-

Paper Information

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Microeconomics and Macroeconomics

p-ISSN: 2168-457X e-ISSN: 2168-4588

2015; 3(2): 30-34

doi:10.5923/j.m2economics.20150302.02

The Modern Situation of Insurance System in Azerbaijan

Shamshad Alizade

Chair of ‘State Regulation of the Economy’, The Аcademy of Public Administration under the President of the Republic of Azerbaijan

Correspondence to: Shamshad Alizade, Chair of ‘State Regulation of the Economy’, The Аcademy of Public Administration under the President of the Republic of Azerbaijan.

| Email: |  |

Copyright © 2015 Scientific & Academic Publishing. All Rights Reserved.

Insurance one of the main part of the economy. It plays great role in every country’s economy. When we speak about insurance we understand people’s assets and health which under guarantee. For this reason, the existence of insurance system is very necessary. Demand to insurance is very high in countries like USA, Switzerland France and England. But in contrast to developed countries, insurance is new sphere in Azerbaijan. Therefore, the insurance system in Azerbaijan is not developed yet. Factors, as the lack of people's trust in insurance, failure to take the necessary measures, the existence of a monopoly in this field, poor quality insurance services prevent the development of the insurance system in Azerbaijan. But in modern period some reforms have been done in insurance field in Azerbaijan. For example we can show measures such as applying of compulsory property insurance, modifying insurance tariffs, making concessions to insurance companies. These measures will accelerate the development of insurance system in Azerbaijan in near future.

Keywords: Insurance system, Insurance market, Insurance products, Insurance companies, Azerbaijan

Cite this paper: Shamshad Alizade, The Modern Situation of Insurance System in Azerbaijan, Microeconomics and Macroeconomics, Vol. 3 No. 2, 2015, pp. 30-34. doi: 10.5923/j.m2economics.20150302.02.

Article Outline

1. Introduction

- The modern world economy significantly associated with different risks. So, the large economic losses which occurimg as a result of risks are inevitable. Insurance system plays great role to prevent occuring these large economic losses. Insurance system is an important element of modern economic relations. It includes financial relations which perform specific functions in economy. In modern period in both developed and developing countries insurance system has a special place in economy. Because insurance is reliable system in the world. Insurance allows individuals, businesses and other entities to protect themselves against significant potential losses and financial hardship at a reasonable affordable rate. [18] All businesses are exposed to risks in their day to day operations. Without insurance cover to provide protection against some of these risks, businesses would find it difficult to operate efficiently and profitably. Therefore, insurance is a vital part of most developed economies.Insurance system is main part of service sector in Azerbaijan. [9] In developed countries this system developed highly. But in Azerbaijan insurance system and insurance market is forming newly. Insurance companies in Azerbaijan operate on car insurance, property insurance, personal accident insurance, travel insurance, cargo insurance and other insurance types. [15] Analyzing modern situation of insurance system and insurance market in Azerbaijan is forthcoming topical problem nowadays. So it is important to analyze insurance sector, insurance companies and its operating spheres. One of the main factors is detect main problems which prevent insurance system in Azerbaijan. Other factor is finding solutions for these problems. Because number of problems effect insurance system badly in Azerbaijan. Improving insurance system in Azerbaijan is too important. So, some insurance companies use practice of developed countries. It is good way to improve insurance market. Number of measures in insurance sector will develop insurance system in Azerbaijan.

2. The History of Insurance System

- Insurance is one of the oldest field of the economy. The first insurance activity appeared nearly 4000 years ago in Babylon. The importance of this trade was non-trade. The main purpose of these activities was protecting people’s personal and property interests from danger. [1] The Babylonians developed a system which was recorded in the famous Codeof Hammurabi, c. 1750 BC, and practiced by early Mediterranean sailing merchants. If a merchant received a loan to fund his shipment, he would pay the lender an additional sum in exchange for the lender's guarantee to cancel the loan should the shipment be stolen or lost at sea.Separate insurance contracts were invented in Genoa in the 14th century, as were insurance pools backed by pledges of landed estates. The first known insurance contract dates from Genoa in 1347, and in the next century maritime insurance developed widely and premiums were intuitively varied with risks. [2] These new insurance contracts allowed insurance to be separated from investment, a separation of roles that first proved useful in marine insurance.From beginning XIV century insurance turned into tradable and profitable field in European countries. During this period, there was development and quality in insurance field than before. Insurance became far more sophisticated in Enlightenment era Europe, and specialized varieties developed. Property insurance as we know it today can be traced to the Great Fire of London, which in 1666 devoured more than 13000 houses. The devastating effects of the fire converted the development of insurance "from a matter of convenience into one of urgency, a change of opinion reflected in Sir Christopher Wren's inclusion of a site for 'the Insurance Office' in his new plan for London in 1667". At the same time, the first insurance schemes for the underwriting of business ventures became available. By the end of the seventeenth century, London's growing importance as a center for trade was increasing demand for marine insurance. In the late 1680s, Edward Lloyd opened a coffee house, which became the meeting place for parties in the shipping industry wishing to insure cargoes and ships, and those willing to underwrite such ventures. These informal beginnings led to the establishment of the insurance market Lloyd's of London and several related shipping and insurance businesses.The first life insurance policies were taken out in the early 18th century. The first company to offer life insurance was the Amicable Society for a Perpetual Assurance Office, founded in London in 1706 by William Talbot and Sir Thomas Allen. In the late 19th century, "accident insurance" began to become available. This operated much like modern disability insurance. The first company to offer accident insurance was the Railway Passengers Assurance Company, formed in 1848 in England to insure against the rising number of fatalities on the nascent railway system. [3] The high development of insurance system coincide beginning of XX century in European industrial countries and in USA. [1] From beginning this period insurance system turn into main part of the economy both in developed and developing countries.

3. The Importance of Insurance System in the World

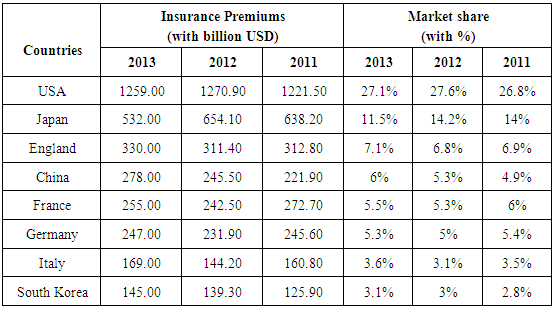

- Insurance is the equitable transfer of the risk of a loss, from one entity to another in exchange for payment. It is a form of risk management primarily used to hedge against the risk of a contingent, uncertain loss. [14] The importance of insurance system in the world is very high. Because it protects people from loss, from danger. It is often suggested that risk sharing and risk transfers are an important aspect of our modern economies. Private insurance markets and social insurance programs have been instrumental in improving welfare over time. [4] Insurance involves pooling funds from many insured entities to pay for the losses that some may incur. The insured entities are therefore protected from risk for a fee, with the fee being dependent upon the frequency and severity of the event occurring. In order to be an insurable risk, the risk insured against must meet certain characteristics. Insurance as a financial intermediary is a commercial enterprise and a major part of the financial services industry, but individual entities can also self-insure through saving money for possible future losses. Risk which can be insured by private companies typically shares seven common characteristics: [5]1. Large number of similar exposure units: Since insurance operates through pooling resources, the majority of insurance policies are provided for individual members of large classes, allowing insurers to benefit from the law of large numbers in which predicted losses are similar to the actual losses. Exceptions include Lloyd's of London, which is famous for insuring the life or health of actors, sports figures, and other famous individuals. However, all exposures will have particular differences, which may lead to different premium rates.2. Definite loss: The loss takes place at a known time, in a known place, and from a known cause. The classic example is death of an insured person on a life insurance policy. Fire, automobile accidents, and worker injuries may all easily meet this criterion. Other types of losses may only be definite in theory. Occupational disease, for instance, may involve prolonged exposure to injurious conditions where no specific time, place, or cause is identifiable. Ideally, the time, place, and cause of a loss should be clear enough that a reasonable person, with sufficient information, could objectively verify all three elements.3. Accidental loss: The event that constitutes the trigger of a claim should be fortuitous, or at least outside the control of the beneficiary of the insurance. The loss should be pure, in the sense that it results from an event for which there is only the opportunity for cost. Events that contain speculative elements, such as ordinary business risks or even purchasing a lottery ticket, are generally not considered insurable.4. Large loss: The size of the loss must be meaningful from the perspective of the insured. Insurance premiums need to cover both the expected cost of losses, plus the cost of issuing and administering the policy, adjusting losses, and supplying the capital needed to reasonably assure that the insurer will be able to pay claims. For small losses, these latter costs may be several times the size of the expected cost of losses. There is hardly any point in paying such costs unless the protection offered has real value to a buyer.5. Affordable premium: If the likelihood of an insured event is so high, or the cost of the event so large, that the resulting premium is large relative to the amount of protection offered, then it is not likely that the insurance will be purchased, even if on offer. Furthermore, as the accounting profession formally recognizes in financial accounting standards, the premium cannot be so large that there is not a reasonable chance of a significant loss to the insurer. If there is no such chance of loss, then the transaction may have the form of insurance, but not the substance.6. Calculable loss: There are two elements that must be at least estimable, if not formally calculable: the probability of loss, and the attendant cost. Probability of loss is generally an empirical exercise, while cost has more to do with the ability of a reasonable person in possession of a copy of the insurance policy and a proof of loss associated with a claim presented under that policy to make a reasonably definite and objective evaluation of the amount of the loss recoverable as a result of the claim.7. Limited risk of catastrophically large losses: Insurable losses are ideally independent and non-catastrophic, meaning that the losses do not happen all at once and individual losses are not severe enough to bankrupt the insurer; insurers may prefer to limit their exposure to a loss from a single event to some small portion of their capital base. Capital constrains insurers' ability to sell earthquake insurance as well as wind insurance inhurricanezones. In the United States, flood risk is insured by the federal government. In commercial fire insurance, it is possible to find single properties whose total exposed value is well in excess of any individual insurer's capital constraint. Such properties are generally shared among several insurers, or are insured by a single insurer who syndicates the risk into the reinsurance market.Insurance system is the main part of service sector in developed countries. Developed countries have big insurance markets. In these countries insurance premiums are very high. We can show the countries in the following table which have big insurance market. [6]

|

4. The Modern Situation of Insurance System in Azerbaijan

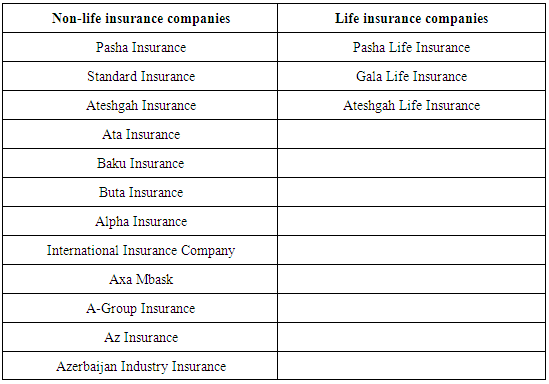

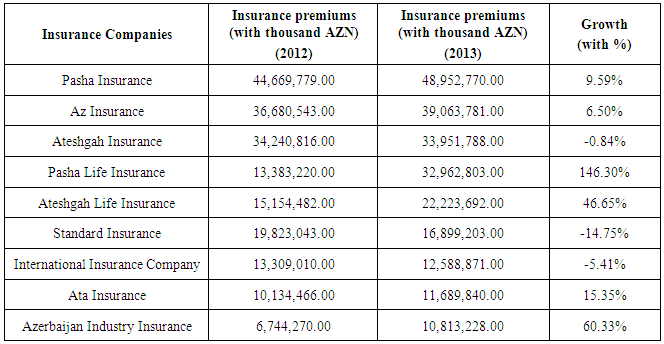

- As an economic category insurance sector, which is part of the financial system, is the foundation and utilization process of the targeted finance funds established to eliminate the damage from the unpleasant accidents and emergency, to provide financial support to the citizens in the accidents connected with their private lives. Insurance system is an important element of modern economic relations. [8] It includes financial relations which perform specific functions in economy. Insurance system is related to compensation of losses which protecting property interest of insured. Insurance is an integral part of the service sector both in developed and in developing countries. [10]The development of insurance in Azerbaijan passed 3 stages: before the October revolution in 1917; after the revolution (1917-1990) and the modern period since 1990. The insurance system developed in the country independently after 1990. State Insurance Control under the Cabinet of Ministers of Azerbaijan Republic was founded in 1991. [6] The duties of the organization were to regulate the insurance service market in the country, to defend the interests of the insurer, insured, and the state, to exercise methodical management, to prepare the relevant normative and legal documents. The national insurance market in Azerbaijan was formed in the early 1992. In January 1993, Azerbaijan Parliament adopted the Law of Azerbaijan Republic “On the insurance” for the first time in Azerbaijan history. Now, the insurance market is in the stage of development. The insurance companies offer more than 40 obligatory and voluntary insurance forms. However, this is not enough. Comparatively in the developed countries, more than 300 various insurance services are provided. [8]Insurance is new field in Azerbaijan. But despite of this factor, insurance system plays important role in country economy. Because in terms of protecting people’s property and health, provision unemployment, increasing welfare of people insurance has spesific place. [16] There are more than 20 insurance companies operate in Azerbaijan. Three of them are life insurance companies and rest are non life insurance companies. We can show Azerbaijan insurance companies in the following table. [12]

|

|

5. Conclusions

- The importance of insurance system in Azerbaijan is very high. Because this system is one of the main part of service sector in Azerbaijan. But insurance system is not satisfactory in Azerbaijan nowadays. There exist some problems in insurance sector. Low information level of population on insurance service, existing monopoly in insurance sector, incomplete legislative base about insurance, poor quality insurance services are the main problems which prevent development of insurance system in Azerbaijan. These problems are too bad for insurance system in Azerbaijan. Because these kind of problems create distrust in people. So, they don’t believe insurance companies and they don’t want to use insurance products. [13]Despite of existing these problems, perspectives from insurance system is too high in near future. Development of life insurance, development of compulsory insurance, improvement of insurance culture and increase in capitalization of insurance companies are main expected perspectives in insurance sector. These following measures are too important to achieve development insurance system in Azerbaijan.1. Using insurance practice of developed countries2. Increasing quality of insurance services by the insurance companies3. Improving legislative base of insurance system4. Taking improving activities by the government for insurance companies5. Applying of compulsory health insuranceThese measures is too important for insurance market and insurance system. If these kind of measures will realize, it will possible to achieve development of insurance system in Azerbaijan. Development of insurance system will accelerate Azerbaijan economy.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML