-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Microeconomics and Macroeconomics

p-ISSN: 2168-457X e-ISSN: 2168-4588

2017; 5(1): 1-5

doi:10.5923/j.m2economics.20170501.01

Analysis about Export and Economical Growth of Countries that Give Economic and Political Direction to Middle East Geography

Murat Beşer, Nazife Özge Kiliç

Department of Economics, Agri Ibrahim Cecen University, Agri, Turkey

Correspondence to: Murat Beşer, Department of Economics, Agri Ibrahim Cecen University, Agri, Turkey.

| Email: |  |

Copyright © 2017 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The purpose of this study has aimed at examining export and economic growth of Turkey, Iran, Israel, Egypt and Russia that designate the general politics of the area in the political uncertainty environment of Middle East but have different political standing from each other. Effect of exports of five countries chosen in this study on the economic growth had been examined with Panel Data Analysis by taking consideration of the economic performances in between 1989-2015. According to empirical analysis result, bidirectional causality relationship from export to growth had been determined.

Keywords: Export, Economic Growth, Panel Data Analysis, Causality Test

Cite this paper: Murat Beşer, Nazife Özge Kiliç, Analysis about Export and Economical Growth of Countries that Give Economic and Political Direction to Middle East Geography, Microeconomics and Macroeconomics, Vol. 5 No. 1, 2017, pp. 1-5. doi: 10.5923/j.m2economics.20170501.01.

Article Outline

1. Introduction

- Relationship between export and economic growth has taken part in between most discussed subjects in recent years. However, there is not a certain consensus about whether export provides the economic growth or else growth increases the export in the relationship between export and economic growth. This argument has become more of an issue in determining the relationship between economic growth and export with respect to develop and apply of suitable growth and development strategies. Export has created some exteriority on economic growth. It has contributed to formation of an effective price mechanism by enabling spread of technical information and recent technologies and by providing increase of general productivity in economic along with increasing competition in the introduction to international markets beside important improved source allocation. Export has played an important role in the growth process of a country by obtaining insufficient currency resources that are necessary to provide financing of important import as investment goods [1]. Economies that has a narrow domestic market obtain the opportunity for production in economical scale by only export [2].Export based strategy has foreseen that countries should make products in the areas that they have comparative advantages in the free trade conditions. In other words, not all industries only the ones that has the potential of development should be tried to encourage. To do so, it has been emphasized that it should be followed a trade regime that is not going to pluck the economy from international trade and that it should be allowed to determine the national resource budget by not only home demand also by international demand [3].The purpose of this study is examining the mutual benefit potential of trade performance and relations between Turkey, Iran, Israel and Russia that form the region politics by being the most important economic and political agents of East Europe and Middle East in terms of these country economies. In this context, relationship between export and economic growth has been analysed in these countries by using annual data for the era 1989-2015. Study has consisted of three chapters. While it has been given place to studies that examines the relationship between export and economic growth in the first chapter, it has been given information about data set and method and panel data application has been done in the second chapter. Finally, it has been given place to result and suggestions in the third chapter.

2. Literature Review

- Relationship between export and economic growth is one of the most argued subjects in the economy literature. In approximately 40 years, most of the developing countries had passed to growth policy based on export from import substitution policies that they applied before. Common view among economists is in the direction of that export affected the economic growth positively. However, it is also possible to see the studies about that there is no relationship beside that there is mutual causality relation in between export and economic growth in the studies that relationship between export and economic growth is examined. It had been given place to studies that examine the relationship between export and economic growth in terms of econometric in this chapter of this research. Doraisami (1996) [4] had examined the relationship between export and economic growth in Malesia by using the annual data of era of 1963-93. In the study, he had used cointegration and error correction model and as a result he had revealed that there is a positive relation in the long term in between export and economic growth. Amoateng and Adu (1996) [5] had analyzed the relationship between export, external loan and economic growth for 35 Africa countries by using annual data in between 1971-1990. They had reached to result that there is bidirectional causality between external loan, export and economic growth in the study that Granger Causality Test was applied. Ekanayake (1999) [6] had analyzed the relationship between economic growth and export for 8 developing Asia countries by using annual data in between 1960-1997 era. Research had been analyzed within the scope of Granger Causality Analysis based on two-steps Engle-Granger, Johansen cointegration and error correction model. Application results have shown that there is cointegration relation between export and economic growth in countries subjected to study. Hatemi-J and Irandoust (2000) [7] had searched the growth hypothesizes based on export for Turkey, Greece, Ireland, Mexico and Portugal. They had applied the Toda and Yamamoto method in the study. While there is not causality relation between export and output for Turkey and Greece in the result of application, it had been found a relation from export to growth for Ireland and Mexico and a relation from growth to export for Portugal.Ramos (2001) [8] had searched the relationship between export, import and economic growth between 1865-1998 for Portugal within the scope of Granger Causality analyses. Research results have established that there is bi-directional causality relation between export increase and economic growth. Ahmed, Cheng and Masshis (2007) [9] had examined the relation between export, foreign direct capital investment and economic growth for five Sub-Saharan Africa countries by using time series and panel data analyses with the help of the cointegration test. According to analysis done, it has been seen that there is long term relation between export and GDP increase in the Sub-Sharan Africa countries. In short term, there is bi-directional causality relation for other countries except South Africa and there is unidirectional causality relation from growth to export for The Republic of South Africa. Bilgin and Şahbaz (2009) [10] had searched the relations between export and economic growth for Turkey by using monthly data for era of 1987-2007. To specify the direction of relation between variables, they had applied Granger Causality Tests based on error correction model and Wald tests converted by Toda and Yamamoto. Unidirectional Granger Causality fact from export to industrial production index had been observed according to Toda and Yamamoto. In addition, bi-directional causality relation had obtained in between export and international terms of trade.Takım (2010) [11] had analyzed the relationship between export and growth for Turkey in between 1975-2008 with the help of Granger Causality test. As a result, it had been observed that increase of export does not support the increase in growth. Mangır [12] had investigated the relationship between economic growth and export for Turkey economy in the study that he did by using the trimester time series data in the era between 2002-2011 with the help of Juselus cointegration and Granger Causality Test. In the results of the study, it had been found that there is cointegration and bi-directional causality between export and GDP. Ağayev (2011) [13] had viewed the export and economic growth for the example of transition economy of twelve Soviet Union countries by using panel cointegration and panel causality analyzes. Research results had shown that export increase does not cause to economic growth and growth hypothesis based on export is not valid for these countries. Results had supported that causality relation is from economic growth to export increase in short and long term. Klavuz and Topcu (2012) [14] had examined the effect of export and import on growth in 22 developing countries in the era of 1998-2006. According to analysis result, it had been determined that there is positive effect of high and low-tech manufacturing industry export on growth. Zang and Baimbridge (2012) [15] had searched the relation between export, import and economic growth for South Korea and Japan by constituting vector autoregressive model (VAR). According to empirical analysis result, it had been concluded to that there is bi-directional causality on export and economic growth for each country. It had been found that export has negative effect on economic growth in South Korea while export has positive effect on economic growth in Japan. Iqbal et al. (2012) [16] had used the Granger Causality analysis in the study that relation between export and economic growth are examined in Pakistan by using annual data between era of 1960-2009. According to Granger Causality test results, it had been determined that there is a unidirectional causality from economic growth to Pakistan. Tapşin (2016) [17] had searched the causality relations between foreign direct investments, export and economic growth in Turkey between 1974-2011. According to Toda and Yamamoto Causality analysis result, it had been found that there is bi-directional causality.

3. Analysis

3.1. Text Font of Entire Document

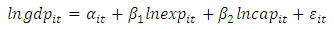

- In the study, annual data between 1989-2015 had been used as research period. Panel data analysis had been done on 51 countries including Turkey. In the analysis, state of ln of GDP per capita and export data and gross capital formation data had been included to model. Variables used in the model had been obtained from World Development Indicators database of World Bank. Gauss 10 had been used for the analysis. Econometric model that is going to be guessed in the study is as shown below.

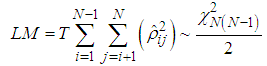

| (1) |

3.2. Empirical Analysis Findings

3.2.1. Cross-sectional Dependency

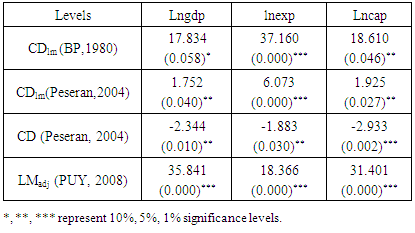

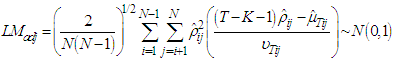

- It had been consulted to Peseran (2004) [18] CDLM test to investigate whether there is cross-sectional dependency or not. The existence of cross-sectional dependency has been checked with Breusch-Pagan (1980) [19] CDLM1 test when time dimension is bigger than cross-section size; it has been checked Peseran (2004) CDLM2 test when time dimension is equal to the cross-section size and it has been checked with Peseran (2004) CDLM test when time dimension is smaller than cross-section size. These tests have been deviant when group average is different from zero. LM test statistic is at first as follows:

| (2) |

| (3) |

|

- Table has shown the cross-sectional dependency test results. As seen in the Table, H0 hypothesis had been rejected since probability values of lngdp, lnexp, lncap variables are smaller than 0.05 and it had been decided to that there is cross-sectional dependency in the series. Because of this, tests considering the cross-sectional dependency had been used when unit root analysis of series used in the study was made.

3.2.2. Unit Root Test

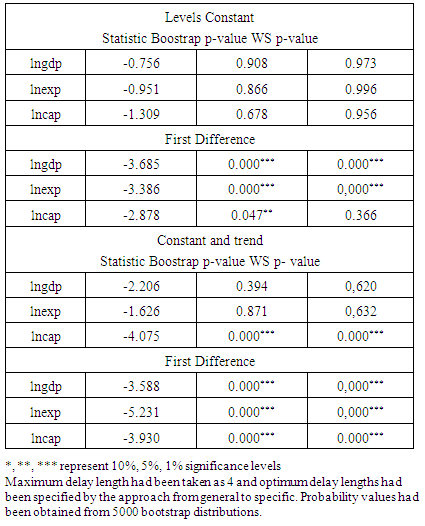

- Since cross-sectional dependency had been found in between the countries constituting the panel, unit root test considering the cross-sectional dependency that Smith et al. (2004) developed from second generation unit root tests had been used to examined the stability of the series in the study. This test has considered the cross-sectional dependency while it is making unit root testing. When there is cross-sectional dependency between series, making the analysis without considering this situation has overimpressed the results that are going to be obtained [19]. Not considering the cross-sectional dependency when unit root test to be conducted are chosen is going to make the analysis results done as unbiased and consistent [18].

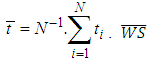

test developed by Smith et al. (2004) [21] is the boostrapt version of unit root test that is incidental to Im et al. (2003) [22] and it has been calculated as

test developed by Smith et al. (2004) [21] is the boostrapt version of unit root test that is incidental to Im et al. (2003) [22] and it has been calculated as  is has been developed by Pantula et al. (1994) [23]. Relevant tests are based on unit root test hypothesis and they have allowed to heterogeneous autoregressive root under the alternative hypothesis [24].Whether series include unit root or not had been examined with test developed by Smith et al. (2004) and results had been shown in below.The calculated unit root test statistics for model 1 are shown in table 2.

is has been developed by Pantula et al. (1994) [23]. Relevant tests are based on unit root test hypothesis and they have allowed to heterogeneous autoregressive root under the alternative hypothesis [24].Whether series include unit root or not had been examined with test developed by Smith et al. (2004) and results had been shown in below.The calculated unit root test statistics for model 1 are shown in table 2.

|

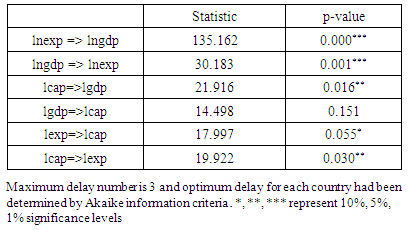

3.2.3. Causality Test

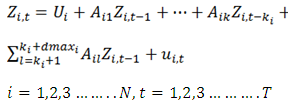

- Panel Fisher test developed by Emirmahmutoğlu and Köse (2011) has been based on the logic of Toda-Yamamoto (1995) causality test in time series. Superior part of this test is that it can include the I (0) and I (1) series together [25]. Following model prediction has been made in the first state of the test:

| (4) |

|

4. Result

- In this study, data set related to 5 countries which are Turkey, Israel, Russia, Egypt and Iran that are chosen for export and economic growth relation had been examined by using panel causality methods.Unit root testing developed by Smith and others had been used to examine the stability features of series of export and GDP variables for this purpose. Then, Panel Fisher test based on Toda-Yamamoto causality logic in the time series had been used to establish the causality relation between export and growth. According to causality test results, it had been found that there is positive causality from growth to export increase and from export to economic growth in 5 countries subjected to research. Economic growth has caused to export increase and export increase has caused to economic growth. This situation can be interpreted as assumption that economic dependencies between countries that direct to regional policies may be an important dynamic in terms of settlement platform between countries in a geography as Middle East that geopolitical profits intersect mordantly.Note1. Chosen countries as part of analysis are Turkey, Iran, Israel, Egypt and Russia.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML