-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Microeconomics and Macroeconomics

p-ISSN: 2168-457X e-ISSN: 2168-4588

2016; 4(2): 56-59

doi:10.5923/j.m2economics.20160402.03

A Micro-Economic Perspective on Social Media in Context of the New Economy

Robert Sasse

University of Gdańsk, Faculty of Economics, Jana Bażyńskiego, Gdańsk, Poland

Correspondence to: Robert Sasse , University of Gdańsk, Faculty of Economics, Jana Bażyńskiego, Gdańsk, Poland.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The paper focuses its attention on an analysis of the Digital Economy and its industrial object – information, particularly through the discussion of social media. The social media is attributed to Web 2.0 – informational technologies, primal aspects of which can be described as a usage of an active user participation, collective intelligence. From the micro economical point of view, this distinctive feature of the media strongly distinguishes it from any classical economical goods, merging together producers and consumers of the content. Another difference, which can be observed in production of digital goods is their low cost of production, which leads to marginal costs of zero. This, and also no barriers of capacity, causes a high risk for a market entry and a strife for a market leadership in a respectful niche. For social media, in any according niche the benefit of a network raises accordingly to the rise in participants’ numbers. Differing medias in different niches are showing the character of natural monopolies, when inferior competitors lose their significance. These features illustrate a big difference to classical micro-economic theories. This work provides an explanation for the micro-economic classification of social media, but up to date the existing economic theory can provide no informed model for explanation.

Keywords: Social media, New economy, Micro economics, Information

Cite this paper: Robert Sasse , A Micro-Economic Perspective on Social Media in Context of the New Economy, Microeconomics and Macroeconomics, Vol. 4 No. 2, 2016, pp. 56-59. doi: 10.5923/j.m2economics.20160402.03.

Article Outline

1. Introduction

- Since the mid-80’s one can observe a dramatic change in the existing economic system, which arises mainly from the digitalization and the encroachment of the internet in every part of life and economy. This system partly distinguishes itself drastically from the classical economy in its dynamics, functionality and rules and abrogates some of its general rules. This new economic order oftentimes is called “New Economy” or “Digital Economy”. The object of the industry New Economy are in contrast to the classic economy no physical goods, but information, which can easily be reproduced and modified. The present thesis wants to follow the term of information by Shapiro and Varian (1998), which names everything, that can be digitalized, as “information” [1].The New Economy distinguishes itself by the advancing of steadily new players on the market, which offer in addition to classic information goods, such as newspapers and books, information-intensive services, such as trips or financial services as well. Based on the networked markets of information new models of value creation arise, which partly erode older models, such as the book store, travel agencies or branch banks [2].In accordance with the above mentioned definition Social Media is considered as a good of information, too. With its properties of scale- and network-effects Social Media show typical characteristics of information goods and need to be researched in the context of the New Economy.The discussion on a “New Economy” began in the mid-90’s when the internet started to spread rapidly across the US and gained momentum in the business press. Central aspects in this discussion are the consequences of technological change, where at this discussion can be divided into two groups: First in the macro-economic discussion on factors, such as economic growth, employment and price level, and secondly in the discussion on micro-economic and managerial implications of the New Economy. The latter will be discussed below and be linked to Social Media.

2. Social Media in the New Economy

- A majority of the current internet innovations is originated in the development of the Web 2.0. In 2005 Tim O’Reilly coined the term “Web 2.0” [3]. He described the Web 2.0 in one of his articles as “a change of the business world and as a new movement in the computer sector towards the internet as platform” [4].Central aspects of the Web 2.0 can be defined as “an active user participation, the usage of the potential of the collective intelligence of all web users and the opportunity to make modifications in the manifold contents of the internet” [5]. Web 2.0 thereby describes the phenomenon of Websites that can not only be created and modified by chosen specialists and companies but by the users themselves. This phenomenon is called the User Generated Content (UGC) [6]. Classic examples for Web 2.0 applications are wikis, blogs, photo- and video platforms, such as YouTube, Pinterest, Instagram and social Networks, such as Facebook or Google+. Such platforms or networks are called “Social Media”. They allow social interaction via the web and therefore construct the participatory Web 2.0. In other words, serves Social Media as construction site in which users can build the new web.Therefore, the web has developed from a media for information into an interactive instrument of communication. So Social Media are goods of information, which unlike classical goods cannot be solely provided by suppliers. While Social Media provides the infrastructure and develops it, the contents are partly generated by users, which become prosumers by unifying the functions of a producer and consumer [5].

3. Micro-Economic Discussion

3.1. Classification of Information Goods

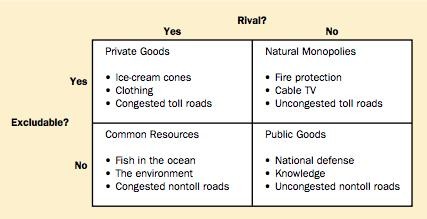

- A common model in national economy for the classification of goods is provided by Mankiw (1998). According to it goods can be divided into four groups by the help of their rivalry and exclusiveness (Figure 1). Exclusiveness means that producers can make the use of their goods dependable on the payment of a fee and expulse owners of specific goods from consumption. Rivalry means that the use of a good by one consumer impairs other consumers. Digital goods fulfil neither of those conditions and therefore cannot be integrated into the public goods.

| Figure 1. Classification of goods [7] |

3.2. Cost structure & Formation of Prices of Digital Goods

3.2.1. Economies of Scale of Digital and Classic Goods

- Costs of development for a digital product are normally much higher than the costs of production or distribution costs. For example: The operation system Microsoft Windows 3.1 generated development costs of 50 million $, the production costs however totaled only 3 $ per unit [8]. In case of a fully digital product, the production costs tend to be zero.The higher the relation of fixed costs to variable costs, the stronger are the unit costs with rising sales volume [9]. These economies of scale on information goods are not limited and especially apply to Social Media, where an additional user generates no costs, but increases the networks’ value for other users.Connected to the marginal costs, which are almost none, it totals in endlessly falling average costs. The exhaustion of the economies of scale experiences in information goods an additional leverage [2]. In case of classic goods, the economies of scale are however mostly limited, which can be led back to a U-shaped course of marginal costs: Costs for an additional produced unit sink at first, but increase when a specific output is reached. The average costs run U-shaped accordingly. This is to be led back to factors such as increased coordination effort, maintenance and capacity constraints at an exceedance of the optimal degree of capacity utilization.

3.2.2. Barriers to Market Entry and Formation of Prices

- Marginal costs of zero and no barriers of capacity: what sounds like an attractive business model for providers of digital goods, actually salvages high risks for the market entry. Concerns, which cannot achieve a top spot in the market, are endangered to a devastating price war or face the danger of not achieving the sales volume, which makes an amortization of the high fixed costs impossible [1].Actually many companies of the “New Economy”, such as Social Media companies, are founded for achieving market leadership in their niche. Oftentimes the reach, which makes a business model profitable in general, can only be achieved by gaining market leadership [10]. This illustrates a big difference to classical micro-economic theories on market entry.The formation of prices of digital goods is under the aspect of classic theories no fully new concept. Marginal costs near zero apply also to e.g. a flight, which generates the same fixed costs autonomous of the total passengers. But there is a difference to digital goods: There are barriers of capacity. An airline can only transport a limited number of passengers. But a software developer or a Social Media platform on the other hand can produce am infinite amount of software or receive an infinite number of users.

3.3. Network Externalities and Critical Mass with Social Media

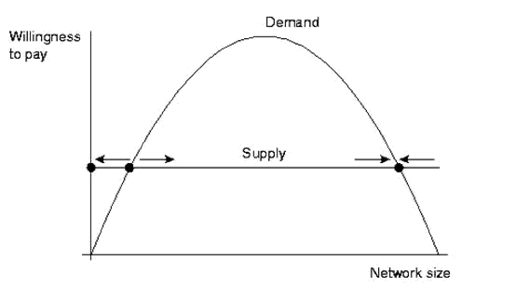

- The benefit of a network raises accordingly to the rise in participants’ numbers. Therefore, networks exhibit positive external effects, which are limited to the users [1]. A colourful example for a positive effect of networks on the demand side is Facebook. The first users had a benefit of almost zero. Not until the user numbers have reached a critical mass, which allows the single user to find old friends or to stay in contact with friends, unfolds the benefit of the network.Social Media, regardless if social network, crowdfunding platform or search tool, show these network externalities. The reason for that is a specific curve of demand, which can be derived by the willingness to pay for network goods.If the size of the network is too little, is the willingness to pay too little as well. If there is a rise in users, rises the willingness to pay as well, but drops at the point where all users that experience a higher benefit as the price, already are participants in the network. The curve of demand shows the form of a parable with its opening to the bottom (Figure 2).

| Figure 2. The curve of demand for social media [12] |

3.4. Natural Monopolies in Social Media

- While differing Social Media networks are dominating in different niches, such as LinkedIn in business, YouTube in Videos or Twitter in Microblogging, these networks show the character of a natural monopoly [12]. This is based on so called feedback effects, which are characteristic for digital goods and can also be found in Social Media. Feedback effects are the result of the cooperation between scale and network effects and see to the effect of inferior competitors losing more and more significance [9].Scale and network effects, which promote a monopoly, were already discussed in the previous chapters. Lock-in effects appear, when the change to another provider or network is accompanied by high costs. With Social Networks costs of change appear in form of sunk costs in the use of established structures.While providers of the classic economy tend to profit from scale effects on the supply side, the New Economy profits from scale effects on the demand side [1].The typical reason for natural monopolies however should not be neglected in Social Media.

4. Conclusions

- The thesis at hand provides a short explanation on the micro-economic classification of Social Media. One can see, that Social Media shows many similar characteristics like network goods or information goods. Therefore, important basic characteristics of Social Media can be explained by help of existing micro-economic concepts. Additional fields of research arise out of the existence of a new market player, the “prosumer” of Social Media, who disrupts the classic dynamic of supply and demand side. Up to date the existing economic theory can provide no informed model for explanation.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML