-

Paper Information

- Next Paper

- Paper Submission

-

Journal Information

- About This Journal

- Editorial Board

- Current Issue

- Archive

- Author Guidelines

- Contact Us

Journal of Logistics Management

2016; 5(1): 1-5

doi:10.5923/j.logistics.20160501.01

Crises and Its Occurence in SMEs in the Czech Republic

Monika Marikova, Ladislav Rolínek, Jaroslav Vrchota

Department of Management, South Bohemia University, Faculty of Economics, Czech Republic

Correspondence to: Monika Marikova, Department of Management, South Bohemia University, Faculty of Economics, Czech Republic.

| Email: |  |

Copyright © 2016 Scientific & Academic Publishing. All Rights Reserved.

This work is licensed under the Creative Commons Attribution International License (CC BY).

http://creativecommons.org/licenses/by/4.0/

The crisis in company's management represents a condition that may threaten its company existence. Compared to the large corporations, SMEs are more endangered. In this paper authors dealt with identification of critical conditions that have occurred in selected SMEs in the Czech Republic. As the research of 183 companies from the year 2014 suggests, the most frequent critical conditions are related to customers, demand and employees. The implementation of strategic management (formulated strategy) has a rather positive influence on anticipation of critical conditions.

Keywords: SMEs, Crisis, Management, Strategies

Cite this paper: Monika Marikova, Ladislav Rolínek, Jaroslav Vrchota, Crises and Its Occurence in SMEs in the Czech Republic, Journal of Logistics Management, Vol. 5 No. 1, 2016, pp. 1-5. doi: 10.5923/j.logistics.20160501.01.

1. Introduction

- The word crisis originates in the ancient Greek expression “krino” which means to choose, decide, judge or measure. The word “krisis”, meaning the moment of change, the necessity to decide, was derived from the original word “krino” [1]. Reference [2], [3] shows a crisis as a stage in a life of a company in which the aims of the company or its existence itself are threatened. At this stage, there can be seen a negative development of company’s efficiency performance, significant drop in volume of revenues, decrease in the net business equity, reduction of the company’s solidity, which causes a threat to the company’s existence provided that this condition persists for a longer period of time ([4], [5]).Reference [1] shows as a specific situation happening during a limited period of time that is crucial for the decision whether the company will return to the original state before crisis or whether the achievement of company’s goals as well as its future development will be endangered. Here we can see either a lack of balance between the company and its surroundings, or a dysfunction among the company’s inner systems. Imbalance and dysfunction are a consequence of risks engagement that reached a critical point ([6], [7]).Reference [8] shows the term crisis describes a situation in a company that consistently, or for a longer period of time represents a negative derivation from a normal state. There are two typical features of crisis in relation to a company:1. major crises – threatening the company’s existence itself2. minor crises – threatening the basic targets of a company on a long-term basisCrises occur either unexpectedly (e.g. accidents, natural disasters, unsuccessful innovation, etc.), or gradually, through continuously developing processes [2]. Reference [9] shows, crises may arise from serious accidents (natural disasters, terrorist attacks), or as a consequence of a severe economic situation. This situation may be caused either by external impacts (e.g. fluctuation of economic cycle, change of product demand, technological progress) or by the company’s internal situation (e.g. wrong financial strategy of the company, wrong company location etc.) [10]. Reference [11] shows, crises caused by inner influence can be divided into 3 groups:● Crises of strategy – arise as a consequence of wrong decisions taken already at the moment of the company start-up (e.g. wrong choice of location, wrong choice of assortment, dependence on one supplier only, etc.)● Crises of business results – caused by mistakes in company’s financing, setting too high prices, high cost of operation, low-quality products etc.● Crises of solidity – they are usually caused by quick growth of the company that is connected with large investment, lack of respect of financial balance rules, insufficient management of working capital, etc.Reference [8] shows, give examples of crises that may arise inside a company:● Material and raw material crises● Financial crises● Human resources crises● Know-how crisesIn the external environment of a company we can see for example:● Sales crises in the company’s surroundings● Quick and significant crises in price policy of suppliers● Legislation permitting unfair competition on the market● Crises of the customer, etc.Many authors (e.g. P. Drucker, R. Mann, Alcalde) do not perceive a crisis as something exclusively negative. On the contrary, a crisis can be viewed positively, as it brings a possibility to change something, to do something differently than in the past. A crisis thus may be perceived not only as a threat, but also as a chance, source of innovation [12].

2. Methodology

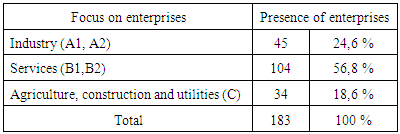

- The aim of this paper is to identify critical conditions that are most frequent among selected small and medium – size Czech enterprises. Furthermore, we wanted to find out whether there is a relation between strategic management of a company and the frequency of crisis occurrence in individual categories. Moreover, our next target was to determine whether strategically managed companies are better prepared for crises that occur and which each company must be able to respond to. This paper was supported by Gaju 79/2013 / S. The data were collected from 183 companies in the Czech Republic in 2014, as shown in Tab. 1. Research sample was selected using non-probable random selection, with regard to circumstances of the data collection. The data necessary for conducting the research were collected by a questionnaire survey and they were supplemented by qualitative data, obtained through in-depth interviews as well as case studies.

|

| Figure 1. Types of crises |

3. The Research

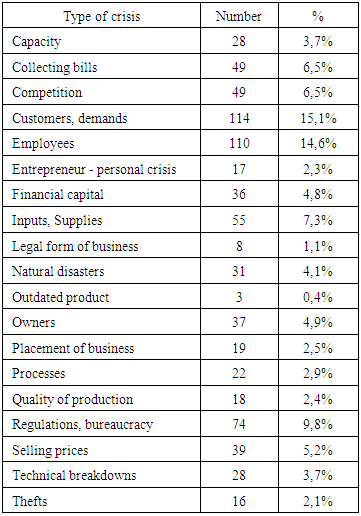

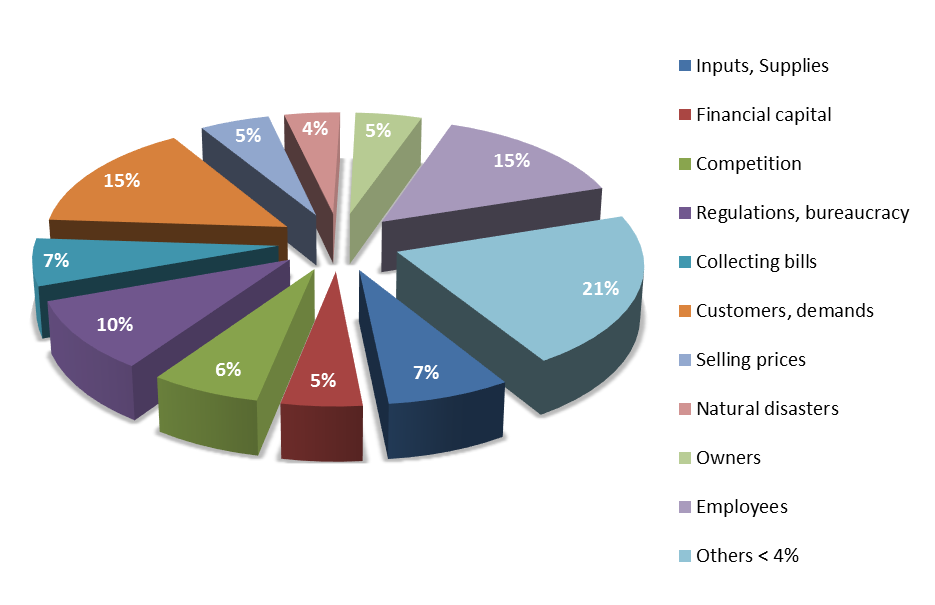

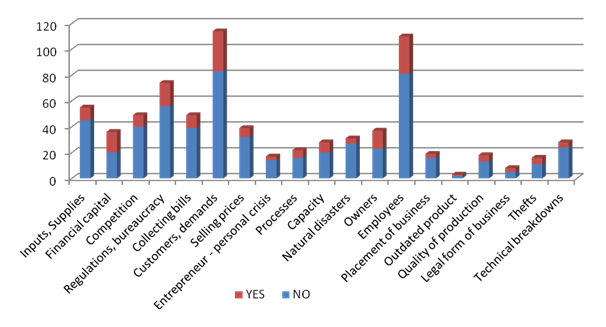

- As can be seen from Table 2, companies most often encounter crises in the following fields: “customers, demands”, and “employees” regardless of the implementation of strategic management of the company.

|

| Figure 2. Frequency of different types of crises in relation with the company strategy |

4. Conclusions

- Critical conditions and their occurrence are a natural part of management of a company. However, it is possible to reduce or even eliminate their impact by using appropriate preliminary measures. From this point of view, it is primarily important to deal with the fact, what crises occur in the case of the article in SMEs. As we can see from the survey results, management of SMEs should significantly strengthen the area of marketing (crises most often occurred in the field “customers”) which can be reduced by entering into business clusters as recommended or better networking [17-19]. The same problem is HR management (the second most frequent crisis occurrence), as well as in the study of Weber [26]. However, crisis occurrence related to customers was to a large extent influenced by the impact of outer environment. In the field of personal management, problems can be found especially in the area of choice of employees and their motivation Hochner [25]. From the owners’ responses we can see that they even had to deal with employees’ thefts. Strategic management represents a set of tools that might be useful for more effective management decisions as well as the anticipation of critical conditions. This fact was confirmed in most cases. Due to this fact it is necessary that the SMEs management focus more on contracts dealing with relations between owners of the company that are prepared in advance. Succession and passing the family businesses on further generations can be as well perceived as other points of discussion. From the management point of view, the occurrence of crises in the field of financial capital is only partially soluble by using suitable decision making methods. Anyway, the final result is to a large extent influenced by complicated predictions of development in many different branches.Organizational crises are rare events that can threaten the viability of organization [20] but also provide opportunities for learning [23, 24]. Learning from organization crisis involves understanding the causes of the crises as well as identifying ways of preventing similar rare events from recurring [21, 22].

ACKNOWLEDGEMENTS

- The paper is based on date from research grant project GAJU 079/2013/S Management Models in small and medium enterprises financing.

Abstract

Abstract Reference

Reference Full-Text PDF

Full-Text PDF Full-text HTML

Full-text HTML