Fatima. I. Abdulkadir 1, Salisu Umar 1, Bashir Garba I. 2, S H. Ibrahim 2

1Department of Business Administration Ahmadu Bello University Zaria, 234, Nigeria

2Department of Maintenance and Services Ahmadu Bello University Zaria, 234, Nigeria

Correspondence to: Bashir Garba I. , Department of Maintenance and Services Ahmadu Bello University Zaria, 234, Nigeria.

| Email: |  |

Copyright © 2012 Scientific & Academic Publishing. All Rights Reserved.

Abstract

The series of microfinance programmes and policies were put in place by the government to reduce rate of poverty through empowering people to have increase access to credit facilities. This research tries to evaluate the impact of microfinance banks (MFBs) on women entrepreneurial development in metropolis. Among the objective of this study was to examine the impact of MFBs in contributing towards women economic and financial sustainability. The research problem emerged out of the needs to assess the extent to which MFBs impact on women entrepreneurial development in . Survey method of study was used. Simple percentages were used in data analysis. The study found that women entrepreneurs knew about MFBs existence. The MFBs also impact positively in enhancing socio-economic life of women entrepreneurs in . The study therefore, recommends that MFBs, should come up with appropriate strategies to attract more investors and women participation in entrepreneurial activities should also be encourage for women self reliance and financial sustainability in the society.

Keywords:

Micro Finance, Entrepreneurship, Credit Unions, Poverty

Cite this paper:

Fatima. I. Abdulkadir , Salisu Umar , Bashir Garba I. , S H. Ibrahim , "The Impact of Micro-finance Banks on Women Entrepreneurial Development in Metropolis", Microeconomics and Macroeconomics, Vol. 1 No. 3, 2012, pp. 28-38. doi: 10.5923/j.m2economics.20120103.01.

1. Introduction

For quit sometime, breaking the circle of poverty and attaining sustainable development has eluded developing countries. Nigeria, like many other developing countries, has for long been making effort accelerate the pace of her economic development by putting in place programmes to reduce the rate of poverty through empowering people, by increasing their access to factors of production, especially credit. Therefore, to enhance the flow of financial services in the rural areas, Nigerian government has, in the past initiated a series of micro/rural credit programmes and policies that targeted at the poor. Among these programmes was the rural banking programme, establishment of Nigerian Agricultural cooperative bank (NACB). National directorate of employment (NDE), peoples bank of Nigeria (PBN), community Banks (CBs). Family Advancement Program (FEAP), National Poverty Eradication Programme (NAPEP) etc.However, these programmes become less or ineffective In comparism with the needs of the country, largely due to the inability to provide services needed by the low-income group and poor at purely grassroots level. Regarding role played by women in the society, as valuable resources for sustainable economic development. Women in are considered to be at the lowest rung of the poverty ladder (poorest of the poor) due to poor access to credit facilities, gender discrimination and other expectations from the society. These pitfalls become impediment in the socio-economic development of women in Nigerian society.The need to enhance financial services in the Nigerian Rural areas and reduce ever-increasing incidence of rural poverty, prompted the CBN to introduce well focused and appropriate policies. The objectives of these policies are to expand financial infrastructure, harmonize operating standards and provide platform for the evolution of microfinance institutions in . Quite true that, the latent capacity of the women for entrepreneurship would be significantly enhanced through the provision of microfinance services. The introduction of microfinance policy and frame work on the 15th of December 2005, bring all the existing informal institutions that serve 65% of the Nigerian population under CBN supervision. The policy also transformed community banks (CBs) on meeting the new capital requirement to microfinance banks (MFBs). Microfinance banks were established to promote self reliance, self esteem and make financial services accessible to large segment of the potentially productive Nigerian population which otherwise would have little or no access to financial services. Recently, there are many microfinance banks operating within the state and local government. These operating units aim at enhancing micro small and medium entrepreneurs, eliminating gender disparity and improving women’s access to financial services. In the past, several efforts were made by the Nigerian government to enhance socio-economic development of rural dwellers by initiating policies and programmes such as; rural banking, National Directorate of Employment (NDE) etc. over time, these became ineffective due to poor capitalization and failure to identify with culture and needs of the communities. Subsequently, these generated synergy for especially women folk, to quest for access to financial opportunities such as credit facilities and other economic activities. The development of sound microfinance polices became imperative to contain with these problems, but most importantly, provide effective services with a strong capital base to empower women entrepreneurship. In essence, this research will try to analyse the extent to which microfinance banks impact on women entrepreneur development in Zaria Local Government. This research will focus on selected microfinance banks and women associations within Zaria Local Government from the period of 2008 to 2010. The study intends to evaluate the impact and implication of microfinance banks policies on financial sustainability among women in Zaria Local Government. The choice of stems to the fact that, economic status of women in is low and that the concentration and predominance of women entrepreneurial activities in are easily identifiable. Microfinance bank as vehicle for socio-economic development for women, the study extrapolates the effect of microfinance on reduction of poverty.

1.1. Definition of Terms

•Microfinance Bank (MFBs) mean any company licensed to carry on the business of providing microfinance services such as savings, loans, domestic fund transfers and other financial services that economically active poor, micro-enterprises and small and medium enterprises need to conduct or expend their businesses. (Microfinance Banks regulatory and supervisory framework, December, 2005).•Micro- credit: Disbursement of small or soft loans meant for rural development.•Rural Dwellers: Are people residing in a country site or an area where there is less or no governmental infrastructures and facilities such as offices, electric power supply, industries and other basic social amenities.•Microfinance: Is about providing financial service to poor who are traditionally not served by the conventional financial institutions.•Informal financial institutions: They are traditional microfinance institutions that provide access to credits for rural and urban low-income earners. Example, rotating savings and credit association, self help groups, co-operative societies.•Microfinance policy: is a regulatory guidelines on micro credits that help to promote monetary stability and sound financial system.•Poor- A poor person shall be defined as one who has magic means of sustenance of livelihood and whose total income during a year is less than the minimum taxable limit set out in the law.

2. The Emerging Theory of Microfinance

Recent developments in and other developing countries bring argument that microfinance or micro credit structures are essential for development of rural areas that are typified and engulfed by complete absence of basic amenities of life. As has been argued by the United Nations Capital Development Fund (UNCDF) that, “the development of microfinance institutions (MFLs) over the last two decades and a number of success have lent credence to the idea that microfinance is a major stimulus for development in the countries of South, and that is a powerful instrument for combating poverty”. This report suggests two assumptions. This first assumption is that, “poor populations posses the capacity to mobilize income generating activities but they lack access to capital”. This is as a result of weak financial market capacity and absence of asset based collateral by the poor people to collect loans from the financial institutions. The second assumption is that, availability of establishment of financial institutions will enable poor people to be progressive in their productive entrepreneurial investments.Microfinance programmes and institutions have gained widespread acceptance across . Research has been conducted on the activities of microfinance institutions in developing countries, especially , and yet a large number of rural farmers, petty trader’s peasants as well as urban salaried dwellers patronize these financial institutions. Therefore, microfinance programmes are not only relevant to Africa’s socio economic and cultural circumstance but also tend to impact immensely on income generation and broad access to financial resources crucial to the poor comprising large percentage of women for sustainable development. The World Bank, United Nation Development Programme (UNDP), United States Agency for International Development (USAID) have all made fund available to microfinance non-governmental organizations in Nigeria with varying levels of success.Microfinance institutions have rapidly evolved in the last decade and have been able to “create significant income and employment opportunities for the poor in developing countries”. Microfinance institutions (MFLs) have reached out to many disadvantaged micro entrepreneurs that enable them to achieve financial self sufficiency. In , Microfinance programmes was founded on sound conception but have failed because of certain limitations as identified by the World Bank and the International Monetary Fund (IMF). “The over investment in this sector by government and the consequent restructuring of the economy embarked by Nigerian government in the mid 1980s, make rural microfinance unsuccessful”. It has been noticed that one of the problems that microfinance institutions have faced in was inclusion of social welfare projects which divert attention form financial sustainability to welfare issues. Therefore, micro credit institutions fail to reach their target populations, “the poor”.In order to remain relevant, microfinance institutions must be able to provide development activities necessary to generate financial sustainability. Hence, Establishment of People’s Bank (PBN), raise financial sustainability of rural poor for economic growth and development. However, there was argument that, the rate of failure of microfinance programmes is an indication that they are not an appropriate policy tool. Economists also augured that “microfinance is an inappropriate policy intervention, and that it is macroeconomic reform and not micro credit delivery needed for cultivating entrepreneurship”. The question in this research however, is to ascertain the fact on whether microfinance banks help in financial sustainability and entrepreneurial development especially in regard to women.

2.1. Overview of Microfinance Activity in

Practice of microfinance in is culturally rooted and dates back several centuries. Microfinance institutions have rapidly evolved in the last decade and have been able to create significant income and employment opportunities for the poor in developing countries. (Ihedure, 2002). According to[13], traditional microfinance institutions have great relevancy and perhaps the strongest system in , among which the indigenous rotating and non-rotating savings, credit associations and self-help groups. Example of these traditional savings and credit institutions are: Esusu and Ajo among Yoruba, Adashi among Hausa, Isusu among Igbo, Oja and Aterugba among Igala and Bam among TIV etc and a vast array of derivatives[14].[8] asserts that, rotating drift and credit association is an association of equals who have decided to come together to pool resources for financial structure of formal financial institutions, the informal financial institutions is structured horizontally with powers of members diametrically neutral” More ever, microfinance is about providing financial services to poor who are traditionally not served by the conventional financial institutions. According to Osaze (1999) The advantage of traditional microfinance over formal financial institutions particularly in the rural areas, lies in their ability to give quick credit and to mobilize savings, their proximity and easy access to those in the rural communities who require their services, the freedom they give their debtors to deploy extended credit to whatever use they desire, the repayment flexibility and adaptability to the peculiar needs of borrowers and their low overhead and transaction costs. The informal financial sector served 65% of the Nigerian population through NGO-Microfinance institutions, money lenders, friends, relatives, credit union and associations. Therefore, the number of NGOS involved in Microfinance activities has increased in recent times due to the in ability of the formal financial sector to provide services, needed by the low income groups and the poor (CBN: 2005:7)The non-regulation of the activities of some of these institutions has serious implications for the CBN ability to promote monetary stability and sound financial system. Therefore, government has in the past attempted to fill a huge untapped gap potential for financial intermediation through establishment of financial institutions and instruments, but have failed due to poor capitalization and restrictive regulatory and supervisory procedures among other factors. Moreover, Community Banks (CBS) were designed to fill the gap, but their low capital base have not enabled them to make meaningful contribution to micro financing (CBN:2005:24) consequently, the CBN has taken activities measures to address the issue of microfinance through the development of appropriate regulatory and supervisory framework which recognizes and bring the existing informal institutions within its supervision and also transform other financial institutions such as community banks to microfinance banks by increasing the shareholders funds to a minimum of N20m.CBN regulatory and supervisory framework CBN (2005) reported that, microfinance banks being established in line with this policy framework shall be adequately capitalized, appropriately regulated and supervised to address the need of financing at the micro levels of the economy. Ehigiamusoe (2005) define microfinance as the supply of loans, savings and other basic finance services to poor.

2.2. Objectives and Goals of Microfinance Banks

The primary objectives of setting up microfinance banks is to make financial services accessible to a large segment of the Nigerian population including rural poor and women which otherwise would have little or no access to financial services. As stipulated by the CBN (2005), microfinance bank policies are set up to achieve the following objectives:i. Enhance services delivery to micro, small and medium entrepreneursii. Contribute to socio-economic development of rural communitiesiii. To improve women’s access to financial services by eliminating gender disparity.iv. Enhancement of the productive activities in both urban and rural areas, thereby creating job opportunities and reducing poverty.v. To create opportunities for self employment and self-reliance to low-income group in the community.vi. Mobilize domestic servings and promote the banking culture among low-income groups.vii. To strengthen the capital base and broaden the scope of activities of microfinance institutions. According to CBN (2005) the establishment of microfinance banks has become impetrative to serve the following purposes:i. To provide diversified affordable and dependable financial services to the active poor in a timely and competitive manner that would enable them to undertake and develop long-term sustainable entrepreneurial activities.ii. Create employment opportunities and increase the productivity of the active poor in the country, thereby increasing their individual household income and uplifting their standard of living.iii. Enhance organized systematic and focused participation of the poor in the socio-economic development and resources allocation process.iv. To mobilize savings for intermediationv. Provide veritable avenues for the administration of the micro-credit programmes of government and high net worth individuals on a non-recourse case basis. This policy ensures that state governments shall dedicate an amount of not less than 1% of their annual budgets for the on-lending activities of microfinance banks in favour of their residents.vi. Render payment services such as salaries gratuities and pensions for various tiers of government. According to CBN report (2005), Microfinance banks can be established by individuals, groups of individuals, Community Development Associations, Private Corporate entities or foreign investors.i. MFBs owned by Individuals or group of Individuals;Individuals or group of individuals within the community come together to promote establishment of microfinance bank within their locality or to operate within the state.ii. Community Development Associations (CDA):These are voluntary or Community based self-help groups that involve people from the same community with the aims of carrying out developmental activities to promote development in their communities. Example, Community Association. This group of people can come together to promote establishment of MFB in their locality or within the state.iii. Foreign and International Investors can expressed interest in investing in Microfinance sector in . The microfinance framework would provide an opportunity for them to finance in the economic activities of low income groups and poor.Therefore, no individuals or group or individuals corporate entities or their subsidiaries, shall allow establishing more than one MFB under a different or disguised name (CBN 2005).

3. Women Entrepreneurship Development in Nigeria

is a country with numerous businesses and investment potentials due to the abundant, vibrant and dynamic human and natural resources it possesses. Tapping these abundant and valuable resources require the ability to identify potentially useful and economically viable fields of endeavour. Onwubiko Entrepreneurship play significant role in the process of any country’s economic development. Therefore, Nigerian business environment offers many entrepreneurial opportunities to both public and private sector of the economy including the involvement of every sector of the society for industrial development process of the country. However, participation of women in economic activities is rated low. The low participation is blame for poor access to credit facilities, gender discrimination and perception of people about women in Nigerian. Until recently, women in grew to accept that their rightful place was in the home and women lives were comparatively idle for they were not involved in anything other than in the home[15]. There is another perception that women is taken to be that of child bearing and rearing and also regarded as an economic tool. According to[1], the role of child bearing and rearing occupies important place in the cultural perception of women in . These perceptions and discrimination against women relegate them to be at the lowest rung of poverty (poorest of the poor) in the society (Iheaduru 2002). According to micro-credit summit campaign (2001) report defines “poorest” as the bottom half of those living below their nation’s poverty line”. Regarding role played by women in the society as valuable resources for sustainable economic development, women are typified and engulfed by poverty unemployment, illiteracy and large responsibilities. These maladies reduce women participation in entrepreneurial development and thus, affect human existence and the nation’s economy.Women entrepreneurship therefore, needs to be encouraged to reduce poverty level and enhance self-reliance. CBN report maintain that, “the latent capacity of women for entrepreneurship would be significantly enhance through the provision of microfinance service to enable them engage in economic activities and to be more self-reliant, increase employment opportunities and create wealth”. Iheaduru pointed out that, women in general are naturally endowed with some exceptional abilities, which if properly harnessed for entrepreneurship purpose, could result in positive and enviable result. Women however can device, design, invent and sustain innovations and techniques. Their technological foresight and creativity usher in Cottage industries, home Management, personal and community health and through this, they keep the family, community and the nation going even with babies on their back[16]. In the economic sphere, women in Nigeria are naturally creative and have abilities to persist and pursue their desires, innovate and develop passion for what they belief in. with this, women posses most of the qualities that are essential and can be enhanced for entrepreneurial success.According to Agbonifoh entrepreneurship refers to the ability to establish and run a business enterprise successfully. In another views, entrepreneurship is the capacity and attitude of a person or group of persons to undertake ventures with the probability of success or failure Onwubiko. Entrepreneurship in is perceived as a major avenue to increase the rate of economic growth and create job opportunities. The perception encourages government to see the need for entrepreneurial development among rural and urban poor. According to UNDP report (2001) entrepreneurship development should be about helping people start and grow dynamic businesses that provide high value added. For this, various programmes and policies were being put in place by both the federal and state governments to encourage entrepreneurial activities especially among women in .A paper presented at the 8th international interdisciplinary congress on women (2002) stated that “the declaration on participatory development noted that, sustainable development only can be achieved with the full participation of women who constitute approximately 50% of the population”. The declaration also noted that “women lacked access to resources including credit and technology. This declaration urged most governments including government in to initiate priority actions that would substantially increase women participation in entrepreneurial activities. Among these programmes were the rural banking programmes, establishment of National Directorate of Employment (NDE), Peoples Banks of Nigeria (PBN), Family Economic Advancement Programme (FEAP), Community Banks (CBs), National Poverty Eradication Programme (NAPEP), Family Support Programme (FSP) etc. These programmes were initiated with the aim of stimulating appropriate economic activities at the grassroots level and creating avenues for the people to earn higher incomes and thus raise their standard of living. Ubom 2003 view, National Directorate for Employment (NDE) and Small-Medium Enterprises (SMEDAN), are some of the means through which Nigerian government aims at encouraging entrepreneurial spirits in the country. Therefore, these initiated government programmes make great impact on women entrepreneurial activities especially women traders, peasant farmers, tailors and artisans. The UNDP report on women’s entrepreneurship development project in Nepal, found that “women who cannot meet the basic needs of themselves and their families, are often keen to undertake entrepreneurial activities, but they face many constrains”.Admittedly, it has been observed that for an entrepreneur in to start a business he/she must have adequate funds and in a situation where the working capital is inadequate, there is also a problem. Women capital capacity for entrepreneurship is very low therefore; women need to be provided with assistance in entrepreneurship training, confidence building and provision of microfinance facilities. Quite true that, access of loan and other financial services from commercial banks to start up small or medium scale enterprises is difficult. Difficult access to loan from conventional Banks constitute great setback to development in Nigeria (Parker, 2006) However, the establishment of micro credit programmes, encourage entrepreneurs including women to have close access to financial services, but unfortunately, some of these micro credit programmes have not been made with respect to the general welfare of women. It has been far removed from the culture and operational framework of the rural financial intermediation process (Osage, 1999). Consequently, women’s access to credit, loan packages, programmes and services are limited because women are considered to have lower capital capacity than men, thereby limiting the range of their economic activities and returns. Perhaps a solution lies in the micro finance Banks’ concept- a concept that depend largely on productive Nigerian population for its proper functioning, a concept that reduce poverty, create opportunities for self-employment and self-reliance and also eliminate gender disparity for women entrepreneurial development in the country.

3.1. Activities of Selected Women Association in Metropolis

For the purpose of this research, four women associations in metropolis for the period of 2008 – 2010 are examined to provide evidence and test the prepositions that microfinance banks are relevant institutions to the economic and entrepreneurial advancement of women in . However, four women associations selected here are the women Nasara Association, Groundnut oil women association, Albarka women Association, and handcraft association of women. The choice of these associations is due to the fact that they are client of microfinance banks located within metropolis.

3.2. Women Nasara Association

The women Nasara association was founded by Mrs. Fatima Aliyu in 1995 in Rimin Kambari of Zaria Local Government as self help group. The member consists of house wives and petty traders. The associations therefore, start with 25 women as members where every first week of the month they meet and contribute certain amount agree upon by the members. The primary aims of this association are to promote well being of members (women) in their businesses and many other social and economic activities for the development of the capacities of women to contribute to self reliance and to achieve sustainable development. From the initial stage, the association starts as self help group by collecting fixed contribution monthly from each member. Part of the savings is set aside for extension of credit to needy members. The association also gives part of the savings when any of the members give birth or for wedding ceremonies. The contribution help women to settle hospital bills, pay children’s school fees or cater for day to day needs of the family where the partners (husbands) are incapable of doing so. Secondly, they also use part of the savings during festivities like Eld-Kabir and Eld-Fitir to buy wrappers, children wears and shoes in bulk from the whole sellers and sells at cheaper price to the association members. Apart from this, they buy cows or rams from the village where they think it will be cheaper and shared based on each member’s request. In addition, the association provide financial assistance to those under condition of medical emergencies, business failure and other kind of hardship. However, at the time goes on, the association recognized the need for enjoying banking services available within the community. According to Hajiya Fatima Aliyu Leader of Women Nasara Association, an account was first opened in 1999 with Birni community Bank all the deposits of members were kept. As at 2009, the association had 45 members and can be able to save approximately N1.million annually. They also extend credit facilities to women involved in poultry farming, cottage industry like groundnut oil extraction and petty trading activities to enable them expand their businesses for self reliance and economic upliftment of women. In 2009, the association was able to obtain credit facilities amounted to N500, 000 from Zazzau microfinance finance bank which was distributed among the members of the association. Hajiya Fatima assert that this amount of credits shared among the members help the women to engaged in enterprise activities and also those already in the business expand while others diversified. This way, the women are able to gain self confidence and achieve economic self reliance.

3.2.1. Albarka Women Association

Albarka women association is an association of market women in Tudun Wada district of Zaria Local Government. The association has a membership of 35 women, meeting to save in accordance with each member’s resources and ability. However once the amount to be contributed is fixed by a member it will not changed. The specific objectives of this association is to render financial assistance to members who may have sustained losses in their trade to be able to have access to credit facilities from the bank and also to protect their interest and determine the price of their business. The members of this association consist group of market women involve in selling fresh vegetables, groundnut oil, plastic household, food items and cosmetics. According to Hajiya Kubra Mai Samira the chairwoman of Albarka Association said that the association is able to mobilize approximately N50, 000 a month. All monthly collection from members are paid into a bank saving account for safety and interest. Therefore, Albarka Association has an account with Ahmadu Bello University (A.B.U) microfinance bank and this helps them to obtain loan or seek for project financing of the association. Apart from this, they use part of the savings from their account to engage in collective ventures that are more profitable or purchasing supplies from wholesales. This way, the capital of the association increases and hence the women are able to gain economic self reliance and empowerment. At the end of the year, members are paid back their total contribution and set aside interest percentages and profit gain for reinvestment.

3.2.2. Impact of Microfinance on Women Entrepreneurial Development

Microfinance institutions play significant role in enhancing socio economic development of women because, viable approach to sustainable growth and development lies in the financial and economic advancement of women and rural dwellers in . Recent development in and other developing countries reinforce the contention that microfinance or micro credit structures are essential for development of rural areas in consideration of the fact that development concentrated in the urban centres in this country Iheduru. Provision of microfinance made positive impact on the individual household’s budget and has changed the quality of life of millions of people in developing countries especially women. Iheduru declared that, microfinance provides the means to generate income that eventually leads to sustainable development and provide the drive to develop a “broad access” to financial resources crucial to the poor (among whom women comprises the majority) in order to provide the basic requirements for sustainable development. Microfinance institutions have rapidly evolved in the last decade and have been able to enhance socio economic activities of rural people and women through the following ways: 1. Easy access to banking services: establishment of microfinance institution in both rural and urban areas, give easy access to banking services than when located in far distant places. According to Iheduru (2002) microfinance make credit directly available to the very poor and thereby promote their self sufficiency. The institutions have reached out to many disadvantaged micro entrepreneurs and have them to build operational and financial self sufficiency. The idea behind microfinance was to bring at door step, banking services to rural and low income segment of the society who cannot meet the requirement of orthodox commercial banks. According to CBN (2005) report, microfinance is about providing services to the poor who are traditionally not served by the conventional financial institution. Therefore easy access to banking helps Nigerian women and poor to generate significant income or more entrepreneurial activities in the country. 2. Encouraging rural savings:[8] maintain that, apart from prompting self reliance and economic independence as well as breaking vicious circle of rural poverty, the encouragement of rural savings has other significant advantages.[11] Succinctly put that, saving go along way in discouraging unproductive household consumption in rural areas and increases their resources based and bargaining position. By the deferment of current consumption through savings, rural dwellers and women become more prudent in expending their hard earned income investment. 3. Encourage self reliance: CBN (2005) reported that “the latent capacity of women for entrepreneurship would be significantly enhanced through the provision of microfinance services to enable them engage in economic activities and to be more self reliance. In addition rural dwellers comprising women, needs technical and financial assistance; need more funds and obviously financial and economic advice[8]. Microfinance offer advisory service to its customers on current business trends. More so CBN reports on microfinance institutions state that agriculture and petty traders were relatively large recipients of the banks loan facilities while significant amount also went to restaurant business, collage industries and substantial amount to small scale enterprises engaged in manufacturing and transportation (CBN, 1993 P.46). Many organizations like the World Bank, UNDP, USAID, Canadian, Swedish and German Governments have all made funds available to microfinance in to alleviant poverty and enhance self reliance (Iheduru 2002). 4. Alleviation of poverty: in the paper presented by Iheduru (2002) establish that it has been estimated that women comprise nearly 74% of the 19.2 million of the worlds poorest people now being served by microfinance institution. It is also reported in the survey carried out by United Nations Capital Development Fund (UNCFD) that out of 29 microfinance institutions, approximately 60% of these institution clients were women. Moreover, with microfinance, the level of women poverty reduces to the minimal level. Micro-credit delivery of microfinance institutions gives greater business opportunities, economic independence as well as sustainable development in women economic activities. According to ledger wood (1997) microfinance clients are typically self employed, low income entrepreneur in both urban and rural areas. Clients are often traders, street vendors, small farmers, service providers, artisans and small producers such as black smiths and seamstresses. Usually their activities provide a stable source of income, although they are poor but generally not considered to be poorest of the poor. 5. Financing entrepreneurial activities: clients of microfinance are often peasant farmers, petty traders, artisans, tailors, service providers etc. Microfinance helps existing business of their client to grow or diversify and thus encourage self sufficiency and to live above poverty level[7]. In the findings presented in the international conference on Administration and business,[7] conclude that microfinance institutions world wide and especially in Nigeria are identified to be one of the key players in the financial industry that have positively affected individuals, business organizations, other financial institution, the government and the economy at large, through the services they offer and the functions they perform in the economy. More so, microfinance contributes to entrepreneurial development with the help of external funding from bilateral and multilateral organizations to . It is expected that with the current reforms put in place by the federal government through its regulatory authorities, microfinance institutions in will be able to compete favourably in the global market and gainfully increase entrepreneurship development among women in .Primary method of data collection was used in this study. The primary data consist of well-structured Questionnaire and personal interview were used for the purpose of this research. The decision to structure the questionnaire is predicated on the need to reduce variability in the meanings possessed by the questions as a way of ensuring comparability of responses. The questionnaire is titled ‘Impact of microfinance banks on Entrepreneurial Development.’A questionnaire consisting closed ended question was designed for simplicity and accuracy to elicit information from the sample population. The first section of the questionnaire deals with the personal data of the respondents while second section deals with the questions about the subject matter of the research.Structural interview was conducted for simplicity and to obtain appropriate data from a sample of women associations who cannot answer questionnaire. An interview was conducted to determine the relationship between women entrepreneurial development[the dependent variable] and microfinance bank[the independent variable] and also to compliment questionnaire in covering areas of the research.

3.3. Population of the Study

The population selected for this research was drawn from four different women associations residing within metropolis. The names of these associations are women Nasara association, Groundnut oil women association, Albarka women association and handcraft association of women. Therefore, the entire population selected for this research was 140 women entrepreneurs.

3.4. Sample Size and Sampling Techniques

For effective contribution, simple random sampling technique was used to select sample size from the total population of 140 women entrepreneurs in metropolis. These associations were drawn from two different Microfinance banks- Zazzau (MFB) and ABU (MFB). Therefore, two women associations were selected from each microfinance bank representing different areas within . The use of random sampling in this study is consider appropriate because of the assertion of[6] that representativeness of the sample is assumed by applying random sampling technique. It should also be pointed out that, limited time and financial resources at the researcher’s disposal could not permit for a greater sample size.A sample size of eighty four[84] were drawn randomly using 60% from total population of one hundred and forty[140] women who are members from four different women associations in metropolis. The research also intends to administer 84 questionnaires to selected sample size for fair representation and reliability from the respondents.

4. Data Presentation and Analysis

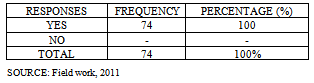

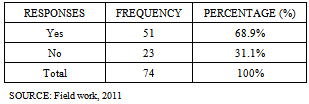

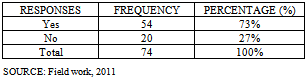

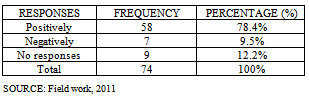

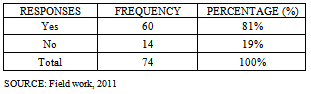

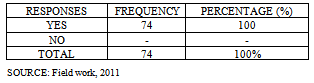

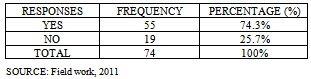

Table 1 to 10 of this context, portrayed primary data collected through the use of questionnaire to the respondents. The data was presented in a tabular form and simple percentages were employed to analysed each question from the table. A total of eighty four (84) copies of the questionnaire were administered to various respondents but the researcher was able to retrieve only 74 copies. A return rate of 88% was however obtained. The responses recorded are presented below:Q1. Are you aware of the existence of Microfinance Bank in your area?Table 1. Respondent views on awareness of the existence of Microfinance Bank

|

| |

|

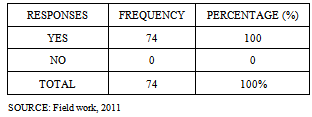

Table1 above depicts that, the whole respondents answered in the affirmative that they are aware of the existence of (MFB). It is discernible that the sample respondents have sufficient knowledge about the Bank and its existence.Q2.Do you belong to any association?Table 2. Responses on whether belonging to association or not

|

| |

|

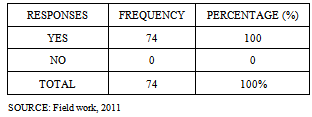

The data presented in the table2, reveals that 100% of the respondents are members from different women associations within metropolis. This is in line with the expectation of the researcher as all the respondents should be a member in any of the associations.Q3.Does your association patronize the services of Microfinance Bank?Table 3. Responses about Patronizing Services of Microfinance Bank

|

| |

|

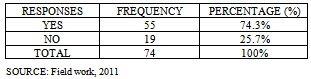

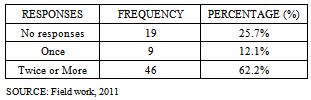

Table3 reveals that 74.3% of the respondents have an account with MFB and also patronizes some of its services, 25.7% constituted those that are not patronizing MFBs services.Q4.How many times annually, have you been able to get loan from MFB.Table 4. Question to ascertain the number of times these associations were able to collect loan from this Bank

|

| |

|

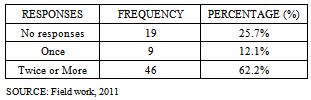

It can be seen from table4 that 46 of the 74 respondents (representing 62.2%) admitted that they collect loan, at least two times or more in a year and 12.1% collect loan only once in a year from (MFB). While 25.7% remain neutral without responding.Q5.In your own opinion are these credits facilities sufficient?Table 5. Respondent’s opinion on whether loan facilities are sufficient enough

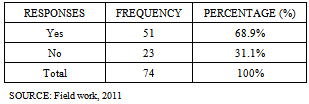

|

| |

|

Table5 shows 68.9% of the respondents are with the opinion that the credits facilities are available whereas 31.1% of the respondents disagree, by saying that credits facilities are not available.Q6.Is there any improvement in your business with loan collected from Microfinance Banks? Table 6. Responses on business improvement from loan granted by Microfinance Bank

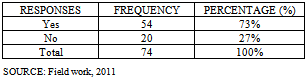

|

| |

|

From the table6 reveals 73% of the respondents agreed that loans from MFB improved their entrepreneurial activities remarkably. 27% have negative response. Majority of these respondents also testify that micro-credit (loan) from MFB facilitates their business activities and contributes to their increased standard of living through business expansion by diversifying into other businesses. Q7.How does the microfinance Bank affect your socio-economic status?Table 7. Respondent views on how MFBs impact on their socio-economic life

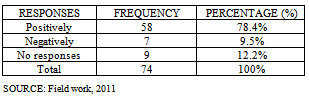

|

| |

|

Table7 reveals that, 78.4% of the total respondents strongly agreed that micro-credit disbursement of MFB uplift their living standard to an optimum level but on the contrary 9.5% disagreed that there was no significant improvement in their socio-economic status. Nine (9) respondents representing 12.2% of the total respondents remain neutral without responding to the question.Q8.Do you believe that microfinance Bank policies are appropriate for financial sustainability among women?Table 8. Respondents opinion about how appropriate MFB policies are on women entrepreneurial empowerment

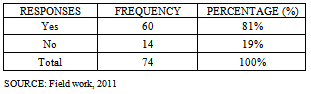

|

| |

|

Table8 reveals that 81% considered (MFB) policies appropriate for small and medium women entrepreneurs. While 19% of the respondent believes that the policies are not meant for improving women’s access to financial services.Q9.What challenges are you facing in your entrepreneurial activities? Table 9. Respondents view on the challenges facing them in business

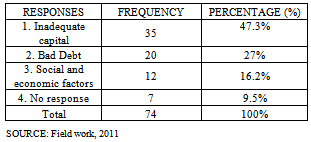

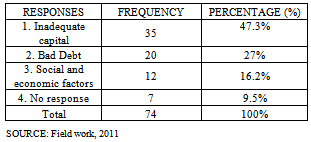

|

| |

|

Table9 shows that 47.3% of the respondents are with opinion that inadequate capital is the major challenges they are facing in business. Although 27% believes that excessive bad debt is a serious obstacle affecting entrepreneurial development. While 16.2% expressed that social and economic factors are among problem affecting entrepreneurs. Seven (7) respondents representing 9.5% remain neural without responding. .

4.3. Findings

This research work has been able to evaluate the impact of micro finance bank on women entrepreneurial development in metropolis.The analysis of data found out that the women entrepreneurs in were sufficiently aware of the existence of MFB. Again the level of patronage was high because 74.3% of the respondents and those interviewed were operating account with MFB. In addition, women entrepreneurs were generally satisfied with the credits facilities and efficiency of MFB services. It was also found out that the concept of MFB has brought tremendous improvement to small and medium women entrepreneurs. They have increased access to financial services, more profits and growth opportunities in business and thus brought positive changes in their socio-economic life.It was also discovered that, risk of non payment by the creditors, cultural expeditions and other social factors affect women entrepreneurial development. In conclusion microfinance bank policy guidelines should be more flexible to accommodate entrepreneurs for effective MFB services.

4.4. Discussion of Findings

It is apparent from the foregoing analysis that the microfinance bank impact positively on womenentrepreneurial development. This means that MFB play significant role in promoting entrepreneurship in . As you can see from the analysis, 100% of the respondents knew about the existence of MFB. This may be as a result of its accessibility that gives opportunities to make financial services accessible to large segment of the society. More so, the patronage of the bank’s services from foregoing analysis was high. About 75% of the respondents patronize MFB services. This also reveals the efficiency and easy accessibility of MFB services to micro small and medium entrepreneurs. The analysed data also indicated that MFB policies are excellent in poverty reduction and women empowerment. This is by placing vital financial resources in the hands of both rural and urban women which otherwise will not be available to them. This however helps them increase their entrepreneurial activities and become self reliance; self esteem and thus raise their living standard.Further to that, the productivity and income generating level of women have increased marginally due to micro credit provided by MFB. The minimum rate of interest negotiable by the members of association made significant contribution in providing favourable ground for these recorded success. For instance, savings, mobilization, counselling and enlightenment on how to manage business have yielded efficiency in the utilization of credits by the customers. In addition, the findings also showed that, inadequate capital is the major challenges facing entrepreneurs. It has been observed that for an entrepreneur in to start a business he/she need to have adequate funds. Lack or insufficient funds is a serious problem to intending entrepreneurs especially women. The Bank faced with problem of bad debt from their customers which in most cases affect their businesses severely. Economic and other social factors posed challenges to women entrepreneurial development. The research findings showed that, gender stereotypes and expectations remain mired in tradition which affects economic and financial sustainability of women in the society.

5. Conclusions

, like many other developing countries, has for long been making effort to accelerate the pace of her economic development by putting in place programmes to reduce the rate of poverty through empowering people and increasing their access to factors of production, especially credit. Therefore, to enhance the flow of financial services in the rural areas, Nigerian government has, in the past initiated a series of micro/rural credit programmes and policies that targeted at the poor. Among these programmes of recent is Community Banks which was upgraded with capital base and transformed to Microfinance Banks in order to widen its activities and enhance operation to reach out to the desired targeted group in the rural communities.Although recent developments in and other developing countries bring argument that microfinance or micro credit structures are essential for development of rural areas that are typified and engulfed by complete absence of basic amenities of life. As has been argued by the United Nations Capital Development Fund (UNCDF) that, “the development of microfinance institutions (MFLs) over the last two decades and a number of success have lent credence to the idea that microfinance is a major stimulus for development in the countries of South, and that is a powerful instrument for combating poverty”. This report suggests two assumptions. This first assumption is that, “poor populations posses the capacity to mobilize income generating activities but they lack access to capital”. This is as a result of weak financial market capacity and absence of asset based collateral by the poor people to collect loans from the financial institutions. The second assumption is that, availability of establishment of financial institutions will enable poor people to be progressive in their productive entrepreneurial investments.The argument and assumption by scholars and international organizations became compatible with Central Bank of whose mission to establish microfinance banks in prerogative to serve the following purposes:i. To provide diversified affordable and dependable financial services to the active poor in a timely and competitive manner that would enable them to undertake and develop long-term sustainable entrepreneurial activities.ii. Create employment opportunities and increase the productivity of the active poor in the country, thereby increasing their individual household income and uplifting their standard of living.iii. Enhance organized systematic and focused participation of the poor in the socio-economic development and resources allocation process, to mobilize savings for intermediation and to provide veritable avenues for the administration of the micro-credit programmes of government and high net worth individuals on a non-recourse case basis. Essentially, a survey technique was employed in conducting this research. Primary source of data was used to gather reliable data from respondents. The simple random sampling method was used in selecting population and sample size. Tabulation and simple percentage were employed in analysing data. Data collected were analysed, summarized and interpreted accordingly. Evidence deducted from the research findings has proved the assumption of positive impact on women entrepreneurial development. This has to a larger extent signifies the role played by MFBs in promoting entrepreneurship in . The opportunity availed the rural dwellers due to the wide network coverage and awareness of its existence, has yielded considerable patronage within communities. In other words, the productive capacity and income generation level of women have increased marginally due to the micro credits provided by the scheme and with minimum interest rate as negotiated by beneficiary women associations.

5.1. Recommendation

On the basis of the findings of the study, the following recommendations were made:1. The policies of the MFB as guided by the Central Bank should be maintained with increased capacity on lending powers to make available finances for the success of entrepreneurship development.2. The MFBs should enhance its campaign programmes to encourage more participation from individuals, Government and other foreign bodies. 3. Stereotype on women and stigmatization should be discouraged to allow more of women entrepreneurship participation.4. Poverty reduction can effectively be achieved in rural household provided women are given the opportunity to obtain credit facilities and be self reliance. 5. High level of investment in the microfinance banking system should be encouraged with a view to effectively realize the spread and establishment of microfinance banks in all nooks and cranny of the country.

References

| [1] | Adeyanju, F.B. “The Effects of Unconscious Ideologies about Women on Sustainable Development” Society for International Development Publication. |

| [2] | Agbonifoh, B.A at el “The Business Enterprise in ”, Long man Nigeria PLC, Ikeja, . |

| [3] | CBN “Regulatory and Supervisory Framework for Microfinance Banks in ” (MFBs) Community Banks Act no. 46 of 1992. |

| [4] | Fatima Abdulkadir “An Evaluation of the Impact of Community Banks in Enhancing Socio-Economic Life of Rural Dwellers in ”, a study of Gyellesu Community Bank, un published project ABU Zaria. |

| [5] | Ngozi G. I. Women Entrepreneurship and Development:“The Gendering of Microfinance in ” 8th International Interdisciplinary Congress on Women, , . |

| [6] | Osuala, E.C. “Introduction to research Methodology”, Africana Fep Publishers Ltd, . |

| [7] | Ojo Olu “Impact of Microfinance on Entrepreneurial Development”case study of , International Conference on Administration and Business, ICEA, FAA University of Bucharest, Romania |

| [8] | Osaze, E.B , Engendering Sustainable Development in Sub -saharan Africa through rural capital mobilization, A curiosum, in Policies And Strategies for Sustainable Development in African shara, (ed),Bola Ayenniyi et al, Society for International Development Publication, zaria. |

| [9] | Odozi, C.M Financial Intermediaries in Nigerian Economy. “The Rotating Credit system in the Economic Development of Bendel state” Un-published Thesis, City. |

| [10] | Parker, S.C. The Economic of entrepreneurship, Edward E. Publishing Ltd, . |

| [11] | Padmanabhan, K.P, “Rural credit lessons for Rural Bankers and Policy Makers”, ITP Publishers, . |

| [12] | Seibel, H.D “Under developing through regulation” will community bank survived? In Journal of International African Forum, 2/1994 vol. 30 |

| [13] | Siebel H.D. & Damachi U.G. Self Help Organization: Guidelines and case studies for development planners and field workers. A participative Approach. (ed) , FGredrich-ebert Stiftung. |

| [14] | Siebel H.D. Linkage Informal and Formal Financial Institutions in Africa & Asia, in Micro enterprises in developing countries, (Ed) J. Levitsky, Intermediate Technology Publications, . |

| [15] | Shaibu, F.B. Women Education for Sustainable Development, in policies and strategies for sustainable Development in African Sahara, (ed) Bola, Ayanniyi etal. Society for int’l Development Publication, . |

| [16] | Tarfa S.B.“ Women and Environment Challenges of the Decade”, in policies and strategies for sustainable development in African Sahara, (ed), Bola Ayeniyi et al (1999), Society for International. |

| [17] | Development Publication, . |

| [18] | Ubom, E. Entrepreneurship, small and medium enterprises: Theory, Practices & Policies, Sendina Limited, . |

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-Text HTML

Full-Text HTML