-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Microeconomics and Macroeconomics

p-ISSN: 2168-457X e-ISSN: 2168-4588

2015; 3(4): 83-88

doi:10.5923/j.m2economics.20150304.01

The Impact of Inflation on Stock Prices: Evidence from Pakistan

Ghulam Muhammad Qamri1, Muhammad Abrar Ul Haq2, Farheen Akram3

1Department of Economics, Nankai University, China

2School of Economics, Finance and Banking, University Utara Malaysia, Malaysia

3Department of Commerce, the Islamia University of Bahawalpur, Pakistan

Correspondence to: Ghulam Muhammad Qamri, Department of Economics, Nankai University, China.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This empirical study design to investigate the association between stock price and inflation in Pakistan. Many previous studies around the globe examine the relationship between stock price and inflation and proposed different results, many of them found that there is positive link between inflation and stock price. On the other hand some studies realized the negative relationship between these two terms. This research is based on past ten years data of Karachi stock exchange (KSE 100) and the statistical results of this research shows that there is negative relationship between stock price and inflation. Furthermore, when prices of stock are low firms avoid to enter in capital market until the central bank provide alternate for firm’s plan to invest in capital market. Moreover, firm’s equity value is also hit by the startling inflation rate. Similarly tightening of monetary policy can reduce inflation and stock prices both as individuals will be left with less money to buy goods or buy stocks.

Keywords: Stock price, Inflation, Karachi Stock Exchange, KSE 100

Cite this paper: Ghulam Muhammad Qamri, Muhammad Abrar Ul Haq, Farheen Akram, The Impact of Inflation on Stock Prices: Evidence from Pakistan, Microeconomics and Macroeconomics, Vol. 3 No. 4, 2015, pp. 83-88. doi: 10.5923/j.m2economics.20150304.01.

Article Outline

1. Introduction

- History has shown that the price of stocks and other assets are essential part of the dynamics of economic activities and can influence or be an indicator of social mood. Also an economy in which the stock market is on the rise is considered to be an up-and-coming economy. In fact, the stock market is often considered the primary indicator of a country's economic strength and development (Yahyazadehfar et al, 2012). Moreover stock market has a marked impact on the economy of every nation. And also stock market is one of the most important way for companies to raise money, along with debt markets which are generally more imposing but do not trade publicly (Zheng et al, 2010). This allows businesses to be publicly traded, and raise additional financial capital for expansion by selling shares of ownership of the company in a public market. Likewise, liquidity that an exchange affords the investors enables their holders to quickly and easily sell securities this is an attractive feature of investing in stocks, compared to other less liquid investments such as property and other immoveableassets.There are three main stock exchanges working in Pakistan and the names of these stock exchanges are Karachi stock exchange (KSE), Lahore stock exchange (LSE) and Islamabad stock exchange (ISE). However, a Memorandum of Understanding (MoU) was signed in Islamabad on 27 August 2015 to form Pakistan Stock Exchange, with the merger of Karachi, Lahore and Islamabad stock exchanges. Further, performance of the stock markets is measured in indexes, index is a method to calculate the performance of the whole stock market. Consequently, in Pakistan there are different indices on which the performance of the stock market is measured. Among these indices three are most popular KSE all share, KSE 30 index and KSE 100 index.Moreover there are two types of forces which influence the stock prices, micro forces and macro forces. Micro force which influence price of equity share is demand and supply force i.e. in bullish trend when people begin to buy than prices go up due to excessive demand (Chakravarty et al, 2010). Similarly in a bearish trend when stock holders start selling shares than prices fall down due to excess in supply. Other factors like government policies, industry and firm's image along with its performance pressure demand behavior of investors are known as macro forces (Chong et al, 2011). Additionally, macroeconomic forces include politics, general economic conditions like performance of an economy, government regulations, etc. (Chong et al, 2011; Ibrahim, 2003). Subsequently, there are some other microeconomic factors like demand and supply circumstances the performance of the various companies and contrast of industries with one and other.Furthermore, relationship between stock market prices and inflation is of great relevance from the policy point of view. As inflation is an integral macroeconomic factor which influence the economy of a country domestically and international level. Previous studies proposing a negative relationship between stock costs and expansion. Chakravarty et al, (2010) visualize that high inflation predicts a financial downturn and keeping in view this the organizations begin auctioning off their stock. An increment in the supply of stock then diminishes the stock costs. Since stocks mirror firms' future gaining potential a normal monetary downturn prompts firms to auction the money related stocks and in this way high expansion and low stock costs have a tendency to go together (Rostagno et al, 2010). Erikiet al (2001) also cited that there is negative relationship between stock prices and inflation. However, Bhattacharya and Mukherjee (2002) demonstrated a two-path causation between stock cost and the rate of expansion, while file of mechanical creation lead the stock cost. Then again, a positive relationship is additionally conceivable in the middle of expansion and stock costs as startling inflation raises the organizations' value esteem in the event that they are net borrower (Kessel, 1956; Ioannidis et al., 2005). While considering the Greek economy Ioannidis et al. (2004), utilized ARDL co-integration method as a part of conjunction with Granger causality tests to identify conceivable long-run and short-run impacts in the middle of expansion and securities exchange costs furthermore the heading of these impacts. The outcomes give proof for a negative long-run causal relationship between the arrangements after 1992.As the inflation rate has diverse pattern in past as a result of change in global oil costs, political components and financial emergencies and terrorism, that hit the share trading system in Pakistan moreover. So this study exceptionally outline to inspect the changing effect of this macroeconomic component on stock costs.Consequently, macroeconomic measures are not quite the same as economy to economy. The degree of study is just for Pakistan with Karachi stock trade, measuring its execution with expansion rate of Pakistan. Indeed, even geologically neighbor nations are keeping up their own approaches for interest rate and inflation and stock records may have diverse file measures. This study directed just considering circumstances of Pakistan. Moreover, there are different components, for example, Interest rate that influences the Stock costs however this study has investigated just effect of expansion on stock costs on the grounds that it has more prominent effect. Furthermore, in Pakistani connection a more prominent inflation is practically speaking, and so ebb and flow examination will help in comprehension this Pakistani setting.

2. Literature Review

- Securities exchanges are the foundation of economy and economy capacities as a result of its macroeconomic components (Yahyazadehfar et al, 2012). Moreover, market analyst setting up that cost of merchandise in an economy set up through strengths of interest and supply powers of that specific economy in light of the fact that the idea of free economy. In the security markets whichever one either essential or optional the costs of offer value restoring through various small scale and full scale powers. Also the methodology of individuals equally impact the costs of securities exchange e.g. on the off chance that individuals are more towards obtaining the shares of some organization than costs of shares go up and also if offering inclination stays same in the business sector the costs goes down. Inflation is one of the compelling macroeconomic variables, which has negative effect on monetary movement (Rostagno et al, 2010). It is figured on the premise of value lists these value files are GDP deflator, consumer priceindex (CPI), and maker value file. However, CPI is utilized to ascertain expansion in Pakistan. Also inflation reduced the estimation of cash, which at last impact on speculation. Individuals buy more strong merchandise, bonds, silver, gold, outside coin and shares, which supports against the inflation (Chakravarty et al, 2010). Furthermore, stock cost relies upon accessible financial and non-monetary data. And this data/information assembled from diverse sources shows uncontrolled change in expansion rate, interest rate, buyer value record and cost of oil (Chong et al, 2011). Also non-financial data relates with political question, crisis in the nation, and different circumstances and market members utilize this data in their decision making. Similarly, business sector value acts as an indicator to a purchaser in choosing about the present versus future utilization (Rostagno et al, 2010). Gompers et al, (2003) argued that stock costs are dictated by association of supply and interest in a business economy. The offer cost in Pakistan is in view of KSE-100 list. This record measures the temperature of securities exchange i.e. warming and cooling and its patterns can be measured by records of business sector costs.The larger part of existing studies focus on the impact of financial measures on stock costs and there are some reasonable works that inspect the impact of administrative measures on the securities exchanges. Niederhoffer et al, (1970) review the stock value practices amid decisions in diverse solid economies, and they discover futility in offer costs around the time of races. Securities exchange is extremely discriminating wellspring of measuring the financial circumstance of any nation (Fama, 1970) and in Pakistan KSE is the best model of stock exchanges working in Pakistan.A few specialists (Yahyazadehfar et al, 2012; Haslem et al, 1973) uncovered that financial specialists are commonly concerned with prospect about the near to future, remembering profit projection and real information to be of significant yields to speculators. Then again, inquire about by (Tweedie et al, 1977) demonstrates that the all in all populace confronts inconveniences in comprehension money related reporting in the share trading system. Consequently, in answer to shift in inflation rate in the past period of Pakistan there is additionally change in KSE 100 list costs which contrast due to fluctuation in expansion rate in light of interest, financial arrangements or other administrative strategies. As expansion has essential influence in interest rate determination and change in interest rate is a basic impression of progress in inflation rates and this can have an effect on stock returns (Chong et al, 2011). Moreover, some exploration demonstrated its outcome as a negative relationship of stock comes back with inflation in created nations in before war period (Bodie, 1976). Additionally, such relationship was acknowledged as an extraordinary exploration result subsequent to looking at it in the gleam of Fisher speculation and sight against that was set up as the normal stock can turn out to be a support against inflation (Yahyazadehfar et al, 2012). Such phenomenon was known as ‘stock return inflation puzzle’ (Pope et al, 1983). Some studies were conducted to decrease this puzzle with the alternative theory that stock returns are negatively correlated with inflation which is a substitute for the positive correlation between stock returns and real activity (Chakravarty et al, 2010; Fame, 1981). Many more empirical and theoretical economists also made their hypothesis as underlying relations and lively relations between real asset returns and inflation rate. Mukherjee et al, (2002) also showed a two-way causation between stock price and the rate of inflation, while index of industrial production lead the stock price.Pakistani economy is continuously facing the classic drama of constitutional instability and share prices also show the active behavior in the age of political instability. As political instability will automatically impacts on inflation rates, interest rates and external reserve rates so stock returns also influenced by that impact (Yahyazadehfar et al, 2012; Rostagno et al, 2010). Few researchers examined the force of different political events on stock prices, but find no indication of major impact of non-economic actions on stock market performance (Pope et al, 1983). Researcher have differences in their point of view that change in government management duet elections circumstances to adopt financial policies, by considerably affecting stock prices (Cutler et al., 1989). This research investigate the stock market changes due to inflation in Pakistan.

3. Research Methodology

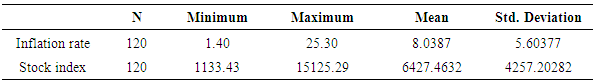

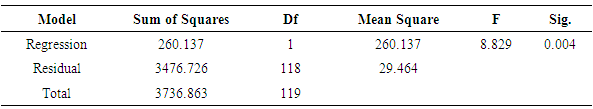

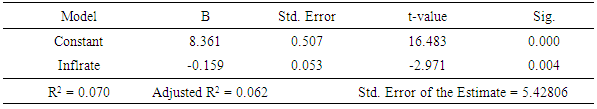

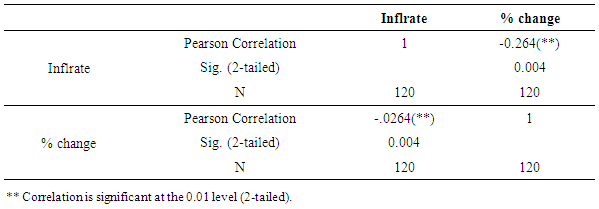

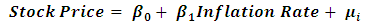

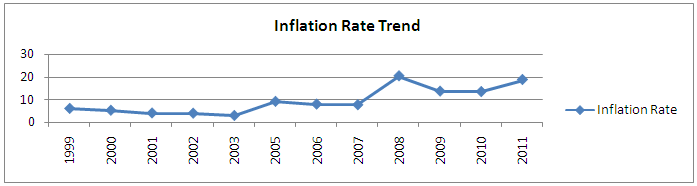

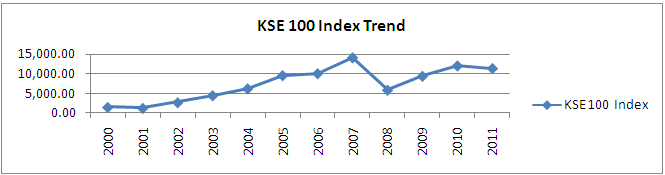

- This study comprises of two variables inflation rate and stock costs. Auxiliary information has been be utilized to demonstrate the relationship among stock costs and inflation rate in Pakistani economy. Comparative examination was done by Ibrahim, (2003) and Smiles et al, (2004) they ascertained the impact of macroeconomic variable on stock costs and one of the macroeconomic elements was expansion rate. Inflationrate is an autonomous variable and a stock cost is a needy variable. Also, there are essentially three renowned lists in Karachi stock trade and for our specimen we have utilized just the information of KSE 100 record throughout the previous ten years for this examination. Similarly, inflation rate information is gathered from diverse sources like State Bank of Pakistan, Economic review of Pakistan and Federal Bureau of Statistics of Pakistan. This empirical research based on the past 10 years data because in earlier decade Pakistani economy confronted numerous changes and expansion rate have indicated exceptionally exasperates pattern and couple of scientists i.e. Eriki et al, 2001 and Gompers, et al., 2003, have utilized the information of most recent ten years (1999 to 2011) with a specific end goal to suffice their necessity of examination. Data in this study has been analyzed by using regression and correlation analysis through SPSS, in order to show the past trends of KSE 100 index.Model,

4. Results and Discussion

| Figure 1. |

| Figure 2. |

|

|

|

|

5. Conclusions and Recommendations

- Securities exchanges are vital markers to gauge financial state of any nation. Numerous elements are influencing securities exchanges (full scale and small scale components). Every element of economic environment impact on money markets however the power is diverse. Here inflation rate is imperative component which influences securities exchange. Also inflation rate itself is a macroeconomic variable, which relies on a wide range of elements like oil costs and legislative arrangements and so forth affecting effect is not quite the same as nation to nation and economy to economy. Furthermore in our economy low negative effect of inflation rate has found on stock costs that we have finished up from our examination done above. We will acknowledge the substitute theory and reject invalid speculation relying on the outcome we had in our examination. As the pattern has demonstrated that inflation rate and stock record has specific relationship. Such association implies when government applies expansionary money related strategy to help up the economy the immediate effect is on the share trading system. As bringing down premium rates are ideal for economy so best time for new and little scale financial specialists to put resources into money markets is when expansion and premium rates are casual.Consequently, impact of inflation on stock prices is not much stronger so other factors like company's performance, earning per share, GDP growth dividend policy and other micro and macro factors can also be considered which influence or can influence stock market. So investor should have a good track of all these things while making investment. Furthermore, government should come up with a strategy to find out the best fit between inflation rates and stock indices. So that it can control unreasonable increase in inflation and encourage bullish trend in a positive way to encourage the local and international investors. Data Sources:● State Bank of Pakistan: www.sbp.org.pk● Secp Pakistan: www.secp.gov.pk● Business Recorder: www.brecorder.com● Federal Board of Statistics: www.statpak.gov.pk

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML