-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Microeconomics and Macroeconomics

p-ISSN: 2168-457X e-ISSN: 2168-4588

2025; 11(1): 1-15

doi:10.5923/j.m2economics.20251101.01

Received: May 27, 2025; Accepted: Jun. 22, 2025; Published: Jul. 28, 2025

Corn and Rice Price Volatility Impact on Food Security in the East African Community

Ntakirutimana Leonard1, 2, Bizimana Egide2, Bigawa Bazira Abel1, Theon Nshimirimana1, Karenzo Jean1

1High Institute of Business (ISCO), University of Burundi, Bujumbura, Burundi

2Faculty of Agronomy and Bioengineering (FABI), University of Burundi (UB), Bujumbura, Burundi

Correspondence to: Ntakirutimana Leonard, High Institute of Business (ISCO), University of Burundi, Bujumbura, Burundi.

| Email: |  |

Copyright © 2025 The Author(s). Published by Scientific & Academic Publishing.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

Food price volatility has remained a persistent challenge for policymakers since 2007, with profound implications for food security and public health, particularly in developing regions. This study analyses the impact of agricultural price fluctuations on the availability and utilization of rice and maize in four East African Community (EAC) countries—Burundi, Kenya, Tanzania, and Rwanda. Using the Generalized Autoregressive Conditional Heteroskedasticity (GARCH) model in EViews 10, we measure producer price volatility, while multiple linear regression (OLS) models assess its effects on selected food security and health indicators. The results reveal no significant impact of price volatility on overall agricultural production at the regional level; however, country-specific analyses uncover notable differences. In Rwanda, a USD 1 increase in rice price per ton is associated with a 0.05% decline in production after nine months. In Kenya, a 1% increase in maize prices is linked to a delayed reduction in anaemia prevalence among women of reproductive age. Conversely, a similar rise in rice prices correlates with an initial 8.1% increase in anaemia prevalence, which is reversed after one year, showing a 17.3% decrease. These findings underscore the complex, crop- and country-specific nature of food price shocks and their health impacts. The region’s dependence on rainfed agriculture, combined with mounting pressures from climate change and demographic growth, further intensifies food security vulnerabilities across the EAC.

Keywords: Price volatility, GARCH, Food security, Climate change, Corn, Rice

Cite this paper: Ntakirutimana Leonard, Bizimana Egide, Bigawa Bazira Abel, Theon Nshimirimana, Karenzo Jean, Corn and Rice Price Volatility Impact on Food Security in the East African Community, Microeconomics and Macroeconomics, Vol. 11 No. 1, 2025, pp. 1-15. doi: 10.5923/j.m2economics.20251101.01.

Article Outline

1. Introduction

- The volatility of food product prices since the food crisis of 2007/2008 is one of the priority problems to which agricultural policies have tried to respond in recent years. This attention is due to their short-term impact on the purchasing power of consumers. Still, also in the long term the incentive for producers to produce more [1] and consequently budgetary imbalance arises. Consumers fear an increase in the cost of access to food products, while producers fear a drastic drop in their income. In either case, the effects of the disturbances reinforce precariousness and weaken the actors to the point of forcing policymakers to take measures to reduce price uncertainty in agricultural markets, since more people can’t afford a healthy diet because of a high price. Given its wealth of human and raw material resources, its expertise, and a vast market, the African continent has immense potential, which should enable it not only to feed itself, to eliminate hunger and food insecurity, but also to become a major player in international markets. However, Africa is the continent that harbors a high rate of malnourished people [2] with a rate of 19.1% of undernourished people (which is more than double the world average of 8.9% in 2019) against 17.6% in 2014, that is to say that in 10 undernourished people in the world, 4 are African, and one in four Africans suffer from undernourishment [3,4]. Within families, young children, as well as pregnant and lactating women, are the most affected and even more susceptible to nutritional deficiencies [5]. Undernutrition for pregnant and lactating women has direct effects on foetuses because undernutrition during the foetal period and the first months of life contributes to both immediate and long-term health problems. It should be noted that child malnutrition can permanently affect the intellectual (lower IQ) and physical abilities (developing chronic diseases in adulthood, including obesity and diabetes) and jeopardize the future of entire sections of the population [5,6].Sub-Saharan Africa is particularly concerned by this burden of undernourishment because it is the region that, in addition to the galloping demography, is home to a high number of people suffering from hunger, with a rate of 22%. In this region of Africa, the East African Community (EAC) is the second after Central Africa to experience the highest rate of undernourishment in 2019 (27.2%) [8]. The report by [7] highlights that in terms of numbers and outlook, all other things being equal, with the trends observed over the past decade, the world and in particular Africa and even more East Africa is by far able to meet the daunting challenge of achieving the "Zero Hunger" objective of the 2030 Agenda of the Sustainable Development Goals (SDGs). It is estimated that the rate of undernourished people in 2030 will be 33.6% in East Africa without considering the impact of the COVID-19 pandemic.To eradicate this food insecurity, which has long shaken the continent, African Heads of State have drawn up strategic documents and set themselves objectives putting Agriculture and the Farmer at the center of development, which is obvious for a continent. With an agricultural vocation to 48% of the population (70% for East Africa) and whose GDP relies heavily on agriculture [5]. In this section, the EAC has had an agricultural and rural development policy since 2006. It adopted an action plan on food security in 2011, aligned with the priorities of the Detailed Plan for the Development of Agriculture in Africa (DPDAA)1[5]. These policies allowed for an increase in production, but productivity remained a continental desire.Despite the combined efforts of these policies, which have allowed an increase in production in general, except in recent years when production has fallen following climatic disturbances, the El Niño phenomena, and the locusts that have recently devastated crops, agricultural prices maintained an upward trend in volatility, thus leading to a decline in household purchasing power and implicitly to a loss in the value of local currencies.This paper will show the impact of food price volatility on the production and utilization of agricultural products, particularly rice and corn products, which constitute the staple diet in the EAC block and occupy a significant share of the caloric intake in the diet [9].

