivity, and banks’ profitability[30]. Our findings in this study also revealed that ICT has led to the bank’s growth and productivity as attested by the majority (89%) of the respondents (Fig 2). This corroborated the findings of[13] that ICT has led to the growth and transformation in the traditional practices in the banking industry.

| Figure 1. Types of Respondents’ Bank Account (N=100), Source: Authors’ Survey, 2010 |

| Figure 2. ICT and the Bank’s Growth and Productivity (N=100), Source: Authors’ Survey, 2010 |

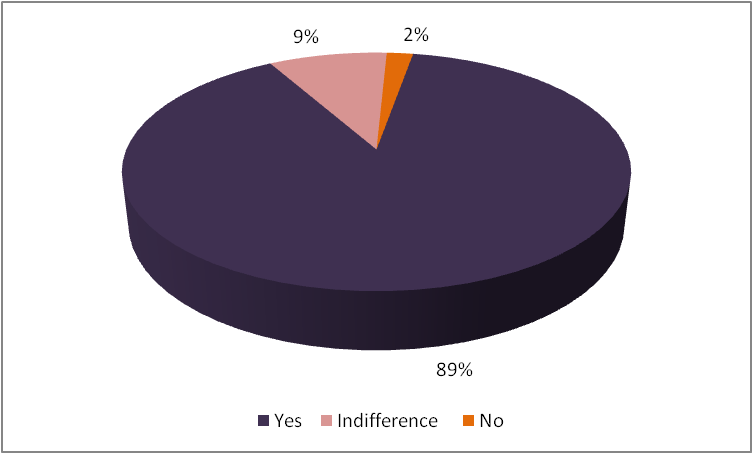

| Figure 3. Effects of ICT on customers’ satisfaction (N=100), Source: Authors’ Survey, 2010 |

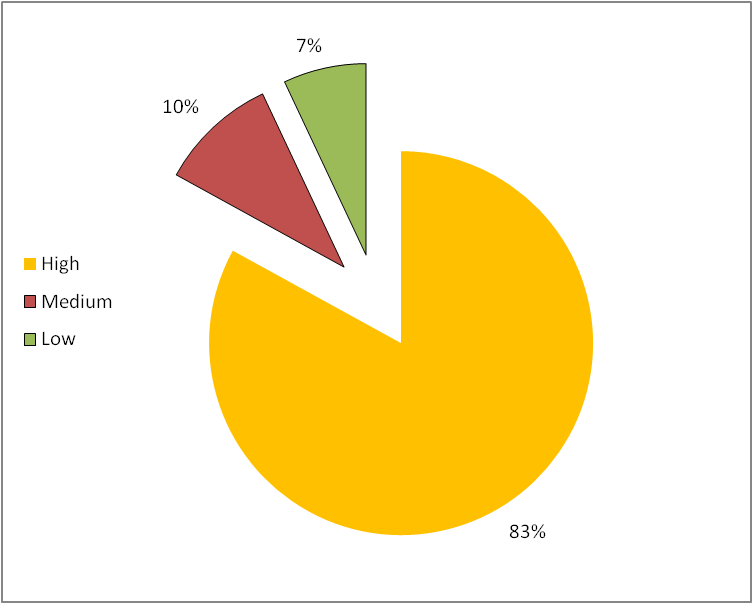

4.3. Application of ICT and Customers’ Satisfaction

- Several studies[20, 22] have shown the impact of ICT on customers’ satisfaction.In a study by the US retail service; the high sales were attributed to the innovative capacity of the retailers who laid emphasis on customer service and satisfaction. About 70% of the respondents reported that ICT-enabled technologies had at least some priority in their strategy to drive customer satisfaction, an improvements to the recorded 67% in a related study in 2007. Also, 85% of respondents affirmed that ICT-based customer-facing tools and devices had priority in their strategies to drive customer satisfaction. Moreover, the findings of the impact of ICT-facilitated banking system in Iran showed that its application has resulted into the provision of services that the customers are deriving satisfaction with particular reference to the use of e-banking[25]. This is in agreement with our findings, illustrated in the Fig 3, with most (83%) of the respondents affirming that the usage of ICT by the bank has resulted in their high level of satisfaction. Our findings also support the assertion that customers were delighted with the tremendous improvement on statement generation, accounts reconciliation and balance enquiries which were as a result of utilization of computerized systems of operation[3].

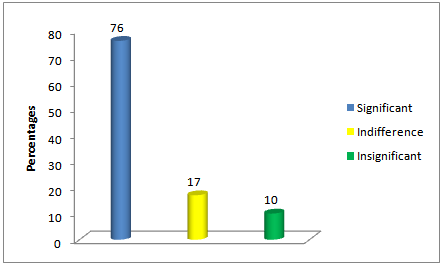

4.4. ICT Utilization and Service Delivery

- Assessing the impact of ICT on service delivery and business value is an important subject for researchers, business managers and other stakeholders[32]. Service constitutes a considerable element of any business ventures and the application of improved ICT in delivering services to customers can enhance both internal and external business operations. Furthermore, the utilization of ICT solutions by business organisation can transform significantly the service delivery to its customers[5]. Although, little research is reported about the impact of ICT investments on service delivery in business organizations[36], a great understanding of the role of ICT in business value and service deliverycan provide investors more confidence and direction in their ICT utilization in order to improve customers’ satisfaction[32]. Moreover, our findings that ICT has a significant impact on service delivery as admitted by 76% of the respondents is consistent with the findings of[29] which established that developments in ICT have impacted positively on service delivery in the Nigeria’s financial sector (Figure 4).

4.5. ICT Adoption and its Effect on Transaction Processing

|

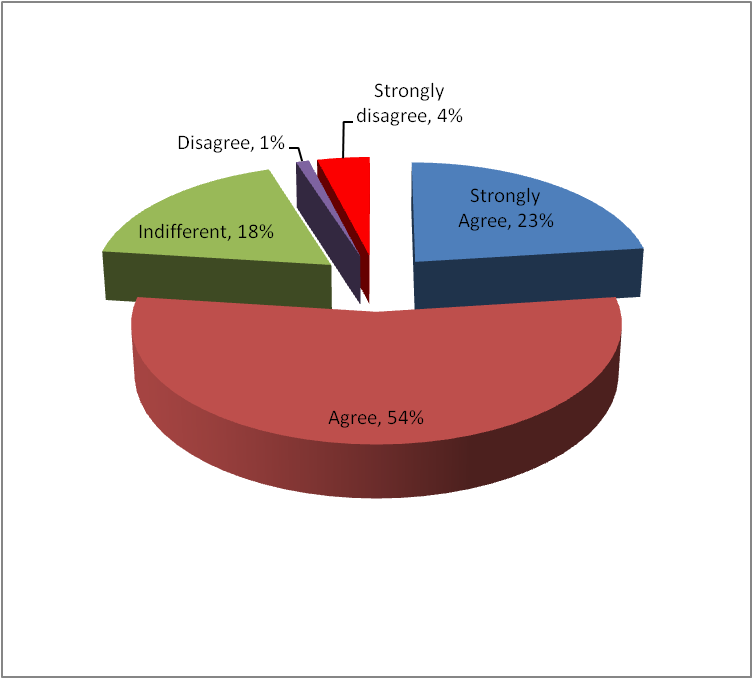

4.6. ICT Utilization and Convenience

- ICT-enhanced payment system such as electronic payments mode are laudable innovations in the Nigeria’s banking sector. They provide a range of convenient electronic payment mechanisms that make internet purchases easier without necessarily having physical and face to face contact with the bankers. In a study by[3] the adoption of ICT in the Nigeria’s banking sector has enhanced business hour and quicker services.A similar research[6] had majority (84%) of the respondents indicating that e-banking is very convenient and flexible. These respondents believed that it has reduced the stress and time wastage associated with queues in the banking hall and has improved business transactions.From our findings as shown in Fig 5, most (54%) of the respondents also agreed that ICT has led to convenient business hours for them.

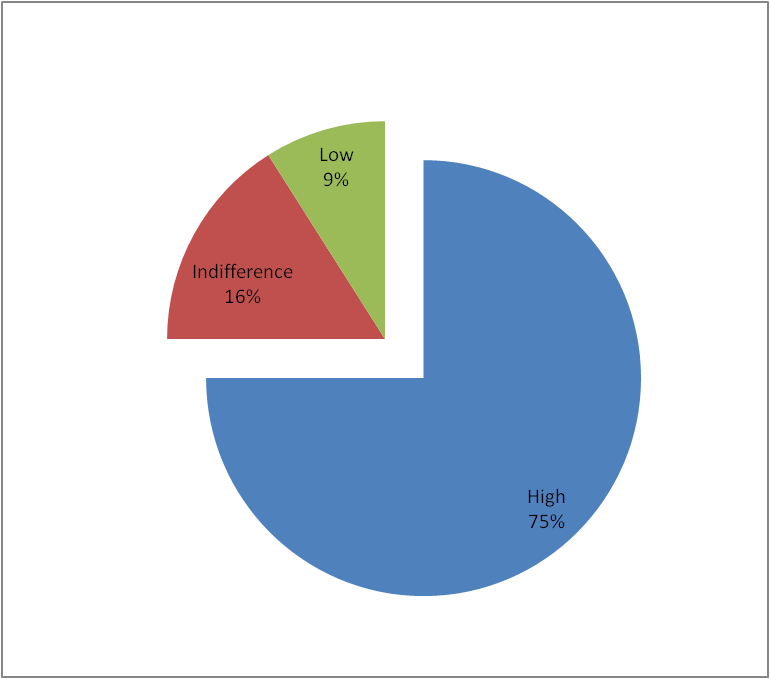

4.7. ICT-Enhanced banking and Customers’ Patronage

- A research found that ICT has appreciable positive effects on banking productivity and increased customers’ patronage [1]. Also, an investigation into the relative importance of banking services to business customers’ needs and choices established availability of ICT as the true determinants of bank selection[11]. Our findings (Figure 6) revealed that 75% of the respondents affirmed that theuse of ICT has attracted more customers and improved business transaction rate of the bank.

| Figure 4. ICT and service delivery (N=100), Source: Authors’ Survey, 2010 |

| Figure 5. Respondents’ view on ICT effect on convenient business hour (N=100), Source: Authors’ Survey, 2010 |

| Figure 6. Customers’ patronage and ICT usage in the Bank (N=100), Source: Authors’ Survey, 2010 |

4.8. ICT and Bank’s Competitiveness

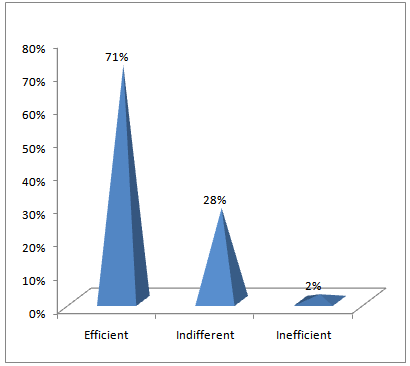

- ICT Innovation is a significant driver for increasing the competitiveness and soundness of the banking sector and a potent tool in enhancing bank’s competitiveness[19]. ICT-enhanced banking enable banks to gain competitive advantage and market share if their attendant problems such as ineffectiveness of telecommunications services, poor power supply high cost, fear of fraudulent practices and lack of facilities necessary for their operation are addressed. The findings of a study on internet banking in India showed that ICT constitutes an invaluable tool in driving development, promoting innovation and enhancing competitiveness[14]. Also, a survey of the e- payment systems and telebanking services in Nigeria revealed that there has been a paradigm shift in banking which has led to competition in the industry[30]. This is in tandem with the findings of this study with 71% of the respondents affirming that the usage of ICT is efficient in giving the bank a competitive advantage in the industry as shown in Figure 7.

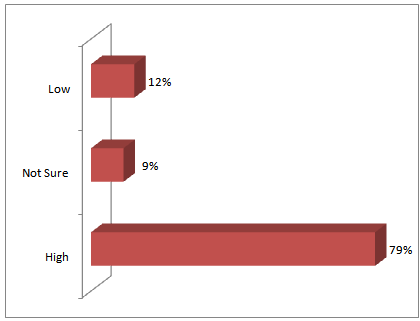

4.9. Effects of ICT on Banking Records Accuracy

- Several studies such as[3, 25] have emphasized the role of ICT in achieving accuracy of records in the banking sector. The adoption and utilization of ICT in the banking sector has greatly improved banking services and brought about accuracy in the banking record within the sector[34]. Finding from this study also revealed that 79% of the respondents agreed that ICT usage has led to high level of accuracy in the banking records (Figure 8).

| Figure 7. ICT adoption and gaining competitive advantage, Source: Authors’ Survey, 2010 |

| Figure 8. Effects of ICT on the banking record accuracy, Source: Authors’ Survey, 2010 |

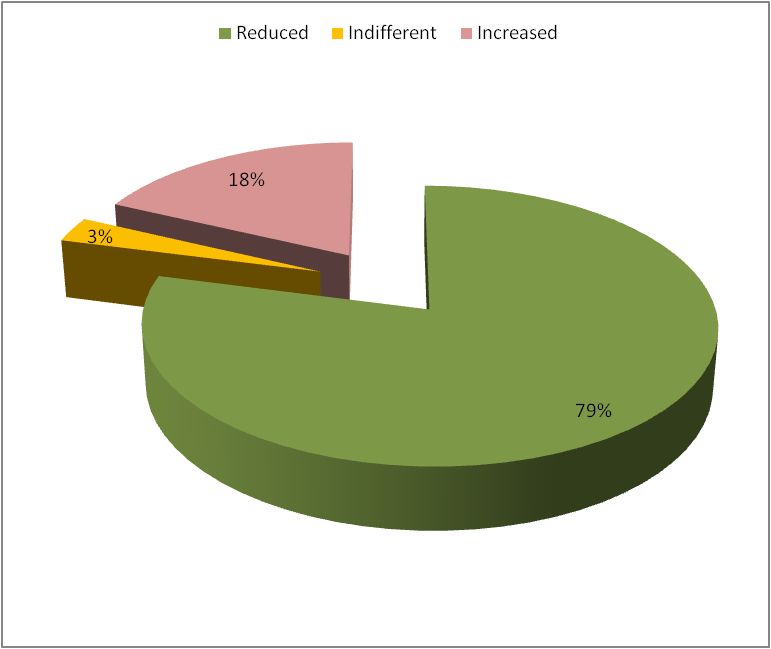

4.10. ICT in Banking and Cost of Business Operations

- For customers to embrace the adoption of modern technologies by the bank, the technologies must be reasonably charged relative to the other available options, otherwise, the acceptance of the new technology may not be viable from the customers’ point of view[4]. Our findings as illustrated in Figure 9 found support in[6] with approximately 79% of the respondents indicating that internet banking has facilitated speedy transfer of funds with lower transaction cost.

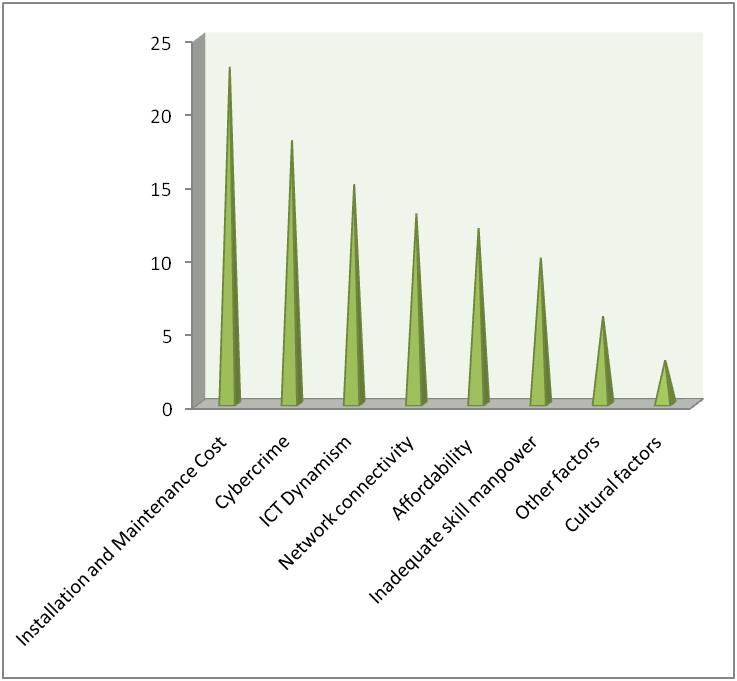

4.11. Challenges of ICT Utilization in the Banking Sector

- As enumerated by[21],some factors serve as constraints to the effective utilization of ICT in the banking sector. In this research, some of the identified factors that pose challenges to the effective application of ICT in the banking sector are also presented in Figure 10.

| Figure 9. ICT utilization and the bank’s transaction cost, Source: Field Survey, 2010 |

| Figure 10. Challenges of ICT Utilization in the Banking Sector. Source: Author’s Survey, 2010 |

5. Conclusions and Policy Recommendation

- It is quite evident from the foregoing that ICT innovation in the banking sector is very critical for effective and efficient operations within the system in order to remain competitive and satisfy customers’ needs. The ease with which transactions are processed is a significant success factor as against the manual method of transaction processing as discussed in the paper. On the part of the customers, the study revealed that various operational options which ICT presented increased their level of satisfaction since they can use ATM, internet, Debit card etc at a more convenient time rather than the rush and queuing experience which characterized the manual method. This has equally increased the banking productivities in terms of turnover, profitability, staff efficiency among others. The application of ICT in the sector also presents its own challenges which ranges from insecurity, cybercrime and fraud which scares some customers away and on the part of the banks, there is the need for them to make huge investment in term of ICT equipment procurement, installation, training and re-training of members of staff. These challenges can be overcome using diverse means and especially the public-private partnership on security issues and infrastructures and ability to develop indigenous ICT equipment, the mastery of which lies with the operators that will defy any act of hacking.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-Text HTML

Full-Text HTML