-

Paper Information

- Previous Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Management

p-ISSN: 2162-9374 e-ISSN: 2162-8416

2012; 2(4): 125-130

doi: 10.5923/j.mm.20120204.07

Investigation in Passenger Air Traffic: Opportunities for Companies

Giovanni Ossola , Elisa Giacosa , Guido Giovando

Department of Management, University of Turin, Turin, 10134, Italy

Correspondence to: Elisa Giacosa , Department of Management, University of Turin, Turin, 10134, Italy.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

This study ascertained that the air transport sector is still of interest for the firms that choose to operate in it, despite the global economic crisis. It can be stated that there is a relationship between the economic trends of a continent and the trends in the passenger air transport sector. This relationship varies according to the geographical area considered. The emerging countries are those that are most affected by the increase in the demand for passenger air transport: of the emerging economies, the Middle East has the highest ratio of growth in passenger air traffic to gross domestic product growth. In addition, we identified the continents with an attitude to attract investments in creating large airport infrastructures. The Asian airports had the highest capacity to attract investments for large airport infrastructures, due to a phase of expansion of its air transport market. In contrast, Europe and America exhibited a low attitude to attract investments in creating big airport infrastructures: in these continents, air transport market demand is in a maturity phase.

Keywords: Passenger Air Transport Sector, Airport Infrastructure

Article Outline

1. Introduction

- Air transport is a tool for facilitating trade within a country or between several countries and, consequently, for promoting their development. Inadequate airport infrastructure creates barriers to interaction between the various players operating in a global scenario. The air transport sector has been recently affected by profound changes connected with market deregulation, which has favoured the entry of new competitors into the passenger and cargo transport market, including both large players and low-cost operators. The business model of the economic operators has therefore radically changed. The objectives of the study are manifold. We aim to analyse whether the economic trends of a continent influence the passenger air transport demand in that geographical area. We identified the continents characterised by a more intense level of reactivity in terms of passenger air traffic demand than that of the gross domestic product. These continents are those of greatest interest for the firms operating in the air transport sector, since they are characterised by a greater increase in market demand.In addition, we identified the continents with an attitude to attract investments in creating large airportinfrastructures. The Asian airports had the highest capacity to attract investments for large airport infrastructures, due to a phase of expansion of its air transport market. In contrast, Europe and America exhibited a low attitude to attract investments in creating big airport infrastructures: in these continents, air transport market demand is in a maturity phase.

2. Literature

- A substantial body of literature has considered the sectors that are associated with air transport. Some have studied the various functions of airport management companies([1],[2],[3],[4]) whereas others have considered marketing([5],[6]), organisation[7], finance[8] and logistics[9] in specific. In addition, some studies have conducted quantitative analyses of data taken from the financial reports of airport management companies to ascertain the stability of their financial performance and standing([10],[11]). In particular, some studies correlated the gross domestic product to the net post-tax profit margin of the companies; in addition, the cash flow of these companies is so far, except in Europe[12].Airports have traditionally been defined as “natural” monopolies([13],[14]). However, in recent decades, across countries, liberalisation of all or some airport services has taken place([15],[16]). This liberalisation process has prevented airports from becoming monopolies, creating more competitive airport systems([17],[18]). In addressing liberalisation, many scholars have concentrated on corporate governance. In particular, they have examined the influence of public administration or other similar bodies on firm capital in various countries([19],[20],[21]) and specifically in Europe[17]. For carriers, deregulation has precipitated the creation and development of new airline companies referred to as low-cost companies([22],[23]) and new alliances between existing companies([24],[25],[26]).Some scholars have highlighted the correlation between local development and airport infrastructure, which has positive indirect effects on the surrounding territory([19],[27],[28]), increasing economic activity([29],[30],[31],[32],[33],[34]). Some studies have evaluated these economic effects in individual countries([35],[36],[37]).Numerous scholars have researched the strategic behaviour of airport management companies([38],[39],[40]), analysing and redefining the company business models used[41]. Some studies have analysed how the strategies of low-cost carriers develop([42],[43]), whereas others researchers focused on managing airport hubs([44],[45],[46]).Particular attention has been paid to the largest airports, which can employ new approaches such as system dynamics[47]. The different types of revenues obtained and tariff systems to be adopted have also been analysed([48],[49],[50],[51]), with particular attention to the European and Italian markets([52],[53],[54]).Our work differs from the previous studies thanks to the following reasons. First, we elaborated a previsional perspective to compare growth in world gross domestic product and airline traffic over a 20-year time horizon. Therefore, we didn’t use only historical overview of these data. Secondly, we focused on the attitude of particular continent to attract investments in creating big airport infrastructure.

3. Material and Methods

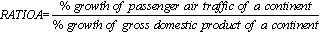

- The data used are taken from important research organisations such as Eurocontrol, Eurostat and Istat, which periodically announce annual trends in the main economic parameters that indicate the “state of health” of an economy. The market data were made available by important trade associations and market research companies operating in the field of air transport, such as Boeing, the International Air Transport Association (IATA), the Airports Council International (ACI) and Enac. First, the subject of the research was analysed in a review of the existing literature. In addition, more than one hundred fifty articles published in international journals were analysed, including articles in both sector journals and economics and management journals. In addition to analysing previous studies, we identified the following research questions:1) RQ1: Is there a relationship between the economic trends of a continent and its passenger air transport demand?2) RQ2: Is it possible to ascertain the capacity of a continent to produce intense passenger traffic given airport infrastructure?To address the above RQs quantitative analysis has been used. RQ1 has been addressed using a ratio (“RATIO A”) that relates the growth in passenger air traffic of a continent to its gross domestic product over a 20-year time horizon:

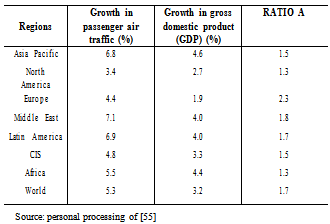

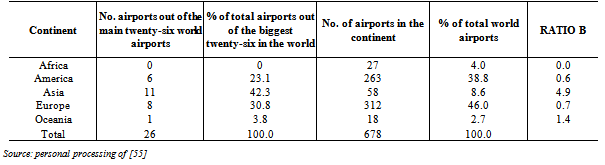

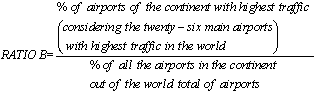

The gross domestic product of that continent is not the only economic measure to compare with passenger growth. Nevertheless, as this is an initial research, we start to analyse this economic indicator, with the perspective to improve our method.The possible scenarios for RATIO A are as follows:a) RATIO A is > 0: Passenger air traffic and the gross domestic product of a continent increase or decrease at the same time. In other words, a given economic trend produces the same effect on passenger air traffic. The two possible effects are as follows: - The trends are both positive: the growth of the gross domestic product produces growth in passenger air traffic;- The two trends are both negative: the reduction in the gross domestic product of a continent produces a reduction in passenger air traffic; b) RATIO A is < 0: The trends in passenger air and in the gross domestic product of a continent are inconsistent; one is increasing, whereas the other is decreasing. The economic situation of the continent has not yet had repercussions for passenger air traffic. RQ2 is examined using another ratio (“RATIO B”). This ratio considers the presence of high traffic airports (those among the twenty-six main airports with the highest traffic in the world) relative to the total number of airports in the continent. Usually, official reports draw up the lists of the world's major airports in terms of traffic. We decide to use one of them, which is particularly representative for the amount of considered airport. RATIO B is used to measure the capacity of particular continents to attract investments in creating big airport infrastructures.

The gross domestic product of that continent is not the only economic measure to compare with passenger growth. Nevertheless, as this is an initial research, we start to analyse this economic indicator, with the perspective to improve our method.The possible scenarios for RATIO A are as follows:a) RATIO A is > 0: Passenger air traffic and the gross domestic product of a continent increase or decrease at the same time. In other words, a given economic trend produces the same effect on passenger air traffic. The two possible effects are as follows: - The trends are both positive: the growth of the gross domestic product produces growth in passenger air traffic;- The two trends are both negative: the reduction in the gross domestic product of a continent produces a reduction in passenger air traffic; b) RATIO A is < 0: The trends in passenger air and in the gross domestic product of a continent are inconsistent; one is increasing, whereas the other is decreasing. The economic situation of the continent has not yet had repercussions for passenger air traffic. RQ2 is examined using another ratio (“RATIO B”). This ratio considers the presence of high traffic airports (those among the twenty-six main airports with the highest traffic in the world) relative to the total number of airports in the continent. Usually, official reports draw up the lists of the world's major airports in terms of traffic. We decide to use one of them, which is particularly representative for the amount of considered airport. RATIO B is used to measure the capacity of particular continents to attract investments in creating big airport infrastructures.  The possible scenarios for RATIO B are as follows:a) RATIO B is = 0: The continent does not have any airports among the twenty-six airports with the highest traffic in the world;b) RATIO B is > 1: The continent has a higher % of airports with high traffic than the % of airports in that continent. It follows that this continent has the capacity to attract investments in creating big airport infrastructures; c) RATIO B is < 1: The continent has a higher % of airports with low traffic than the % of airports in that continent. It follows that this continent has the capacity to attract investments in creating big airport infrastructure.

The possible scenarios for RATIO B are as follows:a) RATIO B is = 0: The continent does not have any airports among the twenty-six airports with the highest traffic in the world;b) RATIO B is > 1: The continent has a higher % of airports with high traffic than the % of airports in that continent. It follows that this continent has the capacity to attract investments in creating big airport infrastructures; c) RATIO B is < 1: The continent has a higher % of airports with low traffic than the % of airports in that continent. It follows that this continent has the capacity to attract investments in creating big airport infrastructure.4. Results and Discussion

- Companies operating in the air transport sector can be represented by their market, in which the purchase of the production factors and thproe sale of the products produced take place. To analyse the air transport market, a distinction must be made between:a) Passenger air transport demand as indicated by RQ1;b) Passenger air transport supply as indicated by RQ2.

4.1. Analysis of Passenger Air Transport Demand

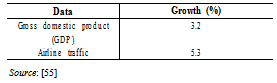

- In considering RQ1, one can relate the trends in market demand with the economic trends of an area to verify whether the latter influences the demand for air transport. The forecasts for market demand for world air transport during the period 2009-2029 are shown below compared with the trends in the gross domestic product (Table 1). To consider RQ1 for a single continent or area, it is helpful to use “RATIO A” to relate the growth in passenger air traffic with that of the gross domestic product (GDP) (Table 2).

|

|

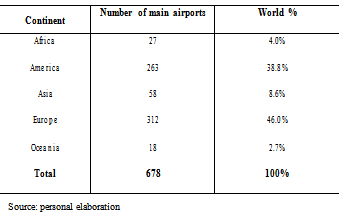

4.2. The Market Supply

- For RQ2, the main market supply data are presented below. The number of airports globally, grouped per continent, are shown below (Table 3). The twenty-six main airports in the world based on passenger numbers are grouped by continent as follows; for each continent, we calculated RATIO B (Table 4).To describe Table 3, the European continent has 46% of the world’s airports, whereas the American continent has 39%. These continents are followed by Asia with 8.6%, Africa with 4% and, lastly, Oceania with 2.7%.

|

|

5. Conclusions

- This study has shown that the economic trends of a continent is one of the factor that influence its trends in passenger air transport demand. In particular, in periods characterised by economic expansion, the demand for air transport grows; conversely, during an economic recession, this demand decreases. This study ascertained the capacity of particular continents to attract investments in creating big airport infrastructures. The Asian airports had the highest capacity for two reasons: the economic growth in Asia, which produces intense air transport demand; the weaker airport infrastructure of Asia compared to that of other continents with more mature economies. In contrast, Europe and America exhibited a low attitude to attract investments in creating big airport infrastructures; they feature a greater percentage of the world’s airports, but a smaller percentage of those with the highest passenger traffic. In these continents, air transport market demand is in a maturity phase. The implications of this research follow from the above conclusions. It has been forecast that over a twenty-year time horizon at the world level, there will be a 5.3% increase in passenger air transport demand, which will be driven by a 3.2%increase in the GDP. Therefore, despite the global economic crisis, the air transport sector is still of interest for the firms that choose to operate in it. Our research presents some limits that can be summarized as follows. The gross domestic product of that continent is not the only economic measure to compare with passenger growth. Nevertheless, as this is an initial research, we start to analyse this economic indicator, with the perspective to improve our method. In addition, it would be motivating to apply this study model to other sectors, in order to make a comparison with the trends of the airport sector. At the same time, this study constitutes a starting base that has highlighted the trend of the operational context of the firms involved in the airport sector. For this purpose, it would be extremely interesting to analyse the characteristics of their business model, with reference to both the airport management companies and the airline companies.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-Text HTML

Full-Text HTML