2. Literature Review

2.1. Agricultural Landscape in the East African Community (EAC)

- The East African Community (EAC) is fundamentally an agriculture-driven region. Despite this, agricultural production and productivity levels remain below global benchmarks [10]. Farmers across the EAC face substantial obstacles in boosting output and efficiency, stemming from a complex interplay of political, natural, and technological factors. Specifically, policy shortcomings include inadequate legal and regulatory frameworks, coupled with weak institutional support. Natural factors limiting productivity encompass natural resource degradation and the increasing pressures of climate change. Technologically, the region suffers from limited adoption of yield-enhancing inputs, such as improved seed varieties, fertilizers, appropriate animal fodder and feed, critical veterinary vaccines, and modern agricultural equipment and machinery. These constraints collectively contribute to, and exacerbate, poor farm management practices across the region. The majority of farmers in the EAC operate as small-scale subsistence farmers, cultivating small landholdings [10,11]. This demographic faces numerous challenges, including limited access to crucial financial resources needed to purchase yield-improving inputs, alongside the inherent instability of agricultural commodity prices in local markets. Broader, cross-cutting issues that negatively impact agricultural production include pervasive poverty, gender inequality, and the under-representation and engagement of youth in agricultural activities. Addressing the multifaceted nature of these challenges requires a comprehensive strategy that promotes more resilient and sustainable agricultural production systems across the EAC.

2.2. Food Price Volatility in the EAC Sub-Region

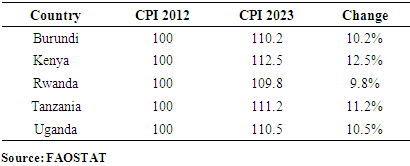

- Food price volatility has been a persistent and significant problem in Eastern Africa for decades. Recurrent surges in food prices have severely impacted food security and the livelihoods of vulnerable populations throughout the region [9,10]. The global food price crisis of 2008–2009 stands out as a particularly impactful event. This crisis was fueled by several converging factors, including escalating food demand from rapidly developing economies like China and India [14], adverse weather patterns in key agricultural producing nations [15], and the global financial crisis, which drove increased speculative investment in food commodities, as well as increases in energy and fertilizer costs [16]. The consequences were dire, leading to a deepening of hunger and poverty across Eastern Africa. Millions were unable to afford adequate and nutritious food, forcing many to adopt detrimental coping mechanisms, such as selling essential productive assets or incurring debt simply to survive [16,17,2]. This crisis underscored the vulnerability of the region to external economic shocks and highlighted the urgent need for developing more resilient food systems capable of withstanding such pressures. Following the 2008-2009 crisis, the Consumer Price Index (CPI) in East African nations has demonstrated fluctuations, yet generally exhibits an upward trend, mirroring persistent inflationary pressures within food markets [19]. Other significant food price spikes occurred in the region in 2011, 2012, and 2017, each driven by a combination of regional droughts, global commodity price fluctuations, and domestic economic factors such as currency depreciation and instances of conflict [19,20]. These repeated and disruptive shocks have placed significant strain on household budgets and have undermined food security for millions of people living within the region [6,21]. East African nations have experienced significant changes in their Consumer Price Index (CPI) over the past decade, impacting the affordability of necessities and overall economic stability. Furthermore, food price volatility presents a persistent challenge to food security and nutrition in the region.

2.3. CPI Trends in East Africa

- Table 1 illustrates the evolution of CPI in the East African Community (EAC) between 2012 and 2023. Data, sourced from FAOSTAT, reveals a consistent upward trend across all member states.

|

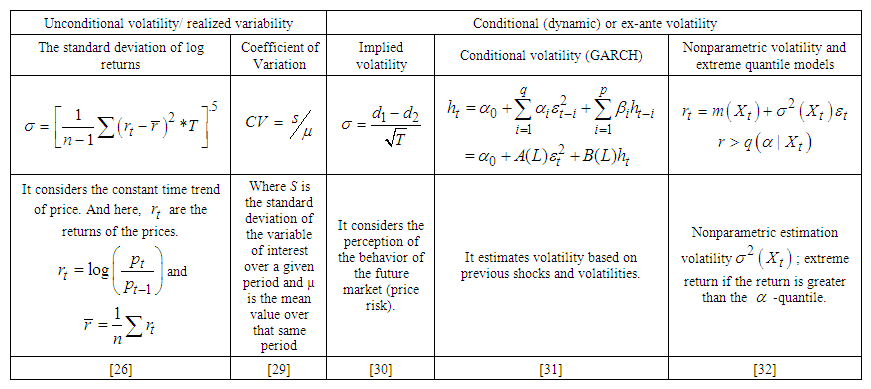

2.4. Understanding Price Volatility

- Price volatility is a statistical measure of the fluctuations in the price of an asset over a specified period. It is often quantified using the standard deviation of returns, indicating the extent to which returns deviate from their average. Engle [4] succinctly describes volatility as a consequence of the arrival of new information in the market. More broadly, volatility represents the degree of variability in prices or quantities [23] or the fluctuation of prices around the long-term equilibrium or trend [23,24]. As Previdoli [26] argues, the value of a financial asset hinges on the future gains investors anticipate. In the context of agricultural businesses, White & Dawnson [27] highlight the importance of expected harvest prices in planting decisions. While increasing prices can incentivize production and increase profits [26,27], such income is inherently uncertain, and dependent on future economic conditions. Investors rely on real-time information to forecast fair asset prices, and the arrival of new information necessitates revisions to these forecasts, leading to price fluctuations. Volatility, therefore, provides critical information about the uncertainty and risk associated with investments. High volatility implies the potential for significant price swings in a short period [26]. An investor's risk tolerance and desired return will influence their willingness to accept high volatility.Two key types of volatility are distinguished:• Historical (ex-post) or unconditional volatility: This measures the realized variability of prices over a long period, assuming constant variance [25,23,32,33,34]. It allows for the measurement of the dispersion of values compared to the average.• Conditional (dynamic) or ex-ante volatility: This refers to forecasting future market volatility based on currently available information. The literature widely acknowledges that price series for economic goods, including agricultural prices, often exhibit trends and seasonality [23]. Therefore, econometric analyses are needed to account for the time-varying nature of variance [36]. ARCH and GARCH family models, as well as nonparametric models, fall into this category.Understanding and managing both CPI increases and food price volatility are vital for ensuring food security and promoting sustainable economic development in East Africa. Further research and policy interventions are needed to mitigate the negative impacts of these factors and build resilience within the region's agricultural systems and economies.

| Table 2. Different measures of volatility |

3. Research Methodology

- The study focused on the EAC member countries, and due to the irregularity of the data for South Sudan and Uganda, only the four former member countries of this community were considered: Burundi, Kenya, Rwanda, and Tanzania.

3.1. Source and Nature of Data

- Existing databases from international institutions responsible for statistics, such as the World Bank and FAOSTAT, served as data sources. This study spans 53 years (from 1966 to 2018) for the food availability model and 19 years, from 2000 to 2018, for the food utilization model due to missing data on certain variables over a longer period. We used Excel, Stata, and/or EViews software for data collection, entry, processing, and analysis.

3.2. Definition of Variables

3.2.1. Food Availability Model

- The volume of agricultural production is used as an indicator of food availability.

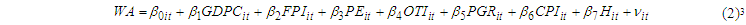

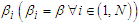

In equation 1, we focus on the effects of the volatility of producer prices represented by

In equation 1, we focus on the effects of the volatility of producer prices represented by  on the volume of agricultural production at the national level

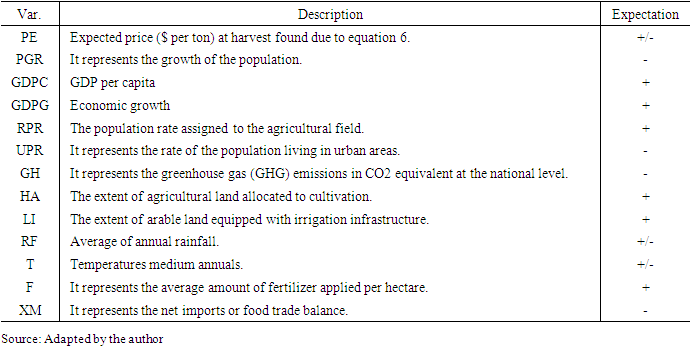

on the volume of agricultural production at the national level  . This volatility is found using equation 7. The control variables and determinants of production considered in the model are defined in Table 3:

. This volatility is found using equation 7. The control variables and determinants of production considered in the model are defined in Table 3:

|

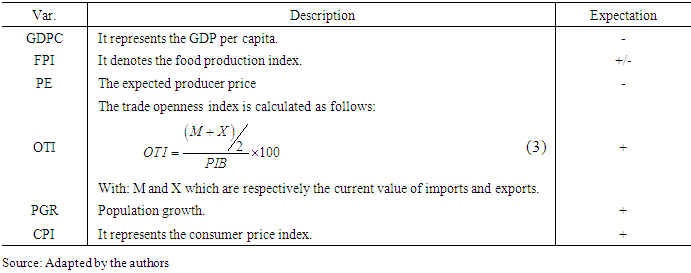

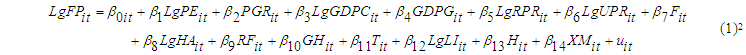

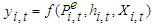

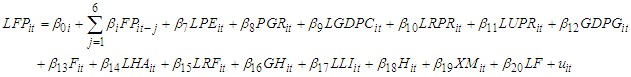

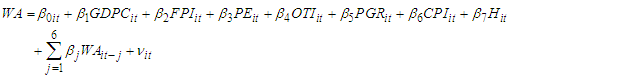

3.2.2. Food Utilization Model

- To characterize the influence of price volatility on food utilization (food security pillar), the prevalence of anaemia in women of childbearing age (15-49 years)

(dependent variable) was considered, which is a proxy of food utilization within families. The detailed equation is:

(dependent variable) was considered, which is a proxy of food utilization within families. The detailed equation is: The meaning of the other control variables is presented in Table 4.

The meaning of the other control variables is presented in Table 4.

|

3.3. Analytical Framework

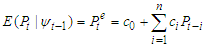

- Multiple linear regression was used to characterize utilization and availability models. A GARCH(p,q) model (Generalized Autoregressive Conditional Heteroscedasticity), developed by Bollerslev [31] based on the ARCH model introduced by Engle [37], was used to estimate the volatility variable. The ARCH model allows the conditional variance to change over time, based on past errors, while keeping the unconditional variance constant [31]. The general estimating equation for the models is

.

.  denotes the total local production of a given good or the prevalence of anaemia among women of childbearing age and

denotes the total local production of a given good or the prevalence of anaemia among women of childbearing age and  is the expected price while representing the predicted variance of the price, which measures volatility and

is the expected price while representing the predicted variance of the price, which measures volatility and  the matrix of other explanatory variables. By assumption of linearity, an empirical specification of the availability model is the following:

the matrix of other explanatory variables. By assumption of linearity, an empirical specification of the availability model is the following: | (4) |

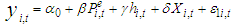

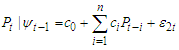

The GARCH process (p, q) is then used to generate the variables

The GARCH process (p, q) is then used to generate the variables  and

and  . The price is a function of the information’s set

. The price is a function of the information’s set  of prices that are available at the moment

of prices that are available at the moment  and are given by:

and are given by: | (5) |

is the expected average of the price, and under the assumption of homoscedasticity:

is the expected average of the price, and under the assumption of homoscedasticity: | (6) |

:

: | (7) |

3.4. Model Diagnosis

3.4.1. Autocorrelation Test

- According to Gujarati [40], the autocorrelation of errors is defined as the correlation between members of a series of observations ordered in time (time series data) or space (cross-sectional data) and it can result from several sources which are either the absence of an important explanatory variable or a bad specification of the model or either a smoothing by moving average or an interpolation of the data [41]. This problem is detected using several tests, but the most common is the Durbin and Watson (DW) test, which detects an autocorrelation of errors of the first order, and the Breusch-Godfrey test based on a Fisher test of nullity of coefficients or Lagrange multiplier "LM test", allowing to test an autocorrelation of an order greater than one and remains valid in the presence of the shifted dependent variable as an explanatory variable [40,41].

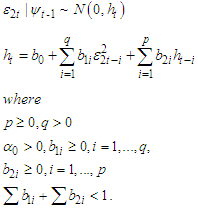

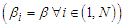

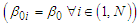

3.4.2. Homogeneity Test

- The homogeneity test is based on the Analysis of Covariance (ANCOVA) of errors of cross-sections (individuals) and is based on a Fisher test [42]. It allows us to successively test three hypotheses:1. The equality of all N

slopes (parameter vectors)

slopes (parameter vectors)  and all

and all  model constants

model constants ; which is called global homogeneity or homogeneous panel;2. The N vectors of parameters

; which is called global homogeneity or homogeneous panel;2. The N vectors of parameters  are identical, while the constants

are identical, while the constants  are different depending on the individual

are different depending on the individual  . This case provides a panel structure with individual effects;3. The N constants are identical,

. This case provides a panel structure with individual effects;3. The N constants are identical,  while the parameter vectors

while the parameter vectors  are different depending on the individual. In this case, only the constants among all the coefficients of the model are identical; we have therefore N different models.

are different depending on the individual. In this case, only the constants among all the coefficients of the model are identical; we have therefore N different models.4. Results of Econometric Analyses

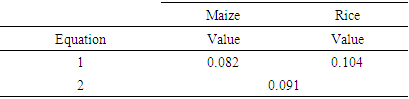

4.1. Autocorrelation of Errors

- The DW test is used to assess the presence of autocorrelation in our models. The table below shows the values of this test resulting from the estimation of equations 1 and 2:

|

| (8) |

| (9) |

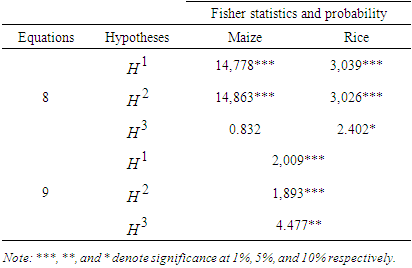

4.2. Homogeneity Test Results

- Table 6 shows the results of all three tests:

|

4.3. Interpretation of Econometric Results

4.3.1. Food Availability in Burundi

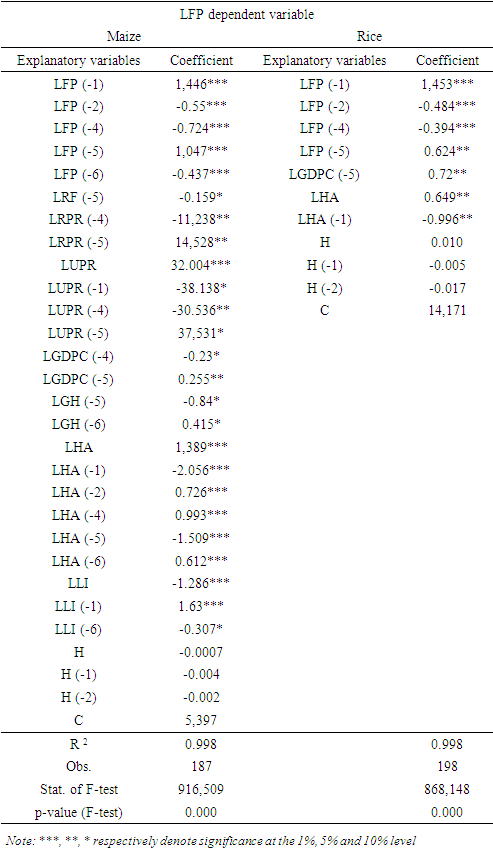

- The results indicate that all the factors included in the model together significantly account for production at a rate of 99%. Regarding individual significance, production is influenced by previous quarters' production levels, rainfall, rural and urban populations, level of development (GDP per capita), sown area, land equipped with irrigation infrastructure, and gas emissions. The following Table 7 presents the contributions of the significant variables and the volatility of the model from Equation 8.

|

4.3.2. Food Utilization in Burundi

- The factors considered in the model influence the prevalence of anaemia in women of childbearing age at 99%. The model is globally significant at 1%. The Ramsey specification, Breusch-Godfrey autocorrelation, and Breusch-Pagan-Godfrey heteroscedasticity tests confirm the robustness of these results. The following Table 8 indicates the relevant results of the study of equation 9.

|

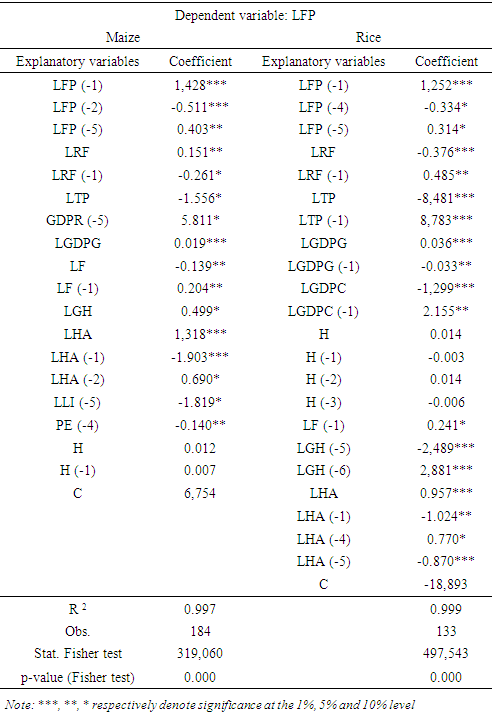

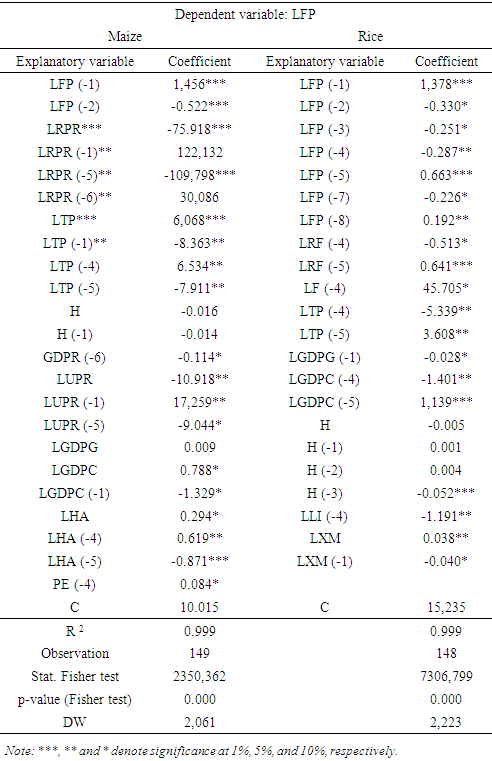

4.3.3. Food Availability in Kenya

- In this study area, the determinants of the production of the two crops are, among others, previous production, precipitation, temperature, the number of fertilizers applied per hectare, the number of GHGs emitted, economic growth, the area sown, population growth, the area of land equipped with irrigation infrastructure, and GDP per capita. The variables taken together explain the variability of the production at 99%, and the joint significance is 1%, as shown by the Fisher test. The autocorrelation and heteroscedasticity test testify to the robustness of these model results. The following Table 9 illustrates the significant variables.

|

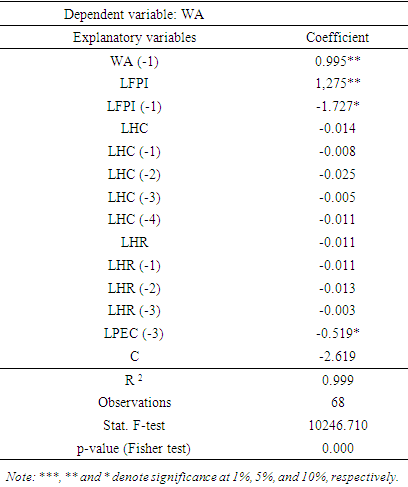

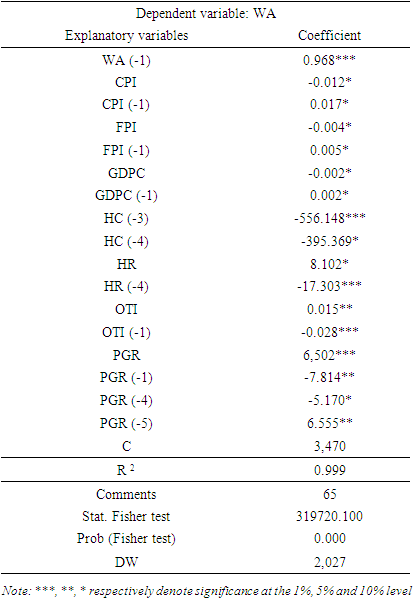

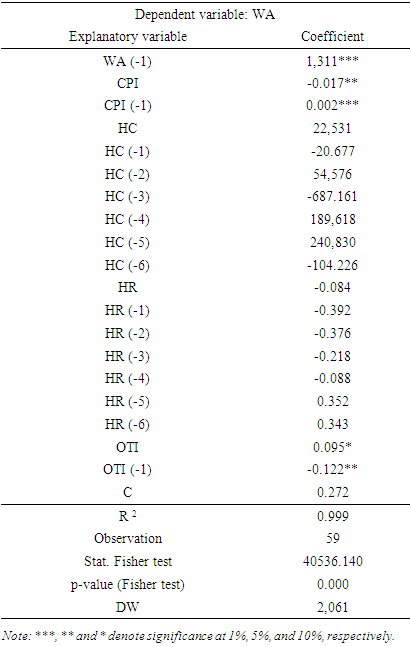

4.3.4. Food Utilization in Kenya

- The prevalence of anaemia among women of reproductive age in Kenya is influenced mainly by the rate of anaemic women in the previous period, the consumer price index, the food production index, GDP per capita, the price volatility of rice and maize, the trade openness index, and population growth. These factors explain the prevalence of anaemia in women of childbearing age at 99%, and these contributions are significant at the 1% level. The following table shows the contributions of these significant variables, and the regression results are appended.

|

4.3.5. Food Availability in Tanzania

- In this study area, the analysis focused only on maize production due to a lack of data on rice prices. Maize production is then explained at 99% by all the factors of the model taken together. Autocorrelation and heteroscedasticity tests confirm the authenticity of these results. Individually, production is significantly influenced by past production, the quantity of fertilizers, economic growth, sown area, rural population, and the expected farm gate price.

|

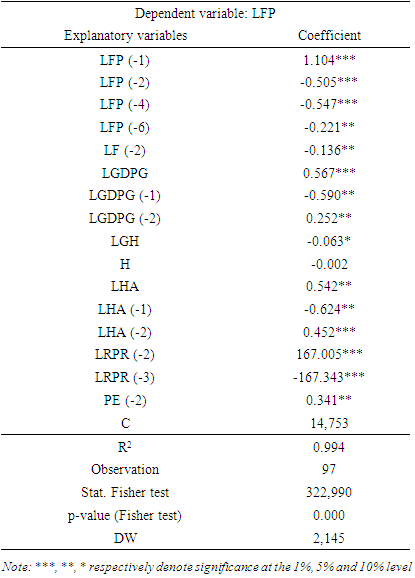

4.3.6. Food Utilization in Tanzania

- The prevalence of anaemia among women of childbearing age in this area is, among the criteria considered, significantly influenced by the food production index, the trade openness index, and the number of anaemic women.

|

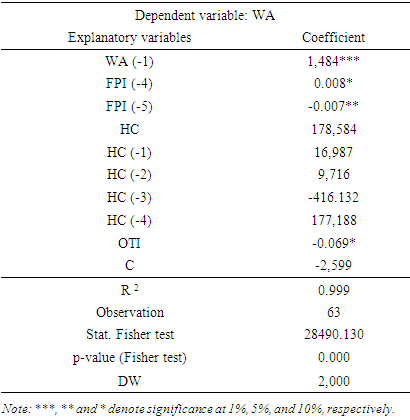

4.3.7. Food Availability in Rwanda

- The local availability of the agricultural products considered in this study is, in this area, significantly influenced by the following factors: the entire population in general, population growth, GDP per capita, harvested area, areas equipped with irrigation, average annual temperature, and precipitation, foreign trade, expected producer price and price volatility.

|

4.3.8. Food Utilization in Rwanda

- The prevalence of anaemia among Rwandan women of childbearing age is strongly explained overall by the factors taken into consideration in the model at 99%. The diagnostic and specification tests of the model attest to the robustness of these results. In deducing individual significance, it is influenced by inflation and trade openness as the prevalence of anaemia in women of childbearing age.

|

5. Conclusion and Recommendations

- Overall, the volatility of agricultural prices does not contribute significantly to food availability in the EAC, except in Rwanda, where it negatively and significantly influences the quantity of rice production. Overall, the negative influence of volatility dominates in the economy considered, however, it is the contrary in Kenya for maize production where it positively influences production. The non-significant influence is not to be taken as such, rather, its contribution is not perceived since farmers do not benefit from enough information from the agricultural market and its trends over time so that they can make an integration of the system's rational production. Farmers take into account only the expected price to boost production, while volatility is another factor contained in the price, which is a conditional variation of the market.However, the influence of price volatility on food security can then be seen in the prevalence of anaemia among women of childbearing age with a positive influence. Price volatility especially discourages the accessibility of agricultural products, which is observed in this area where people suffer from undernourishment while there is a high index of food production. Population growth and the factors responsible for climate change (rainfall, temperature, and greenhouse gas emissions) are imminent obstacles to food security in the region. Greenhouse gases negatively influence (after a year and a half) production.The effects of foreign trade on food security vary according to a zone and according to a period. EAC countries, like other developing countries, are net importers. The food deficit is most often filled by imports, which often limit the performance of local producers and the integration of agricultural innovations to increase agricultural yields. As agriculture remains rainfed, the increase in production is the result of extensification in the region.Based on the results of this study, the following recommendations can be made:- Considering the effects of volatility that degrade the state of food security in the study area, countries should implement a price stabilization policy for necessities, especially by guaranteeing a remunerative price to producers and by making strategic stocks. It would also be all the more judicious to set up a platform disseminating information concerning the situation and the prediction of agricultural markets.- Regarding imports and trade openness, which encourages the proliferation of undernourishment and poverty following the reduction of agricultural income, countries should control the flows and the nature of imported food products to put an end to the evolutionary figures of insecure people;- Looking at the variables responsible for climate shocks that negatively influence production, countries should set up agricultural risk management funds to minimize risks and enable farmers to obtain credit from financial institutions;- Concerning inflation, which increases the prevalence of anaemia among women of childbearing age, countries should control this factor to maintain purchasing power at an acceptable level and consequently reduce the rate of under- food in the area;- Regarding the food production index, which encourages the prevalence of anaemia among women of childbearing age, the countries of the study area are requested to set up structures for sensitization on nutrition. (a healthy and balanced diet) to better control the proper use of food.Finally, as a perspective, the researchers should continue the study on an area as vast as that considered in the present study, especially by using the raw data of short frequency. In addition, other researchers could investigate the determinants of agricultural price volatility in the study area.

6. Paper Limitations

- The results of this study should be interpreted with several caveats in mind. First, due to data constraints, some EAC members—such as South Sudan and Uganda—were excluded, which reduced regional representativeness. Second, although it is methodologically logical, converting annual data to quarterly frequency could not effectively capture the effects of short-term volatility. Third, the lack of household-level data hinders our understanding of coping mechanisms and intra-national differences. Fourth, possibly due to farmers' limited access to market information, price volatility was often found to be statistically negligible. Fifth, factors related to trade and the environment do not account for more specific shocks, such as trade restrictions or severe weather. Finally, the findings' generalizability is limited by the impacts' variability among nations and crops, which necessitates additional regional assessments in subsequent studies.

Notes

- 1. This program is based on four pillars, which are: (i) extension of areas benefiting from sustainable land management and reliable water control; (ii) improvement of rural infrastructure and trade capacity for market access; (iii) increased food supply, to reduce hunger and improve response to food crises; and (iv) improved agricultural research, technology dissemination and adoption [54].2. Here L represents the logarithm transformation.3. In this equation, the variable of price volatility is subdivided into rice price volatility (HR) and maize price volatility (HC). It is the same for the variable PE where we have PEC for maize and PER for rice.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML