-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Microeconomics and Macroeconomics

p-ISSN: 2168-457X e-ISSN: 2168-4588

2015; 3(3): 67-81

doi:10.5923/j.m2economics.20150303.03

The Economic Power of Money Creation

Randa I. Sharafeddine

Doctoral Program of Economics Science, Faculty of Economics and Business, Jinan University, Lebanon

Correspondence to: Randa I. Sharafeddine, Doctoral Program of Economics Science, Faculty of Economics and Business, Jinan University, Lebanon.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

This article is about our monetary and financial system. The main objectives would be the end of expansion and recession periods, through a better economic stability; a fairer distribution of the income resulting from money creation; and the building of a more reliable global financial system. This article explores the possibility for a Central Bank to finance the State's investments at zero interest rate 0%, like was the case when they had this right. This study will show that this model is viable, and would allow the collectivity to pay back the public debt and lower the taxes at the same time.

Keywords: Monetary Creation, Central Bank, Public Debt, Treaty of Maastricht, Currency Principle and Banking Principle, Economic Stability

Cite this paper: Randa I. Sharafeddine, The Economic Power of Money Creation, Microeconomics and Macroeconomics, Vol. 3 No. 3, 2015, pp. 67-81. doi: 10.5923/j.m2economics.20150303.03.

Article Outline

1. Introduction

- This article starts focusing on the monetary creation, which is the basis of our financial system. It talks about its control, which has been transferred from the States to the Central Banks and then to the Commercial Banks. It explores the reasons of this changes and the situation it created, particularly regarding the public debts that started at this time and which kept on growing ever since. We feel concerned about the public debt and have thought several times about how States end up so deep in debt. It is a major problem that most of the States in the world are facing today. This problem gets bigger and bigger every year, it happens that sometimes politicians talk about reducing it when elections are approaching, but in fact, this problem is never taken care of. But who is going to pay it back? And how did the States develop such an enormous debt?For taking the monetary creation subject further and using it to analyze the financial system, and find in there solutions to its instability, a very interesting book, written by Nobel Prize 'Maurice Allais', titled ''the financial crisis: for deep reform of the financial and monetary institutions'', linking monetary creation and financial system. It was really helpful and led me to take this article one step further. Maurice Allais believes that the way out of such crises is best achieved through structural reforms through, adjusting the rate of interest to 0% and revising the tax rate to about 2%. Those reforms would take time to implement and would face many interests, but at the end, they would benefit the collectivity and it would especially aim at making our financial system more stable, before it collapses.

1.1. History of Money Creation

- Money is an instrument used in our daily life in a manner so that its systematic use has become normal, unreflective. Indeed, in a decentralized economy like ours, this instrument plays three roles: it can acquire a good or service, measuring the value of things to each other and can defer consumption in time e.g. money has a store of value. The monetary creation appeared when bankers who kept people's gold gave banknotes in certification of deposit, banknotes that were used to pay on markets. Then basing on the fact that chances for all the depositors to come at the same time asking for their gold was really low, they started issuing more banknotes than they had gold. The monetary creation was born, contingently, by chance.In history, money has taken various forms through a process of dematerialization, objects, base metals, precious metals, paper, and finally electronics. However, these currencies have been living together before being preferred or abandoned. The most important was probably the gold that was used as bargaining chips long before becoming used as a convertible currency in order to ensure their stability. For example, in the early 20th century, a gram exchanged against 0.29 grams of gold and 7.32 grams a pound, which gave us a pound to 25.24 francs. Thus gold was the basis of the international financial system.In 1914, France abandoned the gold for banknotes, but kept the convertibility of bank money in gold. In 1944, at Bretton Woods, the ounce (31 grams) is set to $ 35. Then, even if central banks keep gold in their coffers, demonetization of gold at the international level is effective in 1976 when a reference to gold is removed in the IMF Articles of Agreement.Today, gold represents nothing since money isn’t convertible into gold anymore. Money has nothing to see with something material. It is created by banks and only depends on people’s trust that other people are willing to accept banknotes in payment of merchandises or services. In our economies, commercial banks are the one allowed to issue money and Central Banks aren’t, not even to finance their State’s investment. Did you know that when you borrow money from a bank, the bank issues the money, meaning it creates it from nothing, ex nihilo? If you're not familiar with our monetary system, it's normal. No one knows this fact, even if it the basis of our financial system. Lending money, for banks, doesn't mean ''I lend you some money I have'' but ''I trust you to be able to pay me back''. The bank actually creates the money when you need it. This is how the quantity of money we have on earth has been growing so much over the years. Money is created by banks from nothing to be then lent to borrowers against interests. How can commercial banks create almost as much money as they want, and then lend something they didn't own in the first place charging interests? How the monetary creation power that at first belonged to States was, through successive steps, transferred from the States to the private bank?

1.2. The Money Today

- Today, we classify the currency in four monetary aggregates, ranging from more liquid to less liquid.M0 corresponds to bank account deposits.M1 corresponds to M0 plus deposits with terms less than or equal to two years and deposits with a notice for repayment not exceeding three months (as, for example, in France, young or CODEVI booklet A and blue, the housing savings account, a savings account…)M2 is M1 plus marketable instruments issued by monetary financial institutions (MFIs), which represent assets for which the liquidity is high with little risk of capital loss on liquidation (e.g. funds, certificate of deposit)?M3 consists of M2 plus treasury bills, commercial paper and medium term notes issued by nonfinancial corporations.Banknotes and coins are only a fraction of the existing currency; deposit money now represents over 90%. This is partly why, as the Central Banks are called ''emission institute'', their power of action is relatively low. They still play an independent and effective role with the effect of their interest rate that has effect on the global economy.Banks create money purely and simply, ''ex nihilo'', in other words, from scratch. They create the money by writing a simple book by entering their balance sheet assets and liabilities in the amount of credit. Appropriations do deposits, and not vice versa.Thus, when a credit is granted by an institution with the power to create money, that money will be accepted as payment in the same way that a currency would represent a deposit of gold. Maurice Allais, Nobel laureate in economics, reminds us in his book; Today’s world wide crisis: For deep reforms of financial and monetary institutions: "Basically, the credit mechanism leads to a creation of means of payments scratch [from scratch], because the holder of a deposit with a bank considers it a cash available, while at the same time, the bank has lent the greater part of this deposit, which re-filed or not a bank, is considered an available cash by its recipient. At each credit transaction, there is duplication. In total, the credit mechanism leads to a creation of money out of nothing by mere book entries.''As a result of this process, banks have really slim cover for the money they create. Most of the money they create only corresponds to debt, and banks would be only able to give to their customer more than 20% of their money back. But of course, the system assumes that not everybody is going to ask for his money at the same time. The following scheme represents the portion of the money circulating that is more or less covered by money banks actually own.

2. Theories

2.1. Monetary Policy and the Quantity of Money Theory

- Monetary policy is a process implemented usually by a monetary authority, whether a government or a central bank, in order to manage either the supply of money or trading in foreign exchange markets. Monetary policy can be an expansionary policy or a contractionary policy. The former is a policy that increases the total supply of money in the economy, while the latter is a one that decreases the total money supply.Expansionary policy is usually used to fight unemployment in a recession by decreasing the interest rates. On the other hand, contractionary policy tends to increase the interest rates to fight inflation for example.Four Tools for Conducting the Monetary Policy1. Monetary BaseIt is one of the basic monetary policy tools. This tool; when played around with, changes the total amount of money supply in the economy. As we said money supply is equal to the product of monetary base and money multiplier, so keeping the money multiplier constant, any modification in monetary base affects money supply. In order to do that, the central bank uses open market operations to change the monetary base. In other words, central bank will buy or sell bonds in exchange for currency. This in return will alter the amount of currency circulating in the economy and thus changing the monetary base.2. Reserve RequirementsThe Reserve requirement (or required reserve ratio) is set by the central bank. It is the required proportion of the total assets of a bank that should be held with the central bank.This proportion should be maintained as cash available for immediate withdrawal. The rest is invested in illiquid assets, i.e. mortgages, loans etc. The central bank, by changing this ratio, will be able to change the availability of loanable funds. As a result, money supply changes.3. Discount Window LendingMany central banks have the authority to lend funds to financial institutions inside their country. By making new loans or calling in existing loans, the central bank can change the quantity of money supply.4. Interest RatesThis is an important tool for modifying the supply of money in an economy. When the central bank decides to increase the interest rate(s) under its control, money supply will be reduced or contracted. On the other hand, when the central bank decides to decrease the interest rate(s) under its control, money supply will be increased.Monetary Base: From the perspective of commercial banks, reserves can be viewed as perfect substitutes for currency, if the banks need currency. In other words, a bank can always convert the reserves held at the central bank to cash balances and with insignificant transaction costs. On the other hand, if a bank has high cash balances, it can follow an opposite process and exchange them in return for more reserves at the central bank. This relation between the currency and reserves leads to define monetary base as the sum of both.(MB): MB = C + RWhere C = currencyAnd R = reserves with central bankM1: From the perspective of private non-banks, sight deposits form a perfect substitute to currency in circulation. Nowadays, thanks to cash dispensers, one can transfer an overnight deposit into currency at very low transaction costs. This leads us to the following:Money stock (M1) = C + DWhere C = currencyAnd D = overnight depositsM2 & M3: broader defined monetary aggregatesM2 = M1 + time deposits + savings depositsM3 = M2 + Repurchase agreements + Money market fund shares/units and money market paper + Debt securities issued with maturity up to 2 years.The process of money supply is related to 2 factors:- The creation of monetary base, which is directly managed by the central bank- The creation of the money stock such as M1, M2 or M3. These are the results of the interaction between the central bank, commercial banks and the non-bank sector.In other words, the process can be summarized in the following way, monetary base can be viewed as the input factor, managed by central bank, for the process where money stock M1, M2 or M3 are created as output by commercial banks.How a central bank manages the money supplyTwo main equations to look at:(1): MS = MM * MBWhere MS = money supplyMM = money multiplierMB = monetary base(2): MM = 1 / RRWhere RR = reserve requirementReserve Requirement, or required reserve ratio, is a bank regulation that sets the minimum reserves each bank must hold to customer deposits and notes. These reserves are designed to satisfy withdrawal demands, and would normally be in the form of fiat currency stored in a bank vault (vault cash), or with the central bank.One way that central bank can play around with the quantity of money supplied to the economy is through changing the reserve requirements. If the central bank decides to increase the supply of money, it does this by decreasing the required reserves.By doing so, the money multiplier in equation 2 increases and therefore money supply.(MS) from equation one increases. Similarly, if the central bank seeks the decrease of money supply, it can choose to increase the reserve requirement and by that the Money Multiplier decreases and money supply increases in return.To further study factor one above, consider a monetary base (MB) in an economy:(3): MB = NPf + NPg + Crb – xNPf = central bank’s net position vis-à-vis the foreign sector (including CB’s gold holdings)NPg = central bank’s net position vis-à-vis the government sectorCrb = all credits that the central bank provides to the domestic banking sector.x = all other assets and liabilities of the central bankTo see how the monetary base changes we need to take change of equation 3 above:(4): MB = NPf + NPg + Crb –xAs we said, the central bank is the only monetary authority that is able to control the supply of monetary base. There are three sources of monetary base creation:- When the central bank intervenes in the foreign exchange market and buys foreign currency, this increases NPf. For instance, when the CB purchases foreign currency from any domestic credit institution, this increases the supply of MB. On the other hand, when the CB wants to avoid depreciation in the domestic currency, it will buy the domestic currency in exchange for foreign currency, and by that NPf < 0 and thus MB decreases.- NPg will change when the central bank engages in a transaction with the government. For example if the CB grants a loan to the government, the moment when the government spends this loan in payments to economic agents in private sector, i.e. crediting their account in commercial banks, then _NPg > 0 and so MB increases as a result. NPg can also increase if the CB purchases government securities in the conduct of its open market policy.- Crb will increase when central bank gives a loan to a domestic commercial bank. On the other hand, Crb decreases when the loan is paid back. (Bofinger 2006) Now for the central bank to be the sole controller of the monetary base and perform the 3 mentioned actions, 3 basic institutional arrangements should be respected to make sure that is the case.- The CB should not be forced to increase or decrease money supply excessively through foreign market intervention. However even if this happened central bank can maintain MB by offsetting the changed it was forced to do by modifying its lending to banks in a way that NPf = - Crb. i.e. when the CB is forced to increase NPf, it can decrease its lending to banks.- The CB should not be forced to provide unlimited finance to cover government deficits. High inflation will be a result of this form of financing.- The CB must be the one in control of its lending to commercial banks.Now after we took a look at the “input factor” in money creation; i.e. the monetary base which is found exclusively in the CB’s balance sheet, we will study the creation of the “output” which is the money stock. Initially, all the balance sheets of commercial banks and CB are aggregated into one consolidated balance sheet. By doing so, all claims and liabilities between the banks will sum up to zero. Thus, the resulting balance sheet shows only claims and liabilities with respect to non-banks.Consider money stock M3:(5): M3 = NPf + Crg + Crpr – LL – xNPf = banking system net position vis-à-vis the foreign sectorCrg = all credits that banks provide to the government sector.Crpr = all credits that banks provide to the private sector.LL = long term liabilities of the banking system, i,e, bank deposits, bonds that are not included in M3x = all other assets and liabilities of the banking systemFour basic transactions will cause M3 to change- A domestic bank buys a claim from a resident private individual vis-à-vis foreign check. As a result the bank credits the individual’s current account. NPf increases and therefore M3 increases.- A domestic bank gives the government a loan. Crg increases and therefore M3 Increases- A domestic bank grants a loan to a domestic company. Thus the funds are credited to the company’s current account. Crpr increases and therefore M3 increases.- A resident private individual terminates a savings deposit with a notice of more than 3 periods on maturity. The amount is credited to his current account. LL decreases and therefore M3 increases. (Bofinger 2006)In general, money creation takes place whenever a bank purchases any of the following instruments:- A claim against a foreign counter party (NPf)- A claim against the government (Crg)- A claim against a private domestic non-bank (Crpr)- A “claim against itself” (LL)As we have seen, the process of generating money supply is not different from that of monetary base creation. The only difference is that in the latter case, central bank purchases the above claims from commercial banks, while in the former case such claims are purchased from non-banks. (Bofinger 2006).

2.2. The Money Creation Theory

- This previous scheme can be explained by the money multiplier theory. It involves the expansion of $100 through fractional-reserve lending under the re-lending model of money creation, at varying rates. Each curve approaches a limit. This limit is the value that the money multiplier calculates. The most common mechanism used to measure this increase in the money supply is typically called the money multiplier. It calculates the maximum amount of money that an initial deposit can be expanded to with a given reserve ratio – such a factor is called a multiplier. As a formula, if the reserve ratio is R, then the money multiplier m is the reciprocal, m = 1 / R, and is the maximum amount of money commercial banks can legally create for a given quantity of reserves. The money multiplier is of fundamental importance in monetary policy: if banks lend out close to the maximum allowed, then the broad money supply is approximately central bank money times the multiplier, and central banks may finely control broad money supply by controlling central bank money, the money multiplier linking these quantities; this was the case in the United States from 1959 through September 2008. The first formulation of the quantity theory of money comes from the work of Jean Bodin in 1568. His work focused on the inflationary effects of the influx of gold from the New World. Then U.S. economist Fisher formalizes the quantity theory of money (QTM) as follows: MV = PT with the money supply M, the P prices, quantities traded T and V the velocity of money circulation (number of payments that each monetary unit conducts an average during the year(.You can read the formula as follows: the value of transactions (P x T) = amount of monetary units multiplied by the number of payment methods (M x V). In these conditions, the level of M determines the price level P. If M increases, P increases in the same proportions, the price depends directly on the money supply. The idea of this theory is to explain the price rise by an excessive issue of currency relative to production. To control inflation, it is necessary to regulate the money supply. On what ground rules should the money creation be submitted? The appearance of bank notes was a key step in the dematerialization of money. A certificate representing the basis of deposits, banks always counting on the fact that all the holders shall not seek to convert all their tickets at once. Hence, the name given to the currency notes, in Latin, fiducia meaning trust. Two theories of Money Creation compete since the early of the nineteenth century:1. The currency principle: supported by David Ricardo1, this theory holds that the amount of currency in circulation must be regulated according to the desire of the banks to create, or not the money, where profit maximization plays the main role in money creation;2. The banking principle: this theory is contrary to freedom of monetary creation, and this is based on the needs of growth in the economy supported by Ludwig Von Mises2 (1912).

2.3. Public Debt

- According to Hugh Dalton (1929), a distinction on public debt is often drawn between "reproductive debt" and "deadweight debt". The former is debt which is fully covered, or balanced, by the possession of assets of equal value; the latter is debt to which no existing assets correspond. Public debt, which is fully covered by public assets, is analogous to the capital of a company, and the creditors of the public authority are analogous to debenture holders in such a company. The interest due to them is normally obtained from the income-yielding power of the assets, or, in other words, is normally paid out of income derived by the public authority from the ownership of property or the conduct of enterprises. The interest on deadweight debt, on the other hand, must be obtained from some other source of public income, generally, that is to say, from taxation.

3. The Bank of France

- Since the advent of the euro and the establishment of the European Central Bank, the Bank of France was deprived of any real power over monetary policy. But it was long the heart of the French monetary system, sometimes saving, sometimes disparaged. Here is a brief history of this institution.Under Napoleon, with Canteleu and perregaux, he proposes to make what later became the bank of France, a genuine issue of Institute, funded by the public, but independent of it. In April 1803 it received the exclusive privilege of issuing banknotes. In return for this favor it must come to the aid of various governments for their funding. This will be first to finance wars and to meet expenses of any kind.From 1911, the treaties had the Treasury as the standing creditor, the Institute emission is induced to finance the First World War and its consequences: it became the military arm of the State for distribution of credit and monetary stability.The bank of France will become a creditor of the State, but will eventually oppose the demands of more and more insistent advances of governments. The influence of government becomes final with the nationalization of July 1936 which transformed the Bank of France in a State monopoly, so that even if continues to behave like an ordinary school, it grants credits based on the economic needs of the nation.Then, on 30 January 1973, involving the reform of the statutes of the State Treasury which is Article 25 which blocks any possibility of advance of the Bank of France to the Treasury: '' the Treasury cannot be a presenter of its own affects the discount of the France''. It's the end of the period when the public debt was free. Then this idea will be reinforced in 1992 when the Maastricht Treaty in Article 104 (cited below).Treaty of MaastrichtArticle 104.1No ECB and central banks of member States, grant overdrafts or any other type of credit institutions or organs of the Community, central governments, regional authorities, local or other authorities public law, or public undertakings of Member States the purchase directly from them by the ECB or national central banks of debt instrument is also prohibited.The Euro was introduced in Europe in January 1999. Nevertheless, banknotes and coins denominated in Euro became effectively present in the market starting January 2002. This was considered as a big revolution in the world of money. What happened is that several countries decided to let go of their domestic currency in order to adopt a single currency: the Euro. Consequently, the monetary policy among these countries has been unified under the governance of the European Central Bank (ECB) and the national central bank of each member state. The ECB is one of the most important banks in the world. It was created in 1998 by the treaty of Amsterdam and is headquartered in Germany. It has the exclusive function of permitting the issuance of Euro banknotes and its main role is to assure price stability through keeping inflation at a low rate of 2%.“All member states of the European Union, except Denmark and the United Kingdom, are required to adopt the Euro and join the euro area” (European Commission 2012).Joining the euro area is a long and tedious process. The candidate countries must meet the economic convergence criteria as a prerequisite for admission in the single currency union. These criteria are designed to ensure that the candidate country's economy is prepared to adopt the single currency and can handle the single monetary policy that will be conducted by the European Central Bank (ECB) for the whole Eurozone area without disturbing its national economy and at the same time without disturbing the welfare of the Eurozone as a whole (European Commission 2012). The economic entry conditions to the Eurozone area were agreed upon in the Maastricht Treaty signed in Maastricht, Netherlands in 1991. These criteria are known as the Maastricht convergence criteria that a candidate country should meet to earn its seat in the single currency union.The Maastricht convergence criteria are the following:− The country's inflation rate must be no more than 1.5 percentage points above the average of the three EU member states with the lowest inflation.− The country must have maintained a stable exchange rate within the Exchange Rate Mechanism (ERM) without devaluing on its own initiative.− The country must have a public-sector deficit no higher than 3% of its GDP.− The country must have a public debt deficit that is below or approaching a reference level of 60% of its GDP.− The country's long-term interest rate must be no higher than 2 percentage points above those of the best three EU member states with the lowest long -run interest rates.” (Dinopoulos and Petsas 2000)Each convergence criteria agreed upon in the Maastricht treaty has an economic explanation and reasoning behind it as highlighted and elaborated by Dinopoulos and Petsas (2000) and the European Commission (2012).Government finances criteria (criteria nos. 3 and 4) also known as economic performance criteria are to check if the candidate countries have sound public finances and sustainable public debt levels. The criteria are also enforced to overcome Europe's deficit bias. The criteria was to ensure that the governments of the member countries do not run successive and unsustainable public deficits because the ECB will be obliged to purchase the debt of the struggling members and increase money supply which will lead to inflationary pressures. Besides, as a candidate country registers successive deficits and accumulates public debt, the cost of rolling over the debt will increase because of expectations of default by the creditors who will form expectations of currency depreciation which could result in capital outflows and speculative attacks on the currency (Dinopoulos and Petsas 2000; European Commission 2013). If the member country still fails to implement the recommendations to bring its deficit in harmony with the 3% deficit to GDP ceiling then the council condemns the member country to economic and financial sanctions.Even though the focus is on the Maastricht economic convergence criteria, nevertheless the candidate countries should also meet with the laws and regulations agreed upon for joining the single currency union. These include making changes in their monetary policies which require the establishment of independent central banks.

3.1. How the Public Debt in France Came about?

- According to Salim Lamrani3 (2012), France till 1973 did not have a debt problem and the national budget was balanced. Indeed, the state could borrow directly from the Bank of France to finance the building of schools, road infrastructure, ports, airlines, hospitals and cultural centers, something that it was possible to do without being required to pay an exorbitant interest rate. Thus, the government rarely found itself in debt. Nonetheless, on January 3, 1973, the government of President George Pompidou -- Pompidou was himself a former general director of the Rothschild Bank -- influenced by the financial sector, adopted Law no.73/7 focusing on the Bank of France. It was nicknamed the "Rothschild law" because of the intense lobbying by the banking sector which favored its adoption. Formulated by Olivier Wormser, Governor of the Bank of France, and Valéry Giscard d'Estaing, then Minister of the Economy and Finance, it stipulates in Article 25, that "the State can no longer demand discounted loans from the Bank of France." As a result, the French state is now prohibited from financing the public treasury through zero interest loans 0% from the Bank of France. Instead, it must seek loans on the open financial markets. Therefore, the state is forced to borrow from and pay interest to private financial institutions, when until 1973; it could create the money it used to balance its budget through the Central Bank. With this quasi-monopoly, commercial banks now have been granted the power to create money through credit, whereas previously this had been the exclusive prerogative of the Central Bank, that is to say of the state itself. As a result, commercial banks are getting rich off the backs of taxpayers.Furthermore, thanks to the fractional reserve banking system, private banks can lend up to six times more than the amount they actually have in reserve. Thus, for every euro they possess, they can loan six euros through the system of money creation through credit. As though this were not enough, they can also borrow as much money as needed from the Central Bank at a rate of 0 percent to 18 percent, as we see in the case of Greece. Today, money creation through credit accounts for 90 percent of all money in circulation in the euro zone.This situation has been denounced by the French economist and Nobel laureate, Maurice Allais, who wished to see money creation reserved to the state and the Central Bank. "All money creation must be the prerogative of the state and the state alone: Any money creation other than that of the basic state-created currency should be prohibited in a way that eliminates the so-called 'rights' that have arisen around private bank creation of money. In essence, the ex nihilo money creation practiced by the private banks is similar -- I do not hesitate to say this because it is important that people understand what is at stake here -- to the manufacture of currency by counterfeiters, who are justly punished by law. In practice both lead to the same result. The only difference is that those who benefit are not the same." Today, French debt has grown to over 1,700 billion euros. Between 1980 and 2010, the French taxpayer paid more than 1400 billion euros to private banks in interest on the debt alone. Without the 1973 law, the Maastricht Treaty and the Lisbon Treaty, the French debt would be hardly 300 billion euros. France pays 50 billion euros in interest annually, making this the largest item in the national budget, coming even before education. With that kind of money, the government would be able to build 500,000 public housing units or create 1.5 million jobs in the public sector (education, health, culture, leisure), each with a net monthly salary of 1,500 euros. In this way, French taxpayers are robbed of over 1 billion euros weekly, money that accrues to the benefit of the private banks. Clearly, the state has given the richest group of people in the country the fantastic privilege of enriching themselves at taxpayers' expense. And it has asked for nothing in return, and has not made the slightest effort to do so.Moreover, this system allows the financial world to subject the political class to its interests and dictate economic policy through the rating agencies, which are in turn financed by private banks. Indeed, if a government adopts a policy contrary to the interests of the financial market, these agencies lower the rating scores awarded to states, something that has the immediate effect of increasing interest rates.Meanwhile, when the state and the European Central Bank bailout ailing private banks, they do so with interest rates lower than those same financial institutions charge the state. In reality they are conducting de facto nationalizations without receiving the slightest benefit, for example, being granted decision-making authority within the banks administrative councils.The credit system established in France in 1973, and since ratified by the treaties of Maastricht and Lisbon, has but a single goal: to enrich private banks off the backs of taxpayers. It is unfortunate that a debate on the origins of public debt is not occurring in the media or in Parliament itself, even though resolving the debt problem would require nothing more than restoring the exclusive right of money creation to the Central Bank.

3.2. How are Private Banks Getting Rich off the Backs of the Citizens

- The Financial crisis of 2008 had its impact on the Eurozone and resulted in very large current account deficits and massive public debts. This rendered financial institutions very risky and resulted in a lack of confidence among investors. What’s more, it implied a reduction in potential output and an increase in unemployment rates. The restriction in credit availability and the increase in interest rates made it hard for countries with very high debt burden to finance their debt payments. Increasing exports was a possibility for peripheral countries to be able to repay their debt. However, this was not possible due to price competitiveness. Furthermore, the reduction in income and austerity measures made the situation even more difficult because of recession. Tension is rising across the Eurozone and the prospect of member states leaving the Euro is highly probable.According to Salim Lamrani (2012), all European countries find themselves confronted with debt problems that impact sustainable public finances. The crisis has not spared France, the world's fifth largest economic power, something that makes private banks quite happy.No European nation has been spared the problem of public debt, even if the severity of the crisis varies from one capital to another. On the one hand, there are the "good students," such as Bulgaria, Romania, the Czech Republic, Poland, Slovakia, and the Baltic and Scandinavian states, all of which enjoy a debt lower than 60 percent of their GDP. On the other hand, there are the four "dunces" whose public debt surpasses 100 percent of their GDP: Ireland (108 percent), Portugal (108 percent), Italy (120 percent), and Greece (180 percent). Between the two extremes are found the rest of the European Union countries, such as France (86 percent), whose debt oscillates between 60 percent and 100 percent of GDP. Conservative European governments, exemplified by Angela Merkel's Germany, believe in the importance of lowering public debt through the application of austerity measures. Similarly, Pierre Moscovici, despite being Finance Minister in François Hollande's new socialist government, has set "deficit reduction" as a priority and is attempting to reduce the deficit to 3 percent of GNP by, among other means, cutting public spending. Still, it is common knowledge that the austerity policies promoted by the European Union, the European Central Bank and the International Monetary Fund that are currently being applied across the Old world, are economically inefficient. In fact, they result in the opposite of what was intended. Rather than restarting growth, reducing expenditures; depressing salaries and retirement benefits; dismantling public services, including education and health care; destroying the work code and social benefits -- in addition to the catastrophic social and human consequences that this causes -- inevitably lead to a reduction in consumption. Inevitably, companies cut production and wages and lay off workers. As a logical consequence, the resources that flow from the state are cut back, while the entities dependent upon the state explode, creating a vicious cycle, for which Greece is the poster boy. Because of this, several European countries now find themselves in recession.

4. Monetary Creation Power

- Now, who should have the control over the monetary creation power? Why can’t States be financed by their Central Bank? What are the issues? We will see in a first time that the interdiction to the Central Banks to finance States is responsible for the French public debt and try to imagine an alternative system. This is why we will enlarge the question to who should have the control over the monetary creation power and why?From a couple of decades, the economic and finance world is going on a deregulation trend. This deregulation is based on the idea that markets are the best solution to maximize resources allocation and therefore the States should not interfere with the market or the less the better. It is in this global idea that the monetary creation power has been entirely given to commercials banks and taken from Central Banks and States’ control.This is how from 1973 in France the State had to borrow the money it needed from commercial banks instead of being able to borrow it from the Banque de France, like it was possible before. This means when it borrows money, the State now has to pay interests to the banks since commercials banks have to protect themselves against inflation plus they have to be profitable and so to fix interests rates over the inflation rate.Today, in modern economies, central banks cannot finance government deficits to zero, or at least to a limited rate of inflation, as was the case that there are few decades in France and elsewhere worldwide.

4.1. The Choice of States

- It is first necessary to say that this situation stems from an express intention of the States and it was absolutely not imposed by itself. No debate exists or has existed on the subject, and for good reason, the question has never entered the minds of ordinary mortals.In France, in January 1973, comes a new reform of the statutes of the State Treasury in which we find in particular Article 25 which blocks any possibility of advance of the Bank of France to the Treasury: "The Treasury cannot be presenter its own effects to the discount of the Bank of France".Other public affirmation of it: in 1976 in France, the Minister Raymond Barre takes an historic decision: he decided that the State will pay interest on its debt in excess of inflation.He Said: ''I place the State in the service of creditors, savers. Annuitants live''. It could be because after the French constitution, the parliament has the power to define the rules governing the issue of money.Until the 80s, the French State is interventionist in that it controls more or less direct grant of credits. The financial activity is largely controlled by the government. An important part of the activity is through the State and Treasury, which is then its banker. There was talk then of the Treasury circuit. On the other hand, the State controlled banking institutions. Indeed, in 1984, banks with the State for single shareholder with 87% of deposits and 76% of funds distributed in the economy. Interest rates are administered, 50% of funds are distributed rate "soft", e.g. below market conditions.Also at the time, "credit restrictions" gave the State a real control of the evolution of money supply and thus inflation management and crisis prevention. This scheme has helped create an environment suited to the needs of the French economy and fostered the rapid growth of investment and production boom period. From 1985, the phasing out of preferential credit happened. Then in 1986 the major banks and financial authorities are gradually privatized. The law of 4 August 1993 on the Statute of the Bank of France will apply from January 1st 1994. In Article 3, it prevents overdrafts or agreement of any other type of credit to the Treasury or any other public body, as well as the acquisition of debt securities.Further reflected in this excerpt from Article 104 of the Treaty of Maastricht: "It is forbidden to the ECB and central banks of Member States, hereinafter referred to as' national central banks" to grant overdrafts or any other type of credit institutions or bodies of the Community, central governments, regional authorities, local or other public authorities, other bodies or public undertakings of Member States, the direct acquisition of debt instruments from them, by ECB or the national central banks, is also prohibited. "If one labels the ECB National Bank because it is actually the one who has the power to issue fiat money. But this money now accounts for ridiculous money in circulation.

4.2. The Consequences of This Change

- When they were created tradable treasury bonds in 1985, it was to modernize the management of public debt. These vouchers are now open to all stakeholders. This has resulted, more or less directly, a sharp increase in public debt from 20% in 1980 to 64% in 2007. The State was the largest issuer of securities monetary and financial liabilities in recent years.Certainly, today, all States are in debt in a manner somewhat similar to that of France. In addition, in November2005, the rating agency Standard & Poor's said that the quality of the French public debt deteriorated, while remaining at AAA rated (highest rating on a scale of existing. The OAT (fungible Treasury bonds) with a yield above 4% are more than ever the licensee in a context of crisis in which investors and investors looking for attractive returns, but above all safe.The weight of these interests in the annual State budget is something very heavy. In France, it corresponds, for example, to the whole of the income tax. The payment of interest on debt is the second-largest expense in the State budget, after that of National Education. He therefore created a huge crowding and simply due to interest payments. Imagine what could be the public finances without the burden of this debt!This economy of debt begins to pose problems and show its limits more or less. We say that fiscal policy is sustainable if it does not lead to an accumulation of "excessive" debt that is to say at a level of debt, no major changes, could not be covered by future budget surpluses. The financing of this debt excludes the use of a "Ponzi scheme" where the State would issue indefinitely new loans to pay interest and principal payments due. The borrowing capacity of the State is limited in quantity.

4.3. The Ponzi Scheme

- The Ponzi pyramid or Ponzi chain is a financial fraud based on the promise of big profits to investors. The principle is to pay initial investors with money from new investors interests. Fraudulent system is discovered as soon as there are more new investors. Later investors lose everything. Charles Ponzi (1882-1949) immigrated to the United States in 1903. He spent some time in prison for small fraud. Installed in Boston in 1921, he becomes millionaire in six months in imagining a pyramid system. Ponzi founded the ''Securities Exchange Company''. It attracts investors by explaining that profits come from the purchase and sale of international exchangeable stamps. In fact, Ponzi has bought very few of those. Original investors are actually paid. This good news, the chain, attracts thousands of savers. Recruitment of new investors happened after a few months. The scam is finally discovered and Ponzi is arrested.This fraudulent means has been refined since. Instead of announcing a yield of 50% in 45 days, as the scheme of Ponzi, it promises a yield lesser, but still higher than the market (10-20%). In this way, the pyramid succeeds to function much longer. Pyramids of this scale have been taken around the world. More close to us, one of the countries where pyramids involving huge amounts of money have been exposed, include Romania (1994), Albania (1997), Colombia (2008), Madoff case in the United States (2008) and case of Kazutsugi Nami in Japan (2009).And to think that a few centuries ago, a State were considered poor if it did not have huge stocks of gold, meaning if it wasn’t able to pay for its operations.

5. Modern Economies

- In a globalized economy, it is hardly conceivable that States will still have the power to create money they need because it contradicts the principles of free competition. Indeed, States would be too tempted to use these indirect free credits to help their businesses. Moreover, the Maastricht Treaty prohibiting central banks to finance the States is indicative of the fact that economies are subject to Community rules can use each ticket as it wishes.Also, according to Dominique Plihon in his book "Money and its mechanisms", one of the main reasons that prompted the French public authorities to modernize the capital markets is the need to finance public deficits in good condition. Indeed, when the Bank of France had the power to refuse granting of credits to the State, it could have the effect of reducing stimulus plans by providing insufficient funding, for example. The State now borrowing on the markets is sure to have the money it needs when it needs it, even build up a debt that will be reimbursed during better days. So are the ideas that have led governments in a context of deregulation, to shift the power of money creation in the private side. The most worrying is the increasing debt of States exponentially, and likely eventually to undermine market confidence in the solvency of the States. This would result in an increase in interest rates Treasury bills, adding to a little more weight in the interests of the State budget, and to a more distant perspective, the denial of economic agents to finance that debt. However, solutions exist, as we shall see in the next section. To sum up, this decision has been taken for the following reasons:− The State can now borrow all the money it needs for its investments and operation without having to ask the Banque de France and have its action dependent on this institute's willingness or not loan the money;− The Banque de France was indirectly controlled by politics and the agenda may push them to ask for more money than they really need. This can lead to an excessive creation of money, leading to inflation and so to the currency's loss of value. It is mechanical. Indeed, the monetary management has to be led on a long term basis and politics trend to think too short;− Finally, having to borrow money with interest would be an incentive for governments to have balanced budget since having an increasing debt would not be maintainable on a long term orientation.

5.1. Money Control and Public Financing

- We know that money creation is the basis of our financial system. In this section, after stating how important the power of money creation is, we will discuss the hypo book of a system in which the State would have the right to obtain financing from its Central Bank. This theory is based on the fact that a State is deemed unable to fault its debts. It is not applicable to another type of economic agent.We are going to see how States put themselves in a weak position that led them to be deep in debt today. Also, we will imagine how States could be quite free from their current public debt, especially with the example of the French public debt."Give me control over the currency issue of a nation, and I shall not worry about those who make its laws." Mayer Amschel Rothschild, Rothschild banking dynasty founder, 1743-1812This quotation comes from the founder of the dynasty of Rothschild, one of the most famous families in the business world. More recently, so what happened to the world crisis whose magnitude was forgotten since the 30s, banks cut loans to companies and individuals for fear of future insolvency of these economic agents. What happened on the side of government? It was obliged to guarantee a hare of personal deposits to prevent bankruptcies, and to inject money into the economy out of its pocket. The economy depends on the willingness of banks to take risks and the State is powerless to the whims and desires of banks to grant credits or not.Who benefits?''Then we must proclaim a fundamental right of man is to be effectively protected against unfair operation, if not dishonest, the market economy is currently allowed or even encouraged by inappropriate legislation." Maurice Allais, Today’s world wide crisis.Consequences: What would be a budget without the interests?

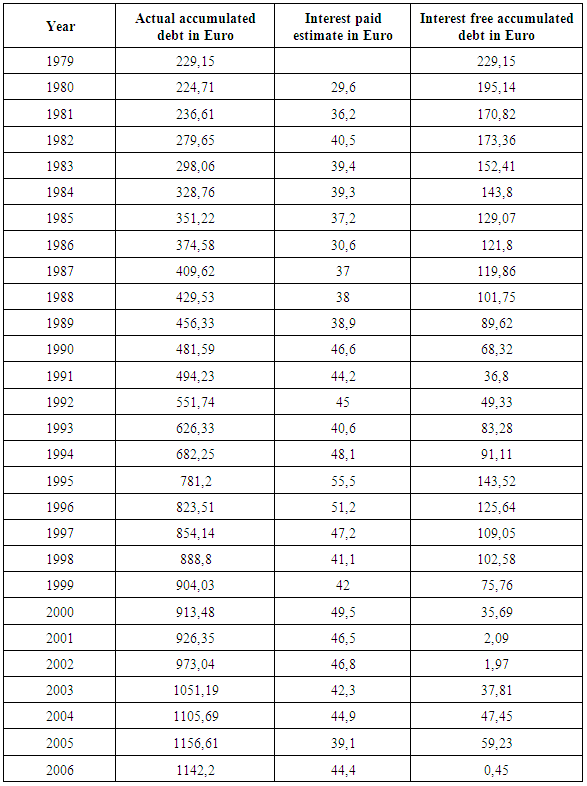

After seeing the catastrophic situation of the French public debt since the abandonment of the power of money creation to commercial banks, what would be the French State without the weight of this debt and to what extent it might be possible to return to funding from the State Bank of France to zero. To begin, what would have been even balances the annual budgets of the State from 1980 to 2006 without the burden of debt interest:

After seeing the catastrophic situation of the French public debt since the abandonment of the power of money creation to commercial banks, what would be the French State without the weight of this debt and to what extent it might be possible to return to funding from the State Bank of France to zero. To begin, what would have been even balances the annual budgets of the State from 1980 to 2006 without the burden of debt interest:5.2. What If States can be Funded by Central Bank?

- We’ve seen so far that the States have given the monetary creation power to the commercial banks, forbidding itself to be financed by its central bank. This resulted as the creation of a massive public debt. Now, we will propose an alternative system to the system in place now that could solve the problem of debt without the risk of creating a large imbalance somewhere.Basic principles− We assume monetary creation is removed from private banks.− The State is an economic agent whose solvency is considered indisputable.− Currency is in essence a collective, whose total privatization can therefore be considered illegitimate.− Only investment expenses are concerned, operating expenditure should be financed by the tax.

5.3. Central Bank Allowed Financing the State

- Again, the State is an economic agent whose solvency is considered to be infallible. State loans are qualified assets without risk that is to say that the State is supposed never lacking in debt. Also, State bonds rates them even qualified for rate of return without risk.From this observation, in this system, the State would be entitled to be funded by its Central Bank interest-free, just as it did forty years ago. The State may thus find a budget balanced without changing its tax policy. We remain in the approach to zero-rated funding strictly reserved for public investment, by admitting that the risk of non-repayment is null.On the other hand, we have to face the risk of excessive use of this power of monetary creation. As we saw earlier, inflation is the main threat to this configuration of power. Also, the establishment of its needs will therefore have to be more or less in line with the anticipation of future growth of GDP and other economic expectations such that it balances budgets.Deadlines would be imposed in order that these credits are a promise to pay in a distant future, and a maximum debt ratio would be allowed to State. If deadlines are not met, the State could even have its borrowing possibilities frozen.

5.4. A Necessarily Independent Central Bank

- To manage State investment funding, an organization's main objective would be the guarantor of monetary stability, e.g. a Central Bank. It would be strictly independent of the Government, that is to say, that the Government would have no direct or indirect means of action on it. To do this, the leaders of this bank would access the function by election or appointment any other medium imaginable for any independent policies, trade unions, captains or other persons having direct interests with the Central Bank. They would later have a long and non-renewable term in order to minimize the influences of the voting or decision makers (masses or specific individuals) always.This does not mean that Central Bank shall have the power to decide what will be done to create money, making it responsible for fiscal and monetary policy, and depriving the power to govern the economy elected Government. The Central Bank will only decide quantities it can grant to Governments based on their needs and their future ability to refund money.

6. The Use of the Central Bank

- This theory would be based upon the following ideas: a State can’t fail to pay back is debts; the money is something collective and it can’t be totally privatized; only investments’ financing are considered. Besides, we are not talking of taking the monetary creation power back from banks.The State would be able to borrow the money it needs in order to invest in whatever needs to be done. Those investments and the money generated to pay it back would be planned in advance over a certain period of time. In case of late payments, loans could be frozen until previous have been paid back to prevent any massive debt creation. The State would be loaned the money from an independent Central Bank. Independent from the politics powers in order not to influence its action from the politics’ electoral agenda. If the Central Bank would be able to accept or not the loans requests from the government, it would not be able to discuss what the government would do with it, in order to leave them the power of directing the economy, what they are actually elected for. The Central Bank would have for only worries the State’s ability to respects pay back plans, and the currency stability. Since we are today using the Euros, those decisions need to be taken from a global Central Bank like the BCE (Banque Centrale Européenne), which would allow loans for each State individually.Those financing would allow States to get back good budgets balances and on a long term to pay back the public debt. States would save a lot of money that people would get back paying less taxes. The only losing parties would be private investors that would lose the goods and risk free return on investment of public obligations.It would give back the States the economic power they lost. It would give them back a capacity of action that used to be huge, but which has been reduced over time. This power reduced, the State is weak when it needs to regulate the economy. And wherever the State has its control reduced, others forms of power appear, and, when this happens by accident, it is rarely for the best.

6.1. Consequences and Learning

- As we just saw, today, the world economy is based on a comprehensive system of credits that is to say from promises to pay in the future, drawing from each other, that might be in the form of a pyramid of debts. For immediate, almost all experts see hardly any other solution, if required by commercial banks, the institutes emission pressures and the IMF, that the creation of new means of payment to face of depreciation and interest of their debts, even by weighing even this burden for the future payment.Let’s go back to the subprime crisis and this incredibly early prediction by Thomas Jefferson:« I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around [the banks] will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered. The monetary creation power should be taken from the banks and restored to the people, to whom it properly belongs. »Thomas Jefferson, 1743 – 1826, the Writings of Thomas Jefferson, Memorial Edition.After taking a look at what happened, we can have second thoughts about this quotation. How the world could have been so blind to the pervert effects of the uncontrolled credit mechanism while a man warned us centuries ago, with a disconcerting accuracy?For the past decades, a wave of deregulation has blown over the financial world, involving the disappearance of any obstacle to the free movement of goods, services and capital. According to this theory, the disappearance of all obstacles to these movements would be both necessary and sufficient for optimal allocation of resources throughout the world condition. Every country and every social group would see their situation improved. Market was seen as likely to lead to a stable balance, completely effective, that could operate on a global scale. In all circumstances, it was appropriate to submit to this discipline.Supporters of this theory, this new fundamentalism, had become too dogmatic as supporters of communism before its final collapse with the fall of the Berlin wall in 1989. This liberal orientation has been reinforced by the communism doctrine collapse. Since an omnipotent State wasn’t the solution, an omnipotent market was at the time the best system for everyone. For them, the application of this globalist doctrine was needed in all countries, and if difficulties presented in this application, they could be only temporary and transitional. The total opening towards the outside was a necessary condition, and evidence was given by the extremely rapid progress of emerging countries of the world. For developed countries, the removal of tariff barriers or other was a condition of their growth, as it showed conclusively the undoubted success of the Asian Tigers, and repeated yet; the West had to follow their example for unprecedented growth and full employment.Such was fundamentally the doctrine of global and uncontrolled economy which had imposed itself upon the world and which had been considered as opening a new golden age at the dawn of the 21th Century. This doctrine established the undisputed creed of all the big international organizations these last two decades, including but not limited to the World Bank, the International Monetary Fund, the World Trade Organization, the Organization for Economic Cooperation and Development, or the Organization of Brussels.Two major factors have played a decisive role in this global crisis of unprecedented magnitude after the crisis of 1929:1. Potential instability in the financial and monetary system global;2. Globalization of the economy both in monetary terms and in real terms.Here is the learning to understand out of it1. With the monetary creation control, private banks are responsible for inflation and deflation which means expansion period and crisis following it; they accept crisis. They are not responsible for economic stability while they bear the tools to ensure it.2. Banks don't bear the responsibility of economic stability. They are interested in profit. But the credits (loans mortgages) they grant are responsible of the economic periods.3. The credit system is naturally instable. To be healthy, it has to be controlled4. The monetary creation power cannot be given to private banks and needs to be controlled by the collectivity, meaning the State, meaning a Central Bank.In fact, what had to happen is reached. World economy, which was devoid of any real regulatory system and was developed in an anarchic framework, could not only lead sooner or later to major difficulties.Indeed, at the basis of contemporary crisis is the uncontrolled loan of credits by private banks allowing expansion as long as investors trust the future, which can last a while. During this time, economic agents contract huge debts (like mortgages or other company’s investments) that are profitable only if the situation keeps up. When doubts about the future start showing up, people who had taken engagement or invested too much money can’t get a return on their investment or simply pay back their loans. Banking institutions need to be reformed also because they are instable. They finance long term investments with money they have on a short term basis from their savers.As a result, we assist today to the collapse of the global free trade doctrine, which was gradually imposed by the existing system. The free market was considered as the invisible power for optimal allocation of resources throughout the world. In fact, what had to happen? The global world economy, which was devoid of any real control, which was developed in an anarchic framework, could only reach, sooner or later, to major difficulties.“Indeed, the new order world, or the so-called world order has collapsed and could only collapse. Evidence of the facts eventually outweighs the doctrinal incantations.”Mr. Allais, today’s worldwide crisisWhat have we seen so far? Money is something immaterial and can be created at will. The question of money creation is purely political. In major developed countries, the States have then contracting enormous debts.Commercial banks have the power to create the money at will, whenever they judge it good for them. They are somehow responsible for economic stability, without officially bearing this responsibility. The financial world is built over a pyramid of debts, making economic agents inter-dependents. This financial system, which has developed in an anarchic manner, has led to several crises against which States have been powerless.

6.2. The World in a Tight Situation

- More recently, Maurice Allais saw in 1999, in The Global crisis today as "inappropriate" the current structure of money supply. He believes the current system is unstable and risky, liabilities and claims are not necessarily the same horizon and the risk of massive liquidity withdrawals by savers is always possible. Thus, according to Allais, "The entire global economy today is based on gigantic pyramids of debt, building upon each other in a delicate balance." He calls for a system where money creation is not the rule, in a framework of fixed exchange rate regime.In major developed countries, the States have given up the control of the money to the private sphere. This had for effect to force them to borrow money from the commercial banks, paying them interest, which lead States contracting huge debts. The paying back of the public debts is still a question. This led the States to be deeply in debt, which make it hard for them to borrow money when it is necessary. For example, to avoid banks to go bankrupt.In the meantime, the financial world has been deregulated over the decades. Commercial banks and investors has been let free to create complex financial products, speculate on inflation, trade in hedge funds and so on. The anarchy in which the world has grown led it to happen fragile, unsure, and unstable. Economic agents are interdependent and the fall of one takes many down with it. And there’s few the State can do about it because, as said earlier.1. States are in deep debts and their borrowing capacity is weak2. Private banks are the only one controlling the money creation3. Commercial banks are therefore responsible of economic stability, without officially bearing the burdenThose three facts make today’s world instable. There is a need for a change. When the crisis struck, everyone admitted it. Banks, newspapers, States, public opinion, economists… Despite their weak action power, all over the world, States saved the banks when the system was in danger. If they hadn’t done so, the whole system may have collapsed, on a worldwide basis. No one wants it to happen. This would be a major disaster. Therefore, there is an urgent need for deeply reforming the financial system, to strengthen it. Otherwise, the next crisis may be the last.We are now going to set up the bases of what should be the new system. We are going to look at the weaknesses of the current system, and try to make it safer, stronger, more reliable, and more ready to face crises. A system that would eliminate, or at least reduce, the amplitude of the expansion / crisis periods the economy has been growing around.With an experience of at least two centuries, all kinds of disorders and the estate expansion and recession periods observed constantly, must be considered as two major factors that have amplified them significantly are creating money and purchasing by ex nihilo credit mechanism and financing of long-term funds borrowed short-term investments. However, it could easily be fixed to these two factors by overall reform which would otherwise terminate cyclical fluctuations, at least to considerably reduce the scale.In fact, as we saw in the first part, the current system of credit, including historical origin was entirely contingent, and seems totally irrational, and this for five reasons:1. Creating irresponsible money and buying power by commercial banks;2. Financing long-term funds borrowed short-term investments;3. High sensitivity of the cyclical credit mechanism;4. Financial instability it creates;5. And finally the impossibility of any effective system by the public credit control and Parliament, due to its extraordinary complexity.This reform must be based on two very basic principles:è Monetary creation should be the State and the State only. Any other than the currency basis by the Central Bank monetary creation must be impossible, so that disappear ''false rights'' currently resulting from the commercial banking currency creating.è Any financing of a given asset must be done according the borrower capacity to pay back the loan at the time of the loan, not speculating on long term predictions.The mechanism of credit reform should thus make impossible both currency ex nihilo creation and borrowing short-term to fund long term loans , by not only allowing loans to haul more than borrowed funds deadlines. As we saw previously, enables banks to finance investments in the long term on the basis of loans of depositors in the short term, resulting in permanent and potential system instability.Creation of Scriptural currency depends on a dual commitment, willingness to banks to lend, and the willingness of economic agents to borrow. In times of prosperity, this dual desire exists and the Scriptural currency increases. In times of recession, this dual desire disappears, and the Scriptural currency decreases. Indeed, without the creation of money and you can purchase scratch allows the credit system, never extraordinary increases in stock market courses there before major crises are possible. Thomas Jefferson wrote:“Bank paper must be suppressed, and the circulating medium must be restored to the nation to whom it belongs. It is the only fund on which they can rely for loans; it is the only resource which can never fail them, and it is an abundant one for every necessary purpose. Treasury bills, bottomed on taxes, bearing or not bearing interest, as may be found necessary, thrown into circulation will take the place of so much gold and silver, which last, when crowded, will find an efflux into other countries, and thus keep the quantum of medium at its salutary level. Let banks continue if they please, but let them discount for cash alone or for treasury notes.”Thomas Jefferson, 1743 – 1826, The Writings of Thomas Jefferson, Memorial Edition.Thomas Jefferson, doesn’t want to suppress the banks. They are in fact a need for economic expansion, supplying financings, loans, and means of payments. They enhance the economic growth. But the monetary creation must be controlled by a central bank, and according to the actual economic growth.This double condition implies a profound change of banking and financial structures based on total banking activities dissociation as they find today and their allocation to three categories of separate and independent institutions:1. Deposit banks ensuring only, for any operation of loan, cash receipts and payments, custody deposits of their customers, the costs invoiced to it, and cannot contain any discovered; customer accounts. The bank's fees would be source of the income the Bank would get.2. Lending banks that would offer loans and mortgages at specific terms, and lending funds that they had to borrow on a longer terms, the total loan amount not exceeding the total borrowed funds;3. Business banks that would find their funding borrowing directly from the private sphere or the lending banks, and investing the funds borrowed in the economy.In principle, such a reform would make impossible monetary creation and ex nihilo by banking and borrowing short-term purchasing power to finance more long term loans. It would only shorter than those corresponding to the borrowed funds maturity loans. Lending banks and merchant banks use intermediaries between savers and borrowers. They would be subject to a mandatory requirement: borrow long-term to lend in the shorter term, contrary to what happens today.In the current system, the three banks are one in most of the cases. This drives them dependent from one another. The money you save is used by the business section of the bank to invest. It also covers (on a fractional basis) the loans the bank grants. If one of them encounters difficulties, it can drag the other down. If the stock market in which the savers’ money is invested goes down, the bank can go bankrupt and the person who just deposited his money loses it.In the new order, those three activities would be separated. This strongly reduces the risk of systemic crisis. If the stock market goes down, it doesn’t mean that people’s savings are going to be in danger in case of the business bank goes bankrupt.

7. Conclusions

- The monetary system as it stands today has appeared contingently, by accident. The principle of monetary creation ex nihilo has allowed the worldwide economy to grow faster, but in a more and more anarchic, or liberal, environment. Its control and benefits now belong to the private sphere, which is not only unfair, but also generator of crisis.The commercial banks now control the economy, while the State has given away this economic regulation power. Banks can now create almost as much money as they want, as long as they make profit out of it, and they do. They don’t care, and it is not their role, about economic stability and social equity.The legal (and non-mechanical) obligation for the States to borrow the needed funds to finance its investments from the money markets has gained. Promoting liberalism, States deprived themselves from the capacity to be financed by its Central Bank. It has been the case in France since 1973. Ever since, States are deep in debt. It created the need for States to lower its investments and higher taxes to pay private investors. This had for main effect the paralyses States’ budget and capacity of action. The worst being that if the State had, during all these years, been able be financed by its Central Bank, meaning without having to pay interest, countries would not be so deep in debt.In addition to be unfairly controlled by the private sphere, the monetary creation system is generator of economic instability. Potentially unlimited quantities of currency that can be offered by commercial banks allow speculators to invest as much as they want, as long as they trust the future. This creates periods of fast economic growth that always ends up in crises when they are too fast. Crises that follow are attributable to uncontrolled and unreasoned investments by commercial banks.For these two reasons at least, the monetary creation control must be given to a Central Bank. This independent entity would be granted the possibility to finance the State’s investment at no interest. Profits made in interests by the money created would be used to repay the existing debt. This would give the public the power to 1) easily borrow money when the situation requires it 2) ensure the economic stability and growth. The increased control of the Central Bank over the supply of money evolution would keep it in congruence with the actual economic growth, thus preventing over monetary creation, resulting in crises.In addition, the banking activity has to be split up, separating investment banking from deposit and loans banking. Banks should not be allowed to speculate for themselves anymore. Stock markets need to be reformed to serve the economy, as it is supposed to, and not to be a giant casino, as it tends to be today. A standard index has to be created to value the currencies.The global financial world, which has got less and less regulated, needs to get back under control, so that disappear illegitimate rights, perverse credit mechanism effects, and global financial system instability.

8. Recommendations

- After having analyzed the current global financial system weaknesses, we would advocate the following recommendation:1. The power of monetary creation must be restored to the collectivity, which it belongs to. It must not be given to politics, but to an independent Central Bank that would have for role to control the supply of money and economic stability.2. The banking industry has to be split up in three independent entities: deposit, lending and investment banking. This would protect depositor from bankruptcy and banks from massive withdrawal risks.3. Stock markets need to quote stock prices on a daily basis, trading software need to be forbidden, and banks should not be able to speculate for themselves.The main objectives would be the end of expansion and recession periods, through a better economic stability; a fairer distribution of the income resulting from money creation; and the building of a more reliable global financial system.After having identified the causes of the financial system instability that were generating crises, inspired from Maurice Allais' book about this subject. Reforms are deep, structural, and therefore would be hard to implement, but they would benefit the large majority, contrary to our current banking system,''It is well the people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.'' Henry ford, founder of the Ford Motor Company, 1863-1947.

Notes

- 1. David Ricardo was a British political economist. He was one of the most influential of the classical economists, along with Thomas Malthus, Adam Smith, and James Mill. Born: April 18, 1772, London, United Kingdom. Died: September 11, 1823, Gatcombe Park, United Kingdom.2. Ludwig Heinrich Edler von Mises was a theoretical Austrian School economist of the classical liberal school. Born: September 29, 1881. Died: October 10, 1973, New York City, New York, United States3. Salim Lamrani (2012), Doctor, Paris Sorbonne, Paris IV University, Lecturer, University of La Reunion. Translated from the French by Larry R. Obeig.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML